Cardlytics ($CDLX): Chase Updates (Related to Chase Acquiring Figg, and Chase Migrating to the New Ad Server)

Summary of findings related to Chase moving / in-progress of migrating to CDLX’s new AWS ad server, and what it means.

For those interested, this post is also available on YouTube, Apple Podcasts, and Spotify.

Market Cap as of 9.21.2022: ~$11.5/Share x 32.9M Shares ~ $378M Market Cap.

Introduction

About this Post

I wanted to provide some new key updates on the Chase-acquiring-Figg situation.

Specifically, this post will cover clues and information related to Chase moving / in-progress of migrating to CDLX’s new AWS ad server:

In-sync timelines

Chase and CDLX related job listings

How we will tell if / when Chase moves to the new ad server, and current observations

A significant portion of these observations and analysis that are included in this post were first released in my Research Notes. If you are looking for this type of information sooner, before it is released publicly, or to to see information I have never released (with no plans of releasing), become a paid-subscriber to gain full access:

Background + Additional Information on the Chase / Figg Situation

As a quick reminder, on July 1, 2022, JPMorgan Chase acquired Figg.

Figg has been considered Cardlytics’ closest and possibly only competitor in the card-linked offer (CLO) space.

While this can be seen as a positive on many fronts (no more close competitor, possible enhanced Chase Offers section, etc.), Chase acquiring Figg has led many to worry that Chase will build out an in-house system utilizing Figg, and then drop CDLX as a partner. This would have a very negative impact on CDLX, as Chase is around 65M+ of CDLX’s 179M MAUs. This could explain the more recent further price decline, despite the many other positive developments with the business (BofA renewing - which contributed to a large portion of the overall price decline, new CEO, and more).

For additional information, I have spoke about the Chase / Figg / CDLX situation at length is my Q2 post, 100 bagger post, and my Research Notes.

In the Q2 post, I discussed:

Chase’s intentions with Figg (SMB, data, travel)

Reasons why Chase won’t drop CDLX (10 reasons)

How Chase acquiring Figg benefits CDLX

CDLX expected value without Chase

CDLX expected value with scenarios of keeping and losing Chase

and much more

In the 100 bagger post, I discussed:

Similar makings of a monopoly to Washington Post (from becoming the only option)

Similar fears of losing advertising distribution leading to a low stock price in relation to intrinsic value

What we could see from Chase that could lead to changes in CDLX stock price

Why Chase could have issues with SMB if attempted

Why Chase utilizing 1st party data will work with CDLX and the new ad server

My Expectations with Chase

I believe Chase will not only move to new ad server, but they are currently in progress of migrating, and will launch the new ad server in Q4 2022. If so, the probability of Chase continuing to use CDLX now and for the long term will increase substantially.

With Chase staying, combined with them moving to the new ad server, we will see improvement in engagement and ARPU with just Chase that matches US Bank + additional benefit from unlocking product-level offers and agency offers given finally reaching critical scale on the new ad server for these capabilities (and then further benefit as the rest of the banks move onto the new ad server, that will likely come sooner as they will not want to lag Chase by too much).

If this scenarios doesn’t occur, there is still more limited downside than most assume with CDLX (i.e., CDLX is still worth considerably more than today’s market price even without Chase), which leads to much better investment prospect than most realize.

Why Chase Moving to the New Ad Server is Important

I see the probability of Chase dropping CDLX as significantly lower than most assume.

The odds of Chase dropping CDLX will decrease further if Chase moves to the new ad server. Chase would not go through the time and work of moving to the new ad server only to immediately drop CDLX. This is why it has been a positive to see all the signs of Chase migrating to the new ad server (which will be discussed in this post).

Additionally, moving to the new ad server would increase Chase’s opportunity costs and switching costs, given CDLX would then be supplying Chase with product-level offers, local offers, a new UI (which would be very hard and confusing to roll back on users), self-service for banks, imagery within offers, and more.

