Cardlytics ($CDLX): Opportunities with PayPal

There may be a non-zero probability of PayPal using Cardlytics for their offers, which would substantially increase the intrinsic value of Cardlytics.

For all my notes on CDLX, check out my Qualitative and Quantitative “Research Notes”:

Introduction

After spending considerable time thinking through Dosh and Venmo, I’ve been spending an increasing amount of time wondering about the opportunities with PayPal.

Venmo, who is owned by PayPal, does not use the same offers as PayPal. Venmo is powered by Dosh (acquired by Cardlytics in March 2021). Given this, it may be possible for PayPal to one day also use Dosh / Cardlytics. I do not give this possibility a high probability of occurring, nor do I know if it is even possible with their current system. However, given the items below, I do not rule it out.

There may be a simple reason for why PayPal is not and cannot use Dosh / Cardlytics. Given I have not seen an official statement for this reason, the majority of the following sections pose hypothetical reasons why PayPal would not use Cardlytics, followed by any conflicting information that would support the use of Dosh / Cardlytics.

This is by far the most speculative piece I have wrote in regards to Cardlytics, given this is not discussing known partners or elements of Cardlytics. Rather, the information presented is from what I have come across while researching both Venmo and PayPal offers and have found interesting.

Not discussed here are the opportunities with other neobanks like Square / Cash App. Although today, this is where I am equally as excited about, and where it may even make more sense than PayPal to use Cardlytics. I will not discuss these at this time, as I feel that would be even more speculative than PayPal. Venmo is at least owned by PayPal, and as we will discuss below, there are many clues that show why PayPal could use Cardlytics.

Why it Matters to Consider

The opportunity for additional MAUs and ARPU is very significant with neobanks, more so than I believe many have consider. In addition, as payment usage with these neobanks increases over the next several years, it is wise for Cardlytics to partner with them early, especially when they are more focused on growth and when revenue share can be negotiated lower (as briefly mentioned at investor day).

To get an idea of the size of PayPal and Venmo, as of year end 2020, there were roughly 377 million active accounts (consisting of 348 million consumer active accounts and 29 million merchant active accounts), and with PayPal’s drive to increase payment volume, this would have a substantial positive impact on Cardlytics.

