Cardlytics ($CDLX): New Observations, Upcoming Earnings Calls, and Updated Allocations

Regarding Q3 and Q4 2021 (Q2 2021 discussed in prior a post)

For all my notes on CDLX, check out my Qualitative and Quantitative “Research Notes”:

Market Cap as of 10.20.2021: $85/Share x 33M Shares ~ $2.8B Market Cap.

This discussion is around Q3 and Q4 2021. For thoughts on Q2 2021, please see the following write-up and video.

Introduction and Purpose

Update

Over the last month, I have slowed down on write-ups, videos, and social media activity, to spend more time focusing on new ideas, my investment process, and reading books and investment letters. However, given it only takes a couple minutes a day, I still actively monitor Cardlytics. Given the current price, coupled with the new observations and associated allocations made, I felt it was worth discussing.

Topics

This write-up will share:

New observations made on Cardlytics during Q3 and Q4 (all post earnings call on 8/3/2021)

Thoughts on upcoming earnings calls for Cardlytics

Updated allocations and investments for Cardlytics

Short-Term vs Long-Term Focus

I felt it would be a nice change to shift focus to a more point-in-time and short-term view of what is currently happening with Cardlytics (especially given the current price), rather than the very long-term focus and potential runway of Cardlytics that has been discussed in the last few write-ups.

For all investments, I am thinking and investing for 5-10+ years out. This still requires monitoring the business to ensure the original thesis is intact, the probability of success is increasing (and in general, the business is improving), and customer value proposition for users, advertisers, and banks is growing.

I have no idea what any short-term quarterly results will be. These are simply my observations, thoughts, and associated allocations. Given the following observations show the original investment thesis is still holding true, probability of success increasing (business improving), and the customer value proposition is increasing, even if upcoming earnings results show poor financial results, I will continue to buy if nothing changes or nothing negative is announced that results in the business worsening or customer value proposition decreasing. Even though the observations discussed below could result in improving financial results, and should in the long term, it may be a while until they show up, and we may see no impact in the immediate future.

Noticeable Changes in Financial Results

Noticeable changes in financial results are less likely to occur until:

More self-service rollout for more offers and more relevant offers

Integration of Bridg for SKU / product level offers for more offers in general and more relevant offers (including usage by CPGs, grocery stores, and more)

New user interface to increase understanding / engagement / redemptions (Panera specifically mentioned wanting more than a logo, as well as functionality for SKU)

Using emails and push notifications to make users aware of these improvements

Therefore, until these occur, results are likely to continue to be much of the same, and requires patience by investors (which is not reflected by the price reactions and short average holding period of the stock, which presents the opportunity in hand).

Reason for Sharing

Despite there being a lower likelihood of significant changes in financial results, I’ve decided to share the thoughts in this write-up as I feel there are still many promising improvements and developments at the exact same time there is negative sentiment and depressed prices. I feel this presents a unique opportunity, where the market price ignores any benefit from the above possible future improvements occurring (please see the following write-up or video on Cardlytics valuations and reverse DCFs to see how the market is implicitly ignoring these possible improvements), while at the same we can observe the company making progress on those exact items (some of which are discussed below).

Observations

Dates

Where I could, I included the dates when the observations were made. This is to illustrate that they were all for Q3 or Q4 2021, and post Q2 earnings call (which took place on 8/3/2021). I believe this is an important distinction for this discussion, as these developments would have not shown up in results yet, nor discussed by management at earnings or when giving Q3 2021 guidance.

Confirmation Bias

It is possible there is a level of confirmation bias in these observations. I may be only seeing the positive, and unknowingly ignoring the negative. However, as will be discussed in the negative sentiment observation section below, negative observations discovered by others have been shared with me. Those shared with me were either opinions (i.e., not factual developments) or were incorrect or possibly incorrect observations (either drawing false conclusions, or no way to tell if correct conclusions from the observations), and therefore not included. I only wanted to focus on observations observed, and those that directly apply to Cardlytics with certainty (to avoid speculation and drawing false conclusions amplified by the negative sentiment).

Prespecified Items to Monitor

In the content posted following Q2 earnings (write-up and video), I included a list of items I am monitoring, and when I would be concerned. I have copied that list below, as the observations I have made are in direct relation to this prespecified items. I also wanted to copy the exact list as previously posted, to remove any chance of “moving the goalposts”.

When I Would be Concerned

If we heard or saw indications of any of the following items (not an exhausted list), it would change my assessment of the company:

Number of Banks or Neobanks: Losing contracts with banks or neobanks

Decreases MAU count, and opens the possibility to larger issue of competitive advantages / benefits to the banks, etc.

Monitored by company releasing information

Awareness Levels: Rejections of new notifications by banks

Decreases awareness of specific offers, relevant offers, and that there is an offer section at all. This would decrease potential for CI redeemed and percentage of users making purchases where there is an associated offer

Tracking based on my own Chase, Wells Fargo, and US Bank apps

Engagement Levels: Rejections of the new user interface (UI) with the banks

Decreases CI redeemed and percentage of users making purchases where there is an associated offer

Tracking based on my own Chase, Wells Fargo, and US Bank apps

Attractiveness to Current Advertisers: More advertisers stop advertising (not pausing)

Decreases number and relevance of offers to users (decreasing CI redeemed and percentage of users making purchases where there is an associated offer)

Tracking based on my own offers, offers of others, management comments, and logos on website and investor presentation (updated quarterly)

Adoption by New Advertisers: Bad reception from agencies with self-service

Decreases number and relevance of offers to users (decreasing CI redeemed and percentage of users making purchases where there is an associated offer)

Monitored by company releasing information regarding number of agencies using self service, if self service is integrated with other platforms (within the bank channel, within Venmo, etc.)

Tracking based on the offers I am getting, and looking up the associated ad agency. I follow the offers (or lack thereof) of VaynerMedia closely.

