Cardlytics ($CDLX): Valuations & Intrinsic Value

Discussions on how Cardlytics could be worth $0 to $1 Trillion+.

For all my notes on CDLX, check out my Qualitative and Quantitative “Research Notes”:

Please Note: For those subscribed and reading via the email, this write-up is truncated due to the amount of detail and pictures. Therefore, please reference the write-up online.

Current Market Cap as of 8.18.2021 = $81 / share x 33M shares = $2.7B

Summary

Given the length and detail of this write-up, I wanted to provide a summary.

Valuations of Cardlytics:

$0 if monthly active users (MAU) and average revenue per user (ARPU) stay constant (can’t surpass fixed costs)

$3B, the current market cap, is appropriate under 0% MAU growth and ARPU reaching $7.12 in 10 years, or 3% MAU growth and ARPU reaching $5.30 in 10 years

Ignores further benefits from more offers and relevant offers following more self-service use, enhancements in user interface (pictures, presentation of offers, organization of offers, etc.), Bridge and SKU level offers, international and open banking growth (with higher gross profit margins), MAU growth from neobanks (with higher gross profit margins), and possibility of lower taxes / higher multiples / higher gross profit margins than are being assumed

$217B valuation today (not 10 years from now) based on the average of top-down TAM approach and bottom-up approach based on consumer incentive data, both using reasonable assumptions, valued at year 10 and discounted back to today

$803B valuation today is the average of the top-down and bottom-up scenarios under more aggressive assumptions but in line with the current market for similar companies (valued at $1.7T in 10 years under the best case top-down approach)

$50B valuation today represents the scenario under reasonable assumptions but then ignoring new neobanks and take 50% of ARPU (or rather assume 50% engagement), or assuming small portion of TAM, and value under remaining reasonable assumption (not aggressive assumptions)

$120B is my best estimate of intrinsic value today (not the valuation 10 years from now), with a reasonable range between $90B - $180B.

It is not a question of whether the best-case scenario will happen or not. Nor are we trying to find the one scenario that is most likely to happen and stop there.

Specifically, we cannot assume the correct intrinsic value is $803B without assuming that will occur 100%. Therefore, we must assign probabilities to all the valuations under different scenarios. However, as time goes on, these probabilities change. For instance, the intrinsic value increases as new developments occur and the business improves, such as more neobanks, as the probability of the larger value scenarios occurring increases.

This quantifies the qualitative aspects of news surrounding the business improving. Therefore, the range under different developments should be referenced and used as a better way to understand this (and not take for certain, given these are only guesses and examples).

Thoughts on Current Price and Future Value

I believe the current market cap reflects short-term thinking and linear extrapolation of MAU and ARPU assumptions, as well assigning no value to future developments due to their uncertainty. Although they are difficult to quantity, the uncertainty should have a value of more than zero.

I feel this is one of the most unique situations I have ever come across, where the market price gives so little weight to the size of the future cash flow potential, which is due to:

The growing size of the total addressable global digital advertising market (as well as the market size beyond this)

The competitive advantages that increase the odds of obtaining and maintaining a large market share

The relatively small amount of capital needed

Upon this, the probability of earning these large amounts of future cash flow is higher than most assume due to:

The business continuing to improve from acquiring Dosh for neobanks, acquiring Bridg for SKU, open banking early success, new user interface and notification development, and more)

A single entity with 600 employees all dedicated to working on the same outcome

The number of constituents acting in the same direction to all maximize their benefit while still benefiting all others

We all have the same information available, but it becomes a function how much is gathered * how it is assessed and interpreted * how it relates to other information known. I believe others have not spent enough time on this to appreciate what is not only possible, but also more likely than assumed.

Enjoy.

Introduction

The purpose of this write-up is to attempt to rationalize and explain why Cardlytics is currently perceived as overvalued, how the current market price could make sense, and why it instead could be undervalued based on best estimates of valuations under different scenarios.

If we knew which was true, and the corresponding actual future cash flows, we could discount them back and know the correct value of the company. However, the true scenario is unknown, and each possible scenario with an associated valuation has a probability of occurring. Given this, I estimate probabilities of each occurring to arrive at an expected valuation, or the intrinsic value of Cardlytics today.

Please remember, this is not investing advice, and for educational purposes only. These assumptions are only my educated guesses based on currently available information. Also remember, the valuation of a company interacting with internal and external complex systems with varying uncertain outcomes cannot be boiled down to a single precise number. Therefore, a range of intrinsic values will be given, based on probabilities associated with each scenario and associated valuation.

If you enjoy this write-up, consider subscribing to not miss any future ones.

Assumptions

A full list of assumptions is included at the end of this write-up. A few important ones are discussed here as well.

Timeline

All valuations are estimating what Cardlytics could be earning in cash flow 10 years from now, or 2031. This is a subjective timeframe. The paths laid out could occur in as little as 5, more than 15, or not at all. The timeframe is arbitrary, and was chosen to allow for a reasonable amount of time for events to play out.

Engagement Under Bottom-Up Approach

When valuing this company from a top-down total addressable market (TAM) approach, total revenue is estimated, and therefore no consumer incentive (CI), average revenue per user (ARPU), or engagement level assumptions are assumed explicitly.

However, under the second valuation method of doing a bottom-up approach, I do make these assumptions explicitly.

For consistency among valuations and scenarios, I will assume 100% engagement, but then vary the CI redeemed and ARPU for these users.

For example, instead of assuming 20% engagement and $10 ARPU, I would assume 100% engagement and $2 ARPU, having the same total revenue impact.

