Cardlytics $CDLX: Current Price Decline, Short Thesis, and Q1 2022 Earnings

Discussions on the Price Decline, Short Thesis, BofA, Cloud, Bank Improvements, More Spend by Banks, Solving the Attribution Problem, CDLX Insights, Self-Service Update and Scalability, Dosh, and more

For those interested, this post is also available on YouTube, Apple Podcasts, and Spotify.

Market Cap as of 5.9.2022: $31.24/Share x 34.1M Shares ~ $1.1B Market Cap.

Introduction

There were many good updates from the Cardlytics Q1 2022 earnings call last week, as well as within their updated presentations.

This post contains my notes and thoughts on the items that most stood out.

I will start with a high-level overview, reflecting on the current price decline, my general thoughts following earnings, and addressing the short thesis. I will then provide my in-depth analysis of the updates at earnings, with many new key insights they are severely under discussed, likely from going unnoticed.

High-Level Overview

Thoughts on the Current Price Decline

I’ve had quite a few people reach out recently regarding their fears with Cardlytics. Most are fearful due to the stock price declining. From that they assume either their previous concerns are true or are worsening, or others must know issues or concerns that they do not.

What most do not seem to be doing is looking at the business to determine what is going on and likely to happen. Or, based on how apparent these business improvements have been, and given the many new strong pieces of discomforting evidence to parts of the short thesis, I can only assume others are not looking at Cardlytics anymore.

In total, based on the commentary during the earnings call, the business seems to be in a very good place, if not its best place, with their offerings improving, and evidence of users, banks, and advertisers taking more advantage of these improved offerings from Cardlytics. This is happening at the same time the stock price of Cardlytics continues to decline, creating a potentially even more interesting investment opportunity.

The next two sections will look at how the business is doing based on the updates provided during the earnings call, as well as how they relate to parts of the short thesis.

Thoughts Following the Earnings Call

The value proposition Cardlytics can offer to users, banks, and advertisers only continues to grow, as made evident by the improvements shared and the actions taken by these constituents.

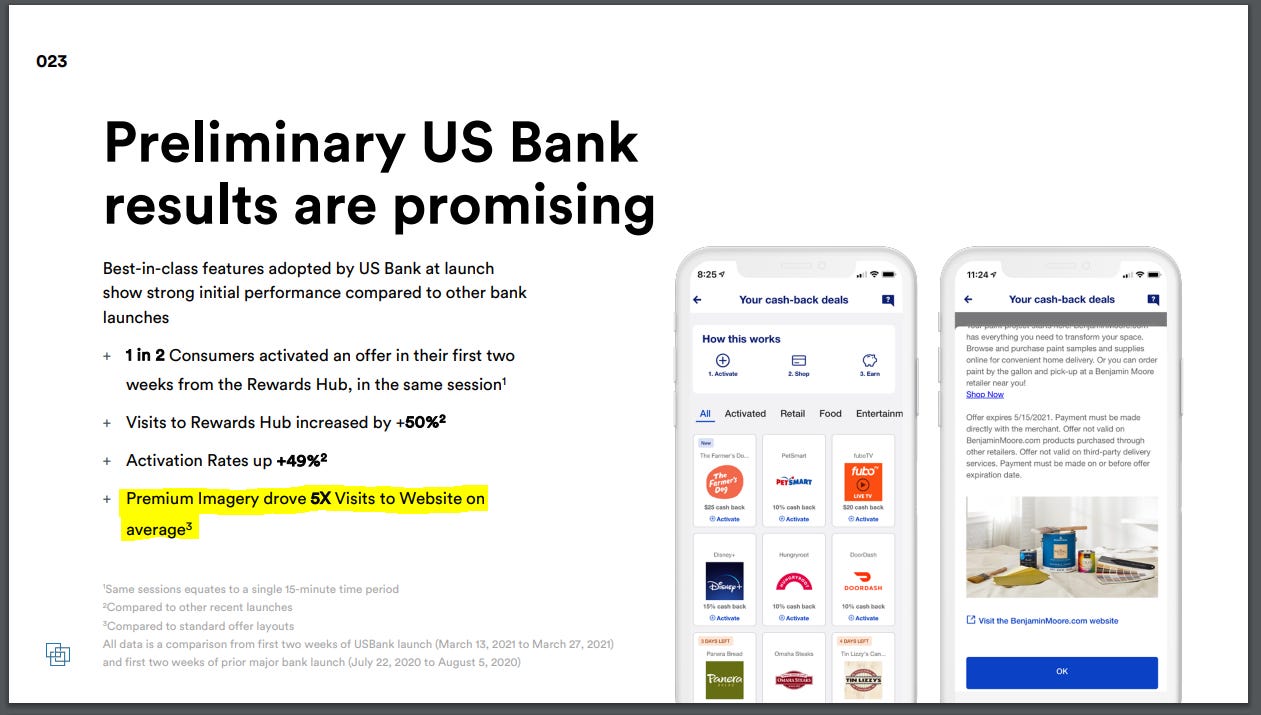

Banks are leaning more into the program, from doubling their investment into the platform (possibly through the new self-service for banks, “Engage” allowing banks to boost offers and increase their differentiation among other banks) and from increasing the visibility of the program (which doubled activations of offers by users). These two new updates should not be diminished. The banks would not do this years after first signing with Cardlytics if Cardlytics was not continuing to be used by bank customers or if the platform wasn’t improving for them, or if it was not leading to the higher engagement and other benefits for the banks, all of which the banks have data on and can track.

The value proposition for users increases from these recent actions by the banks. The odds of users now finding the Cardlytics offer section has increased from the increased visibility online or in the banking app, and the attractiveness of offers increased from the larger cashback from banks boosting offers. As the users benefit now from finding these offers and saving even more money, the banks benefit as well from more engagement, more spend, less attrition and more.

Those updates are only on the existing platform. The value proposition for users is on track to increase exponentially, based on the updates we heard at earning and what we will discuss more in depth in this post. From the banks committing to moving to the new ad server (with Chase likely this year), it will allow for product-level offers, local offers, more offers from the self-service platform, the new user experience with premium hero imagery, and more. This will increase the understanding, attractiveness, and relevance of offers, increasing how much money users save, leading to more engagement and other benefits for the banks, and more revenue for Cardlytics.

The value for advertisers continues to increase as well, which will benefit users with more offers and higher value offers, which then also benefits the banks as mentioned. We heard at earnings that more advertisers are using Cardlytics and renewing due to the unique insights that Cardlytics can provide, and at higher ad spend tiers to unlock these insights (with customization that may increase the stickiness of these clients, and create a form of pricing power through higher ad spend requirements). Existing advertisers could also start increasing their ad spend from gaining more trust with the platform from Bridg helping solve the attribution problem, as it will give them more view into what is now their own data (and not the Banks’s data like before). This will also lead to more advertisers using Cardlytics who have not before for this same attribution problem (that is no longer a problem via Bridg). Self-service continues to improve, with additional reporting. Finally, these advertisers will soon benefit more from being able to place offers via self-service on all banks as they soon adopt the new ad server, as well as benefit from being able to place product-level offers, and now have richer imagery of their offers (which have been shown to increase click out rates to their external websites by 2x - 4x from before, increasing probability of a completed purchase).

And while there has not been a new signed contract with BofA yet, we received extremely strong clues that a renewal with a new and improved contract is nearly certain and very close to being finalized (as will be discussed). While others feel that the longer the time until BofA renews means lower probability of a renewal, I feel the longer wait increases the probability of stronger contract from CDLX continuing to hold out to ensure they get the items that will lead to the most financial benefits long term.

Addressing the Short Thesis

An even stronger point to be made are the multiple pieces of evidence that are disconfirming to parts of the short thesis that was shared during this last earnings call:

Deprioritization by Banks: Banks are not deprioritizing Cardlytics, such as moving them from their current real estate positions within banking apps or online to worse placement. Instead banks are giving more priority to the Cardlytics platform by increasing the visibility, leading to more engagement seen by the double in activation of offers. Also, a bank doubling their investment into the CDLX program does not seem like something a bank would do if they were deprioritizing or about to move the offers program in-house.

See “Update 1: Banks Increasing Visibility” for details on the update provided at earnings

See “Update 3: Double Investment Spend by Bank” for details on the update provided at earnings

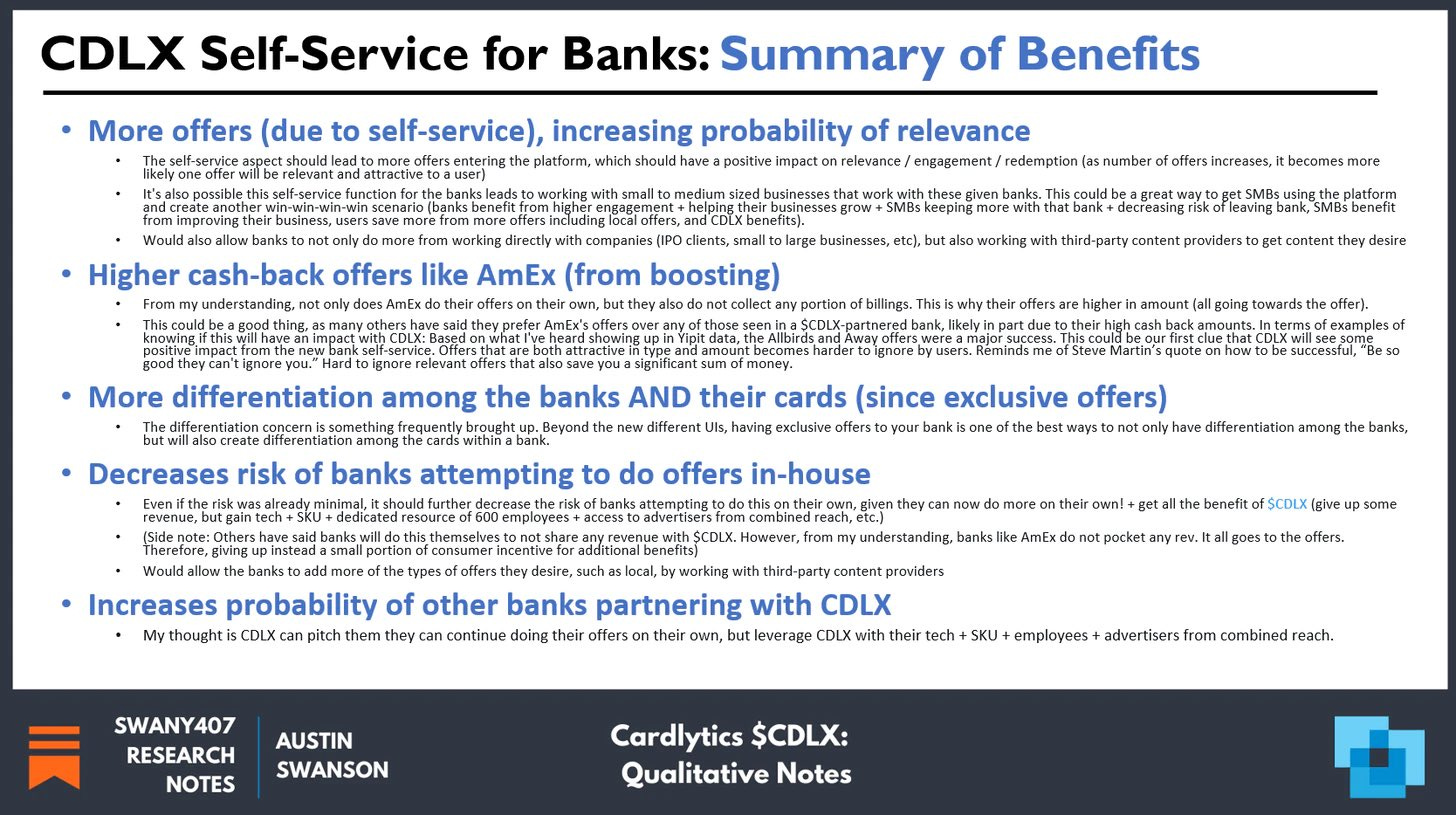

Banks Moving Offers In-House / No Differentiation: Banks are not cutting back or moving to an in-house offers solutions to replace CDLX. Instead they are doubling their investment into the platform. This is likely related to the new self-service for banks, “Engage”, where banks can boost / increase the cash back on offers, making them exclusive to those banks, and increasing differentiation (which will only increase from the new ad server allowing the banks to have other exclusive offers such as with their IPO clients or other bank clients, and from allowing different looking user interfaces). It is quite fitting that it is most likely Chase who is doubling their investment into the Cardlytics program, who is the bank most have worried about pricing it in-house (which is likely why CDLX provided this update in the first place). Additionally, if banks were going to bring the program in-house, they would not be committing to move to the new ad server. Finally, as will be discussed in the Dosh partners section regarding the actions and comments by the new Dosh partner, crypto.com, using CDLX/Dosh may become table stakes for cash-back programs to remain competitive through a sustainable way, and less a concern with differentiation.

