Cardlytics ($CDLX): Open Banking (The Free Option on the Hidden Potential Cash Cow)

Open Banking has the potential to generate significant cash flow for Cardlytics with an extremely long runway. Better yet, it is completely ignored by most investors.

For those interested, this post is also available on YouTube, Apple Podcasts, and Spotify.

Market Cap as of 4.6.2022: $51/Share x 33.7M Shares ~ $1.7B Market Cap.

Note: The first section that follows is a good summary of this entire write-up. The remainder of this write-up will cover the details.

The Hidden Potential Cash Cow from Open Banking

The Free Option

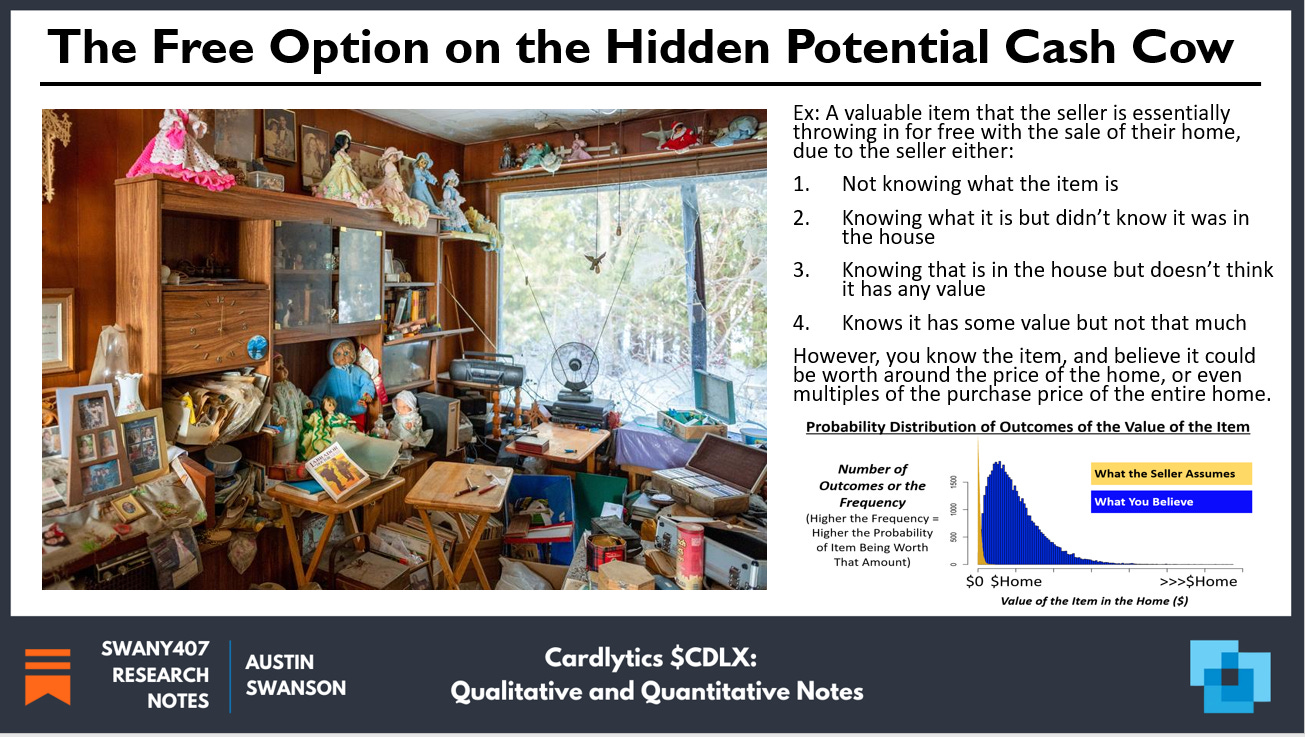

What if someone offered you a free lottery ticket, because they thought the best possible payout was very small, and the probability of that payout was nearly 0%. However, what if you knew the potential payout was significantly more than they thought and the probability of that occurring was significantly higher than they expected? While it is still possible it could expire worthless, I would think most (including myself) would take that free option. Worst case, you lose nothing since they are giving you the chance to win for free. Best case, you get a good payout and it cost you nothing, leading to significant financial gains.

A possibly better example is what if you were going to buy a home from someone’s estate. The seller is familiar with most of the property, but hasn’t gone through everything given how cluttered it is. It is too uncertain to know what is in there.

You and the seller know the property on its own is worth more than the purchase price, therefore giving you a margin of safety already, since it makes it possible to turn around and resell it for at least what you purchased it for. However, you believe there may be a valuable antique that the seller is essentially throwing in for free, due to the seller either:

Not knowing what the item is

Knowing what it is but didn’t know it was in the house

Knowing that is in the house but doesn’t think it has any value

Knows it has some value but not that much

While you don’t know the exact value of the item, you are pretty familiar with what it is, and a range for how much it could potentially be worth. There is a high chance it could eventually be worth nearly what you paid for the home, but you also believe it could be potentially worth multiples more than the purchase price of the entire home (but you acknowledge this has a smaller chance of happening). Therefore, if you bought the home just to wait and see how much this antique could be eventually worth, you have very little risk of losing anything, since you also have the home you could sell for to get your original purchase price back (if not more, since you are purchasing below what it is worth).

More specifically in the context of businesses, what if there was a publicly traded company who had a line of business ignored by others investors and priced in as though it had zero value or had a near 0% chance of any value occurring (possibly from some not understanding that line of business, others not even knowing that line exists, some believing it is too uncertain to value, or thinking not much will come of it based on extrapolating from infancy today). However, what if you knew that line of business was already in motion, had extreme similarities to the core business, could leverage other lines of business to improve the offering, could actually generate near 100% gross profit margins, had minimal capital requirements, had high operating leverage that could lead to high levels of cash flow, had the potential to grow at rapid rates due to strong competitive advantages, had a massive global total addressable market, and had a higher probability of occurring given actual developments shared by the company? While it is possible no value ever occurs, it would seem to be a good free option to take in case one of the many other scenarios with significant value does occur.

That is Open Banking within Cardlytics.

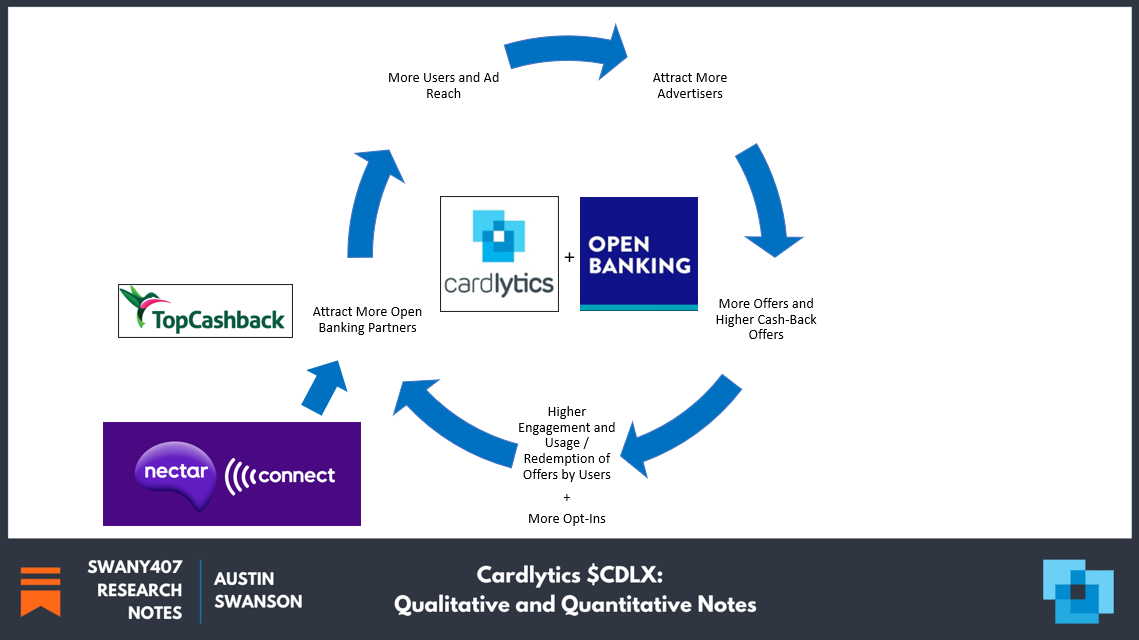

Compared to the core CDLX business, the Dosh and Bridg lines of business are already both discussed fairly infrequently in relation to what I believe are their individual expected values. However, the Open Banking line blows them away in this regard. Not only is it the least discussed, but it is also nearly not discussed at all. Some investors don’t know that Cardlytics is already taking advantage of Open Banking, by already partnering with loyalty programs in the U.K. like Nectar, and now soon TopCashback. Even more, some investors don’t even know what Open Banking is.

I will go more in depth later in the section “What is Open Banking and Why It’s Important to Cardlytics”, but quickly, Open Banking gives users more control over their financial data, allowing them to share their primary transactional data with third parties (like Cardlytics). Loyalty systems can partner with Cardlytics, who has the experience of analyzing and advertising based on this purchase data, where Cardlytics can aggregate the user side to create larger ad reach to attract advertisers to place offers within these loyalty systems to fund rewards and allow for higher-than-normal cash back or loyalty points, making loyalty programs more attractive for users. By users agreeing to share their purchase data, the users receive access to these more attractive offers (earnings the equivalent of 5-10-15%+ back vs the typical 1-2% back on purchases).

With the potential of no revenue share and therefore near 100% gross profit margins, and the ability to leverage existing tech and resources with little additional capital needed to grow, the extremely high gross profit and operating leverage could lead to substantial cash flow once at scale, where scale is more possible with Open Banking given it allows for international opportunities, as well as not being limited to bank partners.

Combine that with the core Cardlytics business expected to be cash flow positive by the end of 2023, we could start seeing some of the cash flow from the Open Banking materialize in the financial statements if some of the underlying actions continue (as we will discuss).

There are now very recent signs of Cardlytics gaining traction in the U.K. which could lead to the scale needed to match the ad demand there. Then there is further international growth potential where Open Banking is live, with potential partnerships including the loyalty systems of the largest airlines. Then there is even further growth from global brands even where Open Banking is not live, and sending offers within those loyalty programs to drive further engagement.