Many will point to that current engagement is fairly low among the total 167M bank channel MAUs. Therefore, one may only assume this number grows say to only 50%, and then assumes higher consumer incentive (CI) redeemed and average revenue per user (ARPU) for these engaged users only, and $0 for everyone else. (I do provide a valuation with 50% ARPU / engagement assumed).

One assumption I am making, is in the fullness of time, all users will use at least one offer per card, and therefore there will be 100% engagement. Part of this increase in engagement will come from the shift of more of the digital desktop users to using mobile, who have shown higher engagement. However even more significant, the thought is there are perfect offers out there for everyone, but those companies are either not advertising on Cardlytics yet, they are advertising to the wrong people, that customer or data is not in the system yet, or the incentive of the offer is currently too low. Over the next 10 years, I assume this will change.

If for instance you were notified of a free meal (large incentive) at the nice new restaurant down the street (now advertising) in the category you love (more likely to redeem, and information known by Cardlytics), would you not consider using the offer? A free meal is not entirely unconceivable, as the return on ad spend could be extremely high based on the lifetime value of the targeted customer (which is purchase data Cardlytics would also have). Different variations could include clothing, travel, etc. The point is, it seems irrational that there is not at least one perfect offer for everyone that would lead to engagement or usage.

Discounting

One can do a reverse discounted cash flow analysis, and back into the interest rate that equates the future cash flows to today’s market price, and therefore gives you the implied return you could earn.

Another way is to use the same discount rate on cash flows for all companies, discount them back, and use that as a way to more evenly compare the difference between price and value for opportunity cost purposes.

A final way, and what is used here, is to attempt to value the company based on how most others may one day value the company (Uh-oh, we may have just walked into a Keynesian beauty contest). By doing so, you have a better idea of what the price could end up being, regardless if you disagree with the approach.

While some may use cash flow multiples, and comparable to companies like Facebook, which is around 30x FCF today, I like to rationalize it with what we are doing, which is discounting future cash flows at how others may discount, such as at the risk-free rate plus an equity risk premium and growth factored in. Assuming an average future 30-year treasury rate of 5%, an equity risk premium of 3% once stabilized and mature, and a growth rate of 3% after year 10, PV = CF / (i-g) = CF / (5% + 3% - 3%) = CF / (5%) = 20x CF. This also means the discount rate is simply 5%.

I wanted to have some consistency in assumptions, and then only change one or so variable at a time. Therefore, the discount rate remains the same across all scenarios and valuations (accept under the aggressive assumptions scenario), but the associated probabilities reflect the likelihood of that scenario and corresponding valuation occurring.

This may not be the most correct approach, but it is how I am thinking about it. Feel free to adjust numbers to fit your assumptions.

With that out of the way, let’s begin.

Overvalued Scenario

A consistent theme by those who initially view the price of Cardlytics is to perceive it as overvalued. If one was to look at traditional point-in-time statistics and financials, one would see things such as no profitability and price-to-sales greater than 10x.

However, investing is about considering what the company will deliver over the future, and not just considering today, or what happened over the last one year. In essence, it’s irrational to assume a company is worthless or expensive at no profitability or 10x sales if in 10 years cash flows will exceed the market price today.

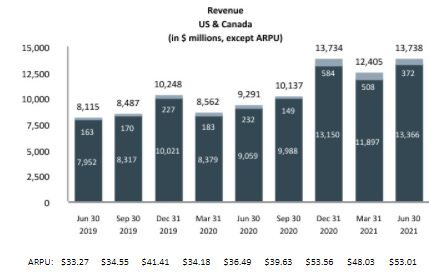

Many know this and look to project cash flows out in the future, and discount that value back to today to arrive at a value for the company. In order to do so, many also understand the driving factors of future cash flow for a company like Cardlytics. Therefore, others naturally start to look at average revenue per user (ARPU). Where the thinking diverges again is in terms of future ARPU levels. Most either assume a consistent level in the future, or linear growth going forward (both of which could prove to be accurate assumptions), rather than exponential growth.

Assuming consistency in all assumptions (MAUs, ARPU, margins, operating expenses, etc.), Cardlytics is essentially worthless, since it would never be cash flow positive. There is a level of fixed costs (which are now higher with Dosh and Bridg) that must be surpassed in order to produce positive earnings and cash flow, and that is not possible with current MAU and ARPU levels remaining the same forever.

Two “simple” ways for Cardlytics to produce cash flow is from monthly active users (MAUs) growing, or ARPU growing. If you assume these will never change (which is possible), then your assessment will likely lead you to a valueless Cardlytics, and the current valuation that is significantly overvalued. If so, easy enough to move on from this investment idea. You could consider shorting, however, I would consider the likelihood of MAUs and ARPU being larger in the future, and how small changes in magnitude lead to large increases in cash flow. Given even a small probability of a scenario where Cardlytics is worth many times today’s value, shorting may not be worth the risk.

Correctly Valued Scenario

There is also the situation where the company is simply correctly valued. Given the amount of people looking for inefficiencies in prices in the market, it very well could be the case that investors have collected all applicable information, assessed the situation, and have traded away any difference between price and value.

Scenario 1

Keeping all assumptions the same, but backing into APRU, leads to ARPU of $7.12 in 10 years from now. This is in line with management’s guidance, and may be why the market is assuming it.

Therefore, if you assume MAUs will be greater in 10 years than today (growth in the bank channel, neobanks, etc.), and/or ARPU greater than $7.12/year (from more offers and relevant offers from self-service, SMBs, SKU, improved user interface, etc.), and/or lower taxes / higher multiples / higher gross profit margins, then the company may be undervalued for you, and worth considering as an investment.