See “Update 2: BofA Renewal and Banks Moving to Cloud” for details on the update provided at earnings related to moving to the cloud for the new ad server

See “Update 3: Double Investment Spend by Bank” for details on the update provided at earnings, including why it is likely Chase

See “Update 11: New Dosh Partner” for details around sustainably of banks finding their own offers and CDLX becoming table stakes

Attribution Problem: Advertisers will now be able to solve the attribution problem via Bridg by giving them more view into their own data, allowing them to perform their own measurement of results, leading to more trusting of the results, which should lead to higher ad spend and new advertisers in the channel.

See “Update 4: Bridg and CDLX Cross Selling and Solving Attribution Problem” for details on the update provided at earnings, and the previous comments made by advertisers that are now addressed via Bridg

Low Engagement / No Time Spent in Banking Apps: Engagement of users (which has never been a problem) will only continue to increase from the benefits of the new ad server, with strong data points from US Bank who already has the new ad server and is seeing dramatic increases from the hero imagery. Additionally, the engagement will increase further from more advertisers using self-service, increases in cashback from banks boosting offers, higher ad spend from solving the attribution problem, higher ad spend to unlock insights, and more relevant offers from product-level offers and local offers. Remember, this is a different channel than something like social media, where users are not there for the ads, and therefore usage time needs to be high in order to increase the likelihood of engagement with the unsolicited ads. With CDLX offers, it is as if all the ads are aggregated in one small area and organized, only taking a few seconds to look through and engage with, with the added benefit users are choosing to look at them. These offers will become even more highly personalized and relevant with SKU and product-level offers.

See “Update 3: Double Investment Spend by Bank” for details on the update provided at earnings related to banks boosting offers

See “Update 4: Bridg and CDLX Cross Selling and Solving Attribution Problem” for details related to the update provided at earnings

See “Update 10: Engagement on New Ad Server” for details on the update provided at earnings related to new imagery increasing engagement

BofA Not Renewing: BofA will almost certainly renew (but anything is possible). It is just a matter of when the approval for moving to the cloud is finalized. It is interesting how it seems investors would have preferred BofA to renew the old contract (without the new ad server or hosting in the cloud) at year end 2021 to just have it done and certain, rather than the delay in renewal but which indicates a higher likelihood of a dramatically improved contract (from holding out) that will enable the new ad server and host it in the cloud, unlocking many more benefits. I take the long-term view and prefer the latter.

See “Update 2: BofA Renewal and Banks Moving to Cloud” for details on the update provided at earnings

Or for even more details, see the BofA detailed write-up, as well as in this BofA update post.

Figg: Many at one time were worried of the threat of Figg, especially as BofA tested their local offers which originated from Rewards Network, of which many others have access to, including Dosh who uses them for their local offers. Now CDLX is running Rewards Network third-party local content for at least one bank (Update as of 5/16/2022: Originally I thought it was for BofA, given the update shared in this BofA update write-up, however based on CDLX comments today, it is likely another bank. More detail in the related section later), and even now has access to more local content via their acquisition of Entertainment. This makes CDLX possibly have even more local content, a point Figg /Augeo used to claim, saying they had the leg up in local offers. This is similar to how some advertisers thought Figg was differentiated given they were able to place offers to users within different financial apps, that had different benefits such as the ability to track location and send related push notifications. These are all the same things Cardlytics can now do with their rapidly growing list of Dosh neobank and fintech partners. Similarly, Figg has made a push into powering cashback for Crypto fintechs, only for CDLX to announce days later Dosh started powering the rewards of crypto.com. In all cases, with local offers, neobanks / fintechs, and crypto fintechs, investors and advertisers thought Figg had a leg up with these areas, but Cardlytics has matched if not now surpassed them in the areas where they were maybe once unique. However, CDLX should not diminish or ignore Figg, as they have shown they are competitive and have a desire to take market share.

See “Update 8: Self-Service Scalability and new Partners for Local Content” for details on the update provided at earnings, such as regarding Rewards Network local offers and potential second bank piloting them

See “Update 9: Entertainment Local Offers” for details on the update provided at earnings

See “Update 11: New Dosh Partner” for details, including on crypto.com

See “Update 12: Dosh Marquee Partner” for details

Self-Service Issues: Cardlytics is continuing to improve the self-service platform to address the deficiencies raised by ad agencies, such as related to reporting, which was discussed at earnings. In terms of issues of scale, the self-service platform supposedly only works with the banks on new ad server, where currently only US Bank is on it. Therefore the technical solution to the issue of scale has already been created and addressed, and will be soon solved as banks move to the new ad server, such as Chase likely this year, and BofA and Wells likely next year. The cloud could also allow for the new ads marketplace which should have dynamic pricing and optimization based on real time ad inventory.

See “Update 2: BofA Renewal and Banks Moving to Cloud” for details on the update provided at earnings that relate to the new ad server and cloud

See “Update 7: Self-Service Platform” for details on the update provided at earnings related to new features

Banks Being Slow: From the December Conference, when discussing how BofA is the only large bank CDLX is not hosting the tech, Lynne said, “If we want to make a change to like Chase or Wells Fargo it takes us 2 minutes, we want to make that same change in BofA it can take us 2 months, because we have to go through their internal processes. So we’re negotiating that they’re going to let us host it. As a part of hosting, we want to put it in the cloud.” I’ve heard elsewhere by CDLX management that the same updates that they push to their system over night (so to the banks like Chase and Wells where they host) might take up to 5 months with BofA. So there has been legitimacy with the worry by investors that Cardlytics has been historically constrained by banks like BofA (who has been their primary bank for most of the company’s history, until signing Chase and Wells). With CDLX expected to soon be hosting the tech and new ad server for all banks (including BofA), and having it in the cloud, Cardlytics has more control over the updates and can push updates to all the banks significantly quicker (and likely at the same time, with the banks being in the same version now of an ad server, unlike before). Therefore, while Cardlytics has historically been constrained by how quickly BofA moves, the constraint will be nearly completely removed. Getting the banks to the new ad server (which will unlock product-level offers, local offers, new user experience with richer imagery, offers from agencies using self-service which only work on the new ad server, and more) should be the last large update whose timeline will be at the mercy of the banks. Once completed, small updates can be quickly pushed by CDLX, and no significant large update besides the new ad server will be needed for a considerable time, especially in relation to the financial benefits CDLX will experience from this single update.

See “Update 2: BofA Renewal and Banks Moving to Cloud” for details on the update provided at earnings

Other concerns, such as related to being another Groupon, the rise of loyalty programs and therefore the decline of CDLX, insider selling, company reviews, and more have been discussed previously. I did not include them here, as I wanted to keep this post related to the updates heard at Q1 earnings. For more information on these additional areas, see the Cardlytics Research Notes:

While this is likely an oversimplification, I believe a large portion of the CDLX stock decline can be attributed to investors selling off the stock as these concerns were first risen. However, as new pieces of disconfirming evidence surfaced, such as even those shared during Q1 2022 earnings, those same investors never changed their mind or returned to look at the updated situation.

High-Level Conclusion

What will it take for the market price of Cardlytics to change? Based on the current market and its reactions, it will not be the evidence of the business improving or disconfirming evidence of the short thesis.

In this current point in time with the market sentiment, it will likely need to be results that are seen and therefore have 100% certainty.

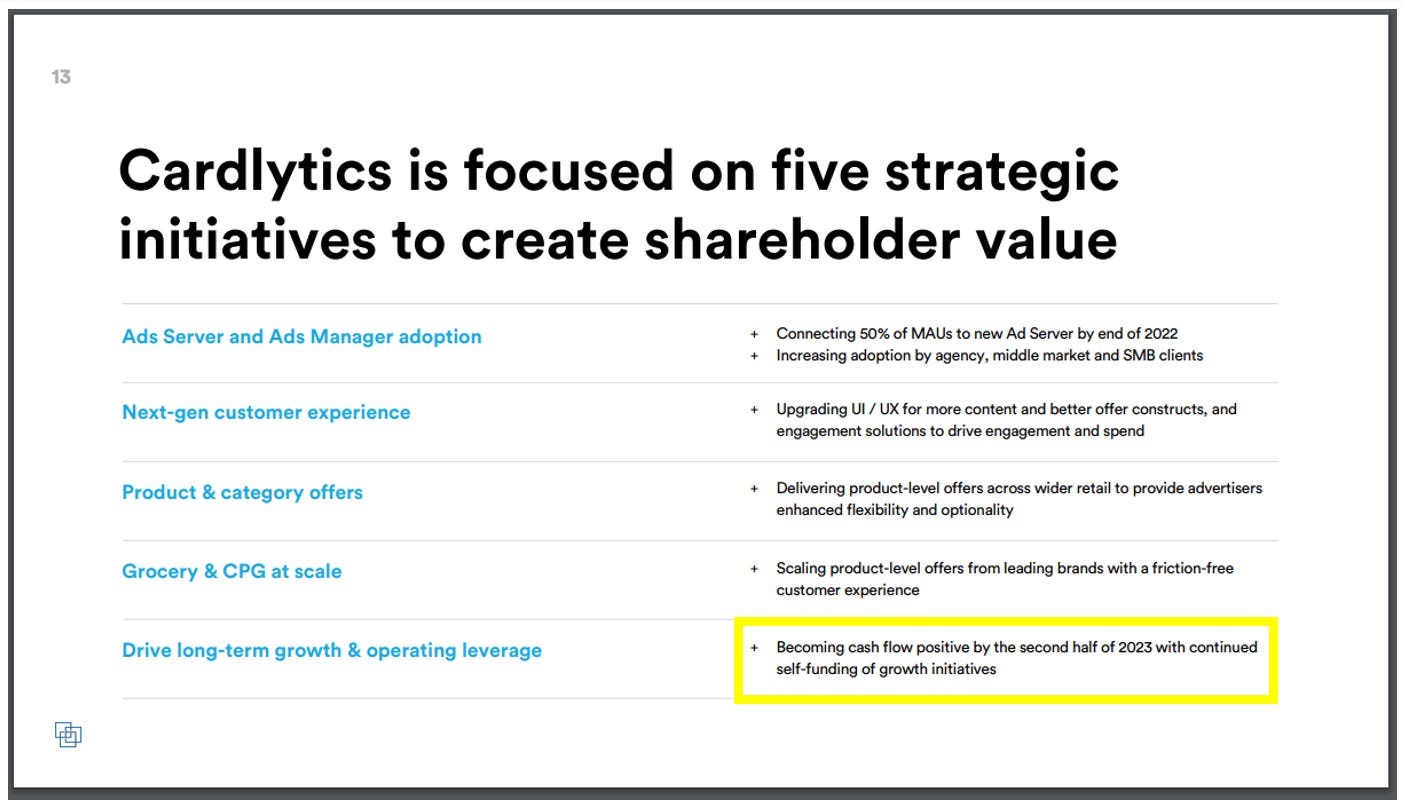

We could see some adjustment in the market price with the official announcement of BofA renewing. Where we will see much more material changes in the market price is from cash flow materializing. Luckily Cardlytics is on track to be cash flow positive by the “second half of 2023” (moved up this quarter from the “end of 2023”, showing an improvement)[see footnotes for detail on an edit made after sending out the original email1]. If Cardlytics continues executing like they have been, and banks + users + advertisings continue to respond like they have been, we should see cash flow start to materialize, especially with adoption of the new ad server. If Cardlytics continues to grow Open Banking operations as well, cash flow generation could be quite significant in relation to the approximate $1B market cap today (such as the base-case levels I discuss in the Open Banking write-up). I think it will be hard for anyone to justify a market price that is a conservative multiple of cash flow when the business has a long runway for growth, overall improving gross profit margins from Bridg and from Dosh and Open Banking partners, strong operating leverage, and competitive advantages for longevity.

The remainder of this post will go more in-depth with the updates shared at Q1 2022 earnings.

