Cardlytics ($CDLX): Thoughts Following Q4 2021 Earnings

Discussions on the Entertainment Acquisition, Ad Agencies, Bridg, Neobanks/Fintechs, Open Banking, BofA, New Ad Server and Q4 and Full Year 2021 Numbers.

For all my notes on CDLX, check out my Qualitative and Quantitative “Research Notes”:

For more general information on Research Notes, see here.

For those interested, this post is also available on YouTube, Apple Podcasts, and Spotify.

Market Cap as of 3.11.2022: $49/Share x 33.7M Shares ~ $1.7B Market Cap.

Introduction

Last week was the Cardlytics Q4 2021 earnings call. There were some major updates that I feel may have went unnoticed by others. This post will go over all the updates and changes that most stood out to me.

As a quick summary:

Core CDLX: Adding more ad agencies with more than 90 advertisers + existing ad agencies doubling spend + acquisition for local & mid-market content + strategic plan to get new banks + potential BofA progress

Dosh: Adding more neobanks and fintechs, and upcoming launch with marquee partner

Open Banking: Adding an additional program with possibly no revenue share, and interest from other programs

Bridg: Three late-stage opportunities in CPG / Grocery

Entertainment Acquisition

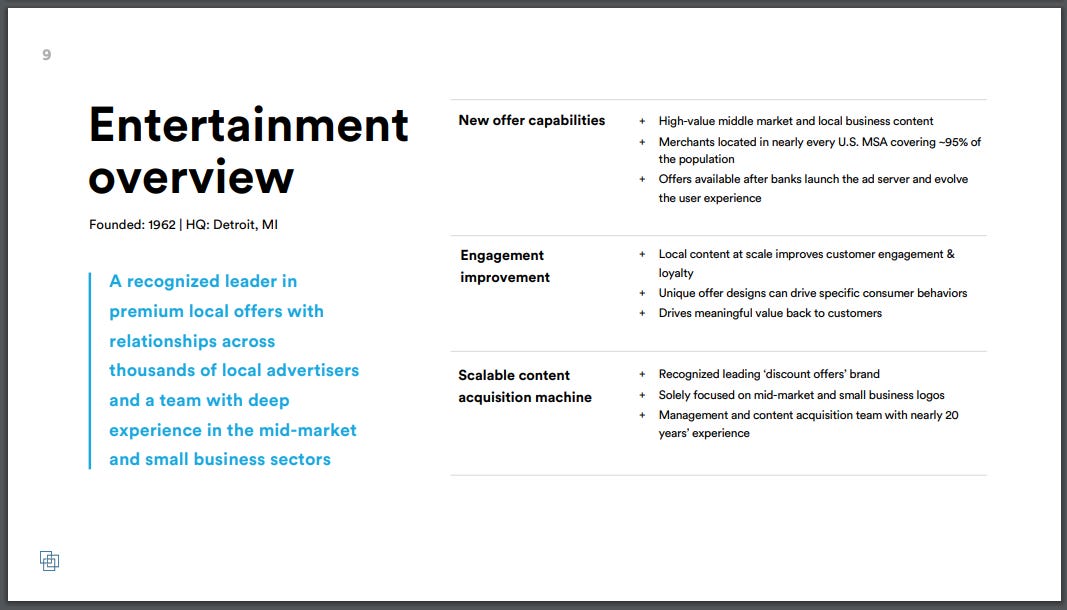

One highlight (and surprise) of the earnings call was the Entertainment acquisition, which was purchased for $15M in cash and stock at less than two times revenue.

This acquisition will add more local and mid-market content to the channel. In terms of some numbers, according to their site: 500K+ coupons, 10K+ cities served, 40K+ local merchants.

The plan for Cardlytics is to use these offers on the CDLX platform:

“With our scale, we see an opportunity to materially grow this business. Our plan is to use Entertainment's content on the Cardlytics platform once our bank partners launch our new ad server and roll out the new user experience.” - Lynne Laube, Co-Founder and CEO, Q4 2021 Earnings

Where this gets better, were the two different mentions of using the Entertainment acquisition to sign new banks, with my guess being AmEx.

