Cardlytics ($CDLX): BofA Renewal & Testing Competitors

Likelihood of Bank of America (BofA) renewing, and discussions on Figg and Rewards Network.

For all my notes on CDLX, check out my Qualitative and Quantitative “Research Notes”:

For those interested, this post is also available on YouTube, Apple Podcasts, and Spotify.

Market Cap as of 12.29.2021: $64/Share x 33M Shares ~ $2.1B Market Cap.

Disclosure

I have spent considerable time assessing this situation, talking with many different people, and gathering as much information as possible. I have been writing down as many pieces of information as possible, attempting to fit them together like a puzzle, in order to make sense of what is going on and what may happen.

However, it is still very possible:

My information is inaccurate

My understanding or interpretations are inaccurate

I do not have all the relevant information

The facts change or the situation changes

Additionally, I have attempted to include all pieces of information I have collected. Some pieces of information I have deemed and labeled as “rumors” or “supposedly”. While I typically do not include anything that I cannot confirm, I have included it because I feel some of that information makes sense to the larger story, makes rational sense, cleared up some of my own questions, and have come from reputable sources.

Finally, regardless of what is discussed here and the conclusions I make, the future is still uncertain, and anything can happen.

Introduction

There have been quite a bit of discussions around Bank of America (BofA) and their upcoming renewal with Cardlytics, and their testing of local offers not powered by Cardlytics.

My view of the situation today is very different from the quick, first conclusion I made when I first became aware of the situation. I believe many still hold that first conclusion. That could be from not spending time assessing the situation, and possibly due to selling immediately upon making the discovery and not since revisiting or reconsidering the situation. As stated by CEO and Co-Founder Lynne Laube, it seems as if many investors have misunderstood the situation with BofA.

I believe this has been the number one topic I have discussed with other investors. Given the large difference in views on the situation even today, I felt it was worth sharing my thoughts from spending quite a bit of time hearing from others, collecting information, and thinking through the situation.

Topics

Background on the the BofA Renewal and Competitors

Reasons BofA Will Likely Renew

BofA Renewal

Upcoming Renewal and Testing of Competitors

Leading into the Q3 earnings call, there were some concerns regarding Bank of America (BofA) not renewing with Cardlytics at the end of the agreement on December 31, 2021. Even today, I am still hearing these concerns.

One reason for the fear of BofA not renewing has been the testing of local offers by another supplier. In BofA, you can see local offers, or “location specific” offers. I first became aware of these location specific offers on September 2, 2021. An example of the local offers seen in BofA is shared below.

From my understanding as of today, BofA is working with Figg, where Figg is getting these offers from Rewards Network, and BofA is using their non-exclusivity rights to place these offers through Cardlytics on Cardlytics’ rails into the Cardlytics system and user interface.

Figg and Rewards Network

When I first saw the location specific offers in BofA, I noticed when you matched by location, they were identical to the offers in Dosh who uses Rewards Network (who works with restaurants to provide funding, and partners with loyalty programs to bring customers to their restaurants to pay back the loan).

Therefore, I assumed Cardlytics was also using Rewards Network to power these local offers in BofA, since if Dosh was using them, no reason Cardlytics wouldn’t use them as well since already integrated and partnered with BofA.

It seems to be true that the offers are from Rewards Network, but what I did not know at the time was the potential use of Rewards Network on behalf of Figg, not Dosh / Cardlytics.

Figg was the newly created company coming out of the Augeo acquisition of Empyr1.

I believe there has been confirmation that the local offers are from Figg (and I have heard this mentioned by many different investors), and confirmation that the local offers that Figg is using are coming from Rewards Network (I am nearly certain, given they are identical local offers, of the same amount, same logos, etc. between BofA and Dosh).

Once again, as mentioned in the disclosure at the beginning, I still have uncertainty myself on the exact arrangements, given most have not been publicly disclosed or discussed.

Cardlytics Announces Renewal May Be After Expiration

The fear of non-renewal started due to the testing of competitors, but was intensified from the Q3 earnings call2 on November 2, 2021, where Lynne Laube mentioned that the renewal would not happen until “early next year”, after the expiration.

Cardlytics Addresses the Competition

Also in the Q3 earnings call, Laube addressed the “competition” that investors were worrying about, which is likely directly related to the concerns with BofA testing Figg.

Reaction by Investors

Many investors have assumed that BofA was testing Figg before the renewal to decide whether to switch to Figg. Once Cardlytics mentioned that a renewal may not happen until after the expiration date of their agreement, many began to worry.

A non-renewal of BofA would lead to Cardlytics losing data and number of users, decreasing advertising reach and attractiveness of Cardlytics for advertisers, possibly leading to less offers and decreases in engagement and redemptions.

A non-renewal would also be a negative signal to investors and other banks that maybe the platform isn’t as great as they think it is.

As will be discussed below, even Lynne Laube felt that the interpretations and corresponding decrease in the stock price related in part due to these concerns were a misunderstanding and an “epic overreaction”.

Reasons BofA Will Likely Renew

There are many points discussed below on why it seems rational and of high likelihood that BofA will renew with Cardlytics. Each point will be discussed in detail for the remainder of this post.

“Epic Overreaction” - Renewal is Misunderstood by Investors

Multiple Previous Renewals (Therefore Not the First Chance to Non-Renew)

One Previous Renewal Was Also After Expiration (Common with Banks and Fine Given Month-to-Month Continuation of the Agreement)

Known Reasons for the Delay (Hosting Tech, Cloud, New Ads Server, Better Economics, Bank Self-Service)

Cardlytics is Likely Reporting Strong Results to BofA (Decreasing Risk of BofA Being Unhappy with Core Offerings)

BofA is Only Testing Local (Not Testing to Replace Cardlytics)

Banks Would Prefer One Supplier (Decreasing Risk of Others Using Figg, or Even BofA Using Figg in the Future)

Cardlytics is Already Integrated (No Switching Cost, More Trust & Experience, Get Upcoming Innovations)

Cardlytics Provides More Benefits to the Banks Than Figg (National, Customization, Increasing Budgets, Larger Dedicated Resource, Larger Reach)

Cardlytics has Access to the Same Local Offers via Rewards Network

Cardlytics May Soon Have a Substantially Higher Number and More Unique Local Offers Than Figg

