Cardlytics ($CDLX): Thoughts Following Investor Day

Thoughts around smaller points and comments made during the investor day presentation, and how MAU and ARPU potential may be larger than originally assumed.

For all my notes on CDLX, check out my Qualitative and Quantitative “Research Notes”:

Introduction

The investor day presentation provided some additional information in areas such as open banking, where the future potential has been unclear. It was also nice hearing from Amit Jain, Founder & Chief Executive Officer of Bridg, who seems excited and passionate about his work.

Although items like the international opportunity with open banking, and SKU level data possibilities via Bridg are important, and likely where a large portion of future growth could come from, this write-up will explore some of the other items discussed at investor day. Some points were explained at length, such as the new user experience and ad manager. Other items were only a single brief comment, but gave insights into what Cardlytics is working on, and showed how Cardlytics is focused on areas that could capture the most potential out of the opportunity at hand.

For a quick overview of what will be discussed:

MAU growth via Venmo’s 70M users

ARPU growth via:

New User Experience

Push Notifications

Habits

Ad Manage / Self-Serve

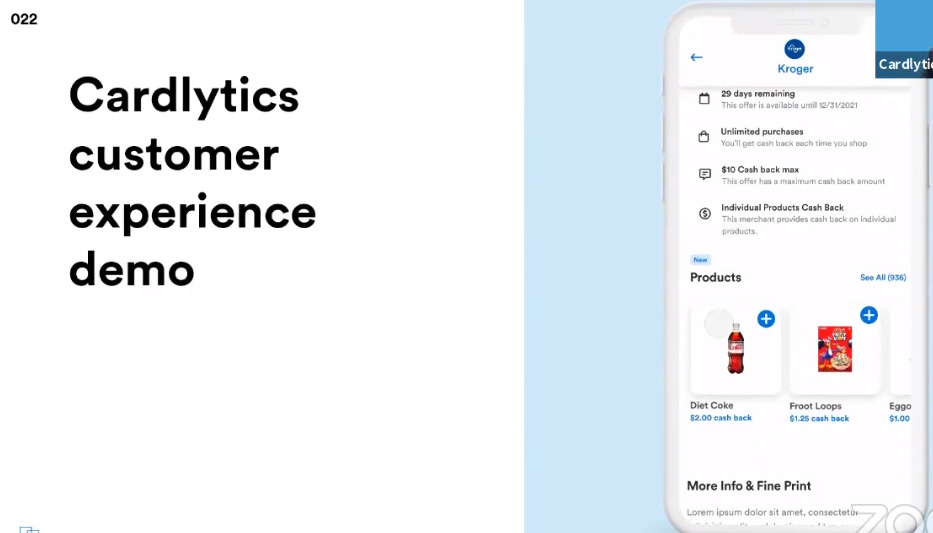

New User Experience

The new user experience looks to be very similar to Dosh, and a big improvement from the current interface. It was very interesting to see a section for “Auto-Activated” offers. This was mentioned by Laube in the past, as a consideration. I was glad to see it on only a portion of offers, as opposed to switching completely to an automatically activated offers model. For further discussion on the topic of the non-activation model, see the first Cardlytics write-up.

With this new interface, it would seem there is more opportunity for different pricing for different ad placement, such as offers that are “featured” (as seen below), and as mentioned by Cardlytics when discussing these featured sections. I need to spend some additional time on how that would work when considering ROAS.

This new interface should also be better for lesser known brands or SMBs advertising on the platform, given the imagery. The ability to have images makes it easier to know what the company offers. Before, such as on the old/current banking platform, the only way to know what the company offered was to read a wall of text, which I don’t believe many people would take the time to do. (As a side note, the bank channel at one point did have images that changed between a few different pictures for a single offer, but I have not seen this back on the platform for a while.) This idea seems to be confirmed by the success of the US Bank launch, “Premium Imagery drove 5X Visits to Website on average”1.

As an example, if I saw the offers seen in the picture below, although I have “seen” all these offers, I am much more aware and able to remember, and consequently more likely to then purchase, from one with a picture shown.