Banks Increasing Visibility

BofA Renewal and Banks Moving to the Cloud

Double Investment Spend by Bank

Bridg and CDLX Cross Selling and Solving Attribution Problem

New Bridg Clients

Clients Using CDLX Insights

Self-Service Platform Improvements

Self-Service Scalability and new Partners for Local Content

Entertainment Local Offers

Engagement on New Ad Server

Dosh New Partners

Dosh Marquee Partner

Changes in Language / Presentation / Logos

Q1 Numbers

For all my notes and thoughts on CDLX, which I continually update and is nearly 600 pages, check out my Qualitative and Quantitative “Research Notes”:

Cardlytics $CDLX: Qualitative Notes (308 Pages and 78,171 words)

Cardlytics $CDLX: Quantitative Notes (282 Pages and 96,504 words)

These notes contain information I have not shared elsewhere. For more general information on Research Notes, see here.

For the large number of you who are already premium subscribers, you have access to these notes, and will also receive access to my upcoming set of Carvana notes which I am finalizing to release.

Update 1: Banks Increasing Visibility

The first update I want to discuss reflects how a small improvement can lead to dramatically better results for Cardlytics.

The Update

“One of our large banks have seen twice as many mobile activation since they improved the program visibility in late February.”

Impact

This is a very large increase in mobile activations from simply improving the visibility of the Cardlytics offers.

Improving the visibility of the offers likely leads to more users finding the offers for the first time, as well as others more frequently coming across the offers and spending a couple of seconds to check them out.

I have Wells Fargo, and noticed the mobile app had an update to their user interface. Looking on the app store, the first update was on Feb 17, 2022, matching the “late February” comment by Cardlytics shared above. Therefore, I believe this “large bank” was Wells Fargo.

To me this update also shows that banks are giving some more priority to Cardlytics. A large portion of investors I speak with worry that since CDLX relies on the banks, the banks could place CDLX offers in worse placements.

Instead, we are seeing the opposite, with improved placement. And placement is not the only thing improving, as we know the banks have continued to want more, such as from wanting to move to the ad server and get all the associated benefits.

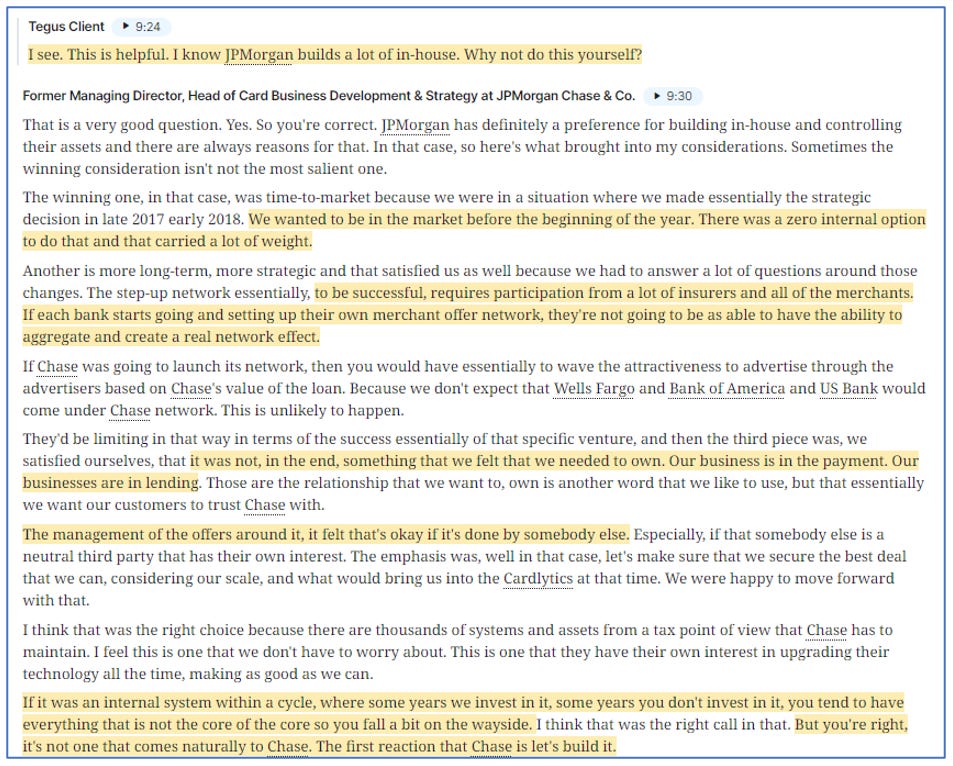

From a 2020 Tegus interview with the Former Managing Director, Head of Card Business Development & Strategy at JPMorgan Chase & Co:

“I’d say that it's odd to remove the service because you don't want that. Moving it another place where it's a lot harder to find, there will be a cost to that. Because you get calls, people are not understanding, it used to be here, why is it not here, you get all those things.”

This updates likely also show that users of CDLX offers have the attributes we hear, such as higher engagement, more spend, less attrition, and more.

From that same Tegus interview with Chase:

“We know that when you click on that type of offer, you're going to be increasing your spending by X percent, increasing your revolving bonds by Y percent, and creating the NPV of the relationship by Z percent.”

This would explain why the banks are placing the CDLX offers in a better position to increase the number of users who use CDLX offers and therefore have more bank users that have these additional beneficial characteristics.

I felt it was important to start with this update given it includes some quantification. This allows us to use this update as a reference point for rest of the updates. I believe the other updates will have a larger impact, with some that would even compound.

Long-Term Impact

This updates decreases the risk of banks deprioritizing or hiding the Cardlytics offers, let alone dropping the platform (a point that is strengthened in the section discussing one bank doubling their investment in the channel).

We should also see higher awareness and therefore higher engagement and redemption within this single bank. If more banks do something similar, we could see large increases in these factors, which strongly benefit Cardlytics as well. This might even create a virtuous cycle, where the improving of the platform by CDLX and increase in advertisers likely have led to the stats bank track to all be improving, leading them to increase the visibility of the program, which increases number engaged users and redemption of offers, likely leading to more advertisers using the platform, and so on.

What is also interesting is hearing that such a small change led to such a big impact. What happens to activation rates (and also redemptions and therefore ARPU) when the banks have a significant change such as the new ad server? Then what about layering on the new user experience with images for the first time, more offers from the self-service platform, local offers from Entertainment, product-level offers from Bridg, boosted offers from the bank self-service platform “Engage”, higher ad spend by CDLX + Bridg clients for solving the attribution problem (discussed more in this post), and even push notifications? Cardlytics has so many positive updates coming that all compound, and should lead to a non-linear outcome.

Update 2: BofA Renewal and Banks Moving to the Cloud

Many investors were waiting for the BofA update during the call. I believe there are many who still worry the renewal will not happen, or are simply waiting for 100% certainty in the renewal in order for the perceived risk to decrease. This gives others an opportunity to take advantage of a mispricing, where the current price almost reflect most assuming BofA is not renewing, despite a near 100% chance of renewal.

Said differently, it as if most already assume BofA isn’t renewing, so the market price reflects the value of CDLX without BofA. One way to think about it is with expected values. If you assumed the discounted value at year 10 of CDLX without BofA was $1B today (I think it is more), and thought with BofA it was around $5B (I think it is more), most are assuming 0% chance of BofA renewing, and therefore assume the value is where there is no BofA, leading to the market cap of around $1B, from $1B * 100% + $5B * 0% (this is an extreme oversimplification to illustrate this idea, but it also shows when there becomes certainty in the renewal from an announcement, the price could change). Therefore, even if the there was a slight positive probability of renewing, there is currently a mispricing, since most are assuming 0% chance of renewal. Well, I believe the probability of renewal is near 100%, leading to a difference in expected value with anyone who assumes less for the probability of renewal.

As a reminder, whether or not BofA renews is not much in question (but I admit, anything could happen). Instead it is more up in the air with what will be in the new contract (as you can also see in the January 2022 quote below).

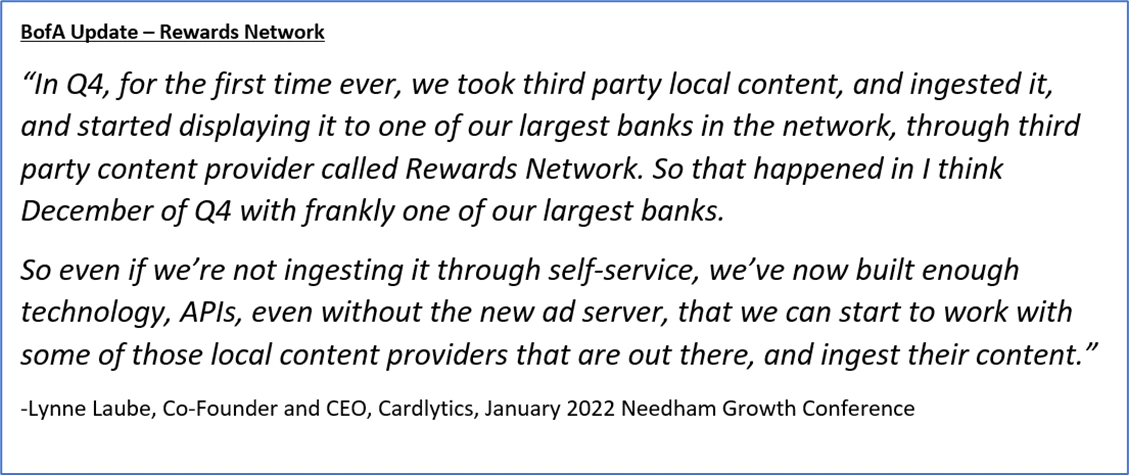

The Update

“Our bank relationships continue to be strong. All but 2 of our banks have committed to moving to the cloud, and 1 of those 2 is in the final stages of approval. The last bank is a midsized bank, and we expect to receive approvals from them in 2022.

The Bank of America contract is still on pace to be renewed, and we're progressing nicely. We fully expect to come to an agreement that is mutually beneficial for both parties.”

Short-Term Impact

I assume the one bank that is in the final stages of receiving approval for moving to the cloud is BofA, given BofA is not “midsized”. This would explain why Cardlytics continues to hold out and does not have a new agreement signed, since this is one of the five items Cardlytics was negotiating on during the December 2021 conference, and was mentioned again during the January 2022 Conference:

I also believe BofA is that one bank in the final stages of approval for the cloud given CDLX gave the BofA update in the next sentence.

I have already felt that the probability of BofA renewing was extremely high (as discussed in this detailed write-up, as well as in this update post). What has been more in question has not been whether or not BofA will renew, but what will be in that new contract. This update at Q1 shows Cardlytics is likely getting the most important items in that updated contract, such as hosting the tech, having it in the cloud, and with the new ad server.

Long-Term Impact

As a reminder, BofA is the only major bank where Cardlytics does not currently host the tech, and it is still sitting within BofA’s environment. Cardlytics described at the 2021 Raymond James Conference what this means:

Therefore, Cardlytics should be able to now make changes on a much quicker pace, similar to Chase and Wells Fargo.

With Cardlytics hosting the tech / new ad server, they will put it in the cloud. Having all the banks moved to the cloud and on the new ad server will be a strong benefit for Cardlytics.

From my understanding, Cardlytics needs to host the new ad server in the cloud to unlock:

Dynamic / machine-learning pricing and targeting

The new ads marketplace which could help with things such as being more real-time and optimize based on current ad inventory

Allow a single point for all the different banks to connect to and on the same version, similar to Dosh and their partners, and different than today where I believe all the banks are on a different version of the current ad server

The new ad server also allows for many of the updates discussed in the remainder of this post. Meaning without banks adopting it, Cardlytics users will not experience the majority of these benefits, which include:

Product-Level Offers from Bridg Clients: Increases number of offers since now brands and CPGs can place offers, increases relevance offers since more specific, and higher cashback due to different margin profiles.

Local Offers: Includes CDLX’s Entertainment Offers or third-party content like Rewards Network, which increases number of offers in the channel and probability of finding one relevant and attractive to redeem.

More Offers from Self-Service: Currently sounds like self-service has been currently limited to the new ad server, where U.S. Bank is the only one on it, so as more adopt the new ad server, more will receive offers from self-service users, such as ad agencies and eventually SMBs.

Richer Imagery / Hero Imagery: Increases understanding of offers, since no longer just a logo. This has been shown to increase click rates to external websites by 2x - 4x, which increases the odds of redemption (and therefore revenue / ARPU for CDLX).

Push Notifications: This is already seen with U.S. Bank. Push notifications increase awareness of the offer section in general (and therefore engagement could increase) and awareness of specific and relevant offers (increasing redemption and ARPU).