Testing of Figg Supposedly Went Poorly

Figg Offers are Based on Location (Supposedly Not Given Access to Purchase Data)

BofA Possibly Lost Negotiating Leverage due to Figg Testing

Truist Renewed with CDLX in Q4 2021 (So No Systemic Problems)

1. “Epic Overreaction” - Renewal is Misunderstood by Investors

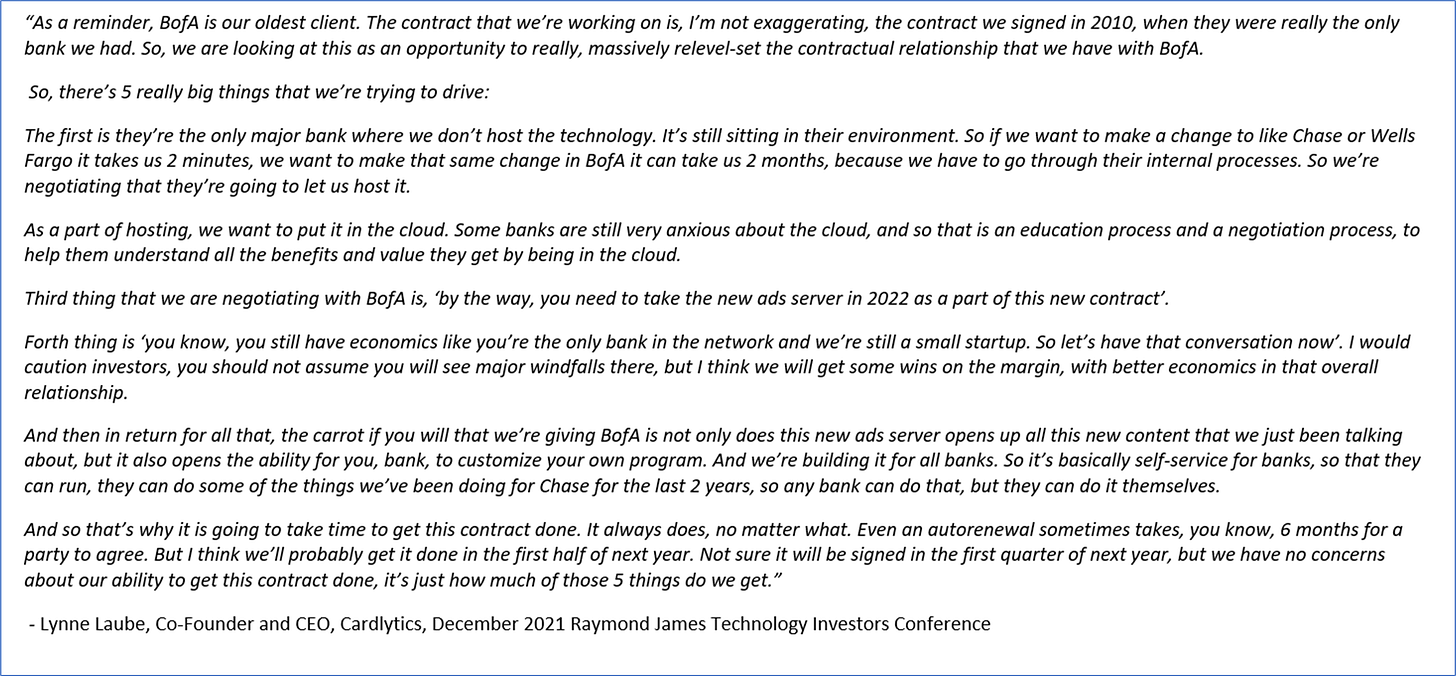

During the December 2021 Raymond James Technology Investors Conference3, when asked what is misunderstood by investors today:

Lynne Laube also publicly stated her confidence in BofA renewing when saying:

I’m not sure any CEO would risk their reputation by saying something so confident as “we fully expect to reach an agreement” when they don’t think it would happen, let alone giving very specific reasons for the delay.

I feel if Lynne knew they were not going to reach an agreement at all, the commentary would be more general and closer to saying they are “still working on reaching an agreement”, and not stating how confident she is and giving very specific reasons for the delay.

Additionally, after the reaction by investors regarding Q3 2021 guidance and the corresponding actual earnings, I believe management has went conservative with their statements. Therefore, this stated confidence by Laube carries even more weight.

2. Multiple Previous Renewals (Therefore Not the First Chance to Non-Renew)

The Bank of America (BofA) agreement (or “General Service Agreement”) looks to have been first effective as of 11/5/2010, with an expiration date of November 4, 20154.

Since the original agreement, there has been multiple amendments, with most extending the agreement:

1/14/2016 Amendment5: “The Expiration Date on page 1 of the Agreement is amended to November 4, 2020.”

8/16/2017 Amendment6: “The Expiration Date on page 1 of the Agreement is amended to November 4, 2021.”

12/20/2019 Amendment7: No change in expiration date, but included this for the fullness of detail.

12/2/2020 Amendment8, updated to say “The expiration date of the Agreement is hereby extended to December 31, 2021.”

Summary:

This is not the first time BofA is renewing (although I believe some investors think it is the first renewal). If it was the first renewal, there would be more uncertainty as to whether BofA has been having a less-than-stellar experience with Cardlytics.

Given they have renewed multiple times in the past, it is more likely they will renew again, especially given the extensive amount of improvements Cardlytics could offer to BofA (new ad server, new UI, SKU/product-level data and offers via Bridg, more offers and increasing ad budgets via self-service, bank self-service, more unique local offers via APIs, etc.).

Even if past renewals were autorenewals, each time was a chance to end the agreement, and BofA did not.

Additionally, even the autorenewals took time according to Lynne Laube:

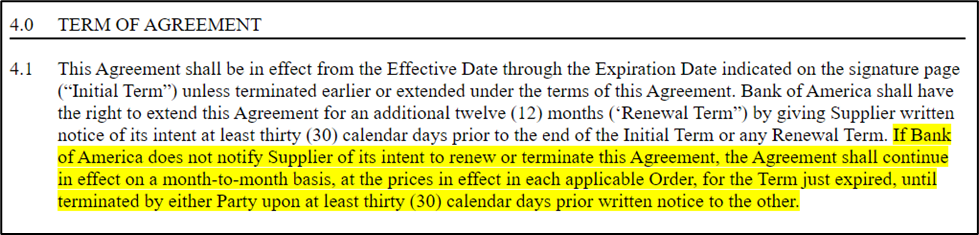

3. One Previous Renewal Was Also After Expiration (Common with Banks and Fine Given Month-to-Month Continuation of the Agreement)

Q: “Shouldn’t it be a concern that BofA is not renewing with Cardlytics before the end of the expiration date?”

