Cardlytics ($CDLX): Chase Launches the New User Experience

Confirmation of Chase on the new ad server. Unlocks new UI, new offer constructs, new ad budgets, and more.

For those interested, this post is also available on YouTube, Apple Podcasts, and Spotify.

Market Cap as of 3.17.2023: ~$3.20 / Share x 33.6M Shares ~ $108M Market Cap.

Chase Launches the New User Experience

It is official. Chase is the major bank partner who moved to the new ad server, and who is rolling out the new user experience with Cardlytics, as seen in the video below (as posted by Clifford Sosin):

3.19.2023 Comment: Looks like Substack videos do not work well through email / mobile. Therefore I uploaded this to YouTube as well.

Unlocks New Enhancements + New Offer Constructs

This new user experience unlocks enhancements such as:

New UI with richer imagery

New product-level offers

New category-level / department-level offers

More spend-stretch offers

New time-of-day offers

More + enhanced intro offers

New local + SMB offers

and more

I believe some of these are the “new offer constructs that will be up in Q1 and Q2”. Therefore, CDLX should start seeing some positive impact soon with Chase now rolling out the new user experience. I will discuss all of these enhancements in more detail below in this post.

Unlocks New Ad Budgets

Related to these new offer constructs are new ad budgets unlocked. This includes:

Advertising budgets that are at the category / department level, and therefore these advertisers previously could not use CDLX with only store-level offers (for example, large home improvement stores, like the one Bridg recently signed).

Budgets from brands and CPGs who previously couldn’t place offers without product-level offers.

Therefore, there will not only be benefits to existing CDLX advertisers, but many more new advertisers are now able to place offers for the first time, including current Bridg clients. (For all of you with a paid subscription, this link will take you directly to the notes and the list of confirmed, suspected, and potential Bridg clients). More advertisers increases the odds of a user seeing a relevant and attractive offer, increases engagement, redemption, and ARPU.

New Ad Server (More Benefits + 50% MAUs Goal)

Chase being on the new user experience also confirms they are on the new ad server, since the new ad server is required first before a bank can roll out the new user experience and features.

In addition to the new experience and new offer constructs, the new ad server also unlocks:

New Ads Marketplace (Should allow for real-time adjustments based on inventory and allow for auction-based or dynamic pricing. Despite the layoffs, CDLX was still hiring for the ads marketplace, showing its importance and likelihood of occurring in 2023.)

Machine Learning and Improved Targeting (CDLX said they need cloud to unlock machine learning, such as for targeting. Therefore this should be available with the new AWS ad server. This is also likely, given it was another role CDLX was hiring for after the layoffs.)

Further Optimization (includes instead of having 18+ different versions of the old ad server, everyone will be on the same version in the cloud, allowing for easier and more optimization)

Self-Service Offers (Before self-service offers were limited to US Bank. This may be put on hold for a while though, with more focus on larger ad budgets first, but could still see more use with the self-service for banks, “Engage”.)

and more

Not all of this will occur day one, but having Chase on the new ad server makes this a possibility that wasn’t previously there.

We now know this is how CDLX got to 50%+ MAUs on the new ad server in 3Q22, with just Chase (CDLX mentioned Chase was the easiest path to the 50% goal for this reason). While all signs pointed to Chase, the video show was the first 100% confirmation of Chase being the bank to move to the new ad server.

CDLX has said the key thing was getting to 50% and having enough scale to get advertisers to start taking advantage of the new offer constructs, like product-level offers.

Figg vs CDLX

While this is maybe less on investors’ minds now given the ongoing Bridg dispute, it is quite the 180 from everyone thinking Chase was dropping CDLX soon for Figg and the stock quickly selling off, to now Chase being the first and only big bank on the new ad server and now the first to launch the new user experience.