Utilization of Users: Decrease in awareness / engagement / attractiveness and relevant of offers

Decreases CI redeemed, percentage of users making purchases where there is an associated offer, return for advertisers, etc.

Monitored by company releasing information (ARPU), interviewing others (CI)

New Observations Made in Q3 and Q4

Monitoring Item #1:

When I Would be Concerned

Number of Banks or Neobanks: Losing contracts with banks or neobanks

Decreases MAU count, and opens the possibility to larger issue of competitive advantages / benefits to the banks, etc.

Monitored by company releasing information

Relevant Observations in Q3 and Q4:

New Dosh Partners

Observation Date: 8/17/2021

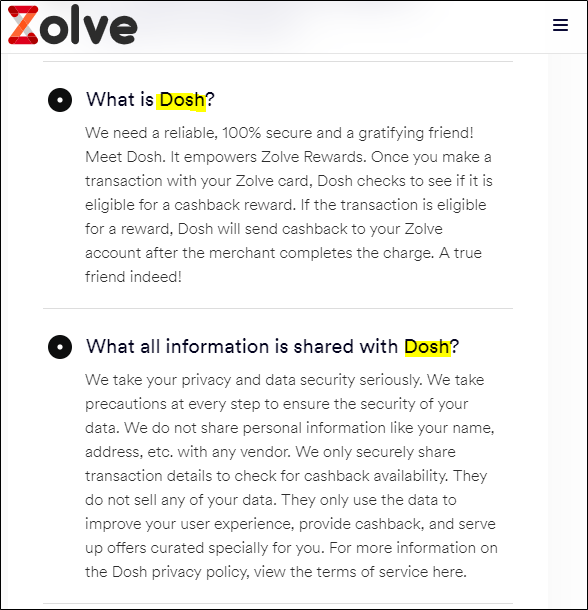

First, Cardlytics posted on Twitter a blog on neobanks, tagging Figure, Betterment, and Zolve (none were mentioned in the actual blog post). Betterment is already an announced partner with Dosh. As of this tweet, Figure and Zolve had not been officially announced as partnering with Cardlytics / Dosh. It could have been implied, but not known for sure based on this post.

However, on Figure / Figure Pay’s website, they explicitly state partnering with Dosh:

And here:

The same is seen on Zolve's website:

Observation Date: 9/7/2021

Later, on 9/7/2021, Cardlytics made an official blog post on their website regarding Zolve.

Observation Date: Around the same time as above

Two others that I have come across as potential partners for Dosh is Line / Line Financial and Treecard.

Similar to Zolve and Figure, both Line and Treecard have terms and conditions pages where they explicitly state using Dosh. Further proof for Line using Dosh / Cardlytics can be found by Line using a Target offer on their website for their rewards that is the exact same as on Dosh's website (same picture, same language, same font, same layout, same offer amount, etc.)

Observation Date: 10/20/2021

Cardlytics also announced a partnership with Sliide.

“Powered by Cardlytics’ cash back platform, the program will allow smartphone users to get automatic cash rewards every time they spend in-store or online at over 10,000 retailers, including Walmart, Dunkin’, Asos, Instacart and Pizza Hut. The rewards can be used in any way the subscriber wishes, including reducing their phone bill.

Users link their credit or debit card to their account and spend as usual.” - Source

Given Sliide is London based and requires users to link their cards, it is possible this is working due to open banking.

Long Term Importance: More neobanks and fintechs provide advertisers with different places to advertise, different consumers, larger reach, and more data. In addition, in the situation where users switch from traditional banks to more neobanks and fintechs for their primary bank and associated transactions, then it is in Cardlytics’ best interest to continually partner with more (and focus more on the larger ones).

Figure Pay also mentions "access buy now, pay later loans". Line mentions getting cash for emergencies and paying later. Buy Now Pay Later (BNPL) was discussed during Cardlytics’ investor day. Could just be a coincidence, but it would be nice to partner with more BNPL providers (larger ones to be specific) in case BNPL is adopted and used significantly more in the future.

Additionally, expanding reach in the UK is necessary to take advantage of the high advertising demand in the UK (currently Cardlytics does not have the scale to match their demand). Additionally, more open banking partnerships will help establish Cardlytics as a leader in the open banking space, and could lead to more looking to partner with Cardlytics, which would expand upon their current advantages in the open banking space (where Cardlytics already has experience in this area with large amounts of transactional data, is a trusted partner given experience and already trusted by the banks, and offers a revenue stream).

Monitoring Item 2:

When I Would be Concerned

Awareness Levels: Rejections of new notifications by banks

Decreases awareness of specific offers, relevant offers, and that there is an offer section at all. This would decrease potential for CI redeemed and percentage of users making purchases where there is an associated offer

Tracking based on my own Chase, Wells Fargo, and US Bank apps

Relevant Observations in Q3 and Q4:

Push Notifications Added

Observation Date: 8/13/2021

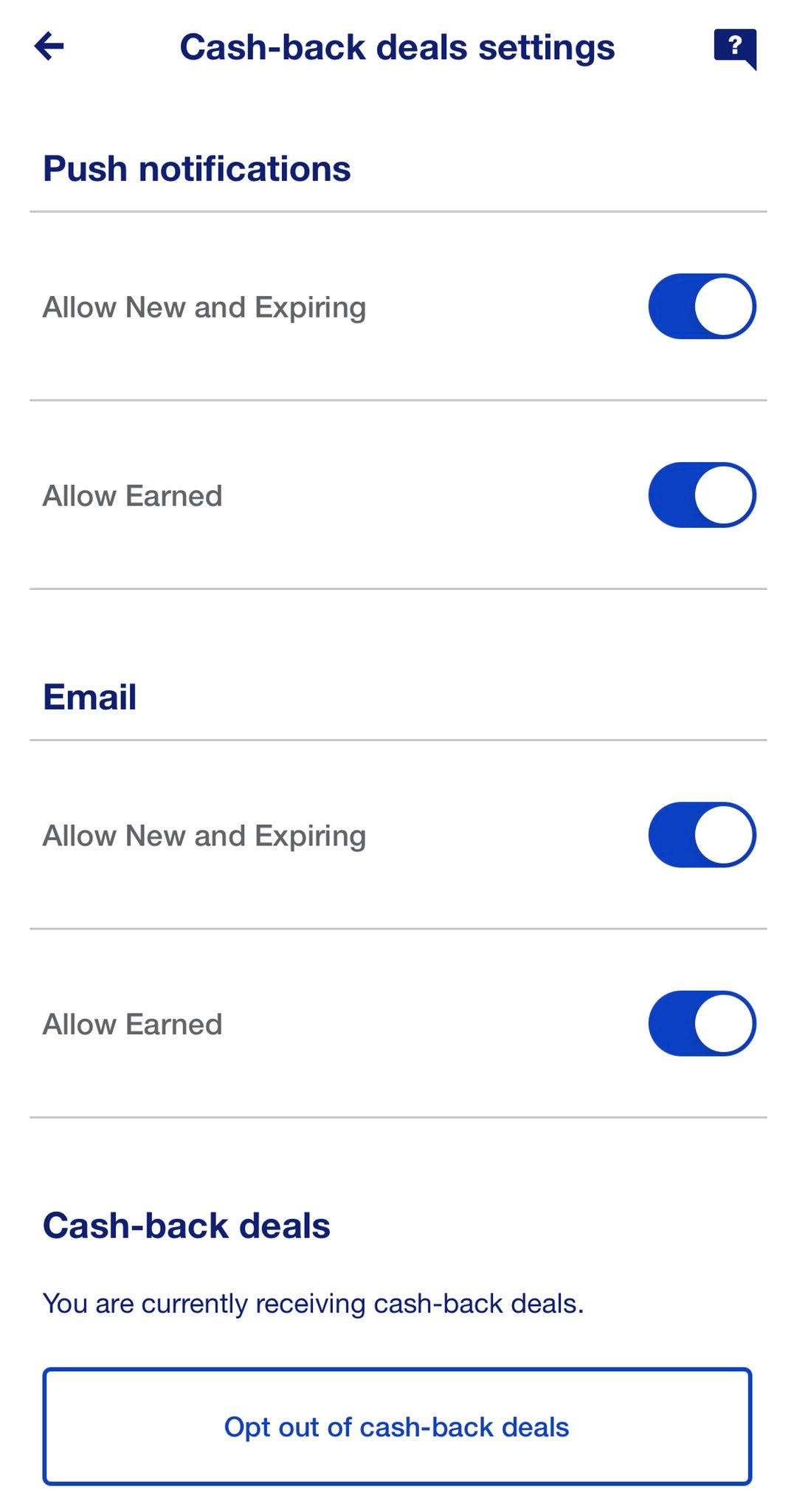

US Bank has settings for push notifications for offers. So far, I have only seen this on US Bank, which may make sense given it is currently the only bank on the new ad server. At the time of the observation, you could not activate the push notifications without getting an error.

Push Notifications Enabled

Observation Date: 9/16/2021

Previously users, such as myself, could not activate the push notifications. Now, push notifications can be turned on for US Bank (some investors thought it would never happen, despite banks mentioning they wanted this feature and already having push notifications for offers redeemed like on Chase).

It will be interesting to see if the push notifications will be defaulted on, with the option to turn off (better for everyone than defaulted off, since if defaulted off, only users who know about offers would turn this on, when the reason for the notifications is also to bring awareness to users who do not know they exist).

Long Term Importance: Push notifications will not only help with increasing awareness of specific offers / relevant offers / time-bound offers, but will increase awareness of offers in general. Cardlytics has waited to notify more users of the offers section, which I feel is the right decision, as you do not want a bad first impression, and therefore should wait until more offers and more relevant offers (from self-service and SKU / Bridg-integration), new user interface, etc.

New / Multiple Entry Points in Chase App

Observation Date: 8/15/2021

Although Chase has not added push notifications for new offers like US Bank (they do use push notifications for when an offer is a redeemed, and emails for new offers and redeemed offers), they have recently added a new “Benefits” tab, with a second way to get to Chase Offers. This shows Chase putting more focus on the Cardlytics-powered offers.

Long Term Importance: With now two ways to get to the Cardlytics-powered offers (like on US Bank), it increases the odds a user will discover the offers and therefore increases awareness, which leads to higher engagement and making corresponding purchases.