The Opportunity and Why it Exists

Open Banking has the potential to be something special for Cardlytics. Better yet, people are ignoring the Open Banking opportunity for Cardlytics, due to:

Some do not know what Open Banking is

Therefore it is being ignored and implicitly valued at zero

Some do not know CDLX is taking advantage of Open Banking (possibly due to how infrequently it is discussed by CDLX)

Therefore it is being ignored and implicitly valued at zero

Some think it is too uncertain to value given how early it is (currently CDLX only has one partnership that started less than 1 year ago)

Therefore it is being ignored and implicitly valued at zero

Others think it will amount to nothing given they are extrapolating from its infancy base today

Therefore ignoring the potential growth within existing partnerships, adding more partnerships in the U.K., adding partnerships internationally where Open Banking is live, and finally all loyalty programs even where Open Banking is not live, all leading to this group of investors arriving at an implicit expected value that is too small

This is why it is so interesting to think about from an investment perspective. While there is uncertainty, I believe the market assumes 0% chance of this occurring or $0 value. This could be implied by the current market being covered by the core CDLX line, Dosh, and Bridg, and therefore assigning no value to Open Banking. Some investors may agree that there are scenarios where this Open Banking line of business has some value (but not much), but assumes it has a very low probability of occurring and therefore they simply ignore it or assigns $0 value. However, I believe we now have evidence that there is traction and therefore a much higher-than-assumed probability of occurring and therefore a higher expected value.

Most of the market thinks extremely short-term, and only reacts to what is happening in current time and adjusts accordingly. Therefore, if the market today is ignoring what is possible with Open Banking, and if a good scenario does occur, we would have been able to purchase at the cheaper price today and benefit from the market price eventually adjusting to reflect one of those good scenarios that could occur.

Why the Value and Probability are >0

Maybe the majority of investors are correct, and nothing will amount from this. However, I believe this optionality on Open Banking is given for free today by the current market price (links to where I discuss this idea in detail1). What is more is it should not be looked at a 0% probability of a good scenario occurring. The reason Cardlytics has a higher than 0% chance of seeing success from Open Banking is:

Cardlytics has competitive advantages in this space

Existing scale in some of these markets, giving an advantage of data and advertising reach

Extensive experience with analyzing and advertising based on purchase data

Trust by the largest banks, giving social proof

Track record of no data leaks

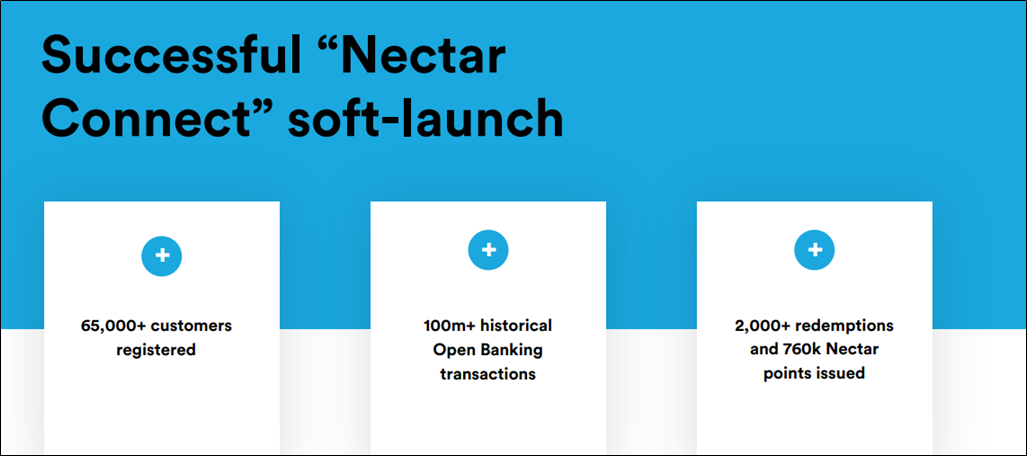

Cardlytics has already entered the space with success with Nectar Connect, which has acted as social proof and a catalyst for further programs

Cardlytics is running a new pilot program with TopCashback

Cardlytics has interest from other U.K. brands that could lead to more partnerships very soon

Assuming 0% probability of anything occurring with Open Banking for Cardlytics or assuming 100% of scenarios result in $0 value is incorrect, knowing there must be at least some scenarios with >$0 value and with a >0% chance of occurring based on the above. And with each additional program, the probability will continue to increase. Maybe no one will ever redeem any offers, however, the probability of this decreases as CDLX adds more programs and attracts more advertisers and improves the relevance and attractiveness of offers to users, which increases the probability of redemption. This is why the number of partnerships should be tracked over time.

Example of a Good and Realistic Valuation Scenario

It may be helpful if I described a baseline good scenario in order to help think about this information judge its potential significance.

In ten years from now we could see…

(19M+15M) x (1+ 0% Growth in Loyalty Member) = 34M Potential MAUs

19M is the number of Nectar members, where the Nectar program was the first and current loyalty program partner of CLDX for Open Banking.

15M is the number of TopCashback users, who CDLX just announced they are running a pilot with.

34M assumes no growth in number of partnerships from the two today, and assumes no growth in the number of users within the two existing partnerships. Given the interest from other U.K. brands, and given the opportunity in other areas where Open Banking is live and not live like in the U.S, limiting to two partnerships seems extremely conservative.

x 15% Opt-in Rate = 5.1M MAUs

This could be thought of as the engagement rate. As will be discussed later, members must opt-in and share their data to access the rewards.

The 15% opt-in rate here assumes lower than the 30% of engaged users in the bank given the friction of manually opting in, and assumes around 50% would opt-in of the 33% or 6.6M digital app users of 20M the total Tesco loyalty members2

x $10 Cash Back Redeemed over 1 Year * $2 Revenue / $1 Cash Back = $102M in Revenue

Assumes one $10 offer is redeemed over 1 year, and assumes same $2 of revenue to $1 of consumer incentive as core CDLX business.

$10 is significantly less than the average $345 in cash back by TopCashback users3. Could be only the most engaged TopCashback users are responsible for the majority of the cash back, but those are the same users that would opt-in. Sharing their data will lead to better targeting and offers from more advertisers, so they should see even better offers. Still want to use $10 instead of $345 despite these advantages to account for less offers by CDLX and to account for non-TopCashback users (like Nectar Connect).

$10 is equal to the Panda Express of spend $10 get $10 back4.

x (1 - 0% Rev Share - 7% Delivery Costs) = $95M in Gross Profit.

Given the U.K. operations of core CDLX will likely handle these operations and given they are likely already in the total company’s operating expenses, which are supposed to be covered by the end of 2023 from being cash flow positive7, and little to no additional operating expenses would be needed for this business at this scale (since can leverage existing resources and tech), that would be around $50-80M in additional cash flow.

A 25x multiple gives up to an extra $2B of value 10 years from now (which would be significant given the current market cap for the entire CDLX business is $2B).

The reason this is so large is due to the significantly higher gross profit margins compared to the banks, the large number of potential users, and leveraging existing operations / tech / resources leading to high operating income margins. And as discussed above, this all ignores many areas of further extreme levels of potential growth.

Please note: This is just one scenario of the many possible. Therefore, the probability of this one scenario occurring is not 100%, but is also not 0% either like most assume.

Also, if you assume about 5% growth in Nectar or TopCashback, or instead assume 1 additional program around 20M users with the same 15% opt-in rate, it would lead to enough cash flow to justify the current CDLX market cap. Maybe this is what investors already assume will happen and explains the current market cap. However if that is the case, then market is ignoring future cash flow from core CDLX growth beyond being CF positive by the end of 2023 and likely many other factors8.

More likely, the market assumes growth from the core CDLX to justify the $2B market cap (this was mentioned earlier, but I will add the supporting links again here9), and instead ignores any value (such as the $2B above) and potential additional growth from Open Banking.

Massive Additional Growth Opportunity with Open Banking and Loyalty Systems

Beyond investors ignoring the possibility and higher than 0% chance of the baseline $2B scenario, investors are ignoring all the future growth that is possible beyond the $2B scenario. While it may have a much smaller probability of occurring, that does not mean it should just be valued at $0.

I believe there are many areas of growth within Open Banking for Cardlytics that is being ignored by others, which could lead to scenarios with valuations far in excess of $2B. These growth factors include:

Average Revenue Per User (ARPU) being much higher within these programs

Cardlytics partnering with more loyalty programs in the U.K. than just those two today

Cardlytics partnering with more loyalty programs outside of the U.K. but where Open Banking is also live

Cardlytics partnering with loyalty programs even where Open Banking isn’t live.

In general, most assume CDLX has no value for companies with loyalty programs or when all customers are in the loyalty program. This is a fear by other investors, where they assume if everyone is in a loyalty program, those companies will have enough data and control the distribution of offers, and therefore have no reason to use CDLX. This is not true. In fact, I believe CDLX can help every loyalty program, and with nearly all of the different cohorts within a loyalty program:

Most Loyal: Target those that are the most loyal in your store in relation to other customers, but are actually spending even more in the category. These existing customers are the cheapest to convert (5x more to convert new customers) and spend more than new patrons (67% more), making them a much more valuable target. This is an extremely misunderstood idea by many investors and marketers (made apparent by only 4% of advertisers saying their biggest growth opportunity was with infrequent or lapsed customers), but this ability of CLDX explains why we consistently see top brands with the largest loyalty programs still use CDLX (I included the source of these statistics in the footnotes10).

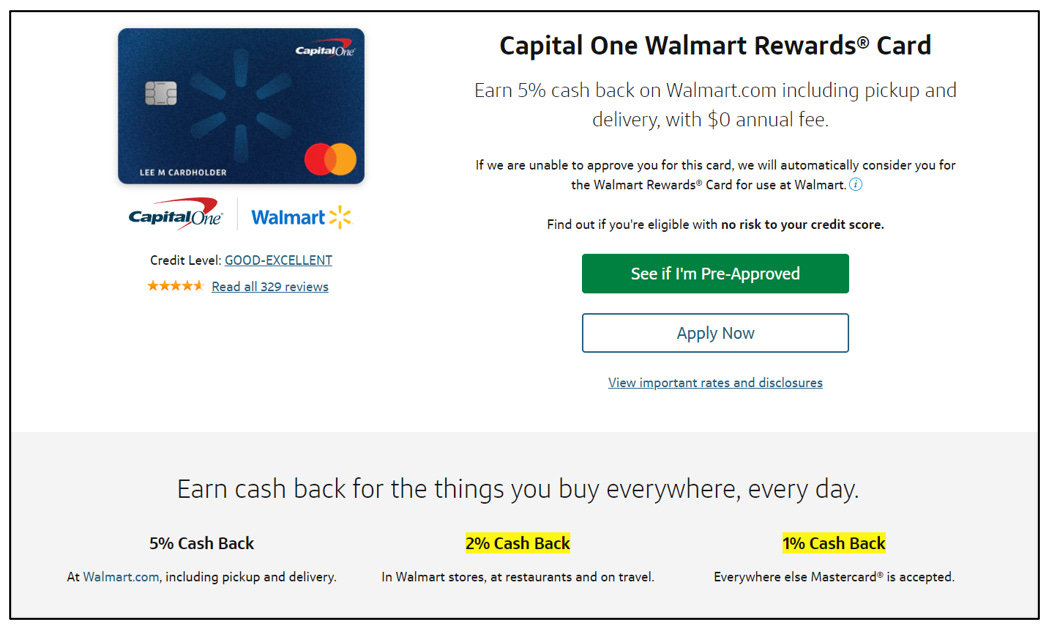

Semi Loyal: Increase incentive to get a store-branded rewards credit or debit card and earn more loyalty points to increase loyalty to the store, by increasing the cash back or “loyalty-points-back” from the typical 1-2% outside of the store to greater than 10% from leveraging Dosh / Entertainment / Bridg / CDLX offers

Not Loyal: Be able to get insights and target those not in your loyalty program, leveraging Bridg

Cardlytics can sell themselves as a complete package for loyalty programs, such as to someone like Target. “Bridg is helpful to identify the remaining customers not in your loyalty program, nor buying online. We can also increase the incentive to sign up for a Target RedCard and earn significantly more cash back elsewhere by leveraging Dosh, Entertainment, and Bridg offers. We can also know if your most loyal customers are still spending more at other grocery stores and send them offers via CDLX. May see that someone spends $500/m at Target and are in the loyalty program, but they are also spending $900/m at Walmart and Kroger still. You won’t know that with just your single store data. We can then send offers to shift that extra spend in the category to Target. Even better, let’s leverage the CPGs to do the offers and fund the offers by leveraging Bridg.”

