Cardlytics ($CDLX): The Power of Bridg (and Why CDLX is Undervalued)

Bridg could lead to high levels of growth from combined insights and targeting, product-level offers, solving the attribution problem, and partnering with POS systems (like Toast, Square, PAR, NCR).

For all my notes on CDLX, check out my Qualitative and Quantitative “Research Notes”:

Pictures may be more clear when viewed on a desktop.

For those interested, this post is also available on YouTube, Apple Podcasts, and Spotify.

Market Cap as of 1.16.2022: $65.37/Share x 33.1M Shares ~ $2.2B Market Cap.

Please Note: The majority of this post is in the footnotes. While some of the footnotes are for sources, most are related to extra details for those interested. I tried to specifically call this out when it occurs, rather than just a number which refers to sources.

This was done to keep the main body of this post as short as possible, while still including all my relevant notes for those interested. My hope is those who want a shorter read, can read the main body of this post and still get the most important information. For the video and podcast, I will be going through the main body first, then the footnotes.

If you have questions, my hope is most answers are in the footnotes, but feel free to reach out to me directly.

Introduction

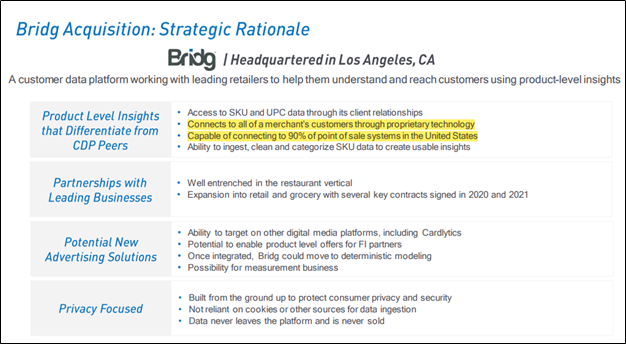

Cardlytics acquired Bridg, a customer data platform with SKU-level (or product-level) insights from POS systems, in April 2021, for $350M (with two potential earnout payments that could total between $100M to $300M)1. Bridg will enable SKU-level insights and targeting, as well as product-level offers, previously not possible with Cardlytics.

Over the next two years Cardlytics will likely experience significant increases in ad spend and revenue, and at higher-than-normal gross profit margins due to lower revenue share, all from utilizing Bridg.

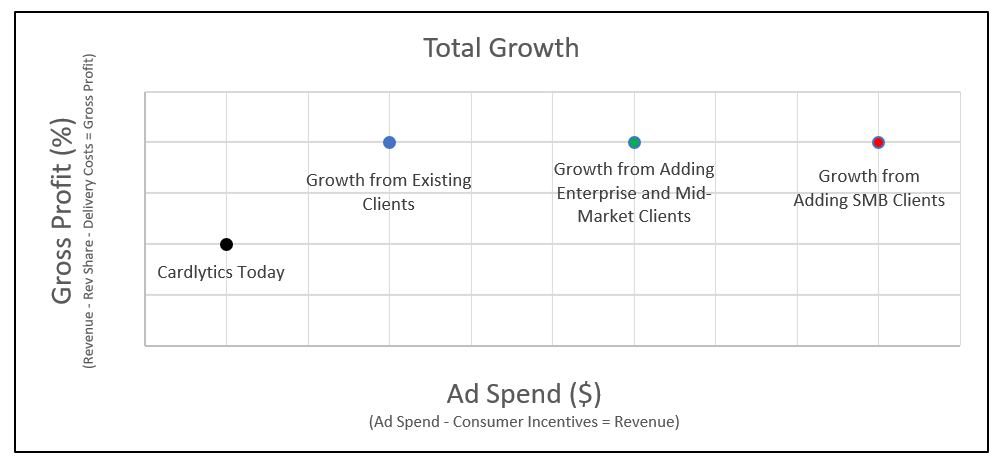

I believe there will be three stages of growth with Cardlytics + Bridg:

Growth from Existing Clients

Growth from Adding Enterprise & Mid-Market Clients

Growth from Adding SMB Clients

Each stage will contribute to Cardlytics increasing levels of ad spend / “billings” (and consequently revenue) and at higher gross profit margins, all directly related to Bridg (for financial definitions, see the footnotes2).

The higher-than-expected growth will be generally due to:

Growth from combined insights and targeting from Cardlytics + Bridg

Growth from product-level offers

Growth from solving the attribution problem

Growth from partnering with POS systems (like Toast, Square, PAR, and NCR)

I believe many of these items from Bridg will address previous desires and issues expressed by advertisers, which when solved with Bridg, it will contribute to Cardlytics’ growth in ad spend and revenue.

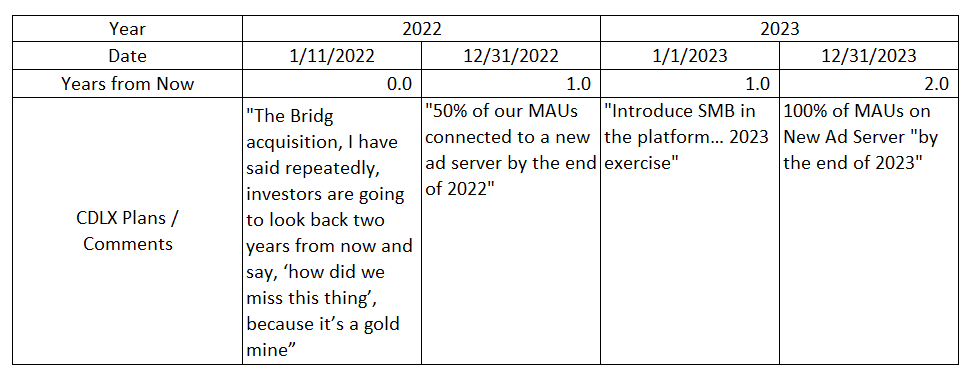

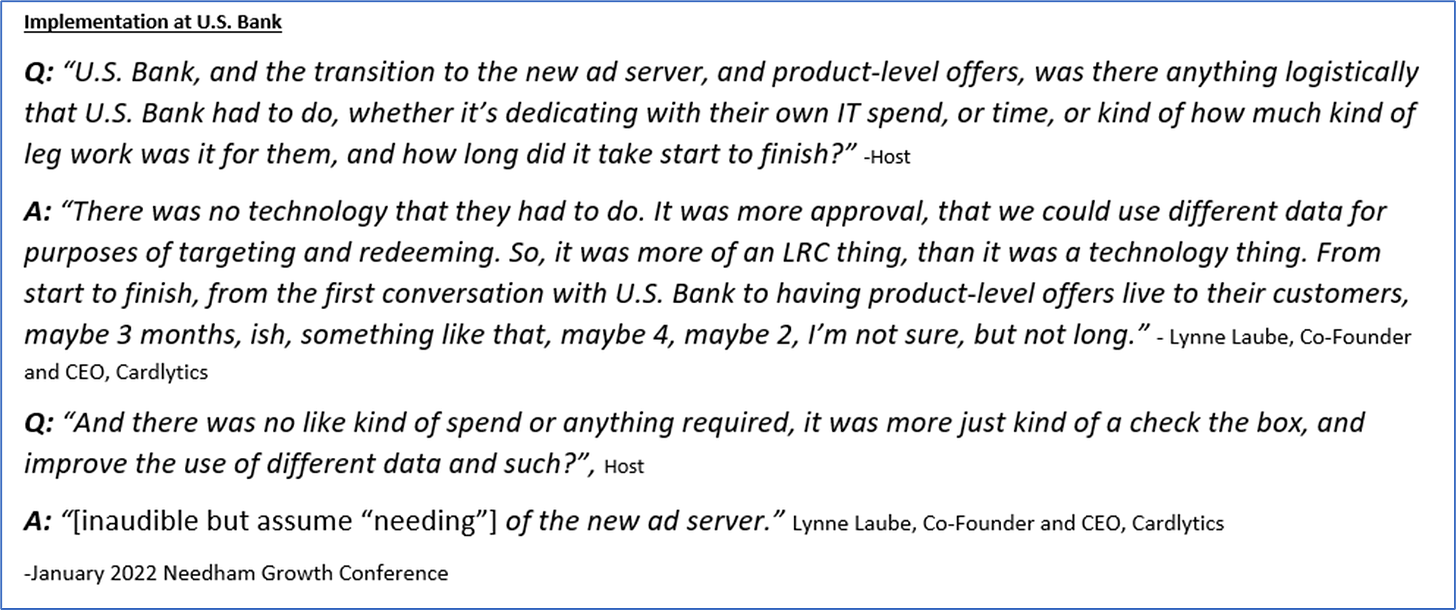

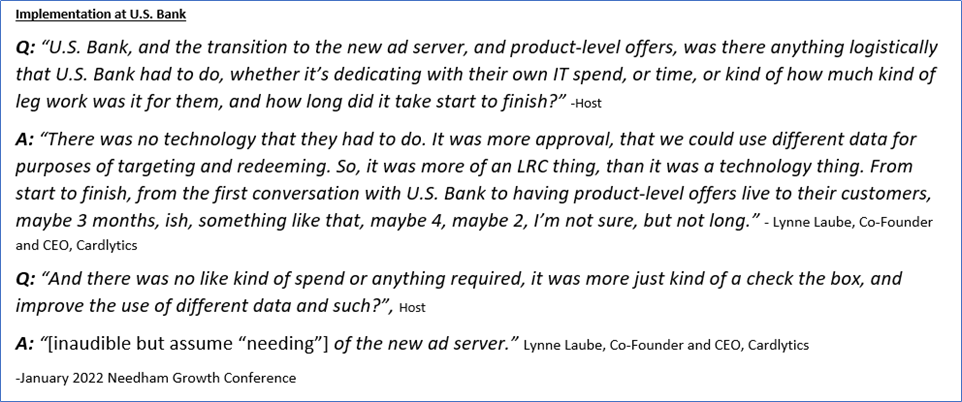

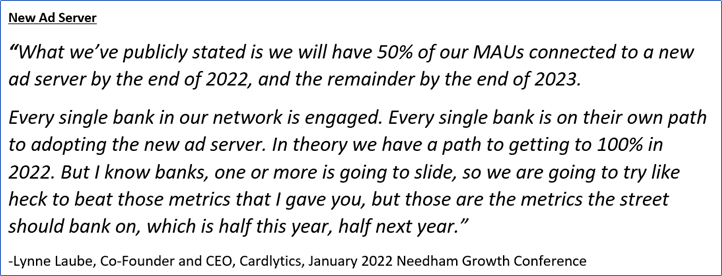

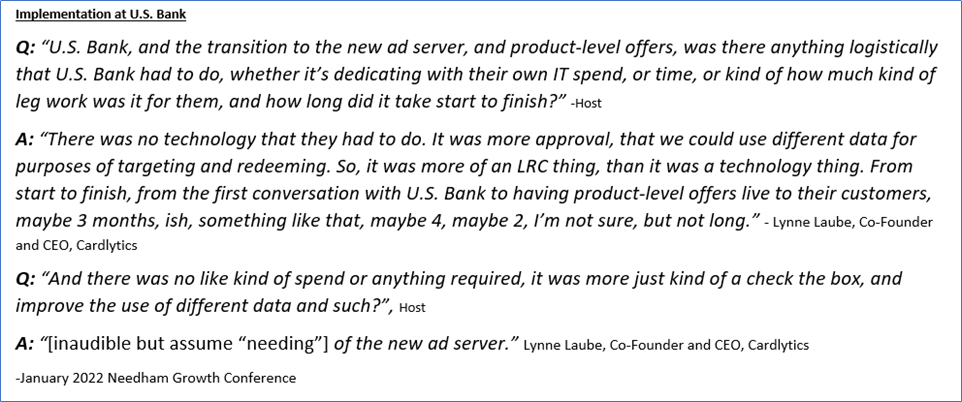

This growth from Bridg will require the new ad server to use the data and place and redeem product-level offers. The current stated goal is to get 100% of MAUs on the new ad server by end of 2023, or 2 years from now, matching Lynne’s comment above regarding “investors are going to look back two years from now and say, ‘how did we miss this thing’ because it’s a gold mine.” (Information on the new ad server, timing, and engagement stats is in the footnotes3).

This potential growth is going unnoticed (or at least under discussed) and ignored (implied by the current market cap under reasonable assumptions), possibly due to the uncertainty on what’s possible or could happen with this relatively new acquisition.

I believe this is related to Lynne Laube’s comment in December 2021 on what investors do not understand or appreciate:

While all of the above is essentially a simplified updated investment thesis for Cardlytics (especially when combined with all the other growth factors ignored that will be mentioned in the closing of the write-up), this post will go into detail regarding Bridg and how it could exactly unfold.

I try not to be too aggressive or optimistic with assumptions or expectations with regards to investing, both in terms of my own investments and what I write about. While some areas of this discussion may come across as overly optimistic, or too good to me true for it to be going unnoticed, I do not believe my claims are out of line. Not only do I provide “reality checks” on my own work (such as where there are quantitative examples), but also nearly all items discussed are based around direct comments made by management, developments and updates that have actually occurred, actual changes in ad spend by clients, existing partnerships, and actual contract language. Therefore, the items discussed are less speculative and have a higher probability of occurring than one may first assume.

If you enjoy the content, or have received any value from the investment insights, discoveries, and thoughts shared, past or present, please consider subscribing or becoming a supporter / premium supporter of the channel. Your support increases the odds of more investment write-ups and content in the future.

Disclosure and Disclaimer

The terminology I use in this post, as well as the explanations for how this could work are my interpretations and may not be fully accurate.

The focus should be on the big picture. My hope is this helps others think about what may be possible and could occur, given management’s comments, company developments, actual changes in ad spend, contract language, existing and developing technology, and existing partnerships.

As always, this is not investment advice. This is for educational purposes only.

Growth from Existing Clients

I’ve divided existing clients into three groups.

Those that are already clients of both Cardlytics and Bridg

Bridg-only clients

Cardlytics-only clients

Given the benefits and desire to have combined insights and targeting ability, and placing product-level offers, I believe a large portion of existing clients will eventually become clients of both Cardlytics and Bridg (especially if it can become a simple process, such as via self-service through the new ads manager). As the number of clients of both Cardlytics and Bridg increases, the financial benefit that Cardlytics will realize will also increase, from each of the points discussed below. More simply stated, if a Cardlytics does not become a Bridg client, they will not get any of the benefits discussed below, which would also limit Cardlytics potential revenue and gross profit.

Growth from Combined Insights and Targeting

Increases in revenue would come from the additional ad spend from clients having the combined insights and targeting when using both Cardlytics and Bridg.

As a real quantitative example, one “significant restaurant client” had a 400% increase in their spending compared to when buying separate. Although it is hard to know the size of the original ad spending, it was coming from a significant client, rather than a smaller client who may have not been spending as much before, where a 400% would not mean as much. (My guess of the client is discussed in the footnotes4).

Therefore, we could expect that those that are already clients of both will increase ad spend as they begin to use the insights and targeting from combining both Cardlytics and Bridg. This is directly related to Lynne’s comment regarding “I don’t think investors appreciate the power of Bridg and Cardlytics’ data combined”.

