Cardlytics ($CDLX): BofA Renewal & Testing Competitors (Update)

Update on the likelihood of Bank of America (BofA) renewing, and discussions on Figg and Rewards Network, following the January 2022 Needham Growth Conference presentation.

For all my notes on CDLX, check out my Qualitative and Quantitative “Research Notes”:

For those interested, this post is also available on YouTube, Apple Podcasts, and Spotify.

Market Cap as of 1.12.2022: $68/Share x 33M Shares ~ $2.2B Market Cap.

Introduction

On December 29th, 2021, I provided my thoughts on the upcoming Bank of America (BofA) renewal with Cardlytics, and the testing of competitors (write-up and video).

Yesterday, on January 11, 2022, Cardlytics presented at the Needham Growth Conference1, where they provided updates, including on the BofA situation.

Quick Background

As a quick recap, leading into the Q3 earnings call, there were some concerns regarding Bank of America (BofA) not renewing with Cardlytics at the end of the agreement on December 31, 2021.

One reason for the fear of BofA not renewing has been the testing of local offers by another supplier. In BofA, you could see local offers, or “location specific” offers2.

My understanding at the time of the previous post was that BofA was working with Figg, where Figg was getting these offers from Rewards Network, and BofA was using their non-exclusivity rights to place these offers through Cardlytics on Cardlytics’ rails into the Cardlytics system and user interface.

The fear of non-renewal started due to the testing of competitors, but was intensified from the Q3 earnings call on November 2, 20213, where Lynne Laube mentioned that the renewal would not happen until “early next year”, which was after the 12/31/2021 expiration.

In my last post, I went over 15 reasons why BofA is likely to renew. At yesterday’s conference, Cardlytics gave us more reasons, as well as strengthened some of the previous points, removing even more doubt.