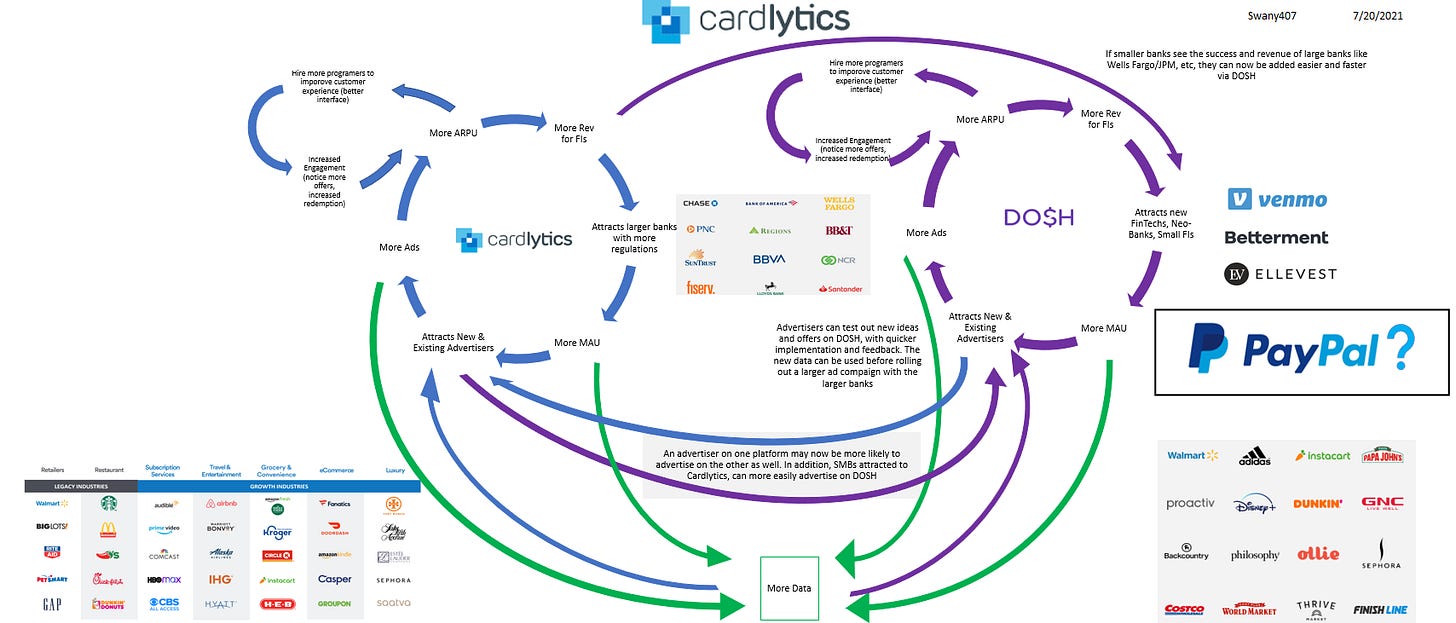

A way to visualize where PayPal would fit into the Cardlytics ecosystem is via the diagram I created below.

If it’s possible for Venmo’s value to equal Cardlytics current market cap with only 70M users, and you then factor in PayPal (let alone Square / Cash app), the value is substantial. Even more important, it does not seem the market is attributing any value to Venmo at this time. Therefore, if PayPal did begin to use Cardlytics to power their PayPal deals and offers, it may go unnoticed or recognized by the market, and further widen the margin of safety of the investment opportunity as the market price stays the same while the intrinsic value increases.

In addition, if the probability of PayPal using Cardlytics is low, but there is an associated high value if it occurred, the expected value can be meaningful to current intrinsic value. As the probability of occurring increases, expected value increases, leading to a larger mispriced bet today. Therefore, we will explore why this probability could be higher.

Why PayPal May Use Cardlytics

The following are reasons why PayPal could use Cardlytics in the future for their offers, and will be discussed in greater detail throughout this write-up:

PayPal Sees Value in a “Deals and Offers” Section

Venmo Uses Dosh Despite Honey

PayPal is Copying Venmo Offers and Dosh

PayPal Invested in Dosh in 2018

A Way to Incentivize QR Code Payments

Utilizing Features of the Other

Single Dedicated Resource

Access to More Advertisers

Higher Future Payment Volume From Venmo

Higher Future Engagement Levels and ARPU on Venmo

Ryan Wuerch’s LinkedIn Mentions PayPal

PayPal Sees Value in a “Deals and Offers” Section

If PayPal did not have an existing offers section, it could be viewed as PayPal sees no value for having offers on the PayPal platform. If this was the case, the probability would be much lower for PayPal to add a brand new offer section (given no evidence in favor of needing it) than if they had an existing offers section and could choose to switch to Cardlytics.

Therefore, it is a positive to see PayPal has a “Deals and Offers” section within their mobile app. This at least proves they know the offers bring some value to the platform. In addition, announced in November 2019, PayPal acquired Honey, a rewards platform and coupon browser extension, further proving PayPal recognizes the importance of offers and saving customers money.

Venmo Uses Dosh Despite Honey

It’s possible that PayPal would never use Dosh / Cardlytics, because of Honey. PayPal currently shows some offers that are purely coupon codes, that are powered by Honey, however, it is unclear if all offers are powered by Honey (specifically non-coupon based offers).

It could be that PayPal will never use Dosh / Cardlytics, since they could simply copy the best features of Dosh seen in Venmo, and power their own offers. If they have success, then maybe Venmo would simply be powered by PayPal (I am not sure the terms of the Dosh / Venmo partnership). Although Honey is predominately a coupon code platform, with Google Chrome extensions, it is possible this could be expanded to power all offers for PayPal, or at least, be the dedicated resource to handle offers for all of PayPal (especially given the $4B purchase price).