Scenario 2

However, if you adjust slightly for modest growth, such as 3% growth in MAUs from the existing banks, adding more digital users, or Cardlytics adding more traditional banks, you get to 224M MAUs in ten years. If this growth is only from the traditional bank channel, then the market may be ignoring Dosh / Venmo and any other future neobanks (such as the 14 new ones mentioned at Q2 earnings), given Venmo alone is around 70M users (167M + 70M = 237M > 224M projected).

Upon this, $5.30 in ARPU is only slightly higher than the $2.30 baseline (and considerably less than the almost $194 in ARPU that Facebook earns in the US and Canada). The $2.30 amount is where ARPU was at when Bank America was on the old user interface and with less offers. Overall ARPU has trended downwards, given the denominator effect of adding significant MAUs from Wells Fargo and Chase (need time for becoming aware of the offers).

Therefore, if you assume ARPU can happen naturally and grow to $5.30 from increased awareness of the existing offers, such as from notifications (similar to the increase I've seen in friends and family once aware the offers existed), then the market is ignoring further benefits from:

More offers and relevant offers following more self-service use by more advertisers / companies & SMBs / individuals

Enhancements in user interface (pictures, presentation of offers, organization of offers, etc.)

Bridge and SKU level offers

International and open banking growth (with higher gross profit margins)

MAU growth from neobanks (with higher gross profit margins)

Possibility of lower taxes / higher multiples / higher gross profit margins

If believed, this may be an indication that the current market price is undervalued, and/or there is optionality in today’s price.

Undervalued

The simple indication of being undervalued is if you believe that the items the market is ignoring will actually come to fruition, or have a high probability of doing so. If they do occur, then the market will need to adjust and the price should increase, and therefore the current price is undervalued. The market tends to wait until things are near certain before adjusting valuations, at least for a short-term holding stock like Cardlytics. (Based on free float / average volume. This metric may not be perfect, but approximately equals 3-4 months, or the time between earnings. This makes sense based on the movement seen after past earnings. This metric also holds true for stocks like BRK.A, producing holding periods greater than 3 years.)

I will approach my best estimate valuation from two ways: from top-down (from total ad spend) and bottom-up (from the consumer level). I will then take the average of the two to come with a representative valuation. I do this both under reasonable and aggressive assumptions.

One baseline adjustment scaled significantly is operating expenses. Before Dosh and Bridg, Cardlytics was around $117M in 2020. I assume that may be closer to $200M in time (Dosh had a smaller employee base, and Bridg was extremely small from my understanding). However, I will assume for these higher value scenarios, that to get this growth, operating expenses will grow 5x that amount to $1B in 10 years. However, unless this numbers grows even more and proves to be widely inaccurate, due to the relative size of gross profit, gross profit is likely to be very close to operating profits in the future, and estimates of operating expenses are less impactful.

Under Reasonable Assumptions

Top-Down

Digital advertising is an incredibly large and growing addressable market, not limited to the US. The entire global ad market is addressable via international banks, neobanks, open banking, etc. The total addressable market may even be in excess of digital advertising, due to how companies may view the use of Cardlytics differently than other forms of advertising.

This is a large market that Cardlytics has the potential to gain and maintain a substantial share, due to competitive advantages over other digital marketing platforms.

To top it off, low levels of capital are needed for that market share and corresponding revenue, leading to high levels of future cash flow and intrinsic value.

Total Addressable Market (TAM)

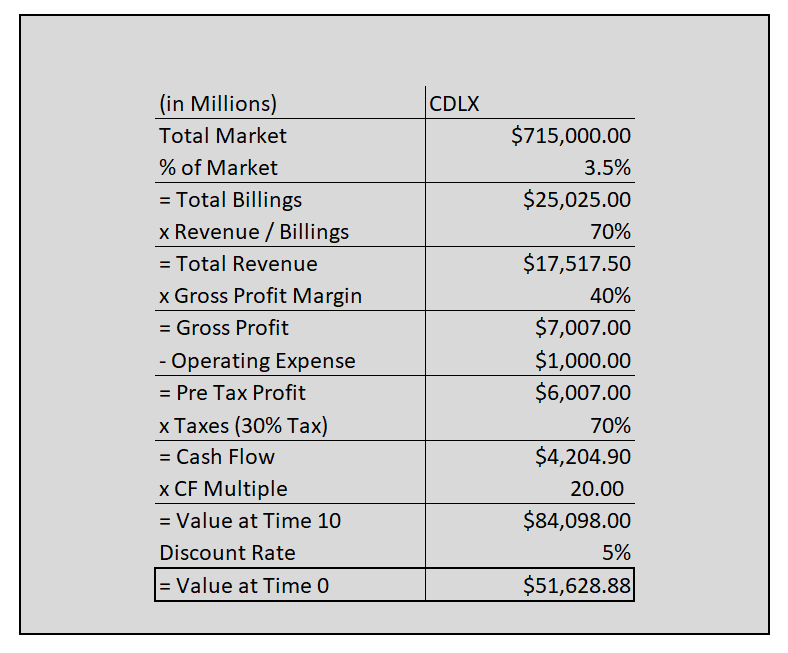

To get to the TAM 10 years from now, I took 2020 digital ad spend of $378B, projected to 2024 to match reported estimates to get to $646B, then used a much smaller growth rate of only 3% until 2031. I feel this is conservative, due to the amount of additional advertising that can shift to digital. From there, I removed automotive ads which have been around 10% (as I assume they will not advertise on Cardlytics for the time being) leading to a worldwide digital ad spend market of $715B in 10 years.

In terms of what portion of the market is addressable, I believe we have already removed the most significant portions of digital ad spend that Cardlytics will not capture, such as ads for automotive. I believe remaining areas such as CPG and SKU are covered by Bridg, SMBs are covered by self-service, branding / imagery / future videos are covered by improving the user interface, and further worldwide ad spend is captured not only by international banks and neobanks but also open banking.

