Cardlytics ($CDLX): Thoughts Following Q2 2021 Earnings and Price Decline

Given the recent price decline following earnings, I wanted to share some of my thoughts.

For all my notes on CDLX, check out my Qualitative and Quantitative “Research Notes”:

Current Market Cap as of 8.5.2021: $89/Share x 31.8M Shares ~ $2.83B Market Cap.

(Correction as of 8.9.2021. There are 33.04M shares outstanding. In Q2, there was 275K shares from “Settlement of restricted stock” and 904K shares from “Common stock purchase consideration for the acquisition of Dosh”, and <100k from other reasons. Therefore, market cap was closer to $2.9B.)

Introduction

I was not planning to release a new write-up on Cardlytics, and have instead been working on doing research on new ideas.

However, the overall decline in the price of the company, I thought I would at least think a little bit more about the current situation.

Quick Summary

No significant information released at Q2 earnings changes the long term value of the company. If anything, it increases due to new neobanks.

Although MAUs were reported to be down, I assume MAUs to be significantly higher in the not too distant future. Cardlytics is not reporting Dosh MAUs, and after the announcement regarding Venmo, MAUs could be significantly higher (and reported as such, based on the definition used by Cardlytics).

Despite not hitting short term guidance by management, the real thing to monitor is the results over the next 1 to 2 years. New user interface (UI), more adoption and usage by advertisers via self-service, and then notifying users with enhanced notifications. Since these are all important factors, and none changed from information during the earnings release, nor did other characteristics underpinning the longer term value of the company, on the surface nothing seems to be of concern.

Bayesian Inference

When I find a business I can understand enough to value, I typically value in terms of probabilities and expected value. This is likely a function of studying and working as an actuary for the last several years. With this thought process, the idea of a “mispriced bet” makes more sense.

When thinking in terms of probabilities, Bayesian inference is useful as new information comes to light, and can be in conjunction with specific scenarios.

Assess new information

Update the probabilities

Adjust expected values (a function of the associated scenario)

Compare new value against current price

Compare to other available investments (opportunity cost)

It works well to focus on the one or two most important metrics. If those change, then adjust the probabilities. Also, you must adjust the scenario for any given information. Depending on the business, that may be the size of the market they can capture 10 years from now, certain margins, etc.

In some situations, new information may conflict with the underlying thesis, decreasing probabilities adversely. Therefore, buy vs sell decisions may be more significant. In other situations, new information is irrelevant in relation to what really matters. In this case, no action is likely the better course.

And of course, sometimes new information comes out that increases the odds and size of scenarios, and therefore the expected value / intrinsic value increases.

New information can be released that shows negative progression. However, for longer term investing, a wider lens is needed. One cannot simply worry when something like MAU decreases by 0.9M QoQ, when it’s up nearly 60M since the beginning of 2019. This is likely a bad example, as MAUs have likely significantly increased recently with Dosh, given the work being done with Venmo.

Therefore, with a company like Cardlytics, you must have an established valuation method with associated probabilities and scenarios. As new information comes out, such as those released at investor day, via announcements, or from earnings calls, you must adjust the probabilities and possible scenarios based on that information, and in the context of a longer time period (if you are investing for a longer time period).

Before adjusting any numbers with new information, one must have a baseline. I will start with doing some reverse discounted cash flow (DCF) analysis, to see what the market is assuming at these current prices, then think through one possible intrinsic value assessment, and finally discuss what I’m looking for and adjusting.

Current Price

Reverse DCF

A possible insightful exercise with Cardlytics, is doing a reverse DCF on the current market cap, with modest assumptions, and backing into the implied consumer incentive redeemed / MAU. If you believe that is realistic to occur, the current price may not be crazy. I find doing the valuation in terms of consumer incentive redeemed is more useful than average revenue per user (ARPU), since with CI redeemed, you can compare to your own and other’s redeemed amounts to get a better idea of the reasonability.

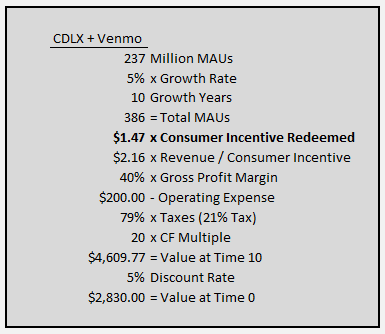

Doing an analysis based on ten years from now:

As you will notice, this includes all 70M Venmo users. Not all users have the ability to see offers, and would not be considered an MAU. However, based on management’s comments, I believe this will change, and it’s reasonable to assume they will all have access to offers 10 years from now.