Also shown was the future capability for product level offers, which is currently in the testing phase and still being built.

In total, the new user experience should increase engagement, increase activation and awareness from more understanding of the offers, and ultimately increase the number of purchases made with offers, which should increase ARPU. This seems to be verified by the US Bank Launch, where, “Visits to Rewards Hub increased by +50%”2 and “Activation Rates up +49%”3.

Push Notifications

When I did my first Cardlytics write-up, adding notifications was one of my first thoughts for how ARPU could grow. The reason, a push notification would increase awareness and the probability of making a purchase with that offer. Therefore, I was excited to hear the following in regards to the testing of push notifications.

"And then bringing it all together, with what we are building, which is a brand new set of messaging, in real time, and engagement functionality. So being able to send push notifications, that there are offers available from merchants around them at that location. Or that quite frankly, being able to create FOMO, 'Hey, here are offers that you are missing out because you are not logging in'. All of those are what we are testing right now and also have been built into the platform." - Michael Akkerman, Chief Product & Strategy Officer, Cardlytics Investor Day4

The current emails sent to bank users to drive awareness of the offers are very weak in my opinion. Push notifications should dramatically increase awareness of offers, purchases with offers, and then ARPU.

The reason these notifications are needed, is even if the offers are highly targeted and have a high probability of being used upon seeing the offer, the user may not be looking at their offers anymore if they never saw anything relevant the first time they engaged with the offers section. Therefore, push notification would let them know of these new highly relevant offers that they may now be interested in.

Even though today you can turn on push notifications for after you redeem an offer, I assumed banks would not allow it for notifying of new offers. Possibly due to coming off as spam. Therefore, the planned usage of push notification is nice to hear.

A reason these push notifications could have higher engagement than push notifications compared to other apps and ads, is due to being alerted by a notification from your bank. I would assume most people would not ignore a notification from their bank, since the first thought would likely be wondering if something is wrong. Therefore, I do not see as many people turning these notifications off, and I believe more people will read these notifications compared to other apps.

In addition, they are testing real time notifications. They mentioned notifying users of offers that are around them in real time. I feel this would dramatically increase usage of offers (and then ARPU). No longer would you have to rely on the user remembering they have an offer that they last saw 1 week ago. If you can target based on past purchases at exact times, and send notifications in real time, this could work very well. As an example, if you know a user who gets Dunkin everyday at 2pm, and can now send a notification at 1:30pm for a Starbucks offer, it is more likely they will utilize that offer when they are more likely thinking about it, and right before the purchase. Compare that to that same customer seeing that offer immediately after purchasing their Dunkin coffee. Cardlytics has to rely on that user remembering to go to Starbucks instead next time, and without their habit kicking in of defaulting to going to Dunkin.

These push notifications could also work very well with the new gas offers. Given it’s mostly a commodity type product, I personally do not care too much where I get my gas (to a certain extent), but currently have a habit of going to the same gas station, around the same time in the morning. A notification of an offer for a gas station on my normal route to work, would likely have a higher probability of usage and redemption, given the thought “I might as well go one station down and save 5%”.

Habits

I may have missed it referenced in the past, but it was nice to hear the term “habitual use” by Cardlytics when discussing the customer during investor day. They may be mentioning it more in terms of a subset of users who constantly use their offers for making a purchase. However, there is still a possibility that Cardlytics is aware of the habits of checking for offers, similar to what is seen on social media apps.

I mentioned previously in a short Cardlytics blog post, and my first Cardlytics write-up, I have built a habit of checking for new offers on all my apps (however, I am a biased customer given my interest in following the company from an investment prospective). But the area I was always curious was in regards to whether it was purposeful, or by luck.

I felt it had to be on purpose, given the consistency in the randomness of new offers presented (i.e., it is always random, and has never changed to a recognizable pattern).

I feel the “addiction” of checking for new offers on Chase, US Bank, Dosh, and Venmo is due to the timing and number of new offers having no recognizable pattern. Compared to knowing 1 new offer shows up every morning at 8am, leading to me only needing to check once a day, I find myself checking constantly, since I can go 4 days without a single offer, then 3 great offers at the same time at 11:00am.