My assumption is those companies and advertisers that currently use Facebook and Google to advertise will continue to do so. Part of this could be explained by consistency bias: “It has worked in the past, why would we change?” Even if companies and advertisers hear their measurements are of lesser standard, they will likely not go back on what they originally believed (similar to those who only advertise on tv, print, radio, etc. since that is all they know). Therefore, I do not see Cardlytics stealing any of the current $231B earned by Facebook and Google. We could assume none of the existing ad spend will change, however anything extra that is locked in, could equally be up for grabs from FB and Googles share. Therefore, I will stick to only excluding FB’s and Google’s existing amounts.

The incremental growth of $484B (=$715B-$231B) seem addressable.

Cardlytics Share of TAM

To figure out the share of TAM, we need to understand how this compares to alternative advertising options.

Certainty vs Other Digital Marketing Options

If Facebook (FB) and Google are considerably better, than it’s hard to expect a large market share in the future for Cardlytics.

Given digital advertising platforms like FB and Google do not have purchase data, they do not have the level of certainty in their results. I had not fully considered the importance of this until the relistening to Cliff Sosin on Business Breakdowns - Colossus and YAVB. My own interpretation of these ideas may turn out to be incorrect. Therefore, I would strongly consider listening to those interviews if you have not done so already.

In my mind, the significance of the certainty of data is more easily recognized when thinking in terms of control groups to compare true incremental returns from ad spend.

I’ve heard others say they don’t trust Cardlytics, since they don’t know if it was due to other efforts like FB and Google. However, the control group would have the same level of FB and Google ad exposure, and the incremental returns would show CDLX’s contribution. If anything, I feel that without the certainty in purchase data for the control group for FB and Google, they can never say with any degree of certainty they contributed to the increase in sales. More importantly, digital advertisers like FB rely on tracking means, such as pixels, that face privacy concerns. In time, this level of data reliability could continue to decrease, further widening the gap between uncertain data on other platforms and the certainty offered by Cardlytics.

Without having certainty in incremental data, I feel any level of ROAS means nothing. For example, say there is a group of people who all recently saw a TV ad. You show a FB ad to 50% of them and all make a purchase, leading to a 100x ROAS on a FB ad, and FB says there was a significant increase in incremental sales between the two groups, showing no additional sales in other group. However, in the control group of the remaining 50%, it is possible they all made the same level of purchases but in store, rather than online, and therefore not known to FB. Therefore, since FB is relying on other secondary means to know if a purchase is made, instead of the underlying direct payment like Cardlytics, they will may not see this data. Therefore, the incremental returns are actually zero, and its was possible you could have spent nothing to get the same additional sales since those same customers were already planning to make a purchase due to a given TV ad (since you simply got in their path of purchase with a FB ad). Also remember, Facebook and Google are incentivized to not let advertisers understand or believe this distinction, out of risk of loss of revenue.

Therefore, Cardlytics has significant advantages over Facebook, Google, and other platforms that cannot be easily replicated. As more advertisers / companies / individuals realize this difference and advantage, usage of Cardlytics will increase, leading to a sizable share of the advertising market. It will only become harder to rationalize spending all your ad budget with uncertain returns, when there is an option for certain returns in the brand safe environment via Cardlytics.

Converting Customers vs ROAS

It seems ROAS isn’t the correct way to think about Cardlytics, since the advertiser could break even from the ad on an individual transaction, and then benefit from future purchases over the lifetime of the new customer (which could be measured with Cardlytics but not on other digital ad platforms).

For example: no incremental profit after ad spend on a Starbucks drink offer, but Starbucks benefits from lifetime purchases that new converted customer now makes (data Cardlytics has). In this case, the return as a function of future purchases on that original single ad could be very large. And if they don’t convert the first time, they can try again for free (when incremental return from the ad equals ad spend). The thought of converting customers is shared by advertisers, given companies like Starbucks mention their loyalty program in their Cardlytics offer, attempting to add them to their loyalty program.

More specifically and better when SKU is enabled, if McDonalds can now see someone gets a breakfast sandwich at Burger King every morning, they can target that individual with a breakfast sandwich offer where once they open the app it shows a rich image of the McDonalds sandwich. (I use this example, as it illustrates that SKU will provide information that is extremely helpful for targeting purposes, when previously it was unknown exactly what they are buying within a retailer with various items. Maybe 10% off McDonalds won’t convert the customer, but when they see a SKU level item that they like, with a deal, and an image to visualize it, I feel conversion would increase substantially.) If for instance the sandwich is $2 and the margin on that incremental sandwich is 50%, and the total ad spend is $1, McDonalds spends $1, but makes that $1 back post purchase (and doesn’t pay unless there was a purchase). But the true benefit is from if you can get the customer to switch, such that now every morning they now get their breakfast sandwich from McDonalds, and McDonalds’ returns on the single $1 are enormous. Future purchases can be tracked on Cardlytics. Not only does this help knowing if they instead go right back to Burger King, and another free attempt can be initiated, but it also allows for the ability for ad spend to be made as a function of future sales, instead of on a single sale.

Comparing to investing in securities, as the risk decreases or certainty increases, investors accept lower returns trending towards risk free rate. Said differently, investors are willing to pay more and accept lower returns based on certainty. Although the future returns and sales are not certain, the data is certain within Cardlytics. At the end of one year, you can see with certainty what was spent, and compare the difference to the control group. Therefore, advertising becomes similar to investing, with returns / ROAS trending towards risk free / certain returns, i.e., advertisers willing to accept lower returns since the returns are certain. With the purchase data, ROAS could become a measure over the lifetime of the customer, and pay an amount later (such as at the end of a quarter or year). Instead of paying $1 for an ad that led to $2 of revenue on the single offer, if that one offer led to $100, then at the end of the year, that advertiser could be contracted to pay a total of $50 since their true and certain return was 2x (instead of 100x from the first purchase). This could also be a function of incremental returns to the control group, which also has certainty. This could lead to a substantial increase in ad spend by companies.