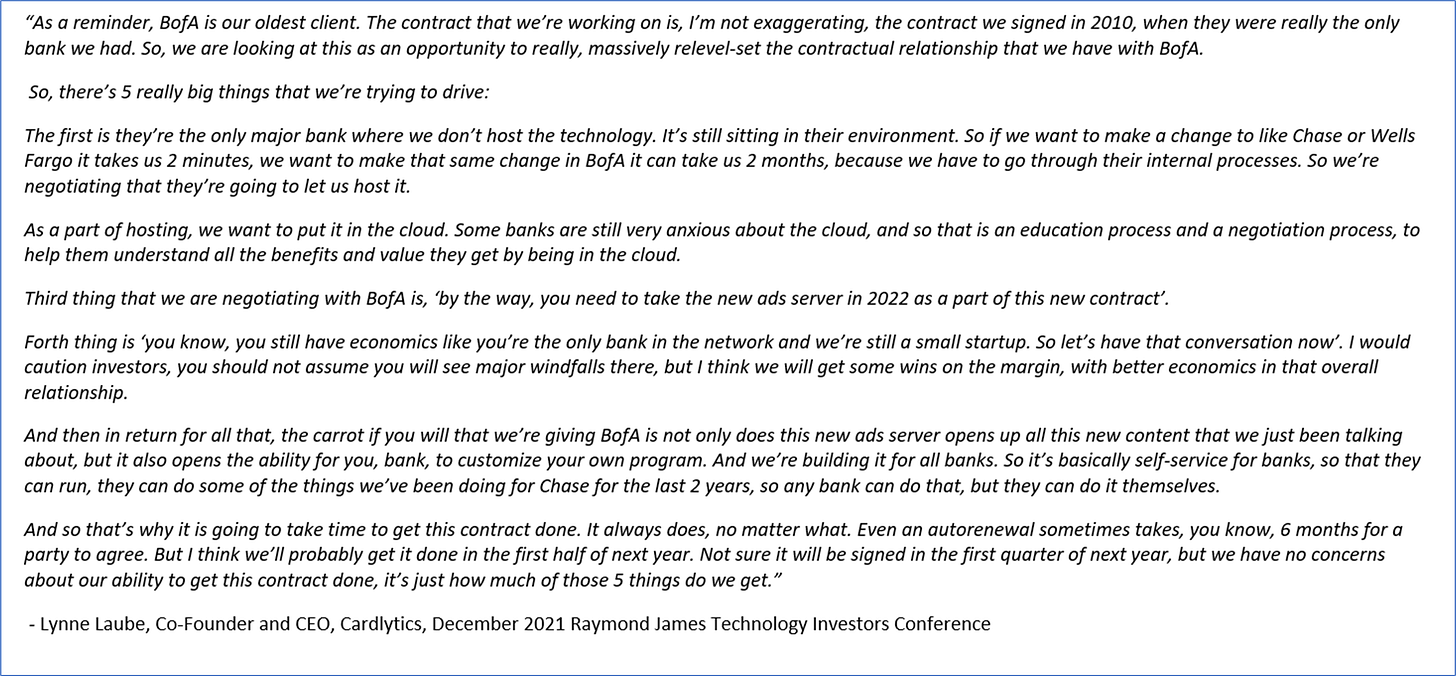

BofA Renewal

When Lynne Laube was previously relaying her thoughts regarding the renewal, she used “fully expect” and “confident”. Yesterday, for the first time, she used “100% confident” regarding getting the new contract signed with BofA. As stated before, for a management team that has went conservative with their forecasts and expectations relayed to investors, using “100% confident” carries weight.

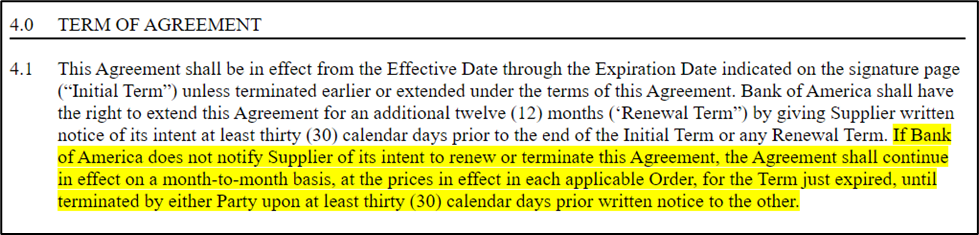

Another important update is the auto-renewal. As discussed in the last post, there has already been multiple contract extensions / renewals4. Additionally, one renewal also did not occur until after the expiration date. This is fine by the contract, given the contract makes it clear that “if Bank of America does not notify Supplier of its intent to renew or terminate this Agreement, the Agreement shall continue in effect on a month-to-month basis"5.

Some investors worried BofA was not going to renew. If that was the case, BofA would of notified Cardlytics ahead of the expiration to terminate the Agreement. Instead, both parties signed. The fact BofA made a conscious decision to keep it going, by signing for the auto-renewal, and did not terminate the agreement as some assumed they would or already did, should be one of the most clear reasons the renewal is occurring.

(Small note: Although it is an auto-renewal, Cardlytics has made it clear that it requires signatures, both here and in December when saying, “even an auto-renewal sometimes takes, you know, 6 months for a party to agree.”)

Even more, both Cardlytics and BofA are exchanging redlines (edits / changes / markups of the original Agreement). Therefore, we know they are negotiating new terms. More specifically, BofA has already sent over their redlines, meaning they have likely sent over a contract that they would be willing to sign. Again, not a termination.

Therefore, BofA has likely agreed to continue the partnership, but now are just negotiating the terms of the new contract.

To top it off, the reason for continuing to negotiate is not due to BofA. Instead, it is due to Cardlytics. Cardlytics specifically said, “we are holding out, to get the right things into that contract”. As a reminder, Cardlytics wants five new things in the contract, including better economics6.

The odds of BofA renewing are all but certain. It’s now just a waiting game to figure out what BofA will accept from the negotiations.