A: It is not uncommon with their renegotiations to go past the expiration date.

As seen in the summary of contract dates above, the first extension following the expiration date of 11/4/2015 was not signed until over 2 months after the expiration date. Therefore, it should not be as worrisome when Cardlytics says the renewal may not be signed until after 12/31/2021.

This point was reiterated by Laube when discussing what investors misunderstood:

And this is fine by the terms of the contract, given the agreement continues in effect on a month-to-month basis:

4. Known Reasons for the Delay (Hosting Tech, Cloud, New Ads Server, Better Economics, Bank Self-Service)

Q: “Even if delays have happened in the past and are allowed, isn’t it still a bad sign if they do not resign until after the expiry?”

A: It could be a bad sign if no explanation was given. However, Cardlytics explained at the December conference the delay is due to all the new items Cardlytics is attempting to get BofA to accept:

This explains the delay, and therefore the delay is not from deciding whether or not to renew.

Important Subpoint

One particular subpoint that also illustrates why BofA is likely to renew, is the fact Cardlytics is attempting to get better economics under the BofA agreement (either from reducing revenue share, or no revenue share on product-level offers since not from the bank and instead from Bridg, or lower revenue share due to both methods).

I do not think if Cardlytics was at risk of losing BofA they would be attempting to gain improved economics, such as by lowering BofA’s revenue share.

5. Cardlytics is Likely Reporting Strong Results to BofA (Decreasing Risk of BofA Being Unhappy with Core Offerings)

Detailed in the General Service Agreement is a report that Cardlytics sends to BofA.

The monitoring items within the report are as follows:

As the number of offers increase, reporting items could show improving results, such as:

Number of New Offers Seen

Number of Unique Accounts Activated Offer (more offers increase the odds that one becomes relevant to a new unique user and then activates)

Number of Offers Activated (more offers allow for more to be activated)

Number of Unique Accounts Redeemed (same reason as activation)

and more…

To get an idea if Cardlytics would be currently reporting stronger or weaker numbers to BofA, one could look at their offers over the last year. In Q3 and Q4 2021 there were some users with 90-140+ offers, with the majority powered by Cardlytics (i.e., excluding the location specific offers). Below is an example from a friend with 90 total offers, with 76 from Cardlytics and not local offers.

BofA is showing more offers than any other bank I’ve seen.

This is to say, Cardlytics should be reporting solid and improving numbers to Bank of America, which increases the chance of renewing.

If the opposite was occurring where we were seeing less and less offers, there could be more room for concern.

I believe these improving results, combined with the new ads server, new user interface, adding product level offers, new ads manager with both API connection for partnering for more SMB/local and the self-service component, and giving self-service for banks, are all reasons why Cardlytics says their relationship with BofA is the best it’s ever been, and the odds of non-renewal are very low.

6. BofA is Only Testing Local (Not Testing to Replace Cardlytics)

Q: “Is BofA testing Figg to replace Cardlytics?”

A: While it is possible that BofA is testing Figg to replace Cardlytics, and while it is an assumption help by others, the testing of Figg looks to be only for local offers, and not to remove the national offers provided by Cardlytics.

As of right now, the only offers by Figg are the “location specific” offers. If Figg is adding other offers, it is unknown to me, and would not match what I am hearing. Additionally, Augeo (the parent company of Figg) has explicitly said Cardlytics does better with national brands and Figg does better with local (despite Cardlytics now having access to the same offers via Rewards Network).

Figg Offers are Running on Cardlytics’ Rails

Given the local offers are in the same offer section as Cardlytics with Cardlytics offers, and based on hearing that Cardlytics has said that they are letting the local-offer supplier run their offers on Cardlytics’ rails, it seems like everything is going through Cardlytics, and not a separate system or rails by Figg.

This was reinforced by the following:

Part of the reason for running the offers from a second supplier through Cardlytics is not to confuse the end user. You do not want to have two different offer sections, nor would you want one offer section with completely different looking offers.

I think a lot could be taken from the fact that with this testing, it is not Figg offers on their own. Figg offers are placed with the Cardlytics offers. I would be more worried if BofA was testing Figg in isolation, with a Figg offer wall. That would more indicate that they were testing to compare the two and was looking to switch, rather than what we are actually seeing which is BofA looking to incorporate Figg offers with Cardlytics offers.

Important to note, I have seen myself and heard from others that there are BofA offer sections with very few national offers from Cardlytics, and many location specific offers in their BofA account. This has led some to believe BofA is testing Figg to replace Cardlytics, or that it has already occurred. From what I have seen and heard, this scenario of offers only seems to be the case where the user does not use that card often. Cardlytics then places very few offers, but Figg is showing every possible offer since it is not based on purchase data, and instead just on location. I know with other cards, such as on Chase and Wells, if it is not the primary card or one that is rarely used, most often there are very few Cardlytics offers.

In all, BofA does not look to be deciding between one supplier over the other.

Q: “Can there be multiple suppliers of offers in the bank channel?”

A: Yes. There is a non-exclusivity clause in the agreement. This was an interesting event that came out of BofA testing local offers from another party, with BofA exercising this “right to utilize other suppliers”.

In the long term, it could be that more banks exercise this non-exclusive right. I believe that will only come to be if Cardlytics is not executing on all the initiatives they are currently working on (local, SKU, self-service, new UI, etc).

For example, the probability of another bank using Figg for local has decreased with Cardlytics having the same access to Rewards Network, and will continue to decrease as they add more unique local content, such as through self-service and API connections (discussed in depth-later).

Q: “Do the neobanks and fintechs have non-exclusivity rights?”

A: It is possible there are similar non-exclusive rights with the neobanks / fintechs.

An interesting data point is the use of QR code offers in Venmo and PayPal. There exists QR code offers that are the exact same in every way, except the Venmo offers are powered by Dosh. This is seen on PayPal’s website where the terms and conditions between PayPal and Venmo only differ by mentioning Dosh for the Venmo offer.