It would seem Cardlytics could earn a large portion of the market share given the advantage of certainty in incremental returns, the ability to acquire new customers for free, and track with certainty future purchases on an individual customer post advertisement.

Resulting Share

If we assume approximately a $715B market in 2031 (10 years from now), it is possible Cardlytics could gain 25% of the remaining additional $484B ($715B in 2031 - $231B currently contributed to Google and Facebook) based on the items discussed above. With the remaining 75% of the additional market assumed to be made up of Google, Facebook, Amazon, and current and new advertising options globally.

If what is assumed above is true, 25% may end up being too conservative. However, it the items mentioned above do not come true, or advertisers do not think in the same way I laid out, then 25% may end up being too high.

Top-Down Valuation

If Cardlytics can get 25% of this incremental worldwide spend of $484B (equivalent to 17% of total $715B market), the total billings would be $121B and the valuation is $283B.

Bottom-Up

Consumer Incentive and ARPU

Given the actual data I have from others, I like to use that when possible, and approach ARPU from consumer incentives. It also makes more intuitive sense and I can rationalize the numbers easier. For instance, it’s easier to make sense of whether $20 in ARPU is reasonable, when I can compare to myself redeeming $80 (which is presumably less than ARPU).

The following are the amount of consumer incentive redeemed by friends, family, and other followers of Cardlytics within the last 1 year, and split by card: $118.5/2, $95, $60, $70, $24, $20/2, $9, $9, $6.35, $7/2, $5/2, $5/2, $3.61,$0, $0, $0. I divide by 2 when there are 2 adults using the offers from the same card. (For more information on CI, such as why I do not sum up consumer incentives from different cards for each individual, see the appendix).

The average of the redeemed amounts is $22.17.

This represents a group of individuals who are aware that the offers exist, and may be an appropriate representation of future users once they become aware of the offers over the next 10 year.

The $22 is only based on current offers and functionality. I believe and assume redemption of offers will increase quite significantly with additional offers from more advertisers from self service, SMBs from self-service, SKU level offers, and overall relevancy and notifications of offers increasing.

Assume redemptions grows by 5% for 10 years from the improvements described above (which is very conservative, assuming $22 can be achieved on the existing offers once aware), and you get $36.11 in consumer incentives. If we can assume $2 in revenue / CI, we get $72.22 in ARPU. (For more information on the $2 of revenue / CI used to convert CI to ARPU, see the appendix.)

One assumption being made is ARPU seen today in this sample from the US, will be representative of worldwide ARPU 10 years from now. As a reasonability check, Facebook ARPU in US and Canada over the last 12 months was $194.23. This will increase over the next 10 years, but I believe other parts of the world for Facebook’s revenue will catch up, such that worldwide revenue will in 10 years match US ARPU today. Given some of the competitive advantages Cardlytics has over Facebook, it doesn’t seem unrealistic assuming 37% of where Facebook is today in the US, or 37% of where they could be in 10 years worldwide. If anything, this seems conservative.

MAUS

MAUs of 565M may seem large at first. However, when considering current 167M in the banks + 80M Dosh and Venmo (and growing) you are already at 247M. Then factor in natural growth of 5% a year (likely higher for Venmo over the next 10 years), you get 402M. The remaining is from assuming 100M from other neobanks, who will grow at 5%. Even if Cardlytics does not sign these additional neobanks this year and gather 100M, they can still sign them 10 years from now when they are significantly larger, and therefore growth of the underlying neobanks is factored in even before signing them. To also rationalize 100M more users from neobanks:

PayPal: I have seen numbers north of 300M for active customer accounts on PayPal, and as high as 400M in 2021. Even assuming 70M is Venmo, that is over 300M using PayPal. Despite the size, I would assume most active are not active within the PayPal app, and the large active amount is a function of checking out with PayPal online. However, app usage could increase over time, making PayPal a valuable potential partner.

NU Neobank = 38M worldwide users

Cash App = 36M users

Revolut Neobank = 15.5M users

Chime Neobank = 12M users

Revenue and Billings

If we assume 167M MAUs from the bank channel, 80M Dosh and Venmo, 100M more neobanks (explained more later), and 5% growth, and with $72 ARPU, it leads to revenue of $40B, or approximately $60B in billings.

To tell whether this is reasonable, I will compare against potential worldwide digital ad spend in 2031 (10 years from now) shown earlier of $715B, which is only 8% of the market. If the competitive advantages hold, and the benefits of this platform over others are true, then this could be more than reasonable, if not conservative. As banks fund more of the offers to drive engagement in the bank apps, and advertisers accept lower returns to convert customers with certainty, revenue can increase substantially.

Bottom-Up Valuation

I assume a slightly higher gross profit margin, since in the bottom-up approach I am making assumptions for MAUs, and then doing a weighted average gross profit calculation to get 45% (vs the 40% assumed in the top-down approach) due to the higher gross profit margins on neobanks from lower revenue share.

Adding this together leads to a valuation of $150B.

This does ignore some amount of the international growth via open banking (with also lower to no revenue share), but the valuation should reflect the international opportunity via MAUs and neobanks.

Combined Valuations

Going forward, the approximate average of the two worldwide valuations of $283B and $150B, or approximately $217B, will be used for simplicity.

Under Aggressive Assumptions

This is only a projection and is likely widely off, but assuming effective tax rate of 30%, CF multiple of 20, and 3% growth from 2024 to 2031 for digital ad spend in the entire market, all reflects some degree of conservatism.