In my eyes, less than $2 redeemed per user over an entire year is easy to occur. One audible or kindle purchase, one meal at a quick service restaurant, one purchase with a retailer, one time filling up gas, etc.

You could say engagement level will never reach 100% with all MAUs. If you assume it could reach 20% for instance, than the CI would be $7.35 over the entire year. Less than $0.60 / month. In terms of over an entire year, $7.35 can be covered by a single redemption for a meal with multiple people, a purchase at a home décor store, purchase with makeup, one stay at a hotel, etc. All of these are examples based on my redemptions in the last year.

I recognize Venmo user count could overlap with existing 167M user base, or never come to full fruition, and therefore…

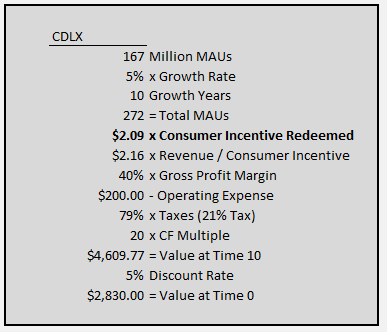

Ignoring Venmo completely:

The difference of including Venmo is minimal, given how low the current market price is. The impact becomes significant when CI increases, scaled across all MAUs, and then combined with operating leverage (part of the reason this company is attractive from an investment perspective).

Cardlytics assumptions are discussed in much greater detail here.

Venmo Offers + Optionality with CDLX

Dosh with the neobanks (like Venmo) supporting the entire current Cardlytics market cap, and the the core Cardlytics business with the large banks instead serving as the optionality piece, becomes easier to support as the price drops.

I have previously discussed this idea at a higher market cap (write-up and video).

I also attempted to think through what would need to happen for the best case scenario to occur with Venmo (write-up and video). There are no numbers, but that information can be used in combination with the valuation framework previously mentioned. Shortly after releasing the write-up / video, I discovered Square was already promoting some of the QR code items I discussed. Therefore, I would be surprised if PayPal / Venmo did not do the same.

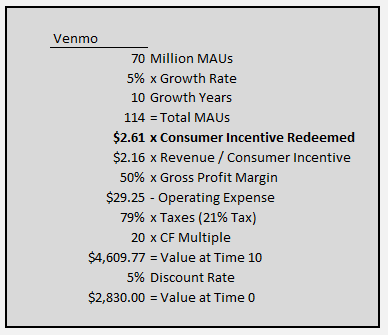

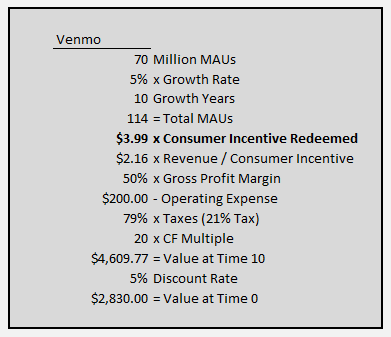

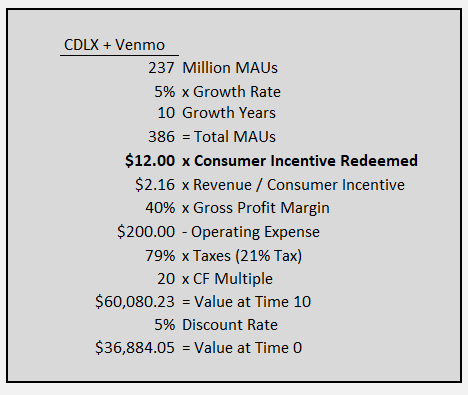

Doing a reverse DCF with only Venmo:

The lower MAU count is offset in part by higher gross margins from lower revenue share. The gross profit margin is only an assumption, based on investor day saying they would be higher from lower revenue share. Therefore, the gross profit margin could be even higher.

Allocating all Cardlytics operating expenses to the valuation:

This valuation is done as it is more accurate if you want to say the Cardlytics component with the bank channel is the optionality piece, given you must pay for the associated operating expenses.

Venmo assumptions are discussed in much greater detail here.

Assessing Intrinsic Value Today

If you wanted to use this for assessing intrinsic value, one could arrive at an assumption for consumer incentive redeemed or average revenue per user (ARPU), calculate the value, assign a probability to it, and the remaining of that probability (1-%) could be the scenario where Cardlytics goes to zero.