Unlocking this additional set of loyalty systems as partners leads to significantly more potential ad spend when accounting for international partners.

The Right Tail of Valuation Outcomes

In one way, from core CDLX, Dosh, Bridg, and Open Banking we have some margin of safety from multiple ways for cash flow to occur to more easily justify the current $2B valuation for CDLX and protect an investment at today’s prices (not something nearly as possible at 10-100x the current price).

Alternatively from the margin of safety perspective, there is the option of free optionality on the Open Banking scenarios with cash flow far in excess of those in the hypothetical baseline good scenario shared earlier.

For illustration purposes of the scenarios and respective probabilities that others believe vs what I believe:

Yellow = What Most Others Believe

Nearly 100% of possible outcomes have a $0 value, with a very small percentage of possible outcomes >$0 but still less than <$2B

Leads to expected value closer to $0, and when combined with others who do not know what Open Banking is or even know CDLX using this, it leads to an aggregate implied assumption of $0 of value

Blue = What I Believe

Possible valuation outcomes are significantly greater in amount than what people believe is possible

And the probability of those right tail scenarios occurring, while lower, are still significantly more than what most others believe (the farther right in the tail, the higher the potential valuation, but also the lower the probability given harder to accomplish, but still possible)

The graph above shows the right tail of outcomes, where there are valuations far to the right that are possible, but simply have a lower probability of occurring.

For a hypothetical example of tying the above into numbers, I listed out the different valuation scenarios, the frequency that those scenarios could occur based on underlying assumptions of the investor, the resulting probability of that scenario, and the expected value.

This gives you an idea how some may see $0 value (at least for those who know what Open Banking is, know Cardlytics is in it, and are thinking about it). These are not the numbers I truly believe (I just wanted to give readers an idea of how this could look, and match it to the distribution of outcomes graph shown just before. This is why the number of outcomes does not match something more typical, like 10K). The point is more in the delta of thinking. Where most assume the distribution is more left and at $0 with not even believing high valuations are possible, where I believe it is more centered at a higher valuation with a right tail of high possibilities. The benefit here is we are not trying to figure out what the value others believe in, “X”, and then try to figure out if the real value is >X. Instead, we are trying to figure out if it is just greater than $0.

This write-up will focus on why I believe these higher valuation scenarios are both possible, as well as have a higher probability of occurring.

Visuals to Explain the Right Tail in Cash Flow Generation from the Long Runway of Open Banking

Open Banking has a long runway. Cardlytics can experience growth within existing users from increasing revenue per user. There can then be growth in the number of opt-ins within existing programs. Then Cardlytics can grow in the number of partners.

All the while, not only do these factors multiply together for revenue, but you also have it equaled to approximately gross profit since no rev share, and then all of it is mostly cash flow since relatively low operating expenses from most being generally fixed and leveraging existing operations, tech, and resources.

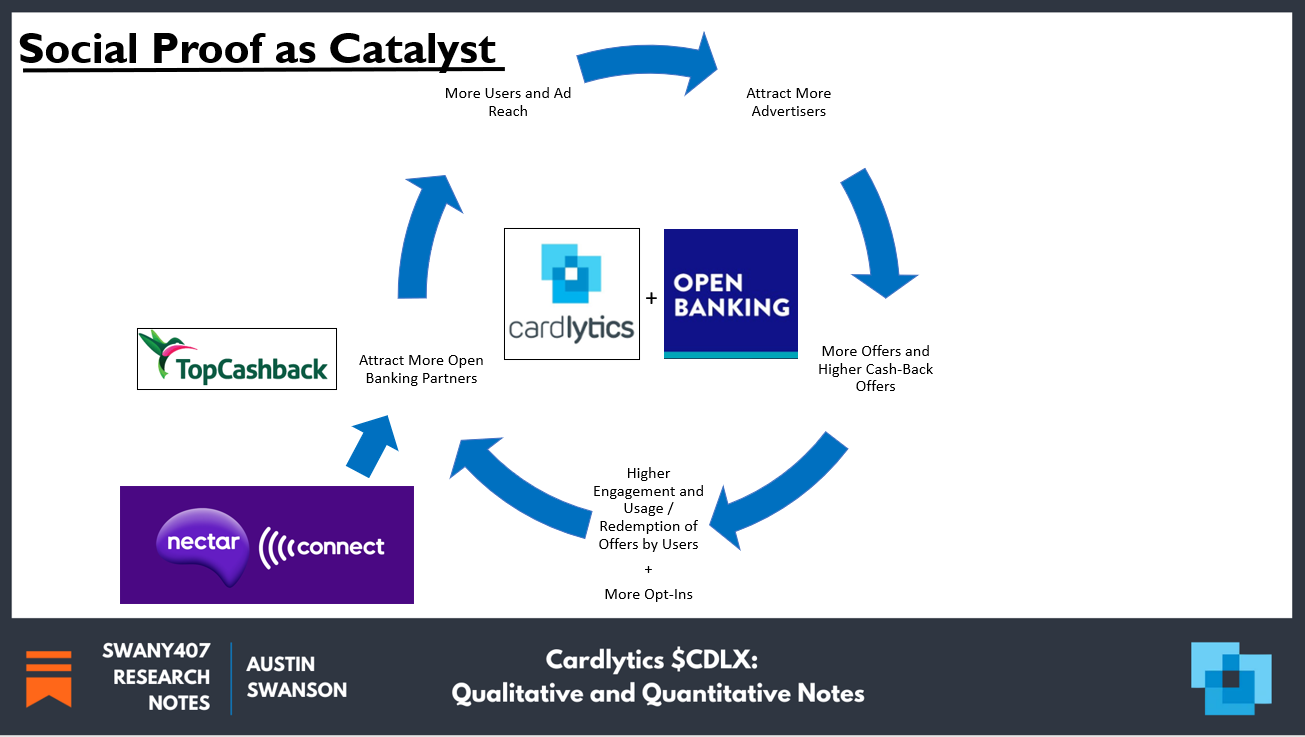

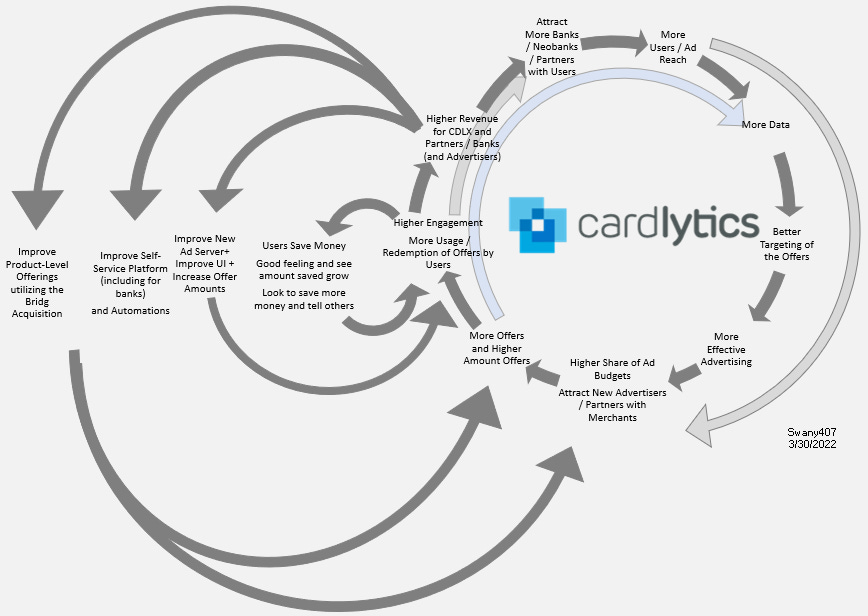

Even better, these factors do not grow in isolation. Instead, the growth of one factor leads to growth in another.

As Cardlytics signs more partners, it increases their advertising reach, which in turn attracts more advertisers. With more advertisers comes more offers (increasing the likelihood of relevance with the users) and the amount of cash back. This leads to higher engagement with existing users (redeeming more offers) and growth in users opting in to take advantage of the more offers, higher in amount offers, and more relevant offers.

This then attracts the interest of other programs, leading to further growth and continuing this perpetual growth engine.

The key, and the hardest part, is needing a catalyst to start this virtuous cycle.

This is where social proof comes into play.

Where BofA was the social proof for more banks to partner with the core CDLX business, and where Venmo was the social proof for neobanks and fintechs to partner with Dosh, Nectar Connect is the social proof that will lead to more programs to get to critical scale to meet the excess ad demand.

Cardlytics will need to continue to sign programs to reach critical scale to attract a new subset of high-value advertisers. Therefore, CDLX should follow the Dosh playbook in regards to signing up more partners in record size and timing.

In total, we have evidence of traction starting. In an end-state, we could see numbers that almost feel silly mentioning, given the scale of users, near 100% gross profit, and extremely high operating leverage (but which I have considered nonetheless11).

However, we don’t have to be exactly right on what that number is, given it is priced in as zero today, as if none of it will occur. If we are right about the core CDLX business OR Bridg OR Dosh (do not need to be right about all, another benefit of a low market cap in relation to multiple business lines12) then we could see this as a free optionality.

Therefore my focus is on why there are higher valuation scenarios than even the baseline good scenario of $2B of value, and why the probability of these scenarios is higher than most assume.

Specifically, the remainder of this write-up will discuss:

What is Open Banking and Why It’s Important for Cardlytics

Loyalty Programs

International Expansion

Zero Revenue Share = ~ 100% Gross Profit

Cash Flow

Nectar Connect

Growth Within Existing Partnerships and Growth in Loyalty Program Partnerships in the U.K.

Social Proof and Scale Advantages

Growth in Opt-ins within Each Partnerships

Growth in Revenue per User within Each Partnerships

Growth in Loyalty Program Partnerships Everywhere Open Banking is Live

Growth in Loyalty Program Partnerships Everywhere

Valuation

Being Wrong

As always, I could be wrong or have the facts wrong. Possibly more so here given there is a shorter history with these operations and less detail from management in general on Open Banking.