Time-of-Day Offers: These offers would likely be higher in cashback due to the extra benefits of increasing traffic during specific times of day. Could be similar to Dunkin’ having 50% of iced coffee from 2-4pm (which would then leverage many of the new features above, such as richer imagery, product-level offers, push notifications, and the time-of-day aspect).

I believe Chase will be on the new ad server this year, to get to the 50% MAU goal by the end of 2022. We already know Chase was supposed to be on it by the end of 2022 (as discussed in the write-up), but sounds like it got delayed for reasons on Chase’s side. Wells Fargo and BofA will likely be in 2023.

Update 3: Double Investment Spend by Bank

The Update

“Another large bank is planning to nearly double their 2021 investment spend into the program to leverage our offers as an extension of their core loyalty program”

Short-Term Impact

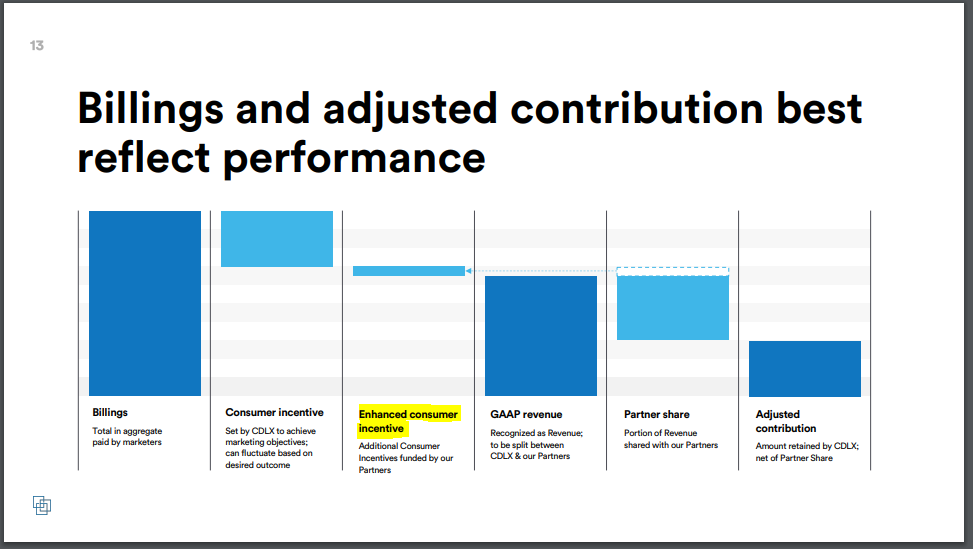

The one area where I believe this additional investment would be spent within the Cardlytics channel is to boost offers. We have seen and heard banks using their revenue share to add to the consumer incentives.

This is discussed in the 2021 10-K:

“Consumer Incentives grew at a higher rate than billings during 2021 compared to 2020 primarily as a result of changes in advertiser mix and an increase in Consumer Incentives funded by partners through a reduction in Partner Share.”

“Partner Share and other third-party costs increased by $32.0 million during 2021 compared to 2020 primarily due to increase in billings partially offset by an increase in Consumer Incentives funded by partner through a reduction of Partner Share.”

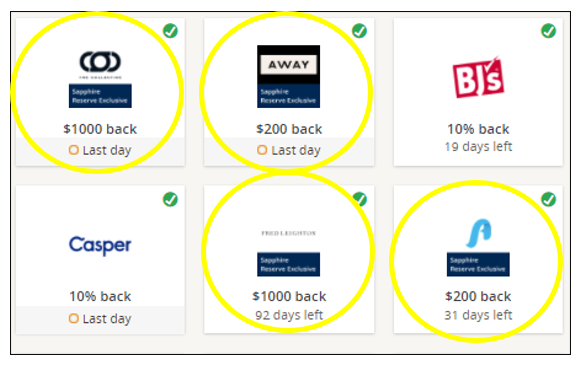

This is also shown in the earnings presentation, where a portion of the “Partner Share” is added to the consumer incentive, as seen in “Enhanced consumer incentive”:

The enhanced consumer incentive could be coming through the new self-service for banks, “Engage”, which allows banks to boost their offers, leading to much higher cash-back offers (similar to AmEx offers).

I discussed this in the write-up on the self-service for banks. The following is a summary of the benefits, including higher cash-back from boosting offers.

I would guess the bank that is doubling their 2021 investment is Chase. This is given the increase in Chase Sapphire Reserve Exclusive Offers, and the success of campaigns like Allbirds and Away Travel which has likely led them to spending more.

On October 1, 2021, I received the Allbirds and Mr. Porter offers. The only other Chase Sapphire Reserve Exclusive offer in 2021 was Kwiat.

I cannot remember the exact dates, but I believe all of the following offers were in 2022.

This alone may have been enough to double the investment by Chase. However, both the Allbirds and Away Travel offers were very successful based on Yipit data. Therefore, Chase may have spent quite a bit boosting these offers. If that is the case, Chase could end up doing even more throughout 2022 than only those exclusive offers shown above.

Chase has even discussed reinvesting their revenue share back to their customers:

Rev Share: “But then Chase decides for the balance of the money, essentially how much goes to the customer and how much Chase keeps. The intent for Chase was not to keep more, the intent was to keep less and channel more value to the customer so that they keep that ladder of keeping those offers as interesting as possible over time.”

- Tegus interview in 2020 with the Former Managing Director, Head of Card Business Development & Strategy at JPMorgan Chase & Co

A few additional related quotes from the Tegus interviews in 2020 with the Former Managing Director, Head of Card Business Development & Strategy at JPMorgan Chase & Co.:

Pulling Back the Program from Customers: “You're right because it's just very hard to take something away from clients. So yes, I think it takes a lot for that to be pulled back and tallied. Particularly, because it doesn't cost anything, so I don't see it being pulled back.”

Chase Considering Building Program In-House:

What makes this even more interesting, is how many feared that Chase was going to move their offers program in-house, given some plans for additional spending in similar areas and more related job openings at Chase. Therefore, many of those fears should be minimized given the previous comments made by Chase and likely being the one increasing their investment into the CDLX program. I believe this is why CDLX shared this update, as many of their updates (both in this earnings calls and previous ones) are specifically given to address know concerns.

Long-Term Impact

Between the one bank improving the visibility of the program here in 2022, and this potentially separate bank doubling their investment into the Cardlytics program in 2022, I believe it shows banks are not looking to drop the program, nor deprioritize. And this makes sense. The Cardlytics offering is improving, and will continue to improve with the new ad server, product-level offers, local offers, and more.

I believe other banks will eventually increase their investment into the program. It becomes very easy to do so if they are simply using their revenue share which they receive from Cardlytics. This reinvesting and boosting of offers leads to differentiation among the Cardlytics banks, and leads to much more attractive offers for users, leading to higher engagement and redemption. Everyone benefits.

Update 4: Bridg and CDLX Cross Selling and Solving Attribution Problem

In my in-depth Bridg write-up, I discussed the idea of Cardlytics cross selling their CDLX clients to become Bridg clients and also how Bridg can help solve the attribution problem, or believability or trust problem with the core CDLX platform.

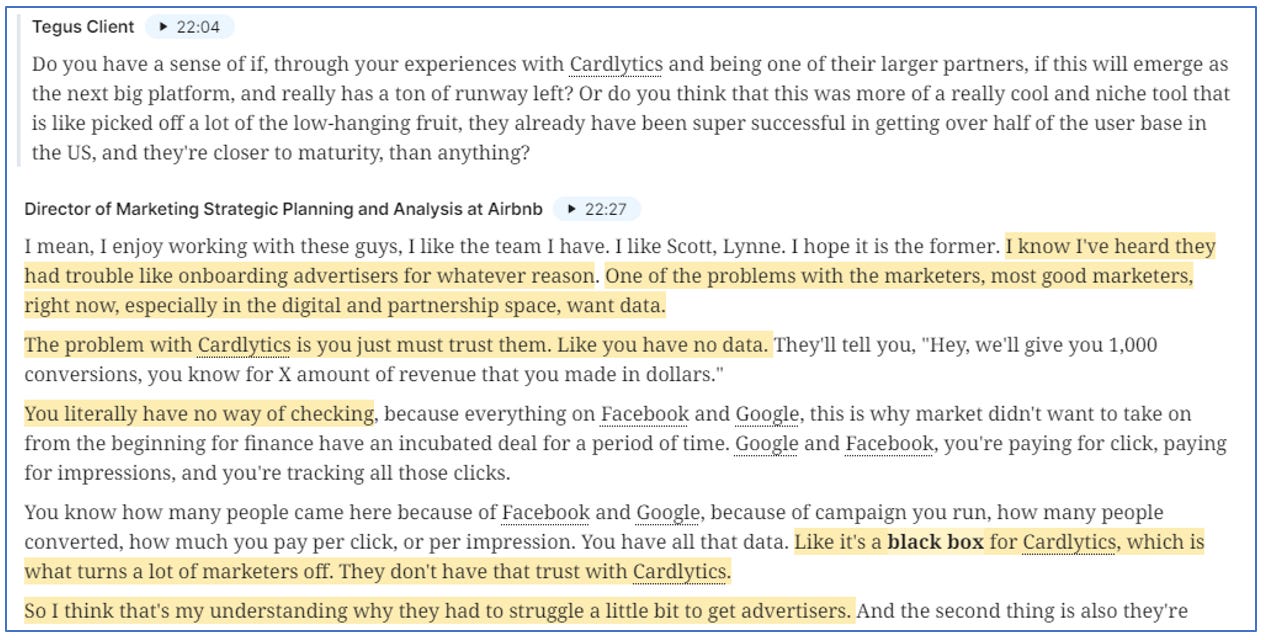

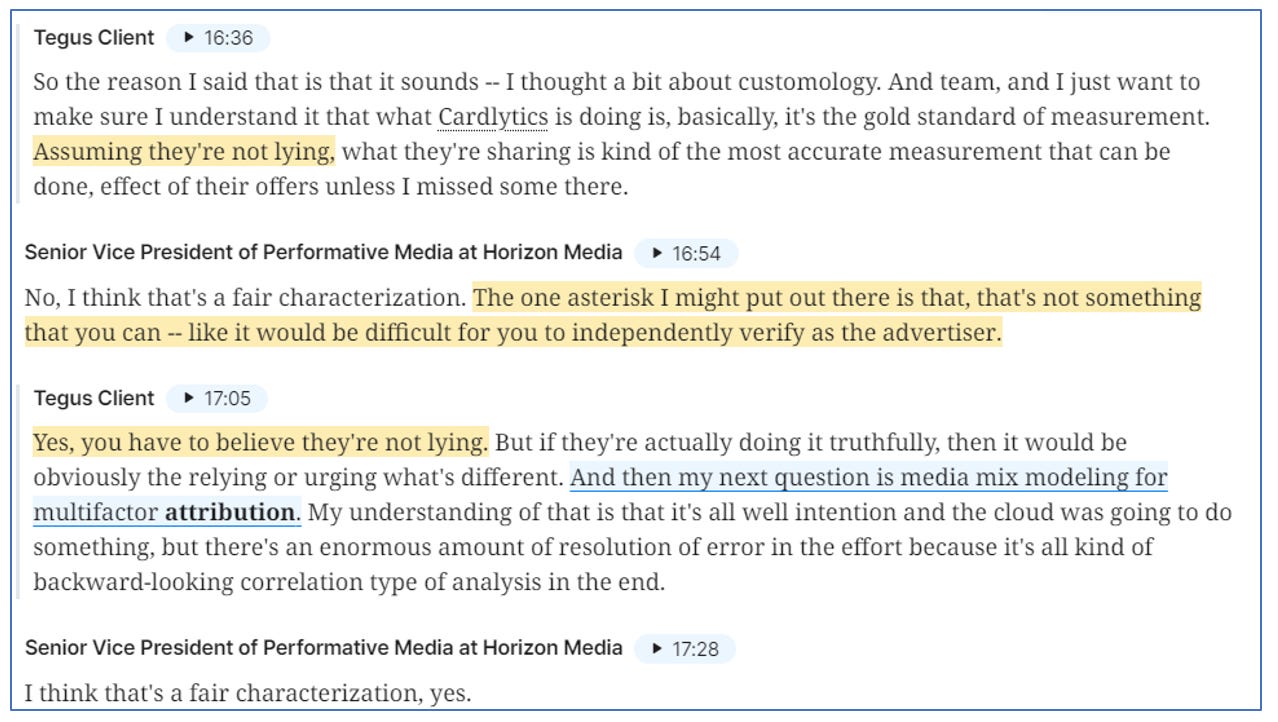

In short, Cardlytics cannot give the same individual level of data that advertisers are accustomed to. This is because it is the bank’s data, and they are not looking to export that data and risk data leaks related to personally identifiable information (PII). The measurement results are in aggregate, and the data stays with the banks, therefore the advertisers cannot easily independently verify the data or confirm the results, and is therefore considered a “black box”

Airbnb:

Panera:

“The challenge with it is it you're having to trust the platform, it's very difficult to independently validate their data.”