These will not happen overnight. Luckily it seems Chase is hiring roles for Chase Offers that relate to rolling out these features and capabilities with APIs, which seems to exactly match CDLX saying the banks will roll out new features and capabilities via API modules (which will be discussed in this post). This is also where execution from new CEO Karim Temsamani will be critical, to ensure Chase is able to roll out these features and experience the maximum benefit in the shortest time possible.

The reason keeping Chase and them moving to the new ad server is important is it will lead to:

Retaining that associated revenue

Higher near-term engagement and ARPU with Chase

See my Research Notes for quantification of the near-term impact of the new ad server

Sufficient reach for Bridg and unlocking product-level offers

CDLX has mentioned needing scale for Bridg from having more than just US Bank on the new ad server.

“I think we've discussed this before, but US Bank ultimately is going to be somewhere in the neighborhood of 4 to 6 million MAU. It's not enough to truly get the scale of significantly different types of offer constructs and offer types, if you will.” - Q1 2021, Laube

Chase on the new ad server will give CDLX the needed reach.

Sufficient reach for agencies using the self-service platform

The self-service platform only works with the new ad server. Advertisers have even mentioned that currently there is not enough reach to make it worth it with just US Bank (given only 4M - 6M MAUs)

Chase on the new ad server will give CDLX the needed reach (given likely 10x+ more reach on Chase than US Bank).

Accelerating the time until BofA and Wells migrate to the new ad server, leading to higher revenue and cash flow sooner for CDLX

With Chase on the new ad server, I do not see Wells and BofA waiting to adopt it at the last minute (December 2023), especially if CDLX has more data to support the higher engagement on the new ad server and at a larger scale with Chase (compared to the data related to US Bank on the new ad server shared at investor day).

I previously shared the following scenarios, probabilities and resulting expected value calculations for CDLX. As the probabilities change, so do the expected values. Therefore, upon clearer evidence of Chase being on the new ad server, the probability of CDLX losing Chase decreases, the odds of the better scenarios occurring increases, leading to higher overall expected values for CDLX than those shared below.

Conservative Medium-Term Expected Value: $22B

Conservative Longer-Term Expected Value: $39B

Not shown are the more near-term expected value calculations, reflecting the near-term increases in engagement and ARPU with Chase moving to the new ad server, followed by the remaining banks.

Note: The CDLX market price may not adjust based on any news or evidence of Chase being on the new ad server. An example of this was seen with the BofA fears, where other investors needed absolute 100% certainty of the renewal, not 99.9% based on all evidence seen and management comments. Therefore, the same could be said here with Chase, such as evidence of Chase launching the new ad server. Even a signal by Chase, such as extending the CDLX contract may not be enough, as some could say Chase could still drop early. Or even Chase expressing their exact intentions with Figg may not be enough, as others could think they are lying or have additional plans (even with no supportable evidence). But here is the thing, this is great for investors. As the odds and expected values change, the market price may not, leading to a very mispriced bet. The market price seems only to reflect certainty, not odds, which lead to the mispricings. (I.e., the market price of CDLX may continue to reflect losing Chase, even after Chase is on the new ad server and there is clear evidence of Chase staying).

Important Historical Information That You Need to Know

An important detail to this story is Chase was supposed to move to the new ad server by year end 2021.

This was discussed even publicly during CDLX investor day. Specifically, Michael Akkerman mentioned one of their large banks committed to moving to the new ads server by the end of that year (2021). Later Farrell Hudzik said, "Chase is also, as Michael mentioned, on track to take the new Cardlytics ad server and UI by the end of the year, which will continue their engagement growth trajectory."

This is important for many reasons. Not only does it show Chase may take the new UI at inception (which is very important, given it may be difficult for Chase to roll that back on users and confuse them), but it shows Chase already planned to move to the new ad server, so more likely to continue to do so, since it is not like CDLX is still trying to convince them.

This should lead you to ask, “why didn’t Chase move to the new ad server?”

