Cardlytics ($CDLX): CDLX 2.0 (Chase Acquiring Figg, New CEO, New Banks, BofA Renewal, 22Q2 Earnings, and more)

Since my last Cardlytics update, there have been a significant number of changes with the company, leading to CDLX approaching an inflection point with significant cash flow in the near future

For those interested, this post is also available on YouTube, Apple Podcasts, and Spotify.

Market Cap as of 8.11.2022: ~$16/Share x 32.9M Shares ~ $525M Market Cap.

Since my last Cardlytics update, there have been a significant number of changes:

Chase acquired Figg (removing CDLX’s only near competitor, with no cost to CDLX)

New CDLX CEO (who previously worked at Stripe and Google)

Increased likelihood of new bank partners (including one no one thought was possible)

BofA renewed (eliminating all worries of losing BofA)

Marquee Dosh partner was announced (with 110M users)

Still on track for EBITDA and FCF positive next year in 2023 (and sooner than before)

And much more

I think Cardlytics is approaching an inflection point.

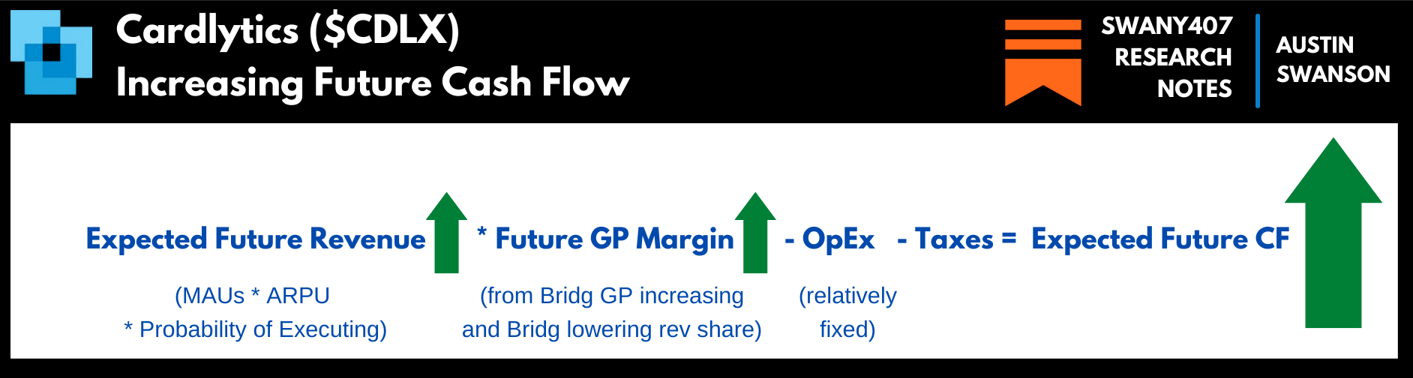

If CDLX was to continue to grow revenue consistent with the recent past, we would start seeing cash flow materialize, given CDLX expects to be free cash flow positive next year, combined with the operating leverage in the business allowing for future gross profit to drop to the bottom line.

But I think do not think revenue will grow in line with the past. There are multiple positive factors working together in the same direction that could lead to more exponential growth:

All major bank expected to be on the new ad server by that same time, increasing average revenue per user (ARPU) (unlocking product-level offers + local offers + agency offers + new UI with richer imagery + push notifications + self-service for banks)

Possibly more major banks partnering with CDLX, leading to more monthly active users (MAUs) (will discuss the possible new banks in a later section)

New senior leadership with more of a tech background, increasing probability of executing (new CEO, new CPO, new CTO, etc.)

Together you expected future revenue increasing dramatically from all factors increasing (where expected future revenue = MAUs * ARPU * Probability of Executing).

Then you have gross profit increasing over time from Bridg (both from Bridg standalone GP growing as well as from CDLX rev share decreasing with Bridg data added in the banks), with significant portions dropping to free cash flow from the fixed operating expenses and from being FCF positive next year.

This business has strong competitive advantages, a long runway, strong new management with the right backgrounds, many catalysts, and increasing revenue and gross profit with operating leverage that should lead to substantial free cash flow in the near term.

Many have brought up the fact that CDLX has been in business for 10 years+ and hasn’t experienced the type of growth many have believed possible, so why is now any different?

It wasn’t until a few years ago CDLX reached critical scale for advertising reach, only recently added new senior leaderships (CEO, CPO, CTO, Bridg CEO, etc.), and the new ad server is only just starting to rollout across major banks with brand new technology (such as the new user experience with richer imagery, product-level offers via Bridg, local offers via Entertainment and third parties, self-service for agencies and banks). Additionally, there are now less competitors, and possibly new CDLX bank partners.

Therefore, it was more as if the first 10+ years was related to developing and securing the bank partnerships, and then onboarding those banks. Now, a different set of technology, skill sets, and objectives will take place to monetize this asset that CDLX built in the first chapter of the company.

This is why following reaching critical ad scale + building/acquiring the necessary tech + hiring the necessary tech-focused management that it is now essentially CDLX 2.0, with a much higher probability of achieving that high growth that is possible.

With so many positive factors working in the same direction, we could start seeing material cash flow in the next few years. Better yet, these prospects come at a time when the company trades at a multi-year low (a good combination for an investment).

While I’ve been adding significant CDLX Research Notes on the following subjects over the last month or so, I wanted to wait to do a full write-up and video until after earnings. Usually there are a few good updates at the earnings calls (which there were).

In this post, I will go discuss the following CDLX updates:

Chase Acquiring Figg (with updated expected value calculations with dilution)

New CEO

New Banks / Neobanks (including AmEx)

BofA Renewal

The Marquee Dosh Partner

Bridg

Results (CF and cost savings, activation rates, 10-15% guide)

For all my notes and thoughts on CDLX, which I continually update and is over 500 pages, check out my Qualitative and Quantitative “Research Notes”:

(Given the quantity of new notes, and hitting Substack limits, I had to split the notes once again)

Qualitative:

Cardlytics $CDLX: Qualitative Research Notes #1 (247 Pages, 91,005 words)

Cardlytics $CDLX: Qualitative Research Notes #2 (19 Pages, 8,030 words)

Quantitative:

Cardlytics $CDLX: Quantitative Research Notes #1 (200 Pages, 72,171 words)

Cardlytics $CDLX: Quantitative Research Notes #2 (101 Pages, 34,473 words

These notes contain information I have not shared anywhere else. For more general information on Research Notes, see here.

I have been adding a significant quantity of new notes lately, given the many changes around the company. I expect this to continue. Once things settle down, I will shift my focus to releasing my Carvana notes, which for the large number of you who are already paid subscribers (and the substantial number of new paid subscribers this last month), you will have access to all current and future notes. I have greatly appreciated your positive feedback lately, and I look forward to continuing adding to these notes, with intentions of expanding them to more companies over the years.

Update 1: Chase Acquiring Figg

“On July 1, 2022, JPMorgan Chase & Co. acquired majority owned Augeo subsidiary Figg, an industry leading card-linking platform.”1

Figg has been discussed at length over the last year, with BofA testing Figg prior to the renewal.

Figg has been considered Cardlytics’ closest and possibly only competitor in the card-linked offer (CLO) space.

Risk of Chase Dropping CDLX

Chase acquiring Figg has led many to worry that Chase will build out an in-house system utilizing Figg, and then drop CDLX as a partner. This would have a very negative impact on CDLX, as Chase is around 60M+ of CDLX’s 179M MAUs.

I see the probability of Chase dropping CDLX as higher than before the announcement, but significantly lower than most assume (I will walk through my assumed probabilities later in this section).

Chase’s Intentions with Figg

One large reason for the risk of Chase dropping CDLX being low is due to building an in-house offer system not being Chase’s current intentions with Figg.

While we cannot know for certain what Chase will do with Figg, we do have quite a bit of information what they may start out trying.

CDLX IR has commented on the acquisition, saying similar things each time:

“Our understanding is that our relationship will not change with Chase…. We believe they purchased Figg to improve placement of offers using their own proprietary data.”

“Our understanding is that they have 1st party data they don’t share with us and they want to be able to use it to better target offers across their platform."

“They have told management they simply want to own technology so they can use their own proprietary data that they are not willing to share with a third party to improve offer presentation and accelerate their efforts in SMB.”

During the Q2 call, Lynne also said:

Chase has actually approved to me saying the following: they remain focused on continuing our partnership period. So nothing has changed at all. There are a bunch of reasons why it makes sense for Chase to own big and not impact our relationship with them primarily to go focus on the SMB space. But absolutely nothing has changed. We maintain huge momentum with them like we always have. They've always been a fantastic standout partner of ours, and they continue to be.

So I see no reason at all for -- the Street to read anything into this other than Chase wanted to focus on SMB.

The consistent message is Chase acquired Figg for:

Utilizing First-Party Data not shared to CDLX to improve offer placement and targeting

SMBs focus and acceleration

One independent confirmation of these stated motives is from Chase’s 2022 investor day. Chase specifically said "So, looking forward here we have 66 million US households, including 5 million small business customers. And now we have 4 million Infatuation dining enthusiasts. We've got industry-leading products, unmatched first party data and a two-sided commerce platform. And our strategy is to expose distinctive content to our broad customer base, making Chase the best way to shop, pay and borrow. Starting, as I said, with travel and introducing our customers to key merchants within our platform at scale."

The following was the corresponding slide from the presentation.

Between Chase’s investor day statement and the corresponding slide, I found it quite surprising how much matched what Chase has told Cardlytics regarding their motives for acquiring Figg. For example, you have specific mention of

first-party data when discussing the two-sided platform,

“introducing our customers to key merchants within our platform at scale” which could relate to Chase SMBs

“providing the right tools to target the right customers” which is for Chase merchants and could relate to Chase SMBs

Before going into all the different reasons why Chase won’t drop CDLX and replace them with an in-house offer system, let’s first go into a little detail regarding the first-party data and SMB aspects.

First-Party Data

Utilizing first-party data to improve offer placement and targeting could be for Chase to improve the offers on the new ad server as well for their higher valued customers (such as for travel, loans, mortgages, etc.)

In regards to the new ad server, it is very possible that acquiring Figg to utilize more first-party data that Chase won’t share with CDLX relates to the new self-service tool for banks, “Engage” (only available on the new ad server).

Before the new ad server, there were issues with sending data to CDLX:

I actually never had this thought until the next Tegus interview with the same VP of Tech at Wells Fargo this week. The biggest ah-ha moment was reading that with the new ad server and self-service for banks tool gives the banks more control over sending data, as well as a blind mechanism with data. This very much could relate to Chase and wanting to layer on their first-party data that they don’t share with CDLX. The new ad server allows Chase to utilize this data without sharing it with CDLX.

The reason you would hire someone like Figg and not do it internally is given Figg has expertise in this field, and would allow Chase to quickly start utilizing this feature of the new ad server. Especially given even Wells Fargo understands the new self-service for banks will allow the banks to build their own models for the offers, which again is not a core strength or focus of Chase, but could be for the Figg employees.

In regards to the high value customers, Chase’s recent acquisitions in travel + Chase’s mention to CDLX of using Figg for their tech and to target offers with first party data + Chase independently saying to improve travel they will use their data to target offers + Chase not focused on advertising but is focused on obtaining and retaining highly valuable customers like travel spenders, all tie together.

With respect to travel, there was a recent WSJ article that discussed some key ideas that relate to this situations:

“Travel has become one of the most important spending categories for banks and credit card issuers, and JPMorgan wants a bigger piece of it. The bank hopes to turn those traveling customers into lifelong Chase fans, drawing in more of their spending and other financial needs”

Chase could lower attrition and increase spend with Chase for these specific customers via Chase Offers.

If Chase has the best offers or highest cash-back, it could lead to higher usage of those Chase cards, leading to more points, leading to more spend with Chase for travel.

“The plan has risks. Travel-rewards giveaways have proved expensive for JPMorgan and other banks, and they haven’t always led to the lasting relationships the banks hoped for.”

Given expensive, Chase can use advertisers’ dollars to fund offers.

“JPMorgan isn’t alone in trying to cross into travel bookings. American Express Co. is currently the sixth biggest travel agent. Capital One Financial Corp. last year invested in a booking company to build its own travel site and opened its first airport lounge. JPMorgan believes it can differentiate itself partly because of its detailed insight into what its customers spend. Its data will power both travel agents and artificial intelligence technology that can target customers with offers and ideas.”

This to me is huge. It links the idea of travel + customer first party data + targeting customers with offers. We knew the customer first party data + targeting customers with offers aspect from Chase even telling CDLX that was their intention with Figg. However, we had not heard that in the context of travel.

Meaning altogether we now have: Chase prioritizing travel related customers and their spend + Chase making travel related acquisitions and improvements + Chase says they acquired Figg for their tech and to improve offer targeting and placement by utilizing first party data + this article saying Chase is doing exactly that but in the context of travel.

This was even just discussed in very recent Tegus interview this month:

Tegus Client:

“And then so now if I'm JPMorgan, I can take Figg and I can go to Airbnb be myself maybe and say, like, ‘Hey, guys, I want offers on maybe your high-tier inventory in Malibu and Hawaii,’ and say give those offers will serve them exclusively to our higher tier customers?”

Former Head of Bank Partnerships at Cardlytics:

“Totally.”

While their context was around Chase using Figg to do this on their own, they did not discuss the ability of the new self-service for banks allowing Chase to add their own data, and therefore still do this but all within CDLX.

I do not see this travel aspect as the exclusive reason of acquiring Figg. I believe this idea would then expand to car loans, mortgages, and other Chase banking features.

This also falls in line with the type of first party-party data Chase is referring to, rather than being more personally identifiable information (PII) or demographics data that carries a higher risk of using (something I do not see the banks making the mistake again, such as related to mortgages based on demographics).

This also relates to the Chase investor day where they said,

“We've got industry-leading products, unmatched first party data and a two-sided commerce platform. And our strategy is to expose distinctive content to our broad customer base, making Chase the best way to shop, pay and borrow. Starting, as I said, with travel and introducing our customers to key merchants within our platform at scale."

“providing the right tools to target the right customers in contextually relevant ways”

SMBs

Additionally in the investor day you have Chase saying they want to introduce their customers to key merchants within their platform, which is likely related to accelerating SMB efforts (To clarify, it is SMB / merchants within Chase. Not external. Chase doesn’t need Figg to get access to the local businesses that Figg uses, given Figg uses some of the same third-party affiliate aggregators that are available to anyone, which is why CDLX and Dosh use them as well. Additionally, Chase wants to support and help their own merchants.).

Also, you have in the slide “For Merchants: providing the right tools to target the right customers in contextually relevant ways”, which would match Chase’s stated motives of accelerating SMB efforts, using Figg’s tech for the tools to help these SMBs, and also help their Chase merchants better target customers and improve the offer presentation which could be from utilizing first-party data which was mentioned in the corresponding statement in the presentation.

This leads me to another piece of independent evidence that could fit into this overall puzzle. Augeo, the parent company of Figg, had / has a product called “Ampre” which was a local merchant portal, or rather a self-service tool for local businesses. This could be one of the pieces of tech CDLX mentioned that Chase apparently wants from Figg. It could also be one of the merchant tools that Chase refers to in the investor day slide. While it was an Augeo product, I wouldn’t be surprised if it was rolled into their newly formed Figg business. And even if it wasn’t, I wouldn’t be surprised if Chase simply wanted to buy it. A self-service tool for local businesses would allow Chase to sign up more of their Chase-merchants, accelerating SMB efforts, and exposing their Chase customers to more merchants within Chase that are also more unique (unlike aggregators like Rewards Network that everyone is using).

Side Note: It does not sound like Ampre was heavily used for local offers. Instead, that was one reason for acquiring Empyr (and then forming Figg) was due Empyr’s “good publishing networks”. Augeo / Empyr / Figg switched to more aggregators of local offers, such as Rewards Network, since they could sign up significantly more local businesses than one at a time.

Another biggest piece of information is a new line of business at Chase called Connected Commerce. Chase has an open position in this division for “Ad Tech and Insights”, where “As part of Offers & Shopping, Ad Tech & Insights are creating a seamless, engaging platform that enables merchants to maximize their marketing spend by leveraging the extensive Chase consumer footprint”. This makes it seem as though this division is creating a platform for Chase merchants to allow them to utilize both Chase Offers and Shop Through Chase.

This is reinforced by, “These Tools Will Deliver Below Capabilities For Our Over 4 Million Merchant Clients.” The bolding is theirs. It was also underlined (I cannot underline in Substack). Additionally, the capabilities include:

Identifying the best campaign structure, goals, and key segments

Creating offer campaigns

Managing offer campaigns (as underlying platform executes them)

Reporting results of offers and learnings for future offers

This really makes it sound like Chase is trying to have a better in-house solution for their 4M merchants to place offers. Chase has been the only bank to do more of the exclusive offers, with “Chase Sapphire Reserve Exclusive” offers, that were all Chase clients, and with much higher cash-back. This is more similar to the AmEx offers. From my understanding, this was through CDLX’s self-service for banks. However, I heard it was more just CDLX working with Chase and pushing these offers manually, which would likely limit how many of these offers CDLX could handle. Therefore, I wonder if Chase is creating a larger team, utilizing the nearly 70 staff of Figg, to build out these types of offers for their merchants, and place them within Chase Offers and Shop Through Chase.

Also, Chase doesn’t need Figg for Rewards Network local offers. If the acquisition was about getting access to Figg’s local offers, which are mostly aggregators such as Rewards Network, then Chase could just get access to the same local offers as Figg from working directly with Rewards Network or from CDLX (who also works with Rewards Network + has exclusive access to Entertainment offers + self-service offers)

Therefore, when we hear Chase acquired Figg to accelerate SMB efforts, it is likely more in regards to their own Chase merchants, rather than Figg’s use of third-party content providers (which are therefore not exclusive to Figg nor now Chase)

While there will still be uncertainty on Chase’s true or developed motives, I find it much more likely that Chase’s stated motives are factual given they can be supported by some separate pieces of information, rather than the competing theories which are more speculative.

Reasons Why Chase Won’t Drop CDLX

I believe there are many reasons why Chase will not drop CDLX to do their own fully in-house offer system, such as:

Here are more details on each:

1) Chase’s Stated Intentions are Not to Build an In-House Offer System

Chase has communicated that their intentions with Figg are for utilizing first-party data and to accelerate SMB efforts.

These stated intentions match Chase’s investor day comments, as well as their comments related to travel, increasing the odds of being truthful and correct.

Additionally and importantly, Chase already tried to build an in-house system, but then elected to go with CDLX given this is not their expertise / focus + they recognized they would not have the required advertising reach without leveraging an independent party who could aggregate the major banks (this was all stated by Chase in 2020).

2) Chase Communicated Intentions of Staying with CDLX

Chase “proactively shared this acquisition with us and have said all the right things about continuing to work with us. They have never lied or given us reason to believe they don’t do what they say.”

While this may be a weak data point to why Chase would stay, it is sure better than the alternatives, of Chase not saying anything regarding whether they would stay, or worse saying they plan to leave.

Additionally, we have the Q2 comment of “Chase has actually approved to me saying the following: they remain focused on continuing our partnership period. So nothing has changed at all.”

3) Chase Shared News of Figg Acquisition with CDLX (therefore not hiding it from CDLX)

Chase “proactively shared this acquisition with us”. Therefore, it wasn’t something Chase was hiding from CDLX.

If Chase’s intention was to acquire Figg to replace CDLX, you wouldn’t share that with CDLX with the risk of CDLX acquiring Figg or CDLX finding a way for someone else to acquire Figg.

4) High Probability of Chase Moving to the New Ad Server (increases switching costs + provides Chase with what they want like product-level offers + local offers + agency offers + UI + bank self-service)

If you keep CDLX while you are testing or building out Figg, you might as well continue with their intentions of moving to the new ad server and get all the advantages for both users and for Chase. And if Chase plans to copy CDLX with Figg, Chase might as well see what the new ad server does firsthand to then copy it.

Chase moving to the new ad server would also increase switching costs. For example, with the new CDLX self-service for banks (“Engage”) that is on the new ad server that allows banks to utilize their own data as well, I find it hard to believe Chase would spend the time and resources to learn and use this new capability that benefits them, only to turn around and not use CDLX anymore. Therefore, if Chase is in progress of moving to the new ad server, then it increases the odds dramatically of Chase staying with CDLX long term.

The largest reason we could still see Chase move to the new ad server, and may even be in the process as we speak, is given CDLX updated decks still state the goal of 50% of MAUs on the new ad server by 2022 and CDLX IR has said CDLX is still on track to hit that goal. While it could be both BofA and Wells will move to the new ad server by year end, I think the odds of both doing so are lower than just Chase moving this year. CDLX has been mentioned elsewhere Chase is the easiest way to get there. We also know Chase was supposed to move to the new ad server YE 2021, so this shows they had the intention of moving. On top of this, it was mentioned in the Q2 earnings call that in Q2 a bank was in migration, when saying, “During Q2, we began the migration of certain internal data and applications for the cloud.” Assuming this is in regards to banks, my guess this is Chase, as BofA did not officially sign until July (after Q2) and there has been no indication of Wells Fargo currently in progress.

5) Lose Certainty of CDLX Working if Dropped CDLX Right Away to Try Figg (instead will test alongside and even continue using CDLX as a backup)

Chase would likely not want to drop CDLX today with the certainty of CDLX working, and take the gamble with Figg in terms of replacing CDLX and risk Figg not working or being able to do everything Chase needs (which could be a higher probability given BofA tested Figg and did not end up using them).

Instead, Chase would build alongside of still using CDLX and see if Figg could work first, and then if Figg was successful and more so than CDLX, then maybe Chase would drop CDLX. Therefore, you would keep CDLX today, which gives CDLX time to improve more and make it harder to replace CDLX (such as following the new ad server with product-level offers, local offers, self-service, new UI, richer imagery, and more). And after the recent Chase expert call on Tegus (notes in my Research Notes), it would seem there is much lower probability of Figg working if trying to utilize it for in-house offers, therefore widening the delta between certainty of CDLX and probability of Figg working.

Additionally, Chase may want to continue utilizing CDLX alongside Figg even in the scenario where Chase builds this all in-house, given banks like Chase like to have multiple providers to decrease their risk of being concentrated with any given one provider or vendor. More likely the opposite will occur, where CDLX is the primary resource, but Chase has Figg as a backup in case something happens to CDLX.

6) Lower Probability of Chase Successfully Implementing Figg for an In-house Solution

Chase already attempted local in-house offers and failed when they acquired Bloomspot

Figg’s test with BofA did not sound nor look like it went well. This gives indication that Figg may not be the best fit for providing offers, but could be used for similar but different objectives (such as for helping with utilizing Chase’s first party data or helping with Chase-only SMB merchants)

At a high level, you also what was discussed in a recent Tegus interview by a Former Head of Bank Partnerships at CDLX, “They realize that, one, they had too many competing projects. Two, they often didn't have the specific expertise. And three, the biggest point on the digital advertising side, like a bank is not built to be an advertising sales tool. When they think about a business customer, they think about them through the lens of lending, through the lens of loans, corporate credit cards, like these kind of things, they don't think of it through the lens of, hey, why don't you give us an offer that we can put in our bank channel?”

7) Dropping CDLX Decreases Chase’s Customer Engagement and Increases Confusion

There is a chance Chase doesn’t want to match CDLX’s capabilities first before dropping CDLX. Maybe Chase just wants to take Figg as-is with Rewards Network offers, then add more offers with Chase-only merchants, similar to AmEx’s model (minus the local offers). From a user perspective, I feel this would be going backwards for Chase.

I have 89 offers right now from CDLX within Chase, with the possibility of a new UI + more offers from self-service that only works on new ad server + product level offers + the same Rewards Network offers + additional local offers from Entertainment and self-service + the same Chase merchants via the new CDLX self-service for banks “Engage”. Taking that away could lead to lower engagement and lower use of my Chase cards. I’ve redeemed $198, $76, and $15 on my Chase cards, and that will likely increase dramatically if they move to the new ad server to unlock all these other offers.

Therefore, I feel Chase would not go backwards with user benefits with the risk of upsetting their customers. In a March 2020 in a Tegus call, Chase specifically mentioned that once you give users something, it is not worth taking away or moving it, since it can upset them and even lead to getting calls wondering where they went.

Also, unless there is something within the contracts regarding the tech / UI, I think if you get Chase users to the new UI, you would not want to roll that back. Instead, you would keep CDLX to have that new UI and place your Figg / Chase-only offers within there, and then also benefit from CDLX rev share + CDLX national offers.

8) Chase Would Lose Revenue Share (Increases Switching Costs)

TTM rev for CDLX is ~$300M, say 50% is rev share, and then say 50% is Chase, that is $75M of revenue share to Chase.

The rev share is very small to Chase relative to their total business, however, this rev share is likely near pure profit to Chase. That likely covers the Figg acquisition price and ongoing expenses/salaries/tech. Meaning, Chase might as well keep CDLX to pay for related endeavors and be cost neutral, rather than going from $75M+ with just CDLX, to $0 with CDLX covering the costs of also having Figg, to then negative expenses with just Figg (no CDLX). Seems irrational.

I would guess Chase would at least keep CDLX around to pay for their other tests, which then gives CDLX more time to improve and become more valuable to Chase.

9) Lower Ad Reach without CDLX

Having large advertising reach is important for advertisers. This is even a reason Chase mentioned for using CDLX, given CDLX allows the banks to aggregate their reach by using an independent third party. Without CDLX, Chase would only have around 65M MAUs. This could lead to less national advertisers placing offers with Chase/Figg, decreasing the attractiveness of the offers section overall, leading to less engagement. I do not think having third-party local content like Rewards Network that Figg uses and Chase-only merchants will be enough.

It would make a lot more sense to keep CDLX integrated, use their UI to place Figg and Chase-only merchant offers, and then leverage CDLX’s combined reach to add even more offers.

A different way to say this is it more beneficial to all parties and will produce an overall better outcome if Chase stays more focused on Chase-only merchants (such as their 5M SMBs) leveraging Figg employees and tech, and let CDLX continue doing what they are good at, rather than Chase trying to do everything, decreasing the odds of success from spreading themselves too thin and from having the disadvantage of less ad reach.

10) Likely Not Reinvesting 100% of Their Rev Share Back into Offers like AmEx

Some think Chase could drop CDLX so can replicate AmEx with no CDLX getting a cut, increasing the total cash back to user. If that was their plan, then the first logical step would be to take advantage of what they can immediately control, which is to also match AmEx by not taking a portion of ad spend and reinvesting it back to the user with higher cash back. If that is Chase’s intention, then why hasn’t Chase been utilizing 100% of their revenue share to boost offers like AmEx?

Also, given there is potential of AmEx eventually partnering with CDLX (such as to get more local offers, product-level offers, non-AmEx merchant offers, etc.) then comparing to AmEx’s in-house solution may not be the right one.

How Chase Acquiring Figg Benefits CDLX

In the scenario where Chase stays with CDLX, Chase acquiring Figg will end up being extremely beneficial to CDLX:

No more Figg (removed the only competitor for free)

Previous Figg banks / neobanks may come to CDLX (USAA, Acorns)

Higher engagement within Chase (higher targeted offers, more SMB offers, etc.)

CDLX Expected Value Without Chase

One way I have gained comfort with investing more into Cardlytics is assuming for conservatism that Chase is gone.

This removes any question regarding whether my probabilities of Chase staying are too aggressive, subjective or arbitrary, since I will assume worst case of 100% chance of losing Chase.

The two scenarios I thought through were:

Cardlytics going to $0

The valuation without Chase = $9.6B

Still have the remaining banks, but less ad reach, worse ads, less engagement and redemptions, so lower ARPU on less MAUs.

Leads to an expected value of $4.8B

From assuming equal likelihood of occurring (I actually believe the probability of $0 is much lower and I will share those calculations later)

I also believe the value without Chase is still significantly more when you account for Dosh + Open Banking + more.

However, this is also assuming 100% likelihood of Chase dropping CDLX, which I believe is actually much less (such as for all the reasons mentioned above.

Therefore, I will also share my more reasonable, yet still conservative, expected value calculations.

CDLX Expected Value with Scenarios of Keeping and Losing Chase

Medium and Longer-Term Expected Value Calculations

I decided to do two different calculations. One for a medium term, and the other longer term.

Medium term to me is within the next 5 years, and longer term is within the next 10 years.

I did this for multiple reasons. One is CDLX has given some guidance on their expected future ARPU within the next 5 years. Another is I wanted to show that higher valuations are possible within a short time frame. CDLX has many things in motion, and the scale in place. It will take all banks taking the new ad server, new management executing, advertisers adopting, and users engaging and redeeming. Given 100% of MAUs are expected to be on the new ad server in 1 year, I believe an additional 4 years is enough time to see growth with ARPU, either matching CDLX’s guidance of HSD, or to surpass those numbers from a lollapalooza effect.

Scenarios

In both the medium-term and longer-term updated expected value calculations, I used the same 4 scenarios:

Keep Chase: Combination of Current Initiatives All Paying Off + More Banks

The best outcome with everything working together leading to new bank partners (leading to more MAUs) and higher adoption by advertisers and engagement by users (leading to more ARPU)

Keep Chase: Constant Progress

No additional MAUs / banks, and current trajectory of ARPU based on management’s guidance

Lose Chase: Keep remaining banks without Chase

Lose MAUs and therefore low ad reach, decreasing both attractiveness for advertisers and then also users, leading to lower ARPU as well

Lose Chase: Lose remaining banks, liquidity issue, goes out of business, etc.

This is more to capture worst-case scenario of CDLX going to $0

I tried to be conservative in each regard, including probabilities, given this is very subjective.

Probability of Chase Leaving

My assumption for the probability of Chase leaving skyrocketed up when I first heard the news (say to 75%+), decreased as I thought about the situation more (50%), decreased after hearing more about Chase’s motives and additional background (25%), decreased significantly after hearing and seeing clues of Chase still moving to the new ad server (15%), and decreased further on news of a new CEO as well as additional pieces of information (10%).

Therefore, while the probability looks low, I went through a progression to get there. So if you are new to the situation, or only seen the headlines, then that has how I got from where you might be to the numbers I provide.

Medium-Term Assumptions and Calculations

Declining, stable, or increase in MAUs

Lower than the high single digit ARPU target, at HSD, and above (as a reminder, although today’s TTM ARPU at $1.59, in 2018 ARPU was $2.30 when it was only BofA)

Constant or increase gross profit margins (due to Bridg and resulting lower rev share and or other initiatives like Open Banking / Dosh with higher gross profit margins)

Constant OpEx

Effective tax rate higher than Google (16.2%) and Facebook (16.7%)

30x multiple to reflect future growth

Leads to an expected value of $22B

Longer-Term Assumptions and Calculations

Declining, stable, or increase in MAUs

Modest ARPU, high ARPU, and higher ARPU

Constant or increase gross profit margins (due to Bridg and resulting lower rev share or other initiatives like Open Banking / Dosh with higher gross profit margins)

50% higher OpEx

Effective tax rate higher than Google (16.2%) and Facebook (16.7%)

20x multiple to reflect less future growth, but still modest growth

Leads to an expected value of $39B

These are not end-state figures. I believe CDLX could do even higher ARPU in the future. While extremely biased, I have redeemed on average $149/year with CDLX (excluding Dosh and Venmo). My wife has redeemed an average of $68/year. I have friends and family on average redeeming more than $30/year. This is all on the old ad server, with no images, no local, no product-levels, and essentially no push notifications.

If we just assume that for those users who are fully aware of the offers and how they work then take advantage of the offers and could reasonably redeem $30 CI, well that is without all the improvements from the new ad server. This is why I believe $20 consumer incentives (CI) to be on the lower end in the much longer term.

You do need to account for a percentage of users who won’t engage. If engagement gets to 50%, and for those aware and engaged behave in line with how those I know redeem, but say it doubles to $60 CI (still less than me and my wife), then $20 CI could prove to be on the low end.

Again, free money for users (and much higher than typical 1-4% cash back cards) based on what they are buying, so attractive and relevant, coming from someone they trust (bank), and completely solicited (unlike nearly all ads).

Dilution

Finding the expected value is not enough. We have to account for future dilution from the Bridg earnout payments as well as with the new CEO who will receive shares upon his start.

I would prefer no dilution and maintain my same ownership of the company throughout time. Even better, I would prefer decreasing shares outstanding and increasing ownership (which is likely probable several years from now with excess cash used for buybacks).

However, I am perfectly fine owning less of something if it means it will be worth considerably more than before.

It is not as if CDLX gets nothing in return from issuing these shares.

For instance, I think some view it as though with the new CEO coming in and the shares he will receive, as if the intrinsic value per share immediately decreases since the denominator increases (intrinsic value per share = intrinsic value of the company / shares outstanding).

I walk through these calculations and go into more detail regarding dilution in the Qualitative Research Notes #1, in the section “Cardlytics Valuations: Dilution Following Bridg Earnout and New CEO” (current direct link to these notes). Just note, this was before the additional information related to Bridg, where I previously was being very conservative. The dilution / shares outstanding is significantly less above than my previous conservative estimates.

Expected Value / Share

Medium-Term: $21.5B / 37.2M shares = $578 / share (36x vs today)

Longer-Term: $38.8B / 37.2M shares = $1,044 / share (65x vs today)

Reminder:

Ignores more mature ARPU numbers that are significantly more

Ignore Dosh and the neobanks (like Venmo with 83M users and Credit Karma with 110M users)

Ignores Open Banking (with near 100% gross profit margins from 0% rev share)

Ignores future share repurchases with excess cash flow

Summary of Chase Acquiring Figg

Overall, I am very content with the situation. I believe the probability of Chase leaving is low, and that Chase acquiring Figg will have many beneficial outcomes for CDLX. Even if Chase does leave, the company is still significantly undervalued in relation to that outcome.

For more detail on this situation overall, I have added a considerable amount of notes regarding Chase acquiring Figg within the Qualitative Research Notes #1, in the section “Company Risks: Chase Acquiring Figg” (current direct link to these notes).

Update 2: New CEO

On July 20, 2022, CDLX issued a press release announcing the resignation of CEO Lynne Laube, and appointment of Karim Temsamani as Chief Executive Officer.

Karim previously worked at both Stripe and Google.

I spent considerable time reading, listening, and watching everything I could find on Karim Temsamani. There were quite a few interviews and presentations on YouTube. I walked away feeling very impressed with Karim.

While the total addressable market of ad spend has remained the same for CDLX after this CEO change, how much CDLX can capture, how fast they achieve that, the likelihood of success, and the methods they use to do so have all likely improved.

Pace of Progress and Execution

One of the issues at Cardlytics has been the pace of progress.

One example is the self-service platform for agencies, which was released but not fully self-service. Another is SMB and local content. While CDLX is now giving banks Rewards Network content and CDLX has acquired Entertainment, it comes much later than the banks wanted. Executing on this sooner could have possibly prevented the BofA situation with testing Figg for local content.

Another example is the self-service for banks, “Engage”. While this is brand new, it sounds like this was also very similar where it was not automated and relied mostly on manual work by CDLX. You could make the argument that if this was fully developed, and sooner, and with more capabilities and scalability, it would have supplied Chase with that they needed for accelerating SMB growth on their side and the ability to add on first party data from their end (since this is a key feature of the new self-service for banks), instead of acquiring Figg to help in both regards. I will say, it is still possible for CDLX to beat Chase to that end-state.

Executing in a timelier manner is one area where I believe Karim can help. One example of when he was in charge of Global Mobile at Google, Karim took that non-existent business to $10B in 2.5 years.

“I made the wise decision in 2007 to join Google, where I spent 12 years, initially running the Australian office, then starting the mobile business for Google, which was essentially a non-existent business in the early days of mobile to within two and a half years a $10 billion business. So we saw a incredible scale and obviously that business continued to grow after.”

While he was able to leverage Google for this mobile division to help with this growth, Karim can also leverage CDLX and its existing infrasture, data, tech, employees, partnerships and acquisitions. This even matches the only statement he has made regarding CDLX, “There is so much potential for further growth following the company’s recent acquisitions and solid progression against its strategic initiatives, and I look forward to leveraging the strong foundation that has been developed.”

Therefore, while totally different situations, there is at least some possibility he can replicate a fraction of that success here at CDLX, given some similar setups, and similar industries. Karim also has 10 more years of experience since his Global Mobile success at Google, so maybe that possibility is even a little higher.

(Just for fun, replicating half that success at $5B of revenue leads to about $1.5B CF, or ~$30B valuation at 20x, compared to ~$525M market cap today, or 57x. This also matches my conservative longer-term valuation at constant progress with 178M MAUs and $15 of CI that I shared above.)

Improving Technology

Additionally, Karim was working on systems for advertisers at Google with more advanced capabilities than CDLX…and that was over 10 years ago. I believe this makes it very likely he will know what needs to be done to get current projects to the performance they need to be, satisfying agencies with the new ads manager and even banks with “Engage” (which is likely more important than even I realized until this week). I think he can help lead CDLX to finish the current tech and build it to the next stage, especially combined with CTO Peter Chan, CPO Jose Singer, and Bridg CEO Amit Jain.

With Karim’s recent work at Stripe that heavily involves APIs, I cannot help but think more use of APIs could be leveraged at CDLX.

When discussing SMB and local, CDLX said that “we’ve built into the new ads manager an ability to connect through APIs to be able to partner with other people and bring that content”. Combine this with POS systems that can connect via APIs, I think there could be some benefits here, such as with partnering with POS systems with Bridg and integrating the new ads manager when it is fully self-service. The odds of this occurring seem higher with Karim, including his latest role that involved partnerships with technology companies.

Both at Google and Stripe, it seems Karim has discussed removing the complexity for the users like advertisers or merchants. Stripe as a whole is based around their simplicity with making it easy for any business to accept payments using Stripe’s powerful and easy to use APIs. And Stripe Capital, Stripe Treasury, and Stripe Issuing, all which Karim was in charge of, all used APIs to give platforms the ability to integrate financial services directly into their product. The same is needed here with CDLX. Make it as simple as possible to use and integrate to increase the number of advertisers and SMBs using the systems, such as through partnerships, leading to higher ad spend. Additionally, the new self-service for banks utilizing APIs to send data, further proving their increasing importance at CDLX.

Improving Measurement Understanding

With Karim coming from Google, it brings the experience with advertising for merchants, while coming from Stripe brings the knowledge and experience with payments. CDLX connects those two.

Where CDLX has struggled is getting to the point where it gets advertisers to view CDLX differently. Rather than looking at it as an affiliate site, or just comparing returns to multi-touch attribution (MTA) output which is not apples-to-apples, CDLX has failed at getting advertisers to view CDLX differently, and as a platform that provides certainty in measurement from closing the loop with actual payments and from incrementality from randomized control testing.

While CDLX was this track, with giving advertisers more view into their own data via Bridg, more needs to be done to accelerate ad spend. I think Karim can help.

On an overall simplistic basis, you now have a CEO who was a senior leader at Google, and has a level of trust when he will compare CDLX to Google. Additionally, I heard in an interview Karim discussing Google Wallet to help close the loop for advertisers, so he does have this understanding. This can be very powerful. However, this needs to be replicated at scale. You can’t have Karim speaking with every advertiser. This is where building out the necessary tech will come into play, such as adding in incrementality results into the self-service platform, as well as other methods to communicate this difference.

Improving Partnerships

At Stripe, Karim was “running Global Partnerships for Stripe across banks, networks, and technology companies.” I believe this, coupled within his deeper understanding of the advertising and tech side, can help retain and build stronger partnerships with CDLX.

For instance, utilizing Bridg and partnering with POS systems and incorporate self-service platforms for all the SMBs and enterprises using the POS systems.

Or creating partnerships with the likes of even Stripe or other large technology companies that work directly with SMBs and where CDLX could partner and integrate their self-service platform or Bridg.

Obviously more bank partnerships and retaining existing ones is important. Where Karim could help is faster adoption / increasing the odds of adoption of the new ad server, such as from ensuring successful execution on current migration and giving the banks what they want sooner (for example, on US Bank who is on the new ad server, I still do not have the new UI, no product-level offers, nor local offers. CDLX could accelerate this to give banks this as soon as they get the new ad server, which could incentivize earlier or faster adoption).

Additionally, a partnership with other large neobanks and Open Banking with much higher gross profit margins could be extremely beneficial. Farrell Hudzik, EVP of Financial Institutions, has done a terrific job at signing up many new partnerships. Between Karim and Farrell, together they could sign the likes of Cash App / Square / Block, as well as other remaining high value targets like Chime.

And not just single partnerships, but possibly more strategic partnerships to increase speed and number of users (such as the likes of Marqueta, given a card is needed for CDLX to work, and also given Karim’s background with Stripe and the card issuing side).

We could see CDLX now execute on supplying rewards not just to neobanks, but also loyalty programs, something Figg was doing, and CDLX was only doing with Open Banking.

Cardlytics has not fully utilized other partners to grow at much higher rates. Maybe part of that is due to not having a fully self-service platform where CDLX wouldn’t need to directly handle additional clients. Which is why executing on the tech is extremely important to complete this vision.

Envisioning and Executing on a Larger Future State

I also think Karim can develop a vision beyond the current state of CDLX, leveraging his knowledge and experience especially from Google given the similarities with advertising, as well as his Stripe experience with banking and financial products and partnerships across banks, networks, and technology companies. All highly relevant to CDLX.

This would lead to a higher probability of capturing more ad spend and a larger share of the TAM.

There has rarely been a vision stated or shared beyond moving banks to the new ad server, having self-service for agencies, and then adding product-level offers and local offers. (That of course does not mean there has been a larger vision that was simply not shared.)

Additionally, it has seemed CDLX has been more reactive to what their partners already want, rather than building in advance. This is a key area where I think Karim can help. First get CDLX over the finish line with existing projects, but then put CDLX on the path for a much stronger future with a higher likelihood of success. This is something strongly needed. I have felt CDLX was progressing linearly, only focusing on the next step forward, rather than thinking about a bigger end-state and working backwards on what needed to be created.

In an interview, Karim explained that Google was in part successful due to setting ambitious goals and shooting for the moon. It’s not just about having large ambitious goals. That isn’t enough. It is the fact that it is both possible and within CDLX’s runway and Karim having the relevant experience and knowing how to achieve it.

It also helps that Karim was responsible for strategy at both Google and Stripe, where,

“Prior to Stripe, he spent 12 years at Google where he oversaw, for the last 6 years, all of Google’s sales and operations across the Asia-Pacific region, determining the strategy for 16 offices and the regional business strategy for Google products including AdWords, AdMob, Google Maps, Google Apps for Business, DoubleClick Ad Exchange, YouTube and AdSense”,

and similarity at Stripe he,

“lead strategic vision and execution across product and engineering for Financial Products (Stripe Capital, Stripe Treasury and Stripe Issuing).”

Summary of New CEO

To capture a large portion of the US or global ad spend (TAM), CDLX will need to build out the necessary technology, and create and retain partnerships to implement that technology and in a more scalable manner. Additionally, CDLX will need to change how advertisers view CDLX and finally get over the hurdle of believing the certainty in purchase data and incrementality.

It is too soon to know if Karim is the one to achieve this. However, based on his background and expertise, previous roles, and previous success, it seems the odds are higher than they were before.

For more detail, I have added a considerable quantity of notes and quotes on Karim with the Qualitative Research Notes #2, in the section “Leadership / Management. CEO: Karim Temsamani” (current direct link to these notes).

Update 3: New Banks / Neobanks

USAA and Acorns

There is a very high likelihood that other banks would stop using Figg given they are now owned by a competitor (Chase).

A former Chase executive even mentioned this idea:

“So and this is based on my experience, if it's a true vendor that's providing a service, it's completely fine to work with multiple banks. However, once you are an own subsidiary of another bank, someone at some point is going to say, this isn't going to work, especially a company, once you are owned by another bank, it would be competitive.”- Former Executive Director, Product Lead for Chase Pay, at JPMorgan Chase & Co. - 8.1.2022 - Tegus

We know USAA is a Figg client, and the neobank Acorns is one as well. While it is possible these banks / neobanks use something lesser like simply using third-party content directly, I think it is much more likely these two will come to CDLX.

USAA may be smaller, but it is known for being more digitally engaged.

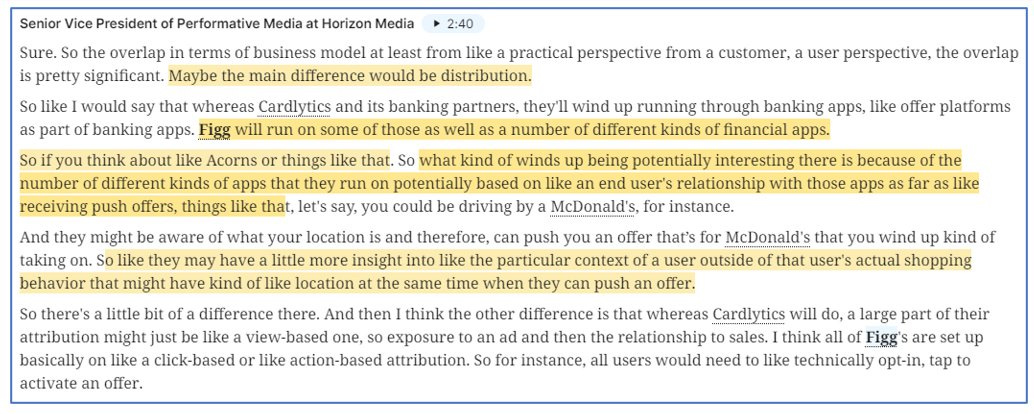

Acorns has been mentioned specifically by advertisers as a preferred app to place offers (I include one such reference by an SVP of Horizon Media later). Therefore, this could be an important addition to Dosh / CDLX.

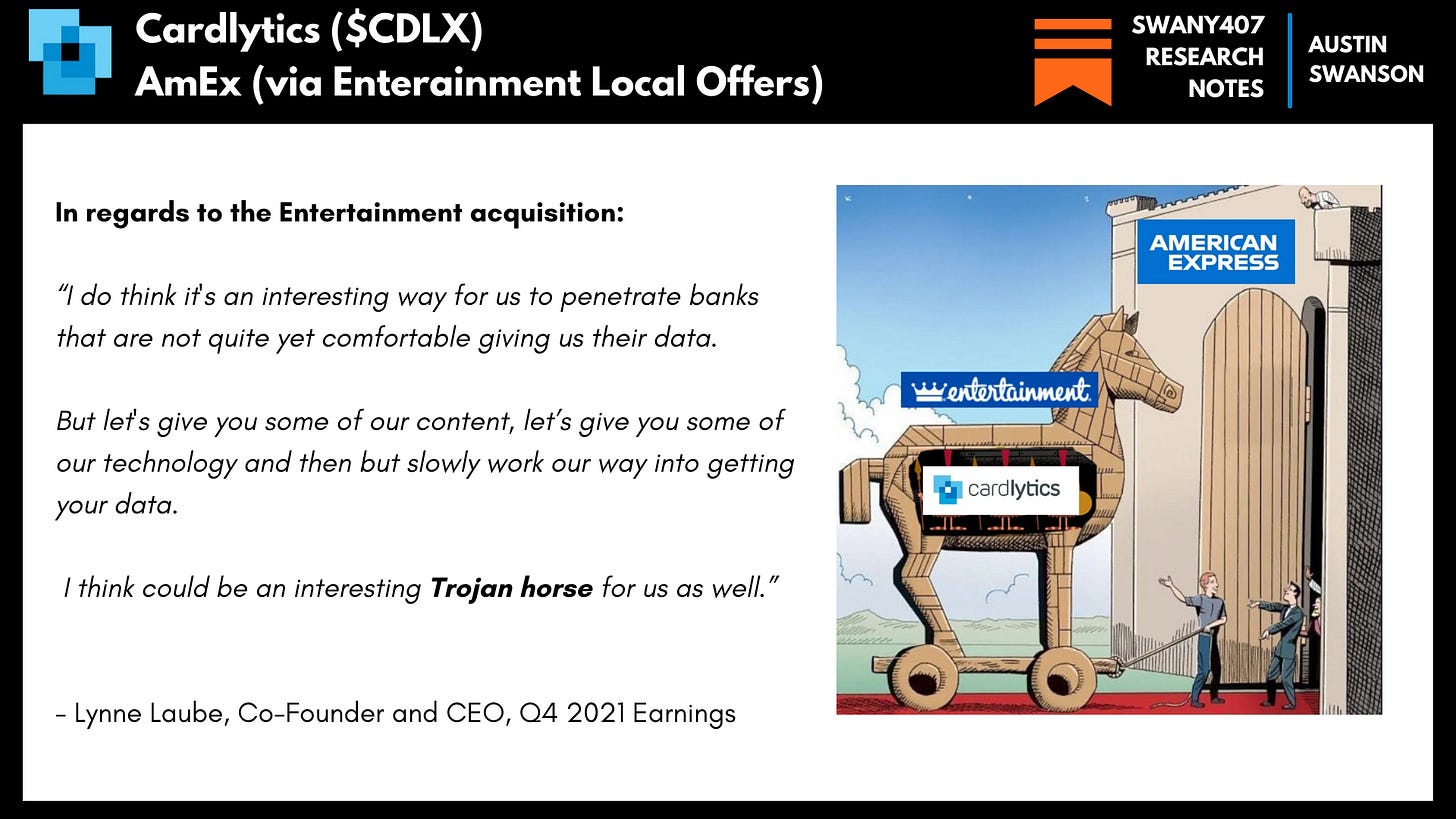

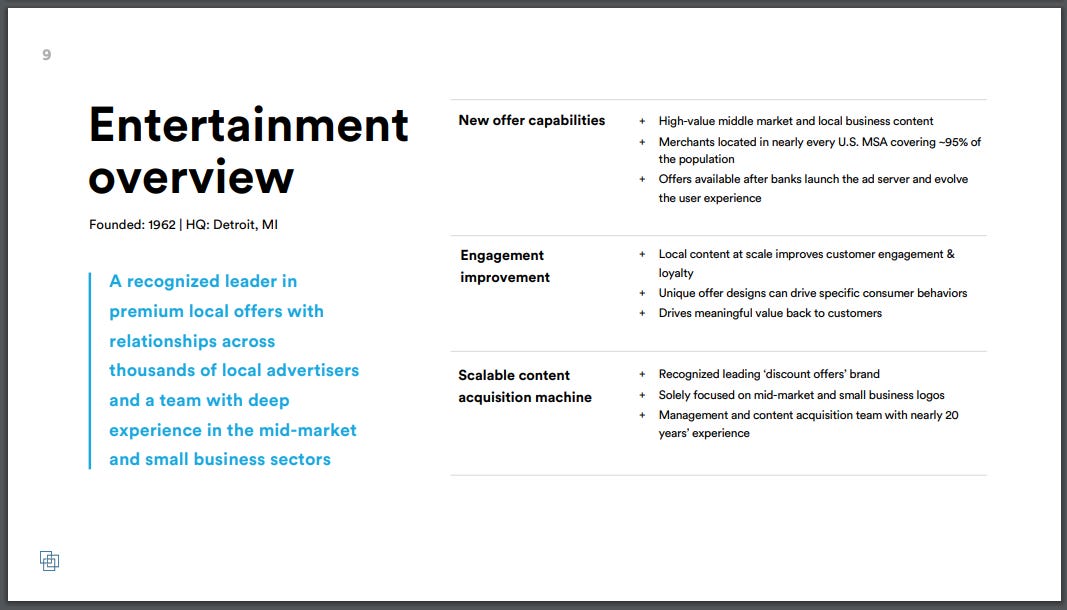

AmEx

CDLX successfully got their Entertainment offers in AmEx (more details here).

This offer of “6 months of Entertainment free”, or even if CDLX got local offers in AmEx, is not a big deal from a revenue perspective. However, it is a big deal from the standpoint that CDLX said this was how they would go about partnering with AmEx, and this is a sign of executing on that.

As a reminder, CDLX CEO Lynne Laube specifically mentioned utilizing the Entertainment acquisition (purchased for $15M in cash and stock at less than two times revenue) to penetrate the remaining banks who are hesitant to show their data but still want local content.

There were two different mentions of using the Entertainment acquisition to sign new banks, with my guess being AmEx.

Specifically:

“Additionally, we think this content will help us penetrate other banks who are hesitant to show their data but still want local content.” - Lynne Laube, Co-Founder and CEO, Q4 2021 Earnings

and

“I do think it's an interesting way for us to penetrate banks that are not quite yet comfortable giving us their data. But let's give you some of our content, let’s give you some of our technology and then but slowly work our way into getting your data, I think could be an interesting Trojan horse for us as well.” - Lynne Laube, Co-Founder and CEO, Q4 2021 Earnings

Why this most likely related to AmEx was the following comment in January:

“So, you know, we’re watching those. They are definitely opportunities. Certainly the one we would love to have is AmEx, which is a home-grown program. Not sure we’ll ever get them quite frankly, because they have this religious thing, as they should, about they don’t want to give their data to anyone. And we need data. So we’ll see.” -Lynne Laube, Co-Founder and CEO, Cardlytics, January 2022 Needham Growth Conference

This shows AmEx is a bank CDLX wants, that also currently has a data hurdle. Therefore, CDLX could give AmEx these local offers first, and worry about the data later.

Therefore, Entertainment was a strategic acquisition, and CDLX and Lynne Laube are successfully executing on that strategy.

For even more information on this, I specifically did a full video discussing CDLX partnering with AmEx by utilizing the Entertainment acquisition:

While this is currently a pilot, and while CDLX needs to get their offers with the other CLO offers to remove friction for users, it is a huge step in the right direction, given it was the strategic intent of the acquisition.

The odds of CDLX eventually partnering with AmEx in a full capacity have increased significantly with this update.

Also very important to the story is the new ad server with the bank self-service tool, “Engage”, allowing the banks to send data in a more secure way. This is important to the potential of partnering with AmEx, given it sounds like part of their hesitation has been with sharing data, which the new ad server and bank self-service tool would address.

Update 4: BofA Renewal

The Renewal

It was announced Tuesday, July 12, 2022, that BofA renewed with CDLX through July 31, 2025. Therefore, there is no longer a risk of BofA not renewing. This likely could have been assumed by most, given the commentary around how the Figg testing went, given CDLX said the renewal was all but certain, and given Chase acquired Figg (removing Figg as an option for BofA).

Some feared that given the timing of the announcement of the renewal (very soon after Chase acquiring Figg) CDLX could have gave in to secure BofA, leading to less favorable terms from negotiating the contract. The two more important items would in the negotiation were BofA agreeing to cloud and moving to the new ad server, and the revenue share.

BofA Accepting the New AWS Ad Server

I have spoken with multiple investors who have heard BofA agreed to cloud and will be on AWS, and therefore on the new ad server.

I believe this makes sense. While others felt CDLX may have caved given the optics of the timing with Figg, I think CDLX would not have been able to give in on this term. CDLX needs BofA to be on the cloud and on the new ad server for many things to work together. Additionally, this will benefit BofA and give them more of what they want (local offers, product-level offers, higher engagement, etc.).

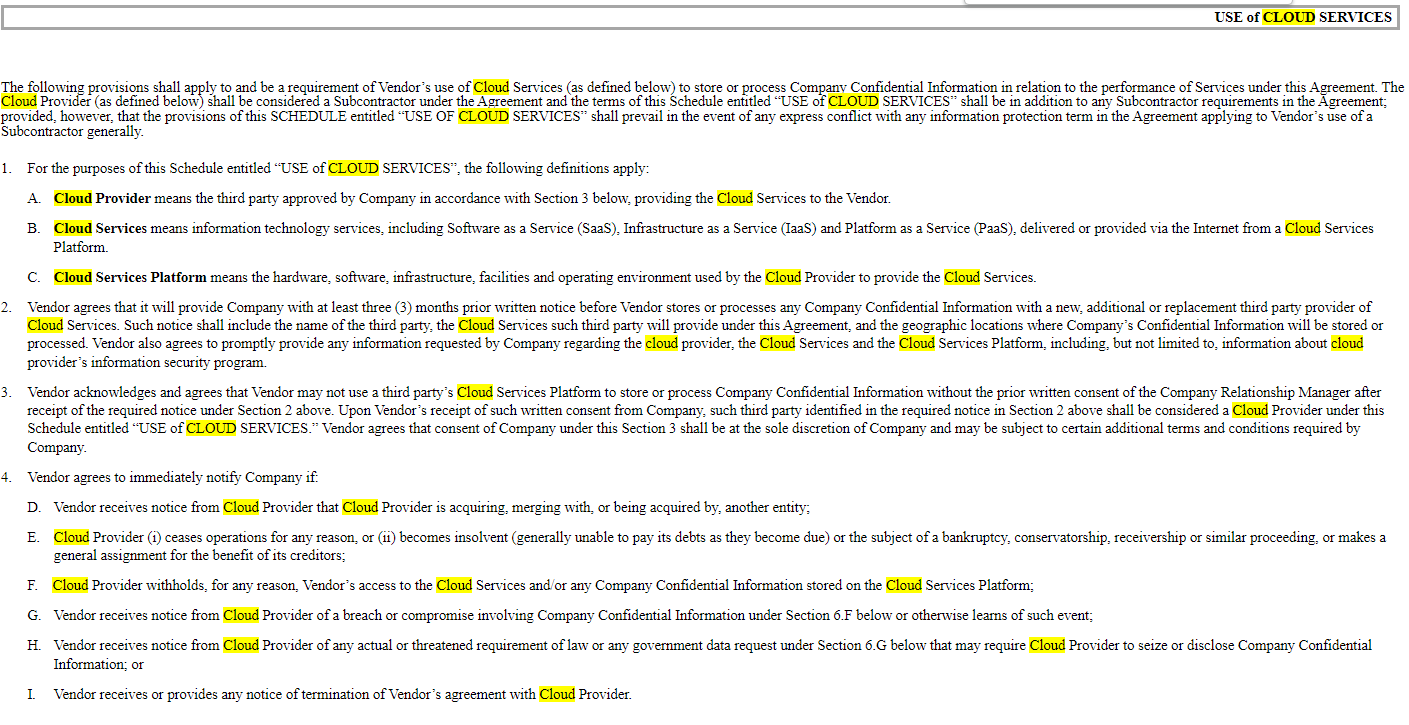

It wasn't mentioned on the call, but based on the new CDLX / BofA GSA that was linked at the end of the latest 10-Q, it looks like there is cloud in the new contract. I've heard this from others, but it is nice to see it there. "Cloud" is mentioned 109 times in the new GSA, and 0 times in the original GSA.

The screenshot below is of the beginning of the section that discusses "Use of Cloud Services":

BofA Rev Share

I think if there were any concessions or no progress made on a given condition within the new CDLX / BofA contract, it would have been on rev share. However, I believe it would simply be that their rev share stayed constant. Not increased.

We know BofA already has the highest rev share of the banks, from being the first large bank on the CDLX platform. Therefore, there is less room for CDLX to increase that for BofA. We know CDLX wanted to bring that down, but it possible this was the one term were CDLX could not convince them to lower, especially given it is the one term where BofA doesn’t benefit when CDLX benefits (it benefits BofA to retain that higher share).

It is possible that the July 21st 8-K was hinting at revenue share staying content when saying,

The SOW is substantially similar to prior arrangements between the Company and Bank of America, and pursuant to the SOW the Company will share revenue that it generates from these cash-back offers within the Bank of America digital channels with Bank of America.

Many people I spoke to were confused my this 8-K, including myself. I asked CDLX IR for clarification, but did not hear back.

Also, if banks continue increasing their reinvestment of rev share back into the program, then this condition is less impactful.

Finally, even if rev share stayed constant, there is potential that with BofA agreeing to the new ad server which will allow Bridg, that the rev share percentage will stay constant but the rev share as a percentage of CDLX revenue will could still come down. This idea is based on the definition of FI share in the 10-K, where the FI share is based on the relative contribution of the data. Introducing Bridg data may lower the FI’s relative contribution of data, and therefore rev share.

CDLX on multiple occasions in the past has mentioned that product-level offers could bring rev share materially down, given Bridg data is not from the banks.

For more detail, I have added more notes on my thoughts around the BofA renewal within the Qualitative Research Notes #1 in the section “Company Risks: Update on BofA Renewal and Terms” (current direct link to these notes).

Update 5: The Marquee Dosh Partner

It was announced on June 21, 2022, that Credit Karma would use Cardlytics to power the cash back on the Credit Karma Visa debit card.

This was confirmed by CDLX as being Dosh’s new marquee partner.

The more interesting aspect of Credit Karma is the number of users. In the announcement of the new partnership, it was said Cardlytics will give “more than 110 million members in the U.S. the chance to earn cash back when they spend money at certain merchants using their Credit Karma Visa® debit card.”2 During the Q2 call, CDLX reiterated that Credit Karma is the largest partner signed on the Dosh platform.

I updated the list of all Dosh partners (included BitPay which was just announced this week):

Given Dosh was acquired more as an insurance policy of primary transactions shifting away from traditional banks and to neobanks, many do not see any significant value or potential with Dosh in the scenario that shift does not occur. Most view the current value of Dosh as being a testing ground for CDLX. I do not agree.

Given the higher gross profit margins (from less revenue share), the ability to have more unique content, utilize push notifications, have less restrictions compared to the banks, I think Dosh and the neobanks that Farrell Hudzik (EVP of Financial Institutions) has signed up at a rapid pace could be monetized.

With Figg likely out of the neobank picture from Chase acquiring Figg, there is potential of both neobanks coming to CDLX and that associated ad spend shifting to CDLX.

The ad spend aspect relates to some comments by the SVP of Horizon Media:

I still believe CDLX needs to offer the ability to choose where their offers are placed within the self-service platform (a common feature of other major self-service ad platforms). I hope this is assessed by the new tech-focused management once self-service becomes more a priority.

For an overly simplistic look into my reasoning, imagine that out of the 193M users between Credit Karma’s 110M users and Venmo’s 83M, that CDLX gets attractive offers in front of an additional 5% of those users, and redeems one $10 offer (along the lines of the $10 off Panda Express offer when you spent $10). If you assume the same $2 of rev / CI, and 75% gross profit margins (lower rev share with Dosh partners than the banks), and given these are incremental users that likely have no additional operational expenses to service them, this is $120M of cash flow (17% effective tax rate like before). At a 20x multiple that is $2.4B of additional value from leveraging existing partnerships, existing technology, and existing resources.

Update 6: Bridg

There was quite a bit about Bridg this quarter.

CDLX bought back $40M worth of shares, or about 1.4M shares, as a form of arbitrage with the Bridg payment. This was something already known and shared around the time the buyback was announced.

Bridg was largely responsible for the negative net income this quarter. There was an $83.1M expense / write-down related to Bridg’s carrying value:

we determined that the carrying value of the Bridg Platform reporting unit exceeded its fair value, and consequently, we recognized a goodwill impairment of $83.1 million.

There are two Bridg earnout payments, seen on the balance sheet with the “Current contingent consideration” and the “Long-term contingent consideration”. The long-term contingent consideration was also marked down QoQ from $38.3M down to $0. This makes me believe that at this time CDLX expects no second earnout payment with Bridg next year. This could be beneficial. If nothing has changed with the long-term potential of Bridg, lower performance today is allowing for less paid for the asset. This could also be related in some part to CDLX saying they still expect positive EBITDA and FCF in 2023 under their adjusted more conservative assumptions, given they could now have significantly less outflows (I will discuss more later in the results section).

On a more positive note with Bridg, ARR grew 56% QoQ from $14M to $21.8M, with Bridg signing 2 new deals (one worth $2M and the other worth $25M over 2 years).

We closed 2 joint Cardlytics and Bridg deals in the quarter. One is worth nearly $2 million and another is worth over $25 million in a 2-year period.

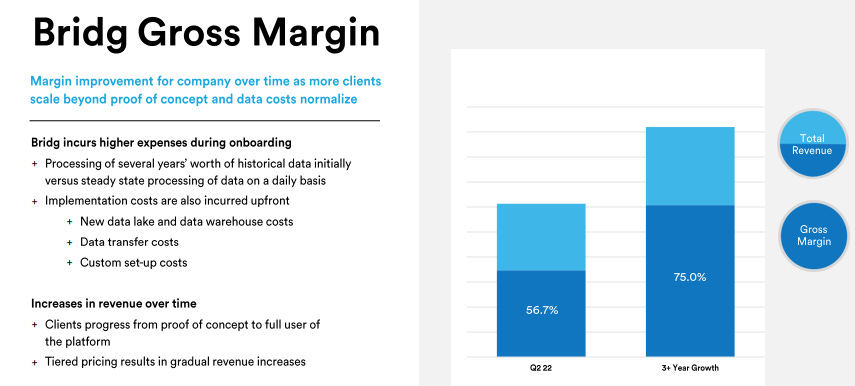

As a reminder, Bridg gross profit margins are expected to grow over time, given the higher expenses during the onboarding phase. This is not related to CDLX gross profit that could increase from lower rev share with the banks from utilizing Bridg data. That is separate.

I have went into extreme detail on the power and potential Bridg here:

Update 7: Results

Cash Flow Positive and Cost Savings

We are taking steps that will immediately reduce our cost structure and ensure a path to sustain positive adjusted EBITDA by Q2 of 2023 and positive free cash flow by Q3 of 2023.

First, we are pausing our hiring activity which will have a positive impact on our operating leverage in the back half of the year. Second, we are immediately active on a plan that contains $15 million of annualized cost savings. This plan does not place our strategic goals at risk and will allow us to achieve sustained positive adjusted EBITDA by Q2 of 2023 and positive free cash flow by Q3 of 2023.

Cost Savings with Bridg

As mentioned in the Bridg section above, one large reason I believe CDLX is able to stay on track with their expectations of becoming EBITDA and FCF positive in 2023 is due to there likely being no second Bridg earnout payment in 2023. This is based on the long-term contingent consideration being marked down QoQ from $38.3M down to $0. With likely 30% at least pay in cash, that is at least a $11M cost savings.

Cost Savings with Open Banking and Self-Service

In terms of the $15M of annualized cost savings mentioned during the call, this could be from Open Banking and self-service development.

There's opportunities to reduce the focus on some of the longer-term growth initiatives, things like open banking.

I don’t love losing progress with Open Banking, given the first mover advantage + long runway + near 100% gross profit margins (since 0% rev share). I understand this isn’t needed for CDLX to be a successful investment, and actually it may be needed to pause for the sake of staying on track to hit positive EBITDA and FCF goals in 2023 (avoiding liquidity issues), but given the opportunity, I do not like seeing it paused. To me this is an amazing opportunity that can help increase the right-tail returns with this investment.

The reason I also believe self-service development is part of these cost saving initiatives is I heard development is currently on pause. Some believe CDLX is dropping self-service forever. I do not believe that will be the case. Additionally, Karim (new CEO) can reassess and will likely make the rational decision in regards to when to resume development. Given this is needed for agencies and to unlock the significant number of SMBs, and given the change in management, I believe self-service development will not be paused forever.

Activation Rates

Many have called out that activation rates are down YoY.

While some viewed this as a sign of decreasing engagement with offers, it is instead related to the substantial increase in total offers (an assumption I had that was confirmed by CDLX after the call).

It was discussed in Q1 2022 how a significant number of new logos have been added to the platform:

In the first quarter, we began piloting local content from a partner with one of our major banks. This is an exciting development and allowed us to test the scalability of our new Ads Manager. In this pilot, we included over 300 hyper-local advertisers from a third-party content provider. In addition, our newly formed mid-market group sold and republished 200 mid-market advertisers in Q1, bringing our total advertiser count for the quarter to over 600 advertisers. We are well on our way towards reaching our goal of having over 1,000 advertisers running simultaneously on the platform in 2022.

Q4 had 505 logos, so there was an increase in Q1 to a total of 600+ which is about a 19% increase for the denominator of activation rates.

Additionally, in the Q2, I have more offers in my Chase account than ever (89). I have heard the same with others, who now have over 100 offers in their Chase account (who also have Rewards Network local offers).

Here is the definition for offer activations:

Offer activation rate: We define offer activation rate as the total number of offers activated by MAUs divided by the total number of offers served to MAUs in the applicable period.

Also, given we know CDLX was pushing Rewards Network content from their comments at the January conference, we know that this would explain a larger increase in restaurant offers versus other categories, which could explain the larger decrease in restaurant activations (larger denominator effect). Additionally, you will likely have lower activation with these offers give worse looking logos + smaller in cash back percentage + less familiar to users.

We can collaborate this with the fact that comparing the same YoY with revenue, that revenue was actually up 26% YoY. This would be much harder to explain if offer count was staying the same and activation rates dropping, while revenue increasing as much as it did.

Therefore, this is likely a positive sign, rather than negative, given it is reflecting an increase in offers in the channel.

Lower Growth Guide of 10-15% in H2 2022

We are assuming the challenging macroeconomic conditions will put pressure on ad budget through the rest of this year and potentially into next year. So we are lowering our expectations to 10% to 15% growth for the second half of 2022. While this uncertainty does affect our top line, we can control our costs and work towards generating positive cash flow. We are taking steps that will immediately reduce our cost structure and ensure a path to sustain positive adjusted EBITDA by Q2 of 2023 and positive free cash flow by Q3 of 2023.

I am less worried about short-term results, as well as results / revenue / engagement that are before the new ad server and full rollout of product-level offers, self-service for agencies, self-service for SMBs, self-service for banks, local offers, new UI, push notifications, etc.

Declining revenue would be a bad sign if there were no areas for future growth, and therefore this would be a sign that the company could be slowing down. I do not think that is the case at all with CDLX, given all the growth factors I mentioned (which still excludes Open Banking with near 100% gross profit margins, neobanks via Dosh, and more). So any short-term fluctuation due to the current environment is of a little concern to me given the many untapped growth factors.

It is a larger concern for those who are reliant on short-term results to produce short term investment returns. That is not a game I am playing.

Closing

Cardlytics will be fun to watch over the new few quarters. I am keeping a close eye on Chase and BofA to see when they move to the new ad server (it is possible it will not be announced, therefore I will be closely tracking their apps). I am also very interested to see what materializes with new potential bank partners (such as with AmEx or USAA). Finally, I’m eager to hear and see what Karim does as the new CEO.

Cardlytics has some of the best prospects I’ve seen when analyzing potential investments (both across public and private businesses, as well as real estate). While there is always a chance that one of the negative scenarios could materialize, I continue to take those odds and bet heavy.

For all my notes and thoughts on CDLX, which I continually update and is over 500 pages, check out my Qualitative and Quantitative “Research Notes”:

(Given the quantity of new notes, and hitting Substack limits, I had to split the notes once again)

Qualitative:

Cardlytics $CDLX: Qualitative Research Notes #1 (247 Pages, 91,005 words)

Cardlytics $CDLX: Qualitative Research Notes #2 (19 Pages, 8,030 words)

Quantitative:

Cardlytics $CDLX: Quantitative Research Notes #1 (200 Pages, 72,171 words)

Cardlytics $CDLX: Quantitative Research Notes #2 (101 Pages, 34,473 words

These notes contain information I have not shared anywhere else. For more general information on Research Notes, see here.

I have been adding a significant quantity of new notes lately, given the many changes around the company. I expect this to continue. Once things settle down, I will shift my focus to releasing my Carvana notes, which for the large number of you who are already paid subscribers (and the substantial number of new paid subscribers this last month), you will have access to all current and future notes. I have greatly appreciated your positive feedback lately, and I look forward to continuing adding to these notes, with intentions of expanding them to more companies over the years.

Follow-Up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more.

-Austin Swanson (Swany407)

Twitter: @Swany407

Website: Swany407.com

More Information on Cardlytics

Research Notes

Free Posts

Current Price Decline, Short Thesis, and Q1 2022 Earnings: Write-up and video

Open Banking (The Free Option on the Hidden Potential Cash Cow): Write-up and video

The Power of Bridg (and Why CDLX is Undervalued): Write-up and video

BofA Renewal & Testing Competitors (Update): Write-up and video

New Observations, Upcoming Earnings Calls, and Updated Allocations (10.21.2021): Write-Up and video

Thoughts Following Q2 2021 Earnings and Price Decline: Write-up and video

Thoughts After Price Decline (5.17.2021): Write-up and video

Disclaimer: This content is not investment advice, and is intended for educational and informational purposes only. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.