If you assume $12 of CI ($1 redeemed per month, or one 10% offer on a $10 item per month), the associated value is $37B. (Note: I assume higher than $12 of consumer incentive will be redeemed over an entire year.)

If there is a 25% chance of this occurring, and 75% of the company going to zero, the expected value is approximately $9B. This may be considered a mispriced bet when compared to market cap of $3B.

You can adjust inputs and probabilities to what you feel is most realistic, and as new information comes out, you can adjust the numbers further (i.e., following the framework discussed at the beginning).

What I am Waiting For

As mentioned in the summary at the very beginning, I will be watching more closely post new UI rollout, more self service adoption, and after notifications. To me, this is what will be extremely important to see how, if any, the business starts performing.

Until then, I will wait and not sell, unless some unforeseen set of information was disclosed.

What I am Watching

Typically, only a few metrics matter. If they improve, the business improves.

Overall Components I Care About

Most other items that I am watching are a component of what will adjust the numbers discussed above. Some examples:

MAUs (banks and neobanks)

Consumer Incentives Redeemed (awareness, engagement, number of offers, relevance of offers, etc.)

Gross Profit Margins (may increase with MAU increase, due to neobanks and open banking with lower revenue share)

What I am Not Watching

I am not watching or monitoring short term management expectations or goals, and comparing that on a quarterly basis. If I based my assessment of this investment opportunity based on the goals of management, I would not be invested. For instance, the goal of $500M revenue and high single digit ARPU is not attractive, nor is it aligned with what I feel is impossible.

I think central to my thesis, and likely the reason for my conviction, is that I have personally redeemed (and therefore not even in regards to ARPU) approximately $80 worth of offers in the last year, and my wife approximately $70 (and an additional $95 on Dosh for travel, but I ignore this for now, given the uncertainty in how this works).

Given our awareness of the offers from being associated with Cardlytics, we have more awareness than others. Therefore, the idea is that as other users become aware of offers (post updated UI and after more offers and relevant offers are on the platform from self service), they will start to have higher redeemed amounts as well. Increased awareness will come from enhanced notifications.

When I Would be Concerned

If we heard or saw indications of any of the following items (not an exhausted list), it would change my assessment of the company:

Number of Banks or Neobanks: Losing contracts with banks or neobanks

Decreases MAU count, and opens the possibility to larger issue of competitive advantages / benefits to the banks, etc.

Monitored by company releasing information

Awareness Levels: Rejections of new notifications by banks

Decreases awareness of specific offers, relevant offers, and that there is an offer section at all. This would decrease potential for CI redeemed and percentage of users making purchases where there is an associated offer

Tracking based on my own Chase, Wells Fargo, and US Bank apps

Engagement Levels: Rejections of the new user interface (UI) with the banks

Decreases CI redeemed and percentage of users making purchases where there is an associated offer

Tracking based on my own Chase, Wells Fargo, and US Bank apps

Attractiveness to Current Advertisers: More advertisers stop advertising (not pausing)

Decreases number and relevance of offers to users (decreasing CI redeemed and percentage of users making purchases where there is an associated offer)

Tracking based on my own offers, offers of others, management comments, and logos on website and investor presentation (updated quarterly)

Adoption by New Advertisers: Bad reception from agencies with self-service

Decreases number and relevance of offers to users (decreasing CI redeemed and percentage of users making purchases where there is an associated offer)

Monitored by company releasing information regarding number of agencies using self service, if self service is integrated with other platforms (within the bank channel, within Venmo, etc.)

Tracking based on the offers I am getting, and looking up the associated ad agency. I follow the offers (or lack thereof) of VaynerMedia closely.

Utilization of Users: Decrease in awareness / engagement / attractiveness and relevant of offers

Decreases CI redeemed, percentage of users making purchases where there is an associated offer, return for advertisers, etc.

Monitored by company releasing information (ARPU), interviewing others (CI)

What I am Seeing

Is the company getting better?

I am not sure there was any information disclosed or shared that changes my assessment of the long term value proposition of the company. I am also not comparing quarter over quarter, but over much longer time periods, as quarter over quarter changes are subject to more short term temporary changes.

Number of Banks or Neobanks:

Q2 2021: Mentioned 14 new ones, and 1 “innovative” neobank just signed with Dosh (Given the term “innovative” was used, I assume it is not Square / Cash app, as I would think a term like “large” or “well-known” would be used instead). Overall, glad to see further integration of Dosh, as I see this is where most MAU growth will come from in the future.

Prior: We know from investor day that management is working closely with Venmo, which could dramatically increase MAUs for Cardlytics.