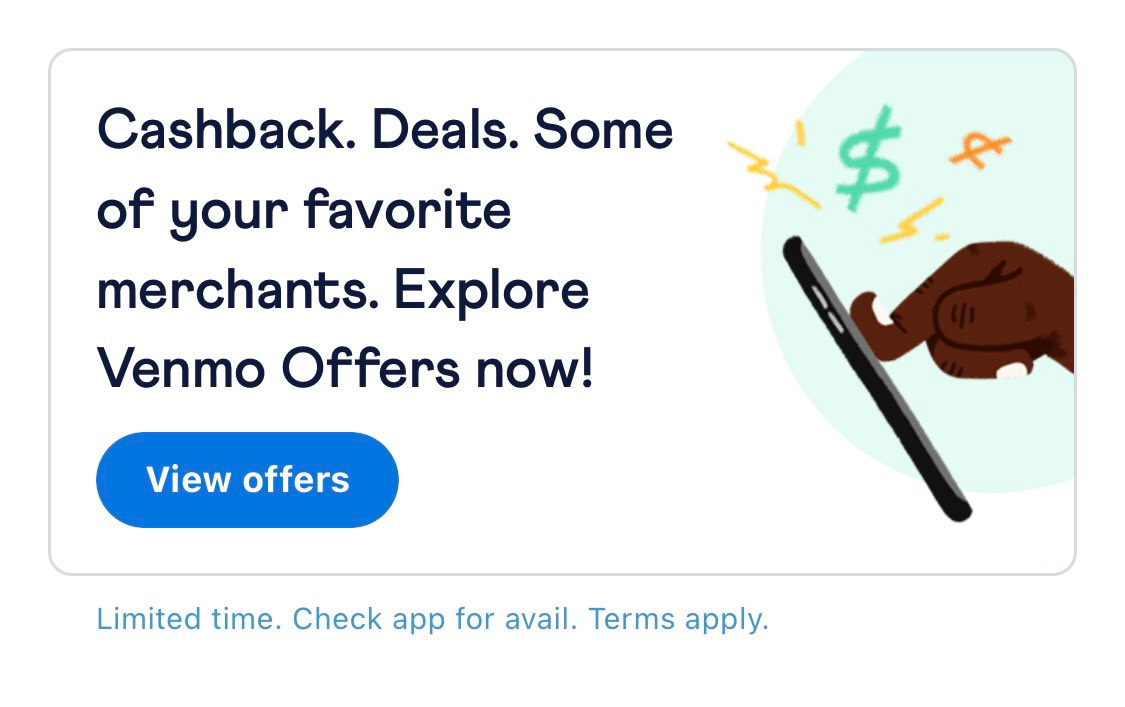

Venmo Rewards Shared on Venmo Social Feed

Observation Date: 9/18/2021

Similar to Chase, no push notifications for new offers have been added in Venmo. Maybe this will be added in the future, given Venmo is powered by Dosh, and Dosh uses push notifications for offers.

Although no push notifications to increase awareness, Venmo does include on their social feed when a user earns cashback via Venmo Rewards / Venmo Offers (Venmo calls it Venmo Rewards in their social feed, and Venmo Offers when promoting it on their homepage).

Long Term Importance: This increasing the awareness of Venmo Offers, leading to higher engagement levels and then more users using the offers over time. I even had a friend reach out and ask what it was, after seeing that on their feed.

Venmo Promoting Venmo Offers (Powered by Dosh)

Observation Date: 10/9/2021

Another way awareness of Cardlytics / Dosh offers is increasing is via advertising within the channel. Below is a promotion for Venmo Offers on their homepage. Not sure if it’s exclusive to the Venmo debit card holders (such as myself), or open to everyone (then only showing QR code offers). This is good to see given the offers are pretty hidden within Venmo.

Long Term Importance: Similar to showing Venmo Offers on the Venmo social feed, direct advertising of the Venmo Offers should increase awareness of offers, leading to higher engagement and redemptions.

Monitoring Item 3:

When I Would be Concerned

Engagement Levels: Rejections of the new user interface (UI) with the banks

Decreases CI redeemed and percentage of users making purchases where there is an associated offer

Tracking based on my own Chase, Wells Fargo, and US Bank apps

Relevant Observations in Q3 and Q4:

As of right now, there have been no signs of rejections of the new ad server (needed before using the new user experience / new UI, as per investor day).

Currently, the only status is US Bank being on the new ad server (but not on the new UI yet), and with Chase on track to be on the new ad server and UI by the end of the year, as per investor day:

“Chase is also, as Michael mentioned, on track to take the new Cardlytics ad server and UI by the end of the year, which will continue their engagement growth trajectory.” - Farrell Hudzik, Executive Vice President, Financial Institutions, Cardlytics Investor Day Presentation

Lynne Laube has mentioned that Bank of America resigning opens up opportunity to discuss moving to the new ad server.

For additional notes, please see the following Twitter thread.

Long Term Importance: The new user experience will likely lead to higher engagement levels, understanding of offers from enhanced imagery (rather than just logos), and increases odds of higher redemption and ARPU levels.

Monitoring Item 4:

When I Would be Concerned

Attractiveness to Current Advertisers: More advertisers stop advertising (not pausing)

Decreases number and relevance of offers to users (decreasing CI redeemed and percentage of users making purchases where there is an associated offer)

Tracking based on my own offers, offers of others, management comments, and logos on website and investor presentation (updated quarterly)

Relevant Observations in Q3 and Q4:

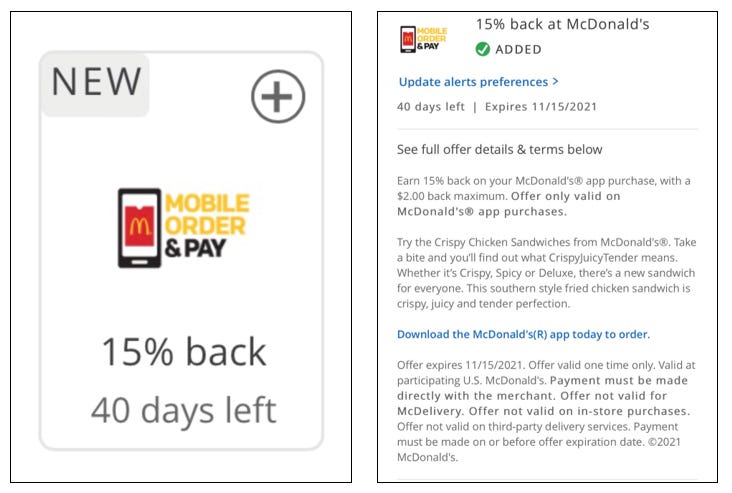

Resuming of Ad Spend (Travel, Food)

Observation Date: 9/4/2021

More advertisers have resumed ad spend with Cardlytics, including restaurants (KFC, McDonalds, etc.) who were possibly having labor and supply shortages that were mentioned during the Q2 earnings call.