I’ve always hoped it was from consciously structuring the offers to model B.F. Skinner’s experiments with a variable schedule of rewards. I’m still not positive that is the case, but it is nice to hear Cardlytics is aware of the habitual use. The reason is, if Cardlytics is aware, and are working to increase this among users, it would increase engagement, awareness, and purchases with offers, increasing ARPU.

And if that is not the case, it is promising to note that engaged customers are using offers often. Therefore, after the new user interface is live on all platforms, with new and more relevant offers from marketers using the self-service platform, push notifications can be sent to non-engaged MAUs, with a now higher probability of increased on-going engagement, and possible future habitual use.

Neobanks and Venmo

In the last video / write-up, I discussed how Venmo Offers could have a value that exceeds CDLX’s then current market cap of ~$3.5B. The following is the background and my thoughts around Venmo Offers, with updated thoughts even from last week.

Cardlytics has the potential to add more MAUs than I originally thought possible, and at higher gross profit levels. This can be achieved via Venmo. Powered by Dosh, Venmo offers were only available to Venmo debit card owners, and when they used that card, which would be a very small amount of MAUs. But this is changing.

From the Cardlytics investor day presentation:

“Our continued focus on growing our Venmo partnership…the team is focused on expanding rewards to additional payment types, creating a rewarding experience with Venmo, regardless of what payment instrument the consumer uses…We will also continue to invest along with product in our teams, supporting the build and partner integrations for enhancements, including currency conversion, pay with QR code currently live at Venmo.” - Farrell Hudzik, Executive Vice President, Financial Institutions, Cardlytics Investor Day Presentation5

Originally, I would assume MAUs from Venmo would be limited to users who had to get a Venmo debit card (or possible credit card). Which would be a very limited number. The following two screenshots are of my wife’s Venmo, where she does not have a Venmo card, and therefore no offers and likely not an MAU.

Versus my Venmo, where I got the Venmo debit card (for purposes of monitoring offers), have access to the offers, and am likely counted as an MAU for Dosh / Cardlytics. It is the Dosh platform, without travel, and I get different offers on Venmo than on the Dosh app.

The important point: Currently, looks to be an individual can only get Venmo Offers from getting one of their cards.