Instead we will assume 25% tax rate, 33.33 CF from 5% growth rate used, and 5% digital ad market growth.

Top-Down

Total worldwide is $818B:

Taking worldwide of $818B, minus $231B locked in for Facebook and Google, is $587B, and assuming a higher assumption of 33% of that is $194B, or about 24% of the total worldwide market.

At year 10, this is worth approximately $1.7T under these assumptions and valuation method. Discounted back, worth $1.24T today.

As a further reasonability check, $194B billions in ad spend in 10 years is only 1% of the global retail sales of $20T today, and only 0.5% or 50bps, of projected $40T by 2030. These are reasonable percentages of retail sales for advertisers to spend to help increase customer count and increase sales.

The advantages over other platforms, not only leads to higher dollars spent, but possibly even in excess of previous budgets, as it may be looked as less of an advertisement, but more of a way to optimize the business from the perspective of gaining additional customers that could be converted. Therefore the market opportunity and possible future cash flow could be higher.

Bottom-Up

Changing the assumptions mentioned above leads to a bottom-up valuation of $364B.

Combined Valuations

Therefore, the average under the aggressive scenarios is $803B. Although “aggressive”, the effective tax rate is lower than Facebook and Google today (FB averaged 18.9% the last 2 years, and Google 14.8% the last 2), and we are using approximately the same cash flow multiples (FB at 32, and Google at 32). Therefore, maybe these are the most reasonable assumptions for how the market could value this company in the future.

Under Conservative Assumptions

Some may say the above scenarios are unlikely. Therefore, doing the same expected value with a more conservative scenario, basing it on the ones using more reasonable assumptions of 30% effective tax rate, 20x FCF multiple / 5% discount, and 3% international growth.

Top-Down

The first is to assume 20% of of the originally assumed ~17% market share, or only 3.5% of worldwide, leading to an approximate $52B valuation:

Bottom-Up

New assumptions:

No additional 100M of neobanks acquired

Since less percentage of MAUs is from neobanks, will assume higher revenue share and lower gross profits

Also will assume 50% the amount of consumer incentives redeemed, or same consumer incentive but only for 50% of the engagement (compared to 100% engagement)

This leads to a value today of approximately $48B.

Combined Valuations

Therefore, the average is approxately $50B under the more conservative assumptions.

Intrinsic Value

The true valuation of Cardlytics is completely uncertain. As said before, maybe some are right and the company is worth $0. Or maybe the market is right and the correct valuation is the current market cap. Or the scenario of $1.7T actually occurs. Given the uncertainty, one can only assume probabilities for each scenario, come up with an expected value, and compare to the current market cap.

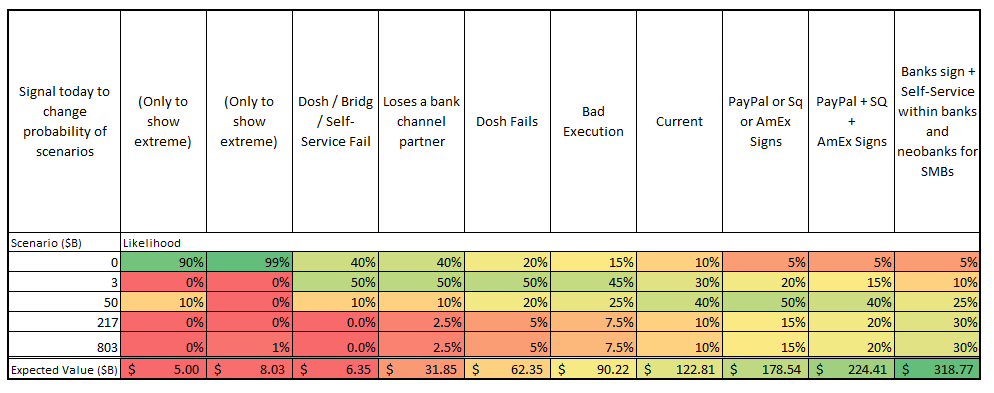

For an extreme example, we could assume only two scenarios, where Cardlytics is worth $0 or where it’s worth significantly more.

Assuming 90% probability of going to $0, and 10% where this works out roughly how I expect, an expected value for the company is 90% * 0 + 10% * $803B= $80.3B, or about 30x today’s price. Even just a 1% probability of occurring gives a value of $8.03B, still 3x today’s price. Reversing it, the current market cap could be a representation of a ~0.3% chance of working out, and a ~99.7% chance of going to zero.

Assuming the same 90% chance of going to $0, and 10% of being worth $50B, we get an expected value of $5B, still greater than today’s market cap of $3B. Backing into the percentage based on the $2.67B market cap, today is assuming only a 5% of this scenario occurring.

If you think the likelihood is higher, than this could be a mispriced bet. The attractiveness of the bet increases as the market price decreases. Therefore, the current decline in the market price has increased the overall attractiveness and decreased the risk. Also, you don’t even need the scenario to occur, you only need the market to realize the mispricing, and benefit from being repriced.

Probabilities Applied to Scenarios

As new information comes to light, the probabilities change, and therefore so does the expected value today.

Below is a full set of expected values from a range of subjective probabilities attached to different scenarios. This is only shown to illustrate how expected value changes as we learn new information and the probabilities change. I did not spend considerable time coming up with these probabilities, so do not take any more than the idea from this section.

For instance, if we knew Cardlytics lost Chase, it would not only decrease returns, it may also be a sign of other issues, and therefore the probability of one of the high valuation scenario occurring decreases substantially, and increases the odds of a lower valuation scenario, leading to a lower overall expected value. However, there is still a small probability of a larger scenario playing out via other banks and neobanks, leading an expected value still in excess of today’s price.