According to CDLX, it was supposed to be Q4, but that date slipped. It wasn’t our fault or theirs. Things came up and they pushed that out. But we have them on schedule for later this year. - May 2022

According to CDLX IR following the Figg acquisition, “Chase had internal technology projects that moved up in their funnel and pushed the ad server out.” - July 2022

It is very possible history will repeat, with Chase not moving to the new ad server on schedule in Q4 2022. However, the differences today are:

CDLX employees mentioning working on migrating possibly Chase in Q2

Expenses related to migration to the cloud incurred by CDLX in Q2 2022

Related hirings by CDLX for integration and cloud work

Related hirings by Chase for Chase offers for a new user experience and rolling out features and working with an existing 3rd party vendor

and more that we will discuss

Where the odds increase further, is from the timeliness syncing up, as discussed next.

Clues of Chase Moving / In Progress of Migrating to CDLX’s New AWS Ad Server

In-sync Timelines

Not only has CDLX said that Chase is scheduled to move to the new ad server in Q4 2022, but there are also many different interesting pieces of information recently where all the timelines also match up to support that Chase is current in progress of moving to the new ad server.

In combination you have the following in 2022:

April 2022: Evidence of employees working on migration for a bank, with the size matching Chase

Around May 6: CDLX says Chase is scheduled to move to the new ad server later in 2022 + job listings for integration consultants for the new ad server

Around May 16: Chase is scheduled to launch the new ad server in Q4 2022 + comment by CDLX of shifting employees from self-service to focus on the new ad server

Early July: CDLX IR confirming 50% MAU goal still on track following Chase acquisition news

August 2: Q2 call detailed expenses related to migration to the cloud that begun in Q2

August / September: Chase job postings that possibly relate to the new ad server

September: New local offers only within Chase

Below are more details on each of these timeline items, and what they mean:

April 2022: CDLX LinkedIn description (posted by Indra on Twitter) that mentions migration to a new platform for a bank that is likely Chase (see reasoning below) starting in April 2022.

Indra pointed out the 45% of CDLX users looks to be based on the $34M in revenue they quoted, divided by Q2 revenue of $75M, which equals 45%, and therefore the 45% of MAUs in the LinkedIn description is simply based on 45% of revenue. This independently matches Richard’s Chu’s latest CDLX write-up where he mentions “As of Q2’22, their top three banking partners, Chase, BofA, and Wells Fargo, formed over 75% of their partner share. Chase and BofA formed >20% each and Wells Fargo formed >10%. Cardlytics stopped disclosing exact splits in Q1’20 but at that point, Chase had already surpassed BofA. Therefore, Chase forms up to 44% of Cardlytics’ revenue today.” This makes me believe this job description and migration of a bank to a new platform is related to Chase. Also note, 100% of campaigns are already on the new ads manager, and therefore I do not believe this “new campaign platform” is related to the new ads manager, but instead the new ad server.

This also began in Q2, where as mentioned during the last earnings call, “During Q2, we began the migration of certain internal data and applications for the cloud. We expect a fairly long migration given the need to work with an administrative and technical processes of our FI partners.” This shows matching timelines, both mentioning migration, and here saying it was for the cloud.

Around May 6: CDLX says Chase was supposed to move to the new ad server in Q4 2021, but the date slipped from something that came up on Chase’s side that pushed it out, but they have Chase on schedule for later this year (2022). Additionally, there was a new CDLX job listing for a “senior integration consultant” for the “technical onboarding” of a “financial institutions onto the CDLX platform” who has “experience with AWS or other cloud platforms” (this is different than the current job listing on CDLX’s website related to Dosh).

Around May 16: CDLX management said they pivoted tech resources from self-service to the new ad server AND said that a major bank is scheduled to launch the new ad server in Q4 2022 who was scheduled to launch in Q4 2021.

The fact CDLX was moving employees to work on the new ad server also matching the LinkedIn work description that started in April 2022 + the Q2 migration costs to the cloud.

We also know with certainty that the bank that was scheduled to launch in Q4 2021 was Chase (confirmed by CDLX IR + discussed during CDLX Investor Day). This then shows Chase is scheduled to launch in Q4 2022.

We also know from comments by CDLX just a couple weeks prior on May 6 that they said Chase was the bank that was supposed to launch Q4 2021, and that they have Chase scheduled for later in 2022.

If they are scheduled to launch in Q4 2022, it would make sense they are the bank currently in migration, starting as soon as April to begin the process, and matching CDLX saying the migration of an FI partner occurred in Q2.

