Cardlytics ($CDLX): Q2 2023 Earnings

Free post discussing Q2 results, improved liquidity position, free cash flow positive, new user experience, new potential banks, new offer constructs, new hires, lower billing share, and more.

For those interested, this post is also available on YouTube, Apple Podcasts, and Spotify.

Market Cap as of 8.9.2023: ~$13.70 / Share x 37.7 Shares ~ $516M Market Cap.

This post is free to read.

Also, if you are new to CDLX, and if you are looking for more general information about CDLX and the investment thesis, check out my recent interview on the After Dinner Investor podcast, called “Will Cardlytics Be a 1,000 Bagger?”.

Additionally, if you missed it, I launched a new Substack for finding new stock ideas, “13F Dashboards”.

Q2 2023 Earnings

Last week was CDLX’s Q2 2023 earnings.

As you will see, there is a lot of information discussed below, due to the large number of updates provided by CDLX (both on the call, after the call, and in the 10-Q).

I already sent this out to everyone with access to the Research Notes, but wanted to provide this information to everyone else as well now.

Below I discuss my notes and thoughts on the following (which includes most of the same items as those in CDLX Research Note #182 on possible announcements and updates, plus some more important information from before and after call):

New User Experience at Chase

Early Stats on the New User Experience*

BofA and Wells on the New Ad Server and New User Experience*

New Potential Banks*

Details on the Updated Chase Billing Share Agreement

Other Banks At a Lower Billing Share*

Naming a New CFO

Bridg RMN & CPG Products Update

Bridg Earnout Update

Product-Level Offers Update*

Q2 Results and Q3 and FY 2024 Guidance (Cash Flow Positive)

Multi-Tier Pilot

Pricing Pilot (Dynamic Marketplace, Bidding, Dynamic Pricing, and more)

New Hires

Liquidity Analysis (Much better than expected, following the Q2 updates discussed in this post)

Increasing Expected Value

More CDLX Information

Including my own actions and allocations of CDLX

*These discussion items includes something important mentioned after the call by CDLX.

I discuss all of these in more depth below.

And if you missed the last public post, make sure you check it out: “Clifford Sosin of CAS Seeks CDLX Board Seat”.

Note, if you are looking for significantly more CDLX information, and sooner, join others and upgrade to access the CDLX Research Notes (and more).

Since just March, I have emailed out over 50 in-depth notes regarding CDLX, with important information, including information that led me to buy CDLX below $3 with leverage.

And others have utilized this recent information from these Research Notes:

Join others, and upgrade today. Doing so locks you into today’s price (and will not increase in the future when the prices increase, even upon your future renewals):