One possible other piece of evidence of BofA renewing, and showing the progress that Cardlytics is making with the negotiations, is a separate comment made regarding banks taking the new ad server:

This shows BofA is also on a path to adopting the new ad server. Maybe Cardlytics only means that BofA’s path is via this negotiation, and BofA hasn’t agreed to this specific item yet. However, I feel given the impressive results of the new ad sever (where when comparing the same exact campaigns between the old user experience and the new user experience from the new ad server, Cardlytics “saw a minimum of 200% increase in click rates. 200%. Some campaigns had 400, actually over 400%”), coupled with BofA sending over their redlines, and this statement of being on a path, BofA likely has agreed the new ad server plans (possibly in their redlines), and therefore is renewing.

My guess where the negotiations are getting hung up is with Cardlytics attempting to get improved economics. As long as the following language stays in the contract (as stated in Cardlytics’ 10-K), Cardlytics should do just fine, even if BofA’s revenue share stays the same, given the power of Bridg (as will be discussed in an upcoming write-up):

Rewards Networks

In the last post, I was very confident the location-specific offers originated from Rewards Network, but was still not 100% sure, given I was not aware of Cardlytics ever mentioning Rewards Network publicly (compared to possibly only when discussing with other investors).

In yesterday’s conference, Cardlytics clarified that the local offers are in fact from Rewards Network.

They did not mention the bank, only that it was “one of our largest banks in the network”. However, given the location-specific offers are only seen in one bank, and based on all the other surrounding information, it is almost certainly BofA.

Interesting Note: September vs December Difference

I first become aware of the local offers on September 2, 2021. This is much sooner than December of 2021 when Cardlytics supposedly started pushing the offers.

Therefore, Cardlytics may not have been the one pushing the offers at that time, and therefore no bank data was being used. Specifically, it was assumed in the last post the offers were going poorly, due to no purchase data being used (and I believe I saw most offers originally all expiring at the exact same time in November). This possibly poor performance could have led BofA to wanting Cardlytics to place the offers in December, pushing the content for them, using purchase data as well, to better target the offers (as will be discussed in the section below).

If this is true, it would likely be adding to Cardlytics negotiating leverage, which has been allowing them to “hold out”.

Figg and Purchase Data

The final updates regarding BofA were in regards to competition. Like Rewards Network, I believe this was the first time publicly (outside of with other investors) Cardlytics mentioned Figg by name (and also Ibotta).

Cardlytics addressed whether competitors such as Figg has access to purchase data. Previously, it was still up for questioning whether competitors, or even specifically Figg, was getting purchase data (but I assumed they were not). As mentioned in the last post, Augeo mentioned they have the same level of transparency into the bank data as Cardlytics, but when asked specifically about purchase data in BofA, they dodged the question. Additionally, the location-specific offers were just like Dosh, and only seemed to be based on location, not purchase data.

Cardlytics made it clear yesterday that they strongly believe they are the only provider that gets the purchase data, and even gave the example that was almost certainly in regards to BofA.

This lines up with the point I made regarding banks are not looking to share their data with everyone, as it increases the odds of security-related issues.

One new item was hearing a bank, who is almost certainly BofA, does not want to give their data to anyone else. This is the reason for Cardlytics pushing the third-party content of Rewards Network on their behalf, to be able to use the bank data and better target the offers.

The fact the reason for pushing the local content on their behalf was from not wanting to share the data makes it much more clear that someone like Figg does not get the bank data here, showing how strong Cardlytics’ advantage, trust, and social proof is.

One item that is still a little unclear is the exact arrangement. Previously my thought was BofA was working with Figg, where Figg was getting these offers from Rewards Network, and BofA was using their non-exclusivity rights to place these offers through Cardlytics on Cardlytics’ rails into the Cardlytics system and user interface.

Cardlytics mentions “working with a partner on their behalf”. I am not sure if this is still in regards to Rewards Network, or Figg. Based on the September vs December difference discussed above, it could be as I assumed where it was originally Figg, starting in September, given the fact Cardlytics mentioned Figg by name right before this, for the first time publicly. However now, as of December, it could be that Figg is no longer in the picture, and Cardlytics is pushing the Rewards Network content directly for BofA. This would remove complexity, and be in line with knowing banks prefer to work with one supplier.