I could also be incorrectly assessing the situation. Or I could be correctly assessing the situation and the possible scenarios and respected probabilities, but the scenario where none of this occurs is the one that transpires.

Or maybe tomorrow regulations changes, or Cardlytics determines they will no longer be continuing this line of business of Open Banking.

Or maybe the business goes away from increased levels of risk from Open Banking, due to the nature of the business (for more information, see the link in the footnotes13).

However, none of these have deterred me from researching and thinking through the possible outcomes. I find it fascinating to think there is a possibility for significantly larger than expected outcomes that others will not even consider simply because you seem foolish for considering it. However, this is where there is more opportunity.

The remainder of this write-up will go into more detail on Open Banking and the opportunity (as outlined above).

For all my notes on CDLX, check out my Qualitative and Quantitative “Research Notes”:

For more general information on Research Notes, see here.

For the large number of you who are already premium subscribers, you have access to these notes.

If you enjoy the content, or have received any value from the investment insights, discoveries, and thoughts shared, past or present, please consider becoming a supporter / premium supporter of the channel. Your support increases the odds of more investment write-ups and content in the future.

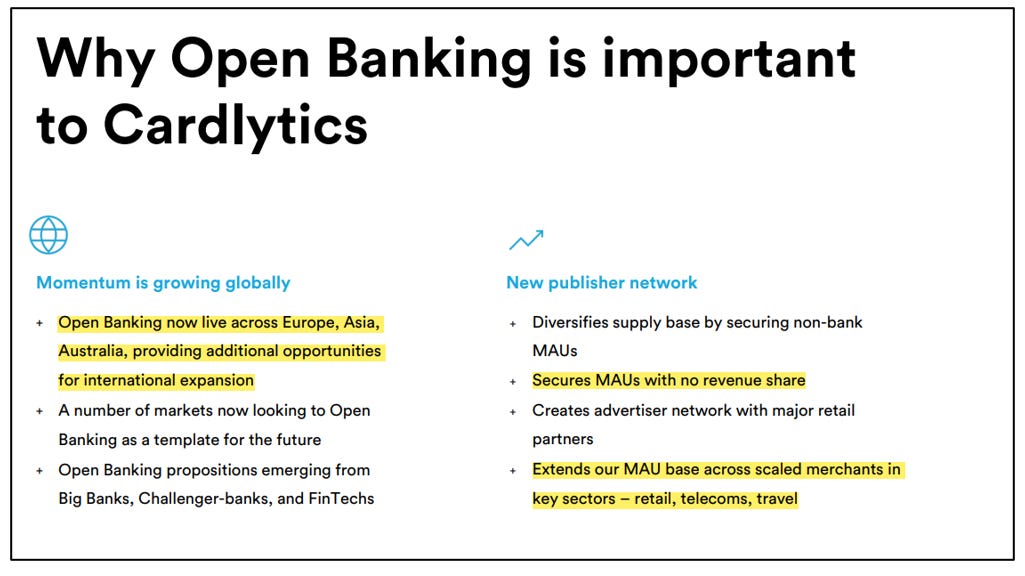

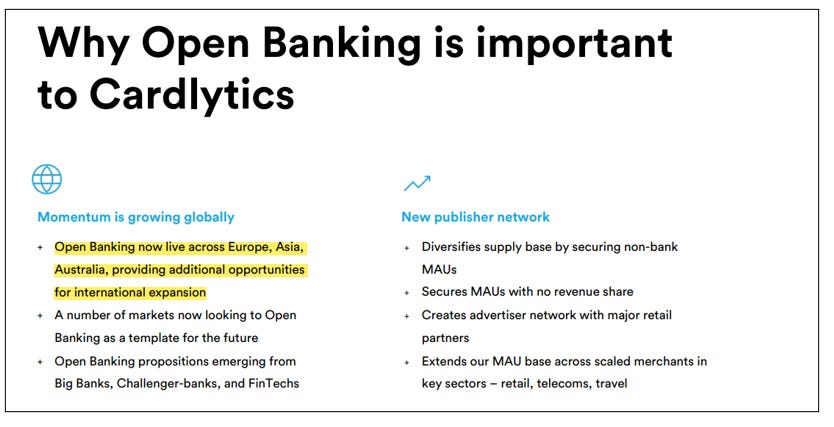

What is Open Banking and Why It’s Important to Cardlytics

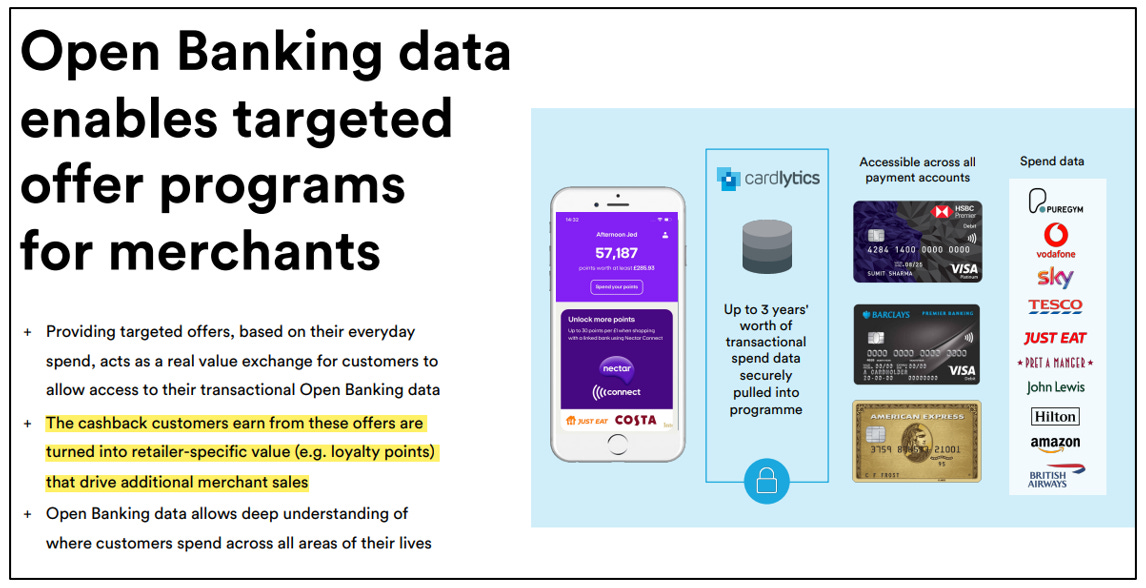

The overarching theme with Open Banking is the consumers own the data, and not the banks. This allows that financial data to become portable to share with 3rd parties. Essentially, the financial data is in the hands of the consumer, and they choose who to share it with.

CDLX can benefit by no longer being limited to just partnering with banks, since they can partner with others, such as loyalty programs, where users can share their primary transactional data and gain access to much better rewards from advertisers willing to target and place offers based on that data.

Loyalty Programs

Loyalty programs can partner with CDLX who has:

Existing scale in some of these markets, giving an advantage of data and advertising reach

Extensive experience with analyzing and advertising based on purchase data

Trust by the largest banks, giving social proof

Track record of no data leaks

The ability to aggregate the user side to lead to higher ad reach to attract advertisers to place better offers within the loyalty programs

International Expansion

Given Open Banking is now live across Europe, Asia, and Australia, it provides an opportunity for Cardlytics to expand internationally.

Zero Revenue Share = ~ 100% Gross Profit

Where this gets even more interesting is the revenue sharing with open banking. So far, there has been zero.

No revenue share with Open Banking has always interested me. Given CDLX’s Gross Profit = Revenue - Revenue Share - Delivery Costs, the Gross Profit % could be near 100% since the Revenue Share would be 0% and the average delivery costs for core CDLX have been around 7%14.

The reason for no revenue share with these Open Banking partners is similar to the neobank / fintech partners with Dosh who care more about the engagement benefits. This is why Dosh partners also supposedly have lower revenue share than the banks (as per CDLX Investor Day).

Given CDLX can leverage existing technology and resources, and little additional capital or resources are needed as this business scales, the high gross profit could lead to very high levels of cash flow (which could materialize in financials given CDLX is supposed to be CF positive by YE 2023).

However, for any of this potential cash flow to materialize, there will need to be sufficient scale. While the core CDLX business has yet to reach sufficient scale to meet the ad demand in places like the U.K., it should be easier to scale with Open Banking (since no longer limited to just partnering with banks to get to the needed scale).

As a reminder, the reason the banks have received such high revenue share is from them providing the data. Now the data is coming from the users. Therefore, since the FI share (or “rev share” or “revenue share”) has been “based on the relative contribution of the data provided by the FI partner to the overall delivery of the services”, and if the user is now providing that data, the contribution from the partners (like the loyalty programs) is minimal, and could possibly have defaulted in the negotiations to zero revenue share.

Cardlytics already has experience in this area with large amounts of transactional data and is a trusted partner given their experience and is also trusted by the largest banks. When you add on knowing these programs are more concerned with loyalty and engagement, it altogether leads to the zero revenue share.

One important point that may relate more to Open Banking than others (or at least for partners like TopCashback) is the following language in the 10-K related to FI Share. There are different FI share percentages depending on who secured the relevant marketer account.

Therefore, it is more likely and conservative to assume CDLX will have near 100% FI share on existing advertisers (i.e., CDLX does not get a cut from those), such as those on TopCashback who has a lot of existing marketers, but will have near 0% FI share / rev share on those that CDLX brings in (i.e., CDLX retains 100% of that revenue). And to me this makes sense as well, and is what led me to searching for this in the first place for confirmation.

In reality, CDLX may see more than 0% gross profit on existing advertisements. The reason CDLX would still get a cut is if they use CDLX’s new ad server, their self-service, the new user experience / UI, and other tech. However, those partners may simply continue to run their offers and bring in new advertisers on their own platform / tech, and therefore maybe 0% GP is most appropriate to assume until we have more information.

Regardless, there is still the major benefit of 0% rev share on the new advertisements, and will likely be the vast majority of what we see with Open Banking partners.

Cash Flow

Summing this all up, Cardlytics has a way to expand growth internationally, in a way that has no revenue share, and has a way to finally achieve scale through non-bank partners to reach large enough scale to meet the excess advertising demand that exists in some areas.

Hard not to see the potential for large cash flow generation with no revenue share combined with the potential scale and high operating leverage.

Nectar Connect

Cardlytics first Open Banking initiative was in the U.K. with Sainsbury’s Nectar, with Nectar Connect.

Nectar Connect launched on June 2nd, 2021, which was the largest U.K. Open Banking launch. Nectar Connect essentially turned the rewards program into what looked more like a bank to Cardlytics.

To get customers into the program, an email / notification was sent regarding how to earn more Sainsbury’s points.

By opting in and giving access to their transactional data to Cardlytics, users could get deals outside of Sainsbury’s. Therefore, they were incentivizing users to share their bank data in exchange for more loyalty points.