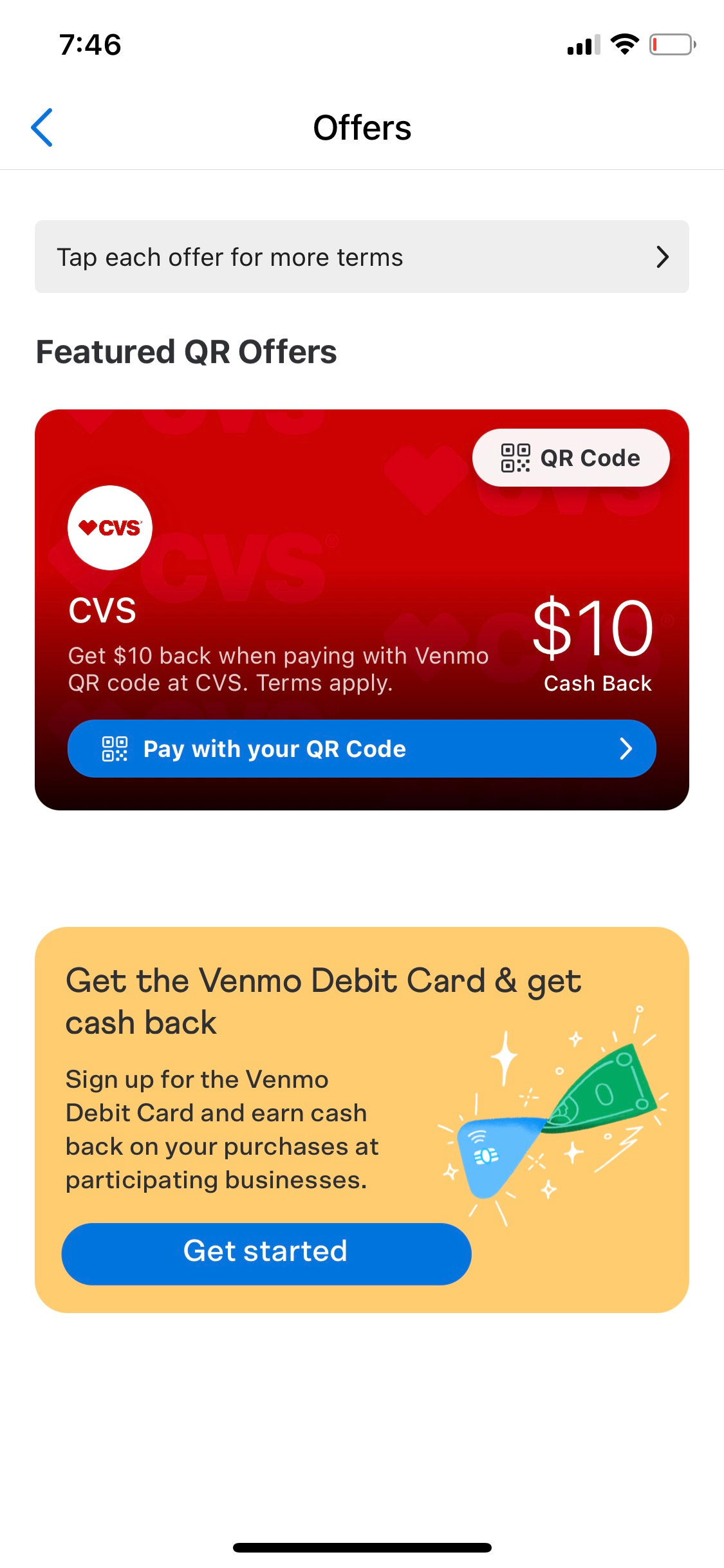

However, if now the focus is building out the capability of offers working on any payment instrument (more on this later), then offers could be available for all Venmo users. This would dramatically increase the MAU potential with Venmo.

There is obviously some double counting of Venmo users who also have Chase, Wells Fargo, etc. and have those cards/banks linked. However, even with users that have a card or bank linked that is currently covered by CDLX, there are certain transactions that would more likely to be made via Venmo. Therefore, even if it is counted as a single MAU, the ARPU for them would likely be higher. These types of transactions on Venmo are discussed in more detail below. Beyond this, there is likely a high percentage of the 70M+ users (updated from 60M just one week prior) who use other cards and banks, like credit unions. For example, I have one debit card and one bank linked, both banks not covered by CDLX.

My first thought was how will a Venmo user use a non-Venmo card or their balance to make purchases without a digital wallet? This is what was meant by Cardlytics mentioning QR codes. Homepage > Scan > “Show to Pay”. Essentially, Venmo’s version of a digital wallet.

Given Cardlytics said “regardless of payment instrument”, my hope is given Venmo “Scan and Show to Pay” allows for Venmo balance, debit, bank account, etc., that Venmo Offers will work for all these payment forms as well, and for all that are already linked to Venmo.

This would be an improvement to previous impediments to utilization. The hurdle of requiring a Venmo card made it very unlikely for offers to be seen or used. Also, requiring a new card to be added would be too much friction. This was always my concern with the Dosh app. Therefore, it is good to hear the mention of working with Venmo on allowing all payment instruments, as well as their focus on using the QR codes.

Further upside and utilization of paying with Venmo could could come from the new Venmo business profiles.

Venmo already shows that they have 2M+ businesses accepting Venmo and using online capabilities. This was something I was hoping for, and unaware of, last week.

This increases the likelihood of a transaction via Venmo, since it is no longer limited to QR code use. As seen in the screenshot below, payments can be made with businesses within their app and website.

I’m curious how many small businesses would use Venmo to accept payments. The probability of use is likely very high for business owners who already have a personal Venmo account. Given that users see the option to open a Venmo account for their business, and are familiar with the platform, I feel this would significantly increase the likelihood of opening a Venmo business account, increasing payments made on Venmo and offers sent by businesses. In addition, in the service business, when dealing with an individual, I have paid via Venmo rather than cash often. It feels very natural to do so. Given that the option to open a Venmo business account is prompted each time I open the app, I feel those who use Venmo on their business will be opening a business account soon. Paying and accepting payments via Venmo will feel more legitimate when it is with a Venmo business account, and therefore will likely be quickly adopted.