The conflicting piece of information, and what leads me to believe there is still a chance PayPal will use Cardlytics, is that Venmo began using Dosh in August 2020, after the Honey acquisition closed in January 2020. One would think that with a $4B price tag, if Honey could service the offers outside of coupon codes, PayPal would have Venmo use it and get the most out of spending $4B. Therefore, between potentially not all offers on PayPal using Honey, and Venmo not using Honey, it seems possible Honey is not capable at this time to service offers at the scale or level Dosh / Cardlytics can.

PayPal is Copying Venmo Offers and Dosh

A reason PayPal wouldn’t use Dosh is if they thought their existing platform and user interface was superior to that seen on Venmo and Dosh.

Instead, it looks like PayPal prefers Venmo’s / Dosh’s platform. So much so, it seems as if they are copying it.

Below is comparison of the PayPal "Deals and Offers” section within the PayPal app (left side) to the Venmo Offers section (right side). Right away, you can see the similarities. Essentially the same location and grouping of offers. Similar wording. Similar imagery and sizes of images (although I would say the imagery and user experience is not as high quality as the Venmo / Dosh platform).

It is possible this is a coincidence. It is also possible Dosh copied PayPal, given I do not have historical pictures of their user interfaces.

PayPal Invested in Dosh in 2018

If PayPal is ran separately from Venmo, and the decision for Venmo offers to be powered by Dosh was exclusively made by Venmo, then it could be possible PayPal does not think highly or see the value in Dosh.

However, in April 2018, PayPal was a part of a $44M funding round for Dosh.

Therefore, PayPal at that time understood Dosh, and was confident with their platform and capabilities enough to invest. This could be why two years later, around August 2020, Venmo began using Dosh to power the Venmo offers, if it was a joint decision with PayPal.

Utilizing Features of the Other

If PayPal and Venmo were ran independently, we would not see PayPal and Venmo utilizing features of the other. This could lead to a smaller chance of PayPal utilizing a Venmo feature like Dosh.

Given Venmo added the feature to checkout with Venmo almost anywhere there is a PayPal checkout button (side note, this was discussed in detail in the previous write-up and video as a new feature, but seems to have been a feature for some time now), you can see how the company is utilizing the positives of each company. Therefore, if Venmo does increasing well, with higher engagement and payment levels from the Dosh powered offers, it may make sense for PayPal to begin using Dosh / Cardlytics as well.

I do not think we would see PayPal and Venmo become one, but I do predict that the percentage of new accounts will be an increasing portion towards Venmo than PayPal, due to younger demographics.

Desire for Single Dedicated Resource

If PayPal was trying to motivate different purchasing behavior than on Venmo, or wanted to keep the offers on PayPal and Venmo operated by separate business units, you would expect to see different offers on each platform.

Instead, both are pushing the use of QR codes for in purchase transactions. To incentivize this payment method, we have seen PayPal and Venmo have an increasing number of QR code offers, including the same CVS and Foot Locker offer.

In fact, the offers are so identical, that the only piece of information that I could find that differentiates the two is at the very bottom of the terms of conditions of the Foot Locker and CVS page, it says the Venmo offers are powered by Dosh. Therefore, it seems that these Venmo offers are powered by Dosh, but not on PayPal.

It seems strange that PayPal would not be using a single dedicated resource to work with the offers on PayPal and Venmo, when they are the same offers. It would seem on the surface there is duplicate work occurring, if Dosh is not the source of both. I cannot know for sure, but it would seem if Foot Locker wants to place a QR Code offer, they would need to go through both PayPal and then through Dosh, instead of only on Dosh to power both Venmo and PayPal.

Given PayPal benefits from using QR Codes, it’s possible PayPal is funding these offers, and that explains why they are okay with doing all the work. This could also explain why on PayPal’s Instagram, they are advertising the offer for both PayPal and Venmo. However, it seems that it would make more sense to dedicate Dosh to this work, and PayPal to focus on payments.

Access to More Advertisers

Venmo benefits from having access to advertisers that are not necessarily PayPal or Venmo merchants. Currently, I have not seen many of the marquee names of Venmo offers on the PayPal offers section. As Cardlytics and Dosh expand their advertiser base from the self-service platform, Venmo will continue to benefit from more advertisers placing offers on Dosh / Venmo. This increases the attractiveness of the offers section, and increases the incentive for users to pay with Venmo at places they are more likely to enjoy.