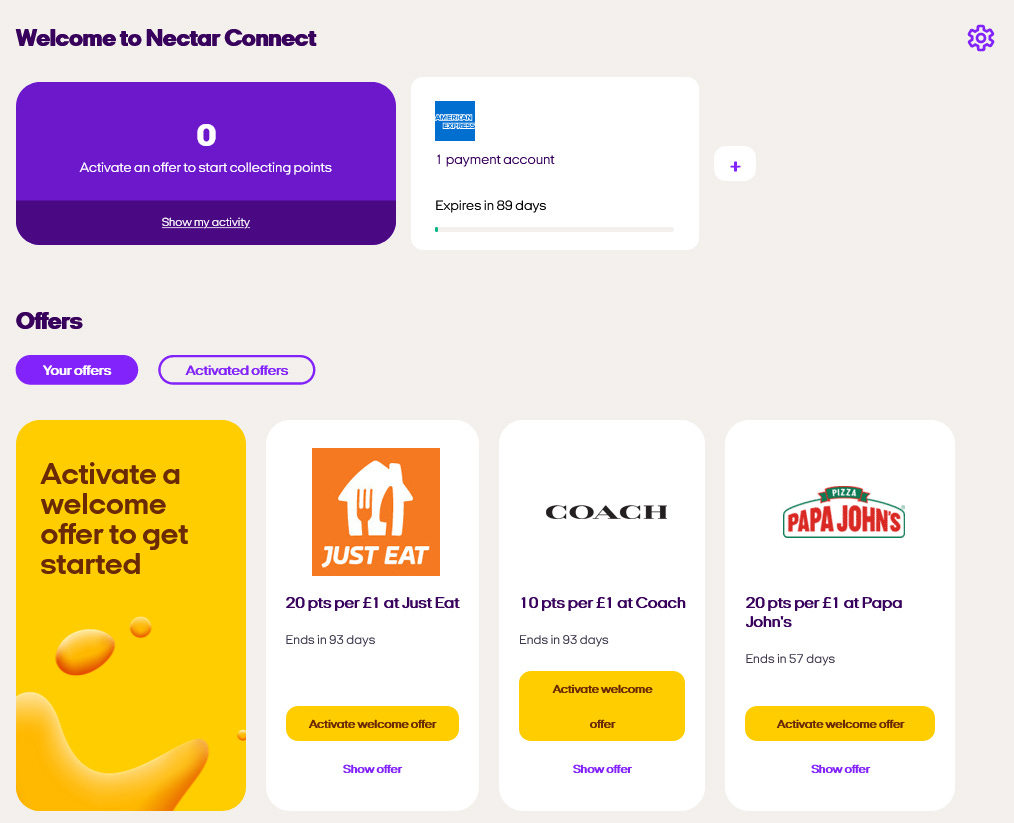

I wanted to provide one visual of the Nectar Connect program. This shows the offers to earn more Nectar points by shopping at other stores and redeeming the offers. Instead of getting cash back to your back account, you get points that go to your loyalty program (here it’s Nectar). These offers are only possible from connecting to your bank account via Open Banking and using Nectar Connect.

One thing to note is users must re opt-in in every 90 days (as seen under the AmEx connect bank account above).

Why Customers Like / Sign-Up

There can be significantly higher cash back from these offers compared to before. Part of this is from advertisers now funding the cash back amounts, as well as from moving past the affiliate ad budgets given advertisers cannot target based on purchase data.

With Nectar Connect, instead of earning 1 point per £1, they can earn up to 30 points per £1 from Nectar Connect, by connecting their bank. From what I’ve seen, 1 point is equal to 0.5p, so 0.5% before, and up to 15% with Nectar Connect.

Why Loyalty Programs Like

Able to offer higher amounts back and richer rewards since they are now funded by advertisers as well as from higher ad budgets than affiliate ad budgets given the ability now to target off transactional data. This allows for the offers to be even higher than those on affiliate sites (like TopCashback).

The higher rewards increase engagement and use of loyalty points within their program.

Also, the higher offers are what incentivized the loyalty members in the first place to connect their bank account and share their purchase data with the loyalty program. Without this incentive of higher offers from advertisers, loyalty members would have no reason to share their data. Additionally, loyalty members would have a hard time to attract advertisers to fund offers on their own, given their small reach on an individual basis. Cardlytics aggregates their reach for advertisers.

Cardlytics also brings the trust and experience with dealing with this data on the user side, and the experience to attract advertisers.

Additionally, using Cardlytics for the advertising side is a benefit for companies with loyalty programs where advertising is not their primary function / competence. Having a dedicated resource with experience is preferred or doing this in house (as well as from having more ad reach than doing it in house).

Why Advertisers Like

Advertisers are willing to advertise more than even their affiliate budgets given they now can target based on purchase data (since users opt-in and share this data due to Open Banking).

Additionally, advertisers like going through Cardlytics since they can reach many more users at one time given the combined reach made possible from Cardlytics aggregating all the loyalty programs.

Growth Within Existing Partnerships + Growth in Loyalty Program Partnerships in the U.K.

For background context, as CDLX adds more partnerships in the U.K., their ad reach increases, making it more likely to meet the excess ad demand there.

As more advertisers place offers, engagement and attractiveness of the programs increase, leading to more opt-ins, as well as interest from more programs.

The interest from more programs could be other loyalty programs in the U.K. or even additional banks, given benefits of scale.

This is a simplified illustration of the one shared previously for Cardlytics that considers other important factors:

What I find interesting here, is other companies like a Walmart, Costco, Amazon have continued the virtuous cycle from using the benefits of scale to lower their prices which saved the customers more money. Here you have a very similar process where the scale benefits for the advertisers leads to more offers placed for users leading to the users saving more and more money.

I don’t think this point should be diminished. An end-state could be that users with these cards could save 5-10-15%+ back on all purchases. When you have enough offers to cover nearly all purchases, the comparison becomes to that of the average 1-3% cash back offered by other cards. This could lead to pressure from the remaining banks or loyalty programs, large and small, to adopt CDLX as a solution (therefore not a function of differentiation but more needing use CDLX to not lag what becomes table stakes), which only continues this growth engine.

Social Proof and Scale Advantages

The only way I could see that flywheel starting and scale occurring with the Open Banking initiatives was if CDLX's first Open Banking initiative led to other partnerships to start increasing the ad reach.

Essentially, Cardlytics needed Social Proof with their Open Banking operations.

The reason I felt social proof had a higher chance of being the success formula here was due to seeing this before with Cardlytics.

Venmo was the social proof for Dosh to get more neobanks/ fintechs.

Could even say BofA was that for the rest of the banks.

The fact is social proof is not just a general concept, nor just a concept that works with businesses, but also a concept that has worked within Cardlytics already, to me increases the odds it could happen elsewhere where there are similar starting characteristics.

Therefore, Nectar Connect could be that same catalyst that leads to other programs using Cardlytics.

Better yet, given what was announced during the Q4 2021 earnings, we now know that is actually occurring with the Open Banking operations.

Proof Of a Catalyst, Increasing the Probability of Success

During Cardlytics’ Q4 2021 earnings call it was said that due to their success with Nectar Connect, the largest open banking initiative in Europe, it led to a second Open Banking initiative with TopCashback + interest from other brands.

One reason this is important is it shows social proof is working.

The success of the Nectar Connect initiative has led to interest from other programs and a pilot with TopCashback which shows there is some initial traction that could lead to much larger scale.

CDLX needed a large partnership and to show success to be able to attract more partners and get the flywheel started:

As CDLX adds more partnerships they will reach a critical scale that will attract more advertisers. This will lead to more offers + higher amount offers + more relevant offers, which will also benefit the existing partnerships and increase the number of opt-ins into the program.

More offers + higher amount offers + more relevant offers increases the incentive to opt-in and share their data.

In order for this to work, Cardlytics needs to keep signing up enough Open Banking partners to get to a critical scale to attract advertisers. This was the same thing needed with the core business, where critical scale for advertisers was not reached until signing Chase and Wells Fargo.

If Cardlytics can replicate the success of Dosh with signing new partners, there should be no issues with growing the number of Open Banking partnerships.

Dosh has recently increased their partnerships from 7 before the acquisition, to now I believe 32:

Why There is a >0% Probability of Growth in Loyalty Program Partnerships in the U.K.

In general, at the core CDLX level of the business, the reason Cardlytics works is from scale advantages. No single bank or loyalty program on their own has enough scale to attract all the top advertisers15.

Cardlytics aggregates the demand / user side, which aggregates the advertising reach. This gives advertisers sufficient scale. For context, CDLX’s core business needed Chase and Wells to reach that critical scale. Neobanks and fintechs have the same problem, if not more so, given there is more fragmentation and therefore less reach. Loyalty programs are very similar. Just think of all the different loyalty programs for all the different stores, restaurants, and more. Nearly everyone today has a loyalty program, creating intense fragmentation and therefore little individual advertising reach.

This leads to many loyalty programs that could be interested in partnering with Cardlytics to aggregate their reach for advertisers.

One may think that makes sense why a loyalty program cannot due it internally, but why will they go with Cardlytics over some competitor?

Cardlytics has competitive advantages in this space:

Extensive experience with analyzing and advertising based on purchase data (if a competitor is just starting out, they will not have this)

Trust by the largest banks, giving social proof (less have these relationships, given so few of the largest banks)

Track record of no data leaks (if a competitor is just starting out, they will not have this, and this is very important given dealing with financial data)

Existing scale in the U.K. with their bank partnerships, giving an advantage of data and advertising reach

Cardlytics has already entered the space with success with Nectar Connect, which has acted as social proof and a catalyst for further programs, such as the new pilot program with TopCashback and interest from other U.K. brands

Cardlytics’ first mover advantage is leading to larger scale than others in the U.K., making it harder for others to compete for these loyalty programs. If you were a loyalty program, why do it internally or use someone other than Cardlytics if Cardlytics has the best offers and rewards which leads to the highest engagement and loyalty given they are already the biggest? Their scale leads to these benefits and in turn attracts more programs, and makes it more difficult to compete.

Due to these competitive advantages, I believe other loyalty programs will go with Cardlytics over others, or at least a high percentage of them. Therefore, I believe there is a greater than 0% probability of Cardlytics signing up more Open Banking partners. Even better, there are many large and well-known U.K. loyalty programs that could be potential Open Banking partners.

Potential U.K. Partners

In my Cardlytics Quantitative Research Notes, I go into depth of the potential U.K. Open Banking partners, and why I believe each would be a great fit and has a higher probability of occurring. I’ve left that information out in order to keep this write-up as short as possible. For the larger number of you who are already premium subscribers, you have access to this information here.

Together we have the following potential partners with their total program size:

Nectar: 19M

TopCashback: 15M

Morrisons: Unknown

Total: 106M

When assessing the total addressable market, and summing up the total loyalty program size, it is possible there is a significant overlapping of members with existing programs like Nectar, given the transfer ability to programs like Avios.