This helps see how the valuation is mostly a function of how likely the $217B and $803B scenario are, given their magnitude in relation to other valuations. Given scenarios such as the ones with only a 10% of being greater than $50B, and the expected value is greater than the market cap today, the market is simply giving no weight to the higher value scenarios.

I believe based on the competitive advantages, operating leverage, scale, management efforts, acquisitions, etc., of the company, I would say there is at least a modest probability of the $217B or $803B scenario occurring, and not 0% assumed by the market.

Given this current inefficiency in not yet converting more addressable customers due to previous inability to do so with certainty before Cardlytics, or rather deviation in what could be optimized by the company, I feel that once the power shifts to the advertisers / companies and SMBs / individuals via self-service, the flood gates open, and the efforts will no longer be limited to Cardlytics. Similar to how the internet allowed for more information to be easily accessible, making the market more efficient to trade away any gain based on new information. You now have a platform that allows you convert all customers much quicker and more reliably than ever before, which will lead to spending what it takes until there is no more additional benefit. Therefore, the odds of success and future ad revenue increase dramatically, and specifically for the scenario of $217B or $803B occurring.

Another reason for even larger market share / higher probability of a large valuation scenario, is Cardlytics has very little headwinds, given every constituent in the ecosystem is benefiting. If consumers didn’t like their data being used (like on Google or Facebook), it may increase privacy concerns and less usage by users. However, consumers want and enjoy saving money. Given the level of trust with the banks and since its seen as more of a reward similar and better to the 1% or 2% they associate this with, I see customers finding their way to save more money. I also don’t see banks pulling this reward from consumers, given they cannot do this on their own in the same scale with the same benefits as leveraging a common dedicated resource like Cardlytics. I also see the banks attempting to maximize engagement, and thereby giving up more of their share not to Cardlytics, but the consumer, to incentive more usage (which increases usage and redemptions for Cardlytics). Not only do you have the 600 employees of Cardlytics working on this, but you also have everyone in the ecosystem working in the same direction trying to remove any inefficiency and grab every single dollar possible. Cardlytics found the way to solve these problems for everyone and gets a small percentage for doing so. This all increases the odds as well of a high valuation scenario occurring.

In addition, I feel there is a high chance of $50B from just the traditional bank channel, a reasonable chance of being correctly valued if a lot of things do not occur, and a slight probability of going to $0 (I will never assume 0%), leading to a best estimate intrinsic value of $120B today (not 10 years from now). This is shown as the “current” scenario above.

As new information comes out, I would adjust the probabilities, either increasing or decreasing the expected value.

I believe a reasonable range is between $90B to $180B for today’s value, given anything could be announced in the short term that could immediately adjust these probabilities.

Although probabilities and the associated expected values adjust, it does not mean action needs to be taken. Given the market price’s significant discount to the expected value, even large changes in value still lead to returns far in excess of other opportunities, and does not dictate major buy or sell decisions. Large announcements and updates could change the probabilities and expected values more, leading to bigger decisions to be made.

Probabilities Applied to Assumptions

You can also look at this by instead applying the probabilities to the individual assumptions, such as ARPU and MAU. I have done so separately in my own calculations. However, this leads to the same end results as above, and simply a different way to approaching it. For instance, you can say there is a X% chance of ARPU being a certain level, multiply those together for an expected ARPU, use it in the calculations, and come up with an expected valuation. This compares to coming up with the valuation under the full ARPU and applying the same probability. You are simply moving the order of when the probability is multiplied. The net result is the same. Differences come from different unique probabilities to multiple assumptions. I found assigning probabilities at the assumption level removes the simplicity in the work accomplished above, given then you are making more individual probability assumptions (probability ARPU is X AND probability MAU is Y AND probability gross profit is Z AND so on). Therefore, I will not show this work here.

Allocation

Even if the expected value is significantly above the market price, there may be a scenario where there are negative returns or permanent loss. Even if there is only a small probability of permanent loss, that does not mean that single scenario won’t occur. In order for the actual outcomes to trend towards matching the probabilities, we must repeat the same event multiple times and have the law of large numbers work its magic. If we bet everything, and the single true scenario that plays out is the low probability one of permanent loss, we will not have anything left to continue taking new bets and making the most of the law of large numbers. Therefore, to avoid ruin, we must only allocate a portion to a given idea, but can scale that based on the probability of success and the size of success.

Given that, I have not allocated 100% to Cardlytics. However, in the accounts I manage, I have allocated a substantial portion to Cardlytics. Within my personal portfolio, I am willing to allocate an even higher percentage. Although you do not want to bet the farm, I’m young enough where I can always save up again and buy another one.

Closing

Given the uncertainty in what will actually happen, it is better to both:

Assess what the current market assumes, and decide whether you agree or not

Use ranges of expected values based on probabilities

The largest catalyst to close the gap between price in value is simply management executing well on all the items the market is currently ignoring, leading to substantial increases in MAUs and ARPU and consequently higher cash flow reported.

There are simply too many forces working on the same direction for Cardlytics to not gain substantial market share in the end, such as all constituents in the ecosystem benefiting and attempting to optimize their business, as well as the advantages of certainty and durability of data that other digital advertisers cannot offer.

Based on my own personal assumptions, and what I laid out here, I believe $3B is quite inexpensive for this opportunity. I do not need the Kelly formula or expected values to see this may be one of the few investments in my lifetime I understand, checks nearly so boxes, and is significantly undervalued. Therefore, I have invested appropriately to make the most of the opportunity.

Follow-Up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more.

-Austin Swanson (Swany407)

Twitter: @Swany407

Website: Swany407.com

Subscribe: If you enjoyed this write-up, subscribe to not miss future ones.