This would then explain the next bullet / comment in early July, where CDLX IR said CDLX is still on track to hit 50% MAU goal by YE 2022, and why they mentioned this in response to questions about Chase acquiring Figg (since Chase was the bank who was moving to the new ad server).

Early July: CDLX IR says CDLX is on track to hit 50% MAU goal by YE 2022 (where CDLX has previous mentioned Chase is the easiest path).

Matches all points: LinkedIn description of migrating + Chase scheduled to launch in Q4 2022 + migration costs in Q2

August 2: Q2 earnings comment of migration to the cloud beginning in Q2, saying “During Q2, we began the migration of certain internal data and applications for the cloud. We expect a fairly long migration given the need to work with an administrative and technical processes of our FI partners.”

Not only does this fit given it is a migration of an FI partner to the cloud that begun in Q2 (matching points above), but this statement also shows it is a long migration that would not yet be completed, which matches the fact that Chase’s migration would still be in progress (since no definitive observations showing it is complete, like product-level, local, new UI, pics in offers, etc.).

August / September: Chase job postings that possibly relate to the new ad server (will discuss in depth next)

September: New local offers within only Chase. I discussed this in detail in my Research Notes.

While there was possible one distribution of “Shop Local” offers in Chase around 12/31/2021, there hasn’t been any since until just this month of September 2022. I believe the “Shop Local” offers are related to the Chase / Eureka partnership with small businesses, which is also likely where the “Minority-Owned” + “Black-Owned” offers come from. This is based on CDLX investor day comments, saying, “We've also partnered with Chase and Eureka, a company focused on bringing small businesses, majority of them minority-owned”. Given minority-owned is only the majority of small businesses, and not all, it makes me believe the remaining small businesses may have the “Shop Local” tag.

The partnership was announced / disclosed in June 2021 during investor day, despite only now seeing the “Minority-Owned” + “Black-Owned” offers in September 2022. The reason for the delay with these Eureka offers could be from CDLX waiting until Chase moves to the new ad server and takes the new UI for richer imagery (increase understanding, given not nationally recognized brands) and better categorization (rather than mixing with all others, and having 100+ offers making it hard to find something relevant and attractive). The reason to place them now is to test before the new ad server and new UI, and then post migration, which will be soon, with Chase now supposed to be on the new ad server in Q4 2022, according to CDLX in May 2022.

Having so many different independent data points with the timing matching up makes it seem extremely likely Chase is currently migrating to the new ad server, especially with the fact that CDLX said Chase is scheduled to launch the new ad server in Q4 2022.

Not included here is what was discussed in the last post, on the similarities to a 100 bagger. In that post, I discussed how Chase has the supposed intention of using Figg to utilize first party data to improve targeting, where Chase doesn’t currently share that data with CDLX. If true, that would fit the fact that within the new self-service platform for banks on the new ad sever, CDLX built the ability for banks to share data but with a blind mechanism, to address issues and concerns originally mentioned by Chase. Therefore, it is possible Chase is leveraging Figg employees and their perfectly related experience to do just that. However, Chase mentioned doing something similar for travel. This could still be related, but this is where Chase’s intentions with Figg are still unclear.

Chase Job Listings for Chase Offers

I recently came across two job listings on Chase, specifically for Chase Offers. Not only do the job listings seem to perfectly describe CDLX’s new AWS ad server and its capabilities, but it almost seems as if Chase’s job listings are based on the exact language CDLX has previously used (such as during earnings calls), and the language CDLX would likely be using in the process of moving Chase to the new ad server. This makes it seem likely that the job listings are not for an in-house solution, but instead for migrating and rolling out features related to the new ad server (where CDLX has said it will take banks a series of months to turn all the different modules on, and where the job listings describes this aspect).

Given we have seen other clues of Chase moving to the new ad sever (such as those shared above), this new data point only strengthens this idea. Or viewed from a different angle, if the other observations we have seen / heard are true, then it only makes sense to see Chase job listings related to moving to CDLX’s new AWS ad server, especially given US Bank said they would need to dedicate additional resources to integrating some of the new capabilities, which even perfectly matches one of the Chase jobs of “Chase Offers-Product Delivery Platform Integrations”.