Additionally, one thing to note is we know out of Tesco’s 20M, 6.6M have the app, which will be required for Cardlytics to benefit. That is 33% of the total members. Therefore, likely better to assume 33% for those programs (minus TopCashback, since I assume 100% members must use online in order for it to work). Using that percentage would be good for more conservatism, but I believe that as CDLX adds more advertisers, it will increase not only the number of opt-ins to sharing their transactional data but also the number that will have a reason to download the app in the first place, leading to more than the 33% ceiling.

Growth within Existing Programs

While it is likely to see growth within existing programs, the difficulty is it requires adding one customer at a time, and even re-opting in 90 days later.

However, one key insight is although the number of users within a program is small in relation to the total possible (for instance, 500K have opted-in to Nectar Connect out of the 19M possible), the awareness and engagement of those users who opt-in are very high. The reason is the users must literally choose to connect and share their financial data (made possible by Open Banking) to receive access to the better offers.

This differs from the CDLX MAUs in banks, where a high proportion do not know the offers even exist.

Therefore, it would be incorrect to assume the same percentage of these Open Banking MAUs (like the current 500K Nectar Connect MAUs) have the same ~30% engagement rate of the FI MAUs.

While there is still the hurdle of signing up one customer at a time within one program, which is why Nectar Connect is only at 0.5M members of the 19M, I think we will see growth within each program + growth in the number of programs.

In terms of growth within each program, this should increase as offers improve, which is a function of growth in advertising reach to attract more advertisers.

A piece of evidence of this comes from myself having that theory above a week before watching this YouTube video on Nectar. In it, he discusses Nectar Connect. The important quote regarding the offers from CDLX, “Now these are quite healthy, because normally you get 1 point per £1 spent, to get 20 points [per £1 spend] is really good. That’s an equivalent of 10% back….But as you can see, there really isn’t a huge number of retailers. What are we looking at, a dozen?” This was a point of validation to my theory. As Cardlytics can get more programs, increase MAU count, attract more advertisers and offers, the number who will sign up within existing programs increases. A form of scaled benefits shared, in the sense that as Cardlytics grows, the original customers benefit in the form of being able to save even more money. (Interesting enough, he also mentioned in the video using a card with other points and specifically mentioned clicking through from TopCashback since points / rewards / cashback compounds. Beyond a good example of how customers may be thinking, it also shows TopCashback is actually used, who is the next program Cardlytics is working with.)

Further indication of a growing number of users within each program can already be seen with Nectar Connect. The program rolled-out June 2nd with 65K customers registered. As of yesterday, it is now 500K. This shows significant growth.

With 19M in their loyalty program, there is a long runway.

For TopCashback, we heard there are 15M U.K. members. Given the only way to use these TopCashback offers is likely through digital channels, we may see here a significantly higher portion of opt-ins, compared to Nectar Connect where I believe not all Nectar members are digital.

Growth in Engagement + Product-Level Offers/Targeting/Insights

We have also heard at investor day that the Nectar program is on the new ad server. I've also heard elsewhere it is possible to layer on Bridg data (which is possible on the new ad server). These provide additional benefits from Open Banking initiatives.

In a recent write-up on the self-service for banks, I described some benefits of the new ad server:

Benefits of the New Ad Server:

SKU / Product-Level Offers, which should lead to more offers, higher amount offers (since can vary by margin profiles of products), and more relevant offers (sending offer on specific item rather just the store in general)

New User Experience and Higher Engagement, leading to the minimum 200% increase in click rates discussed during Jan 2022 conference (which can be found in the Qual Notes)

More local and SMB offers, since CDLX has been waiting for the new UI on the new ad server, since it will allow for better organization for these local and SMB offers. Could come from third-party content providers like Rewards Network, or from the POS partnerships (discussed in the write-up on Bridg.). May be able to partner third party content providers that are more in the U.K.

Push Notifications like U.S. Bank. Maybe be able to send more push notifications regarding new offers, limited time offers, expiring offers, etc.

and more

I do not necessarily think in all programs that are from Open Banking will use all the same things as the banks, such as local offers or the UI. Hard to know, but product-level offers / targeting ability / insights will be the big thing. Again, I spoke about Bridg at length in my write-up on Bridg, going through all the numbers related to growth and while it will occur.

Growth in Loyalty Program Partnerships Everywhere Open Banking is Live

In general, there already exists many more countries where Open Banking is live outside of just the U.K., which increases the number of possible loyalty programs CDLX can partner with, leading to a significantly higher portion of total digital ad spend that CDLX could capture versus today.

Cardlytics has already made note of the additional international expansion opportunities of where Open Banking is also live, including across Europe, Asia, and Australia.

Given Cardlytics has acknowledged it, it to me shows they know what is possible, which increases the odds of additional partnerships outside of the U.K.

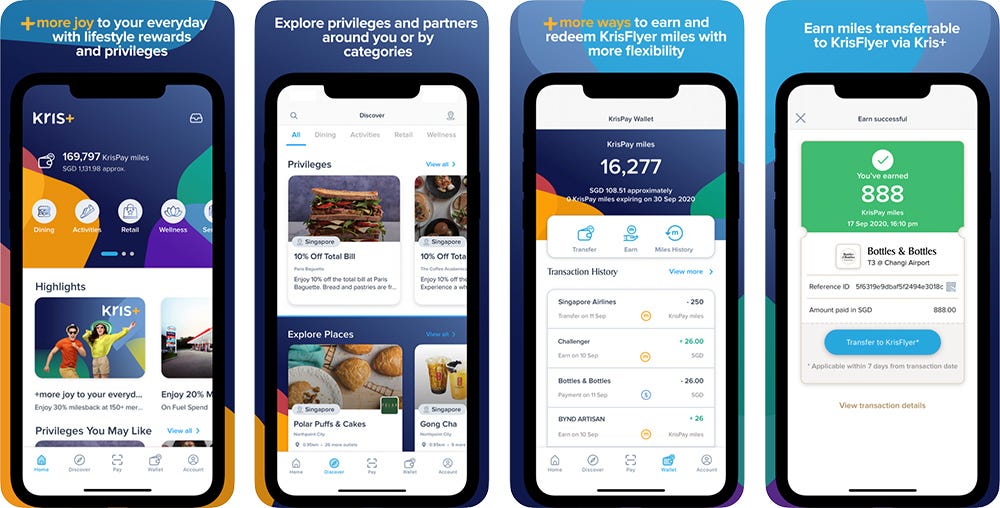

Cardlytics has even specifically mentioned Kris+ of Singapore Airlines. The context was just in general, with no mentioned of Cardlytics working with them. However, Kris+ could be a potential Open Banking partner. Cardlytics mentioned how they currently have 18 merchant partners for earning rewards with Kris+ by making purchases with these external partners. With CDLX, they could expand that program, increasing the number of offers and relevance of offers, leading to more opt-ins and more engagement and loyalty points that could be redeemed with Kris+.

Kris+ is just one of many potential partners. Cardlytics has specifically mentioned airlines as potential partners, for which there are many other large ones where Open Banking is live. Additionally, there are all the other loyalty programs where Open Banking is live.

I believe more countries will continue to adopt Open Banking, leading to even more potential partnerships. If you then layer on the solutions for loyalty programs where Open Banking is not live (discussed next), the TAM is nearly any loyalty program.

Growth in Loyalty Program Partnerships Everywhere

Beyond the potential of focusing on companies with loyalty programs where Open Banking is currently live, there would also be the opportunity to partner with more global brands with loyalty programs where Open Banking is not live.

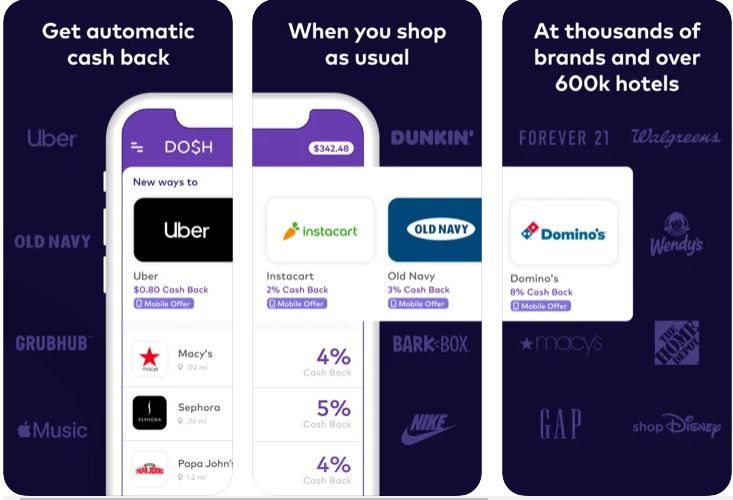

Rethink Loyalty is already doing this for loyalty programs in the U.S., which already proves this is possible.

By partnering with the likes of Rakuten, Figg, and more, they have created a way for Fanatics loyalty members to earn more points (or FanCash) with Fanatics when shopping at other stores (redeeming offers by Rakuten, Figg, etc.).

This is essentially what CDLX is doing with the Open Banking programs. The difference is being able to receive transactional data from the users with Open Banking, and then being able to gain insights and target based on that additional data, allowing for larger ad budgets (beyond just affiliate advertising budgets).

At the beginning of this post, I mentioned how in general, most assume CDLX has no value for loyalty programs or when all customers are in the loyalty program. This is a fear by other investors, where they assume if everyone is in a loyalty program, those companies will have enough data and control the distribution of offers, and therefore have no reason to use CDLX. This is not true. In fact, I believe CDLX can help every loyalty program, and with many different aspects, essentially becoming the premier loyalty program partner:

This table is explained more in-depth below:

Most Loyal

Target those that are the most loyal in your store in relation to other customers, but are actually spending even more in the category. These existing customers are the cheapest to convert (5x more to convert new customers) and spend more than new patrons (67% more), making them a much more valuable target. This is an extremely misunderstood idea by many investors and marketers (made apparent by only 4% of advertisers saying their biggest growth opportunity was with infrequent or lapsed customers), but this ability of CLDX explains why we consistently see top brands still use CDLX.

From a CDLX article16:

“We were surprised that only 4% said their biggest growth opportunity was with infrequent or lapsed customers even though our platform insights challenge this notion. Studies show that repeat customers spend 67% more than new patrons, which also cost around 5X more to convert. The ROI related to customer loyalty cannot be underestimated and is a huge growth opportunity we see for brands that may be lacking in this area.”

“Using actual purchase data can guide marketers on the true loyalty of their customers. Take these two customer types, for example:

Does it make sense to target the “loyalist” with the same ad spend or cash-back offer as the “customer of many”? Of course not. Ultimately, marketers want to convert the “customer of many” into a “loyalist” with targeted advertising that draws intelligence from their shopping habits. In short, you should invest in the customers with the highest spend potential. The best indicator of this is how much they are spending in the category when they aren’t spending with you.”