It could be that PayPal is doing something similar to BofA, where they are choosing to put their own content within the channel, but using the Dosh rails. This could be due to an agreement, and/or it could be to not confuse the end user with different looking offers, and/or it could be similar to Cardlytics mentioning giving the banks a self-service platform so “they can do some of the things we’ve been doing for Chase for the last 2 years, so any bank can do that but they can do it themselves” which I’m guessing are the Chase Sapphire Reserve Exclusive Offers of high value.

Therefore, the PayPal/Venmo situation may be more similar to the Chase exclusive offers that Cardlytics is rolling out to more banks, and less similar to the BofA situation with a second supplier.

Q: “Isn’t it bad for Cardlytics that the banks are exercising their non-exclusivity rights?”

A: In terms of the banks, BofA is the only bank exercising the non-exclusivity right.

One benefit to Cardlytics with the non-exclusivity is it doesn’t make it one over the other with competition. If the offer section was exclusive to Cardlytics, it would force the bank to not renew their agreement if they wanted different offers.

The negative impact of the non-exclusivity is Cardlytics would not be the only provider and financial beneficiary of all offers. However, I am not sure whether or not Cardlytics receives some economic benefit if the second supplier offers are run through Cardlytics’ rails and placed in their offer wall and the new user interface.

Even if Cardlytics does not have a direct economic benefit, it is likely that the banks are filling a current gap in customer demand, such as local offers, that when appropriately organized and shared to the user, could increase the overall engagement and redemptions by those users, therefore indirectly benefiting Cardlytics. This is also mentioned by Cardlytics when they said some of the content is complementary.

Additionally, as seen with the Venmo QR code offers that seem to be coming from PayPal rather than supplied by Dosh, those QR code offers on Venmo have been the best offers on any of the channels ($10 off Panda Express when you spend $10, $25 cash back at Bloomingdale’s when you spend $1 etc.), likely helping increase awareness and engagement with the other Venmo offers as well.

7. Banks Would Prefer One Supplier (Decreasing Risk of Others Using Figg, or Even BofA Using Figg in the Future)

Q: “Do the banks want to work with multiple providers of offers?”

A: Banks likely prefer to work with one supplier, but will seek out additional suppliers when they feel it is necessary (such as BofA wanting local offers when Cardlytics couldn’t / wouldn’t supply them).

Augeo even mentioned that the banks prefer one supplier. This is likely why Figg has to go through Cardlytics’ rail and placed in Cardlytics offer wall. The banks and Cardlytics do not want to confuse the consumer by having two different offer sections and different looking logos, nor do they want to go through the additional work/time/costs from long integrations of a second supplier.

Additionally, according to Augeo, the banks also do not want the extra complexity of having to deal with two different suppliers. And to their point, I am not sure BofA will continue working with Figg in the future once Cardlytics has their own unique local offers in addition to the Rewards Network offers (discussed more later). By only working with Cardlytics, it reduces the complexity and work involved for BofA.

I believe as Cardlytics continues to execute and add additional offering (product-level offers via Bridg, new unique local offers from API connection and the self-service built into the new ads manager, new user interface, etc.), there is less reason for a bank to seek out additional suppliers of offers and add complexity and work.

8. Cardlytics is Already Integrated (No Switching Cost, More Trust & Experience, Get Upcoming Innovations)

In addition to banks preferring to work with only one supplier, the benefits to BofA (and other Cardlytics-partnered banks) with sticking with Cardlytics who is already integrated include:

No Switching Time or Cost

Cardlytics has Trust and Experience

Get New Ad Server / New UI with Local Offers and SKU

No Switching Time or Cost

Even if a competitor had a lighter integration process, it seems there would be lower probability that a bank such as BofA would go through the integration process again with a new partner, when Cardlytics is already integrated. This is likely why Figg offers are going through Cardlytics’ integrated rails. If BofA was looking to integrate Figg (which I heard a rumor they tried, but Figg’s tech supposedly wasn’t able to accomplish this, and may explain the the substantial time between first contacting Figg and first seeing an offer in BofA), we would not see Figg’s offers being placed through Cardlytics in Cardlytics’ offer wall. It would be tested instead on its own, which currently is not the case.

CDLX has Trust and Experience

Cardlytics has worked with BofA for over 10 years, which likely leads to a higher level of trust with Cardlytics than Figg. In addition, Cardlytics has much more experience, and social proof, with working with other large banks. This trust and experience are important when dealing in the banking channel and working with this purchase data.

Get New Ad Server / New UI with Local Offers and SKU

Cardlytics can offer the new ad server and new user interface, which will allow better organization of offers to separate national and local offers to increase overall engagement and redemptions, as well as allow for SKU / product-level offers (which are now live in U.S. Bank and on Dosh).

If BofA is looking for a switch due to not having local offers or product-level offers, then there would no longer be a need for a switch since Cardlytics can provide these offers.

9. Cardlytics Provides More Benefits to the Banks Than Figg (National, Customization, Increasing Budgets, Larger Dedicated Resource, Larger Reach)

Even if it BofA was deciding between only Cardlytics or only Figg, Cardlytics would provide more benefits to the bank with higher engagement and ad spend from Cardlytics’:

National Offers

More Customization and Differentiation Between Banks

Self-Service for More Offers and Increasing Budgets

Larger Dedicated Resource for Better Communication, Better Analytics, and Faster Innovation

Larger Reach

National Offers

Augeo has specifically mentioned that Cardlytics is better at national brands, and Figg is better at local (although I do not believe that is longer the case, and will continue to tilt in Cardlytics’ favor, as will be discussed a later section regarding unique local content). Given national offers have more recognition, larger ad budgets, can be given to more users, and are typically of higher value and more attractive, I feel more banks would favor having the national offers over the local if they had to choose.

More Customization and Differentiation Between Banks

Cardlytics is continuing to add ways to offer banks the ability to have more differentiation between the banks using Cardlytics.

Cardlytics is rolling out a bank self-service platform to allow the banks to place more offers on their own, which will likely look like Chase and their Chase Sapphire Reserve Exclusive offers (pictured previously in this post).

During investor day, Cardlytics mentioned creating unique and original offer sections in the new user interface.