I list the job postings, and highlight the relevant descriptions, but will discuss them in-depth below.

Chase Offers - Product Delivery Manager VP

Posted: 8/23/2022

Chase Offers-Product Delivery Platform Integrations

Posted: 9/13/2022, but there was the same listing on 8/8/2022 (taken down, possibly from being filled)

I will note, when I first began reading the Chase job listings, I could interpret it as a new in-house offers platform, possibly leveraging Figg. For instance, “This is an exciting opportunity to join a new line of business and help the Consumer product team build and deliver a new offers experience for our customers.” The new line of business is Chase’s Connected Commerce. I have not only seen this in other job listings related to Chase Offers where they mentioned “Connected Commerce is a new and innovative line of business”, but the Chase Integrations job says “for Offers and Shopping for newly formed Connected Commerce division”. The more initially-concerning wording was “build and deliver a new offers experience for our customers”, with the specific word of concern being “build”.

But given the new ad server allows for Chase to pick and choose which modules to include in their offers platform, including the ability to customize the UI for further differentiation, that specific line did not give conclusive evidence that the job listing was for a Chase in-house platform or for moving to CDLX’s new ad server.

However, when reading the listing in full, and seeing some very specific points and language (as described next), it made it much harder to see this as related to a new in-house offer platform, but rather made it more much more likely to be related to CDLX’s new ad server.

To start, in the two job listings on Chase for Chase Offers both mention:

Next generation of offers / ad platform (with one mentioning a new offers experience)

Working with 3rd party vendors

Roll-out / launches of new features and capabilities

#1: The mention of “the next generation of offers / ad platform” and even the one listing mentioning “a new offers experience for our customers” seems to perfectly match Cardlytics’ new ad server that allows for new offers like local and product-level, and allows for the new user experience / new UI. CDLX specifically calls the new UI the “new customer experience” and “new user experience”. Given “new experience” is not a term I would even use to describe the update, I do not think of it as a general term that could also be commonly used by others like Chase. Instead, it seems much more likely, especially in combination, that Chase is referring to the new offers (local + product-level), new platform (new ad server), and new experience (new UI). However, you could still conclude that a new in-house solution fits these descriptions. But this is why the point #2 and #3 make it harder to believe this is related to in-house.

#2: The mention of aligning goals/roadmaps, and managing “3rd partner vendors”, makes me believe it is Cardlytics. CDLX is the only 3rd party vendor I know of that Chase is using for Chase Offers. I am pretty sure, based on previous commentary, Rewards Network is running through Cardlytics, making it such that Chase would likely only be working with Cardlytics for those offers (and therefore the only 3rd party vendor to “manage” as mentioned in a listing). Figg is no longer a 3rd party vendor, at least not in my eyes, given they are owned by Chase. Maybe you could make that argument if these job posts were before the 7/1 acquisition date, but they are posted two months after the acquisition (8/23 and 9/13). Additionally, the specific term “existing” 3rd party vendors makes it even more likely Cardlytics. Remember, we are only taking about Chase Offers here.

#3: Regarding the roll-out / launches of new features and capabilities, the following quotes from CDLX very closely describe these exact aspects of the new ad server:

…

…

- 5/4/2021, Q1 2021 Earnings, Lynne Marie Laube Cardlytics, Inc. – Co-Founder, CEO & Director

Even more conclusive is when you take together the job listing and match up the language to the CDLX quotes above and other observations:

The job title of “Product Delivery Platform Integrations”

Matches the integration of modules, where Cardlytics mentions “The [new] ad server offers both API and SDK integrations to enable faster iterations of any user experience module”

“With the ability to understand…event driven/restful APIs”

Matches using APIs to do the integration

“Responsible for overseeing existing 3rd party vendors”

Matches CDLX being a 3rd party vendor, and an existing 3rd party vendor

“Assist in managing 3rd party partners and align roadmaps”

Matches CDLX being the 3rd party partner that would need to be managed and have aligned roadmaps.