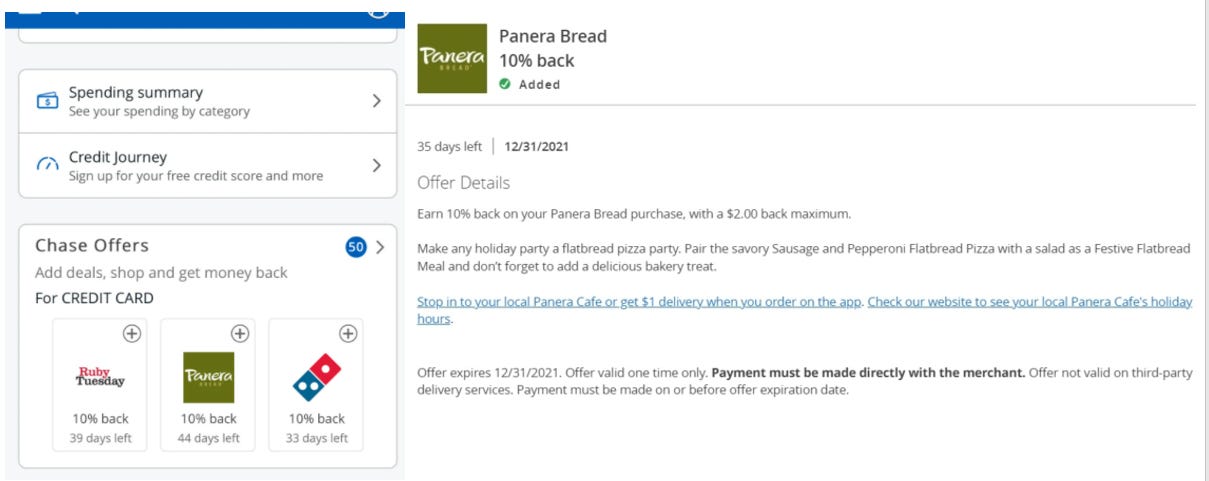

One company where we could see the increase in ad spend even more is Panera, who earlier this year had said they used both Bridg and Cardlytics, but wasn’t seeing the benefit yet. At the same time, they mentioned more doubling of their ad spend next year, but this seems independent of the combined benefits of Bridg and Cardlytics, given their other comment. Therefore, as they also learn and experience these benefits from the data combined, we could see someone like Panera, or anyone else who is already a client of both, start increasing their ad spend even more.

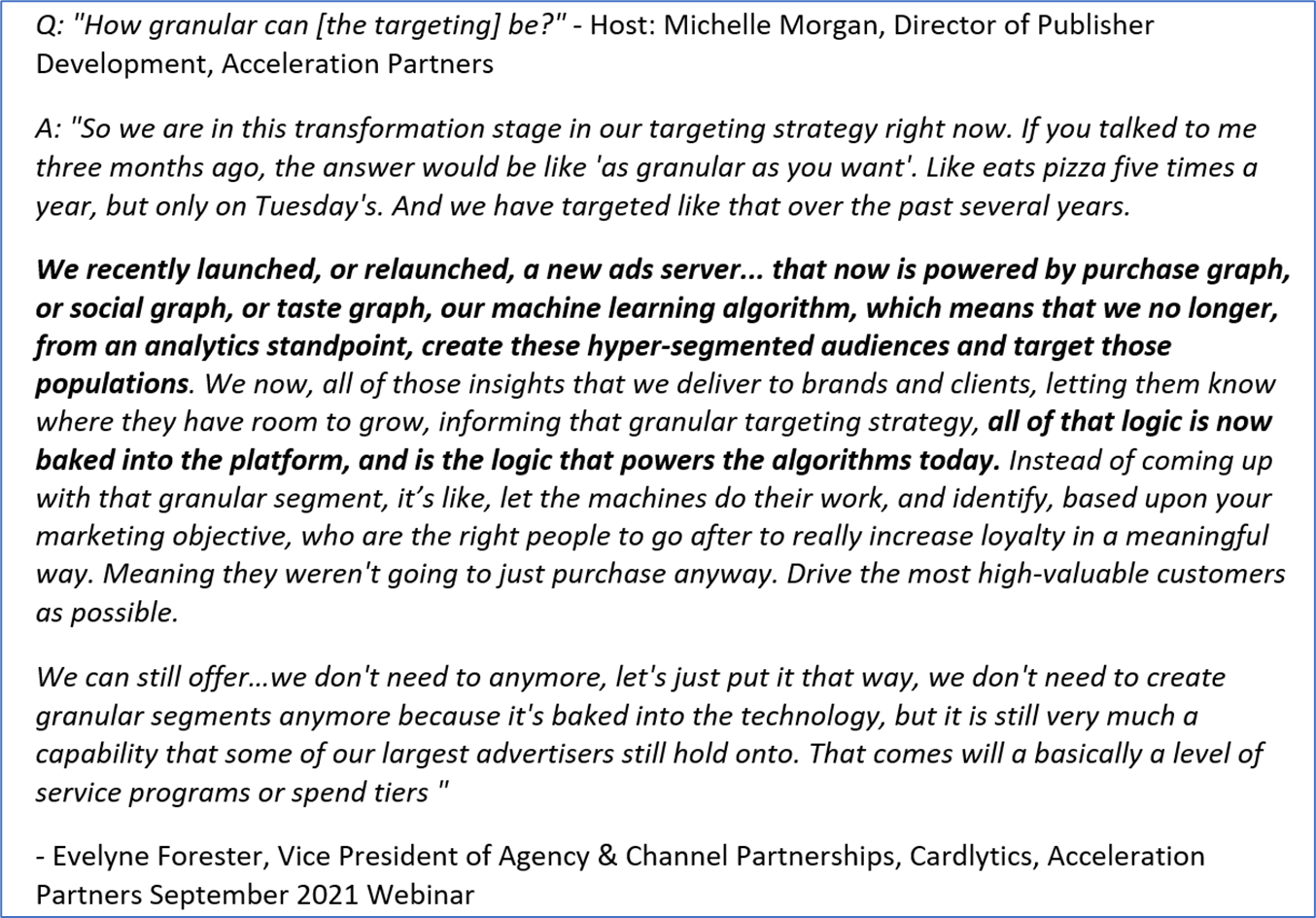

In order for Cardlytics to experience the highest increases in revenue, they will also need to get those that are only Cardlytics clients and only Bridg clients to become clients of both.

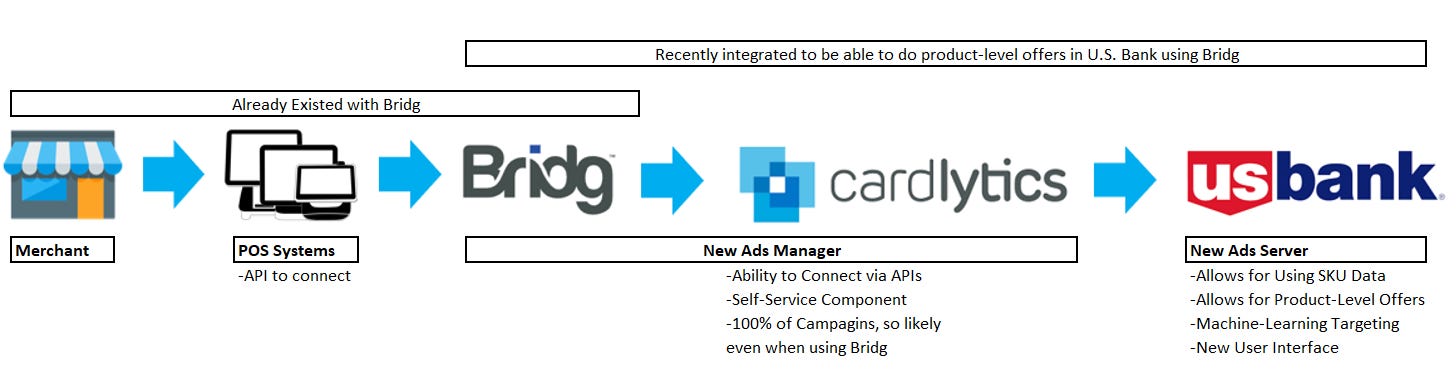

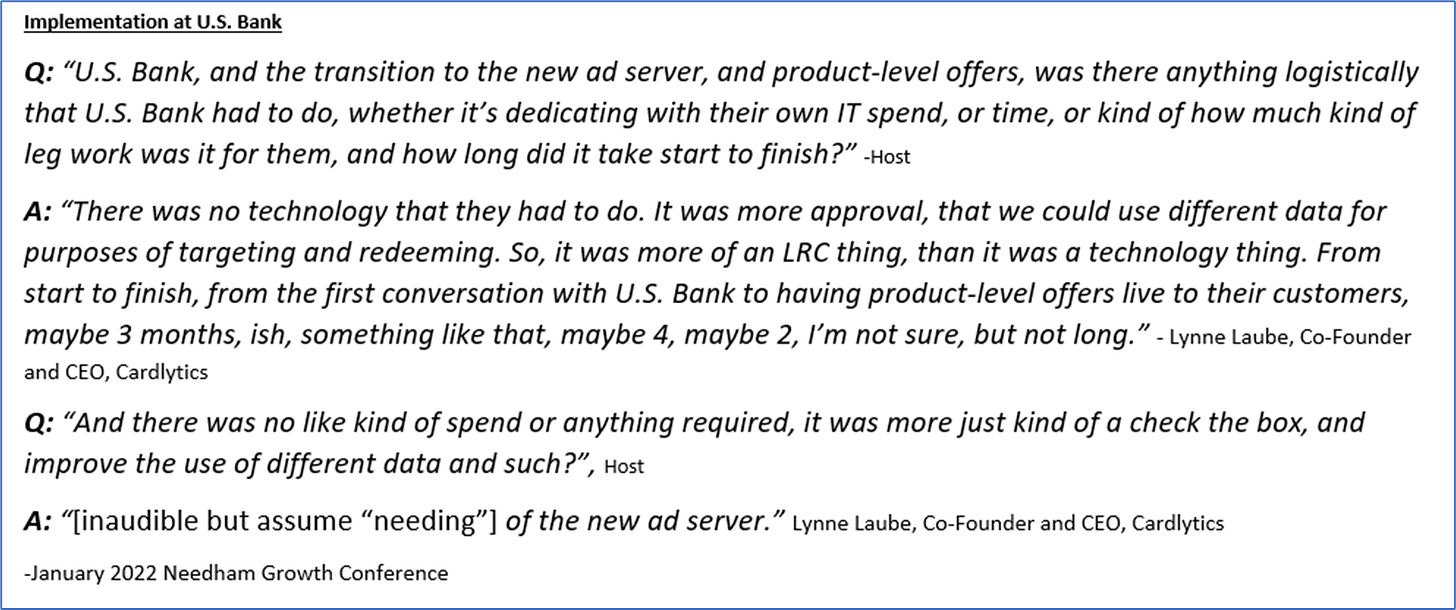

I believe those that are currently clients of Bridg will be able to easily add in Cardlytics data and insights and be able to place offers in the bank channel. Given Cardlytics’ new ad manager has a self-service component, and given Cardlytics’ new ad server has more automation such as using machine learning for targeting to be more hands off (discussed more in the SMB section later), I feel it should be easy for Bridg to simply use Cardlytics for both the data and to place offers. We know this integration is possible, given product-level offers are now live at U.S. Bank (or at least testing)5.

Those that are only Cardlytics clients, it may become as simple as within the self-service platform of Cardlytics having something that says, “Want to add SKU-level data and product-level offers? Simply log in to your POS platform to connect via our APIs.” Although the mention of connecting to partners via APIs was in the context of adding SMB clients (and will be discussed at length towards the end), I believe this ability, or something along the same lines, could extend to adding Bridg data, especially where partnerships with POS systems exist (which will also be discussed in the SMB section at the end).

Even if there is not an easy way today for Bridg clients to also become Cardlytics clients, or Cardlytics clients to also become Bridg clients, I believe Cardlytics will find a way to make it an easy addition.

Important Point (Examples, and Why the Best Loyalty Program Still Need Bridg and CDLX)

I can think of at least one area where there could be extraordinary benefits from combined insights and targeting. For a given Cardlytics and Bridg client, they can see both the product-level purchases made by customers from Bridg, and then also where they are shopping and the associated share of wallet in that industry from Cardlytics. Although a given client would not have the product-level purchases made at competing stores (given the Bridg data is from the individual company’s POS system, and likely not shared to other competing companies), Bridg and Cardlytics data combined could lead to making reasonable conclusions and insights on what the customers are buying elsewhere, and using that to determine who to advertise to and determine what would be an attractive offer for those customers.

For instance, if you are Starbucks, you may have a set of customers who buy from you, as well as Dunkin’, McDonalds, and Burger King. With only Cardlytics, you may only know the share of wallet between the four, and know Starbucks has a very small share of wallet compared to the total of the other three. Placing a 10% offer may only be so effective, since the customer may only associate Starbucks with coffee, and therefore the targeting is not very effective. However, by also being a Bridg client, Starbucks could then also see that a certain subset of those customers always buys breakfast sandwiches when they buy from Starbucks (with only Cardlytics, there would be no way of knowing what they are purchasing, just purchase totals). Combined with knowing where else they buy and possibly the amounts and times, Starbucks could conclude they are also buying breakfast at the other restaurants. Therefore, from this combined insight of share of wallet in the category and product-level purchases, Starbucks could have much better targeting effectiveness by either excluding that group of customers from certain targeting sets, or by sending that group customers breakfast sandwich offers, higher offer amounts but only during breakfast hours, or showing those specific customers pictures of the breakfast sandwiches they offer (different pictures for different customers on the new user experience is not something I’ve heard discussed, but could be effective, as seen with Netflix). This increases the relevance and attractiveness of the offers, leading to higher engagement and conversion.

Crazy enough, I wrote that example above before the January 2022 call, where Cardlytics publicly disclosed that Starbucks is a client of both Cardlytics and Bridg. Better yet, they confirmed my theory of how this works, also using Starbucks as an example:

One additional point that is hit home is how visibility and engagement with customers increased with Starbucks after using Bridg. Only 12% of customers are in their loyalty program6, which is where they need to be to see what they are buying and be able to use that information to engage with them. Bridg allows retailers and restaurants such as Starbucks increase that, where Starbucks now has that ability with 90% of customers, including those not in the loyalty program.

This data point can likely be used with many other Cardlytics clients to be able to convince them to add Bridg. If Starbucks saw this dramatic change, with their large loyalty program, then nearly everyone else can likely benefit even more. Given Cardlytics is publicly discussing this statistic and how they helped, I’m sure they will use it to sell to others, such as Cardlytics-only clients.

The Starbucks example of dramatically increasing Starbucks’ visibility into customer purchases and then targeting those customers, including those outside of their loyalty program, perfectly illustrates one massive benefit of Bridg. When combined with Cardlytics, they can infer what they are buying elsewhere, increasing the targeting ability, as well as being able to place the offers in the bank channel. This is a reason I believe a large portion of clients (at least in terms of revenue contribution) will become clients of both Cardlytics and Bridg.