While Chase could be still be building out Figg to eventually replace CDLX, the probability of Chase/Figg doing that and dropping CDLX are now significantly lower. Beyond Chase saying Figg was instead for SMBs (which matches their other multiple acquisitions for SMBs), with Chase adopting the new user experience, the customer value proposition increases, making it more difficult for Figg to match and surpass CDLX’s offerings. I also think it would confuse users if Chase rolls out the new user interface, and then switched to something created by Figg. Or CDLX introducing many new types of offers and a much higher quantity of offers, only for Chase to take that away from their users and go to less-attractive and less-cash-back affiliate offers. Therefore, I think the switching costs increase with Chase now on the new ad server and rolling out the new user experience.

New UI with Richer Imagery (+ Early Signs of Success)

The new user experience and new UI allows for the use of images. Up until this point, Chase only had a single logo on their offers, and no images.

US Bank has been on the new user experience, and we have heard very good initial results from just adding images within offers (they did not roll out images on the outside of offers).

At the CDLX Investor Day in 2021:

“Additionally, the richer imagery is driving substantially more click outs to advertiser websites.”

“And so as we saw from the results of click outs to advertiser website, a picture really is worth a thousand words.”

With stats such as the following:

And at the January 2022 Needham Growth Conference:

“You talk about the new user experience. We compared campaigns in Q4, the same exact campaign, that ran on the old experience versus the new experience, and we saw a minimum of 200% increase in click rates. 200%.

Some campaigns had 400%, actually over 400%.”

Higher click-out rates to advertisers’ websites make sense, since most people likely don’t spend the time to read what the company sells, but a picture conveys this and more in a second.

Chase looks to have even went one step further than US Bank, and adopted the use of images on the outside of offers, on what looks like the majority of offers. Even Dosh doesn’t do that apart from their featured sections, where they still just use logos on the outside of most offers. This should significantly increase the number of activations in Chase from higher understanding of what the company is selling (such as from companies that are less familiar to the user), which then should lead to higher redemptions and ARPU.

