Detailed Real Estate Investment Analysis: Profits from Selling My First Rental Property

Last week I sold the first rental property I ever purchased. Using the BRRRR method, I made over $20K in less than 1.5 years (16 months), from investing $0 of my own money, and with minimal work.

Introduction

On 1/31/2020, I purchased my first two rental properties. One of which I just sold last week, on 5/27/2021. The following write-up is a detailed analysis on the numbers, from purchase and closing costs, to rehab, to rent and cash flow, to the refinance, and finally to the sale of the property.

The process of buying, rehabbing, renting, refinancing, and then repeating the process by using the refinance proceeds to purchase another property, was used here, and is known as the BRRRR method.

I thought it would be interesting to do a post-mortem analysis on this investment, and see how things worked out.

Post Rehab Picture of the Kitchen.

Purchase

On 1/31/2020, I purchased this single family home for $77,000.

The loan terms were a 30 year loan, 5% interest rate (higher rate since it was before rates began to fall, as well as from being on an investment property with a lower loan amount), and 20% down.

Cash to close was $15,400 for the down payment ($77K * 20%), $3,750 in closing costs, and $350 for the inspection, for a total of $19,500.

To fund the down payment, closing costs, and inspection, I used a HELOC (home equity line of credit). By using a HELOC, I did not have to use any of my own money to purchase this property. Instead, I borrowed money to purchase the property, where the collateral was my personal residence. I discussed the risks and benefits of using a HELOC for purchasing investment properties in this video.

Rehab

Overall, very minimal rehab was needed.

The $6,047 was the total rehab costs based on our bookkeeping. I added approximate numbers where I did not have exact information (paint, landscaping, and electrical). To fund these repairs, I used the same HELOC.

As you can tell from the before and after pictures below, the differences are mostly a function of higher quality photos. This helped significantly for renting out the property, and selling it.

Kitchen

Updates made included changing the light fixture, painting the cabinets, adding cabinet handles, buying a new microwave and oven, and updating the countertops.

Bathroom

Updates included replacing the mirror, changing out the light fixture and fan, and adding an accent wall.

Laundry Room

The only update here was getting a new washer and dryer.

Bedroom

Only updates in the 3 bedrooms were changing out blinds where needed, and changing all door handles from bronze to satin nickel.

Rent

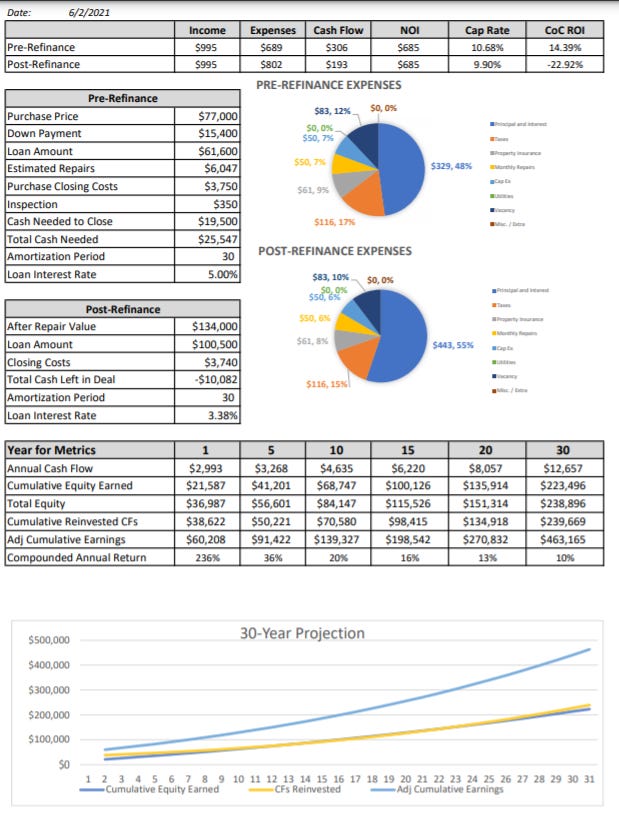

Before the refinance, with the smaller loan and lower principal and interest payment, expected cash flow was around $300. The tenant was responsible for utilities and lawn care / snow removal. Expected monthly repairs and budgeted cap ex were lower, due to the repairs completed immediately after purchase.

Post refinance, the mortgage payment increased from getting a larger loan, decreasing the monthly expected cash flow to approximately $200.

In the 16 months of owning, the property was rented out for 11 months. Therefore, overall cash flow was much lower than projected, given the high vacancy. The property was not rented between the time of purchase until the first tenant, and then again from after the first tenant until the sale. Total principal and interest reflects the total amount actually paid, given the delay in first payments following the purchase and refinance.

Overall cash flow was only $1,047. However, I am happy that it was not negative.

In the following, negative cash on cash returns reflect the negative amount of cash “left in the property”, post refinance. Here, we received more money back on the cash-out refinance, than we originally invested.