Additionally, there is a current inaccurate assumption by investors where companies with loyalty programs do not need help from Cardlytics or Bridg. I believe this Starbucks example is the best showcase of why they do need them, and why even the best uses them, especially since other investors even use Starbucks of someone who doesn’t need them (despite using both Cardlytics and Bridg)

Growth from Lower Rev Share and Higher Gross Profit Margins

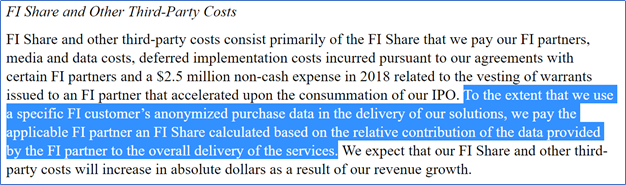

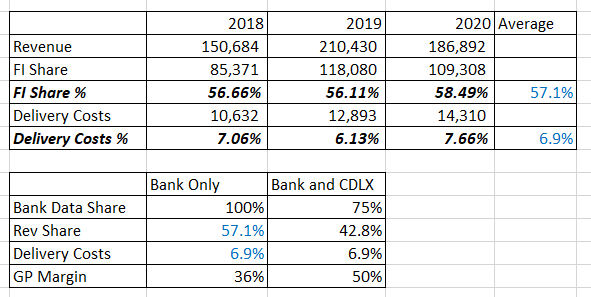

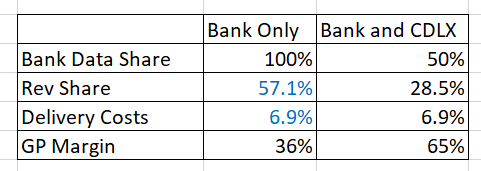

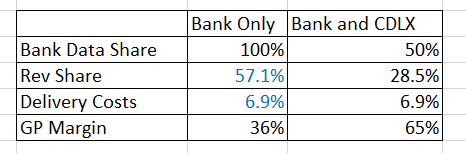

On top of that, for those who use both Cardlytics and Bridg data, it has been stated that given the Bridg data does not come from the bank, there could likely be less revenue share. Therefore, this revenue may have higher gross profit margins.

This matches the FI Share description in Cardlytics’ 10-K, where it states:

I believe the highlighted section is very important. Cardlytics has mentioned that with the introduction of Bridg and SKU-related data it could dramatically reduce revenue share with the banks. The banks want this data and insights since they do not have it. And the retailers want the bank data and insights since they do not have that. Cardlytics is the counterparty that has access to both.

Revenue share could decrease because, as stated, the FI Share is calculated based on the relative contribution of the data provided by the FI partner to the overall delivery of the services. As of right now, I believe only the bank data is being used. Therefore, 100% of the data for the overall delivery of the services is from the FI partners. However, once you add in Bridg and SKU-level data, the banks’ contribution decreases. (Example calculations in footnotes7)

Originally I thought this would only occur on product-level offers. However, based on how you read the definition, it is possible that simply when the Bridg data is also used it would reduce the bank’s relative contribution, even if it was not related to a product-level offer. Cardlytics has made it known that certain clients are already increasing ad spend due the combined insights and targeting ability from using both Bridg and Cardlytics. Given product-level offers are only in testing phase and only in U.S. Bank, my guess is these clients are using Bridg data but only with store-level offers. Therefore, revenue share may also decrease on non-product-level offers, as long as Bridg data is also used. However, I do not know for sure.

This large change in revenue share may be what is holding up the BofA negotiations. Will BofA and other banks be okay with this? I believe so, given they do not have this SKU-level data and want it. They also want product-level offers. U.S. Bank already agreed to it. Additionally, although their FI share percentage will decrease, their FI share will likely increase in absolute dollar amount with the increases in ad spend related to the growth discussed in this post (increases in ad spend and revenue from enhanced insights and targeting, product-level offers, new advertisers both large and small, more credibility, etc.). There, the banks should be more than okay with this.

The banks also receive more benefits than just the FI share, where the other benefits outweigh the FI Share: engagement, less attrition, more spend on their cards, cross using of other products in their bank, etc. These should also increase as the Cardlytics offering improve, such as when Bridg is used.

Growth from Product-Level Offers

Beyond more ad spend from the benefits of combined insights and targeting is the additional ad spend from being able to place product-level offers. This was specifically mentioned as a separate area of growth during the Q3 earnings call:

Growth from the enablement of product-level offers will not just be from brands (Sony, Nike, etc.) or CPGs (consumer packed goods, like from Unilever, Kraft Foods, PepsiCo, etc.) who need product-level offers to use Cardlytics. Existing large clients of Cardlytics, who currently can only place store-level offers, have already stated their desire to also place product-level offers. One reason is the different margin profiles within a business, and not able to vary the percentage based on the different product margins.

A real example is Panera. The Chief Digital Officer at Panera, where Panera is a client of both Cardlytics and Bridg, has specifically said they want more than just taking off a percentage off the order, and would like to have ads for specific items in their business, like their coffee subscription. Offers like this will likely have a non-linear impact for Panera and Cardlytics. By combing the insights of Cardlytics and Bridg, Panera could target customers who both buy coffee at their store by using Bridg to know what they buy, and then also target based where customers also spend a higher relative amount of their wallet elsewhere in the coffee industry (Starbucks, Dunkin’, etc.). Without Bridg and Cardlytics, Panera cannot as effectively know what they are buying and where and how much, with the largest group of customers (not just loyalty members), and then be able to target those customers as effectively. Additionally, on the customer side, without Bridg and the new user experience to highlight specific offers, a coffee drinker may not even know Panera has coffee, or their “Unlimited Sip Club” coffee subscription offering, and therefore a 20% store-level will not be near as effective as a relevant coffee offer, especially if also higher in amount (like 50% off or even free like they are already doing). (For more pictures of possible new ad types, as well as information on how the flywheel may start spinning faster, related to this Panera example, and Bridg in general, see the footnotes8.)

In order to have product-level offers, it will require the new ads server, based on only U.S. Bank currently receiving these types of offers (since U.S. Bank is on the new ad server), and given the comment at Q3, “The new ad server will enable new offer constructs at scale, such as product-level offers…”. This is one large reason for Cardlytics being focused on adding more banks to the new ads server in 2022 (exact quotes and timelines included in the footnotes9).

Growth from Attribution, Credibility, Believability

One of the larger issues that has prevented increases in ad spend has been the attribution problem, or credibility or believability with Cardlytics and their results.

I’ve heard that Cardlytics has mentioned that if a Cardlytics client also becomes a Bridg client, they now have more view into their own data, solving the attribution problem. This is in comparison to Cardlytics-only clients who only have access to aggregate anonymized bank data. Therefore, Bridg may help with the attribution problem in some capacity by giving more access and insight into their results, given its their own data, and it is not the bank’s data. It may also allow for more comparable testing. Ultimately this could lead to increases in ad spend as credibility and believability of results increases. (See footnotes for more details and thoughts10)

Additionally, there have been concerns with Cardlytics checking their own results. Most of this concern has been addressed by Cardlytics utilizing Nielsen Sales Lift Measurement for an independent, third-party process for measuring and reporting sales lift from Cardlytics’ campaigns. However, some concerns may still be present, meaning there is still room for additional ad spend if these concerns are removed.

Product-level offers should remove even more, if not all doubt of Cardlytics’ credibility with advertising campaign results, especially where the numbers are very good in relation to other digital advertising programs. Some current Cardlytics advertisers want to do geo-lift testing or geo experiments, to see the impact in certain areas, but that may require significant ad spend to do the testing, which an advertiser may not be comfortable spending yet. This is where product-level offers can help, by allowing advertisers to give offers on very specific items, possibly even ones typically not purchased. This would allow them to see for themselves the uptick in the number sold of that exact item. That should remove a substantial portion of doubt that Cardlytics works, leading to increases in ad budgets with Cardlytics.

Summary of Growth from Existing Clients

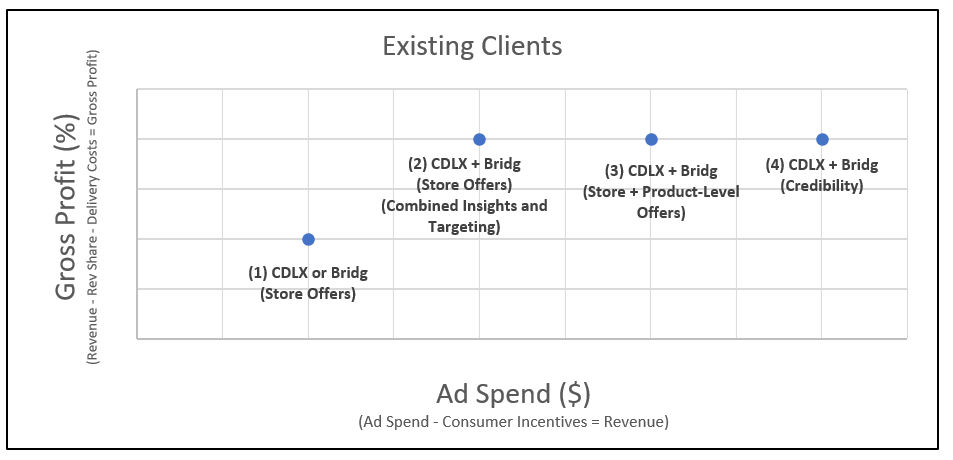

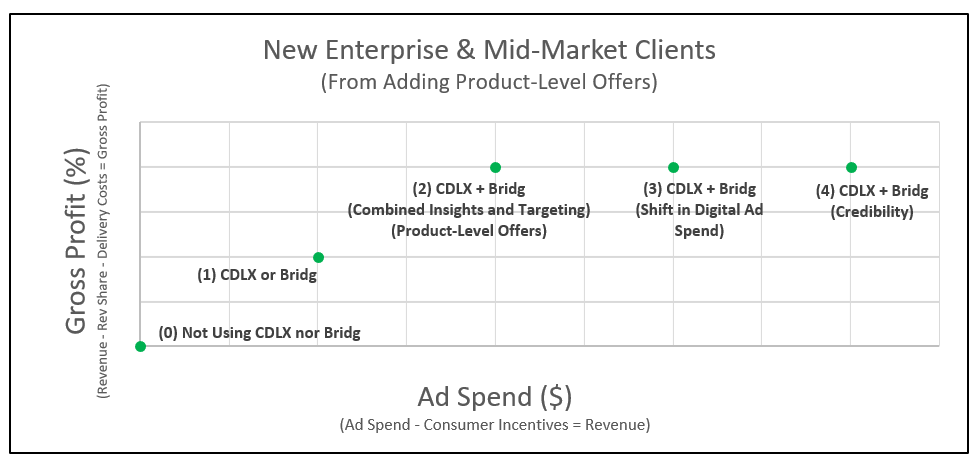

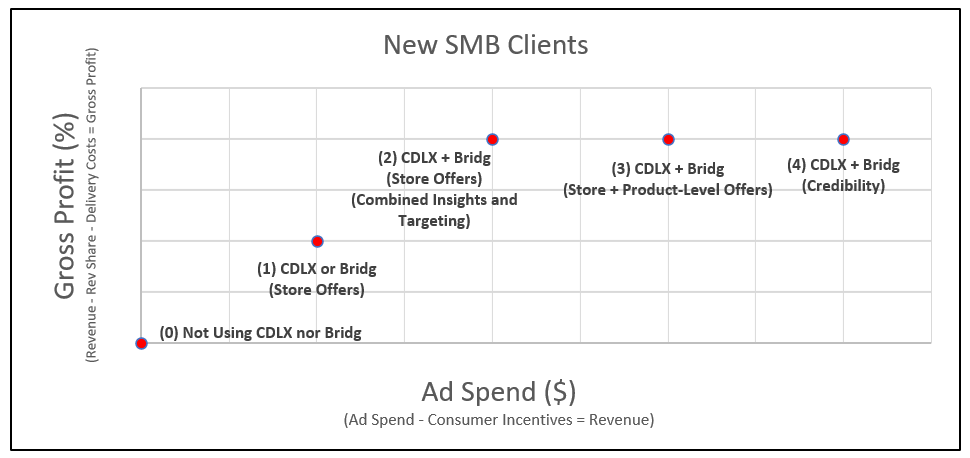

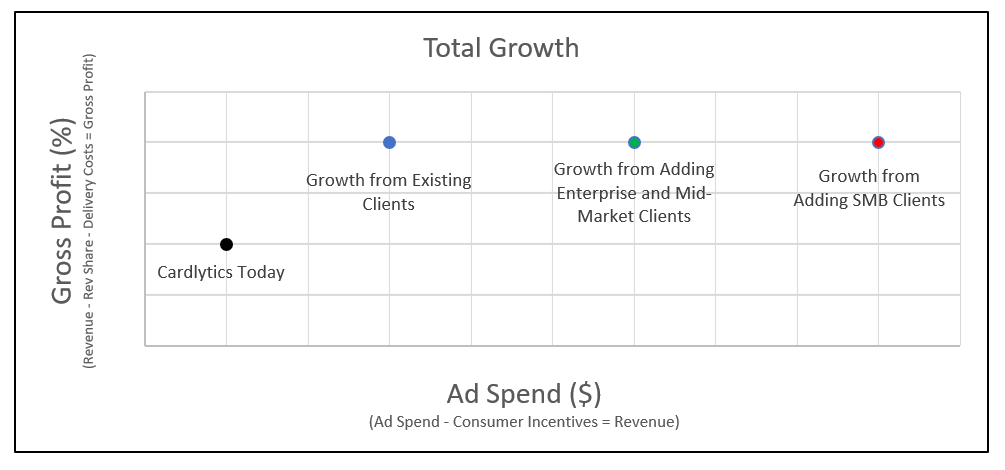

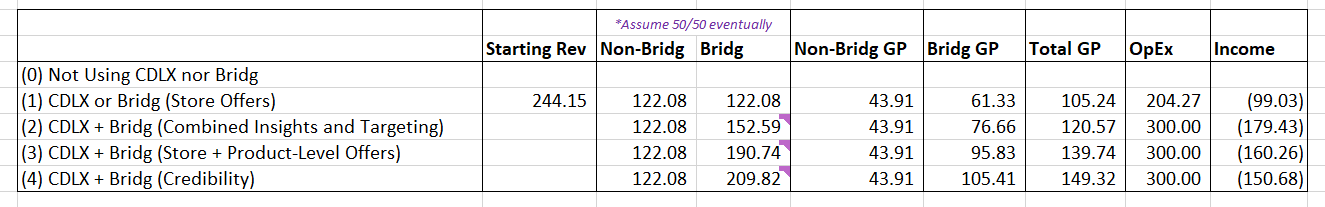

As a summary, I’ve thought about all of this in following steps (with a graph below to visualize):

CDLX or Bridg clients, and using store-level blanket offers (do not vary by product): This includes those who have been clients of both, but are not using or yet seeing the combined capabilities and benefits at this time. An example is Panera, who is a client of both Cardlytics and Bridg, but at the time (around September 2021 I believe) was saying they haven’t seen benefits yet, but still more than doubled their ad spend for next year. This is where Cardlytics has been, and represents the financials entirely as we see them today.

CDLX and Bridg clients, also still only doing blanket offers, but are utilizing the combined insights and targeting: This is where we have heard the increases in ad budgets, such as “400%”, from the “combined power” of CDLX and Bridg data. This is still without product-level offers, since this news came out at Q3 earnings in November, before product-offer testing went live and were announced in December. This is why we see an increase in ad spend moving from (1) to (2) (moving right on the graph). The extra benefit is the possible lower revenue share when using this non-bank data (given the data is from the client and Bridg) leading to higher gross profit (moving up in the graph).

CDLX and Bridg clients, using both blanket offers and also product-level offers: The addition of product level offers will lead to more ad spend by existing clients (moving to the right on the graph), as even stated by Lynne as a separate growth aspect.

CDLX and Bridg clients, using both blanket offers and also product-level offers: By using Bridg to help increase the view into their own data, it helps solve the attribution problem. Additionally, product-level offers can be used for a form of testing, increasing credibility and reliability of Cardlytics results, leading to further ad spend.

I believe over time we will see more and more clients of Cardlytics moving from (1) to (4), leading to substantial growth in ad spend and revenue, as well as at higher gross profit margins (none of which would be possible without Bridg). This significant financial growth is only from existing clients, and ignores the benefits from adding more enterprise, mid-market, and SMB clients.