As Cardlytics adds more agencies and local/SMBs via self-service and partnering via APIs, Cardlytics will be able to increase the level of personalization to users.

Augeo mentioned local is a way to have differentiation, but if all the banks are getting their offers from the same source as Rewards Network, then every user in the same location would be shown the same offer, and there would be no differentiation in offers by banks.

Instead need more local content that is then based on purchase data, not just general location, which allows for each user to have different local offers that are actually relevant and attractive. This can be accomplished by Cardlytics (and discussed in depth later).

Self-Service for More Offers and Increasing Budgets

Cardlytics’ self-service capabilities will eventually allow for more local offers, through partnerships and APIs, and/or from the bank self-service platform.

Additionally, Cardlytics is rolling out more self-service to agencies, which increases the number of offers to a given individual, and the number of users shown an offer, increasing overall engagement for BofA. It seems irrational for BofA not to renew with Cardlytics right at this moment, given how much BofA will benefit. If anything, in the scenario where BofA is on the fence about renewing, it would make more sense to renew for one more year to see the impact of all these changes.

Cardlytics has a Larger Dedicated Resource

Cardlytics has a larger employment base with ~600 at Cardlytics compared to around ~60 at Figg (I cannot confirm this number. It could be higher, but consistently I’ve seen ~60 reported online by various sites.). This larger dedicated resources allows for better analytics ability, better communication between advertisers and the ad platform (Cardlytics), and faster innovation (new ads server which uses machine learning, new UI, new ads manager with self-service, etc.).

Cardlytics has Larger Reach

Regarding Figg’s reach, from information seen online, it seems as though Figg has recently grown from 60M cards and $300B in transaction volume to now 100M cards and $500B in transaction volume. While very likely to be true, it is hard to verify or completely trust the numbers given they are not a public company. Also, the number of cards can be very different form the number of users, where there are usually significantly more cards than users. Additionally, are the cards and transactions the total from that bank, or more similar to Cardlytics where they only include those who were actually shown an offer? Could Figg be including all of BofA now? There are many questions, so it hard is to make much of those numbers and Figg’s total reach.

However, what we do know is advertisers such as Horizon Media have specifically called out how they cannot spend as much with Figg as they can with Cardlytics, due to Cardlytics’ larger scale and advertising reach. This was Cardlytics’ biggest hurdle until getting to their larger current size post the Chase and Wells Fargo partnership. Additionally, this difference may only widen if Cardlytics continues to add MAUs. While not a focus, there is still a chance more MAUs will be added to Cardlytics in the near future (such as the rumor of Cardlytics signing another large bank in Q4 of 2021).

The banks also know they cannot get enough reach on their own, and need the combined reach through someone such as Cardlytics. This decreases the likelihood of any bank leaving, such as BofA.

I believe Figg partners with USAA, who is more digitally engaged, but a smaller bank and therefore less reach. It is also possible Figg shows higher ROAS for advertisers. However, while Figg could have significantly higher ROAS, it only means so much with less reach. For instance, if you can offer 10 ROAS but can only spend a small sum in ad spend, most advertisers have said they would prefer to have lower ROAS as long as they can increase their spend and generate more sales. VaynerMedia has specifically mentioned this idea saying while a higher ROAS ad spend is great, they wouldn’t need as high ROAS and would be okay with less if they can generate more sales.

In addition to ROAS dropping due to more reach, I think we will see ROAS drop significantly due to the certainty of results since based on purchase data. The way I have thought about this is similar to a risk-free rate, where investors pay more (earning lower returns) for certainty. Then it will shift from focusing on ROAS of a single purchase to LTV / CAC, making ROAS go even lower.

In all, it doesn’t seem to make sense for a bank to switch from Cardlytics who is already integrated to a new service with less trust, experience, and benefits. Maybe it would be a closer decision if there were more areas where Figg was better, however, that does not seem to be the case. The one area that Figg discusses often is being better at local offers, and Cardlytics will likely soon surpass them in this area.

10. Cardlytics has Access to the Same Local Offers via Rewards Network

Cardlytics has access to these same local offers through Dosh using Rewards Network. This is how Dosh gets access to local offers, and therefore Cardlytics has access to the same offers. You can see that BofA and Dosh/Cardlytics are using the same local offers by looking at BofA offers and Dosh offers in the same location, and seeing identical offers from the same restaurants (same in offer amount, logo, and number of restaurants, etc.)

Rewards Network partners with many different loyalty programs, making their offers not unique.

Q: “If Cardlytics has access to the same local offers, why is Cardlytics not providing them instead of Figg?”

A: Previously, Cardlytics did not have local offers. At one time, I believe they may have even partnered with Empyr for local offers.

One set of information that cleared up some of my initial confusion of events, as well as some conflicting statements from Augeo and Cardlytics, was a timeline.

The following is the timeline as I know it:

Supposedly around 2 years ago BofA wanted local content. Cardlytics did not own Dosh at the time who had access to the same local content through Rewards Network, who Figg also uses (and is why Dosh and Figg have the same exact offers). Cardlytics was also (and still is) more focused on getting more of the larger ad budgets from the more attractive and recognizable national brands, rather than on adding more local content. This led BofA to go to Figg for their local offers to add to the BofA platform.

~10 Months Ago / March 1, 2021: Cardlytics announces acquisition of Dosh, who has the same local offers from also using Rewards Network.

~9 Months Ago / April 13, 2021: Cardlytics announces acquisition of Bridg, to allow for SKU data and product-level offers.

~7 Months Ago / June 10, 2021: At investor day, many new upgrades were announced: the new ads manager with a self-service component, a new self-service platform for the banks, and a new user interface (UI) that would be on the new ads server that would allow for richer imagery and better organization for local content.

~3 Months Ago / September 2, 2021: First time I became aware and saw the location specific offers in BofA.

~3 Months Ago / September 20, 2021: Cardlytics mentioned the new ads server’s targeting is based on machine learning, instead of the more hands-on targeting typically done by Cardlytics, which would allow greater scale of use by advertisers.

~2 Months Ago / November 2, 2021: Cardlytics has their Q3 earnings call. Announces delay in BofA renewal.