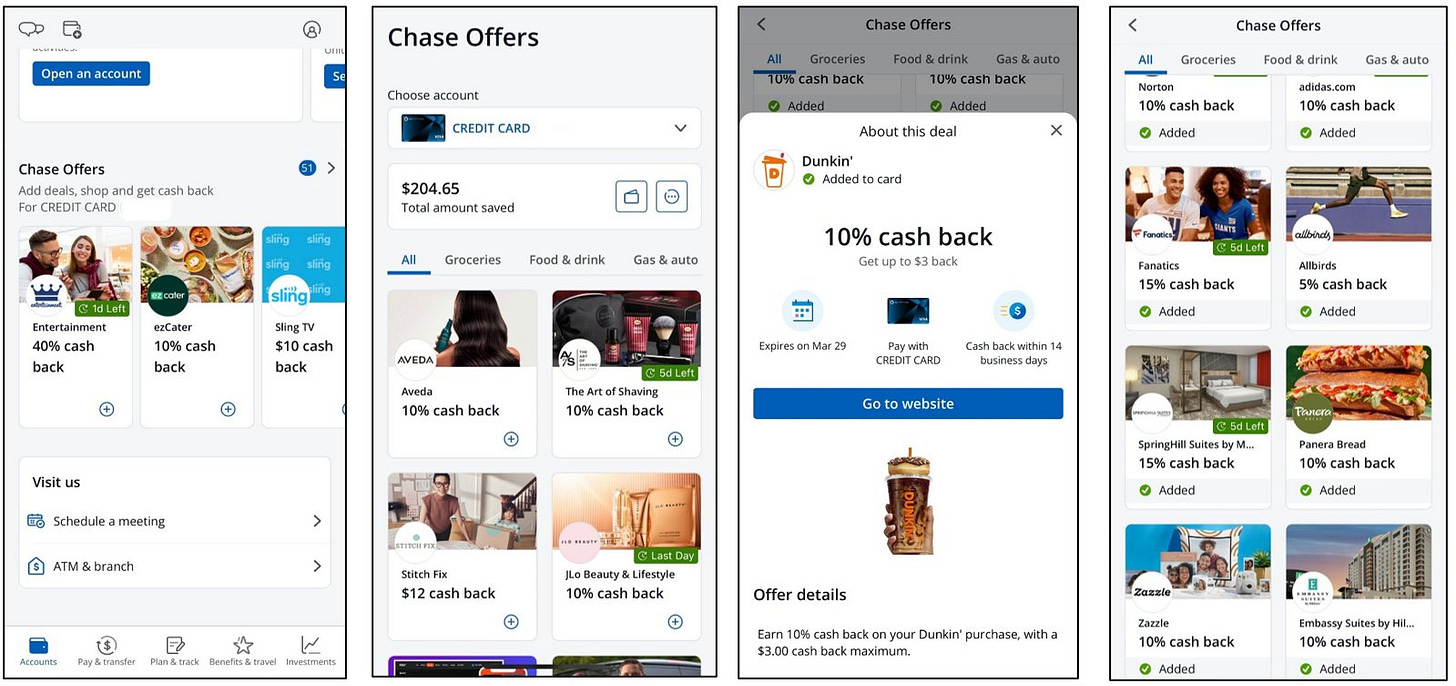

1. New User Experience at Chase

I believe 25% of Chase users were on the new user experience for the entire Q2 based on the Q1 update (I was on as of March 26th).

By July 7th all my Chase accounts / cards were on the new user experience. It also sounded like most others were also on the new user experience.

Then on July 18th, this LinkedIn post indicated that Chase was at 100%.

That LinkedIn post was deleted pretty quickly after I posted it (or maybe I simply couldn't / still can't see it anymore). So I wanted confirmation on the Q2 call of 100% of Chase users on the new user experience.

And then on the Q2 call Karim confirmed 100% of Chase users on the new user experience.

“We are happy to announce that Chase is 100% live on the new user experience.”

- Karim Temsamani, CEO & Director, Q2 2023 Earnings, Aug 1, 2023

As mentioned by Karim before, and even again after the call, he mentioned their relationship with Chase is better than ever, which is very good to hear, and evident with Chase being the first major bank to move to the new ad server and new user experience, and even lower their rev share.

One thing to keep in mind is 100% of Chase users on the new user experience did not occur until Q3, so it would have had a minimal impact on Q2, but may have a slight impact during Q3.

I say slight, since Chase is only maybe 35% (65M / 188M) of users. Additionally, it is still early, and the new offer constructs are only now being launched. Therefore, visible impact may take a little bit of time.

This was a very big update, and opens the door for all future enhancements that are starting to be rolled out, including new offer constructs.

I discuss the new user experience and the new offer constructs unlocked more in the free post, “Chase Launches the New User Experience”, such as:

New UI with richer imagery

New product-level offers

New category-level / department-level offers

More spend-stretch offers

New time-of-day offers

More + enhanced intro offers

New local + SMB offers

and more

2. Early Stats on the New User Experience

Seeing proof of revenue increasing with users on the new user experience at Chase would be evidence that the investment thesis will very likely play out, with higher ARPU materializing on the entire MAU base.

Karim mentioned all key numbers are showing improvement with the new user experience, with not only engagement / activations, but including redemptions.

That was one of the key items I was waiting for confirmation on.

Question: “I'm just curious what with Chase have you seen that really clicks or that maybe clicks with Chase or your advertisers to prove or to validate this new user experience?”

Karim: “Well, again, we are seeing all of our key numbers, whether you're thinking about activations or redemptions or engagement in the program overall continue to improve. So these are very, very positive signal for us but we're making the right changes in the business.”

Q2 2023 Earnings, Aug 1, 2023

Based on discussions after the Q2 call, it sounds like it is still too early to want to share numbers, given too early for attribution due to all the other improvements at the same time, with new offer constructs, dynamic marketplace and bidding, and more. But on the call and after the call, Karim still confirmed that the improvement from the new user experience is definitely positive.

While I don’t love not having hard numbers at this time, I am feeling more and more comfortable with CDLX and specifically Karim and his ability to execute.