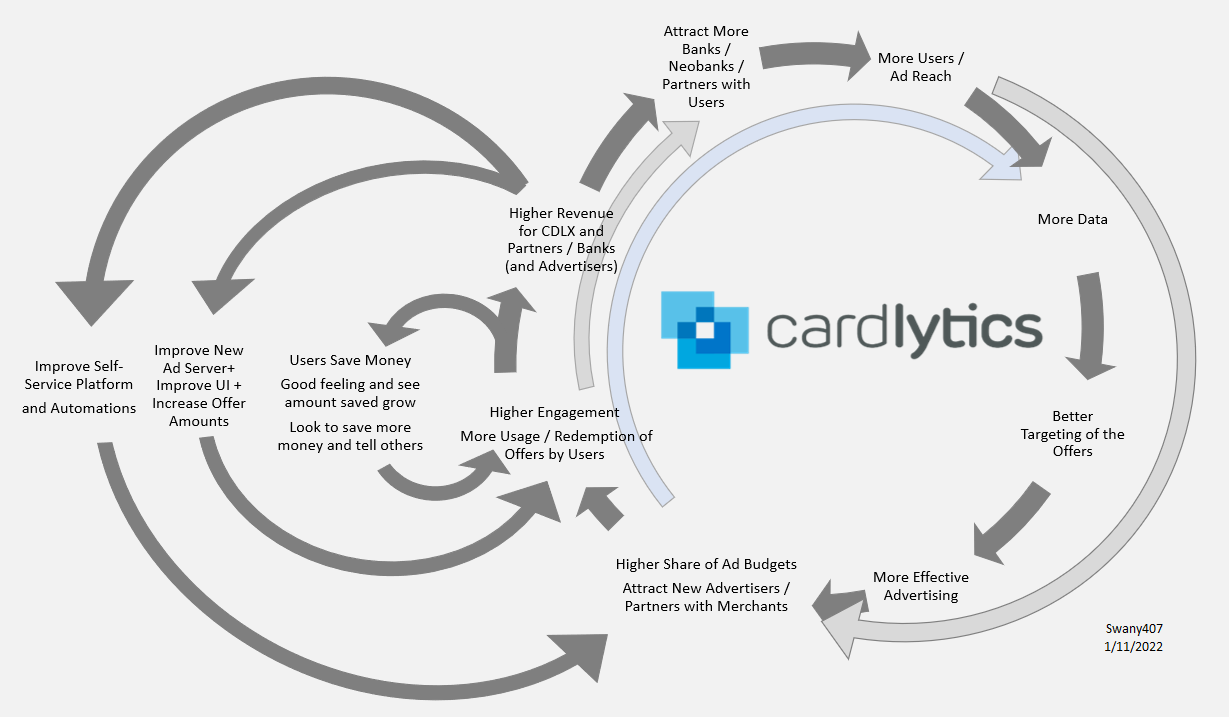

Finally, product-level offers should increase the number, relevance, and attractiveness of offers for users, increasing engagement and revenue in the channel. This increase in engagement would be separate from the increasing in engagement we have heard with campaigns on the new ad server (assuming it was not a comparison of with and without the use of Bridg). When giving quantitative examples later, I ignore these extra benefits and second order benefits. However, the footnotes include a flywheel to at least start thinking of what could be possible.

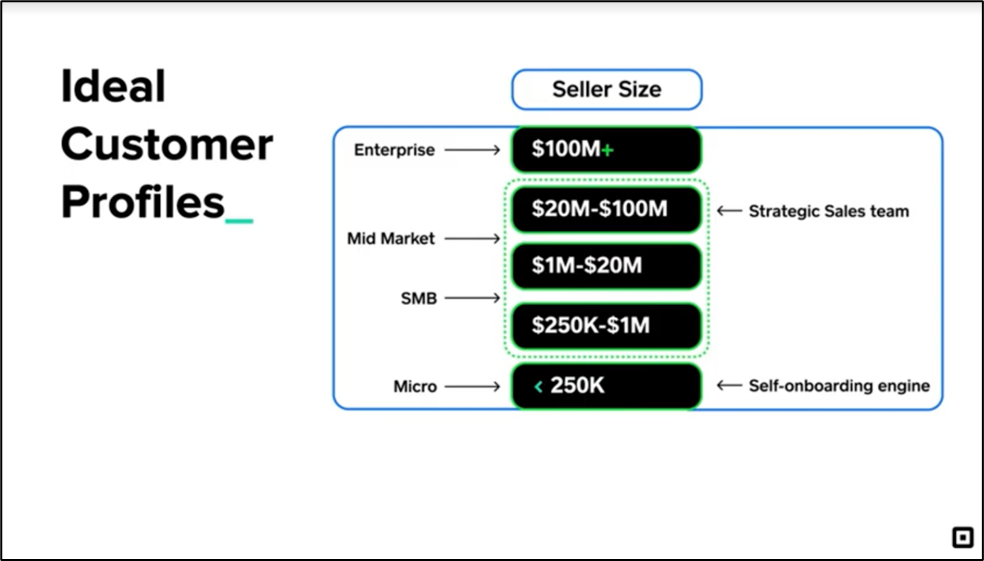

Growth from Adding Larger Clients

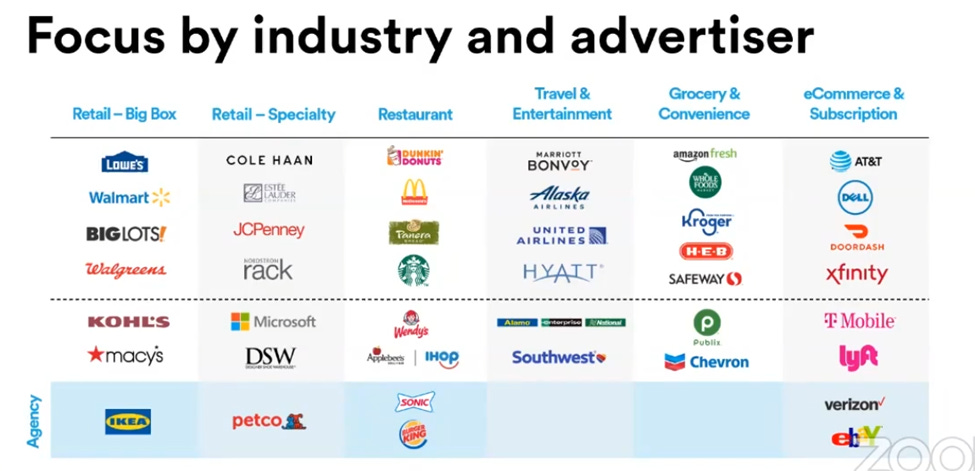

For this conversation, larger clients = enterprise & mid-market clients, including those represented by agencies (detail on classifications in the footnotes11). Smaller clients, such as small and medium-sized businesses (SMBs) will be discussed in the next section.

Another significant area of growth would come from the addition of more enterprise and mid-market clients to using Cardlytics, including those who are using an advertising agency. Specifically, the ad agency Horizon Media has said they have maybe 10-15% of their current customers using Cardlytics, but could add more with self-service and product-level offers.

Growth from New Clients Who Need Product-Level Offers

Beyond self-service, the reason for additional clients now being able to use Cardlytics within these agencies is from those who have needed product-level offers to be able to advertise. Examples of this are the brands (Sony, Nike, etc.) and CPGs, or companies with only individual products and no stores. Some examples of VaynerMedia clients12, who is a user of the Cardlytics self-service platform, would be Unilever’s Dove Soap, Johnson and Johnson’s Tylenol, Kraft Mac and Cheese, Heinz Ketchup, PepsiCo’s Pepsi or Lay’s Chips, or Planter’s Peanuts.

There are also the many stores that have not used Cardlytics yet, given they are a store with many different products with different margin profiles who could not offer the same percentage off across all products in that store. These companies can now become Cardlytics customers. (With existing clients, some may have been placing small offers to solve this issue. However, there still exists many more companies, such as a Target, who has not had any offers on Cardlytics yet, so this additional benefit of Bridg could lead to more companies, such as Target, to have offers in the channel).

Shift from Other Digital Ad Spend

There are also are many CPG advertisers looking for ways to track in-store purchases of CPG digital advertisements, since right now, most are just used for brand awareness (typically consumers do not buy individual CPG items online when they see them in an online ad or on social media, and instead wait to buy them in store, such as paper towels or soap, leading to less visibility and certainty in ad performance). Product-level offers by Cardlytics that are activated online and redeemable in store can solve this issue. Therefore, we could see a higher portion of ad spend shift from other digital advertising to Cardlytics for these CPG companies, leading to higher ad spend with these new enterprise CPG clients relative to existing Cardlytics clients, given the additional problem they are solving for these CPG clients.

“It Doubles Our TAM”

Altogether, by adding product-level offers it significantly increases Cardlytics’ total addressable market (TAM). This was specifically discussed by Lynne Laube:

Growth from Combined Insights and Targeting, and Solving Attribution

As mentioned before, the benefit is adding more clients to Cardlytics who also use Bridg, that could then also be expected to have higher ad spend than we are currently seeing due to having combined insights from Cardlytics and Bridg (since they need to be a user of both Cardlytics and Bridg if doing product-level offers). Additionally, given the use of additional data, this revenue may have less revenue share, and therefore higher gross profit margins.

Although there may be less ad spend from a given client not doing both store-level and product-level offers, I believe that will be made up by the additional shift from other digital advertising, as discussed earlier, or at least make it such that these clients will spend in total similar to those with both store and product-level offers.

As with existing clients, Bridg also allows users to have more view into their own data, solving the attribution problem. Also, testing with product-level offers should remove doubt of Cardlytics’ credibility with advertising campaign results, increasing ad spend with these clients as well.

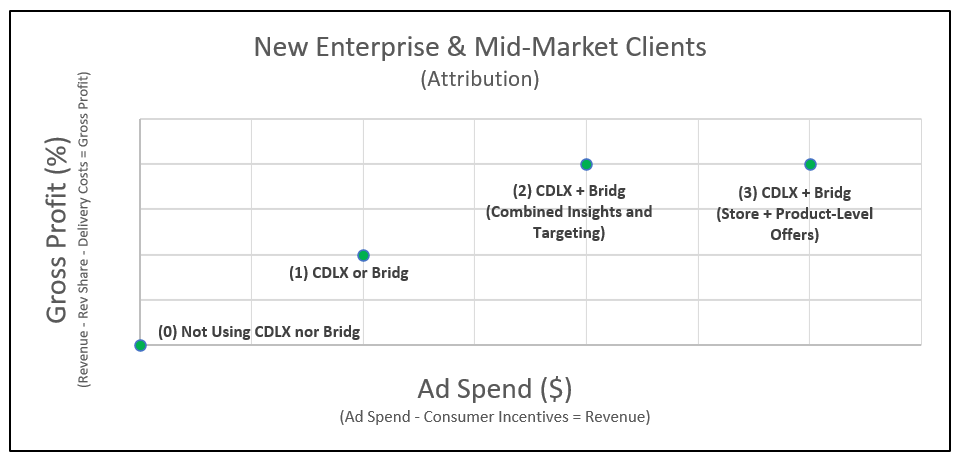

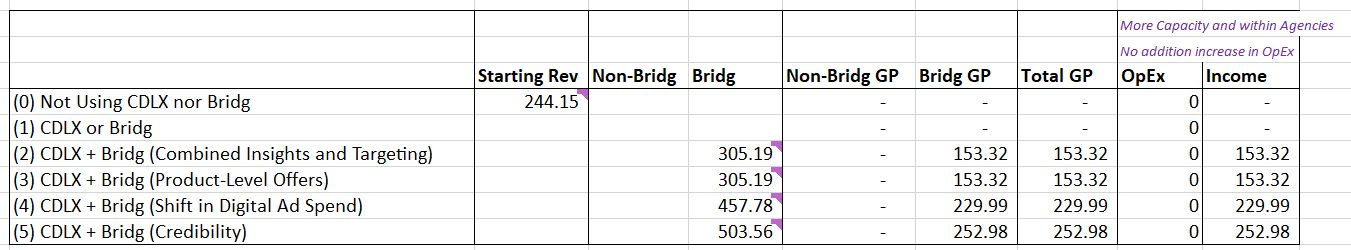

Summary of Growth from Adding Larger Clients due to Product-Level Offers

As a summary of the path of growth:

Start with those not advertising in Cardlytics, given they require product-level offers: Essentially, these clients are contributing no ad spend to Cardlytics at this time, reflect by (0) below.

Skipped, since not going to be just a client of Cardlytics or Bridg. Need to be client of both for product-level offers.

Starting point where they spend by having product-level offers: Once they become a client of both, they will be spending at a higher level than normal, given they will benefit from the shared insights and targeting from Cardlytics and Bridg. Additionally, since using Bridg data for delivering the offers, it decreases the proportional contribution of the bank data, leading to less FI share, and possibly higher gross profit levels. There may not be additional ad spend from product-level offers, as we saw earlier when you have a client who was originally doing store-level offers, and then added product-level offers as well, increasing overall ad spend. (For this reason, in the graph we do not see an additional stage of growth for going from only store-level offers to now also product-level offers).

Although there may be less ad spend from a given client not doing both store-level and product-level offers, I believe that will be made up by the additional shift from other digital advertising, leading to more ad spend than a typical client given the additional benefit for CPG companies for instance.

Given Bridg helps with the attribution problem, and given Bridg product-level offers can be used for testing, these should increase credibility, which could also then increase ad spend.

This shows Cardlytics going from getting $0 from these clients today, to then getting their ad spend, but at much higher relative ad spend amounts than we see today (due combined insights and targeting, shift in spend, credibility), with the additional benefit of higher gross profit margins (from decreasing the FI’s relative contribution of data).

Growth from New Clients due to Solving Attribution / Credibility / Believability Problem

Bridg could also lead to advertisers who have never used Cardlytics due to the attribution problem, or lack of trust, to now start using Cardlytics.

Therefore, there could be even more new companies that begin to use Cardlytics once this issue is solved by Bridg.

Summary of Growth from Adding Larger Clients due to Attribution

As a summary of the path of growth:

Start with those not advertising in Cardlytics, given they do not trust the platform due to the attribution problem.

Skipped, since not going to be just a client of Cardlytics or Bridg: These clients will need to be a client of both to have the view into their own data and to do product-level offer testing.

However once they become a client of both, they will be spending at a higher level than normal, given they will benefit from the shared insights and targeting from Cardlytics and Bridg. Additionally, due to also using Bridg data, FI share should be lower, leading to higher gross profit margins.

These clients could be doing both store-level and product-level offers, since their reason for not advertising before wasn’t due to just needing product level offers. This allows for both types of offers, allowing for more ad spend as they add in product-level offers.

I have chosen to leave out increases in ad spend from credibility and attribution, and say these types of new clients will not spend even more due to increase credibility, given they needed that to enter the platform. However, given their new level of trust with Cardlytics, they will likely reach the same level as other clients, and then there is no reason they cannot be spending at the same level of others.

As with the addition of new enterprise and mid-market clients from adding product-level offers, these new clients who needed the attribution problem solved are currently not spending with Cardlytics, and therefore contribute $0 to revenue. If they become clients of both, and then have the ability to have the attribution problem solved, and have their believability of the platform increase, we could see higher relative ad spend with these clients (due to combined insights and targeting, and from also adding product-level offers) and at higher gross profit levels (from using the Bridg data, which lowers the FI’s data contribution).

Growth from Adding Smaller Clients

The last area where Cardlytics could experience a substantial amount of growth due to Bridg is the small and medium-sized business (SMB) space.