The social aspect of being able to appear on the feed seems like a benefit for businesses, as it would increase awareness and social proof of their store. This increased visibility could incentivize businesses to start accepting payments via Venmo.

Another reason for business owners to use Venmo for accepting payments is due to lower transaction fees. From what I see currently, compared to Square’s fee of 2.6% + $0.10 per transaction, Venmo looks to have lower fees at 1.9% + $0.10.

Similar to the banks, if businesses start a Venmo account and have the ability to create ads/offers directly within Venmo, it creates more opportunity for additional ARPU. With the self-service platform integrated on Venmo, it would lead to a higher likelihood of SMBs advertising on Venmo (which benefits Cardlytics), since there would be less steps compared to needing to leave the app to then go to Cardlytics to advertise, and from them already having an account with the functionality to advertise (no second Cardlytics account needed to be created).

I am curious if the transactional data will be limited to transactions made via Venmo, or if it will be more similar to what we saw with Nectar Connect, where upon linking a bank account (which many Venmo users have already done in order to fund their account), CDLX gained access to last 3 years of transactional data.

Combined, if users can use this Venmo Pay type feature, both online and in stores, and with their existing funding method for Venmo (minimizing friction for the customer), this should maximize availability and usage of Venmo Offers, and increase ARPU.

A big headwind would be changing customer behavior. Although many use Venmo, and other digital wallets, how many people will use the Venmo digital wallet or Venmo to pay beyond the areas where they already use Venmo to pay (i.e., the service business)? Maybe not much now, but we may see increase in usage if users want to make more use of their Venmo balances, use the sharing/splitting payments feature, see others using payments via Venmo on their feed, and if digital wallet usage increases.

One area that could lead to significantly higher usage of Venmo payments is the ability to split payments at purchase (similar to what is already available on Uber). Using Venmo to pay another person back is likely the single biggest reason for using Venmo. At purchase splitting (compared to post splitting, which is used now) would lead to reduced awkwardness of requesting payments, proof of amounts paid, less forgetting to “I’ll Venmo you later”, etc. Therefore, we may see increased use of paying with Venmo to split, instead of using a different card and then splitting on Venmo manually. The following in on Venmo's website:

Another possible boost in usage with Venmo, compared to other CDLX platforms, is from the social aspect. When a user makes a purchase with an offer, if it were to show up on the social feed, it would increase awareness of the Venmo Offers. Currently, it is known that payments to businesses with Venmo will show up on the feed. I have also seen when Dosh balances are transferred to Venmo that it also shows up on the feed. I am not aware if Venmo Offers used with Venmo purchases will be shown on the social feed. It does not seem that is likely, since it would lead to users making purchases with offers that did not need the offer to make the purchase. Regardless, an increase in payments using Venmo should lead to an increase in usage of Venmo Offers.

Also, once IDs are valid on phones, the need for physical wallets decreases, increasing use of digital wallets. Apple recently announced the ability to add an ID to your phone. It may be awhile until this is accepted everywhere, but shows where things are moving.

Therefore, it is nice knowing all existing bank cards can still use Cardlytics offers with digital wallets, and Venmo has their own form of a digital wallet, which could increase in use.

In regards to higher gross profits with the neobanks and Venmo:

“The ARPU opportunity at neobanks is actually greater, because the neobanks, this is their core loyalty program and they are not nearly as focused on the revenue, because they laser focused on growing their base, and see this as an engagement opportunity” - Farrell Hudzik, Executive Vice President, Financial Institutions, Cardlytics Investor Day Presentation6

I will assume instead that ARPU will remain the same, but gross profit will be higher. This is assuming that the comments mean that the revenue share is lower than with the big banks. We have heard that with the open banking model, revenue share is currently around 0%.