- Tegus Interview. SVP, Chief Digital Officer at Panera. 9/7/2021

Horizon Media:

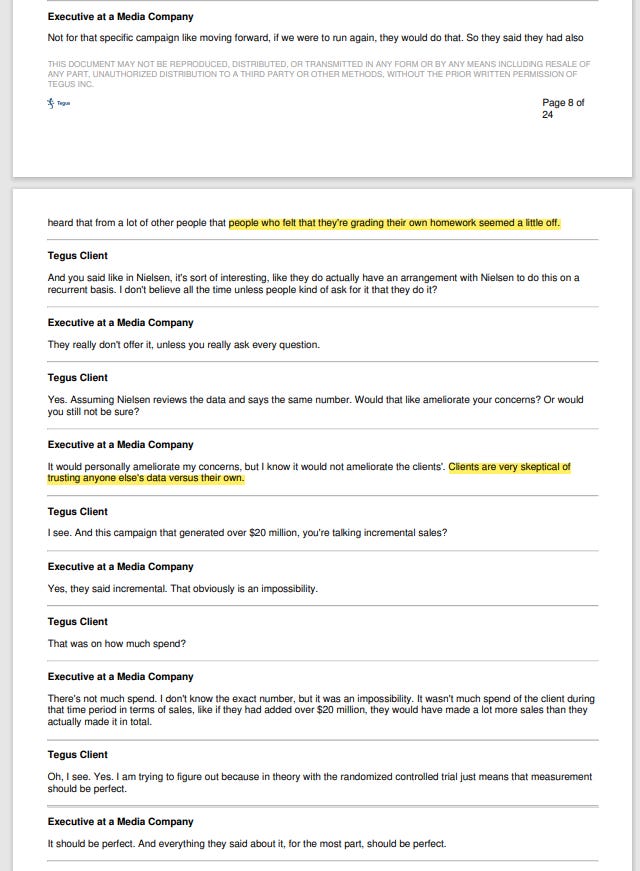

Media Company:

This discussion, including what is not highlighted, always stuck in my mind:

This is why the following update was very important to hear.

The Update

“We have 25 clients that we've identified are ideal cross-sell targets for Cardlytics and Bridg. These are clients that we know would benefit from the Bridg solution. And in many cases, these are clients that are worried about measurement and attribution on the Cardlytics solution. So the ability to have Bridg be their own attribution solution is really powerful.”

Short-Term Impact

The Bridg data is owned by the Bridg client, not the bank. This gives the ability to have more view into their data and perform more of their own measurement of results, helping solve the attribution problem.

Given some clients have not fully believed the results given the lack of ability to independently verify (such as those CDLX referred to in the update), this should allow them to do so, leading to more trust, and therefore more ad spend.

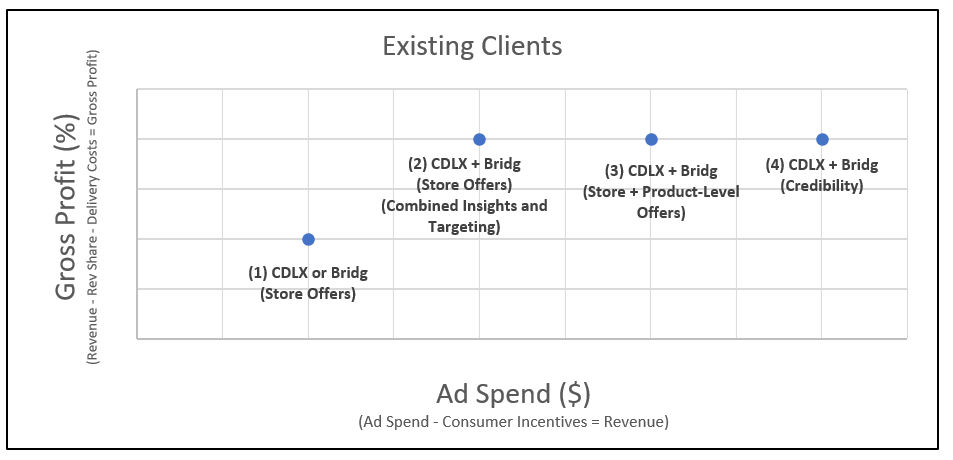

In the Bridg write-up I discuss the potential benefit for existing clients. In the context of the Q1 2022 update and cross selling, we have current CDLX clients at (1) below, with lower ad spend at a lower gross profit margin. If they become Bridg clients as well from the cross selling, they benefit from having combined insights and targeting ability, where this has led the clients of both to increase their ad spend, which is also at higher gross profit margins (2). Then you have those clients being able to also place product-level offers now, which increases ad spend more (3). And finally, and directly related to the Q1 comment, is these have been clients that have not fully believed the results of Cardlytics. By solving the attribution problem, and increasing believability, it should lead to even more ad spend (4).

Long-Term Impact

Another section in the Bridg write-up is “Growth from New Clients due to Solving Attribution / Credibility / Believability Problem”. My thought was there are advertisers not using Cardlytics at this time due to the attribution problem, or rather the due to the lack of trust with Cardlytics results. This was even mentioned in the Airbnb interview included above.

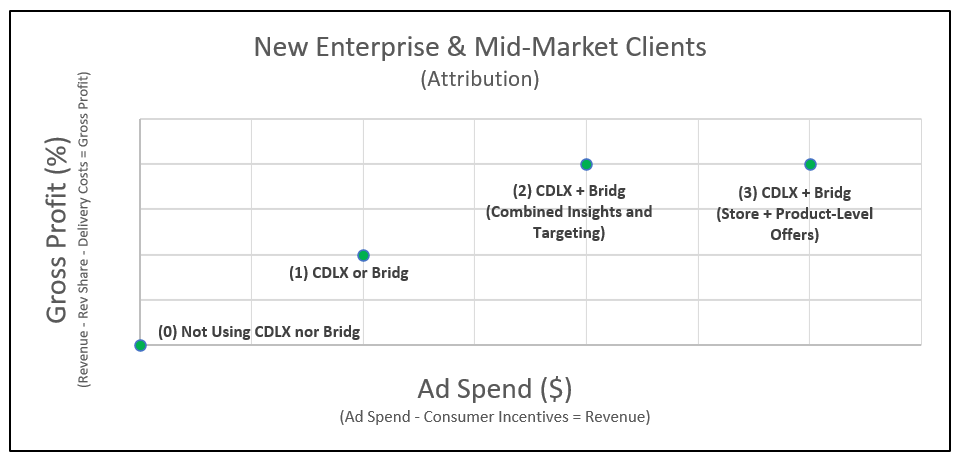

Making it easy for these advertisers to become both Cardlytics and Bridg clients, and then solve this attribution problem, it should lead to more advertisers using the platform, with similar benefits as above, where these advertisers who have been at (0) below (from not being clients due to not being able to independently verify before) will jump to (2) with now advertising and also having combined insights and targeting ability (since they will also have to be Bridg clients to solve the attribution problem) and then possibly spend more with product-level offers and move to (3).

For significantly more detail on this topic, see the Bridg write-up or the related sections in the Research Notes:

Cardlytics $CDLX: Qualitative Notes (308 Pages and 78,171 words)

Cardlytics $CDLX: Quantitative Notes (282 Pages and 96,504 words)

Update 5: New Bridg Clients

The Update

“The Bridg progress and pipeline remains strong and still includes late-stage opportunities in CPG and grocery that we mentioned last quarter, which are very close to being signed.

In addition, we have several new pipeline opportunities within retail, grocery and convenience and restaurants that were initiated through a joint sales effort between the Cardlytics and Bridg teams.”

Short-Term Impact

If these are clients of both CDLX and Bridg, we could see additional ad spend from the combined insights and targeting, and from solving the attribution problem. It will take a little bit of time to see the increase in ad spend from product-level offers, since currently only U.S. Bank is on the new ad server.

Long-Term Impact

We should continue to see more cross selling, and I would expect in time the majority of Cardlytics clients will become Bridg clients. I hope this becomes extremely easy and frictionless, eventually allowing SMBs through self-service to leverage the benefits of both CDLX and Bridg.

Update 6: Clients Using CDLX Insights

Cardlytics can provide their clients with some unique insights, such as related to the clients’ competition.

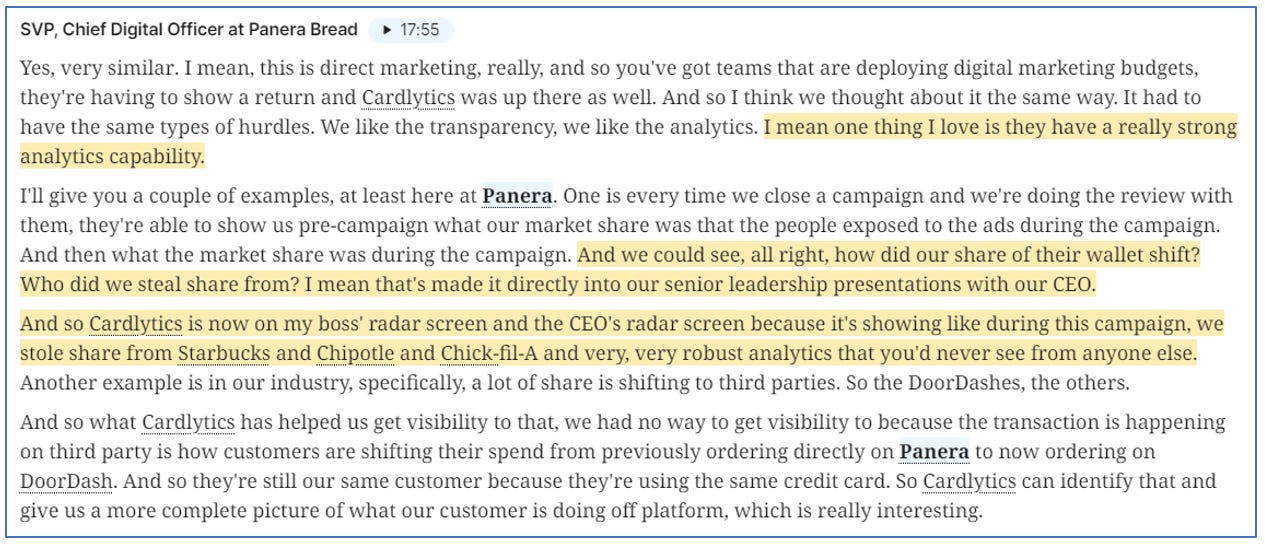

An example of this was shared in an interview with Panera’s Chief Digital Officer. What always stuck in my mind after reading this is how they reviewed the CDLX analytics and competitive insights in senior leadership presentations with their CEO.

The Update

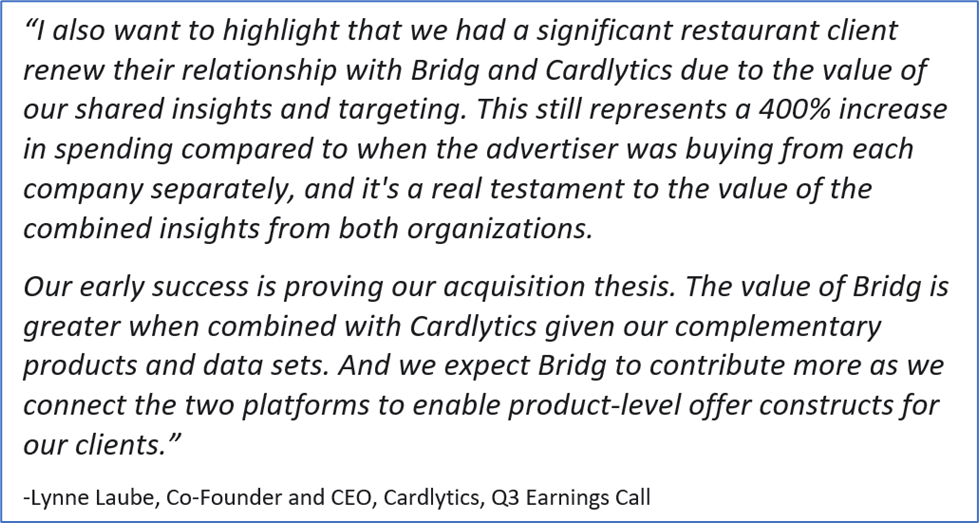

“In the direct-to-consumer sector, a large subscription service provider that piloted with us in 2021, signed a new contract in the mid-7 figures. While incremental return is important to this client, a key factor in the increase was the unique insights that we can provide on purchase behavior around subscription rates and churn rates.