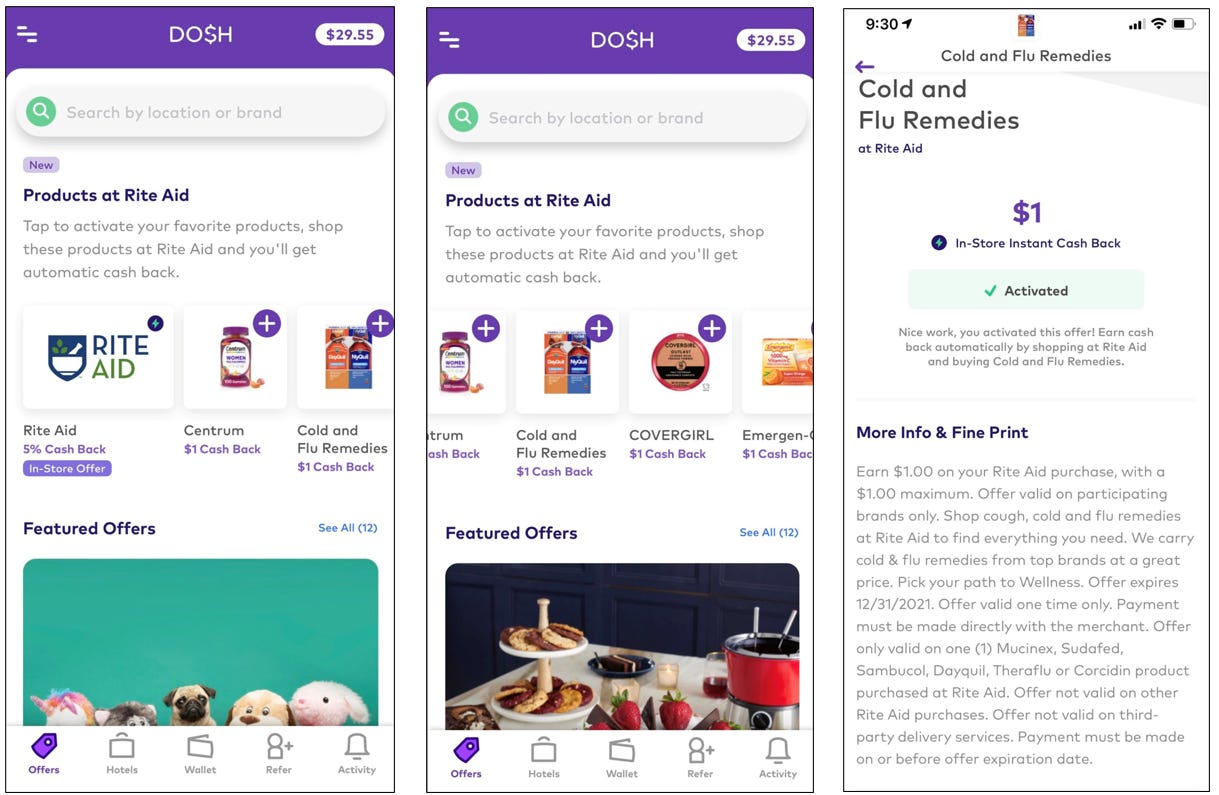

New Product-Level Offers (+ Early Signs of Success)

CDLX shared stats at 22Q4 earnings from an early test of product-level offers that are unlocked with the new user experience:

“Receipt level offers which are construct tailored to specific product categories or items.”

“These are the offers we are most excited about and for good reasons.

In an early test, 10% of activations came from customers who had never activated an offer before, and 19% of those customers had not shopped at that retailer in 12 months prior to the campaign.”

New users activating offers + proof of shifting customer spend for advertisers is great to see. And both make sense, given the benefits to users.

Some benefits of product-level offers include:

More relevant to users (since can be more specific to what they buy, rather than at store level)

Potential for higher cash-back (due to different margin profiles)

Can lead to higher activations and redemptions from customers who may not have known a store sold that item until seeing the offer or thought to buy it from there (e.g., a 10% Panera offer may not be relevant nor attractive, but 50% off Panera coffee is more relevant + higher % cash back + I may not of known they had coffee).

The early stats above are also great for cross selling CDLX advertisers to become Bridg clients and to start placing product-level offers. There are also many advertisers who previously couldn’t use CDLX without the ability to do product-level offers, like the brands and CPGs at the existing ad agencies currently using CDLX for other clients (this should allow for quicker adoption and placement of product-level offers).

I did add a list of confirmed, suspected, and potential Bridg clients, who could then start placing product-level offers. For all of you with a paid subscription, this link will take you directly to the notes and that list.

And for some ideas of what we could see, Dosh did test product-level offers in the past:

And there was a little shown during the 2021 investor day:

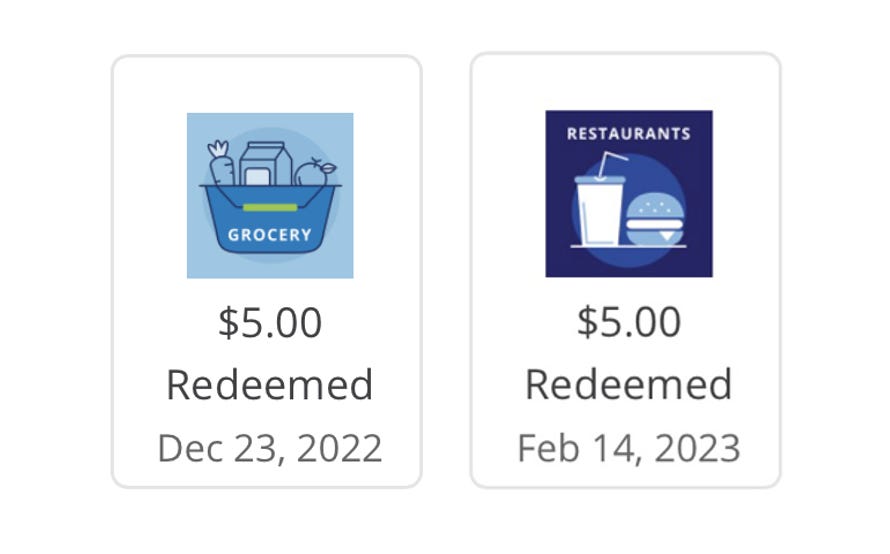

New Category-Level Offers (+ Early Signs of Success)

The new user experience should also lead to more category-level or department-level offers, where there has already been some early signs of success:

“Merchant category code offers, which allow bank-funded campaigns that are targeted to specific types of transactions such as gas or grocery purchases.

In a test with a large bank partner, we saw around a 2x increase in redemption dollars of a standard campaign.”

A 2x increase in redemptions is very large. I believe part of this success was due to being able to use the offers at many different places (which is likely why they were bank-funded), like the following offers from Chase (which both my wife and I each redeemed).

Note: I think these worked by looking at the debit/credit card statement and seeing if the store shopped at qualified, rather than looking at the product-level. This is why I believe adding Bridg will allow for individual stores to do category / department-level offers.

While CDLX might not see 2x redemptions in say “$5 off groceries at Kroger” or “20% home decor at Target”, there will be an improvement over store-level offers. Similar to the product-level offers, the higher activations and redemptions will be a function of more relevant offers + higher cash back due to different margins in different categories.

Unlocking category-level offers will unlock the associated ad spend where their advertising budgets are at the department level. This includes some of the current big Bridg clients, including the ones more recently signed (For all of you with a paid subscription, this link will take you directly to the notes and that list).

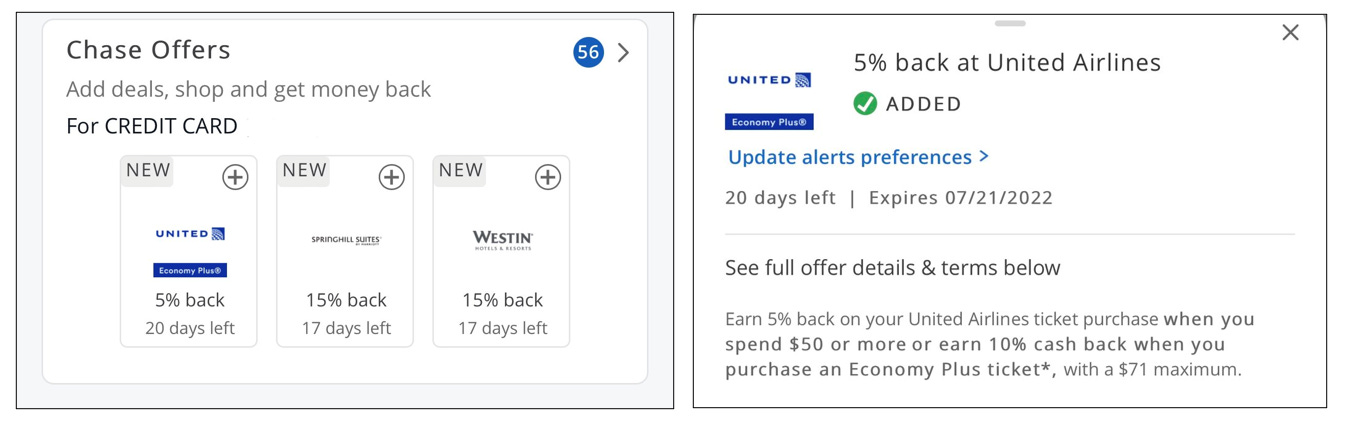

More Spend-Stretch Offers

Spend-stretch offers will also be used more:

“Spend stretch offers or the ability to incentivize a set of customers spending in a certain range to increase their spending on their next visit.

An example will be a customer who spends $20 on average, receiving a $5 cash discount if they spend $40 or more.”

Karim used the United Airlines example where you earn 5% when you spend $50 or more, but earn 10% when you purchase an Economy Plus ticket.