~1 Month Ago / December 6, 2021: Cardlytics speaks at Raymond James Conference. Andy Christiansen, CFO, mentioned will go after local/SMB by utilizing the ability to connect via APIs that is already built into the new ads manager, and use the self-service component of the new ads manager. Lynne Laube mentions reasons for the delay in the BofA renewal are for trying to host the tech, put it in the cloud, get new ads server, obtain better economics, and give BofA the bank self-service platform.

The only timeline event that I’m not positive about, is BofA wanting local content around 2 years ago. However, if that is true, a lot of other pieces of the story, such as the different comments by Augeo and Cardlytics make a lot more sense. Two years ago would be before Cardlytics acquiring Dosh and having the same local offers, before the new ad server and UI, and matches Augeo's outdated comments (saying Cardlytics hasn't innovated in years, despite the last year it seems like Cardlytics has made a lot of progress to offer many new items: local, SKU, new ads server, new UI, new ads manager with self-service including for the banks, notifications, neobanks, open banking, and more).

A reason for Cardlytics waiting to add local offers in BofA and other banks, even after the Dosh acquisition and gaining the corresponding access to local offers, is it to wait for the new user interface where there could be better organization, have the local offers in a separate location in the offer section, and to not make it difficult to find the more relevant and more attractive national offers (such as when there are 150+ total offers). Additionally, it is much better to wait for new UI with improved imagery, especially with less recognizable names such as local restaurants. The new UI requires the new ads server first, which Cardlytics is targeting 50% MAUs on new ad server by end of 2022.

Outside of BofA, the chance of another Cardlytics-partnered bank considering Figg for local offers is much lower now, given Cardlytics, who would be already integrated and trusted, can provide the same exact offers, and soon will be able to provide more unique local offers (discussed later).

Q: “Given Cardlytics did not get local offers until the Dosh acquisition in 2021, and after BofA said they wanted local content, indicating BofA was waiting on Cardlytics, is Cardlytics the bottleneck for the banks?”

A: It's possible, but it doesn't make sense. Although Augeo says Cardlytics is the bottleneck (which could be based on outdated information, as explained above), Cardlytics has conflicting statements that seem more reasonable and likely true. As stated in the beginning, Cardlytics is attempting to get multiple technology improvements to BofA with the negotiations.

These new technology improvements that Cardlytics is trying to get BofA to implement would have the following benefits:

Host Technology: BofA is the only remaining bank hosting Cardlytics’ technology, making it such that “if we want to make a change to like Chase or Wells Fargo it takes us 2 minutes, we want to make that same change in BofA it can take us 2 months, because we have to go through their internal processes.” Cardlytics is looking to host the technology for BofA to be able to make changes and upgrades faster than what is currently possible. In this aspect, BofA is the bottleneck.

The Cloud: Putting the technology in the cloud is needed for auction-based pricing / dynamic pricing, optimization, and to be more efficient and effective. I have heard Cardlytics say the cloud is needed for machine learning, and I have also heard the new ads server uses machine learning for targeting, instead of Cardlytics doing this themselves for clients (mentioned at the Acceleration Partners presentation in September 20219). Therefore, there are quite a bit of improvements for the platform that are currently waiting to be implemented until BofA allows the technology to be in the cloud.

New Ads Server: The new ads server will allow for the product level offers, the new user interface which also allows for Cardlytics’ local offers, and more. Given the product-level offers are using Cardlytics' / Bridg’s data, and not the banks, Cardlytics has mentioned getting better revenue share (if not simply zero to the FI partner for this portion). These revenue share discussions regarding SKU data (as well as from BofA being the first major bank and having the best revenue share) add to the delay in reaching a new agreement. In all, once again, to be able to add the product-level offers and the more unique and attractive local offers that BofA wants, it is a matter of them taking the new ads server. Given product-level offers are live at U.S. Bank who has the new ads server, Cardlytics is waiting on BofA.

Self-Service for Banks: Cardlytics has also mentioned that with the new ad server there is a self-service platform for the banks. I believe this was first mentioned at the investor day presentation. This will give banks the ability to do more on their own, such as, “do some of the things we’ve been doing for Chase for the last 2 years, so any bank can do that but they can do it themselves”. This will likely be more bank and card specific offers. With Chase, they have been placing very attractive, card-specific offers. This will lead to more differentiation between the Cardlytics-partnered banks, as well as other banks, and even differentiation between the cards within the same bank.

Therefore it doesn't seem like its Cardlytics the issue in terms of updating the technology and adding new features, when Cardlytics must wait until BofA accepts these new items, and Cardlytics is having to negotiate for them.

Q: "If BofA said they wanted local offers, why wouldn’t Cardlytics simply go out and get local offers from someone and put them in the channel before the new ad server and new UI, even if that isn’t what Cardlytics wanted?”

A: I think Cardlytics has always knew they wanted local/SMB, but they have continued to focus where there is the most ad spend and most desire by users, which is the big well-known national brands. And the ability to get these larger brands has really only started once Cardlytics partnered Wells Fargo and Chase and had enough advertising reach. Cardlytics says agency spend is still the focus through 2022, then local/SMB is more of the focus in 2023.

I also think the reason they did not go out and add local when BofA wanted was due to the outcome that is occurring. While it is coming from Cardlytics, they said overall adding local is hurting the channel at the moment, since there is no organization available, making it hard to find offers that are relevant and attractive to each user, since national and local offers are mixed together. So it may be to Cardlytics’ benefit that they did not add local to BofA when they wanted it, made BofA initiate it, have BofA see worse results, and strengthen Cardlytics’ position.

11. Cardlytics May Soon Have a Substantially Higher Number and More Unique Local Offers Than Figg

Q: “Would Cardlytics ever partner with Figg for local offers? Buy them?”

A: It is possible. Cardlytics supposedly used to partner with Empyr. It is also possible Augeo wants Cardlytics to buy them. A lot of people thought the Dosh and Bridg prices were crazy (I do not), but it could lure others trying to get Cardlytics to buy them. This could be why Augeo talks themselves up so much, but that could also just be to help get them into other banks.

I really hope Cardlytics does not purchase Figg, since they have access to the same local offers from Rewards Network. If anything, Cardlytics should attempt to buy Rewards Network, removing access for Figg. However, if the goal was to not have Figg in the picture, it would be better to spend time and resources to get Figg’s banks to switch to Cardlytics.