Also, despite NOI (net operating income) staying constant from no operating expenses increasing post refinance (only the mortgage increasing) and the rent staying the same, the lower cap rate is lower. The reason is I included the rehab costs with the purchase price, when calculating the cap rate post refinance. Technically, and as seen in the numbers, doing the rehab did not increase the income of the property. The rehab only increased the value, where value is not a function of NOI on residential properties, but a function of price per sq. ft. comparable sales, or “comps”.

Debt service coverage ratio (DSCR) is a function of annual NOI and principal & interest (P&I), and is calculated as NOI / P&I. The DSCR decreased, as NOI stayed the same, but the P&I increased from refinancing at a higher loan amount.

Refinance

I did a cash-out refinance on 1/4/2021. The reason for not doing the refinance immediately after the seasoning period, was due to refinancing and purchasing multiple properties all on the same date (1/4/2021). The appraisal came back at $134,000. I benefited from a increase in price per sq. ft. comps due to the current market, as well as from buying below market value at the time of purchase. At 75% loan to value (LTV) on the cash-out refinance loan, the new loan was $100,500 ($134K * 75%).

After paying off the existing loan of $61,131.37 (slightly lower than the original loan amount from paying down the mortgage before refinancing), and after closing costs of $3,739.57, I received back $35,629.06.

Given the purchase price + closing + inspection + rehab = $25,547, after the refinance, I had an additional $10,082.06 ($35,629 - $25,547) in cash to buy the next property.

Sale

On 5/27/2021 I closed on the sale of this property.

It was not a smooth process. When we first listed the property, we had multiple offers, and accepted a full price offer, with no inspection contingencies. It was great. However, right before closing, a loan issue came up on the buyer side. This led to them not being able to close and purchase the property. We had to relist the property. Luckily, we received another great offer, and we were able to negotiate the remaining items.

The sale price was $123,900, while the asking was $124,900 (below appraisal, as we felt the appraisal came in high). We paid for closing costs, which were $3,000 (this is an outcome of having to relist the property after the first property fell through, and now having to list a property that has been on the market for a long period of time). I also gave a seller credit of $1,125 to fix some small items so I would not have to complete them myself. The closing costs were $9,106.48 (including realtor commissions). Therefore, my net gain after the sale, and paying off the existing mortgage, was $10,261.

Summary of Numbers

Below is a summary of all the numbers.

Total Invested of my Own Money = $0 (given I used a HELOC to fund this investment)

Total Earned from Sale / Refi = $20,342.62

Total Cash Flow = $1,047

Total Earned = $21,389.42

Why I Sold

I currently have another investment opportunity I would like to capitalize on.

In addition, given the age of the property (built in 1897), I could not see myself holding this rental another 30-50 years without significant capital expenditures, that were in excess of my original assumptions.

Finally, I thought that this may be a better than average time to sell, given the current housing market. While currently being more of a seller’s market, it allowed me to have higher negotiating power following inspections, something I am not sure I will have next year, or ever again. This specific property had a crawl space, that in a typical market, I feel would have been more difficult to sell, without a significant updating cost from my end. Therefore, I was happy to have a market where this was seen as less of an issue, and likely allowed me to profit more on this property.

Opportunity Cost

Where things get interesting, is in regards to opportunity cost.

The following are the projections, based on a traditional buy and hold, with a refinance, but without using a HELOC to fund the purchase and repairs.

These future returns are what I gave up from selling the property.

Assumptions used in the projections / report above are provided below. I assumed lower repairs and cap ex, given the rehab done at purchase, but as mentioned, they will likely be higher in the future. I also assumed 1 month of vacancy per year. No property management fee, given we self manage. In aggregate, I wanted to assume lower expenses, to show how good this investment could of been, and show what I potentially gave up.

Final Thoughts

Overall, only a modest amount of work was done on this property, leading to a fairly easy investment with a good return. Without using the HELOC, it would of essentially been a double on my original investment, or 58% annualized. However, by using the HELOC, no upfront investment was required to create this profit, something I am pleased with. This has given me confidence to expand on this strategy, such as how I purchased my duplex and other public company investments, both items which I will likely discuss in the future.

Follow-up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more.

-Austin Swanson (Swany407)

Twitter: @Swany407

Website: Swany407.com

Subscribe: If you enjoyed this write-up, subscribe to not miss future ones.

If you enjoy the content, or have received any value from the investment insights, discoveries, and thoughts shared, please consider becoming a supporter of the channel. Your support increases the odds of more investment write-ups and content in the future.

Additional Resources and Links

Rental Estate Analyzers, Calculators, Checklists and Spreadsheets: https://www.swany407.com/spreadsheets

I will review your rental property before you buy: https://www.swany407.com/consulting

Recommended Books: https://www.swany407.com/books

Website: http://swany407.com

Twitter: https://twitter.com/Swany407/

Twitch (investment related livestreams): https://www.twitch.tv/swany407

Instagram: https://www.instagram.com/swany.407

Disclaimer: This content is intended for informational purposes. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.