Supposedly according to Deutsche Bank and citied in a WSJ article on July 1, 202013, SMBs accounted for 76% of all spending on Facebook. This gives an idea of the positive impact SMB content could have on Cardlytics, who also relies on advertising spend.

There are multiple ways Cardlytics could go about adding SMB content to the channel. However, one specific area where Bridg could help significantly is by partnering with POS venders (such as the ones where Bridg is already connected to, or already partnered with), to allow SMBs to use Cardlytics’ new ad manger with self-service to place both store-level offers and product-level offers in the banking channel.

Partnering with POS Systems for SMB Content

One initial area of confusion for myself was my incorrect idea of these POS systems, where I thought any reference to POS was in reference to ordering or checking out at a store.

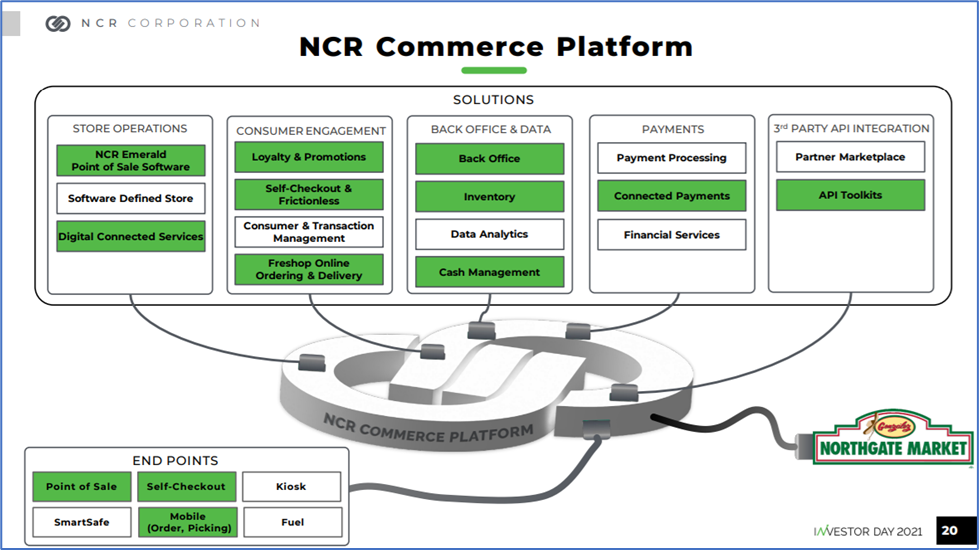

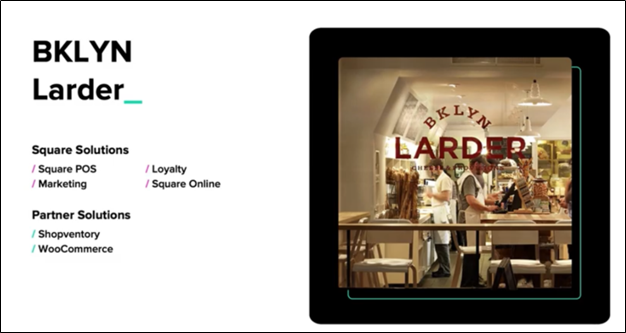

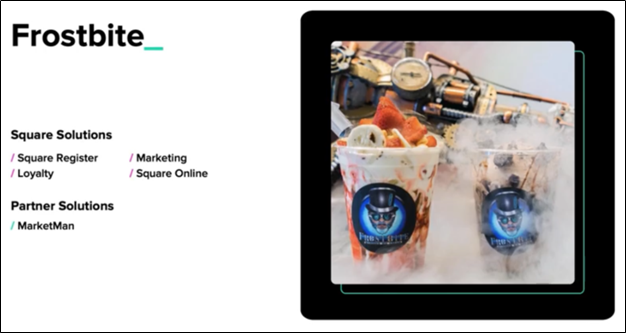

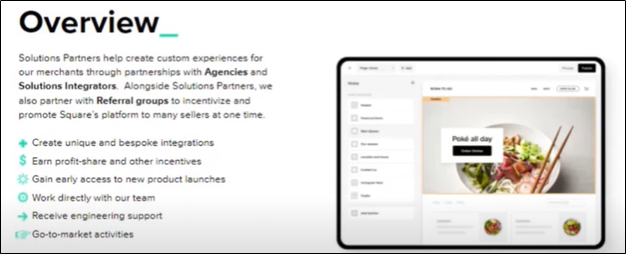

I did not know they have evolved into more of a platform that integrates with different technology and 3rd party partners. This transformation was even mentioned by the Chief Strategy Officer of Northgate Market during NCR’s December 2021 Investor Day.

As an illustration, here is a graphic of NCR’s Commerce platform related to their NCR Emerald Point of Sale Software, with other solutions that Northgate Market utilizes (clarifying details in the footnote14). Merchants can connect to 3rd party applications via APIs (as seen in the top right of the picture below).

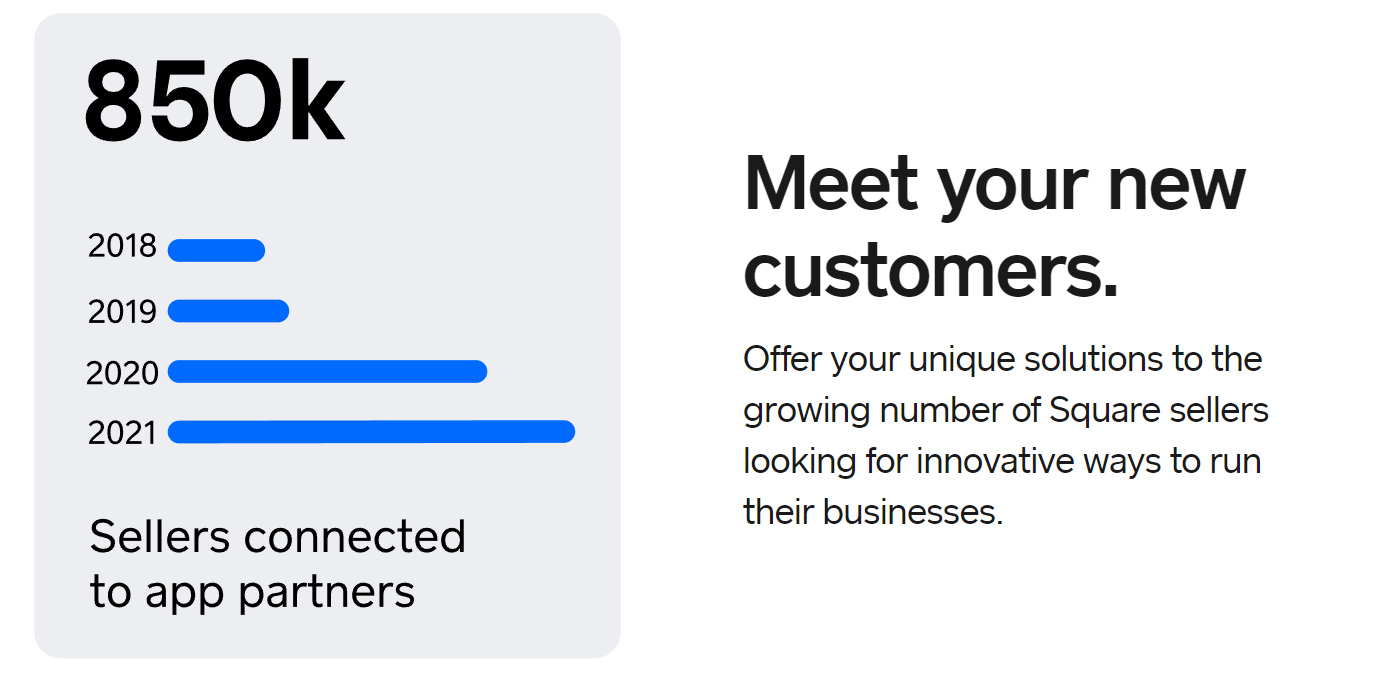

For Square, there is even an app marketplace of all the different apps that a Square seller using a Square POS system can use with their business. (The 1-minute video in the footnotes may help with visualizing what is possible and where Cardlytics can fit into this platform.15)

Therefore, it is possible for Cardlytics to partner with these POS venders to allow their POS system users to connect to Cardlytics via APIs to be able to place offers in the bank channel.

This would allow Cardlytics to connect to a staggering number of SMBs in an environment where these merchants are thinking about all aspects of their business, and looking to easily leverage existing connections with their POS system.

Cardlytics often highlights how their offers are with users in the bank channel, where they are most thinking about their money. Connecting to POS platforms would then be the other side, where you connect with SMBs in an environment where they are most thinking about their business and increasing sales and returns.

Cardlytics’ Plans for SMB Content

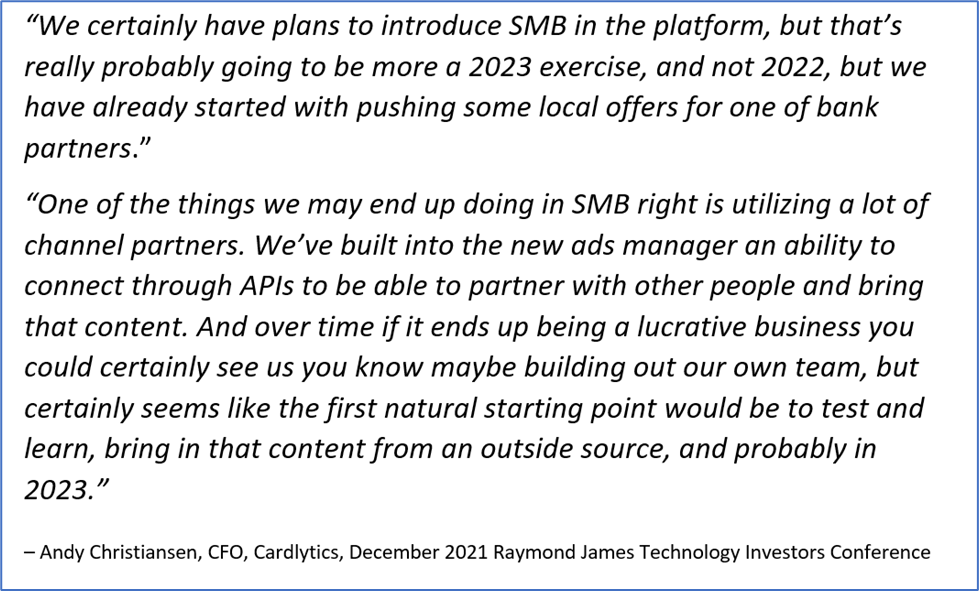

Cardlytics has explicitly addressed their plans for future stages of growth by bringing local and SMB content to the channel (a focus of 2023), through self-service and the ability to connect via APIs.

As discussed in a recent write-up and video, a competitor of Cardlytics laid out what would be needed by Cardlytics to get local and SMB content, or simply, what would be required to onboard a significant number of retailers and restaurants. Below is a quick recap (additional details, such as current progress and condition of the tech, is included in the footnotes16):

New Ad Server and New UI: Needed for product-level offers and new user interface (for richer imagery and organization for local offers and product-level offers)

Self-Service and Machine Learning: Needed given Cardlytics cannot work directly and hands-on with a very substantial number of businesses. Already 100% of new campaigns are on the new ads manager which has the self-service component, and machine learning targeting was built into the new ad server for hands-off targeting.

Partnering: Cardlytics will not be able to add each SMB one at a time. This is why Cardlytics has already built into the new ads manager the ability to connect to partners via APIs. Cardlytics could use this ability to connect via APIs to partner with the point-of-sale (POS) providers (such as those where Bridg is an integration partner), use the machine learning and self-service for automation, and then use the new bank self-service tool for regulation (where the regulation aspect was discussed during investor day).

It could be that Cardlytics is looking to partner with more third-party content providers who already have a large number of local or SMB content, connect to them via APIs, and place their same offers in the channel, like what they are doing with Rewards Network (as mentioned in the January 2022 meeting).

Even if that is the exclusive plan as of today, I believe it should not be difficult to connect via APIs to POS systems, given Bridg and their ability to connect to 90% of POS systems. It would simply require full self-service for them to be able to place offers in the channel.

Also, given the ability to connect to partners via APIs is within the new ads manager, it may possibly allow Cardlytics clients within the new ads manager to be able to quickly become Bridg clients by easily syncing to their POS systems.

Important Point

This ability to connect via APIs within the new ads manager could also eventually (if it can’t already) go the inverse direction. Instead of Cardlytics and Bridg clients connecting to the POS systems to bring in that data, it could be that it will allow Cardlytics to partner with POS systems and allow those retailers and restaurants using the POS system to connect to Cardlytics’ new ad manager via APIs, allowing those SMBs to connect and place offers on their own. The partnership between Cardlytics/Bridg and the POS venders would be what allows for a pre-existing (or prefab) integration, to more quickly and easily allows POS system users to use Cardlytics/Bridg, instead of manually signing up each POS systems user.

Said differently, this connection could work one direction, where enterprise clients (such as those who use advertising agencies) who are already using the new ads manager (since “100% of our campaigns are running on that new platform”) can use APIs to connect to their POS systems to bring in that SKU-level data using Bridg.

However, it should be just as easy to go the other direction, especially since the original context of APIs was local and SMBs when discussing that Cardlytics “built into the news ads manager an ability to connect through APIs to be able to partner with other people and bring that content”. More specifically, we could see Cardlytics partner with the POS platforms, of the likes of NCR, PAR, Toast, or Square, and allow users of their platform to easily connect to Cardlytics’ new ad manager via APIs (utilizing established integrations from the new partnership), and place offers in the bank channel using the self-service component and other automations.

Bridg Connects to Most POS Systems and Has Existing Partnerships

Bridg comes into the picture given Bridg is “capable of connecting to 90% of point-of-sale systems in the U.S.”.

This would allow all the SMBs that are using a POS system where Bridg can connect (or is already connected) to leverage Bridg / Cardlytics, and place offers in the banking channel using the new ads manager with the self-service component and other automations (like targeting using machine learning, instead of hands-on help from Cardlytics).

Cardlytics can leverage Bridg, given they already know how to connect to POS systems. Even better, Bridg is already partnered with at least one, as PAR is still listed as a partner on PAR 's website. Cardlytics also knows how to get Bridg data and product-level offers to the bank channel from the merchant using Bridg (based on product-level offer testing now live at U.S. Bank). Therefore, Cardlytics can complete the journey from merchant to POS to Bridg to Cardlytics to the bank.

The merchant also benefits from the combined insights and targeting, as well as being able to place product-level offers, all leading to higher levels of ad spend and at higher gross profit margins. Bridg brings the “know how” and existing partnerships, making the partnerships for Cardlytics much more possible and likely.

I’m not sure without Bridg (who has already worked and connected to POS systems) that Cardlytics would consider this, and if they did, it would likely take a considerably longer time to accomplish.

Key to Unlocking a Significant Number of SMBs

The largest reason for myself even considering the possibility of a partnership with POS systems is the fact Bridg’s main job is connecting to POS systems. On top of that, Bridg is already integrated with the likes of PAR. However, I originally questioned, if Bridg can connect to POS systems, and already partners with them, why do we not see more revenue from Bridg, or hear about significantly more Bridg clients. I believe the answer is self-service.

I do not believe Bridg had a self-service component to their system when they were on their own. This is likely why Bridg was not able to unlock the substantial number of merchants using the POS systems already integrated with Bridg (and the corresponding large scale) until after Cardlytics acquired Bridg (where Cardlytics has now developed the self-service component and automation capabilities, and continues to enhance them to be fully self-service).