If you enjoy the content, or have received any value from the investment insights, discoveries, and thoughts shared, please consider becoming a supporter of the channel. Your support increases the odds of more investment write-ups and content in the future.

More Detail

I discussed this topic in more detail in the following video:

Sources

Cliff Sosin’s interviews contain a significant amount of information on Cardlytics. After relistening, I heard things I had missed and not thought of before, specifically in areas regarding the quality of data and results, and how advertisers may use the platform differently. I strongly suggest you spend time listening or reading these interviews if you have not done so already.

Cardlytics, Facebook, and Google 10-Ks and FB 10-Q

Assumptions

Bank Channel MAUs: 167M MAUs is based on current 2021 company data.

Dosh and Venmo MAUs: 10M from known neobanks with Dosh (such as N26) and 70M for Venmo is based on the company website. All users do not immediately become MAUs. For now, only limited to those with a Venmo debit card. I believe all users have access to the Venmo QR code offers powered by Dosh, so it’s possible all users could be counted as MAUs, but engagement and utilization will not be there until more payment types open up.

Bank Channel Gross Profit: 36% gross profit margins are from the average of the last 3 years.

Dosh Gross Profits: We know from investor day, that neobanks have lower revenue share, and therefore higher gross profits. Therefore, I’ve assumed instead of a total gross profit of 36%, I assume 50%. This includes delivery costs, and not just FI share. This leads to weighted averages of around 45%. Under more aggressive assumptions, I assume Dosh and neobanks at 60%, leading to weighted averages closer to 50%.

Current ARPU: $1.36 is based on the last 4 quarters.

My Data on CI: $118.5/2, $95, $60, $70, $24, $20/2, $9, $9, $6.35, $7/2, $5/2, $5/2, $3.61,$0, $0, $0. I divide by 2 when there are 2 adults using the offers from the same card. You could also count each one with 2 as two individuals, leading to more points, which slightly adjusts the CI amount. (Other friends and family are not in the CDLX ecosystem, and not eligible for rewards).

The reason for not summing up individual card redemptions per individual, is to leave MAUs to reflect all individual cards / accounts. For example, counting 2 MAUS from 1 Chase card with $60 redeemed and 1 Dosh account with $20 redeemed for a total of $80 but $40 / MAU, rather than 1 MAU showing a total of $80 and an average of $80/ MAU. In total it is the the same when adjusting MAUs accordingly. I do this because people use different cards for different reasons, and redemptions can be more with more cards, different offers, etc. For those I have asked that are active, they have redeemed at least 1 offer on each card, given the offers vary by card. Upon this, I reduce the number of assumptions I have to make. If I find the average across all cards per MAU, I then have to make an assumption on number of individuals per MAU, something I do not know how to calculate with any degree of confidence, unless Cardlytics has adjusted for this already.

Revenue / CI: 2.16 based on 10K, ignores revenue from non-CPS and non-CPR (i.e. “other”).

The consumer incentives used above ignores purchases made where there was an associated offer, but the offer was not activated, and Cardlytics was still paid under the cost per served sale (CPS) pricing model. However, I feel there is a very small portion of purchases made where there is an offer, but no activation occurred with aware and engaged users.

Further complications come from what portion of redeemed offers were funded by the bank. This leads to questions regarding if only CPS CI is in the 10K, excluding CPR since paid by advertisers, and excluding CI paid by the banks.

For now, I will continue using the 2x revenue / CI assumption, as I feel in time, advertisers will accept far less ROAS, and banks will pay more of the offers, leading to higher revenue in relation to CI, and therefore offsetting other items mentioned, and therefore reasonable to keep the assumption at approximately 2x. There are too many adjustments that can be made, that I would rather be generally right if possible.

Total Operating Expenses: Before Dosh and Bridg, Cardlytics was around $117M in 2020. I assume that may be closer to $200M in time (Dosh had a smaller employee base, and Bridg extremely small from my understanding). However, I will assume for these higher value scenarios, that to get this growth, operating expenses will grow 5x that amount to $1B in 10 years. This expense will grow over time but will remain generally fixed in relation to growing revenue, and therefore provides operating leverage.

Taxes: 30% tax rate, based on 21% corporate tax rate (could very well increase over time), and margin for state taxes and future increases.

CapEx: $6.5M of CapEx (capital expenditures) is based on the average of the last 3 years, which is approximately equal to the average depreciation and amortization of $5.2M over the last 3 years, so these have been cancelled out and ignored, especially in light of their size in relation to revenue.

Discounting: 20x and 5% discounting was discussed at the beginning. 30x CF multiple can be looked at as a multiple that investors may be willing to pay for a mature CF generating business with growth potential. Also, could be thought of as the present value of all future cash flows, discounted at the risk-free rate plus an equity risk premium and growth factored in. Assuming an average future 30-year treasury rate of 5%, an equity risk premium of 3% once stabilized and mature, and a growth rate of 5%, PV = CF / (i-g) = CF / (5% + 3% - 5%) = CF / (3%) = 33.33x CF. This also means the discount rate is simply 3%.

More Information on Cardlytics

Thoughts following Q2 2021 Earnings and Price Decline

Opportunities with PayPal

Best Case Scenario with Venmo

Cardlytics Investor Day

Discussions on new UI, notifications, Venmo, and more.

Venmo Offers: Valuation

I walked through potential valuations in the following write-up and video:

Detailed Write-Up and Valuation

If you are looking for more detail on this company and the investment thesis, I have created a write-up, which is free to read via Substack. The write-up is formatted in bullets to more quickly skim and read sections of interest.

I also discussed the investment on YouTube.

Disclaimer: This content is intended for informational purposes. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.