For retail, consumer spending is still growing, and we're seeing a stronger-than-expected return to brick-and-mortar. We had 8 7-figure contract wins in the retail space in Q1 due to our incremental return and custom competitive insights.”

Short-Term Impact

We have heard in the past that when an advertiser spends over a certain amount, getting into that tier gives them additional insights from CDLX.

Therefore, I wonder if that is why when discussing the client signing a mid-7 figures contract CDLX says, “a key factor in the INCREASE was the unique insights that we can provide…” Meaning, this client may have increased their ad spend in order to unlock these insights. This would also line up with the eight new 7-figure contracts, where CDLX is calling this out given it was related to spending at this tier to unlock the insights, since “due to…custom competitive insights”.

Why does this matter? It gives a strong incentive for existing clients to increase their ad spend above a tier (possibly 7-figures, given CDLX mentioning that amount twice) to unlock these insights, and new clients to start their ad budgets above this amount to unlock the insights. This is powerful, given this increases ad spend and therefore revenue for CDLX.

This is a work-around of not being able to sell the insights, given it is the bank’s data. I feel this is even better, given it would directly increase usage of CDLX and benefit users and therefore banks as well, and not just CDLX.

Long-Term Impact

I believe if more advertisers start using Cardlytics to take advantage of the unique insights Cardlytics can provide, we may see more use them in regular senior level meetings like Panera. This can lead to a reliance on the data, leading to continued usage of the platform.

One very interesting and important observation: CDLX said “custom competitive insights”. If custom, clients of CDLX could become even more reliant on this data they can’t get elsewhere, leading to very sticky clients. This is a trait I look for in businesses that I’ve never seen show up in Cardlytics until now. Another reason this is powerful is it gives rise to pricing power. But what is stronger here with CDLX is it would be forcing higher ad spend, which benefits everyone.

If the insights are as good as I believe they are and what they seem to be based on the comments made such as by Panera, others may feel they are at a disadvantage without these insights. This could lead to more advertisers joining and using Cardlytics to also benefit from the insights Cardlytics can provide.

We may also see more ad spend with the combined insights when a Cardlytics client also becomes a Bridg client, as seen by the following example:

Update 7: Self-Service Platform Improvements

The Update

“We also produced several new reports for agencies via our self-service tool in the quarter.”

Short-Term Impact

There were some comments in Tegus calls back in December 2021 that not all the usual reports that advertisers see in managed services were in the self-service platform, so it is good knowing they added new reports and ensure self-service meets their expectations.

What is unclear though is if they have added everything that advertisers are requesting. The most important would be showing results versus the control group and detail around incrementality.

Long-Term Impact

The self-service platform is very new. No one should expect that the self-service platform should be just as good as the top advertising platforms day one (although ad agencies and investors do). This update at least shows Cardlytics continues to improve the tool, and over time we should see them close the gap between where it is today vs where needs to be to be on par with other advertising self-service platforms.

Additionally, the reach of self-service will grow significantly as more banks adopt the new ad server, which is required to place self-server offers.

Update 8: Self-Service Scalability and new Partners for Local Content

The Update

“In the first quarter, we began piloting local content from a partner with one of our major banks. This is an exciting development and allowed us to test the scalability of our new Ads Manager. In this pilot, we included over 300 hyper-local advertisers from a third-party content provider.

In addition, our newly formed mid-market group sold and republished 200 mid-market advertisers in Q1, bringing our total advertiser count for the quarter to over 600 advertisers. We are well on our way towards reaching our goal of having over 1,000 advertisers running simultaneously on the platform in 2022.

This pilot is also important because it tests our new platform scalability. On the old platform, we could launch a maximum of 40 new campaigns a week. With this pilot on the new platform, we launched 325 campaigns over a few days. This is a compelling early proof point on the potential to reach many thousands of advertisers over time.”

Short-Term Impact

Likely Rewards Network third-party content is the hyper-local offers, based on previous information we have heard in past conferences (such as discussed in the BofA write-up and BofA update write-up).

However, the above quote mentions December of Q4, not “first quarter” as mentioned on the Q1 2022 earnings update. Therefore this could even be with a different “major bank” like Chase or Wells. I have both, and have not seen local offers, not as mentioned in the late, Cardlytics is currently only doing a pilot.

[Update as of 5/16/2022: Based on comments from CDLX management today with some investors, it does sound like BofA was in fact working with Figg who was getting their local content from Rewards Network. Before this confirmation, it was still not clear to me if BofA was working with Figg or working directly with Rewards Network. Additionally, I originally thought CDLX was taking over pushing Rewards Network content for Figg within BofA (based on a quote discussed in the BofA update post). This assumption was due to the cryptic way CDLX described the situation, and also separately mentioning pushing Rewards Network content. Based on CDLX management comments today, it does not seem as though CDLX was pushing Rewards Network offers for BofA. Instead, CDLX is pushing Rewards Network content for another bank, but BofA is aware that CDLX is doing this. CDLX also reiterated that Figg is likely not getting purchase data from BofA (which matches other comments elsewhere). Where this gets complicated, the Jan 2022 comment says CDLX started pushing Rewards Network content in Dec 2021 for one of their largest banks. We now know that it was not BofA. Given the “Shop Local” Chase offer as of 12/30/2021, this comment was likely related to Chase. However, the offer seen was for automotive, where Rewards Network is usually for restaurants. It could be this offer was from the Entertainment acquisition, but the Q1 comments on May 2, 2022 make it seem CDLX has not yet started pushing out any of these offers to the banks, and CDLX did not acquire Entertainment until Jan 7, 2022 (after this offer was seen). To add to the confusion, in Q1 on May 2, 2022, CDLX said “In the first quarter, we began piloting local content from a partner with one of our major banks. This is an exciting development and allowed us to test the scalability of our new Ads Manager. In this pilot, we included over 300 hyper-local advertisers from a third-party content provider.” The first quarter is much different than the comment in Jan 2022 saying CDLX started pushing Rewards Network content in December of Q4. Also, this comment of “first quarter” would be after the Chase “Shop Local” offer as of Q4. While a name was not mentioned in Q1 for the third party local content provider of the 300 hyper-local offers, CDLX mentioned today it was Rewards Network. Therefore, while I thought maybe there was two different CDLX banks getting local offers, I believe at this time it is only one bank, coming from Rewards Network, and likely Chase. I believe the difference of when these offers started was likely just an oversight when communicating, but I could be wrong, given I do not think the automotive offer would originate from Rewards Network.]

600 advertisers in Q1 is quite the increase from 505 logos in Q4, and getting to over 1,000 by year end is even more impressive.

Long-Term Impact

This update shows how CDLX could onboard many more at quick rates. This includes ad agencies and eventually SMBs from self-service, partnerships with POS venders like discussed in the Bridg section of the Research Notes and this Bridg write-up, local offers from the Entertainment acquisition, or leverage all the partners already being used by Dosh like Rewards Network or more affiliate-type partners, which could all contribute to get to the “many thousands of advertisers.”

Update 9: Entertainment Local Offers

The Update

“Integration with Entertainment is proceeding well. The acquired business met expectations for the quarter, and we're working to start leveraging their content on the broader Cardlytics platform.”

Short-Term Impact

These local offers from Entertainment will likely contribute to getting to the goal of 1,000 advertisers running simultaneously on the platform that Cardlytics mentioned during earnings (shared above).

Adding all of these local offers will increase relevance and attractiveness of offers, and therefore engagement, redemptions, and revenue as well.

From this we could see more banks continuing to increase the viability, awareness, and their investment of the CDLX program, as we are already seeing.

Long-Term Impact

Given the Entertainment business is meeting expectations, it increases the odds of being able to get Entertainment local offers to a place where CDLX can allow non-CDLX banks to use them, such as AmEx or USAA. Over time, this may lead to them becoming full partners, which would increase MAUs for Cardlytics, and increase the attractiveness of the platform even more for advertisers from the additional reach and data.

This idea of using the Entertainment acquisition to get AmEx and USAA comes from the following:

“Additionally, we think this content will help us penetrate other banks who are hesitant to show their data but still want local content.” - Lynne Laube, Co-Founder and CEO, Q4 2021 Earnings

and

“And one last point I'll make, and I know I said this in the script, but I do think it's an interesting way for us to penetrate banks that are not quite yet comfortable giving us their data. But let's give you some of our content, let’s give you some of our technology and then but slowly work our way into getting your data, I think could be an interesting Trojan horse for us as well.” - Lynne Laube, Co-Founder and CEO, Q4 2021 Earnings

Why this most likely relates to AmEx is the following comment in January:

“So, you know, we’re watching those. They are definitely opportunities. Certainly the one we would love to have is AmEx, which is a home-grown program. Not sure we’ll ever get them quite frankly, because they have this religious thing, as they should, about they don’t want to give their data to anyone. And we need data. So we’ll see.” -Lynne Laube, Co-Founder and CEO, Cardlytics, January 2022 Needham Growth Conference

This shows AmEx is a bank CDLX wants, that also currently has a data hurdle. Therefore, CDLX could give AmEx these local offers first, and worry about the data later.

[Update as of 5/16/2022: I removed some comments related to BofA, given they were not correct, after hearing an update from CDLX management today]

Update 10: Engagement on New Ad Server

The Update

“We continue to see the new ad server outperform the old server in interesting ways. For instance, customers that are served hero imagery are 2 to 4x more likely to visit an advertiser website via an external click.”

Short-Term Impact

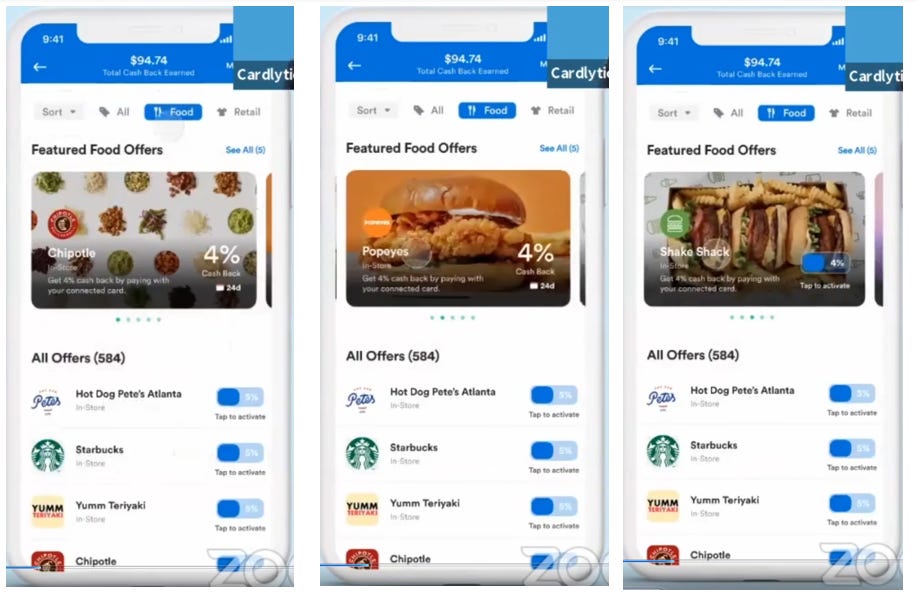

During the investor day presentation, it was mentioned that the new user experience would have “premium hero offers that in the future may demand premium pricing”, as they went through the large images in the food category of offers:

At that time, they were seeing with U.S. Bank that “Premium Imagery drove 5x visits to website on average”.

We also heard an update in January 2022:

“You talk about the new user experience. We compared campaigns in Q4, the same exact campaign, that ran on the old experience versus the new experience, and we saw a minimum of 200% increase in click rates. 200%. Some campaigns had 400, actually over 400%.

So, engagement is not our problem. And as more banks adopt the new ad server, its going to become even more not our problem.

-Lynne Laube, Co-Founder and CEO, Cardlytics, January 2022 Needham Growth Conference

For right now, this benefit will only be seen with US Bank users, as they are currently the only ones on the new ad server.