Just like with Cardlytics, it would be near impossible for Bridg to manually do campaigns for the substantial number of merchants, let alone with Bridg’s much smaller employment base. This is likely why we would only hear about a few marquee Bridg clients, and did not hear any mention of a significant number of clients using Bridg to advertise. By combining Bridg and Cardlytics, and leveraging benefits of both, both in employee resources and technology such as self-service and automations, I think together Cardlytics and Bridg will be able to unlock all these merchants and the associated scale.

Additionally, regarding the new ads manager, “100% of our campaigns are running on that new platform”. Therefore, given Cardlytics has went live with product-level offers using Bridg data at U.S. Bank, that also likely means that Bridg and the POS connected data is possibly already running through the new ads manager, which has the self-service component. However, this is likely handled either directly by Cardlytics/Bridg or an agency. Therefore, this leads me to believe the only remaining thing required for this unlock is a partnership / integration, and have a fully self-service component to new ads manager (allowing POS users to find and connect to Cardlytics/Bridg on their own).

High Likelihood of a POS Vender Partnering

With major platforms such as PAR, NCR, Toast, or Square (to name only a few who are somewhat more well-known and public companies, $PAR, $NCR, $TOST, and $SQ), all have a large number of partnerships for their POS users. For example:

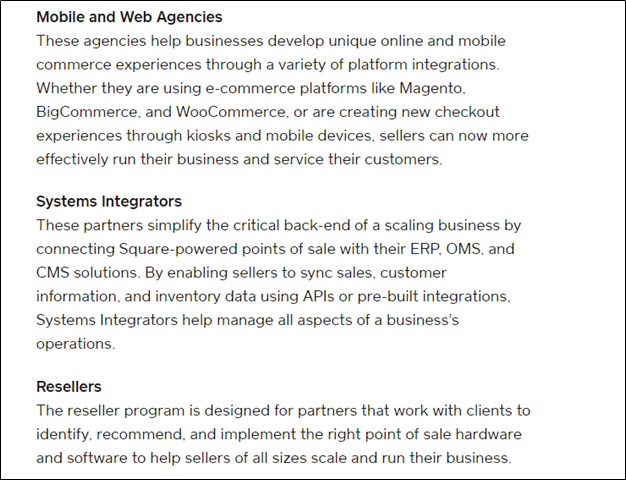

PAR: Already has over 200 integration partners.

Square: Already has over 700 partners connected to their platform.

Toast: Already has over 150 partners in their partner ecosystem.

This not only shows that partnerships are common, but also that is much more likely for a POS vender to partner with Cardlytics.

Additionally, I see Bridg is listed on PAR 's website as an integration partner.

For additional detail see the “Likelihood of POS Wanting to Partner” footnote17, and “How to Partner and Why Its Required” footnote18.

Everyone Benefits from a Partnership with POS Systems

Cardlytics Benefits

The largest benefit to Cardlytics by partnering with a POS platform like PAR, NCR, Toast, or Square would be unlocking the possibility for a staggering number of restaurants and retailers to be able to use Cardlytics. This was likely not previously possible by Bridg alone without automation and self-service, and likely why we only ever heard Bridg mention marquee clients who they were able to help manually.

To get an idea of the numbers and how many SMBs use these POS systems:

Toast: Toast reportedly has 48K+ restaurant locations (Toast’s S-1 mentions 48K locations using Toast, and, “As of June 30, 2021, over 33,000 locations on Toast utilized our partner ecosystem”). For context of number locations, according to Toast’s Q3 earnings presentation, there are 860K locations in the U.S., and 22M globally19. In terms of sizes, “A majority of our current customer base consists of small- and medium-sized businesses, or SMBs”.

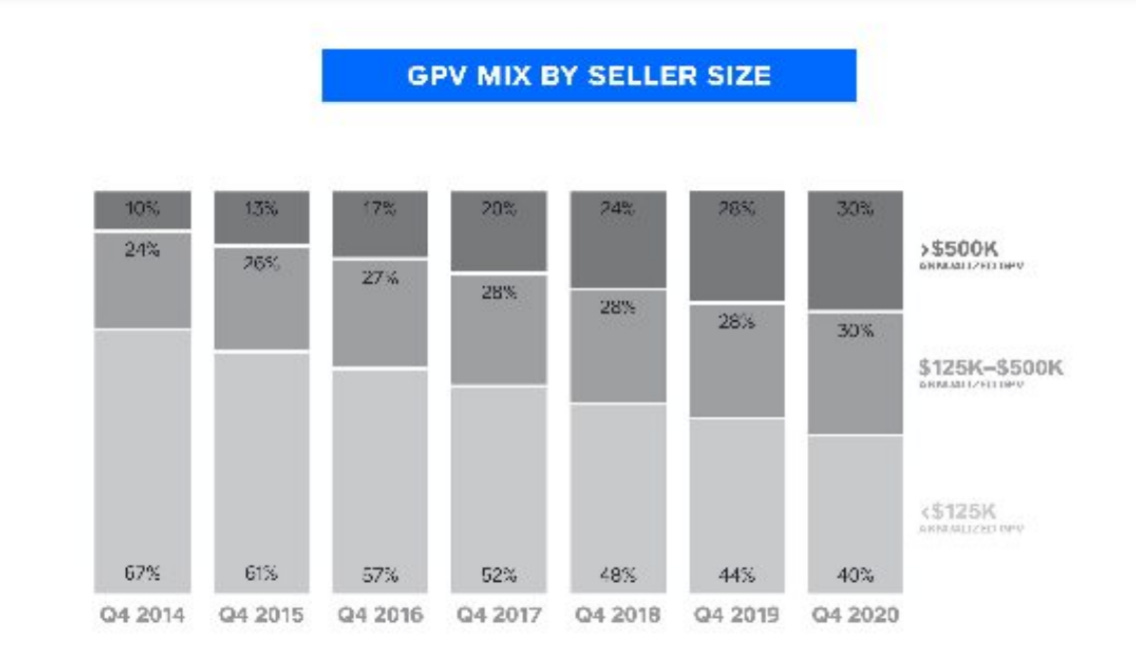

Square: Square’s point of sale has “already worked for more than 2 million businesses globally”, and “Our sellers represent a diverse range of industries (including services, food-related, and retail businesses) and sizes, ranging from sole proprietors to multi-location businesses.” Specifically for sizes, “We are also increasingly serving larger sellers, which we define as sellers that generate more than $125,000 in annualized GPV.” However, from the table below, we can see that still 70% of Square users are earning less than $500K, fitting most definitions of an SMB.

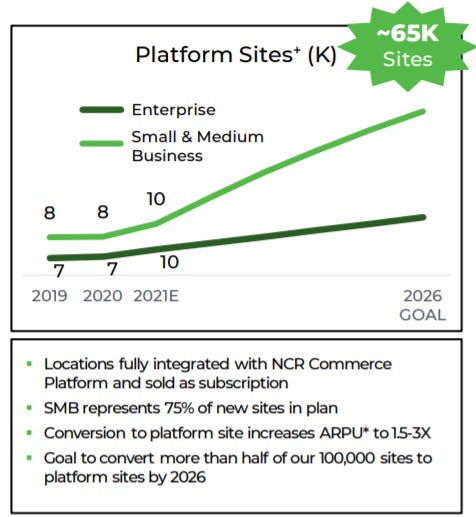

NCR: With NCR, currently the majority of their restaurant revenue comes from larger enterprises (more than 50 sites) compared to SMB restaurants (less than 50 sites)20. In terms of NCR’s platform sites for restaurants, there is a more 50% / 50% mix of enterprise vs SMB compared to their contribution to revenue, with roughly 10K enterprise sites and 10K SMB sites (it sounds like not all platform sites had or used payment sites). However, the focus seems to be switching to SMB. NCR expects that out of the additional 45K restaurant sites they expect to add, 75% will come from new SMBs on the platform, making SMB a meaningful portion of NCR users. (More detail in footnote21).

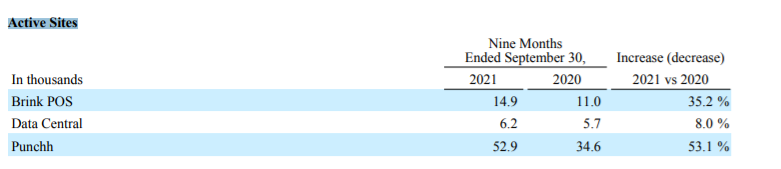

PAR: According to PAR’s Q3 earnings report, there were 14.9K active sites using their Brink POS (more detail on difference with updated numbers in investor day presentation in footnotes22). PAR’s previous investor day presentation mentions 500+ brands using PAR products, so there should be SMBs using PAR in addition to just enterprise clients.

Given the number of restaurants and retailers between these POS systems, there is potential for Cardlytics to increase revenue significantly. In terms of the amount of ad spend that restaurants or retailers could spend within Cardlytics as billings, one approximation is figuring out their total revenue and taking a percentage that could be reasonably assumed to be spent on advertising and specifically Cardlytics / Bridg:

Toast: Toast reported Nine Months Ended September 30, 2021 Gross Payment Volume (GPV) of $39.9B. Annualizing that leads to $53.2B of GPV. Assuming this represents total revenue of their POS users, and if we assume 50bps could be spent as billings with Cardlytics to help the restaurants or 10% of restaurants spend 5% of revenue (explanation in footnotes23), and ignore any further growth in Toast, that would be $266M of billings, or $186.2M of revenue (at 70% revenue-to-billings). Cardlytics’ 12/31/2020 full year revenue was almost exactly that amount at $186.89M. Therefore Toast alone could double ad spend in the channel, ignoring additional growth by Toast or from adding PAR, Square, NCR, and more. The 50bps is also from an example of a restaurant Cardlytics client and before the combined insights and targeting, product-level offers, and solving attribution problem. Therefore, the spend of these Toast users could be even higher, as well as at higher gross profit margins, given the use of Bridg data (decreasing the FI’s relative data contribution and consequently their revenue share).

Square: Square’s seller ecosystem in 2020, “processed $103.7 billion of Seller Gross Payment Volume (GPV)”24. Once again assuming this can be used as an approximation of total revenue for their Square sellers, at 50bps, or 10% spending 5%, that would be $518.5M in billings, or $362.95M in revenue for Cardlytics, or nearly double Cardlytics 2020 revenue of $187M. While the Square seller ecosystem may contain some type of transactions that would not be typical of those advertising on Cardlytics, I believe most businesses could still advertise on Cardlytics, and this serves as a good approximation, given it is only an estimation and to give an idea the scale of Square and what it could mean for Cardlytics.

Additional benefits from partnering with POS systems over other partners:

App Stores / Marketplaces / Visibility: By being a partner with one of the major POS systems, it increases the odds of an SMB finding Cardlytics / Bridg as a solution for advertising.

One Software Solution: Many retailers and restaurants want to only use one platform for all their business needs. Therefore, these SMBs are more likely to use Cardlytics as an advertising solution if it is integrated with their POS system. I believe the POS system is the central and vital piece of technology (hardware and software) to their business. Given all the other solutions integrated with the POS systems, most if not all of their business needs can be met directly on that platform. If Cardlytics isn’t connected, those SMBs may not use Cardlytics and use someone else (availability misweighing tendency and effort minimization tendency).

In-House Advocates: Having Cardlytics integrated increases the odds of being mentioned by the POS platform as the solution to the merchant’s needs. At NCR’s 2021 Investor Day by the Chief Information Officer of Northgate Market mentioned “I have one person I go to, no matter what my store needs are, and they can take care of it”. For Square Managed Platform Partners, they are given a dedicated partner manager within Square, who serves also a “champion” within the company. Therefore, it is likely these in-house company representatives can tell the client about a solution like Cardlytics. (More detail and sources regarding Square App Partners in the footnotes25).

Agencies / Consultants / Partner / External Advocates: Some POS providers work directly with consultants / partners. Square says, “our consultative approach extends to our partner ecosystem. Our job is to help sellers build the right solution set to support their goals. Often, that includes a partner app.” Therefore, if they know about Cardlytics / Bridg as a partner app when/if its connected and integrated with Square, and if they know about its success with other merchants, these Square Solution Partners could recommend it to others as well. (More detail and sources on Square Solution Partners in the footnotes26).

Bridg Data and Product-Level Offers: Since these sellers would likely use Bridg to connect to the POS systems (maybe this is why there is already the ability to connect via APIs in the new ad manager), it would allow merchants to have the enhanced insights and targeting ability from using both Bridg and Cardlytics, be able to place product level offers, and solve the attribution problem, all leading to higher levels of spend at higher gross profit margins (since using Bridg data as well).

More Unique Local Offers: Right now, many loyalty programs have the same local offers as each other, from all using the same offers from channels like Rewards Network. These offers from POS users, such as restaurants and retailers, would be much more unique, given it requires integration with the POS system and self-service. This leads to more differentiation that Cardlytics can offer to banks and users.

POS Venders Benefits (PAR, Toast, Square, NCR, etc.)

For POS systems that provide payment solutions and collect revenue from transactions, increases in transactions and sales due to Cardlytics/Bridg will lead to increases in revenue for these POS venders.

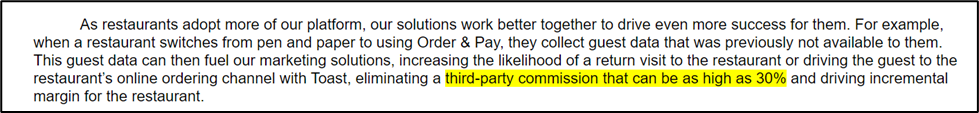

A partnership could also lead to higher retention and expansion of the retailer and restaurant base who are using the POS systems. According to their S-1, these are all goals of Toast27.

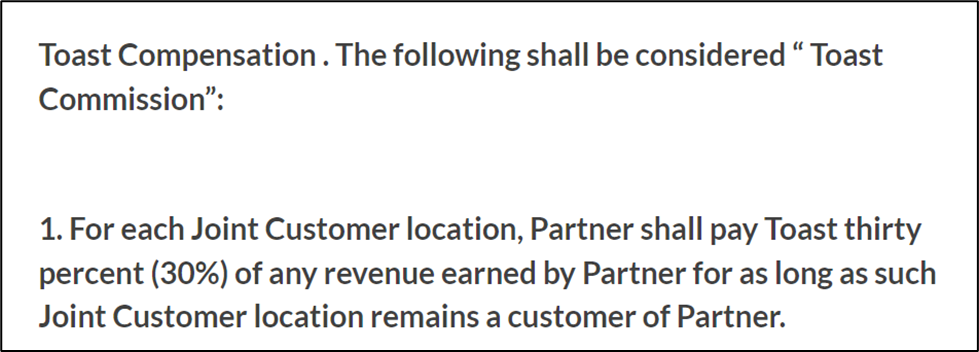

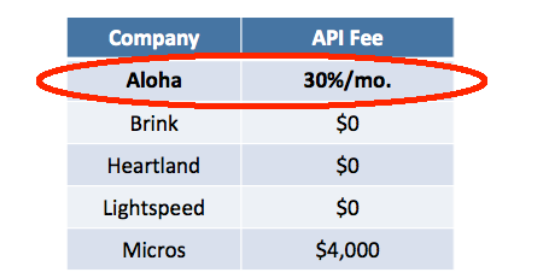

For Toast and NCR, third party partners have to pay 30% commissions on the related transactions, similar to the Apple app store, or the bank revenue share agreement. Therefore, these POS venders can significantly benefit financially if they get a 30% cut of the advertising billings of merchants using Cardlytics28.