Therefore, I believe PayPal will have a harder time ignoring Venmo’s advertisers (current and future) if PayPal doesn’t match this. In addition, if it’s leading to more payments with Venmo than PayPal at those locations, it’s further reasoning for PayPal to simply use Cardlytics.

I don’t see Google Pay ever switching or using Cardlytics, given they are predominately an advertising company, with access to nearly all advertisers. In contrast, PayPal is focused on payments. Therefore, it may make sense to use Cardlytics, gain access to more advertisers, increase attractiveness of offers, and increase usage and payments with PayPal, similar to what they are dong on Venmo.

Higher Future Payment Volume From Venmo

Venmo is accepted nearly everywhere that PayPal is accepted. For instance, PayPal is beginning to roll out their point of sales and payment hardware solutions via Zettle (acquired Zettle for $2.2B, about 3 years ago) to in-store commerce, where users can use both PayPal or Venmo to pay. Therefore, PayPal could responsibly assume that consumers are choosing between Venmo and PayPal to make the purchase.

If PayPal saw higher payment volume from Venmo than PayPal in stores where the retailer was advertising on Venmo from Dosh / Cardlytics, and not on PayPal, if the data was statistically significant, and proved that the higher payment volume was due to these offers, it would be a reason for PayPal to use Cardlytics.

Higher Future Engagement Levels and ARPU on Venmo

Total payment volume would not need to be higher for PayPal to use Dosh / Cardlytics.

One scenario that could lead PayPal to using Dosh / Cardlytics is where:

Dosh ARPU on Venmo (if not seen, could take Venmo share / rev share / users)

x PayPal’s Estimated Revenue Share (potentially higher than on Venmo)

> PayPal’s Current ARPU on Offers (known figure to PayPal)

However, given revenue from offers is currently small in comparison to revenue from other parts of the business, the monetary gain from switching to Dosh / Cardlytics would likely not be the reason for the change. Instead, seeing higher ARPU levels on Venmo could be an indication of higher levels of engagement in the app due to the better offers section / larger number of offers / more relevant offers, all from using Dosh / Cardlytics. Essentially, user level statistics like ARPU could lead to a change for PayPal.

Ryan Wuerch’s LinkedIn Mentions PayPal

While looking at Ryan Wuerch’s LinkedIn profile, the CEO & Founder of Dosh, I noticed that PayPal is listed, and in the context of powering their offers.

I assume including PayPal is due to Dosh powering Venmo offers, and with PayPal owning Venmo he included PayPal in the list, possibly for credibility. There is likely nothing that can be taken from this, but I found it interesting, especially in light of all the other observations.

Closing

The information shared in this write-up could be used when thinking in terms of probabilities, and adjusting the likelihood of PayPal using Cardlytics based on the shared information and observations.

Even with a low probability of occurring, when considered in combination with the extra value it would add to Cardlytics, the expected value could be quite significant.

In addition, if PayPal does switch to Dosh / Cardlytics to power their offers, it may go unrecognized by investors for a considerable amount of time, allowing for an opportunity to purchase at attractive prices in relation to the increased intrinsic value.

I will continue watching and post more in the future.

Follow-Up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more.

-Austin Swanson (Swany407)

Twitter: @Swany407

Website: Swany407.com

Subscribe: If you enjoyed this write-up, or any of the previous ones, please consider subscribing to not miss future releases.

If you enjoy the content, or have received any value from the investment insights, discoveries, and thoughts shared, please consider becoming a supporter of the channel. Your support increases the odds of more investment write-ups and content in the future.

More Detail

For a video version of this write-up, please see the following video:

Best Case Scenario with Venmo write-up and video:

I discussed Venmo Offers in detail in the Cardlytics investor day write-up and video:

I walked through potential valuations of Venmo Offers in the following write-up and video:

If you are looking for more detail on this company and the investment thesis, I have created a write-up, which is free to read via Substack. The write-up is formatted in bullets to more quickly skim and read sections of interest.

I also discussed the investment on YouTube.

Disclaimer: This content is intended for informational purposes. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.