Also matches the CDLX LinkedIn job description from earlier that seems to be related to migrating Chase to the new ad server, where it says “assessment and roadmap development”

“Assist in establish roll-out plans / release of new features and functionality”

This matches the rollout of new features and functionality of the new ad server and its modules. CDLX literally uses the words of “rollout”, “offer features”, and “new functionality”. This also matches US Bank who said they would hire additional personnel or dedicate additional resources at a later time to handle the additional rollouts. This may be the strongest piece of evidence of Chase hiring additional personal for the phased launches of the new ad servers capabilities/modules.

Additionally, the second job listing mentions “Create initiatives, epics and user stories in JIRA backlog”. I found this interesting given in CDLX’s May job listing for a senior integration consultant for the “technical onboarding” of “new Financial Institutions onto the Cardlytics platform” who has “experience with AWS or other cloud platforms”, it also mentioned “familiarity with ticket tracking tools like Jira”. Maybe Jira is an extremely common system. I just haven’t heard of it, so I found it interesting to see it on both CDLX and Chase job listings that could be both related to the new ad server.

At this point, I will be shocked if Chase is not currently in progress of moving to the new ad server. It is very possible all of these matches in the job listings to the new ad server are coincidences or me simply finding the similarities and making connections that are not there, and Chase is not in progress of moving to the new ad server. If so, it will be interesting to look back on all these data points. Maybe it will be more obvious in hindsight. However, the odds of that seem almost impossibly low when you combine the other observations mentioned above regarding CDLX comments and the in-sync timelines. While all these are strong pieces of evidence to support Chase being in progress, and even stronger when combined, I have not heard / seen anything to give me 100% certainty of Chase being on the new ad server (such as seeing pictures within the offer section, or product-level offers, or a new UI, or an announcement). Given CDLX said migration is a long process, this would make sense.

How We Will Tell If / When Chase Moves to the New Ad Server

Images Within the Offers

Seeing images within the offers will likely be the first major indication of Chase moving to the new ad server. The reason I believe we will see this first, is given this is one of the only new features I have seen US Bank implement while on the new ad server.

New User Experience (outside of the individual offers)

The other obvious clue of Chase being on the new ad server would be a new user experience (given the new ad server is required for the new UI). However, given US Bank is on the new ad server and still hasn’t rolled out this new UI, not seeing this on Chase won’t tell us anything.

One reason we may see Chase move to the new UI immediately upon launching the new ad server, is given CDLX mentioned this at the CDLX investor day, "Chase is also, as Michael mentioned, on track to take the new Cardlytics ad server and UI by the end of the year, which will continue their engagement growth trajectory."

Bridg Product-Level Offers

The new ad server is needed for Bridg product-level offers. Therefore, if we saw one product-level offer, it could be evidence Chase is on the new ad server.

However, CDLX has mentioned in the past working with other partners (not Bridg) for product-level offers. This may not require the new ad server. Therefore, it would require seeing a product-level offer from a Bridg client to more confidently conclude Chase is on the new ad server.

CDLX mentioned the Bridg pipeline of grocery, convenience, restaurant, home improvement, and existing clients in restaurants, retail, and movie studies, so a product-level from one of these could be a clue. Known current clients include Starbucks and Panera. A past pilot seen in Dosh was with Rite Aid, and I heard of a pilot with a beauty care product, but I do not have certainty that these were with Bridg or a 3rd party.

Current observations / Who I am watching to place product-level offers:

I have seen a lot of Home Depot and Best Buy recently, so these could be the home improvement client and the retail client in the Bridg pipeline.

And maybe Home Depot is the existing Bridg client that CDLX said was interested in CDLX but only markets at the product level, not the store level, which matches Home Depot and where even CDLX’s former CRO in June 9, 2021 the same thing regarding Home Depot and SKU:

Separately, Kroger has done quite a bit of different offers lately as well, so this could be someone who is more receptive to Bridg, and could be the grocery client in the Bridg pipeline.