[Update as of 5/16/2022: Based on comments from CDLX management today with some investors, it does sound like BofA was in fact working with Figg who was getting their local content from Rewards Network. Before this confirmation, it was still not clear to me if BofA was working with Figg or working directly with Rewards Network. Additionally, I originally thought based on the quote above when talking about Figg, that CDLX was taking over pushing Rewards Network content for Figg within BofA. This assumption was due to the cryptic way CDLX described the situation, and also separately mentioning now pushing Rewards Network content. Based on CDLX management comments today, it does not seem as though CDLX was pushing Rewards Network offers for BofA. Instead, CDLX is pushing Rewards Network content for another bank, but BofA is aware that CDLX is doing this. CDLX also reiterated, like the quote above, that Figg is likely not getting purchase data from BofA (which matches other comments elsewhere). Where this gets complicated, the Jan 2022 comment says CDLX started pushing Rewards Network content in Dec 2021 for one of their largest banks. We now know that it was not BofA. Given the “Shop Local” Chase offer as of 12/30/2021, this comment was likely related to Chase. However, the offer seen was for automotive, where Rewards Network is usually for restaurants. It could be this offer was from the Entertainment acquisition, but the Q1 comments on May 2, 2022 make it seem CDLX has not yet started pushing out any of these offers to the banks, and CDLX did not acquire Entertainment until Jan 7, 2022 (after this offer was seen). To add to the confusion, in Q1 on May 2, 2022, CDLX said “In the first quarter, we began piloting local content from a partner with one of our major banks. This is an exciting development and allowed us to test the scalability of our new Ads Manager. In this pilot, we included over 300 hyper-local advertisers from a third-party content provider.” The first quarter is much different than the comment in Jan 2022 saying CDLX started pushing Rewards Network content in December of Q4. Also, this comment of “first quarter” would be after the Chase “Shop Local” offer as of Q4. While a name was not mentioned in Q1 for the third party local content provider of the 300 hyper-local offers, CDLX mentioned today it was Rewards Network. Therefore, while I thought maybe there was two different CDLX banks getting local offers, I believe at this time it is only one bank, coming from Rewards Network, and likely Chase. I believe the difference of when these offers started was likely just an oversight when communicating, but I could be wrong, given I do not think the automotive offer would originate from Rewards Network.]

I have asked others if they have seen any changes in the location-specific offers within BofA (different logos, less offers to be more targeted, closer in location, etc.), and I have not heard anyone say they have seen any differences at this time.

An interesting point was how they said it took them a decade to get Chase comfortable, leading Cardlytics to state, “I don’t think investors appreciate how big our moat is”. This shows how difficult it is for someone else to get the bank data. If that is the case, it is likely very hard for a competitor to do the same, especially with lack of social proof, trust, and experience.

Closing

The updates on the BofA renewal and competitors were all very positive.

I would think given how clear Lynne Laube was regarding these perceived issues it would remove some investor worries. However, it may take a public news release of the signed new contract for these worries to be completely behind Cardlytics. Therefore, the current market price may still reflect some of this doubt, leading to a possible future price increase once such announcements occurs.

If you enjoy the content, or have received any value from the investment insights, discoveries, and thoughts shared, please consider becoming a supporter of the channel. Your support increases the odds of more investment write-ups and content in the future.

More Detail

I discussed this topic in more detail in the following video:

Follow-Up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more.

-Austin Swanson (Swany407)

Twitter: @Swany407

Website: Swany407.com

More Information on Cardlytics

New Observations, Upcoming Earnings Calls, and Updated Allocations (10.21.2021): Write-Up and video

Thoughts Following Q2 2021 Earnings and Price Decline: Write-up and video

Thoughts After Price Decline (5.17.2021): Write-up and video

Disclaimer: This content is not investment advice, and is intended for informational purposes only. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.

Cardlytics Presents at the 24th Annual Needham Growth Conference: https://ir.cardlytics.com/events/event-details/cardlytics-present-24th-annual-needham-growth-conference

CDLX Q3 2021 Earnings Call: https://ir.cardlytics.com/events/event-details/q3-2021-cardlytics-inc-earnings-conference-call

Thanks for the update Austin! It would be incredible to know with certainty that Figg did not use purchase data. CDLX = monopoly?