Awareness Levels:

I receive push notifications and emails from the banks regarding redeemed offers, and emails from the banks regarding new offers. Both prove to me that Cardlytics has the ability to do the real time push notifications discussed by management. Others have felt this is not possible, given Cardlytics does not own the platform, however, Cardlytics is already doing it. As long as there is option to opt-out, I do not see a problem at this time. I don’t see others turning off notifications, given most like to have bank notifications on in case of fraud and other concerns.

One area where Cardlytics actions to drive awareness do seem to be down (and not a function of Q2 earnings news), is advertising the offers section. I used to see social media ads from Chase about using offers. Maybe they did not have great success.

Engagement Levels:

Q2 2021: I’m still on the old UI for US Bank. I’m not sure if I’m a hold out group, but if I am on the new UI discussed, it does not match the new user experience displayed at investor day. I hope to see my US Bank, and any remaining users, get switched to the new UI for higher engagement levels, and then to see all banks on the new UI over the next couple of years. Combine that with more offers and relevant offers from the self-service platform (discussed below) and notifying users of the offers on the new UI via enhanced notifications, it is hopefully what leads to further success. If it does not, I will need to reassess.

Prior: We have seen at investor day that engagement levels increased on the new UI for US Bank. Therefore, we can assume that as this rolls out to other banks, engagement will increase as well. Awareness should also increase via notifications.

Attractiveness to Current Advertisers:

Although quarter over quarter the number of offers was done slightly (based on myself and other’s offer section), I have seen advertisers that came onto the platform in the past, recently come back out with new offers with different offer amounts, new images, etc. This tells me they have not stopped advertising, and still see value in the platform.

Adoption by New Advertisers:

Q2 2021: There has also been quite a bit of new offers from advertisers I have never seen on the platform before. Given their smaller size, I assume some of this is from the adoption and utilization of the self-service platform by agencies. Compared to approximately a year ago, the self-service platform has went from only 2 using to 27. That is progress. In addition, VaynerMedia, an ad agency with a founder who understood Facebook and Twitter before other agencies, and is typically going to platforms before others (like TikTok), has continued to use Cardlytics, and has done many tests with different features (Cardlytics and different logos, Dosh with flash sales, etc.). If I stopped seeing offers from their ad agency, I might get concerned.

Utilization of Users:

Q2 2021: Pretty much the same ARPU levels, and slight decrease in redemption of offers from myself and others (discussed more later).

Prior: Utilization by myself and others seemed to be increasing in lockstep with new offers from new advertisers coming onto the platform and advertising in the bank channel. Therefore, as more continue to do so from self-service, utilization should increase, as it’s more likely there is an offer that is relevant to a user (also allows for more targeting ability when there are more offers possible in the Cardlytics universe).

What I am Doing

This quarter gave no significant information that I saw that changes to the long term value of the company in a negative way. If anything, the disclosure of more neobanks has increased the value of the company (a function the size of each of these neobanks).

When calculating intrinsic value / current price, assessing management and business qualities, and factoring in additional quantitative factors, and comparing that overall “score” to other companies and investment opportunities, it is hard to compete with Cardlytics.

Therefore, I have continued to increase my position for myself and others.

As always, I recognize I can be wrong, and this is what has stopped me from allocating 100% to Cardlytics. Also, by doing so, it makes it so you cannot rebalance when there are price actions such as this week. One might ask, “this is the same price as back in May, so why add again here?”. More cash (continued selling of rental properties), higher appreciation from other holdings, and higher expected value following investor day.

Validity in Management Guidance and Comments

Many people seemed upset that results fell short of management’s guidance. As said above, and reiterated here, I am not watching or monitoring short term management expectations or goals, and comparing that on a quarterly basis. If I based my assessment of this investment opportunity based on goals of management, I would not be invested.

Another comment by management, that was questioned by others:

“We believe advertisers spent less than we forecasted for three reasons. First, there were labor shortages. Second, retailers and restaurants had supply chain issues. And third, there was an increase in consumer demand, reducing the need for advertising with several key clients….As a result, some marketing budgets across our client base were actually paused in Q2” - Lynne Laube

These comments make sense. However, I wanted to compare against my own experience and data.