Also, originally I thought this Panera offer could be the first product-level offer. While we had seen subscription offers before, the difference here was knowing Panera was a Bridg user and given the bank statement descriptions were not different than a normal order (so I wasn’t positive how they would know what I bought without Bridg and POS data). At this time, I do not believe there is enough evidence to conclude this offer is using Bridg.

Push Notifications

We could see a change in push notifications. For example, if the settings change, where users can allow notifications for new offers and not just when a Chase Offer is used (something that has not been on Chase yet), this could be a sign.

However, BofA recently added this feature for push notifications for new and expiring offers, and I do not believe they are on the new ad server. Therefore, this would not be enough evidence.

Entertainment Offers

CDLX mentioned they would not give these more local offers from Entertainment to the banks until they move to the new ad server. So if we saw these offers (which we could match up by location using the Entertainment app), it could be a clue that Chase is on the new ad server.

However, given CDLX has been giving a bank local content from Rewards Network without the new ad server (likely Chase), CDLX could possibly give the banks Entertainment local offers as well, before moving to the new ad server. So seeing these offers would not be enough.

Time-of-Day Offers

Time-of-Day offers, where the cash-back only works if you buy during a certain period of time (e.g. 7-11am), is a feature that that only works on the new ad server. Therefore seeing one of these offers would be a sign of Chase on the new ad server.

Current observations:

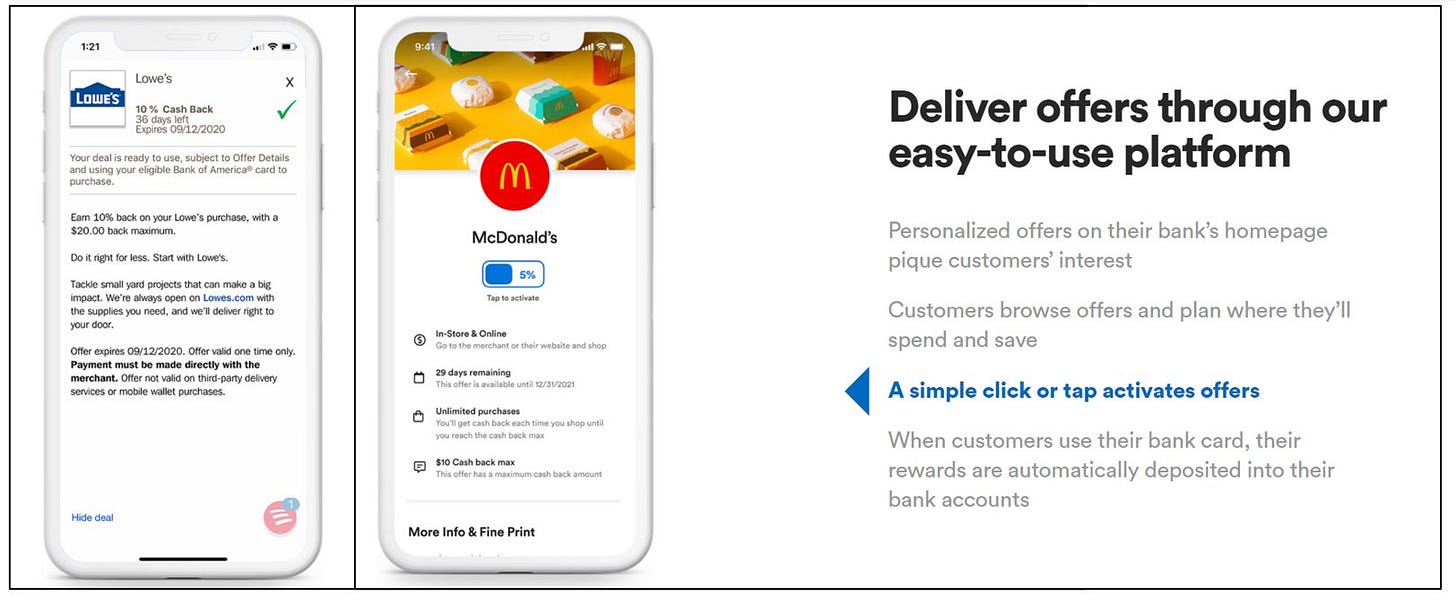

I didn't realize until now that during the CDLX investor day, CDLX included in their new UI example the time-of-day offers capability. More interesting is the McDonald's example, given they supposedly specifically expressed interest in this capability. Therefore, this could be the first one we would see within Chase.