The benefit of purchasing Figg, or even partnering with Figg, would only make sense if Figg had more unique local offers from having the ability to tap into the local/SMB market in the way a Facebook / Instagram can. This requires more automation, self-service, machine learning, etc. I do not believe Figg has any of this, since in a recent interview, Augeo laid out what it would take, making it seem as though they have not done it.

Q: “If Cardlytics doesn’t partner or buy Figg, how will Cardlytics get local content”?

A: Small Businesses, Self-Service and Machine Learning, Partnering

Augeo specifically mentioned that if Cardlytics or someone else was going to go after local, they could go after the small business space within the banks, aggregators / partners, but would also need automation, self-service, machine learning, etc., all of which Cardlytics has already created or is currently working on, which will lead to original local content at scale, which Figg is not providing. This increases the value proposition of Cardlytics in relation to Figg for the banks, decreasing the odds of Figg going into more banks, or BofA sticking with Figg in the long run.

Small Business Space

Augeo mentioned how banks have large small business spaces who could be a source for local offers. I believe Cardlytics is working on this via the self-service tool they are giving banks.

Self-Service and Machine Learning

Augeo mentioned that if Cardlytics wants to get more into local, they need more automation and leverage machine learning, given Cardlytics cannot work directly and hands-on with tens of thousands of local businesses.

This is why the new ads manger has a self-service component.

Cardlytics also mentioned they just recently added the ability to target with machine learning, rather than having to be hands with each set of targeting for each campaign.

Partnering

Augeo questioned how Cardlytics would go about signing up tens of thousands of local merchants, and how to regulate the offers. The answer is Cardlytics has already built into the new ads manager the ability to connect to partners via API. Cardlytics could use this ability to connect via APIs to partner with the POS providers already integrated with Bridg, use the machine learning and self-service for automation, and then use the new bank self-service tool for regulation (where the regulation aspect was discussed during investor day).

Possible partnerships via self-service and API connections could be leveraging the existing integrations Bridg has with Point of Sale (POS) systems. It looks like Bridg at one point had integrations with NCR’s Aloha and PAR’s Brink. I see Bridg is still listed on PAR 's website as an integration partner. I've also heard Bridg is/was integrated with Toast's POS systems, but I do not see them listed as an integration partner on their website. All of these POS systems could provide a link for Cardlytics to have many thousands of different offers, as well as product-level offers with Bridg.

Summary on Unique Local Offers

Altogether, I think Cardlytics is quietly executing on exactly every item Augeo said was necessary for Cardlytics to get into local. Therefore, not only does Cardlytics have the same local offers as Figg via Rewards Network, but will soon have a substantial number of original and unique local content, taking the lead in local content, and making it less likely other banks will use Figg, and even less likely of BofA continuing to use Figg in the future (removing the costs/complexity/time of working with additional suppliers, as discussed earlier). Essentially, Figg would no longer have their one advantage they talk about.

It is possible Figg can eventually do the same, but I believe Cardlytics has more financial resources and more employees to continue to further their technological innovations for local/SMB, making it harder for Figg to catch up. Figg was only ever ahead of Cardlytics in local given that has not been (and still is not) Cardlytics’ main focus. And the only way Figg got their local content was from a single provider that many loyalty programs use, such as Dosh. I believe that Cardlytics has made more progress on local than many realize, and in a very short period time, all while not even being their main focus.

12. Testing of Figg Supposedly Went Poorly

An interesting part of this story has been hearing how the testing of Figg has been going. One potential negative outcome for Cardlytics would be if the testing of Figg was going perfectly. This could lead to BofA continuing to use Figg for local content until Cardlytics adds all the additional local content discussed above. And has discussed before, even if BofA simply continued to use Figg, it would not be removing Cardlytics for the channel, and therefore not the worst outcome possible.

Instead, I have been hearing from multiple different sources that the testing of Figg has been going poorly. Given I do not know for certain, and it is possible that the source if from Cardlytics, I have added the “supposedly” to this context.

Q: “Why is the testing of Figg supposedly going poorly?”

A: Multiple people have reported that the testing is going poorly. Possible reasons for the testing of Figg going poorly include:

Figg’s offers were low in amount (5%, compared to 10-20%+ on national brands supplied by Cardlytics), and therefore not enough of an incentive to use

Figg’s offers had poor logos (in some cases only words)

Figg’s offers had no images to know who they were or what they were selling (with national brands the name and logo are more recognizable)

Figg’s offers were shown to anyone within a large radius (making them less relevant and known)

Figg’s offers were supposedly not targeted based on purchase data (making them less relevant)

Figg’s offers were mixed with national offers (making them less easy to find and likely decreasing overall engagement)

Q: “Do we know for certain the testing of Figg went poorly, or is that only according to Cardlytics?”

A: It is possible other investors are hearing this from Cardlytics, and Cardlytics is only saying these local offers from Figg are not going well.

However, when I try to assess the situation rationally and independently, not only are they potentially not targeted by purchase data + not nearby + have poor logos and imagery + only 5% offers, but if the offers are from Rewards Network, which I strongly believe they are, then the type of restaurant offers Figg is showing are very unattractive.

From my understanding, Rewards Network provides funding to restaurants in need of capital. This is an important point, because the restaurants on Rewards Network are typically ones that need capital for one reason or the other, such as from struggling in their operations. To pay back the loan, Rewards Network works with loyalty programs to bring customers to those restaurants, and Rewards Network gets a piece of that additional revenue as a way of repayment, by “dining down the balance of the funding”.

I cannot say for all locations, but in the local areas around my state, all restaurants are not ones that are attractive to dine at, I have never eaten there, and I would not go even with a cash-back incentive offer (even if higher than the typical 5% offer mostly seen). This likely explains in part the reason they need capital in the first place.

Another data point is in the 3rd largest city in my state (so not a restaurant in the middle of nowhere) there are two restaurants on Rewards Network (seen on Dosh), and one of those businesses was for sale for an extremely long period of time. Given the restaurant is both on Rewards Network (who provides capital) and was also attempting to sell, it is likely a sign they are not doing great (but this could be speculation).

I know this is not the case for all restaurants on Rewards Network. In more densely populated locations, there are quite a bit of decent restaurants (from the perspective of someone who doesn’t live there, so I do not know for sure). However, this does not mean those businesses are not struggling. Additionally, maybe when assessed on an aggregate basis in those large cities, there may be only a small percentage of worthwhile restaurants out of the many.