At least with Toast, restaurants also pay Toast a monthly software service free to access the technology partners. Therefore, a Cardlytics partnership may increase the value for existing restaurants using this service, leading to less attrition of the software service fee, and possibly adding more restaurants to the fee.

Retailers and Restaurants Benefit

These retailers and restaurants would likely be connecting their POS through Bridg, and therefore also benefit from the combined insights and targeting from being a client of both Cardlytics and Bridg (such as those illustrated by Starbucks, whose loyalty program, while one of the biggest, only has a small fraction of the visibility and targeting ability as Bridg and Cardlytics, which is why they use both Bridg and CDLX). They would then also benefit from being able to place product-level offers.

An additional benefit for retailers and restaurants would be from also using Cardlytics, which would enable the ability to advertise in the bank channel with Cardlytics’ 171M MAUs (or at least within their specific locations).

This is a significant benefit for someone like Square, who if they did the advertising on their own, their Square merchants would be limited to the Cash App users, which is significantly less than the 171M in Cardlytics (which ignores Venmo and more neobanks and fintechs). Even if the advertise is only located in one city, and cannot benefit from Cardlytics’ 171M, Cardlytics is much more likely to have access to many more users in their specific city, compared to Cash App users. Additionally, my initial guess is that there are very few Cash App users who also have a Cash App debit card to be able to make payments (I do, but that was only to track their Boost offers).

Additionally, most stores only see data related to transactions from their own store, and not that of others. As with the larger clients, the benefit is being able to advertise to customers who shop in their category but where their store is not earning as high of a percentage of that wallet as they would like. This includes customers who are not a frequent or loyal customer of their store, and also loyal customers who could be spending more (some advertisers focus a lot on new customers, but there are many existing customers that they are not aware of that spend even more elsewhere who would be good to advertise to).

(For more detail, see the “Likelihood of Merchants Using Cardlytics / Bridg” footnote29)

Banks / Neobanks / Fintechs Benefit

Banks would get more of the content they have been requesting, such as local content, and product-level offers.

Engagement would likely increase, as long as the new content is organized within the new user interface (which Cardlytics wants to add before placing product-level offers and SMB content, and where both the new user experience and product-level offers need the new ad server).

Users / Consumers Benefits

Users would save more money by receiving offers from more retailers and restaurant, more relevant offers due to SKU data and product-level offers, and possibly in higher amounts (due to things like different margins on different products and better targeting capabilities).

Summary of Why Partnering with POS Systems is Possible and Likely

As a summary of why this is all possible and likely:

Cardlytics specifically stated they plan to add SMB content

They plan on doing so by partnering (where POS systems like Square, PAR, and Toast already have 700+, 200+, and 150+ partners)

Bridg is capable to connecting to 90% POS systems in the U.S., and is already an integration partner with at least one (PAR)

They plan on using self-service for SMB content (which is needed for an SMB in using a POS to be able to use Cardlytics/Bridg on their own)

They plan on connecting to more partners via APIs (where POS systems can connect to 3rd parties through APIs, such as Toast, which states, “Toast has curated a portfolio of approximately 150 restaurant technology partners that utilize Toast APIs to deliver a broad range of specialized solutions”)

Cardlytics already built and continues to work on a self-service component in their new ads manager, machine-learning targeting in the new ad server, a new UI for richer imagery and organization of local and product-level offers, and the ability to connect to partners via APIs. By already building this technology, it makes it both a reality and closer in time until it occurs.

Cardlytics said they plan to test and learn first, where Bridg is already integrated with a POS platform (at least PAR, maybe more) who has direct connection to SMBs who use their POS platform for all functions of their business (the comment regarding testing could be more in regards to Rewards Network content that Cardlytics is already pushing, but given the existing integrations with PAR, there shouldn’t be much else needed to at least test)

Cardlytics has already successfully used Bridg to place product-level offers in the bank channel, showing a complete connection from Bridg to the banks.

Partnering benefits everyone: Cardlytics, POS venders, POS users / merchants, banks / neobanks / fintechs, end users and consumers.

Cardlytics said “I don’t think investors appreciate the power of Bridg and Cardlytics’ data combined, and what we’re going to do there, and how much we are going to scale Bridg.” This shows there is something Cardlytics plans to do with Bridg that will lead to significant scale, such as the SMBs.

To top it off, the timing matches up between multiple comments, such as

“What we’ve publicly stated is we will have 50% of our MAUs connected to a new ad server by the end of 2022, and the remainder by the end of 2023.”

“We certainly have plans to introduce SMB in the platform, but that’s really probably going to be more a 2023 exercise”

“The Bridg acquisition, I have said repeatedly, investors are going to look back two years from now and say, ‘how did we miss this thing’, because it’s a gold mine”

Altogether you have:

CDLX is attempting to get 50% of MAUs on the new ad server by the end of 2022 (with the remainder by 2023), which would allow for half of MAUs to get local/SMB content in 2023, since the new ad server is needed for the new user experience which can organize local content from SMBs. Additionally, the new ad server allows for Bridg data (and product-level offers) which would be needed if SMBs are connecting to Bridg / Cardlytics through a connection with their POS system (since Bridg connects to POS systems).

CDLX has explicit plans to introduce SMBs in 2023 (which is likely why they need 50% of MAUs on the new ad server by the end of 2022, or before 2023).

CDLX says Bridg, not just Cardlytics, will have recognizable impact two years from (or the end of 2023), which is after the new ad server is connected to 100% of MAUs, and a year after using SMBs on the new ad server which can also use Bridg data

I could be off base, but it would be quite the coincidence if these were not all related, coupled with the rational sense explained in this entire SMB section.

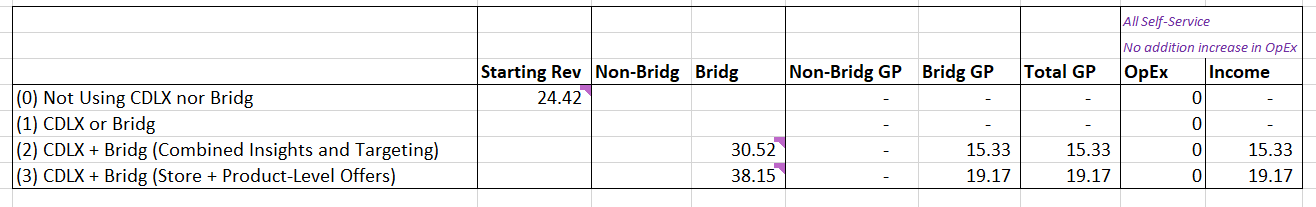

Summary of Growth from SMBs by Partnering

The path of growth we could see with SMBs is similar to others.

Start with those not advertising in Cardlytics, given they do not have a way to advertise in the channel

Without self-service, there are likely not many SMBs that will be placing offers in the channel on their own. It is possible this level of ad spend could include the likes of Rewards Network, who isn’t combining Bridg, and only doing store-level offers

For SMBs connecting to Cardlytics from their POS to Bridg, these clients will be both Cardlytics and Bridg clients, benefiting from additional insights and targeting, leading to higher ad spend (such as we have seen with the existing larger clients), and at possibly lower revenue share levels (given data is from the client and not the bank, decreasing the FI’s relative contribution of data to the delivery of the service), leading to higher gross profit margins.

Please note, some POS venders may charge for connecting to them and using their data (as discussed in the footnotes), and therefore the increases in gross profit from lowering the FI share may be offset by the decrease in gross profit from paying the POS fee of in some cases 30%. Fortunately, this fee not on all POS platforms, and therefore the final gross profit margin will likely still be higher than today (this will be reflected in the calculations later). Even if the fee was on all platforms, the net effect would be going back to the same gross profit as we in today’s financials, but with the benefit of no real increases in OpEx, leading to the gross profit dropping to the bottom line.

Since Bridg is being used, product-level offers could also be placed in addition to store-level offers, leading to more ad spend.

Then there may be slightly more ad spend due to the attribution and credibility possible with having Bridg data. It may not be significantly more than without compared to the enterprise level, but it should help increase ad spend with those who are already users and lead to new users who needed that level of comfort or data.

Once again, Cardlytics would go from (0) which was $0 of ad spend and revenue, all the way to (4) at the higher gross profit margins as well, all thanks to Bridg.

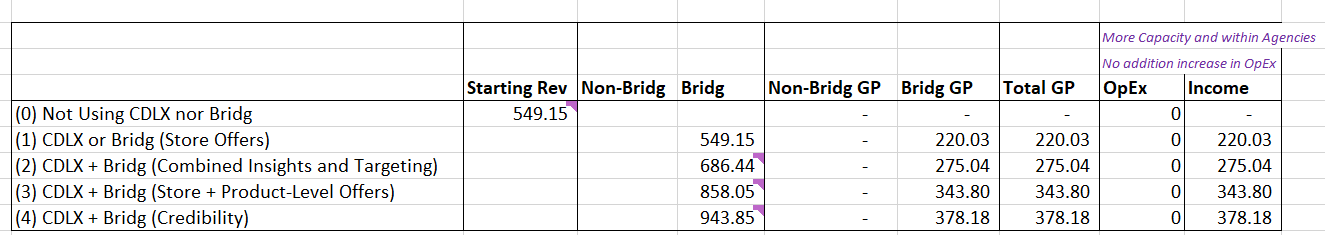

Adding It All Together (with Numbers)

The combination of each group’s growth together could lead to large increases in ad spend and revenue, and possibly at higher gross profit levels. There shouldn’t also be much in additional operating expenses required (more detail in footnotes30), leading to most of this dropping to the bottom line and taking advantage of operating leverage. The associated large amounts of operating income and cash flow will likely be much harder for the market to ignore, and therefore could lead to changes in the market price.

I did not want to make any quantitative estimates of what this could look like. There are so many different assumptions and possible scenarios that it’s nearly impossible to try and arrive at an approximate number, or even a range. However, this may be the exact reason this is not being priced in to today’s market price. With too much uncertainty, it is easier to simply value it at zero, which may be going on today.

Therefore, for even my own personal thought process, I’ve laid out some scenarios. All the work, assumptions, and thought process is in the footnotes (and will be called out below). Please note, this is more just to try and fit all this information together. It is very possible this is very off, but it should at least given an idea of the impact Bridg could have to Cardlytics, and help explain why this will be a “gold mine”, as Lynne mentioned last week.

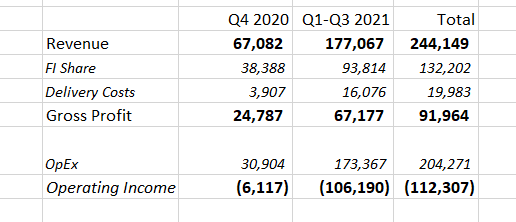

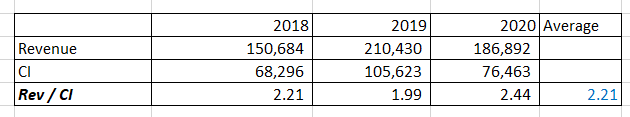

To have a base for comparison purposes, below are Cardlytics’ financials over the trailing 12 months (my calculations31):

Revenue: $244M

Gross Profit: $92M

Operating Income: -$112M

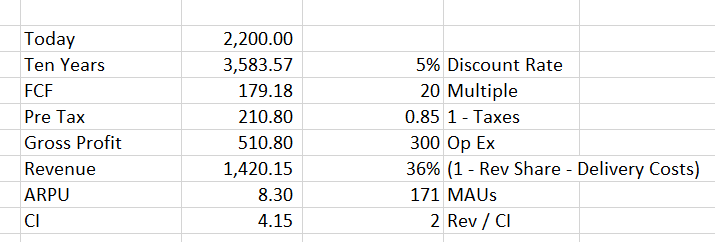

For a basic, more conservative scenario, I took the known increases in ad spend from actual clients, and decreased them substantially for conservatism. For other assumptions, I used lower levels of growth where there was less known examples. This growth below is only related to Bridg and the growth discussed in this post. The only requirement should be the new ad server (explanation32) and full self-service for these improved financials (such as to capture the SMB growth):

Revenue: $1,817M

Gross Profit: $800M

Operating Income: $500M

For those interested, I’ve included the full calculation, assumptions, and explanations in the footnotes (see the related footnote here33).

Under more aggressive assumptions, but closer to current actual results and what seems possible (details, assumptions, waterfall of changing assumptions in the footnotes34):

Revenue: $2,862M

Gross Profit: $1,672M

Operating Income: $1,372M

If the effective tax rate is 15% (Facebook was 12.2% in 2020, and Google was 16.2% in 2020), and we assume a 20x multiple, that’s a valuation of $23B (again, ignoring all the other non-Bridg growth in the closing).

This is in relation to the current market cap of approximately $2.2B, and Bridg acquisition of price of $350M (up to $650M with earnout payments).

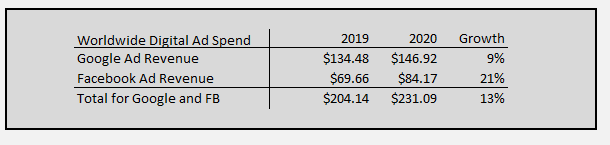

This is also in relation to 1% of global digital ad spend, 2% of Google’s 2020 revenue, and 3% of Facebook’s 2020 revenue (details in footnotes35). This is a nice reminder that although these are large percentage increases in revenue, it is from a small revenue base in relation to the TAM and competitors.

Again, the range of possibilities and variations in assumptions are large. However, I feel this at least gives an idea of how I’m thinking about it, and what could reasonably occur.

Closing

I believe this possible growth from Bridg is currently unrecognized, and implicitly ignored by the current market price.

The current market price today could imply around $8 in ARPU at the end of 10 years, or possibly $4 in redemptions (calculation in footnotes36). I believe this small increase from levels today could be achieved with the existing platform and advertisers, simply from increases in ad budgets. This would be from what we are already seeing for next year with clients like Panera who isn’t even yet utilizing the benefits of Bridg and CDLX, but still doubling their budget for next year. This is also supported by the fact, according to the January conference, Cardlytics has more engagement than they know what to do with, even before the higher engagement levels on the new ad server, and just needs more ad budgets to fill the demand of users. My wife and I may be representative examples of what is possible with even with the existing platform and offers (no product-level offers, no new UI, no improved insights and targeting, no new advertisers, no local, etc.). We have redeemed over $300 in the last year, or an average of $150 per person. Therefore, $4 does not seem unreasonable in 10 years from now. Or even if our level of engagement is only achieved be 10% of users, $40 also does not seem unreasonable 10 years from now, if nothing else changed with the existing platform and only ad budgets increased.

If the market is ignoring what is possible with the current platform as it exists today, this would also imply the market price is implicitly ignoring (or assuming it will not occur) all of the future growth discussed in this post related to Cardlytics and Bridg:

Ignoring growth from existing clients

Ignoring growth from adding enterprise and mid-market clients

Ignoring growth from adding SMB clients (quick note on GP%37)

This likely explains Lynne’s comment:

Even better from an investment perspective, this would also imply that in addition to the list above, the market is also ignoring any additional growth (or assuming it will not occur), such as:

Ignoring any growth from additional content like Rewards Network, utilizing the newly created APIs to connect and place offers with third-party content providers, without self-service

Ignoring any growth from other SMB users, beyond those from partnering with a POS vender.