Closing

Similar to others, my first reaction to the news of Chase acquiring Figg was not positive. However, upon additional findings and thinking through the situation, I now believe Chase acquiring Figg to be highly favorable for CDLX, with Chase launching the new ad server here shortly in Q4.

While it is possible I have missed key details, or misinterpreted observations and facts, I have yet to find anything disconfirming at this time, beyond the simple assumption that Chase is using Figg for in-house (without any evidence to support this). That doesn’t mean that isn’t true or won’t develop to be true (even if it makes little rational sense). I simply haven’t been able to see that as being the case thus far, but I’ll be watching closely.

Until seeing anything disconfirming, it is my belief that Chase will not only move to the new ad server, but is currently in migration, and will launch the new ad server in Q4 2022. There is a strong possibility that CDLX will announce this at Q3 earnings. And if not, we have enough information to be able to conclude when it occurs. With Chase moving to the new ad server, CDLX will not only experience higher engagement and ARPU in the short term, but it will increase the odds of Chase staying with CDLX in the long term, increasing CDLX’s expected value further.

For all my notes and thoughts on CDLX, which I continually update and is over 600 pages, check out my Qualitative and Quantitative “Research Notes”:

(Given the quantity of new notes, and hitting Substack limits, I had to split the notes once again)

Qualitative:

Cardlytics $CDLX: Qualitative Research Notes #1 (268 Pages, 94,958 words)

Cardlytics $CDLX: Qualitative Research Notes #2 (65 Pages, 20,037 words)

Quantitative:

Cardlytics $CDLX: Quantitative Research Notes #1 (209 Pages, 73,442 words)

Cardlytics $CDLX: Quantitative Research Notes #2 (139 Pages, 45,224 words)

These notes contain information I have not shared anywhere else. For more general information on Research Notes, see here.

I have been adding a significant quantity of new notes lately, given the many changes around the company. I expect this to continue. Once things settle down, I will shift my focus to releasing my Carvana notes, which for the large number of you who are already paid subscribers (and the substantial number of new paid subscribers this quarter), you will have access to all current and future notes. I have greatly appreciated your positive feedback lately, and I look forward to continuing adding to these notes, with intentions of expanding them to more companies over the years.

Follow-Up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more.

-Austin Swanson (Swany407)

Twitter: @Swany407

Website: Swany407.com

More Information on Cardlytics

Research Notes

Free Posts

CDLX 2.0 (Chase Acquiring Figg, New CEO, New Banks, BofA Renewal, 22Q2 Earnings, and more): Write-up and video

Current Price Decline, Short Thesis, and Q1 2022 Earnings: Write-up and video

Open Banking (The Free Option on the Hidden Potential Cash Cow): Write-up and video

The Power of Bridg (and Why CDLX is Undervalued): Write-up and video

BofA Renewal & Testing Competitors (Update): Write-up and video

New Observations, Upcoming Earnings Calls, and Updated Allocations (10.21.2021): Write-Up and video

Thoughts Following Q2 2021 Earnings and Price Decline: Write-up and video

Thoughts After Price Decline (5.17.2021): Write-up and video

Disclaimer: This content is not investment advice, and is intended for educational and informational purposes only. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.

Following posting this write-up, I discovered some important information regarding what Chase’s intentions with Figg could be. I just added these notes to my CDLX Research Notes in the section on "Chase Acquiring Figg".

I cover:

- Clues of Chase’s intentions with Figg

- New Chase platform for SMBs + 1st party data + advertising

- Matching Figg jobs

- Matching timelines

Those of you who are already paid subscribers can access these notes using this direct link to the section (depending on when you read, there may be additional notes in this same section, so look under 9.23.2022): https://swany407.substack.com/p/cdlx-qual-research-notes#footnote-52

Given the importance of the info, I may do a full public post on it, but for now I just have this info in my CDLX Research Notes.