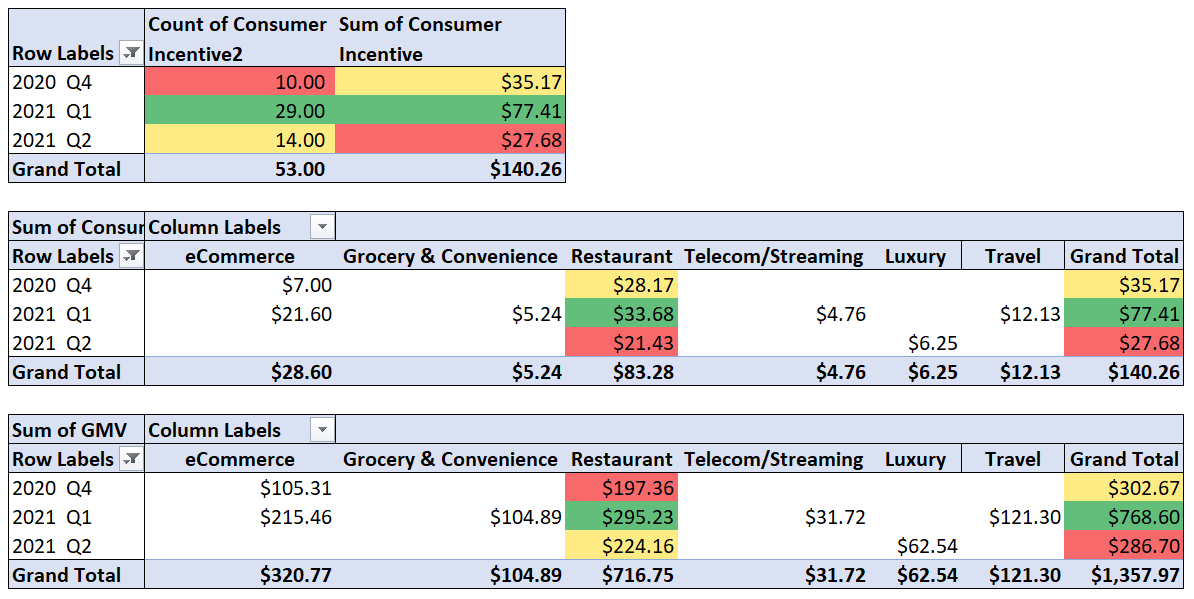

I have been aggregating my results (mostly attempting to estimate ARPU based on gross merchandise value, consumer incentive, ROAS, etc.).

If you look at mine and my wife’s redeemed offers (biased, but aware and engaged users), you can see a trend that is in line with the comments made. Comparing Q1 to Q2, both quantity of redemptions and dollar amount of redemptions fell. This was a function of less offers in total, and less new, attractive, or relevant offers.

For the consumer incentive and gross merchandise value (GMV) totals, I broke it out by category as well. Restaurant followed the overall trend, and I believe it was partially to explain from the lack of offers from restaurants.

However, eCommerce had the largest decline. This was due to us no longer using DoorDash (categorized as eCommerce by Cardlytics) and their associated offers, despite still receiving them. This dropped to zero for my wife and I post vaccine and nicer weather, and not due to reasons discussed by management.

This is not enough of a sample size to confirm or deny management comments. However, it did seem like a good excuse to finally make use of this data.

Closing

It is very possible I have an incorrect assessment of Cardlytics. I fear my judgement could be distorted from my sizable amount of public posts regarding my thoughts around the company, and have developed "commitment bias”. This is why for years I did not post anything on my investment thoughts, nor discussed it with others. However, I feel the benefits of hearing from others and thinking through my thoughts more concretely via writing, outweigh the negatives from a recognized bias.

Things are not perfect, but if they were, there would possibly be no investment opportunity. At the end of the day, it’s not about finding the biggest or best company. It’s about finding the best investment.

Follow-Up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more.

-Austin Swanson (Swany407)

Twitter: @Swany407

Website: Swany407.com

Subscribe: If you enjoyed this write-up, subscribe to not miss future ones.

If you enjoy the content, or have received any value from the investment insights, discoveries, and thoughts shared, please consider becoming a supporter of the channel. Your support increases the odds of more investment write-ups and content in the future.

More Detail

I discussed this topic in more detail in the following video:

More Information on Cardlytics

Opportunities with PayPal

Best Case Scenario with Venmo

Cardlytics Investor Day

Discussions on new UI, notifications, Venmo, and more.

Venmo Offers: Valuation

I walked through potential valuations in the following write-up and video:

Detailed Write-Up and Valuation

If you are looking for more detail on this company and the investment thesis, I have created a write-up, which is free to read via Substack. The write-up is formatted in bullets to more quickly skim and read sections of interest.

I also discussed the investment on YouTube.

Disclaimer: This content is intended for informational purposes. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.