Long-Term Impact

As more banks move to the new ad server, more users will see these improved images, leading to higher understanding of offers and higher engagement, as well as more users experiencing the 2x to 4x in click out rates, leading to more qualifying purchases, which would increase average revenue per user (ARPU).

Update 11: Dosh New Partners

The Update

“With our recent focus on neobanks and fintechs via Dosh, we now have 18 publishers live and 15 publishers that are under contract and scheduled to launch later this year.”

Short-Term Impact

The update above compares to the one provided Q4 2021:

"With Dosh, now have 13 publishers live with the program and 19 publishers under contract and scheduled to launch later this year."

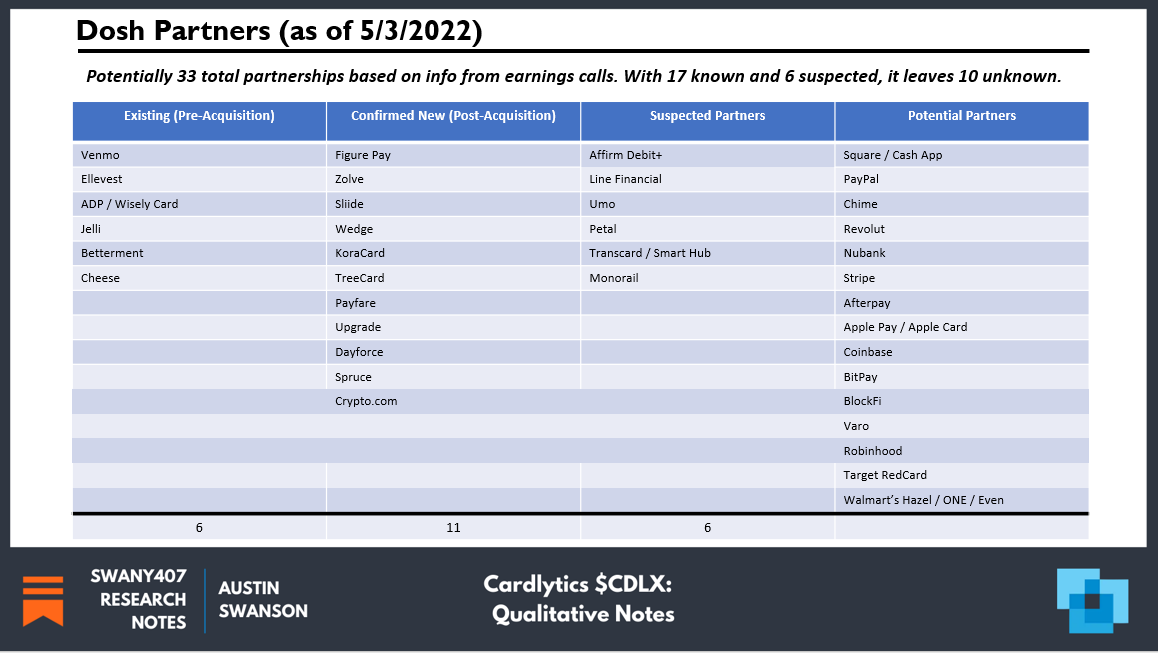

Based on the change in numbers, there are now 5 more publishers live, and there are a total of 33 (18+15) partners now vs 32 (13+19) at Q4, therefore on the surface there is one new partner.

However, I came across that as of January 11, 2022, “The German-based neobank [N26] shut down its U.S. operation and has been unavailable to U.S. customers”.

Therefore, I removed N26 from the list of Dosh partners. It is good news this is not from N26 dropping Dosh / CDLX, but instead from N26 stopping their US operations, where when Dosh powered their offers it was only for the US Rewards Program.

This leads me to believe there was actually two new Dosh partners. 32 total at Q4 2021, then lost N26 in January 2022, so 31 total, then now there is 33 total as of the end of Q1 2022 (and therefore 2 new partners).

I updated my list of existing, confirmed, suspected and potential partners, that I update frequently in the Qualitative Research Notes.

I also updated the logos of the confirmed partners:

Long-Term Impact

Dosh is likely to continue signing more partners, which decreases the risk of primary transactions switching from traditional banks to neobanks / fintechs (which is why CDLX acquired Dosh, as an insurance policy against this risk).

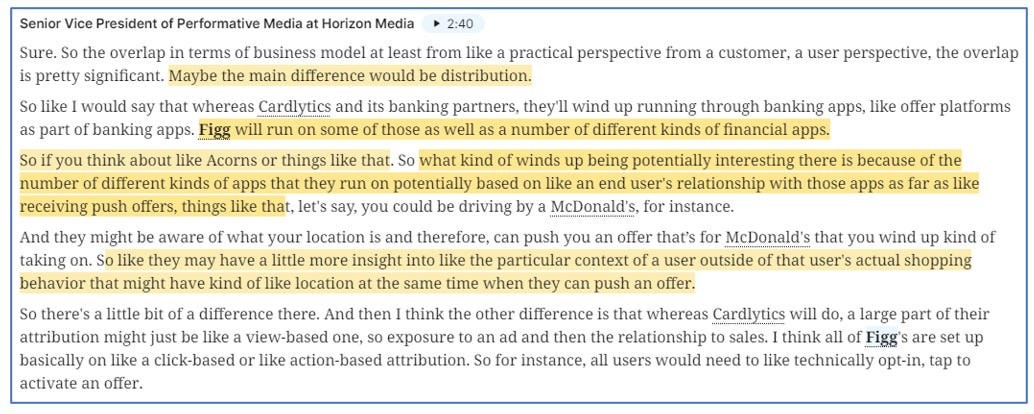

Separately, if CDLX can monetize the Dosh platform, it could contribute significantly to the bottom line, given the higher gross profit margins from the lower revenue share (as mentioned during Investor Day). These Dosh offer sections are similar to the new ad server and new user experience in the banks, with richer imagery, local offers, and the ability to have product-level offers. While the traditional banks have more users and purchase history, advertisers have said in Tegus calls that they like Figg for advertising within financial platforms and apps, such as Acorns.

The items discussed, such as being able to place offers to users within different financial apps that can likely also track and send related push notifications, are all the same things Cardlytics can now do with all their Dosh neobank and fintech partners. This is similar to how CDLX also pushes the same Rewards Network local content but also has local offers now from their Entertainment acquisition. In both cases, with neobanks / fintechs and local offers, investors and advertisers thought Figg had a leg up with these areas, but Cardlytics has now surpassed them in the only areas they were unique.

Therefore, if CDLX can add the option within the self-service to choose where they place offers, such as the banks vs Dosh and the neobanks / fintechs (or all), it could shift ad spend away from Figg, given the larger reach with the more neobank and fintech partners with Dosh (especially following the marquee partner who “reaches more users than any Dosh partner we've signed”.

One separate note. Dosh is now powering the cash back with a crypto fintech (which Cardlytics announced right after Figg said they were getting into it, as I discussed in my Research Notes on the March Crypto conference). What is very interesting is Crypto.com just recently decreased some of their cash back on their cards to be more sustainable: “Launched in November 2018, the Crypto.com Visa Cards have grown to be the world’s most popular crypto-linked card program, available in 40 countries. To ensure long-term sustainability, we are introducing a number of changes to the CRO Card rewards programme…”

They were able to do so by retaining Dosh cash back: “Introducing these changes to the card program is a difficult decision. We are committed to continue exploring and forging new partnerships to unlock greater value and benefits for our cardholders such as our partnership with Dosh, a cash-back rewards platform in the U.S.”

This may prove to be a very valuable data point. One it shows that banks / fintechs / neobanks / loyalty programs can use CDLX / Dosh for the cash back and have advertisers fund those rewards, instead of funding it internally which may not be sustainable. It also shows how CDLX / Dosh can help these partners, and how they are providing value.

It is also possible competitors of these banks / neobanks who fund their rewards program will not be able to increase and compete with the high cash back of CDLX / Dosh without sacrificing long-term sustainability, and therefore would need to use CDLX / Dosh as well to remain competitive.

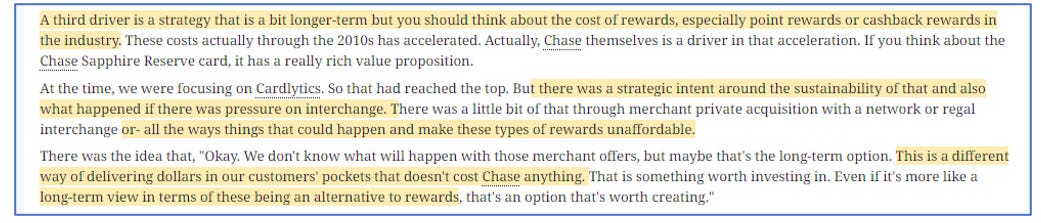

This topic idea of sustainability was discussed by Chase as well, when listing the reasons for deciding to use Cardlytics. From a Tegus interview with the Former Managing Director, Head of Card Business Development & Strategy at JPMorgan Chase & Co.:

Many investors focus on differentiation as an issue with banks / neobanks using CDLX / Dosh, but to me it is not about differentiation, as much as it is about the new higher rewards becoming table stakes. These banks / neobanks need to use CDLX to remain competitive and not lose customers or users to the much higher cash back programs that are only possible by leveraging CDLX with their combined reach for advertisers who then fund the rewards. A banks or neobank attempting to match these significantly higher offers through self-funding will run into sustainability problems, as seen by crypto.com.

Therefore we may continue to see more partner with Cardlytics / Dosh, such as marquee partners.

Update 12: Dosh Marquee Partner

The Update

Related to the unknown marquee partners was the following update:

“Additionally, despite the delay, the marquee partner we mentioned last year is scheduled to launch the Dosh program this quarter. This partner reaches more users than any Dosh partner we've signed, and we are excited to be working with them.”

Impact

The bolded sentence is new.

I have heard previously from someone who spoke to CDLX investor relations that said they were shocked by the number of customers this marquee client had.

I feel Venmo with 83M users is hard to beat. If this is the case, where CDLX is referring to total potential users, then the partner would need to quite large.

However, it could be they are talking strictly from a perspective of who sees the offers (despite all Venmo users seeing the QR code offers which are still powered by Dosh), where the number of Venmo debit card users is likely low. If that is the case, Affirm with the Debit+ card is still my best guess (as discussed in the Dosh potential partners section in the Research Notes and in this write-up).

There are other clues it is Affirm, such as CDLX is waiting to announce when the partner releases a debit card (heard from investors who spoke with CDLX management). Given Affirm is releasing their new Debit+ card soon, this makes me feel it is them. That also matches the comment of CDLX waiting until the Dosh program launches, which wouldn’t launch until the card launches.

Additionally, we have known of the marquee partnership since last year, but the launch / official announcement keeps getting delayed. That is the same with Affirm Debit+ card launch, which has been announced as a new card last year, but with no launch date shared. CEO Max Levchin said in December, “This is one of the very very important products for us. We want to make sure we really get it right. If it takes us longer to get it perfect, we’ll take longer. If it’s beautiful and perfect on day 1, we’ll bring it out to as many people as we can.”

The Affirm Debit+ card will likely have many more users than the Venmo Debit Card, and possibly more than the crypto.com card (which I feel has a large number of users). However, the marquee partner could be someone else, such as those listed as “Potential Partners” with the Qualitative Research Notes.

While it could be Klarna, I don’t think so, given the announcement of the Klarna card is much more recent, while we have known about the marquee partner for much longer, which coincides with about how long we knew about the Affirm card.

Another benefit of signing Dosh partners like Affirm or Klarna that work with merchants is it leads to those merchants learning about advertising on the channel, including outside and in the bank channels. Additionally, this announcement may lead to new interest by advertisers from hearing of CDLX for this first time.

Changes in Language / Presentation / Logos

Changes in Language: Cash Flow Positive

In the previous investor presentation, it said “Cash flow positive by the end of 2023.”

In the updated presentation, it was changed to “Cash flow positive by the second half of 2023”.

This may mean the same exact thing, but if that was the case, why not leave it?

Therefore, it is possible it could mean we will see Cardlytics be cash flow positive a quarter earlier, such as Q3 2023. However, given how conservative Cardlytics has been, I would not be surprised if this means they feel they can be cash flow positive even sooner, but wants to surprise investors or leave room for error.