I also think we will slowly start seeing a non-linear benefit from all these different efforts rolling out, with the new user experience, new offer constructs, unlocking new ad budgets from brands / CPGs / budgets at category level from now having receipt-level data and product-level offers, more automations, dynamic marketplace + bidding (which to me is very big). I discuss some of these items more below, but wanted to make sure to mention that even if the new user experience didn’t show much improvement yet, it is still early to estimate near-term ARPU given all these different enhancements rolling out.

And as mentioned in CDLX Research Note #185: “Important Items for 23Q2 Earnings”, it is possible CDLX will wait to share these states, given they stated in the Q1 call, “and we intend to disclose some of these statistics when we have scaled data across more bank partners.” So maybe CDLX will have to wait until the new user experience is rolled out across BofA and Wells. This could also be a function of not being able to share bank-specific information, which was something communicated by CDLX in the past.

3. BofA and Wells on the New Ad Server and New User Experience

Having these two other major banks move to the new ad server and roll out the new user experience increases their switching costs, which increases the likelihood they stay with CDLX.

But there is another large benefit, where the sooner BofA and Wells are on the new user experience, the sooner CDLX can start benefiting financially.

Karim provided an update on the Q2 call:

“We expect nearly all major banks to move to the new ad server and new user experience by the middle of 2024 versus the end of 2023.

As we said in the past, bank time lines can change quarter-to-quarter. We're having constructive conversations with our partners, and our goal is for adoption to happen as soon as possible.”

Q2 2023 Earnings, Aug 1, 2023

Related to the “constructive conversations”, after the call Karim mentioned BofA is working with CDLX on what they want the new UI to look like, which provides a level of confirmation with their intent to move.

While the timeline may not be what most want to hear, I did mention in CDLX Research Note #185: “Important Items for 23Q2 Earnings” that:

“Chase moving to the new ad server and rolling out the new user experience was the most important, and has already occurred.”

“It isn’t the end of the world if this gets pushed back further, but the earlier the better, such as for the reasons I mentioned earlier, with having more time to scale revenue before the 2025 converts mature. And to be clear, CDLX doesn’t need to have the cash on hand to handle the converts. If CDLX continues to improve their financials and become cash flow positive, they shouldn’t have an issue with rolling over to new converts.”

Where CDLX is now on track for free cash flow positive on an annual basis now, based on the Q2 updates provided. Therefore, having some delays isn’t a deal breaker here, with still over 2 years until the 2025 converts mature.

Additionally, Karim seems to be giving himself some room with timelines. For instance, Karim / CDLX recently pushed back the CF positive timing, only for them to hit it earlier than originally expected! Therefore, we could see the same occur with BofA and Wells moving to the new ad server and rolling out the new user experience.

Not only does it sound like CDLX is working with BofA on what they want the new UI to look like, but I also think an earlier timeline is possible given on 6/9 I saw the following with the Wells Fargo app:

“We are continuing to roll out the reimagined Wells Fargo Mobile® app, with new app updates each month.”

“More coming throughout 2023!”

Could mean there will be an upcoming update with Wells rolling out the new user experience. Given it is saying throughout 2023, that could still mean by year end (rather than 2024). But these updates in the Wells Fargo App could be unrelated.

I also believe there is a higher probability of the major banks moving sooner, given it is likely easier to convince BofA and Wells to do this sooner given Chase has already rolled it out. It will be even more likely BofA and Wells roll it out sooner if there are early stats of the new user experience showing improvement.

Example: If Chase is seeing much higher app opens, card spend, etc., and CDLX has those numbers, they can go to BofA and Wells and have convincing reasons to move to the new ad server and rollout the new user experience sooner.

But again, there are only a few more months until YE 2023, and mid 2024 is not that much longer.

4. New Potential Banks

“Discussions with multiple top 20 U.S. banks and several high-upside fintechs remain ongoing. And we are confident we will sign at least one of these major partners by the end of 2023.

We will continue to update you as we make progress on these potential partnerships.”

- Karim Temsamani, CEO & Director, Q2 2023 Earnings, Aug 1, 2023

This was nice to hear, that it is still likely to have a new major partner sign by the end of this year.

Maybe it is only a fintech, but maybe it is one of the major fintechs.

Karim also said “at least one”, so maybe even more, including a major bank.

