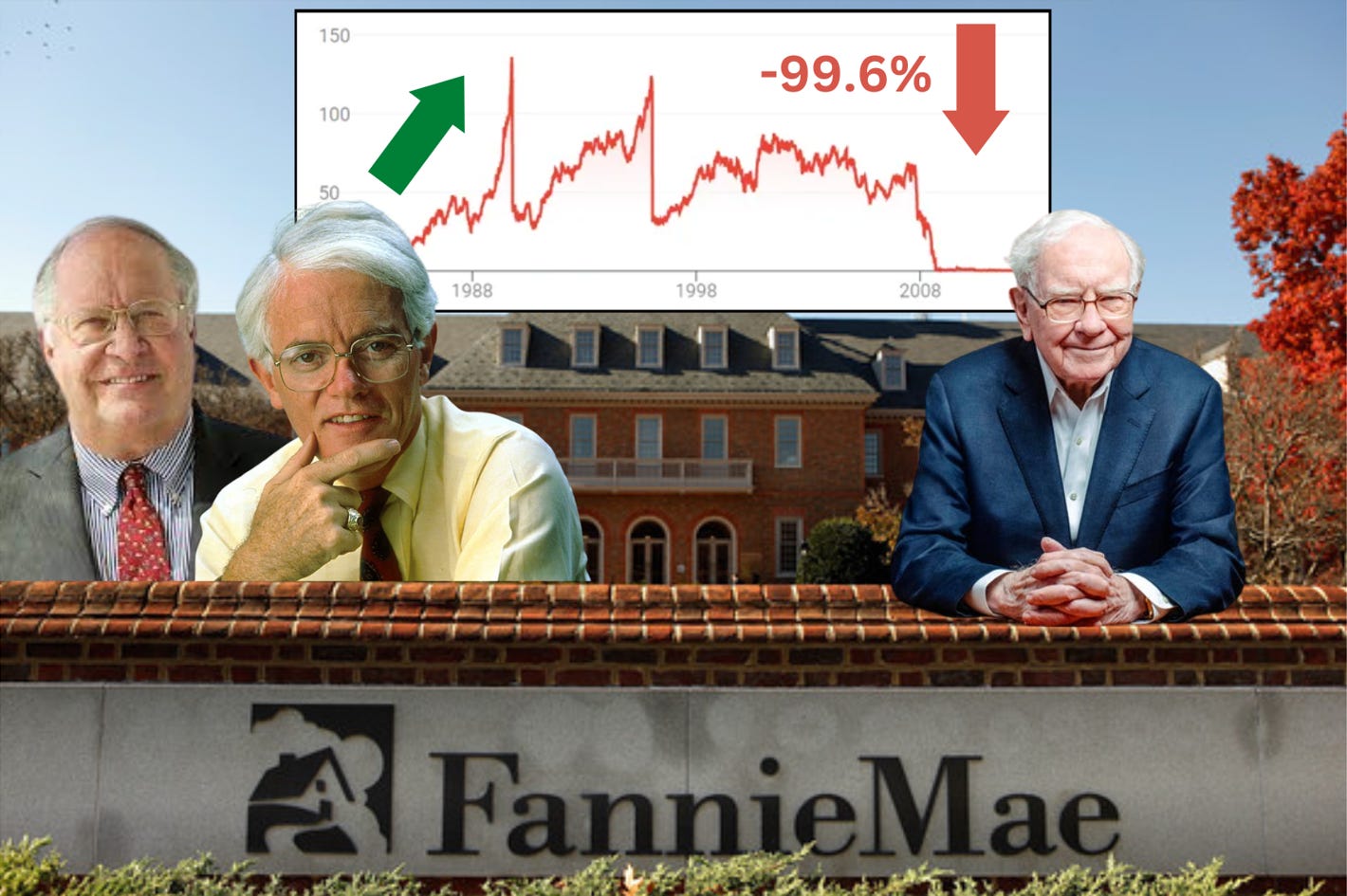

Peter Lynch, Bill Miller, Warren Buffett and Fannie Mae and Freddie Mac (General Research Notes #5)

The rise and fall of Fannie Mae (1980-1990s, and 2008, and investments by Peter Lynch, Bill Miller, and Warren Buffett.

The Rise and Fall of Fannie Mae (1980-1990s, and 2008)

At a high level, Fannie Mae interested me given Peter Lynch, Bill Miller, and Warren Buffett were all invested at one time.

What prompted me to research Fannie Mae and include the following excepts was given the reference to Fannie Mae by Miller when discussing what he saw in Amazon to invest at the lows in the early 2000s, saying “Amazon was Fannie Mae.”

I wanted to highlight these competitive advantages of Fannie Mae (such as those that were similar to Amazon), as well as some comments towards the end from Buffett.

Buffett went from stating it was a mistake not buying more of Fannie Mae in his 1991 letter, only to soon after buy again, but then eventually sell again before 2008. I provide Buffett’s comments on what he saw early on to sell before the collapse in prices in 2008, and why he knew Fannie Mae and Freddie Mac wouldn’t ultimately work (which proved accurate).

In terms of the 1980s and 1990s (which led to large stock price appreciation for Lynch and Miller), what is interesting is beyond Fannie Mae’s similarities with Amazon in terms of competitive advantages that led to Miller’s Amazon investment, Fannie Mae had some additional similarities to investments like GEICO and Amazon in terms of “blemishes hiding the beauty” and using the “cancer surgery approach” to show that “beauty”, as well as rumors/fear of going out of business + bad press, which allowed investors to buy at very low prices.

The following is what I found to be the more interesting and relevant information. I bolded what I felt is the most important, for you to skim more quickly if desired.

While Fannie Mae and Freddie Mac are similar, there is more focus here on Fannie, given they were more discussed and focused on by Lynch and Miller.