Specifically:

“Additionally, we think this content will help us penetrate other banks who are hesitant to show their data but still want local content.” - Lynne Laube, Co-Founder and CEO, Q4 2021 Earnings

and

“And one last point I'll make, and I know I said this in the script, but I do think it's an interesting way for us to penetrate banks that are not quite yet comfortable giving us their data. But let's give you some of our content, let’s give you some of our technology and then but slowly work our way into getting your data, I think could be an interesting Trojan horse for us as well.” - Lynne Laube, Co-Founder and CEO, Q4 2021 Earnings

Why this most likely relates to AmEx is the following comment in January:

“So, you know, we’re watching those. They are definitely opportunities. Certainly the one we would love to have is AmEx, which is a home-grown program. Not sure we’ll ever get them quite frankly, because they have this religious thing, as they should, about they don’t want to give their data to anyone. And we need data. So we’ll see.” -Lynne Laube, Co-Founder and CEO, Cardlytics, January 2022 Needham Growth Conference

This shows AmEx is a bank CDLX wants, that also currently has a data hurdle. Therefore, CDLX could give AmEx these local offers first, and worry about the data later.

It is possible Cardlytics thought of this after the BofA / Rewards Network situation.

Essentially, let AmEx try running the local offers first and then realize how much better it would be when targeted with purchase data. This relates to BofA where they tried running local offers of Rewards Network first (likely via Figg) but then asked CDLX to push the content to also add purchase data (since BofA only trusted CDLX with the data and did not want to share with anyone else). Therefore, CDLX would also have the data from BofA on before and after using purchase data on the local offers to target to help convince AmEx to eventually do the same.

For more information on the BofA renewal, see the following:

Where this gets even more interesting is the comment regarding “But let's give you some of our content, let’s give you some of our technology and then but slowly work our way into getting your data…”

We know the ad server and new user experience is needed first based on the comment, “Our plan is to use Entertainment's content on the Cardlytics platform once our bank partners launch our new ad server and roll out the new user experience.”

The ad server would also give the ability for product-level offers and the new bank self-service (“Engage”), and therefore could also be a part of the technology they would be giving AmEx.

In the “Self-Service for Banks” write-up, I mention how the technology of the self-service for banks would also increase the probability of other banks partnering. Even stronger, I specifically mention AmEx, and using the new self-service for banks as an additional way to help AmEx get over the data hurdle.

Altogether you have local + self-service for banks + SKU. Therefore, I think it is now more likely than ever that CDLX could partner with AmEx, a bank many have thought was impossible to get (even despite AmEx wanting to work with CDLX, but just came down to sharing data).

An additional reason AmEx is a big deal is they have a large user base that is also likely more engaged, with $180M statement credits in 2020.

$180M in statement credits from AmEx in 2020 compares to $76M of consumer incentives by CDLX in 2020 and $127M in 2021. Given they have a smaller user base than Cardlytics (I’ve seen online around 63M cardholders, which would be even less MAUs), the higher statement credits is likely a combination of more engaged users + long-running program + higher offer amounts given all billings goes to customer incentives from what I’ve heard. Given the last point, even if we take 1/3rd of their $180M to covert it to consumer incentives as of it was in CDLX for a better comparison, that’s still $60M (compared to $76M in CDLX).

If CDLX came into the picture, I think worst case would be CDLX would not get the share of any of the offers that were originated from AmEx.

This comes from the languages in the 10-K:

However, any offers from marketers that Cardlytics brings in such as from ad agencies using the new self-service component of the new ads manger, or from Bridg / product-level offers (which have lower rev share) or SMB / local from Entertainment (which is what they are after), would likely earn Cardlytics revenue.

And it’s still possible CDLX would get a cut of the existing offers if AmEx moves to the new ad server and UI, and given the “minimum percentage” in the 10-K language above.

A lot of uncertainty, but if we assume CDLX could double the offers and redemption in AmEx through product-level offers, self-service used by agencies, and local/SMB, that could be an additional $180M in billings (since assume that equals statement credits in AmEx), or $126M in revenue (70% conversion), or around $50-$60M in gross profit (but could be higher with lower rev share on product-level data and offers).

Assuming this is achieved at the end of 2023 when core CDLX is supposed to be CF positive, then this could drop to the bottom line (since likely minimal incremental operating expenses based on knowing adding Wells Fargo took little additional costs, the tech is already created, self-service is used, etc.), and at a 20x multiple it would be another $1-$1.2B of value (great in relation to the $15M required to achieve this via the Entertainment acquisition).

However, that is only in the short term. It doesn’t take into account secondary impacts like larger reach with AmEx leading to more advertisers and better and more offers, which then increases engagement and redemptions further. Could also have AmEx existing advertisers start placing offers in the rest of the Cardlytics’ banks.

It also doesn’t take into account the decreased risk of failure for CDLX, or rather the validation / confirmation of their competitive advantages. How many people would continue worrying about other banks doing it in-house if the largest in-house program for many years all of sudden started using CDLX as well?

Ad Agencies

“Speaking of agency and our self-service initiatives, we secured our largest annual agency agreement to date in Q4. This multimillion-dollar contract brings 90-plus potential advertisers to the table for Cardlytics and is indicative of the broader trend we're seeing.” - Lynne Laube, Co-Founder and CEO, Q4 2021 Earnings

90 is extremely large and significant when you put it in relation to the “505 logos on the Cardlytics platform”.

“In Q4, agencies more than doubled their ad budgets with us year over year.” - Lynne Laube, Co-Founder and CEO, Q4 2021 Earnings

This seems to be in line with advertising agencies saying they would continue to increase their spend, despite their comments of not being fully self-service. Therefore, as said before, this shows that further benefit is still to come as it becomes fully self-service, and it shows not being fully self-service is accepted and an improvement from before, leading to this increase in ad spend. This is even without fully unlocking all the brands and CPGs who will eventually be able to place offers.

“Throughout 2021, we added over 30 advertisers through more than 10 new agency relationships.” - Lynne Laube, Co-Founder and CEO, Q4 2021 Earnings

30 more advertisers is great. Given the large agency was signed in Q4 2021, it is hard to know if any of these 30 are from that single large agency.

Altogether, Cardlytics seems on track to match the December 2021 quote of 2022 being a massive growth year for agency spend and mid-market spend:

If Cardlytics can get more MAUs on the new ad server + sign up more Bridg clients to accept CPG ad spend (as discussed next) + partner with AmEx, 2022 could be an even bigger year than most assume.

Bridg

“Bridg pipeline remains extremely strong and includes three late-stage opportunities in CPG and grocery” - Lynne Laube, Co-Founder and CEO, Q4 2021 Earnings

This got me excited, given it shows Cardlytics may soon show a significant unlock in billings and substantially increase the quality of the channel in terms of more offers and more relevant offers.

This could also go together with the new ad agencies who likely have a large number of CPG clients where they would need to be redeemed at grocery stores or supermarkets.

In terms of who the three could be, my thought is the comment on “pipeline” makes it seem that they are not a Bridg client yet. For grocery, Kroger looked to ramp up offers in Q4. I am not sure if they are a Bridg client, but if maybe they plan to be this could be why they started increasing their offers in Q4, by doing more testing before product-level offers go live.

The only other physical evidence for who one of the three in the pipeline could be is Rite Aid, given the offers in Dosh seen below. (I have not seen or heard anyone else besides one individual who has had these product-level offers in Dosh. I really hope we see a rollout across all Dosh partners, including Venmo, and Open Banking.)

The only other large client that could fit is Walmart. This could explain why Walmart, and specifically Walmart Grocery, was shown more than any other company in the updated investor presentation:

Walmart is a client of CDLX and Dosh, but I have never heard anything on them also being a Bridg client.

Now the comment regarding the Bridg pipeline makes it seem more a function of adding new Bridg clients. This could be separate, but a client of Cardlytics (who started advertising in Q4) and who has been rumored as a Bridg client, is Target. Target would also allow for grocery and CPG opportunities. I would think Cardlytics would focus more on clients of both Cardlytics + Bridg first, and where their ad agencies with CPG clients can spend the most money. Target seems like a logical fit.

The odds of seeing product-level offers in the bank channel from Target are pretty high, given they are now advertising in Chase as of Q4.

This to me showed Target would soon be placing product-level offers (or from the new ad agencies with CPG clients), even before the information supplied at Q4 earnings. The reason is I wouldn’t think we would see someone like Target ever place an offer without product-level offers, so maybe they know it is coming soon and are testing offers in general. In terms of numbers, I think having Target on the platform to allow product-level offers will have a significant positive impact on its own (as discussed next).

There are a few important ideas related to Target that Cardlytics should take note of.

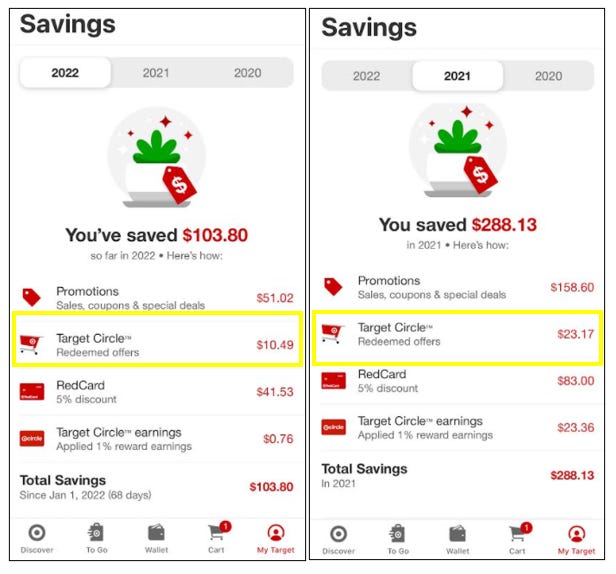

One is the “Target Circle” app and loyalty program. Speaking with my wife, she said, “I always look at the Target Circle offers before I go into the store”. This should be a goal of Cardlytics, getting users to think like that for all shopping. Below are a couple of screenshots from my wife’s Target Circle app, showing she redeemed offers totaling $23.17 in 2021 and $10.49 in less than 3 months through 2022. I believe these high amounts show what will be possible with Cardlytics when they add product-level offers and more stores that are relevant to the users, such as with grocery or supermarkets. This is why I got excited with the Bridg update of the three late-stage opportunity in CPG and grocery.

If this was in Cardlytics, and if the $2 of revenue / $1 of consumer incentive continues to hold up (which through 2021, it has, and we will discuss this more later in the section on numbers), then that implies about $46 of ARPU in 2021. If you annualized the $10.49 in 2022, you get about $55 in consumer incentives, or $110 in ARPU. Average of those two years is $78. This is from a single store, and without better targeting with purchase data from outside of Target. Therefore ARPU could even be higher with Cardlytics from better data, and then benefit from additional ARPU from other stores.

Imagine Cardlytics replicating this across all major stores, and aggregating all these offers in one central location of your bank app, rather than several loyalty program apps, increasing the odds of users seeing and engaging with the offers. Then you also have the benefit of more users, not limiting yourself to those who have Target Circle or any given loyalty program PLUS the benefit of having transaction outside your store for better targeting. With those two factors, it becomes easier to see why Starbucks is a client of both, and why it should be easy for Cardlytics to convince others (including Target). I will discuss social proof in the open banking section, where the logic applies here as well, that as Cardlytics signs the biggest and most well-known loyalty programs, more will do the same, as they realize a loyalty program is not enough on its own due to its limitation in users and data.

I believe there are relevant offers out there for all 175M MAUs, and given you have the purchase data, it should be easy to match the offers in the right amount with the right users to get redemptions. The problem up until this point is having enough advertisers and offers to accomplish this. Therefore, the progress of adding all the new ad agencies with CPG clients and now adding more Bridg clients in areas like grocery, it’s hard to think Cardlytics cannot get the right offers to the right people and have similar results to my wife at Target, but across multiple stores and possibly with better results from better data.

Additionally, other investors say, “how often do people go in their banks apps or spend time there?” Beyond the point of not needing to spend much time in a bank app for these offers since users are choosing to look at the ads which are in an aggregated and organized location that only takes seconds to view, if you have more offers + higher in amount offers + relevant to the user in both location and product, there is the opportunity to create a thought similar to my wife at Target, where “I always look at the Target Circle offers before I go into the store”. Then it doesn’t matter even if the bank’s hide the Cardlytics offers. If the offers are that good and relevant, leading to users actually earnings / saving money, they will find it and use it. (“Be so good they can’t ignore you”)

There is simply such a massive opportunity here that I hope Cardlytics takes advantage of.

For more detail on Bridg, see the following write-up.

For a product-level offers update, see the following write-up.

Local / Mid-Market + Ad Agencies + Bridg

These three updates alone show the overall progress Cardlytics has been making towards significantly increasing the number of offers and billings in the bank channel. I believe some get too focused on quarterly numbers, such as comparing ARPU, and miss what is going on with the business.

When you start combining these together (local + ad agencies + product-level offers), I feel we will start to see some compounding positive benefits. In the simplest form, more offers increase the odds of an offer being relevant to a user, increasing odds of making a qualifying purchase, and Cardlytics earning revenue. You also have CDLX adding more ad agencies with CPG clients who can then also place product-level offers with the new Bridg clients. When you layer on lower revenue share with SKU, and then lower incremental operating expenses (tech already created, not much additional employees needed, self-service platform, etc.), I feel it is easy to see how Cardlytics will get to cash flow positive by the end of 2023 (as management has targeted) through just these new additions.

As a reminder, the local and product-level offers require the new ad server. This is why it is imperative Cardlytics gets all bank partners on the new ad server as soon as possible (hence the management goals of 50% of MAUs on the new ad server by the end of 2022, and the rest by the end of 2023).

Open Banking

“The year-over-year growth in the U.K. was aided by our open banking solution. The Nectar Connect program now has nearly 0.5 million members, making it one of the largest open banking initiatives in Europe.

Due to the success of this program, we've seen strong interest from other large U.K. brands, and we're on track to launch a second open banking initiative in Q2. We will be running a pilot with TopCashback, one of the largest traditional affiliate publishers in Europe with over 15 million U.K. members.”

- Lynne Laube, Co-Founder and CEO, Q4 2021 Earnings

One thought I had before this update provided at Q4 was that we could possibly see a similar pattern unfold with open banking, regarding social proof. We have seen this in other areas of the business, where Venmo was the social proof for Dosh to get more neobanks/ fintechs, and you could even say BofA was that for the rest of the banks.

My thought was Nectar Connect could be that same catalyst that leads to other programs using CDLX. The reasoning is due to the first mover advantage and being a larger program. If you add in Cardlytics experience with analyzing and advertising based on purchase data, and then layer on their trust from even the banks, I thought combined it could lead to more programs using Cardlytics for their open banking initiatives (this could also happen with loyalty programs in the U.S., given Starbucks is using both Cardlytics and Bridg).

This is why this update was big. We now know this social proof is actually occurring, based on the news of the next pilot with TopCashback (which should just add to the social proof, and have a snowball effect).

Beyond the single new program, we heard, "due to the success of this program, we've seen strong interest from other large U.K. brands". This shows the new interest is a function of the success of Nectar Connect + being one of the largest open banking initiatives.

As CDLX signs more open banking partners, advertising reach also increases, leading to more advertisers and more attractive offers, which increases engagement with the existing loyalty programs, which then attracts even more programs, increasing the reach further and so on. As a reminder, there has been outsize ad demand in the U.K., where CDLX has not reached enough scale to meet that demand. Open banking could be that answer.

Additionally, the increase in Nectar Connect members from 65K to now 500K users is quite impressive. Given these users have to opt-in, unlike the banks, these users are much more aware of the offers and likely to be more engaged. This to me is a key insight that should not be ignored. When you combined that with 0% rev share and near 100% gross profit margins, it will not take much to produce significant cash flow from this business. On top of that, as mentioned before, as Cardlytics grows and adds more partners, it increases the advertising reach, which attracts more advertisers and more offers. This should lead to increasing opt-ins and engagement in the existing programs like Nectar Connect.

After thinking through the details and numbers, there are some reasonable scenarios where the current market cap could be covered by open banking initiatives within the next 10 years, even in scenarios where the revenue from the other lines of business all go zero. That’s the benefit of a low market cap and a company with so many different ways to win. In order to increase the probability of this occurring, Cardlytics needs to continue to have focus on open banking, add more programs, and leverage Bridg.

Note: I’m currently working on a full write-up / video on CDLX and Open Banking. I believe there is a significant opportunity here, and the odds of that occurring have dramatically increased with this news shared at Q4. My plan is to release it soon. If you would like access to my current notes and work on this now rather than later, see here:

Cardlytics Quantitative Research Notes (Notes on TAM, How Good Could it Get?, FI Share: When 0% and When 100%, Reverse DCF)

Neobanks / Fintechs

“Additionally, despite a delay, the marquee partner we mentioned last year is scheduled to launch the Dosh program in Q2”. - Lynne Laube, Co-Founder and CEO, Q4 2021 Earnings

My heart started pounding when Lynne started saying this! I thought for sure the name was finally going to be revealed. I still think it is Affirm, as discussed in the following write-up. Affirm and their Debit+ card is still not fully live. It is on a waitlist. Someone else mentioned CDLX is waiting until this unnamed partner’s debit card goes live. That does not guarantee its Affirm, but combined with the points made in the write-up linked above, I still think it’s Affirm.

"With Dosh, now have 13 publishers live with the program and 19 publishers under contract and scheduled to launch later this year." - Lynne Laube, Co-Founder and CEO, Q4 2021 Earnings

These numbers took me by surprise. I have recorded below 16 Dosh partners confirmed, and 18 when including suspected partners.

Does that mean 14 or so unknown new CDLX/Dosh partners? (The 14 comes from 13 live + 19 under contract = 32 total - 18 suspected = 14 unknown).

However, it could be 19 total instead of 32. If Lynne stopped at “19 under contract” I would more likely think 19 total, but the other comment of “and scheduled to launch this year” makes it seem like a separate 19 partners. Also, if it was 19 total, I think CDLX would have said "With Dosh, now have 13 publishers live with the program and 6 more publishers under contract and scheduled to launch later this year."

Although Dosh is more an insurance policy in the situation where primary transactions shift away from traditional banks and move to neobanks and fintechs, there is still some value in the scenario that does not occur. I still believe there is a way to get users to redeem rewards in these channels, leading to additional revenue with higher gross profit margins (since lower revenue share, as per CDLX investor day). I will discuss more on this front in the next section.

For more information, and to see my continually updated list of Dosh partners:

Open Banking + Dosh Opportunity

I believe Open Banking has the potential to be a cash cow for Cardlytics, and that there is still untapped value with the neobanks / fintechs even if primary transactions stay with the banks.

In order to realize that value, it will mostly be a function of increasing the number of offers and relevance of offers. That is where there are further crossover benefits with the progress discussed at the beginning.

At least with the neobanks and fintechs, Cardlytics needs to leverage the advertisers placing offers in the bank channel and also place them in the neobanks / fintechs. Given you may not have the same level of purchase data for targeting, possibly make them only 5% cash back, or even less to match other Dosh offers.

Additionally, add the local offers from Entertainment and product-level offers from Bridg (which I have already seen in Dosh, but is not on everyone’s account, nor in other partners like Venmo).

We have heard open banking can add product-level offers via Bridg, so that will help. However, given there is much less scale to meet the ad demand in the U.K., Cardlytics needs to continue doing what they are doing, and add more programs to increase the advertising reach to attract more advertisers.

Further benefits could come from giving the open banking partners “Engage”, the self-service for banks, and adding self-service within partners like Venmo for Venmo Business Accounts who accept their payments through Venmo.

It only takes one high value and relevant offer for each user in these channels to produce significant revenue / gross profit / cash flow, and make it all worth it.

This is simply another substantial opportunity available for Cardlytics.

BofA Renewal

“Our BofA contract renewal is going well, and both parties are confident that our mutually beneficial relationship will continue for years to come. Both parties are working hard to get this done so that we can launch the new ad server and the experience it enables.” - Lynne Laube, Co-Founder and CEO, Q4 2021 Earnings

The comment regarding the new ad server and experience makes it seem as though BofA already agreed to take it. On the other hand, it is also possible BofA has not agreed to taking the new ad server yet, and this is what Cardlytics is holding out for (since CDLX is the one holding out, as will be discussed later). However, it could be more a function of ensuring Cardlytics is the one hosting the tech and allowed to put it in the cloud, given CDLX has mentioned how banks have been hesitant on the cloud aspect, and knowing that these were negotiating items. If that is the case, it likely means progress has been made with the negotiations, with BofA at least agreeing to the new ad server.

In the 10-K, there was an update on the BofA contract:

“The GSA has been extended through August 31, 2022 and, if not extended again, will automatically renew for one-month periods thereafter unless terminated earlier in accordance with the terms of the GSA.”

This shows that the contract was extended through August 31, 2022, and even if not extended again after that, that is still okay, given they can still go month-to-month.

Remember, CDLX is the one holding out! This is such a key point that I feel goes ignored. This comes from the following quote, saying “We’re holding out…”:

One may think that CDLX is simply just saying that. However, recall CDLX has even more leverage now following the Figg / Rewards Network situation (if we have all the correct information).

For more information on the BofA renewal, and discussions on leverage and what is happening, see the following:

Chase on New Ad Server

As discussed in the last post on “Self-Service for Banks”, I was quite sure it was going to be announced that Chase was already on the new ad server.

The biggest piece I kept going on was the investor day comment of:

"Chase is also, as Michael mentioned, on track to take the new Cardlytics ad server and UI by the end of the year, which will continue their engagement growth trajectory." - Farrell Hudzik, Executive Vice President, Financial Institutions, Cardlytics Investor Day Presentation

However, it is likely that it simply got delayed.

Maybe something will transpire during 2022 to help hit the goal of 50% of MAUs on the new ad server by the end of 2022.

Q4 and Full Year Numbers

I do not want to get too in the weeds on the numbers surrounding Q4 and year-end 2021, as I feel it is more important to focus on the updates that will impact the business long term, rather than short-term results. However, I will focus on the numbers that relate to how the business could look in the end state.

Summary

Here is a summary from the CDLX Quantitative Research Notes:

MAUs

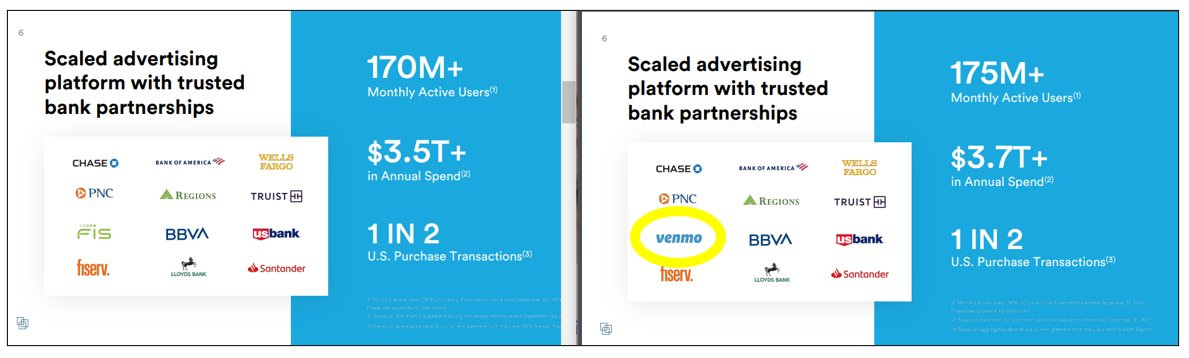

MAUs continue to increase. We could see a significant increase with the signing of a new bank, like AmEx or USAA (as discussed in the Entertainment acquisition section). Today, there are around 175M MAUs.

One change quarter over quarter was adding Venmo to the list of bank partners. I would be curious to know of Venmo is included in the 175M. If they are, they would only be including the small number with a Venmo debit card, and not include the now 83M using Venmo and who likely all had access to the Dosh QR Code offers.

Gross Profit %

Gross Profit % is the highest in four years. This is likely a function of the following from the 10-K: “Partner Share and other third-party costs increased by $32.0 million during 2021 compared to 2020 primarily due to increase in billings partially offset by an increase in Consumer Incentives funded by partner through a reduction of Partner Share.” I think it could be another year or so until we see the increasing overall gross profit margin from the lower revenue share with Bridg.

Operating Expenses %

OpEx as a percentage of revenue (tracking for operating leverage) increased in 2021. This is likely a function of the Dosh and Bridg acquisition. I expect this will decrease significantly over time.

ARPU

ARPU increased even with the increase in the MAUs. This is impressive since it makes it more difficult to achieve ARPU growth with an increasing denominator / MAU base.

Rev / CI

Revenue / Consumer Incentive (Rev / CI) held above 2. I track this to see if I can still use this assumption when doing bottom-up analysis (such as in the earlier section on Bridg and Target).

CPS vs CPR

Cost per Served Sale (CPS) % decreased, with more share of CDLX platform revenue going to Cost Per Redemption (CPR), and reaching the highest percentage in four years.

Engagement

An interesting stat is now knowing how many unique MAUs are activating offers.

The important numbers are:

Engagement Rate of 29.84% (=51M / 170.925M)

Average Revenue per Engaged User at $5.24 (=$267.12 / 51M)

Average Consumer Incentive per Engaged User at $2.49 (=$126.96 / 51M)

Now it is still possible CDLX gets paid when an offer is not activated but where there was an offer and the user makes a qualifying purchase under the CPS pricing model. Therefore, there is likely a portion of revenue not attributable to the activated offers and engaged users. However, I would assume this is likely minimal. Additionally, I would even assume that in these cases that the user who made the qualifying purchase was someone who activates offers and simply did not activate that particular one. Therefore, the Average Revenue for Engaged Users at $5.24 is still helpful to know.

However, I feel the more accurate and important number is the Average Consumer Incentive per Engaged User, which is $2.49. A user only gets the consumer incentive if they activate the offer, so this number should be more accurate given we are basing engaged user off of the MAUs activating offers.

This is also why it is helpful to know if the ratio of Rev / CI is holding constant. We can then take these two assumptions and see what revenue would like with higher engagement rates (higher than the current 30%). And I believe we will see that percentage of unique MAUs activating offers increase as CDLX sends more emails and push notifications following the rollout of more offers from self-service + product-level offers + SMBs / local from the Entertainment acquisition + new ad server and new UI and more. CDLX has mentioned waiting to “activate” these users, and I think that is the right decision. You do not want a bad first impression with the offer section.

Closing

One way I like to tie all the above points together and think about it from an investment perspective is by thinking of individual paths with their own scenarios and probabilities, and adjusting those probabilities based on new information (Bayesian inference).

Essentially we have the core CDLX business, Bridg, Dosh, and Open Banking. Each have their own value from how much cash flow they can help generate. For any given one of those scenarios, there is a corresponding probability, leading to the expected value today. (Note: I may do a more in-depth write-up on this topic in the future, but for now, just know I am thinking in terms of each line of business separately and what they could produce in terms of cash flow if completely independent, which leads to some fun lines of thinking, since can support the entire market cap of CDLX today from any one line of business under certain scenarios, leading to a large margin of safety today).

Based on the updates from Q4 that were discussed in this post, it looks like overall Cardlytics’ business continues to improve, with the probability of each good scenario increasing. Specifically, the probability of each increases from:

Core CDLX: Adding more ad agencies with more than 90 advertisers + existing ad agencies doubling spend + acquisition for local & mid-market content + strategic plan to get AmEx + potential BofA progress

Dosh: Adding more neobanks and fintechs, and upcoming launch with marquee partner

Open Banking: Adding an additional program with possibly no revenue share, and interest from other programs

Bridg: Three late-stage opportunities in CPG / Grocery

Therefore, as the business and each line of businesses continues to improve, the probability of one of the great scenarios occurring increases as well, which leads to higher expected values today.

I also added these updates (in purple) to the flywheel I’ve shared previously, to get an idea of how all this can work together (only a rough thought process):

I look forward to seeing what occurs throughout 2022.

If you enjoy the content, or have received any value from the investment insights, discoveries, and thoughts shared, past or present, please consider becoming a paid subscriber of premium supporter of the channel. Your support increases the odds of more investment write-ups and content in the future, and gains you access to existing and future Research Notes.

Follow-Up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more.

-Austin Swanson (Swany407)

Twitter: @Swany407

Website: Swany407.com

More Information on Cardlytics

Research Notes

Free Posts

The Power of Bridg (and Why CDLX is Undervalued): Write-up and video

BofA Renewal & Testing Competitors (Update): Write-up and video

New Observations, Upcoming Earnings Calls, and Updated Allocations (10.21.2021): Write-Up and video

Thoughts Following Q2 2021 Earnings and Price Decline: Write-up and video

Thoughts After Price Decline (5.17.2021): Write-up and video

Disclaimer: This content is not investment advice, and is intended for educational and informational purposes only. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.