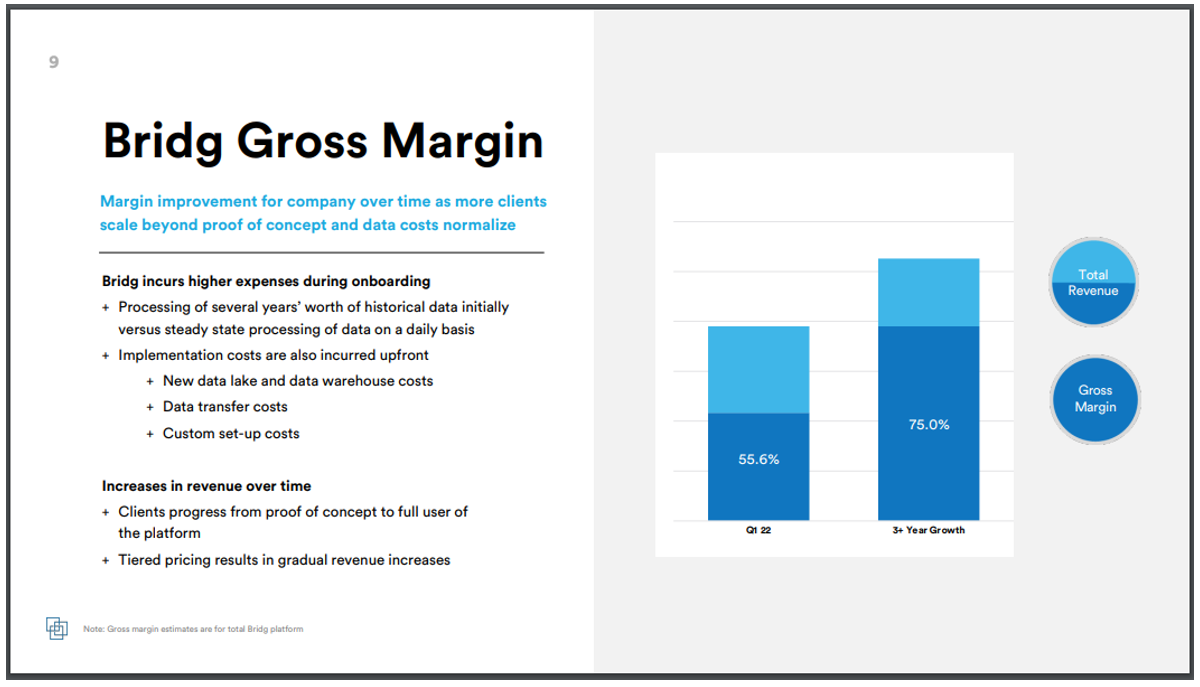

Changes in Presentation: Added “Bridg Gross Margin” Slide

The following is the new slide:

With this new slide, I assume this is only related to Bridg-only clients and offers not in the CDLX bank channel.

I still believe that the revenue share will be less and therefore gross profit will be higher for offers and product-level offers in the bank channel when using Bridg data.

This is from Cardlytics mentioning that with the introduction of Bridg and SKU-related data it could dramatically reduce revenue share with the banks. The banks want this data and insights since they do not have it. And the retailers want the bank data and insights since they do not have that. Cardlytics is the counterparty that has access to both.

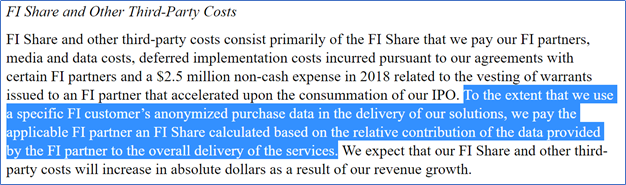

As discussed in the Bridg write-up, the FI Share description in Cardlytics’ 10-K states:

I believe the highlighted section is very important, where the FI share is “based on the relative contribution of data… to the delivery of the services”.

Revenue share could decrease because, as of right now, I believe only the bank data is being used. Therefore, 100% of the data for the overall delivery of the services is from the FI partners. However, once you add in Bridg and SKU-level data, the banks’ relative contribution decreases, decreasing their FI share, and increasing CDLX’s gross profit.

Changes in Logos

The following logos changed quarter over quarter:

New advertisers on the list include:

Petco

Shake Shack

Seat Geek

CVS Health

Stitch Fix

Gilt

Coach

Brilliant Earth

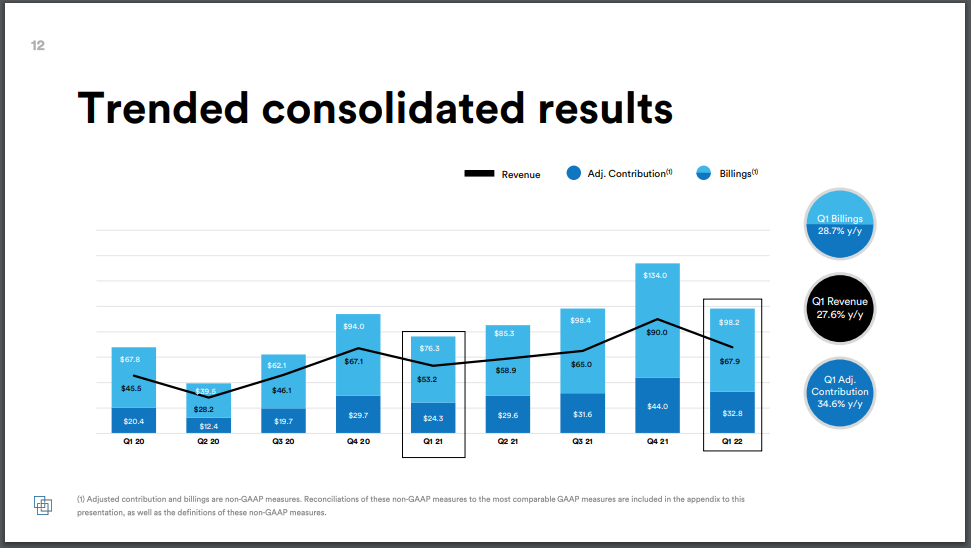

Q1 Numbers

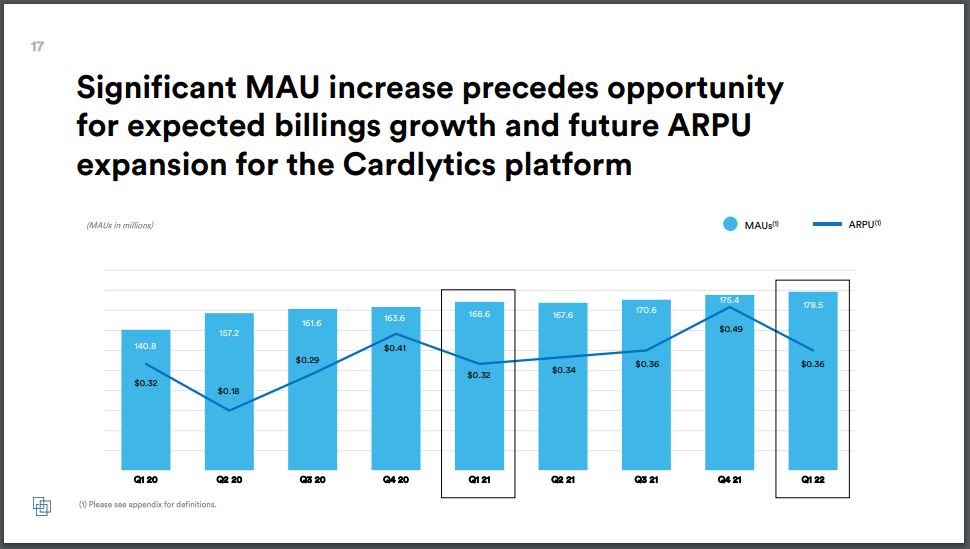

MAUs grew slightly, from 175.4M to 178.5M. If Cardlytics could successfully penetrate the banks through their planned strategy with their Entertainment acquisition (as discussed earlier), we could see MAUs grow significantly. And as a reminder, I do not believe the MAU count includes Dosh or Open Banking partners, which while small today, could be larger in the future (and even if not, they should benefit from low to no revenue share and possibly higher engagement, and therefore should not be ignored).

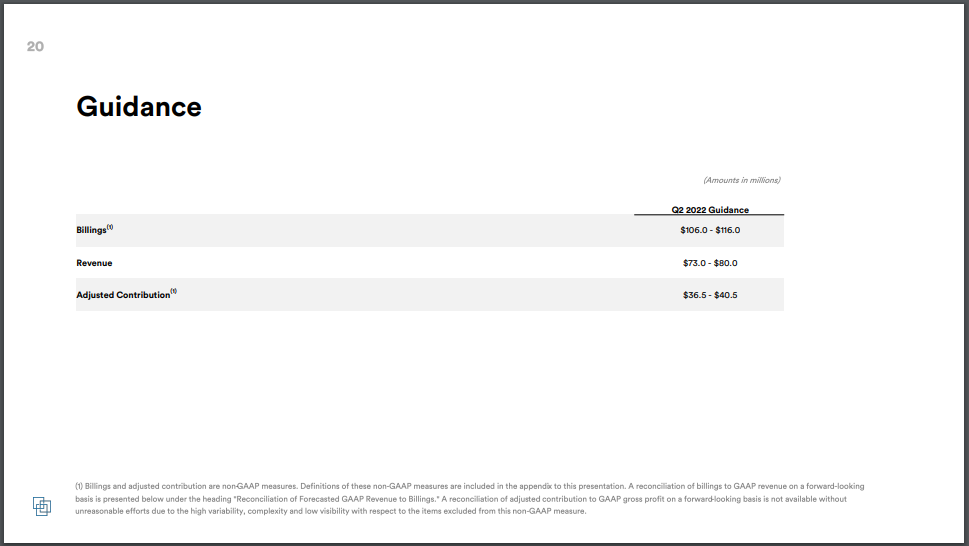

Revenue and other financials were about in line with what most expected, with the strongest Q1 in company history (a quarter that is typically lower due to seasonality).

I liked the high end of Q2 guidance at $80M in revenue, reflecting good consistent growth.

Overall, numbers looked good, and give no reasons for concerns.

Closing

I am eager to hear what is in the new BofA contract, find out the marquee Dosh partner, and start seeing the banks move to the new ad server that will have all the new benefits discussed throughout this post. All of these could be catalysts for increases in intrinsic value and therefore market price.

Overall, management continues to execute, the business continues to improve, and many previous concerns have been or are currently being addressed.

For all my notes and thoughts on CDLX, which I continually update and is nearly 600 pages, check out my Qualitative and Quantitative “Research Notes”:

Cardlytics $CDLX: Qualitative Notes (308 Pages and 78,171 words)

Cardlytics $CDLX: Quantitative Notes (282 Pages and 96,504 words)

These notes contain information I have not shared elsewhere. For more general information on Research Notes, see here.

For the large number of you who are already premium subscribers, you have access to these notes, and will also receive access to my upcoming set of Carvana notes which I am finalizing to release.

If you enjoy the content, or have received any value from the investment insights, discoveries, and thoughts shared, past or present, please consider becoming a supporter / premium supporter of the channel. Your support increases the odds of more investment write-ups and content in the future.

Follow-Up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more.

-Austin Swanson (Swany407)

Twitter: @Swany407

Website: Swany407.com

More Information on Cardlytics

Research Notes

Free Posts

Open Banking (The Free Option on the Hidden Potential Cash Cow): Write-up and video

The Power of Bridg (and Why CDLX is Undervalued): Write-up and video

BofA Renewal & Testing Competitors (Update): Write-up and video

New Observations, Upcoming Earnings Calls, and Updated Allocations (10.21.2021): Write-Up and video

Thoughts Following Q2 2021 Earnings and Price Decline: Write-up and video

Thoughts After Price Decline (5.17.2021): Write-up and video

Disclaimer: This content is not investment advice, and is intended for educational and informational purposes only. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.

Edit 5/9/2022 12:37pm: Originally there was an incorrect year in “High-Level Conclusion” section. Should have said 2023 (not 2022) to match the discussion at the end of this post in the section “Changes in Language: Cash Flow Positive” where the presentation uses 2023.

The concerns discussed and addressed in this post were more focused on the internal concerns, specific to CDLX. I did not address more macro concerns (which likely have had a strong impact on the stock price) and how they may impact the business. I added some of my thoughts within my CDLX Qualitative Research Notes, regarding inflation and recessions, and how they may impact CDLX:

Current direct link to the section "Company Risks: Inflation and Recessions":

https://swany407.substack.com/p/cdlx-qual-research-notes?s=w#footnote-50