Ignoring any increases in engagement levels from the new ad server (where Lynne has mentioned engagement “It will absolutely be higher than the old ad server. I just don't know if it's going to be 3-4x higher, of it's going to be 50%”, and how in the January 2022 presentation it was said how “We compared campaigns in Q4, the same exact campaign, that ran on the old experience versus the new experience, and we saw a minimum of 200% increase in click rates. 200%. Some campaigns had 400, actually over 400%.”38)

Ignoring any benefit from the IDFA and other privacy related issues causing other digital advertising platforms problems, but not impacting Cardlytics, leading to possible shift in ad spend.

Ignoring any growth from giving the banks the new bank self-service platform to place more offers on their own (likely similar to the Chase Sapphire Exclusive offers that have been extremely high in amount and attractive)

Ignoring any growth from dynamic pricing

Ignoring any growth from auction-based pricing

Ignoring any growth from showing LTV/CAC and any associated growth from advertisers switching towards thinking about LTV/CAC vs ROAS

Ignoring any benefit from time-based offers

Ignoring any benefit from companies using Cardlytics to optimize their business (promote new payment types like QR Codes or App Only / Mobile Only)

Ignoring any growth from using different pictures for different customers (like used by Netflix)

Ignoring any increases in the number of bank-channel MAUs, such as if Cardlytics signs a new bank

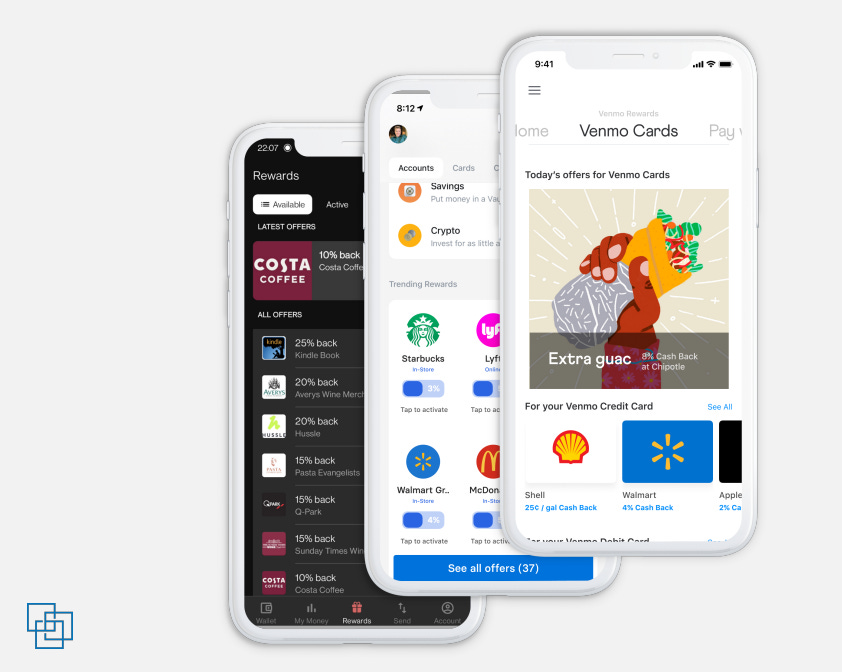

Ignoring any growth from current or new neobank (such as Venmo) or fintech partners (such as possibly Affirm and their new Affirm Debit + card whose rewards could be powered by Cardlytics / Dosh)

Ignoring any growth from open banking

None of these multiple paths for growth have to occur for this investment to work. However, all paths are possible and likely, leading to high levels of optionality at the current market price.

This explains why I continue to be interested and invest more into Cardlytics.

At the end of next two years after Cardlytics gets more MAUs connected to the new ad server and clients begin utilizing the power of Bridg, we should see quite a bit of this growth. My hope is investors look back two years from now and say, “how did we miss this post”.

If you enjoy the content, or have received any value from the investment insights, discoveries, and thoughts shared, such as those in this post, please consider subscribing or becoming a supporter / premium supporter of the channel. Your support increases the odds of more investment write-ups and content in the future.

More Detail

I discussed this topic in more detail in the following video:

Follow-Up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more.

-Austin Swanson (Swany407)

Twitter: @Swany407

Website: Swany407.com

More Information on Cardlytics

BofA Renewal & Testing Competitors (Update): Write-up and video

New Observations, Upcoming Earnings Calls, and Updated Allocations (10.21.2021): Write-Up and video

Thoughts Following Q2 2021 Earnings and Price Decline: Write-up and video

Thoughts After Price Decline (5.17.2021): Write-up and video

Disclaimer: This content is not investment advice, and is intended for informational purposes only. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.

Bridg acquisition: https://www.cardlytics.com/blog/cardlytics-completes-acquisition-of-bridg/

Financial Definitions

Within Cardlytics’ financial statements, and based on their 10-K, they define:

Revenue = Billings - Consumer Incentives

Gross Profit = Revenue - FI Share and other third-party costs - Delivery costs

where:

Billings: “Billings represents the gross amount billed to marketers for advertising campaigns in order to generate revenue. Billings is reported gross of both Consumer Incentives and FI Share” and as stated in their Q3 2021 earnings presentation, “Total in aggregate paid by marketers”

Therefore, I assume “ad spend” = “billings”, since the amount an advertiser would spend would be the aggregate amount paid

FI Share and Other Third-Party Costs: “FI Share and other third-party costs consist primarily of the FI Share that we pay our FI partners, media and data costs, deferred implementation costs incurred pursuant to our agreements with certain FI partners and a $2.5 million non-cash expense in 2018 related to the vesting of warrants issued to an FI partner that accelerated upon the consummation of our IPO. To the extent that we use a specific FI customer’s anonymized purchase data in the delivery of our solutions, we pay the applicable FI partner an FI Share calculated based on the relative contribution of the data provided by the FI partner to the overall delivery of the services. We expect that our FI Share and other third-party costs will increase in absolute dollars as a result of our revenue growth.”

FI Share = Rev Share

I believe the bolded section above is very important, as it likely explains why Cardlytics rev share they pay the banks will decrease. In the write-up, I will discuss this idea more in depth.

Delivery Costs: “Delivery costs consist primarily of personnel costs of our campaign, data operations and production support teams, including salaries, benefits, bonuses, stock-based compensation and payroll taxes. Delivery costs also include hosting facility costs, purchased or licensed software costs, outsourcing costs and professional services costs. As we add data center capacity and support personnel in advance of anticipated growth, our delivery costs will increase in absolute dollars and if such anticipated revenue growth does not occur, our delivery costs as a percentage of revenue will be adversely affected. Over time, we expect delivery costs will decline as a percentage of revenue.”

Bridg Needs the New Ad Server (Reason, Timing, and Engagement Stats)

Reason

Based on January 2022 conference, it sounds like no real additional expenses are needed for both being a Bridg client and also placing product level offers, only need to first have the new ad server (and approval so, “we could use different data for the purposes of targeting and redeeming”).

Originally I thought maybe the new ad server was needed for only product-level offers, and not also to use the data. But the last question below specifically asks this, and Lynne’s answer seemed to be that it just needed the new ad server.

Timing

From January 2022 presentation, most likely 100% of MAUs will be connected to the new ad server by the end of 2023, but possible for 100% by the end of 2022.

Engagement Stats

From January 2022 presentation, engagement stats with the new ad server were given. I believe many were surprised to hear a minimum increase of 200% in click rates, and in some cases more than 400%. Therefore, not only will the new ad server allow for Bridg data and offers, but also at higher engagement levels.

Additionally, these stats may help increase the time until adoption of the new ad server by the banks. It’s possible that is why these stats are in hand and being shared publicly.

Significant Restaurant Client - 400% Increase in Ad Spend

The significant restaurant client could be Starbucks, given we now know they are also a client of both.

It could also be Panera who uses both, and mentioned increasing ad spend next year.

However, I most suspect it was Chipotle. This is given it has been rumored they are a Bridg client who also started using Cardlytics. It was also rumored they stopped using Cardlytics or Bridg (but we have seen new Chipotle offers in the bank channel very recently, so maybe the rumor was confined to Bridg) so Cardlytics may have had extra motivation to hint at them, like they have done other perceived issues during calls. Additionally, they were featured in a picture in the investor day presentation that was updated the same day as the Q3 earnings call when this was discussed.

Starbucks Loyalty Program Stat

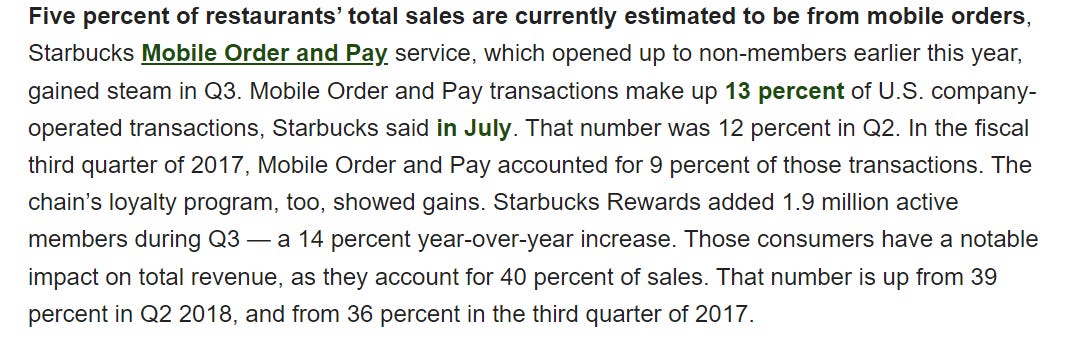

I’ve been trying to find this stat, where only 12% of their customers are in their loyalty program.

First thing I found was this quote from a book:

While the following “Pymnts” article is from 2018, it looks like the number above may have come from the following article:

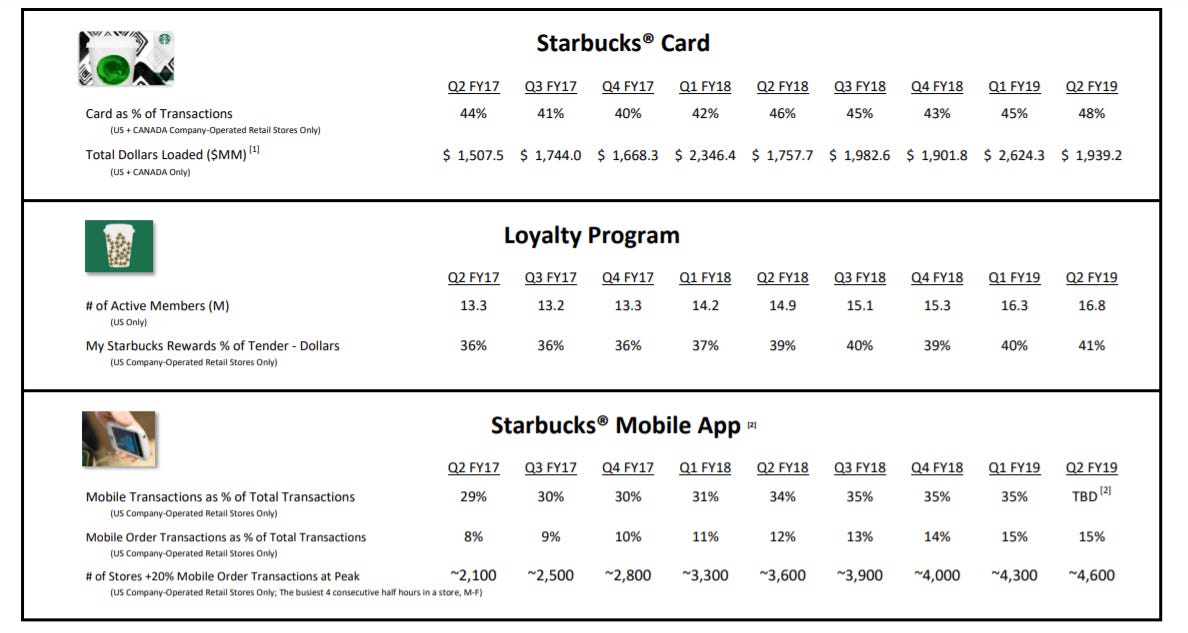

These numbers (12% mobile orders in Q2 FY18, 13% in Q3 FY18, and 1.9M increase in active members over 1 year ending Q3 FY18), look to match this old Loyalty Mobile Dashboard by Starbucks:

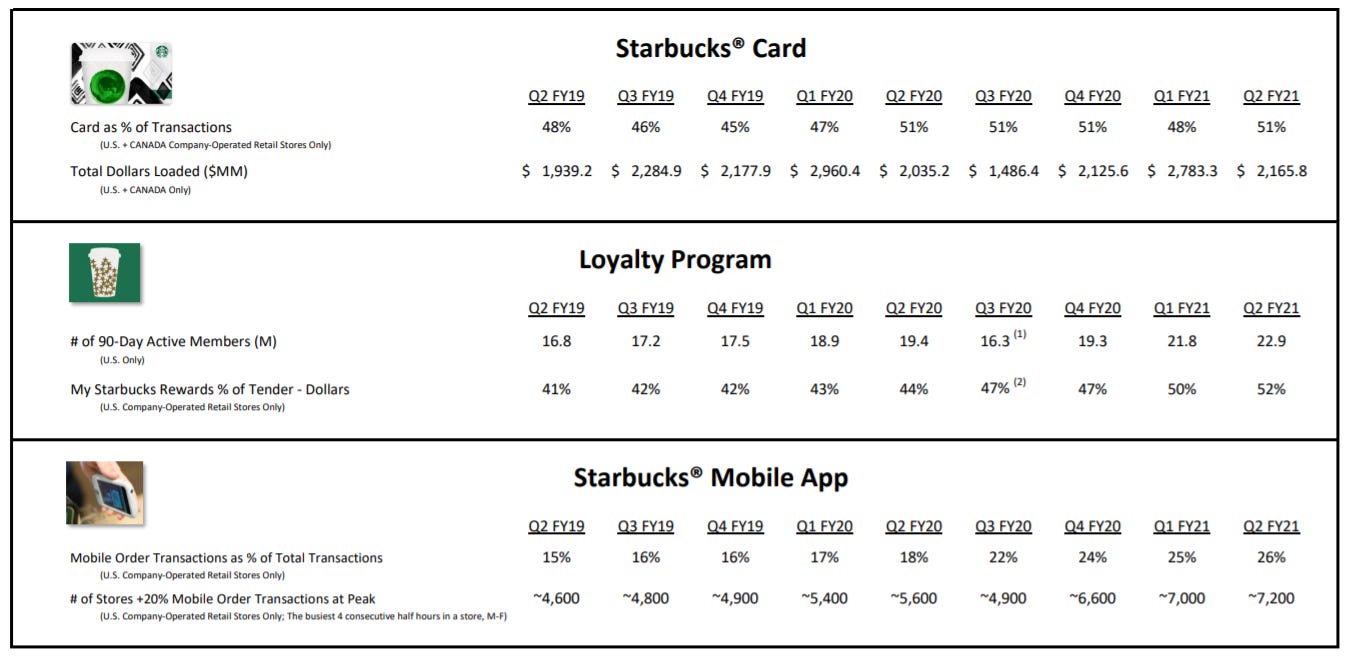

I found an updated Dashboard:

Therefore, it could be the 12% is outdated, if basing it on “Mobile Order transactions as % of Total Transaction’, since today it is closer to 26%. Still much lower than 90% with Cardlytics.

Example Calculation of Lower Rev Share and Higher Gross Profit Margins

As mentioned earlier in this post, the rev share, or revenue share, or FI share, is calculated as “To the extent that we use a specific FI customer’s anonymized purchase data in the delivery of our solutions, we pay the applicable FI partner an FI Share calculated based on the relative contribution of the data provided by the FI partner to the overall delivery of the services.”