In addition to the restaurant offers that were paused and now resumed, travel offers have returned. I have since received:

Carnival Cruises $35 back

Hyatt 15% off (I redeemed and received $27 back)

Best Western 10% off

Marriot 5% off

Long Term Importance: Some feared that advertisers were not actually pausing, and instead were stopping advertising on Cardlytics entirely (speculating that the channel was not working as intended). This shows that advertisers were truly only pausing advertising (most likely for the reasons mentioned during the Q2 earnings call), since they have since resumed. This also shows that the platform likely works as intended and will continued to be used by advertisers. I would say this has been less of a concern to me, given other advertisers have continually used the platform, mentioned how well it works, and continually increased ad budgets (such as mentioned by Panera, and discussed later). I think others began to fear larger problems based on these isolated cases of pausing, which should no longer be of concern.

Enhanced Capabilities of Offers

Observation Date: 8/21/2021

Beyond advertisers resuming and increasing offers, others have started to use the platform in other ways.

The offer below was the first time seeing an “App Only” offer. I’ve seen “Pump Only” with gas stations, “Online Only” with quite a few stores like Disney, “Pickup/Delivery Only” with Walmart. “App Only” was new (to me).

App Only purchases increase the odds of customer conversion (more likely to make a profile or join loyalty program).

Long Term Importance: This is a sign of companies using Cardlytics to change purchasing behaviors to optimize their business. This could lead to using the channel differently, and lead to budgets outside of those limited to advertising. This also reiterates the need for Cardlytics to target customers not currently customers of the company (many think there is no longer a need for Cardlytics when they have an app and can send offers directly, but that is not the case, as evident with offers like this).

New Uses of Logos and Incentives

Observation Date: 10/6/2021

New McDonald’s offer, only valid when the purchase is made on the app. What I found interesting is they are taking advantage of the very small space for a logo to instead promote their app. I don’t think I’ve ever seen this before. (There was a short period of time where there were changing images for the logos, but that has since went away).

Long Term Importance: This offer shows more advertisers are beginning to use the channel to do more than offer small discounts on single purchases (similar to Starbucks’ App Only offer). This also shows advertisers are spending time within the channel to make the most out of it. Instead to simply placing their McDonald’s logo, McDonald’s spent the time to create a new small image in place of their logo as a way of advertising their mobile order option.

Monitoring Item 5:

When I Would be Concerned

Adoption by New Advertisers: Bad reception from agencies with self-service

Decreases number and relevance of offers to users (decreasing CI redeemed and percentage of users making purchases where there is an associated offer)

Monitored by company releasing information regarding number of agencies using self service, if self service is integrated with other platforms (within the bank channel, within Venmo, etc.)

Tracking based on the offers I am getting, and looking up the associated ad agency. I follow the offers (or lack thereof) of VaynerMedia closely.

Relevant Observations in Q3 and Q4:

New Advertisers, Likely due to Self-Service

Observation Date: 9/2/2021

In September, myself and others began noticing significantly more offers within the bank channel. Although I cannot know for sure, it seems likely that most of these new offers / logos are from agencies using the self-service platform.

In addition, there was a large increase in local offers. Specifically, these local offers matched Dosh. The reason for this is likely due to affiliate marketers, such as Rewards Network, advertising on multiple channels, including the Cardlytics bank channel and Dosh. This explains the substantial number of small restaurants placing ads at the same time and on different channels.

More will likely be known during Q3 earnings call, given agency numbers are supposed to be reported.

Long Term Importance: Increases number of offers and relevance of offers (local), leading to higher engagement and redemption of offers.

Monitoring Item 6:

When I Would be Concerned

Utilization of Users: Decrease in awareness / engagement / attractiveness and relevant of offers

Decreases CI redeemed, percentage of users making purchases where there is an associated offer, return for advertisers, etc.

Monitored by company releasing information (ARPU), interviewing others (CI)

Relevant Observations in Q3 and Q4:

Higher Offer Amounts

Observation Date: 9/13/2021

This quarter there were a few extremely attractive offers in relation to others seen in the bank channel or those powered by Dosh. For example, Uber Eats had an offer for 48% off first purchases.

This offer amount has changed at times. When we used this on my wife’s Dosh app for a $20 total order, the offer amount switched to $16 (so 80% off!), but now looks like it is back to 48%.

Long Term Importance: Offers like this will lead to higher redemptions (why pass up on 50% - 100% off?). This also leads to more word-of-mouth advertising by users. Equally important, given the offer is only for the first order, it is used for customer acquisition. This is a sign of more advertisers thinking in terms of Lifetime Value / Customer Acquisition Cost (LTV / CAC), which likely leads to higher ad spend in the channel compared to only thinking about Return on Ad Spend (ROAS) for a single purchase.

Free Order

Observation Date: 9/15/2021

Another highly attractive offer this quarter was the Venmo QR code offer for $10 off a $10 minimum order at Panda Express. As others and I figured out, this can be essentially a free meal.

Given this was a little more unique, where never before could you essentially get 100% off or close to 100% off (until the Uber Eats switched from 48% to $16), I wanted to make sure it worked. Sure enough, I had a $12.09 meal (split the meal with my wife, Emma…I can’t have you think I ate the whole thing!) and received $10 from Venmo fairly quickly.

As an illustration for the power of large incentives, I told my Dad about the $10 off Panda offer with $10 minimum order. He recognized it as a free meal, and the next day, he texted me asking how to pay with Venmo to get this deal. An hour later, I hear he successfully made the purchase and redeemed the offer. He is someone who would have never otherwise paid with Venmo.

Long Term Importance: Attractive offers lead to more word-of-mouth advertising of offers, increasing awareness, engagement, and redemption, even leading to people wanting to learn how to redeem offers that are too good to pass up. This website had quite a bit of discussions around the offer, showing how people are willing to ask how to find the offers and use the offers when they are worth it. I believe this outcome will continue to occur as more high value offers that individuals want are available.

Another important point is if high value offers like this are possible, such as free meals, or free items, as more offers come on the channel and the odds of a relevant offer being shown to a user increases, I feel it is reasonable to assume engagement could reach 100%, or 100% of users will redeem at least one offer. To assume otherwise would be to assume users will not take the free money (given we can assume with time that more advertisers will be on the channel and ad budgets will continue to expand, based even on the observations in this write-up).

Exclusive Offers

Observation Date: 10/1/2021

Chase has increased their usage of Chase Sapphire Reserve Exclusive offers, which are offers typically of higher-end brands that have correspondingly higher value offers. Previously, Kwiat was the only exclusive offer. Now there are additional exclusive offers, such as from Allbirds ($50 back) and MR PORTER ($200 back).

Based on feedback from friends and those on Twitter, many seemed happy with the Allbirds offer, and even redeemed it.

Long Term Importance: In general, higher dollar amount offers will lead to higher engagement and redemption levels. Additionally, higher redemption will occur when there are offers on brands that typically do not discount (such as Allbirds). This shows another way how Cardlytics can be used, i.e., by providing discounts on brands, but in a private and individual manner, to not risk discounting the brand itself.

Possibly even more important, it is possible Chase used their revenue share to fund all or part of these offers. Given the revenue share is less important to the banks in comparison to the engagement levels and other metrics around the bank customer, if the banks started using their revenue share to increase the attractiveness of offers, it would increase the benefits for everyone (customers save more money, higher engagement and usage of those cards for the banks, more sales for the companies with more funding of the consumer incentive by the banks, and more engagement and redemption for Cardlytics). However, as per the investor day, it could be Chase is using their “loyalty marketing dollars” for this effort (assuming different than revenue share), as per the following quote:

"Chase continues to take full advantage of our platform by reinvesting their own loyalty marketing dollars into the program with the focus on driving audiences and brands.” - Farrell Hudzik, Executive Vice President, Financial Institutions, Cardlytics Investor Day Presentation

Different Offers Possible from Different Statement Descriptions

Observation Date: 10/15/2021

Below was the first time I saw a DoorDash subscription offer (which is a specific item within DoorDash), rather than only 10-20% off.

This threw me off a little at first since it was essentially a product level offer. I believe this works since it shows up on the statement as “DoorDash DashPass” instead of only “DoorDash”. Therefore, it looks like Cardlytics / DoorDash found a way to have a product-level type offer.

Originally, I thought this would only be possible with integrating Bridg. Good to see, given in a recent Tegus interview, Panera mentioned wanting this feature for their coffee subscription. Panera already uses Bridg, but it would be nice if they can get this working now and for non-Bridg clients and before Bridg integration.

Long Term Importance: Increases relevance of offers. As offers can get closer to the SKU level, advertisers can target users with more specific and relevant offers, increasing the attractiveness to users and the probability of redemption. Specifically, to subscriptions, we could see higher ad spend while thinking in terms of LTV/CAC.

Increasing Ad Spend

Date Seen: 9/21/2023

In a recent Tegus interview, Panera mentioned doubling their ad spend with Cardlytics next year.

“We've ratcheted up our spend significantly this year versus last year and intend to do even more doubling our spend next year versus this year. So more and more of our budget is going to Cardlytics” - SVP, Chief Digital Officer at Panera Bread

Long Term Importance: Higher ad spend in the channel, leads to more users with offers or higher value offers, leading to more engagement, word of mouth, and redemptions, eventually leading to higher ARPU and cash flow.

Negative Sentiment

Date Seen: Frequently Following Q2 Earnings Call

There is likely a large amount of negative sentiment built into the current price. Many sold last quarter, including people I know who understand and previously liked the company. Stock average holding around than 3 months (when using free float and average volume), and at times less, so people are playing for the quarter.

Beyond public comments made (twitter, blogs, podcasts, etc.), I had several individuals reach out, all regarding concerns of the company. It remined me of March 2020, where everyone only focused on the worst possible outcomes (even those that were not issues), since that is where the mind can go following large and quick price declines.

I believe a lot of the negative sentiment comes from two consecutive quarters of lackluster revenue and earnings, and no new large announcements (beyond Dosh, Bridg, and investor day announcements). In addition, there was no full year guidance, which likely lead investors assuming it will be worse than expected, judging by the corresponding large price decline.

Long Term Importance: Current price of Cardlytics could have a lot of built-in negative sentiment, leading to even further gap between price and value.

Conclusions Based on Observations

Concerns

Given the above observations, there does not seem to be anything of concern at this time (despite what might be assumed by most if looking at the price as guidance). If anything, it looks like there has been progress made.

Probability of Success

Additionally, the probability of a future success (success defined by scenarios mentioned in the Cardlytics valuation write-up and video) has increased given the progress made. If instead we saw none of those observations, and even noticed concerns (such as less offers, no resuming of offers, and so on), the probability of one of high value scenarios occurring would likely have decreased.