Karim mentioned that this:

Is better for consumer since more cash back

Drives higher engagement so the banks are happy

Advertisers get a better ROI since have a better margin on the premium tickets

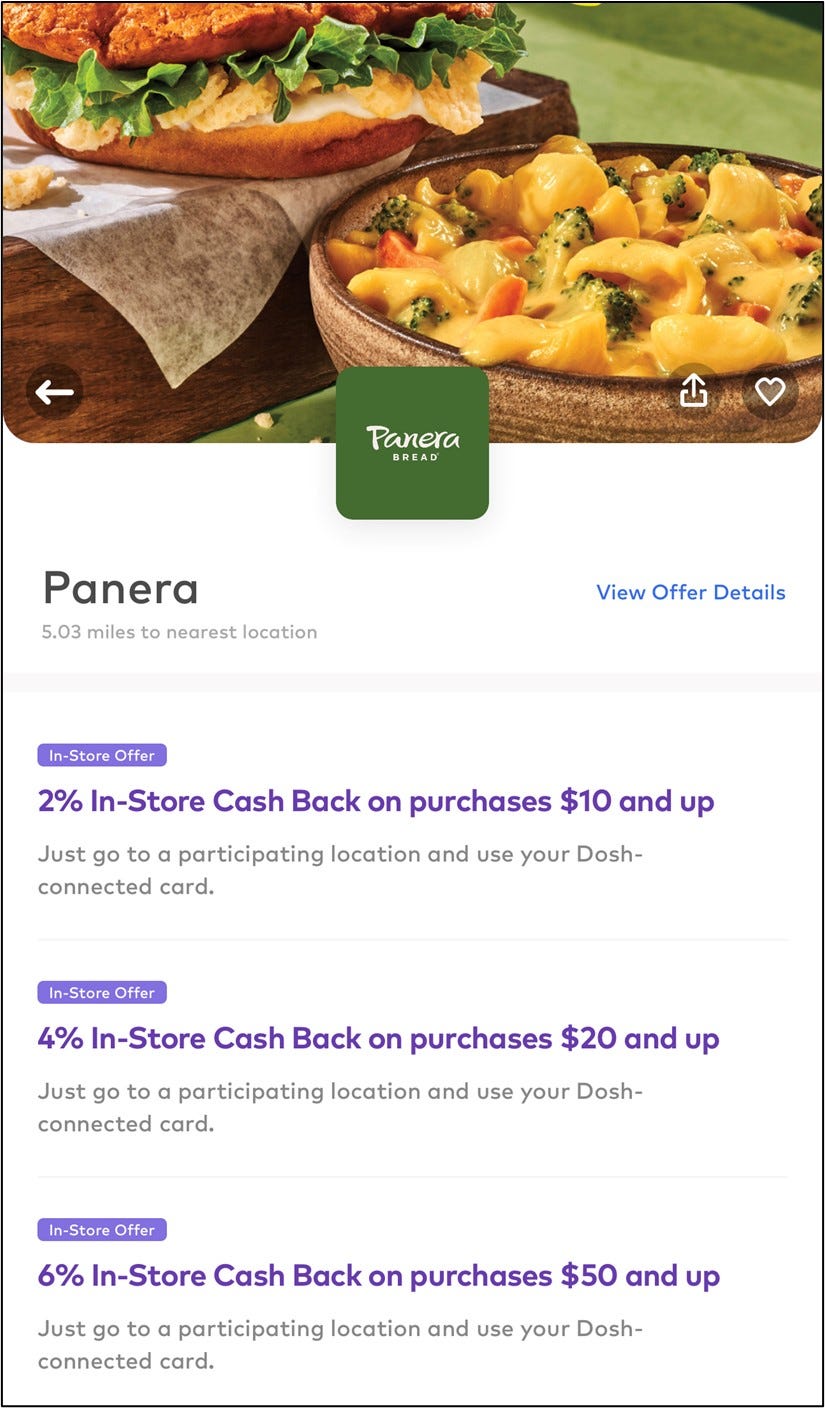

Panera also just did a similar type of offer on Dosh, where the more you spend, the higher the cash-back percentage.

Here is also an example from Shake Shack:

So while we have already seen one spend-stretch offer on Chase, even before the new user experience, I think CDLX has been waiting to roll out more of these offers until the new user experience, such as from all the advertisers using them on Dosh. I feel the new UI will be able to make this clearer to the user, both inside and outside the offer, leading to higher redemptions, and then higher use by advertisers given it works, and so on.

