Carvana ($CVNA): How 23Q2 Could be Better than the Updated Outlook (Update #5)

Despite the higher updated outlook for Q2, there is a real possibility the actual results could be much better than most are assuming.

Stock Price as of 7.6.2023: ~$24.97 / share.

(#5) 7.6.2023: How 23Q2 Could be Better than the Updated Outlook

Despite the higher updated outlook for Q2 2023, there is a real possibility the actual results could be much better than most assume.

In the notes below, I walk through different scenarios that could result in significantly higher actual Q2 numbers than most anticipate (including analyst estimates).

Previous Guidance and Updated Outlook

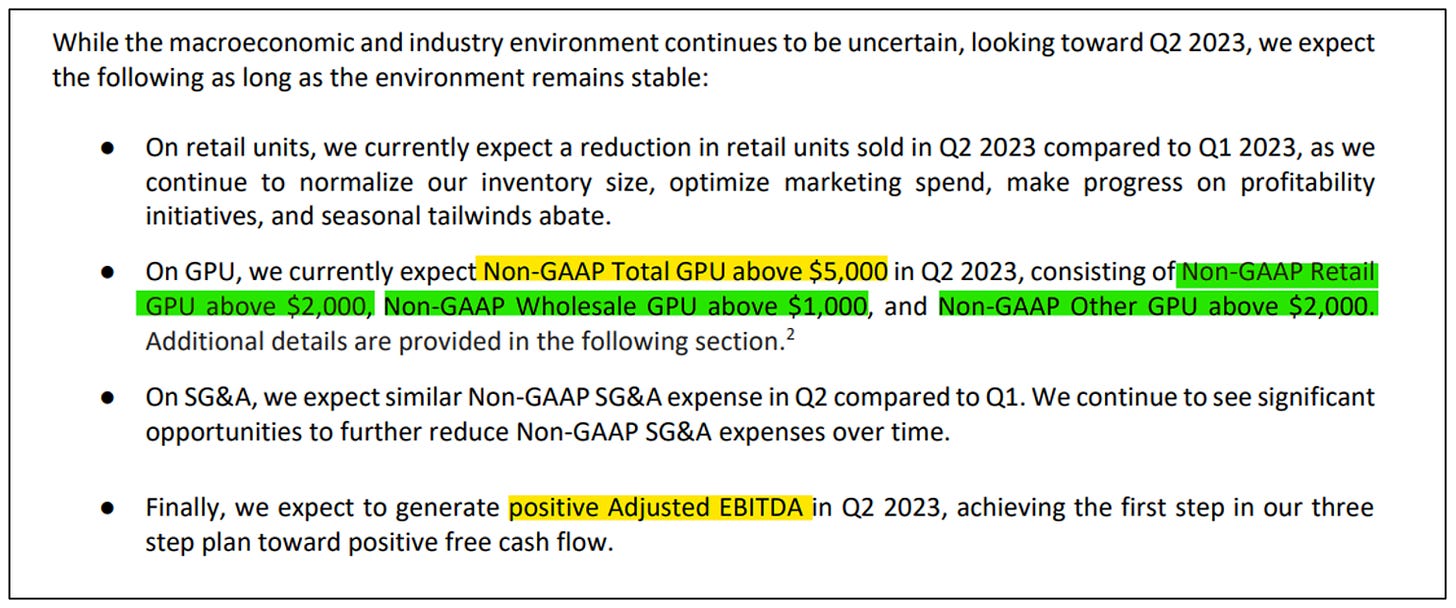

Originally, in the Q1 2023 letter to shareholders, the following was the guidance for Q2 2023, with non-GAAP total GPU above $5,000 + positive adjusted EBITDA.

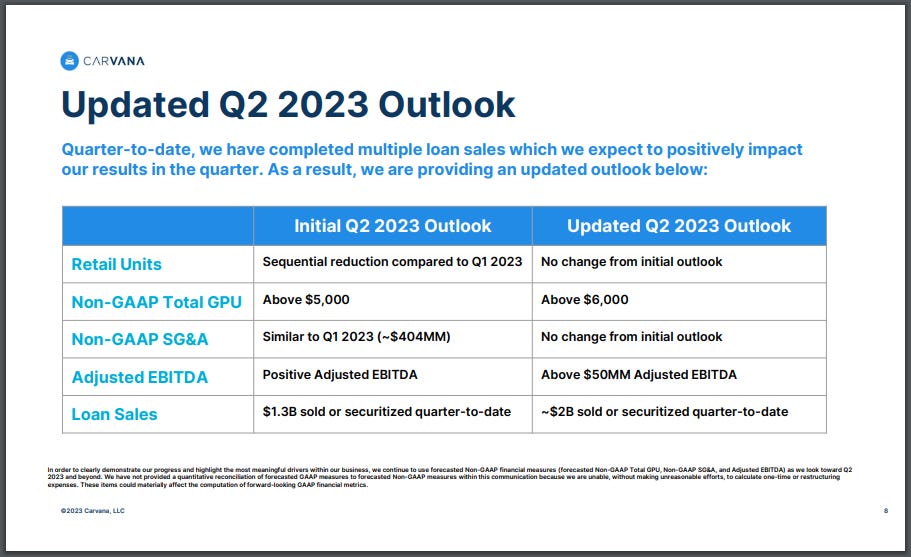

On 6/8, Carvana released “Improved Q2 2023 Financial Outlook Ahead of Industry Conference”, where CVNA expects to achieve non-GAAP total GPU above $6,000 + adjusted EBITDA above $50 million in second quarter 2023.

Below I discuss why I believe there is a real possibility that CVNA will report non-GAAP total GPU and Adj EBITDA much higher than $6,000 / $50M, respectively.