In total, I will be following the Venmo developments closely, and post small updates on twitter. I am eager to see what happens.

Ad Manager

The self-service platform would have a significant impact if there was integration within each of the native platforms, such as the banks. This would allow SMBs who already have a bank account to easily send offers themselves (without the help from the banks) from within the app or online (without needing to create a Cardlytics account or leave the app/website), at a time when they are thinking about their business. This would help increase the number of SMBs sending offers on Cardlytics, and increase ARPU. I am not sure if that is going to happen, but there were some discussions regarding onboarding new advertisers by the banks when discussing the ad manager.

When asked "Could you please talk about the bank systems you are building, and can banks onboard new advertisers and new campaigns at a very high pace?":

"The way we built the ads manager, is to allow anyone to be in the driver's seat: whether that is an advertiser, an agency, our own managed service team, or yes, indeed, a bank within the emerging services organization. So they can leverage that exact same platform to go and drive their own desires as they pertain and work with their merchants. Additionally, as I touched upon, we have created a lot of governance tools, for the banks themselves, that allow them to monitor, report, and control the program at large. So they get greater insight into how consumers are engaging, and greater insight into their ability to audit everything going through their channels, and those two things combined, mean this becomes a platform not just available for advertisers, but banks at scale too." - Michael Akkerman, Chief Product & Strategy Officer, Cardlytics Investor Day Presentation7

It seems as if this would incentivize banks, both current and potential new bank partners, to use the ad manager. Not only would it provide increased insights from the ability to analyze payment data, and control the offers being fed onto their platform via self-service, but it gives them more power to incentivize SMBs to open or switch accounts to them. Given the focus on adding new accounts, one would think this would be a benefit, and a way to increase how much SMBs keep and earn in a given account. Since effective ad use would also benefit the SMBs, it would seem this is another way how everyone wins.

It is difficult to say whether self-service integration with the banks that is accessible and usable by the SMBs can be drawn from the comments made, but it would seem that the ad manager in the hands of the banks would at least increase the chance of more SMBs sending offers, increasing ARPU.

Closing

So far, quite a few of my previous concerns have now been addressed, or at least discussed in terms of recognizing what is needed and how they are working to address them. These items are necessary to fulfill the potential of Cardlytics.

Long integration times with the large banks has been answered via Dosh, with shorter integration times for smaller banks and neobanks.

Concerns regarding no more MAU growth has been answered by Venmo, with potential of 70M+ more MAUs added very soon.

Not having capabilities to advertise at the SKU level data has been addressed via Bridg, ran by a capable and passionate leader.

International opportunity can possibly be addressed via open banking.

Currently not driving more awareness to the app has been previously reasoned by waiting until the new UI is in place along with more and relevant offers from self-service, but will be made aware to users via push notifications in the future.

Self service is now in the hands of more agencies, and potentially has the capabilities to be used via the banks.

Increasing engagement among users has been addressed via the new user experience, with initial success at the US Bank launch.

My current thought is the good scenario may be better than I originally thought. As always, anything can happen, where today’s market price may be the highest we ever see it again. However, everything seems to be working in the right direction, and the current market price seems to reflect conservative assumptions of today and the future, so all that may be left is some patience.

Follow-Up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more.

-Austin Swanson (Swany407)

Twitter: @Swany407

Website: Swany407.com

Subscribe: If you enjoyed this write-up, subscribe to not miss future ones.

If you enjoy the content, or have received any value from the investment insights, discoveries, and thoughts shared, please consider becoming a supporter of the channel. Your support increases the odds of more investment write-ups and content in the future.

More Detail

For more detail, I discussed these topics in the following video:

If you are looking for more detail on this company and the investment thesis, I have created a write-up, which is free to read via Substack. The write-up is formatted in bullets to more quickly skim and read sections of interest.

I also discussed the investment on YouTube.

I also released a write-up regarding valuing Venmo, and a the following video . Both were based on last week’s information of only 60M users (compared to now 70M), and assuming utilization based on not knowing the extent and capabilities of Venmo business profiles that were discussed in this write-up.

Disclaimer: This content is intended for informational purposes. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.