New Time-of-Day Offers

Time-of-day offers, such as breakfast only, late night only, non-busy times, should help businesses, leading to further use of CDLX (since the offer now serves an additional function of benefit, of optimizing the business). When combined with push notifications, they could create quite appealing offers for users.

Supposedly some clients such as McDonalds have already expressed interest in having time-of-day offers. This even matches CDLX using them as an example:

More + Enhanced Intro Offers

One of the first things I noticed with Chase’s new UI is the updated “intro offers”, seen on the outside of the Chase Offers section, on the homepage.

Three differences versus previously:

6-12 offers instead of just 3 (more likely at least one offer is relevant and attractive for a user to start using CDLX offers and click to see all the other offers)

Images on the outside of the offers instead of just logos (increases the probability of seeing the offers, understanding what they are, and clicking to learn or see other offers)

Scrolling feature to see all the intro offers (Versus US Bank where you have to click to page through the offers. The scrolling makes it much easier and more likely users will see the other offers, and find one worth clicking.)

New Local / SMB Offers

The new user experience and new UI allows for better categorization and organization (as seen with the new tabs at the top in the offer section in the video). This makes it easier for users to find offers that are relevant to them (rather than 150+ offers just listed all together).

This is also what CDLX was waiting for before adding too many new local offers (again, so there wasn’t 150+ offers in just one spot), such as from third-party content providers, and even offers from their acquisition of Entertainment. To get an idea of the number of offers we could see, these are Entertainment offers near the Chicago and New York areas. Only dining offers are shown…

More CDLX Info (and sooner)

I have recently added a lot more information regarding Cardlytics to the CDLX Research Notes, such as regarding 22Q4 earnings, updated liquidity analysis, and much more.

For all of you with a paid subscription, you can find some of the recent updates here (with even more added since, regarding the drawdown of the LOC).

If you like access to all the information, including a lot of information not within this post + being able to read it in real-time, join others and upgrade to a paid subscription below if you haven’t already.

About Research Notes

Research Notes contain information I have collected while researching, investigating, analyzing, and thinking through businesses, such as CDLX.

This is where I continue to add additional notes, observations, and thoughts.

Some of the notes have never been made, nor will be made, into official posts that are public to read.

In addition to CDLX Research Notes, upgrading your subscription will give you access to all Research Notes listed below.

Cardlytics ($CDLX) Research Notes:

Carvana ($CVNA) Research Notes:

General Research Notes on Businesses, Investments, and CEOs (Historical to Current):

Reviews on the Research Notes

Gain Access

If would like access all these “Research Notes”, upgrade your subscription here:

Follow-Up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more.

-Austin Swanson (Swany407 Investment Research)

Twitter: @Swany407

Website: Swany407.com

More Information on Cardlytics

Research Notes

Free Posts

Updates on Investment Prospects, Liquidity, and Bridg Earnouts: Write-up and video

Chase Updates (Related to Chase Acquiring Figg, and Chase Migrating to the New Ad Server): Write-up and video

CDLX 2.0 (Chase Acquiring Figg, New CEO, New Banks, BofA Renewal, 22Q2 Earnings, and more): Write-up and video

Current Price Decline, Short Thesis, and Q1 2022 Earnings: Write-up and video

Open Banking (The Free Option on the Hidden Potential Cash Cow): Write-up and video

The Power of Bridg (and Why CDLX is Undervalued): Write-up and video

BofA Renewal & Testing Competitors (Update): Write-up and video

New Observations, Upcoming Earnings Calls, and Updated Allocations (10.21.2021): Write-Up and video

Thoughts Following Q2 2021 Earnings and Price Decline: Write-up and video

Thoughts After Price Decline (5.17.2021): Write-up and video

Disclaimer: This content is not investment advice, and is intended for educational and informational purposes only. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.

Looks like Substack videos do not work well through email / mobile. Therefore I uploaded the video of Chase on the new user experience to YouTube as well.

https://youtube.com/shorts/0BRTfAAU5gk