Adding another major bank would be a big win, leading to more scale and data for advertisers, leading to additional spend and more advertisers, leading to more offers and more cash back for users, leading to higher engagement and spend by users, which could attract even more banks or have existing banks lean even more into the program (similar to Chase who was quick to move to the new ad server and roll out the new user experience and even lower their rev share).

In CDLX Research Note #184: “Potential New Major Bank Partner”, I discuss other potential bank partners + and actually go into depth on one specific major bank partner that seems more likely than others.

I go into detail on why this bank is not only likely, but why it could happen, despite many investors ruling them out due to past comments from the former CRO.

While I explained in the post why I didn’t think that would be an issue anymore, Karim confirmed after the Q2 call that this banks is certainty a prospect, which was contrary to what many believed.

See the Research Note above for more details.

5. Details on the Updated Chase Billing Share Agreement

On July 5th, 2023, CDLX announced within an 8-K that CDLX’s Billing Share with Chase, which is their portion of advertiser billings retained by CDLX, increased on June 1st, 2023.

There is a high probability that this % to CDLX will increase further, as stated by the 8-K. The reason I think this is a very high probability of increasing is CDLX wouldn’t state that in the 8-K if it wasn’t a possibility.

I have estimates of the potential % change that I will share in the future. It seems slightly higher than the low-end that I was expecting.

Again, this only had an impact for 1 month in the quarter, so Q3 will get the full benefit.

Karim was asked “what new products or services that you're providing that would encourage bank partners to want to renegotiate with terms that would be more favorable to Cardlytics?”

I discuss billings share more in CDLX Research Note #180: “Change in Billings Share with Chase” (which was my most read post in a while), where I discuss:

What this Means in the Near Term (financial impact to CF and liquidity and other strong signals)

Assumptions on the % Changes

What this Means Longer Term

And much more

6. Other Banks At a Lower Billing Share

While I still feel it is likely we will eventually see BofA and Wells also follow Chase with lowering their rev share, Karim did not comment on this.

I also mentioned in CDLX Research Note #180: “Change in Billings Share with Chase” that new banks should be at a lower rev share when they are onboarded.

Even Lynne mentioned new banks should be at a lower % given less risk taken vs the first major banks.

And Karim has made additional comments on this front, and did confirm after the call that ideally new banks will be on a much lower rev share, which would have a large positive financial impact (combined with the low incremental OpEx with a new bank).

7. Naming a New CFO

On July 18th, 2023, CDLX announced they appointed a new Chief Financial Officer (CFO), Alexis DeSieno.

I believe the odds of CDLX being able to handle near-term items like the maturing LOC and Converts has increased with Alexis joining (combined with the improved financial position based on Q2 updates, which I’ll discuss later).

On the call, Karim said:

“Product is not the only area we are upgrading. We are responsibly investing in our people, too. I want to welcome our new CFO, Alexis DeSieno at Cardlytics. We are thrilled to have attracted such a talented and capable executives.

Alex's track record of collaboration across business lines and driving financial results through data-driven analysis, maxed a perfect fit to drive long-term growth and profitability for Cardlytics.

She started in less than 2 weeks and excited to speak with all of you on our next earnings call.”

- Karim Temsamani, CEO & Director, Q2 2023 Earnings, Aug 1, 2023

I discuss Alexis more in CDLX Research Note #183: “CDLX Appoints New CFO”, where I discuss:

The New CFO

Experience (and thoughts)

Education (and thoughts)

Start Date (and thoughts)

RSUs (and future value per share)

Upcoming Needs From the New CFO (detailed discussion)

Overall Current Thoughts on the New CFO

8. Bridg RMN & CPG Products Update

As a reminder, Bridg has already made a recent switch from focusing on being a customer data platform to creating a product for Retail Media Networks (RMNs). And by building scale for these retailers, it opens an opportunity to also create a product for CPGs.

This has been discussed briefly the last two earnings calls.

CDLX 22Q4 Earnings Call:

CDLX 23Q1 Earnings Call:

The RMN space is a large market + high gross margins.

During the Q2 call, Karim said:

“We are making fast progress in transforming the Bridg business.

Our retail media network pilots have received positive responses from major national CPG brands, and the initial feedback we've gathered highlights the excitement around the flexibility they'll have in building sophisticated audiences, seamless access to a national footprint and user friendly tools that empower them to get valuable insights, drive substantial incremental sales and accurately measure the impact of their campaigns.”

- Karim Temsamani, CEO & Director, Q2 2023 Earnings, Aug 1, 2023

On the Q1 call, CDLX mentioned hoping some RMN clients would convert to full scale relationships later this year.

After the Q2 call Karim said he still expects them their RMN products to scale into year end and for next year.

I discuss this more in CDLX Research Note #179 “The $100B Opportunity with Retail Media Networks and CPGs”,

Bridg and Retail Media Networks

Building the scale for the retailers for RMNs

Using these retail partnerships for a new CPG product

The opportunity in terms of CF for CDLX

Why Smaller / Mid-Market / Regional Retailers? And Why Bridg?

CDLX vs Bridg Focus

and more

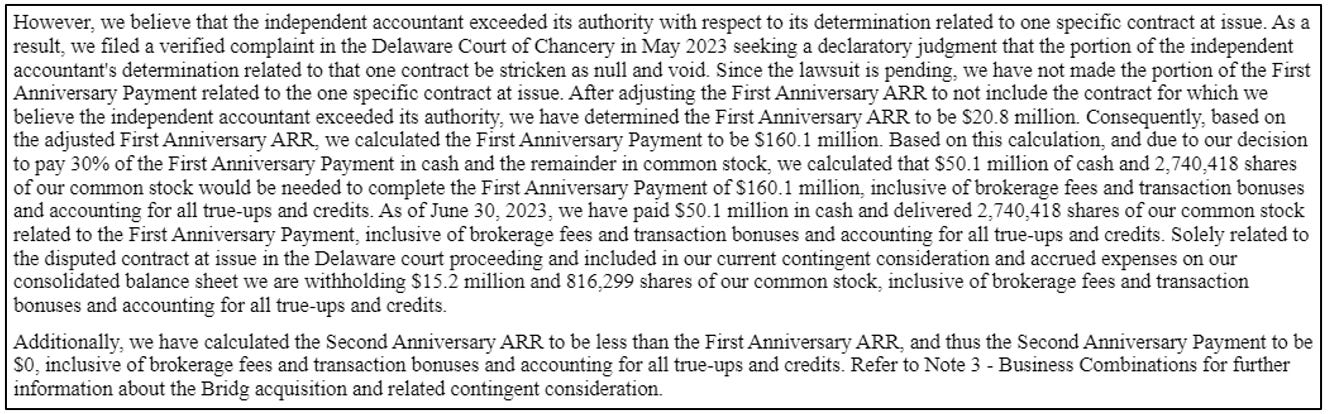

9. Bridg Earnout Update

This was one of the better updates, that was discussed in the 10-Q, and not as much on the call.

CDLX paid Bridg less than originally announced ($50.1M vs $72.6M), more in line with what was originally communicated. This led to a much higher-than-expected Q2 cash balance.

CDLX could end up not paying any additional amount.

And even if they do, it might not happen for a while, given how long it takes in the Delaware courts.

And given CDLX’s improved liquidity position (as I’ll discuss later), CDLX is in a very good position to handle any additional amounts.

I have a very in-depth CDLX Research Note about the Bridg earnouts that I plan to send out later.

10. Product-Level Offers Update

“We launched our first campaign with receipt level reporting.

This is important because it opens up incremental demand from CPGs and retailers who need product level reporting. It also gives consumers access to better content and offers they want to see.”

- Karim Temsamani, CEO & Director, Q2 2023 Earnings, Aug 1, 2023

This was sooner than expected. I knew it was possible to occur by the end of the year, but I didn’t know CDLX already launched their first campaign with receipt-level reporting.

Depending on how quickly CDLX can start to scale this, it could be interesting in Q3 and Q4, especially with now 100% of Chase users on the new user experience.

There are many brands and CPGs at the ad agencies that already use CDLX + there are the existing Bridg clients.

Karim confirmed that receipt-level offers would double TAM and ARPU but it will take some time to scale into something big. This matches what past management said as well, and makes sense given the large number of advertisers who literally could not use CDLX without this capability.

2018 ARPU was $2.30. So ignoring benefits of new user experience, travel, luxury, other new offer constructs, more mobile banking engagement and usage, then that would be near $5 of ARPU alone from 2x with product level.

But I have also heard that $2.30 was weighted down by other banks at the time, with one regional bank actually closer to $4 of ARPU, which would put ARPU at $8+ with 2x from product level (emphasis on the “+” given all the other improvements).

To get a feel of that impact: ([($8 ARPU x 200M MAUs x (1 - 50% rev share) - $205M OpEx & Delivery Costs) x (1 - 20% tax rate) x 20x multiple] - $260M Converts & LOC) / 46M Diluted Shares = $201 / share, vs $13.70 today, or >14x.

Ignores the much higher ARPU that seems not only possible but likely

Ignores MAUs growing with new banks in US + internationally

Ignores lower rev share like Chase, and even lower for new banks

Ignores new RMN / CPG products with higher gross margins

Ignores large NOLs to offset taxes

Ignores using cash flow to either reduce debt or share count

For much more detailed valuations scenario (including ones that lead to much higher future values per share), check out CDLX Research Note #177: “1,000 Bagger" Valuation Scenarios”.

Some of the high-value scenarios have increased in probability, given Chase has agreed to decrease their share of billings.

11. Q2 Results and Q3 and FY 2024 Guidance (Cash Flow Positive)

Q2 Results

Revenue: $76.7M (vs guidance of $65M to $74M)

Adj Contribution: $37.5M (vs guidance of $32M to $38M)

Adj EBITDA: -$4.1M (vs guidance of -$10M to -$6M)

Operating Cash Flow >$5.7M this quarter

Free Cash Flow: >$3M (taking Operating Cash Flow - All Investing Activities)

Note, the Q2 commentary had an error, providing in some places numbers for 6 months, vs 3 months, so you should instead refer to the cash flow statement and do the adjustments to get to the Q2 only numbers. This leads to better results than communicated.

“During Q2, we used $4.3 million of cash in operating activities and $5.5 million for software development and capital expenditures.”, where this is actually for the first 6 months, not just Q2.

Q3 2023 Guidance:

Revenue: $75M to $84M

Adj Contribution: $39M to $45M

Adj EBITDA: -$2M to $2M

Therefore, we could see positive operating CF and FCF

FY 2024 Guidance

“We are now on a path to sustain positive operating cash flow, free cash flow and adjusted EBITDA on an annual basis.”

“Our expectation is positive annual adjusted EBITDA and operating cash flow for 2024.”

12. Multi-Tier Pilot

On the Q1 call, Karim said:

“We also expect to launch an alpha version of multi-tier offers in Q2. These offers allow flexibility for advertisers to provide variable incentives based on their objectives. The steering structure also gives customers more choice.

For example, a travel client can reward 10% on all stays in Los Angeles and 5% on all other states in the U.S. Our subscription provider could reward 10% back on annual subscriptions and 5% back on all other purchases.”

- Karim Temsamani, CEO & Director, Q1 2023 Earnings, May 4, 2023

A version of this offer type was actually seen on August 12th, 2022:

On the Q2 call, Karim said:

“Multi-tier offers, which provide variable incentives based on objectives, have been effective in shifting purchase channel behavior.

In a pilot of a 21-day period, in-store channels as a percentage of total spend increased from 34% to 71%.”

- Karim Temsamani, CEO & Director, Q2 2023 Earnings, Aug 1, 2023

13. Pricing Pilot (Dynamic Marketplace, Bidding, Dynamic Pricing, and more)

“We launched a target return on our spending pricing pilots in the past months.

This pricing model leverages a dynamic marketplace and features bidding on impressions, dynamic pricing adjustments and immediate reconnection of campaign spend.

While early, these capabilities at scale will vastly improve the efficiency of our financials in the long term.”

- Karim Temsamani, CEO & Director, Q2 2023 Earnings, Aug 1, 2023

This has been discussed by prior management who said it required the cloud / new ad server, so it nice seeing this finally come out.

The bidding sounds closer to auction-based pricing, which could lead to increases in ad spend as advertisers may be willing to accept lower returns than they are currently getting, given the certainty in the measurement + given how much larger the returns are currently.

I believe this could have a larger impact in the future than most assume.

14. New Hires

“Product is not the only area we are upgrading. We are responsibly investing in our people, too. I want to welcome our new CFO, Alexis DeSieno at Cardlytics. We are thrilled to have attracted such a talented and capable executives.

Alexis is just one example of the high-level talent we are adding to the business. Cardlytics potential and the tangible improvements we are making, attracting diverse and innovative talent. We saw several senior level hires with exceptional background during our product, engineering and sales teams this quarter, which will continue to elevate our capabilities and bolster our competitiveness in the market.”