Therefore, the origination of local offers from Rewards Network may not be attractive to users, regardless of the incentive (let alone if no imagery to know who they are, unknown name, not nearby, and not related to purchases).

13. Figg Offers are Based on Location (Supposedly Not Given Access to Purchase Data)

Q: “Does Figg receive purchase data?”

A: I have heard Augeo mention Figg has the same kind of transparency into the bank data as Cardlytics, but they did not specify when and where they receive this data (if it is at Augeo rather than Figg, if is when they are the only partner and not a second supplier, do they get the whole share of wallet data, etc.). It is possible Figg has purchase data when they are the primary provider of offers and is integrated with a bank. When they are not the primary provider of offers and not integrated, like in BofA, I do not believe they have purchase data, and instead are location based. This is why they are not always relevant, combined with showing anything within a very significant radius.

This would then match Augeo’s comments saying they do have purchase data, but then in another interview when asked directly about BofA purchase data, they did not answer whether they do or do not have the purchase data with BofA. This would also match Cardlytics’ comment saying the competition does not have purchase data (likely in regard to when Cardlytics is the primary provider).

I also believe Figg is not getting purchase data, since their local offers seem to only be location specific, and not based on actual purchases, just like Dosh. Within Dosh, you can go to any location and see the offers available. Every time that I have matched the location to someone’s BofA offers and Dosh, they are the exact same offers (same logos, same amount, same number of restaurants, etc.). If it was based on purchase data, it would not be the same for everyone, nor would it match Dosh every time (who is simply based on location). Additionally, for users who do not use their BofA card, they have very little transactions and therefore very few Cardlytics offers, but still receive the same ~50 local offers based on location.

I do not think the banks want to share their data with everyone, as it increases the odds of security-related issues. I believe the banks are only looking to share the data to one party at a time, and with BofA, this would be Cardlytics who is already integrated.

14. BofA Possibly Lost Negotiating Leverage due to Figg Testing

Q: “Why is BofA using Figg for local offers?”

A: It has been rumored that BofA was not completely happy with Cardlytics. Augeo mentioned that BofA was not satisfied with Cardlytics, due to BofA wanting local offers right away (and BofA has been wanting SKU for a while as well, according to the former Cardlytics CPO), while Cardlytics has been more focused on national clients and waiting for the new ads server and new user interface to not show all offers in the same area and make it difficult to find offers, and to wait for richer imagery to help with the lesser-known brands. Therefore, if BofA was not willing to wait, they likely reached out to Figg to have them provide local offers within their channel.

Additionally, the Figg testing could have also been for negotiation leverage. Cardlytics has publicly mentioned they are attempting to renegotiate the economic terms of the agreement, and it was separately rumored that BofA was unhappy due to Cardlytics attempting to decreases BofA’s revenue share. With BofA being one of the first large banks partnering with Cardlytics, they have the best terms (as they took the most risk at the time, before other banks were onboarded). Beyond additional renegotiation of revenue share for the traditional offers, Cardlytics has mentioned wanting different revenue share on SKU-level offers, since it would not be from using the bank’s data. The banks want SKU data and offers (information they do not have, and offers that would increase engagement), making it more likely Cardlytics will get favorable terms here. All to say, with these renegotiations, BofA could be trying to gain leverage from saying they could switch to Figg if the terms with Cardlytics are not to their liking. This is only speculation.

However if true, or even if BofA was not attempting to gain additional negotiating leverage, it is possible BofA is losing leverage from the testing of Figg supposedly going poorly. This increases the odds of a renewal, better economics, hosting the tech, putting in the cloud, and BofA taking the new ads server.

15. Truist Renewed with CDLX in Q4 2021 (So No Systemic Problems)

On October 31st, 2021, Truist Bank agreed to extend their agreement with Cardlytics through October 31st, 202410. This shows that there are no across-the-board issues with Cardlytics that has led another bank to not renew at the exact same time.

Closing

I found it interesting how even myself jumped to very pessimistic assumptions when I first heard BofA was testing a competitor. It was not until sitting on the information for some time, thinking through the situation and facts, and gathering additional pieces of information did I come to a much different conclusion. I also wonder if the price situation was reversed, where we were at all-time highs with very optimistic prices, if people would even be talking about this, or the assumption would be a BofA renewal was all but certain.

Even if there has never been a chance that BofA was not going to renew with Cardlytics, it is still likely an assumption held my other investors that has impacted the stock price. Therefore, a renewal may lead to a change in that assumption, where the probability of non-renewal assumed goes from greater than 0% down to 0% (until next renewal), and ensures no significant loss of users and the corresponding reach for advertisers. This could lead to a change in the price of Cardlytics’ stock (where the current market cap is almost priced as if Cardlytics already lost BofA).

There is still always a non-zero probability that BofA doesn’t renew, such as from some new development occurring before they sign. However, even if BofA does not renew, the investment proposition would still be worthwhile at this approximate $2B market cap, as long as Cardlytics retains their relationship with their other banks. BofA is not the largest bank partner with Cardlytics. Any short-term decreases in engagement from a loss of BofA would likely be quickly made up for (or go unnoticed) with the continued increase in ad spend from agencies from the self-service, the additional agencies now using self-service, the addition of product-level offers, new notifications, and a new user interface.

I will continue to follow this closely and provide updates.

More Detail

I discussed this topic in more detail in the following video:

Follow-Up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more. Additionally, if you feel anything is inaccurate, please reach out so I can provide updates / corrections.

-Austin Swanson (Swany407)

Twitter: @Swany407

Website: Swany407.com

Subscribe: If you enjoyed this write-up, subscribe to not miss future ones.

If you enjoy the content, or have received any value from the investment insights, discoveries, and thoughts shared, please consider becoming a supporter of the channel. Your support increases the odds of more investment write-ups and content in the future.

Share: If you enjoyed this write-up, use the link below to share.

More Information on Cardlytics

New Observations, Upcoming Earnings Calls, and Updated Allocations (10.21.2021): Write-Up and video

Thoughts Following Q2 2021 Earnings and Price Decline: Write-up and video

Thoughts After Price Decline (5.17.2021): Write-up and video

Disclaimer: This content is not investment advice, and is intended for informational purposes only. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.