Customer Value Proposition

Finally, the customer value proposition for users, advertisers, and banks has increased during Q3 and Q4:

Users:

In general, users are able to save more money in total, and at more places and on more items that are relevant to them

More offers and more relevant offers from self-service

Higher value offers from bank exclusive offers, including on brands that rarely discount

Higher value offers from companies focused on customer acquisition (like Uber Eats) or those promoting different payment types (like Venmo QR Code payment at Panda Express), leading to offering higher percentage offers from 48-100% off

Resuming of offers such as restaurant and travel

Increases in ad budgets for next year, which will increase the number of users with offers from those companies, or the amount of money saved from those offers

Advertisers:

Self-service allows for more control, quicker use, more testing, and a better experience. It also increases the number of advertisers that can eventually use the platform (since before, SMBs may not of had an easy time, given previously one could only advertise on Cardlytics if you worked directly with Cardlytics)

Given the additional entry points added by banks like Chase, users are more likely to find the offers. Similarly, promotion by Venmo of the Venmo Offers on their homepage and showing redemption of offers on their social feed increases awareness and redemption of offers placed by advertisers

Progress of notifications, which will increase awareness of company specific offers and offers in general that marketers are placing within the channel, leading to higher utilization of offers

Increased capabilities within the channel, such as product specific offers (DashPass subscription offer, rather than only having capabilities for DoorDash percentage off order)

Increased possibilities for business optimization, such QR Code offers (like Venmo) and App Only offers (such as Starbucks and McDonalds)

Additional advertising capabilities, such as using the logo space to promote other items (like McDonalds and their app)

More places to advertise, larger reach, more data, and longer company life with advertising with Cardlytics via the additional neobanks and fintechs

An advertising platform to use that has certainty in results, when other platforms are losing that capability given iOS14.5

Banks:

More advertisers from the self-service increases the number of offers and relevance of offers, increasing engagement levels in the banks

Higher value offers all leading to higher engagement levels and usage of the banks’ cards

Progress of notifications, which will increase engagement within the mobile banking apps, and increase usage of bank cards

Increases in advertising spend for next year, which will lead to higher engagement and revenue share

Thoughts on Upcoming Earnings Calls

Disclosure

It is worth repeating: I have no idea what any short-term quarterly results will be.

Despite the observations discussed above, it may be a while until any of the benefits from those improvements show up in financial results, and we may see no impact in the immediate future, such as in Q3 or Q4 2021.

Specifically, most progress was made in September, or the last month of the quarter, which allows for less time for users to make qualifying purchases and for the benefits to occur and show up in results.

Earnings Announcements

Given Lynne Laube has mentioned the impact of a depressed stock price for senior employees, given a higher portion of their compensation is stock based, there could be a higher probability of an announcement this quarter to help increase positive sentiment with the company or increase long term expectations, both of which could increase the price of the stock.

There are many possible announcements (some very speculative, so my view of likelihood is provided):

(Very High Likelihood): Announcing self service agency results (supposed to start Q3)

(High Likelihood): Possibly more agencies using self-service. Went from 2 to 27, so even more would be good to hear

(High Likelihood): Any of the positive developments around push notifications, new advertisers, resuming of ad spend, increasing ad spend, exclusive offers, new use of offers, etc.

(High Likelihood): Possibly discussions on BofA resigning (some may be nervous they will not resign, given more are thinking about worst case scenarios at these depressed prices)

(High Likelihood): Officially announcing the names the new neobank/fintech partners (possibly naming the innovative fintech that was hinted at last quarter)

(Medium Likelihood): Possibly more neobanks / fintechs signed up, in addition to the 14 announced last quarter (large partners would include Nubank, Chime, Revolut, Cash App, etc. Revolut could be possible since they look to be updating their rewards section…currently one offer, instead of many before…and previously their rewards section and offers looked very similar to Dosh.)

(Medium Likelihood): Increasing MAU count based on neobanks, fintechs, or open banking. Given some of the overlap of users, and not being primary accounts, it is possible these will not be included. However, given Venmo’s size, even a portion of that included in the total Cardlytics MAU count would be significant.

(Medium Likelihood): Possibly more success of open banking, such as more partners (possibly this is how Sliide is working, given London based and requires users to link their cards)

(Medium Likelihood): News around more banks planning to go to new ad server, such as Wells or BofA (matching up with resigning)

(Medium Likelihood): News on integration of Bridg timeline (some may assume this might not happen on time or not at all)

(Medium Likelihood): Could be announcement related to banks putting more of their revenue share back into the program to fund exclusive offers (possibly explaining the increase in Chase Sapphire Reserve Exclusive offers). Also, could mention Venmo promoting offers (also possible PayPal/Venmo is funding the QR Code offers, given some are the same on both PayPal and Venmo).

(Medium Likelihood): Given more time with iOS14.5, could hear about more advertisers increasing their ad budgets due to better value proposition on Cardlytics, or more using Cardlytics given they can incorporate the Cardlytics results in updated modeling with Marketing Mix Modeling (MMM), instead of only using Multi-Touch Attribution (MTA). For more information:

(Low Likelihood): Potentially new partnerships for merchants to more easily advertise within the channel (such as Stripe)

(Very Low Likelihood): Possibly other traditional banks were signed and will be announced (hasn't happened in a while, but increased possibility given self-service and more offers, new ad server results are promising, SKU possibilities, push notifications etc., which are items Citi wanted back in 2016 and may increase odds of them to be okay with the investment required to integrate with the platform, especially given there is now higher probability of the financial burden being offset by revenue share. Additionally, possibly these enhancements are enough for AmEx, who previously wanted to use Cardlytics, to go back to discussions to using Cardlytics and be comfortable with the handling of data).

(Very Low Likelihood): Possible integration of self-service in the banks for SMBs, or integration within neobanks / fintechs like Venmo (similar to how self-service is directly built into Facebook, Instagram, Twitter, TikTok, etc.).

Earnings Results

Given there is some sense of pressure to have good earnings this quarter (for reasons mentioned above), it is possible Cardlytics could have simply notified more users of the offers via emails to get better results this quarter. Cardlytics has previously stated they have been patiently waiting to turn this activity up, possibly until new UI / more offers / more relevant offers, etc. to avoid a bad first impression. However, given the significant number of new offers and higher likelihood of relevant offers, it is possible more emails have been sent out this quarter.