Semi Loyal

Increase incentive to get a store-branded rewards credit or debit card and earn more loyalty points to increase loyalty to the store, by increasing the cash back or “loyalty-points-back” from the typical 1-2% outside of the store to greater than 10% from leveraging Dosh / Entertainment / Bridg / CDLX offers.

Where Open Banking is live, users would need to opt-in and share their transactional data to access these better CDLX offers, which would be higher in amount due to the targeting that is possible.

In places where Open Banking is not live, the offers could be more similar to Dosh, where it is not as based on transactional data, and therefore they are lower in amount, but still significantly more than the typical 1-2% back.

CDLX could also leverage their recent acquisition of Entertainment, to place more local offers.

One last fun thought is it was mentioned during Investor Day that Nectar Connect is running on the new ad server. Therefore, it is very likely that all Open Banking partners would be running on the ad server, which would also allow for product-level offers from Bridg. We have even seen trials of this within Dosh:

I believe if Cardlytics does all of this for one marquee loyalty program, it will have the same social proof impact, and lead to many more partnerships.

Not Loyal

Be able to get insights and target those not in your loyalty program, leveraging Bridg.

Altogether, Cardlytics can help with every type of customer in or not in loyalty programs, making Cardlytics a valuable partner for loyalty programs. If Cardlytics can utilize their power, it would unlock an additional cohort of loyalty systems (those where Open Banking is not live), leading to significantly more potential growth.

It would also lay the groundwork if Open Banking becomes live in other countries, where CDLX can then just turn that lever on with the existing partners.

CLDX Should Target Existing Bridg Clients

Many existing Bridg clients are those who wanted to be able to have more insight and targeting ability for those outside of their loyalty programs. This means these companies have loyalty programs and it is important to them. Cardlytics should then be able to more easily upsell with regards to increasing the incentive for semi loyal customers to use a branded card (through higher cash-back / loyalty-points-back from Dosh / Entertainment and Bridg offers) and make the most loyal customers spend even more with you (using CDLX and Bridg offers).

Partner with Loyalty Program Providers

At first I thought maybe it would be smart for CDLX to partner with loyalty system creators, where when they create a loyalty system, CDLX is already integrated.

One I keep thinking of is PAR and Punchh. Bridg is already an integration partner of PAR. If Punchh provides the loyalty program, it could be built-in function to allow their loyalty members to earn points by shopping externally (from Dosh, Entertainment, and Bridg offers).

Partner with those with Store-Branded Rewards Credit and Debit Cards

When thinking about partnering with loyalty solutions, I started to think if the TAM for this type of business is all loyalty programs, how that would work in the end-state? Banks and neobanks/fintechs all of their own cards. The loyalty programs would also need store-branded cards I think to redeem outside offers (rather than connecting an existing card to the loyalty program, like Dosh). They don’t need to issue physical cards. With Revolut, I have no physical card, but I added one to my mobile wallet. For the Fanatics program, they need a Fanatics card:

Therefore, it may make more sense to partner with a card issuer like Marqeta. When companies reach out for a store-branded card, they can mention how they can integrate with CDLX to get more benefits, and be able to advertise those higher rewards at the launch of the card when it is advertised. Marqeta could be a good partner, given already worked with Affirm, Afterpay, Klarna, Square, Goldman Sachs, JP Morgan, Google, Coinbase, Uber, Instacart, DoorDash, Zip, and Sezzle.

Target Loyalty Programs Where Open Banking for them is Both Live and Not Live

I’ve also thought about other programs that have members where Open Banking is live in some locations where they have business, as well as where they have additional operations where Open Banking is not live. Essentially businesses with more globally diverse operations.

Some examples would be travel partners such as Hilton Honors, Marriott Bonvoy, Southwest Rapid Rewards or United Mileage Plus. Starbucks could be another example, who has loyalty programs in both locations where Open Banking is live and not live.

The additional benefit with these loyalty programs is there is likely a significantly higher percentage of members who have the app (if not near 100% of members, since I’m not sure you can be a Starbucks loyalty member without the app).

Cardlytics could start with doing a partnership where Open Banking is live, then also say, “Hey, we can do something similar where Open Banking is not live, and leverage Dosh, Entertainment, and Bridg offers”.

Potential Partners Fitting this Criteria

First thought was Bridg partners like Starbucks, given they are CDLX and Bridg clients, and also have a store-branded rewards card that could be used outside of Starbucks to earn points to redeem at Starbuck (more info: 1, and 2).

In terms of the points, Starbucks loyalty members earn Stars from using their Starbucks card including outside of Starbucks:

Therefore, Cardlytics could offer solutions where users will actually earn even more points / Stars by redeeming Dosh / Entertainment / Bridg offers that are integrated in the app.

However, Starbucks may not work, given the card is already a part of Chase and would have access to the normal CDLX offers:

“Accounts subject to credit approval. Restrictions and limitations apply. Starbucks Rewards credit cards are issued by JPMorgan Chase Bank, N.A. Member FDIC. Offer subject to change.”

Therefore, a possible partner who is also a CDLX and possible Bridg client (or could be soon), and also has a store-branded loyalty card is Target.

“The RedCard credit cards (Target Credit Card and Target Mastercard) are issued by TD Bank USA, N.A. The RedCard Debit Card is issued by Target Corporation.” More Info

A partnership with the Target RedCard could have social proof and increase the odds of more programs using Cardlytics, and have large impact given the high usage of the Target RedCard (at least within Target):

“We monitor the percentage of purchases that are paid for using RedCards (RedCard Penetration) because our internal analysis has indicated that a meaningful portion of the incremental purchases on RedCards are also incremental sales for Target”

Instead of the friction of having to add that Target RedCard to Dosh, you could see those offers within the Target app. Target benefits too from both using that card outside of Target due to the incentives, but where those incentives are in the form of points to use only at Target which leads to further spend within their store.

Another similar thought would be a partner like Walmart, improving the cash back from the low 1-2% currently, to be over 5-10-15%+ with Dosh / Entertainment / Bridg offers.

Valuation

At the beginning of this post, I described what I believed to be a good baseline scenario.

I will repeat it here, but add more detail from what has been discussed throughout this post.

In ten years from now we could see…

(19M+15M) x (1+ 0% Growth in Loyalty Member) = 34M Potential MAUs

19M is the number of Nectar members. 15M is the number of TopCashback users.

Ignores growth in the number of users within the two existing partnerships.

Ignores growth in number of partnerships in the U.K. from the two today. Given the interest from other U.K. brands and the number that is possible within the U.K., limiting to two partnerships seems extremely conservative.

Ignores growth in additional loyalty programs where Open Banking is also live.

Ignores growth in additional loyalty programs where Open Banking is not live.

x 15% Opt-in Rate = 5.1M MAUs

Assumes lower than the 30% of engaged users in the bank given the friction of opting in, and assumes around 50% would opt-in of the 33% or 6.6M digital app users of 20M the total Tesco loyalty members.

While difficult to know how many users will opt-in, as CDLX continues to add more partners, increasing their ad reach, leading to more advertisers and larger quantity offers + higher offers + more relevant offers, it will increase the incentive to opt-in.

x $10 Cash Back Redeemed over 1 Year * $2 Revenue / $1 Cash Back = $102M in Revenue

Assumes one $10 offer is redeemed over 1 year, and assumes same $2 of revenue to $1 of consumer incentive as core CDLX business.

$10 is equal to the Panda Express of spend $10 get $10 back.

Is $10 of cash back too much? Too little? The new pilot program Cardlytics is running is with TopCashback, where on their site, they mention “Members earn on average £345 cash back a year”, or $460 (despite their U.S. site also saying $345…but this does not impact the point being made, since still significantly larger than $10 redeemed). Could be only the most engaged TopCashback users are responsible for the majority of the cash back, but those are the same users that would opt-in. Sharing their data will lead to better targeting and offers from more advertisers, so should see better offers.

To get an idea vs similar other programs, we could look to Honey, “with 17 million members and counting” and “10.2 million active accounts contributed by Honey on the date of acquisition in January 2020” from PayPal’s 10-K, which was acquired by PayPal for $4B. Apparently on average Honey members save $126 / year. Again, significantly more than the $10 assumed.

To top it off, and what to me was an important realization later, given members must opt in, it means they are aware of the benefits, increasing odds of higher engagement. A user is more likely to look like the fully engaged users in the bank channel, since many users in bank don’t know offers exist. This makes it more likely have higher engagement numbers, closer to aware and engaged users such as myself (who has on average redeemed more than $100 / year).

x (1 - 0% Rev Share - 7% Delivery Costs) = $95M in Gross Profit.

Assumes no revenue share as mentioned by CDLX, and same 7% delivery costs which is the 3-year average of core CDLX.

Given the U.K. operations of core CDLX will likely handle these operations and given they are likely already in the total company’s operating expenses, which are supposed to be covered by the end of 2023 from being cash flow positive, and little to no additional operating expenses would be needed for this business at this scale (since can leverage existing resources and tech), that would be around $50-80M in additional cash flow.

A 25x multiple gives up to an extra $2B of value 10 years from now. If you assume about 5% growth in Nectar or TopCashback, or instead assume 1 additional program around 20M users, it would lead to enough cash flow to justify the current CDLX market cap. Maybe this is what investors already assume will happen and explains the current market cap. However if that is the case, then market is ignoring future cash flow from core CDLX growth beyond being CF positive by the end of 2023 and likely many other factors.

More likely, the market assumes growth from the core CDLX to justify the $2B market cap, and instead ignores any value Open Banking (like this extra $2B), as well as any growth beyond the $2B scenario above, such as from:

ARPU being much higher

Cardlytics partnering with more loyalty programs in the U.K. than just those two today

Cardlytics partnering with more loyalty programs outside of the U.K. but where Open Banking is also live

Cardlytics partnering with loyalty programs even where Open Banking isn’t live.

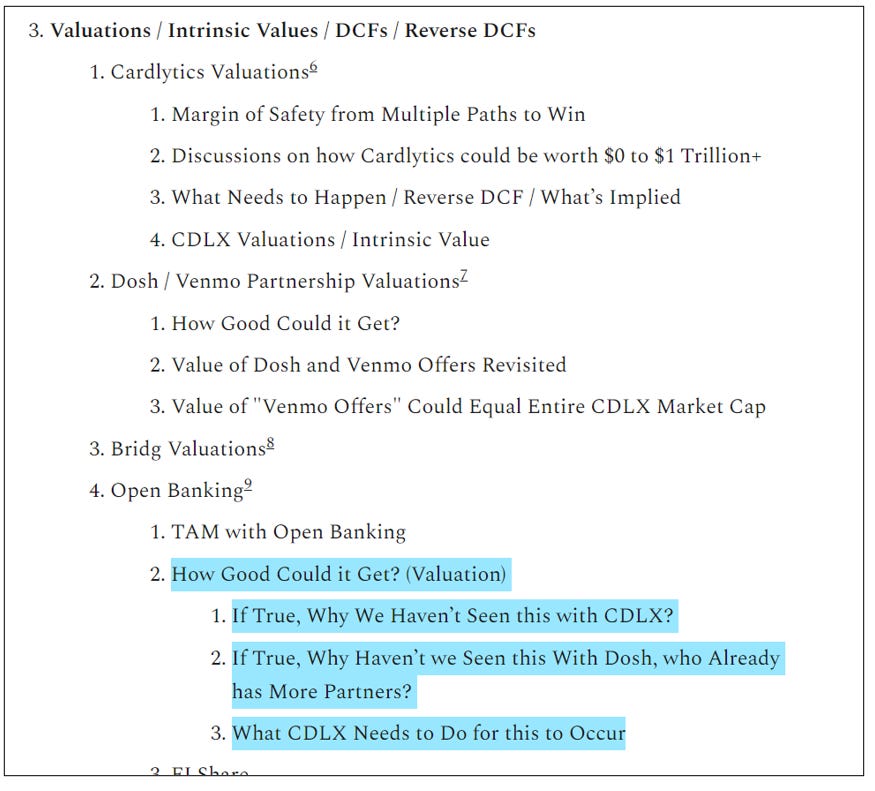

In terms of how good this could get for Cardlytics with Open Banking from a valuation perspective, I have spent some time thinking through it.