- Karim Temsamani, CEO & Director, Q2 2023 Earnings, Aug 1, 2023

In general, this is simply a very good sign that CDLX can attract good talent now, and speaks to not only Karim but also the condition of the business (which I think is also apparent based on all the other updates provided, the liquidity, cash flow, relationships with the banks, etc.)

15. Liquidity Analysis

In the past CDLX Research Notes I have provided projections of liquidity, including after the Q1 earnings call.

With the updates provided at Q2, liquidity has improved meaningfully (as seen below, in the column “After Q2”, compared to my earlier estimates under “After Q1”).

Cash flow improved significantly vs previous estimates, from me previously assuming around -$15M to over >$3M of free cash flow materializing (for operating cash flow, it was -$13M to now >$5M)

Additionally, CDLX paid out less for the Bridg earnout, as they are challenging the dispute. CDLX could end up only paying around this amount, leading to significantly less cash paid out than originally expected and communicated by CDLX, and any additionally amount would likely not be paid out for a long time, due to the Delaware courts, leading to more liquidity in the interim:

*I ignored some small items, which contributes to my Q2 cash of $92.15M being slightly different than the reported $92.069M, but it is pretty close.

16. Increasing Expected Value

Overall, this was a good quarter with many good updates, both during and after the call.

CDLX’s liquidity is in a very good position. The future cash flow guidance was very nice. Paying out less for Bridg would be extremely beneficial. Hearing the progress with not only Chase but with BofA was also extremely comforting. And knowing CDLX is seeing improvements with not only engagement but also redemptions on the new user experience is also encouraging. Altogether, the downside risk with CDLX has appeared to decrease by quite a bit vs before the call, which is great.

It also seems CDLX is simply making a lot of progress in many different areas, that I believe combined could start having a non-linear positive impact in the future (let alone when you factor in operating leverage and improving gross margins).

So downside risk seems less, and probability of achieving the upside seems higher, leading to an increased expected value for CDLX.

17. More CDLX Information

If you’re looking for more info on Cardlytics, check out the CDLX Research Notes.

In general, Research Notes contain information I have collected while researching, investigating, analyzing, and thinking through businesses, such as CDLX.

This is where I continue to add additional notes, observations, and thoughts.

Some of the notes have never been made, nor will be made, into official posts that are public to read.

Or if you are looking for my specific actions taken with CDLX (buying, selling, holding), or my current CDLX allocation, check out the latest Portfolio Updates.

Upgrading your subscription will give you access to all the Research Notes below (including CDLX, CVNA, General, Portfolio Updates, and more to come).

Cardlytics ($CDLX) Research Notes:

I have also added a page to keep track of these updates as well.

Carvana ($CVNA) Research Notes:

I have also added a page to keep track of these updates as well.

General Research Notes on Businesses, Investments, and CEOs (Historical to Current):

Portfolio Updates:

Current holdings and allocations, and reasons behind recent buy / sell / hold decisions.

Reviews on the Research Notes

Gain Access

If would like access all these “Research Notes”, upgrade your subscription here:

Closing

I will continue to add more to the CDLX Research Notes, especially as new information is released and discovered. (There are actually quite a few notes in my draft that I plan to release soon).

In the meantime:

If you haven’t already, check out my interview on the After Dinner Investor podcast discussing Cardlytics, on the episode, “Will Cardlytics Be a 1,000 Bagger?”.

Or check out the latest updates within the CDLX Research Notes.

Thanks,

Austin Swanson

Swany407 Investment Research

Disclaimer: This content is not investment advice. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details. Also please note, my thoughts shared are my own thoughts and opinions.

Hi Austin, great writeup as usual. I just had a few questions:

1. When do you feel ARPU for this business will really start to take off (assuming this is the main driver of the biz)? 2Q23 ARPU was $0.38, which annualized is $1.52. Do you see this metric improving significantly in 3Q/4Q23 or is this more of a 1H24 story?

2. Regarding cash flow, does the business need a lot of capex to scale effectively? Or does positive operating cash flow go straight down into free cash flow when the platform gets bigger and ARPU ramps up?

3. Regarding the loss of the UK banking partner in 2Q23 (UK rev down 35% while US rev +7%), is this one-time in nature and what in your view caused this? Is this likely to be non-material going forward (and potentially sets up for very easy base compares in 2Q24)?

4. When do you expect the company to possibly provide an update on Cliff's request for a board seat(s)?

Thanks again!