The following is to illustrate how few of additional users would need to redeem small amounts of offers to produce record revenue results:

Q3 Guidance:

Rev: $57M - $66M

Consumer Incentives: $28M - $29M

Billings: $85M - $95M

To beat revenue by 25%, Cardlytics would need revenue $82.5M (I do not think Cardlytics has posted greater than $70M in a single quarter), or possibly (if ratios hold up) $36.25M in consumer incentives.

$36.25M-$29M = $7.25M more redemptions. This extra $7.25M in consumer incentives (CI) could come from more users redeeming either the Panda Express offer of $10 off, Uber Eats offer of $16 off, or from the resuming travel offers (for example, I redeemed $27 from one night at a Hyatt). I believe it is reasonable to assume the average CI from these offers is $10.

Backing into what percentage would need to have used $10 CI… 7.25M/(167M*10) = 0.0043, or less than 0.5%, or 5 out of 1000 users.

This seems possible and likely if notified users via email of the travel offers in the bank channel, and from natural discovery and discussion of the Venmo and Dosh offers for Panda and Uber Eats (especially given the addition of redemption of Venmo offers on the social feed and the discussion of offers online).

However, most of these offers did not come until the last month of the quarter, promotion of Venmo Offers did not begin until the Q4, and the other high value offers like the Chase Sapphire Reserve Exclusive offers did not start until Q4. Furthermore, although US Bank push notifications are allowed to be turned on and could possibly be used in Q4, they were not defaulted on nor used in Q3.

Therefore, I feel if there is going to be a quarter of record results, it will be Q4, given there will be more time for the above to have an impact and more likely of more awareness of offers in general. There are many issues with trying to predict quarterly results, but I feel if Cardlytics has seen the first few weeks going into Q3 earnings, it could lead to a higher-than-normal Q4 / full year guidance, if one is provided.

New Allocations

As discussed in the “Conclusions Based on Observations” section, the observations above lead me to believe the probability of a high value scenario occurring has increased and the customer value proposition for users, advertisers, and the banks was also improving during Q3 and Q4.

There is a chance that despite these favorable developments occurring, that corresponding favorable results will not occur in either Q3 or Q4. Even the prevalence of these additional offers and higher value offers do not mean users are redeeming them or making the corresponding purchases for Cardlytics to be compensated. However, when deciding on different allocations for Cardlytics, I wanted to think about any change in prospects, as well in relation to other investments.

Other investments that I find attractive stayed constant (no significant changes in value in relation to price). The good scenario values for Cardlytics I feel have not changed over the last few quarters, but the probability of success has increased (based on the observations above), leading to higher expected values. At the same time, the price of Cardlytics has fallen considerably. Together, I feel the ratio of reward over risk has increased.

This has led me to allocate 100% of my available-to-invest holdings to Cardlytics (only excludes current employer 401K which cannot invest in individual companies) and I have been selling my rental properties to buy more Cardlytics (sold some in Q3, and more are set to close in Q4, leading to nearly 100% of my net worth in Cardlytics). Additionally, I am using leverage in the form of non-callable loans. For accounts I manage, Cardlytics as a percentage of net worth is substantially smaller, and allocations within the accounts is not 100% (but still high). The line of thinking is I am still young. While I hate to lose any capital given the lost opportunity cost over 60-100+ years (I hope to live long!), I feel the current amount of capital and loans is small in relation to what I could conservatively earn again over the next 5 years or shorter. I feel it will be much less likely to find equally attractive investments over the next decade (I hope to find some!) and therefore I want to make the most of this one at this time. Finally, while I recognize there is a non-zero probability of the stock going to zero, the minimal debt held by Cardlytics and the current valuation makes me comfortable holding at these levels, especially in comparison to other opportunities (please see the following write-up or video on Cardlytics valuations and reverse DCFs).

In addition, given the points above, combined with a depressed stock price and negative sentiment, I have made the decision to buy out of the money call options for Q3 and Q4 (something I have never done previously, nor plan to make a practice of continuing). The percentage allocation for the portfolio is extremely small. If proven to be worthless, that is okay given it is only a small percentage loss of the overall portfolio (but still mentally significant in terms of lost dollar opportunity cost over a lifetime), and there is a higher likelihood for a disproportionate positive outcome.

To top it off, regardless of the announcements and financials at the upcoming earnings, as long as the business and customer value proposition for users, advertisers, and banks continues to improve, it will be a win-win scenario. Good earnings / announcements with equally good reception by the market and adjusted stock price will increase the value of the options. Bad reception by the market and further decline in the stock price will allow me to invest the proceeds from selling more of my rental properties at the lower prices.

Closing

I have always wanted to see any notes or the thoughts corresponding to great investments made by investors in the past. Therefore, I included the information that I wish I could see from others.

A large reason for posting this write-up is to keep myself honest. If it works out well, I want to see if I was right for the right reasons, and not trick myself. If I’m wrong, I’d rather fail in public and learn from it, since by not sharing publicly makes it easier to ignore and not learn from it (and act as if I did not make mistakes at all). Additionally, I will care less about what others think about my decisions, and more about my own outcome.

I hope the information shared can be of some use for others, or can be eventually used to learn from my mistakes.

More Detail

I discussed this topic in more detail in the following video:

Follow-Up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more.

-Austin Swanson (Swany407)

Twitter: @Swany407

Website: Swany407.com

Subscribe: If you enjoyed this write-up, subscribe to not miss future ones.

If you enjoy the content, or have received any value from the investment insights, discoveries, and thoughts shared, please consider becoming a supporter of the channel. Your support increases the odds of more investment write-ups and content in the future.

Share: If you enjoyed this write-up, use the link below to share.

More Information on Cardlytics

Thoughts Following Q2 2021 Earnings and Price Decline: Write-up and video

Thoughts After Price Decline (5.17.2021): Write-up and video

Disclaimer: This content is not investment advice, and is intended for informational purposes only. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.