I have included that detail and analysis that shows how revenue and operating income could become quite ridiculous in size in relation to the current CDLX market cap in the Cardlytics Quantitative Research Notes (for the large number of you who are already premium subscribers, you already have access to view these notes).

I think it is worth repeating before you view the numbers in the Research Notes, the reason this large amount of potential cash flow is possible is due to scale from international partnerships (no longer limited to just the U.S.) + extremely high gross profit margins (from no revenue share) + high operating leverage (from leveraging existing operations / resources / tech). I do account for high operational expenses from additional resources needed in this right tail scenario, as CDLX would likely need to hire more in these new locations.

Additional Information

I have been thinking about Open Banking in regards to CDLX for a while.

In order to continue to provide additional value for the larger number of you who are already premium subscribers, I have included additional detailed information and thoughts in the following sections within my Research Notes:

Valuations: How Good Could Open Banking Get (in terms of Valuations)?

If True, Why We Haven’t Seen this with CDLX

If True, Why Haven’t we Seen this With Dosh, who Already has More Partners?

What CDLX Needs to Do for this to Occur

For all my notes on CDLX, check out my Qualitative and Quantitative “Research Notes”:

For more general information on Research Notes, see here.

Closing

Open Banking has very high potential and I will continue to monitor the situation and add notes to my Research Notes.

Open banking is simply another path to win, and another way to provide a margin of safety, both of which are possible due to the current Cardlytics market cap.

If you enjoy the content, or have received any value from the investment insights, discoveries, and thoughts shared, past or present, please consider becoming a supporter / premium supporter of the channel. Your support increases the odds of more investment write-ups and content in the future.

Follow-Up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more.

-Austin Swanson (Swany407)

Twitter: @Swany407

Website: Swany407.com

More Information on Cardlytics

Research Notes

Free Posts

The Power of Bridg (and Why CDLX is Undervalued): Write-up and video

BofA Renewal & Testing Competitors (Update): Write-up and video

New Observations, Upcoming Earnings Calls, and Updated Allocations (10.21.2021): Write-Up and video

Thoughts Following Q2 2021 Earnings and Price Decline: Write-up and video

Thoughts After Price Decline (5.17.2021): Write-up and video

Disclaimer: This content is not investment advice, and is intended for educational and informational purposes only. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.

Implied in Current Market Cap

I have talk about this at length in other areas.

Please see either:

The specific section is currently under 3.1.3: Valuation, Cardlytics Valuations, What Needs to Happen / Reverse DCF / What’s Implied

Bridg Write-Up (Closing Section at the end)

Interview on Value Hive Podcast (Around the 1:13:00 mark)

Panda Express Free Meal

From the write-up on New Observations, Upcoming Earnings Calls, and Updated Allocations:

Free Order

Observation Date: 9/15/2021

Another highly attractive offer this quarter was the Venmo QR code offer for $10 off a $10 minimum order at Panda Express. As others and I figured out, this can be essentially a free meal.

Given this was a little more unique, where never before could you essentially get 100% off or close to 100% off (until the Uber Eats switched from 48% to $16), I wanted to make sure it worked. Sure enough, I had a $12.09 meal and received $10 from Venmo fairly quickly.

As an illustration for the power of large incentives, I told my Dad about the $10 off Panda offer with $10 minimum order. He recognized it as a free meal, and the next day, he texted me asking how to pay with Venmo to get this deal. An hour later, I hear he successfully made the purchase and redeemed the offer. He is someone who would have never otherwise paid with Venmo.

Long Term Importance: Attractive offers lead to more word-of-mouth advertising of offers, increasing awareness, engagement, and redemption, even leading to people wanting to learn how to redeem offers that are too good to pass up. This website had quite a bit of discussions around the offer, showing how people are willing to ask how to find the offers and use the offers when they are worth it. I believe this outcome will continue to occur as more high value offers that individuals want are available.

Another important point is if high value offers like this are possible, such as free meals, or free items, as more offers come on the channel and the odds of a relevant offer being shown to a user increases, I feel it is reasonable to assume engagement could reach 100%, or 100% of users will redeem at least one offer. To assume otherwise would be to assume users will not take the free money (given we can assume with time that more advertisers will be on the channel and ad budgets will continue to expand, based even on the observations in this write-up).

No Revenue Share with Open Banking

The reason for no revenue share with these Open Banking partners is similar to the neobank / fintech partners with Dosh who care more about the engagement benefits. This is why Dosh partners also supposedly have lower revenue share than the banks (as per CDLX Investor Day).

As a reminder, the reason the banks have received such high revenue share is from them providing the data. Now the data is coming from the users. Therefore, since the FI share has been “based on the relative contribution of the data provided by the FI partner to the overall delivery of the services”, and if the user is now providing that data, the contribution from the partners is minimal, and has defaulted in the negotiations to zero revenue share.

Cardlytics already has experience in this area with large amounts of transactional data and is a trusted partner given experience and already trusted by the banks. When you add on knowing these programs are more concerned with loyalty and engagement, it altogether leads to the zero revenue share.

One important point that relates more to Open Banking than others is the following language in the 10-K related to FI Share. There are different FI share percentages depending on who secured the relevant marketer account.

Therefore, it is more likely and conservative to assume CDLX will have near 100% FI share on existing advertisers (i.e., CDLX does not get a cut from those), such as those on TopCashback who has a lot of existing marketers, but will have near 0% FI share / rev share on those that CDLX brings in (i.e., CDLX retains 100% of that revenue). And to me, this makes sense as well, and is what led me to searching for this in the first place for confirmation.

In reality, CDLX may see more than 0% gross profit on existing advertisers. The reason CDLX would still get a cut is if they use CDLX’s new ad server, their self-service, the new user experience / UI, and other tech. However, those partners may simply continue to run their offers and bring in new advertisers on their own platform / tech, and therefore maybe 0% GP is most appropriate to assume until we have more information.

Regardless, there is still the major benefit of 0% rev share on the new advertisers.

Cash Flow Positive for Core CDLX

Note, Andy made this comment that the “core business” would be cash flow positive by end of 2023.

I refer to the core business being the original CDLX business, and then the non-core being Bridg + Dosh + Open Banking.

The core CDLX business to me would include some of the U.K. and Open Banking business, but I believe that is relatively small, and therefore there is little risk of double counting. Therefore, we could assume that the existing business grows just slightly as expected to be cash flow positive, or rather to cover operating expenses.

What is Implicitly Ignored my Current Market Price

If we are able to conclude that the core Cardlytics business today can cover the total Cardlytics operating expenses 10 years from now, which seems reasonable given they expect to be cash flow positive by the end of 2023, and if we can conclude that the open banking initiatives can produce enough cash flow to cover today’s market cap of $2B, then the market is ignoring all growth potential in Cardlytics’ core business, such as:

Ignoring any increases in the number of bank-channel MAUs, such as if Cardlytics signs a new bank (which seems increasingly possible given the acquisition of Entertainment which will be used to help get AmEx).

Ignoring any growth in revenue from more ad spend due to Bridg

Ignoring any improvement in gross profit from Bridg

Ignoring any growth from additional content like Rewards Network or Entertainment

Ignoring any growth from SMB users using a self-service

Ignoring any increases in engagement levels from the new ad server (where Lynne has mentioned engagement “It will absolutely be higher than the old ad server. I just don't know if it's going to be 3-4x higher, of it's going to be 50%”, and how in the January 2022 presentation it was said how “We compared campaigns in Q4, the same exact campaign, that ran on the old experience versus the new experience, and we saw a minimum of 200% increase in click rates. 200%. Some campaigns had 400, actually over 400%.”38)

Ignoring any benefit from the IDFA and other privacy related issues causing other digital advertising platforms problems, but not impacting Cardlytics, leading to possible shift in ad spend.

Ignoring any growth from giving the banks the new bank self-service platform to place more offers on their own (likely similar to the Chase Sapphire Exclusive offers that have been extremely high in amount and attractive) which lead to higher cash-back offers (from boosting) and more offers (due to self-service), increasing probability of relevance (as discussed in this write-up on the self-service for banks)

Ignoring any growth from dynamic pricing

Ignoring any growth from auction-based pricing

Ignoring any growth from showing LTV/CAC and any associated growth from advertisers switching towards thinking about LTV/CAC vs ROAS

Ignoring any benefit from time-based offers

Ignoring any benefit from companies using Cardlytics to optimize their business (promote new payment types like QR Codes or App Only / Mobile Only)

Ignoring any growth from using different pictures for different customers (like used by Netflix)

Ignoring any growth from current or new neobank (such as Venmo) or fintech partners (such as possibly Affirm and their new Affirm Debit + card whose rewards could be powered by Cardlytics / Dosh)

Or one step further, if we are able to conclude that it is in fact possible with open banking initiatives to cover all Cardlytics operating expenses and produce enough cash flow 10 years from now to cover Cardlytics current market cap of $2B, then the market is ignoring all revenue and growth from the core Cardlytics business + Bridg + Dosh and even further growth from open banking.

Implied in Current Market Cap

I have talk about this at length in other areas.

Please see either:

The specific section is currently under 3.1.3: Valuation, Cardlytics Valuations, What Needs to Happen / Reverse DCF / What’s Implied

Bridg Write-Up (Closing Section at the end)

Interview on Value Hive Podcast (Around the 1:13:00 mark)

Targeting the Most Loyal Customers

“We were surprised that only 4% said their biggest growth opportunity was with infrequent or lapsed customers even though our platform insights challenge this notion. Studies show that repeat customers spend 67% more than new patrons, which also cost around 5X more to convert. The ROI related to customer loyalty cannot be underestimated and is a huge growth opportunity we see for brands that may be lacking in this area. “

“Using actual purchase data can guide marketers on the true loyalty of their customers. Take these two customer types, for example: