Cardlytics ($CDLX): Clues of Chase's Intentions with Figg

New Chase platform, statements by Chase to CDLX, Figg's tech and capabilities, related job openings at Figg, matching timelines, comments by employees, and much more.

For those interested, this post is also available on YouTube, Apple Podcasts, and Spotify

Market Cap as of 9.29.2022: ~$9.81 Share x 32.9M Shares ~ $323M Market Cap.

Subscribe to not miss upcoming posts, or upgrade to access Research Notes:

Introduction

With Chase scheduled to the launch CDLX’s new ad server in Q4 2022, combined with Chase possibly already being in migration to the new ad server, the odds of Chase continuing to use CDLX appear quite high.

This led me to wonder, then what are Chase’s intention with acquiring Figg?

This post will go over my most recent discoveries that gives clues to what Chase’s intentions could be (and with a relatively high probability).

Given CDLX’s stock is down in part due to the uncertainty with Chase’s intentions with Figg and whether it will result in dropping CDLX as a partner, I believe this post could help reduce some of that uncertainty.

Summary of What Will be Discussed

This post will go into detail on updates added to my CDLX Research Notes this month (for those who read the related notes when I first posted them, there are additional important details added to this post that are worth reading).

Clues of Chase’s intentions with Figg

What Chase told CDLX

My Findings: New Chase platform for SMBs + 1st party data + advertising

How this platform matches Chase’s stated intentions to CDLX on why they acquired Figg

Evidence this platform relates to Figg

Evidence Figg is working or will do work related to this platform

Figg’s related capabilities and tech

While this info was already released in my notes, I decided to make this into a public post given the feedback I received from those with access, as well as given the number of discussions I had after sharing these findings. I also wanted to go more in-depth, given the importance of this topic.

If you want access to information like this sooner (and to get access to info never posted publicly), upgrade to access Research Notes:

I also added a section on “Anticipated FAQs (Is This Bad for CDLX?)” at the end of this post, to provide my own thoughts and analysis regarding these discoveries, and to cover the questions you may have while reading this post. There are some important and key details in this section.

Clues of Chase’s Intentions with Figg

I recently came across something extremely interesting that could support what we have heard as the reasons for Chase acquiring Figg.

Given the near-perfect (or even 100% perfect) similarities to what Chase told CDLX, I have little doubt that this was what Chase was referring to (the timelines even match up). It also makes sense of where Figg fits in and there is possible proof Figg is working on this or will be working on this (as I’ll detail later).

What Chase Told CDLX

As a reminder, Chase told CDLX (and CDLX IR recommunicated to different investors the following) that Chase acquired Figg for the following reasons:

“they have told management they simply want to own technology so they can use their own proprietary data that they are not willing to share with a third party to improve offer presentation and accelerate their efforts in SMB”

“to improve placement of offers using their own proprietary data”

“they have 1st party data they don’t share with us and they want to be able to use it to better target offers across their platform.”

And then at the last earnings (Q2 2022), CDLX reiterated that Chase is using Figg for SMBs.

While I had some guesses on what this all could mean, nothing has checked all these boxes or fit together as completely as the following…

My Findings: New Chase Platform for SMBs + 1st Party Data + Advertising

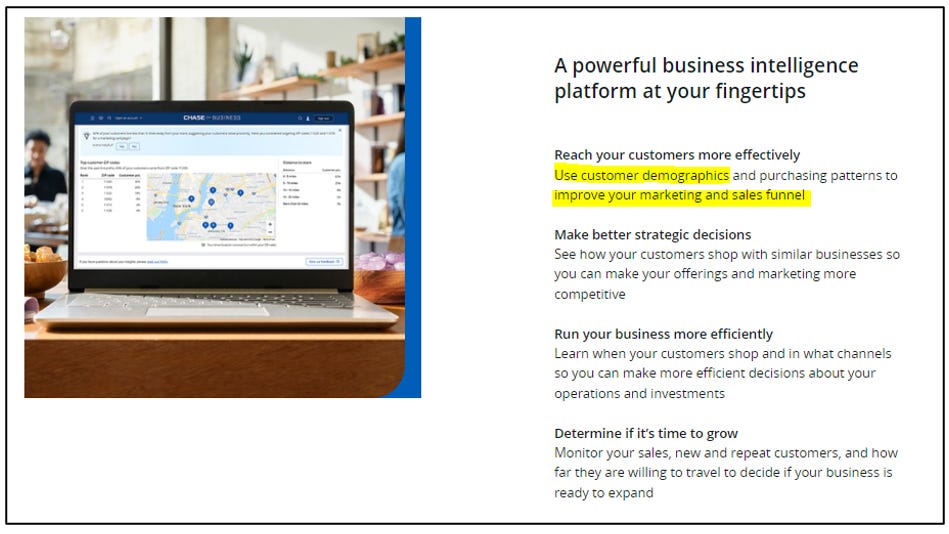

I came across two articles related to a new Chase platform called "Customer Insights" that launched in June 2022 for SMBs, that involves using first party data, as well as to help with advertising.

"ML-driven Chase platform distills data for business insights: More than 70% of SMBs want customer insights from their bank", By Whitney McDonald, September 8, 2022

“How JPMorgan Chase is using payments data to woo merchants from fintechs”

By Kate Fitzgerald, June 09, 2022

(See the footnote1 at the end of this post for links to these articles and additional detail)

Even more important is how I found it (which I’ll detail later).

How this Platform Matches Chase’s Stated Intentions to CDLX on Why They Acquired Figg

Below is a list of the key details from those articles and how it relates to Chase’s stated intentions with Figg that were communicated to CDLX.

“Chase recently launched its data analytics-based Customer Insights platform in order to provide its small business clients with a deeper understanding of their customer base through their transaction and payment history…. The platform, launched in June”

Launched in June 2022, right before the acquisition of Figg in July 2022.

For small businesses and deals with transactional data, matching what Chase told CDLX Figg was for, and matching Figg’s expertise.

“Small business customers can receive a big-picture overview of their clients’ average age and geographic location; where they come from to visit a store; channel insights that break down online versus in-store sales; and the ability to benchmark store performance with meaningful peer groups”

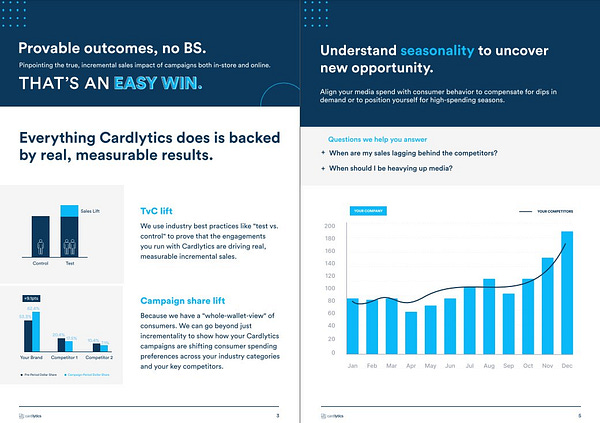

The benchmark to others, or “gain insights on similar businesses” is similar to the share of wallet that CDLX / Figg use.

These insights / analytics / reporting are similar to what CDLX provides to larger ad-spending clients. This would then match the fact Figg has all these same capabilities and experience (as I discuss in more detail later).

“Small businesses can use this [card] data to figure out exactly where to set prices and store hours and staffing–for example, how many people need to be on duty? Do they need to stay open later? Do they actually need to be open on Mondays?"

Shows this is not just for advertising, which explains the different Chase divisions that could be working on this, as I discuss later.

I will also show how these profitability and operational efficiency aspects are also mentioned in a current Figg job opening, which as stood out to me, given not only the similarities to the platform, but given it isn’t as related to advertising / card-linked offers (which Figg seemed to be focused on).

“The bank is betting its trove of data can be a competitive differentiator against other card issuers and payment technology firms that offer merchant services to businesses, such as Fiserv's Clover, Block and Stripe.”

Explains the reason for Chase doing this, and why the focus is on SMBs.

Also shows the primary focus is not on the advertising feature, but instead the focus is on attracting more merchants to use Chase Payment Solutions with all these additional features given the increased competition from others.

“The new service harnesses anonymized customer card and purchase data so small businesses can compare their own customers' demographic details and shopping habits with those of nearby rival…”

Once again, shows this is for just SMBs.

Mentions anonymized customer card and purchase data, which is what Figg was dealing with.

CDLX does not receive demographics information from the banks, so this fits Chase saying they want to use data not sent to CDLX.

We know that Cardlytics does not receive demographics information, and therefore does not use that for targeting.

The Chase Customer Insights platform allows merchants to “use customer demographics…to improve your marketing and sales funnel”. Or rather, Chase will use first party data to improve targeting.

Together, this fits the statement of Chase wanting to use first party data they don’t share with CDLX, and use it for improving targeting.

“…through a dashboard with tools to apply the insights to refine advertising, operations and loyalty programs.”

The dashboard and tools could relate in part to Chase telling CDLX they want to own the tech, since these insights on the dashboard are similar to what CDLX does (I believe there has to be a tech CDLX currently has that Chase wants in order for that statement by Chase to make sense, but this could apply to the other Figg tech I will discuss later).

The insights related to advertising, operations, and loyalty programs, as well as using this data to enhance targeting of offers, are key. Without this, I was less sure where Figg came in. This completes the puzzle.

“Refine advertising” also matches Chase saying that want to improve their offer targeting and placement.

“The dashboard provides a weekly summary of customer spending patterns comparing an individual business’ sales results to those of nearby businesses in similar niches.”

Again, similar to the share of wallet analysis that CDLX / Figg use (I confirmed Figg provides share of wallet analysis, and there is a screenshot of this later in this post).

While Chase may not end up using 100% of Figg for this new platform, this seems to match exactly what Chase told CDLX they were using Figg for. Not only is it for SMBs, but also 1st party data, and has a purpose for improving advertising. Additionally, this platform just launched in June (right before the Figg acquisition).

But the support for this increases with the following…

But what evidence is there that this platform relates to Figg?

One of the articles quotes someone who is “Managing Director, Head of Data & Analytics, JPMorgan Payments”, and the other article quotes someone who is “Managing Director, Global Head of SMB Payments, J.P. Morgan”. Given the Customer Insights platform is for SMBs who use Chase Payment Solutions, it would seem this platform is under the payments side of Chase.

There are some Chase employees who are liking many Figg posts, who work in “Chase Offers” and “Connected Commerce” (which I believe is above both Chase Offers and Chase Shopping / Shop Through Chase), which makes me believe those are the divisions Figg is working for.

While possible different divisions, this platform could have multiple divisions working on it, especially since advertising isn’t the key functionality here. Maybe that is where Figg comes in, under “Connected Commerce” and helping with the offer side and improving the offer placement related to these SMBs (just one of the features). This would explain how the Figg job listings below mentions “cross functional projects”.

The stronger evidence of why this relates to Figg is:

How this platform matches Chase’s stated intentions to CDLX on why they acquired Figg (discussed above)

How I found about the new Chase Customer Insights platform (discussed next)

How we know Figg is working or will be working on this platform (discussed next)

Figg insights / reporting / measurement capabilities (discussed next)

How I Discovered This New Chase Customer Insights Platform

The way I found this was from a Chase Executive Director who likes a ton of posts related to Figg on LinkedIn, making me believe her area works with Figg. Based on some posts, including a recent job listing that specifically said it was for her area, it seems to be that she may be at least above the Chase Offers and Shopping team in the Org Chart. She was the one who liked a post on LinkedIn last week regarding one of the articles about the new Chase Customer Insights platform.

Well even more interesting was not only did she like it, but so did the Head of Chase Offers (showing more so how it could relate), as well as someone from Cardlytics (which could make a lot of sense since CDLX was made aware of Chase’s intentions with Figg before the acquisition was announced, which could be why this CDLX employee knows what the platform is and how CDLX’s role fits into it, otherwise why like it?).

How do we know Figg is working on this? (Job Openings)

Well, you could say that even if Figg is under this area, and there are people within this area working on some aspects of this SMB platform, how do we know Figg is working on it?

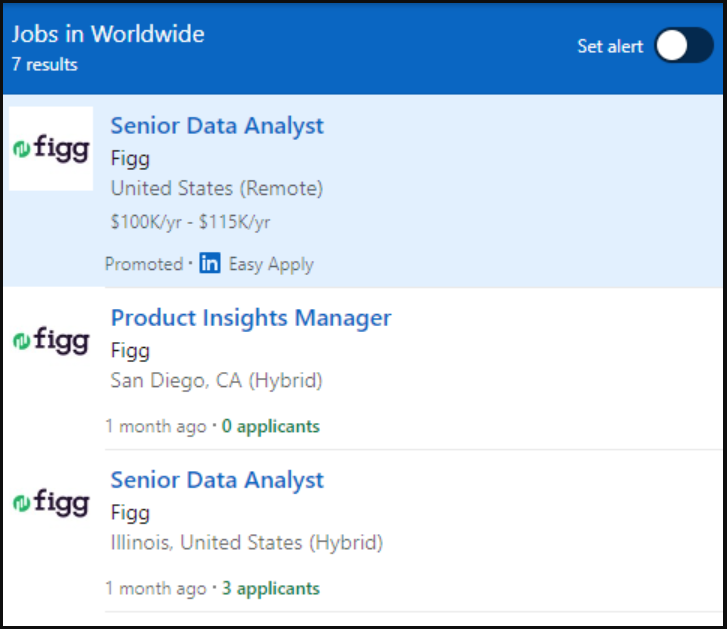

This is where I found a current job listings for Figg are for a Senior Data Analyst. (Originally I thought there were 7 job openings, with 2 for this senior data analyst, but it looks like it may be the same post duplicated, given one is promoted. However, of all job listings that are promoted, it happens to be the one possibly related to Chase.)

The following is the job listing, with key points highlighted:

The following analyzing this job listing:

Partner with internal and external clients to analyze data and provide reporting, insights, and recommendations. Lead cross-functional efforts to drive strategic improvements in profitability, operational efficiency, new client growth, and existing partner relationships.

Given this matches everything, I find it hard to think how it doesn’t relate to Chase’s new Customer Insights platform, but maybe there is more Figg does that I’m unaware of.

Analyzing data and providing reports/insights/recommendations matches the whole data aspect of the new platform, since it was all built based on data, with a dashboard to provide reporting / insights / recommendations.

In one of the articles, they said, “How do you let a machine learn the data and then translate it to a business recommendation?”, where this job post mentioning using the data to provide recommendations.

The profitability and operational efficiency match key aspect of the platform. For profitability, Chase says “A business intelligence platform with analytics you can use to better reach customers and manage your bottom line.”. For operational efficiency, Chase says, “To help merchants improve their marketing, pricing and staffing strategies in a tightening economy,” where “Small businesses can use this [card] data to figure out exactly where to set prices and store hours and staffing–for example, how many people need to be on duty? Do they need to stay open later? Do they actually need to be open on Mondays?”

These are extremely strong similarities, that doesn’t directly relate to card-linked offers which is what Figg has previously focused on. This is what stuck out most to me.

Participate in enhancing the data and reporting product roadmap.

Again, a focus on data and reporting, matching the new Chase Customer Insights platform.

While I could be reading it differently than intended, it is interesting that it says “data and reporting product”, in the singular case, as if only taking about one product related to data and reporting.

Lead complex and often cross-functional projects, coordinating teammates and other colleagues to develop new product and process capabilities.

Design and develop new tools and analyses to support the sales process, manage ongoing advertiser campaigns, and demonstrate business value to internal and external clients.

Once again, a focus on new tools and analysis.

The sales aspect could relate to signing new SMBs at Chase to use their Payment solutions, since Chase’s purpose of offering these insights is related to obtaining / retaining SMBs on the merchant side of the business to use their Payment Solutions, given the threats of the likes of Square. More conclusively, if you go to the Chase Customer Insights platform website, it directs you to call their sales team, showing this is used directly by Sales and the sales process:

The internal vs external clients aspect interested me. If you think in terms of CDLX, who is an internal vs external client? Maybe this is Figg distinguishing between Chase and an SMB?

Coordinate with Sales, Relationship Management, and other internal colleagues to deliver on their reporting and analysis objectives.

Focus again is on reporting and analysis.

Seems to perfectly match the Chase’s Customer Insights platform for SMBs, especially given the mention of “reporting, insights, and recommendations” on “profitability and operational efficiency”. But it is always possible this is for something else, such as an existing offering in their business.

Figg’s Insights / Reporting / Measurement Capabilities

The new Chase Customer Insights platform is supposed to provide analysis similar to the “share of wallet” analysis Figg provides clients, and therefore has expertise in this area.

Additionally, Figg has expertise in many other insights, reporting, and measurement features:

Reporting is one of the key selling points Chase is using for their new platform. Also, the platform is called Customer Insights.

Additionally, the Figg screenshot above also has another important connection to one of the Chase Customer Insights platform, where Figg says, “Advertisers can take these insights to make actionable plans beyond card-linking”. This even matches the Figg job post above that says “analyze data and provide recommendations”. Where Chase in the article discussing the platform said:

“How do you let a machine learn the data and then translate it to a business recommendation?” Tony Wimmer, managing director and head of data and analytics for JPMorgan Payments, told Bank Automation News. “The key is to find the right data field in the data, then distill it to the insights of the consumer users.”

Altogether, you have a business that may have been trying to be sold by its parent company, that has experience and the knowledge related to the reporting / insights / recommendations, and also knows how to use this for advertising.

We also know businesses want these insights and reports, where many CDLX clients have said they really enjoy the data analytics side.

“In the direct-to-consumer sector, a large subscription service provider that piloted with us in 2021, signed a new contract in the mid-7 figures. While incremental return is important to this client, a key factor in the increase was the unique insights that we can provide on purchase behavior around subscription rates and churn rates.” - Q1 2022 CDLX Earnings

CDLX can’t sell this data, given its the bank data. They can however make this analysis available when clients spend above a certain tier.

Well, maybe this is similar to what Chase is trying to do, but instead with the motivation to get more SMBs using their Chase Payment Solutions (instead of using those from the likes of Square). And given it is Chase’s data, they have more freedom on what is shared and what they do with it.

Anticipated FAQs (Is This Bad for CDLX?)

In summary, why would Chase acquire Figg?

While I do not know for certain, it would seem likely that one aspect (if not the primary and only aspect at this time) is related to helping with the Chase Customer Insights platform for SMBs.

Figg has experience and knowledge that perfectly aligns with the new platform, with using anonymized purchase data for insights / reporting / recommendations, as well as for advertising, and specifically for SMBs (it was always emphasized by Augeo that Figg was more focused on local / SMBs).

Additionally, if the more granular area that Figg will focus on is the advertising side, it is possible Chase will want Figg to develop automations for placing offers on behalf for their clients (rather than recreate a platform where the offers are only placed within Chase to Chase users, versus CDLX’s 179M MAUs).

This could make a lot of sense, given SMBs likely will not spend the time learning / understanding card-linked offers, and would likely spend their marketing efforts on more familiar methods like Facebook or Google, or even more traditional forms like TV / print if they are older / an SMB that has been in business for a long time.

Therefore, Chase / Figg could create a method to place advertisements on their behalf, with one channel being Chase Offers. This would be a very large net positive for CDLX. This all fits into the following from the article:

Making richer business-management data easier for time-pressured small-business owners to utilize could be a winning strategy, as long as it’s effectively marketed to end users, she said.

“The danger is that banks continue to make features available and then wait for customers to find them. If there’s not real attention paid to the value customers are receiving with this data, these initiatives could fail,” Hewitt said.

This even makes more sense when you combine that with knowing Figg already has some technology Chase / Figg could leverage. This could be a part of the reason for Chase acquiring Figg, and not just simply hiring some of their employees.

Figg has a self-service tool for local businesses called “Ampre” (amplify rewards).

I learned about this self-service tool from the following interview from Augeo:

Given most SMBs are likely not going to have the time or want to place these offers on their own, Figg can use their self-service tool to do it on their behalf, possibly in channels such as Chase Offers. This is likely, given CDLX essentially does the same for their clients, placing offers on their behalf using their own self-service tool (I believe this has been discussed in regard to working with agencies, and not yet “turning the screen around to them” or “getting their hands on the keyboard”).

With Chase soon to be on the new CDLX ad server with the new self-service tool for banks, “Engage”, it would allow Chase / Figg to place local offers in the channel, with richer imagery to increase understanding of the stores, as well as with better categorization to find the offers. The local aspect with Engage was even specifically discussed by CDLX saying “that is part of the Engage self-service tools, if you really want local, we can run it on our rails and make it better”. Maybe Figg can leverage Ampre to then place the offers through Engage into Chase Offers.

The CDLX self-service platform also allows the banks to add more of their own data with a blind mechanism via APIs, which may allows Chase / Figg to use some of their demographics data they are looking to use to improve targeting.

These both give more reason for why Chase is scheduled to launch the new ad server in Q4 2022, and looks to be already in migration.

In terms of why Figg would sell, it is possible Figg, like CDLX, has high fixed costs and Augeo didn’t want to keep funding Figg. This could explain the rumors Augeo was trying to sell Figg. Or the sale could have been related to Augeo using it as a way to return capital to investors from the recent other acquisitions that led to Figg.

“Seeing an opportunity to introduce advanced technology to an emerging industry, Augeo acquired Edo Interactive in early 2017. Building on that success, in April 2020, Augeo acquired Empyr, in conjunction with legacy and new investors. Figg was formed to combine the unique engagement strategy, advertiser and publisher networks, user base, and data insight capabilities of the two companies.” - Figg’s Website

Even within that statement, it highlights a key aspect that would fit perfectly into what Chase is after, the “data insight capabilities”. So even if Chase wanted only certain aspects of Figg, they would be required to purchase the entire business. This would also explain why not all of Figg is working on Chase related projects at this time. Maybe even Chase wants to sell those aspects off, or keep them running as a backup to CDLX. Either way, we know traditional banks move slowly.

In terms of how Chase would even know about Figg, I started by searching one of the Chase Directors quoted in one of the articles related to the new platform. I wanted to see if there was anything I could find that would lead me to believe there was a relationship established before the acquisition.

What surprised me was his previous work experience, which included about 1 year working as the president / COO at Dosh. This could be how Chase knew about Figg, with him working in the same industry (not just from Chase using CDLX).

However, it could be Chase become aware of Figg through Augeo trying to sell Figg and working with brokers, or given BofA was testing Figg for local, or any number of other connections.

With Chase creating a platform for SMBs that allows them to advertise in Chase, wouldn’t they drop CDLX?

The focus is not on advertising for SMBs. This new platform was created specifically with the larger goal of Chase is incentivizing small businesses to use Chase Payment Solutions by offering these other benefits on this platform. So the focus isn’t even as broad as “SMBs” like we heard, but more specifically for SMBs to use their payment solutions.

Where the first thing on the Chase’s site says, “Exclusively available when you use Chase Payment Solutions℠ for credit card processing.” and then right below is has a phone number to call to sign up for Chase Payment Solutions.

And if you go to their website for the Chase’s Payment Solutions, it even mentions the Customer Insights platform right below the products:

Additionally, in the June article, it mentions this Customer Insights platform is for users of the QuickAccept pictured above:

The new resource, called Chase Customer Insights, rolled out this week after months of testing to Chase small-business customers and users of QuickAccept, the newest version of its small-business card acceptance service, according to Brad Brodigan, head of global SMB payments at Chase.

We also know incentivizing small businesses is what Chase is more worried about, where the following comes from an article with a fitting title, “How JPMorgan Chase is using payments data to woo merchants from fintechs” (linked in the footnotes):

The bank is betting its trove of data can be a competitive differentiator against other card issuers and payment technology firms that offer merchant services to businesses, such as Fiserv's Clover, Block and Stripe.

We also know from the other article that the focus isn’t even the advertising feature, but more generally providing SMBs with more insights into their business:

“We hope that at least a couple of these [offerings] help small businesses really make better decisions”

In a recent study by JPMorgan Chase that surveyed 1,000 small business owners, more than 70% of respondents said it’s important for financial services providers to offer customer insights and business intelligence services.

Additionally, when I searched on LinkedIn the Chase Directors who was quoted in one of the articles, and who worked at Dosh for a year, it shows he is the “Global Head of SMB Payments”, showing this work is likely more limited to SMBs, with even profile’s bio says “passionate about helping small businesses thrive”.

Therefore, I do not believe Chase is looking to replace CDLX. If anything, with the small aspect of advertising with SMBs, they could place offers through CDLX into Chase Offers, leading to better results for Chase’s SMBs. If Chase dropped CDLX, not only would it lead to less attractive offers for uses, but those SMBs would have less offer capabilities that are offered on the new ad server, and would have less users to advertise to.

But SMBs / local businesses don’t need the large reach that CDLX offers and that national brands require, so why would Chase still use CDLX?

I believe local businesses need large reach just as much. Just because Chase has 60M+ users, that doesn’t help the local shop owner in a small town of say 30K. They won’t be advertising to everyone in the US, but instead only to those in their small town. And in that town, maybe Chase only has 25-30% coverage of that town, with others in that town using BofA, Wells Fargo, or a local bank. Then the number of people who would be interested in that SMB is even smaller. Therefore, CDLX partnerships with the other banks can be leveraged, where it becomes more likely to find a relevant user in the larger data pool for that small town.

Additionally, let’s say Chase does drop CDLX to just have Chase SMB offers as the only cash-back options. Does this lead to higher engagement for Chase card users, leading to more card spend, lower attribution rates, better relationships with the customers, increased mobile and app use, increased cross-selling and more, which are more important than the higher share of revenue from the ad spend?

I would believe it would have an extremely negative impact on these results. You would be using only Chase SMBs, and lose out on from CDLX their non-Chase SMBs, product-level offers, new offer constructs like time-of-day offers (which would even fit into how Chase’s new insights platform gives insights on time-of-day trends), a new UI, richer imagery in the offers, national advertisers that need larger reach, and all already working and ready on the new ad server, which also has the new self-service for banks for them to place their local offers. This is why the clues of Chase already migrating to the new ad server are key, as it shows they want to utilize these features, and not drop CDLX to build something internally.

If Chase is successful with this insights platform, couldn’t Chase expand this to national advertisers and take away share from CDLX, or even then drop CDLX since will have both SMBs and national?

The focus of the platform is customer insights. Yes, Chase could expand this to national advertisers, but let’s think about this from two aspects.

Data related to their stores only

Data related to comparing to other stores

With the first, are the simple reports / insights Chase is giving to SMBs going to be better than what the national large businesses already have? I would assume they have these capabilities built, and are much more tailored and detailed to what the business needs.

This was even mentioned specifically in the article discussing the new platform:

The service targets businesses like restaurants, brick-and-mortar merchandise stores and services like plumbers and electricians to help merchants pinpoint opportunities to boost sales and improve efficiency…

Large retailers tend to have their own proprietary customer data, but small businesses typically only have access to generalized local sales data…

This shows Chase is not focused on expanding this to larger clients.

But what about data external to their stores? Couldn’t Chase expand into this aspect for larger businesses?

Well this is what they already get from CDLX when they spend over a certain tier. Even if Chase builds something as good as CDLX, CDLX allows the advertisers to use that data to inform or how advertise across all banks, not just Chase.

Additionally CDLX offers product-level insights + targeting and offer placement. For Chase to do the same, it would require integrating with those businesses’ POS systems or them using Chase’s SMB Payment Solutions, where both seem unlikely.

In terms of the importance of adding in SKU insights that CDLX offers together with Bridg:

You could say there will be national large businesses that want this data without even using CDLX, where maybe that is the only reason they use CDLX today. Ignoring product-level data / insights / targeting, let’s say Chase matches CDLX in other regards. That gets back to what is Chase’s incentive to do so for national / large companies? They are giving these data insights away for free to SMBs, given they are focused on attracting and retaining their business and to use their Chase Payment Solutions, which these large businesses won’t be using.

Given the SMB payment solutions is the present focus, this gives CDLX even more time to get ahead of Chase, such that if Chase shifted focus years from now, CDLX should have widened their moat / value proposition to the banks. If they haven’t, the business would likely not be performing as well even if they kept Chase anyways.

You mentioned SKU insights and targeting. Couldn’t Chase do this as well, at least with SMBs, since they are incentivizing SMBs to use their POS systems?

At this time, SKU does not seem to be a part of the insights on the platform:

By combining cardholder data plus individual store sales, merchants can see details such as their typical customers' income, ZIP code and their routine mix of purchases including ticket size and shopping-trip frequency.

While Chase could likely get SKU data from the payment systems they are trying to get merchants to use, the issue will be every merchant could have a different way to enter each SKU, requiring an incredible amount of data cleaning (rather than a national brand that has more consistency across all their stores, which is what CDLX / Bridg is focused on).

This was discussed by the Chief Brand Officer of Bridg on 5/5/2021:

And so you pick up all that SKU data. It's not particularly clean all the time. If it is, then you're just lucky. But what could happen is you could have like multiple franchisees who all enter chicken wrap like a different way. And one has it like CHCKNWP and one has it like CW.

And so there's like some SKU mapping that you need to do in order to get it all cleaned up…It can take weeks. I mean, just depending on how messy the data is and how large the data set is, it can take quite a bit of time. I mean one might say a couple of weeks to like months.

Ignoring everything we discussed above, if Chase attempted an in-house offers solutions, do we have any evidence that Chase will be successful?

Chase Has Already Attempted an In-House Solution

Chase previously acquired in 2013 a card-linked offer provider who was focused on local offers, called Bloomspot, where “I would say of the additional 250-person team, by the three-year mark, there was a very small handful of maybe 10 to 15 people who remained. It was very small.” And then after, Chase ultimately decided to use CDLX.

Figg Tech (Comments by Employees)

If the plan is to leverage Figg to build an offer system, we have the comments on their tech stack (which includes a comment from a current Senior Software Engineer saying it’s dated), as well as some comments when testing it in BofA (with BofA ultimately sticking with CDLX).

I included the following not only because it is important information in the context of figuring out Chase’s intentions with acquiring Figg, but the information appears to be highly accurate, especially given one piece of information comes directly and publicly from a Figg employee.

Earlier this year I heard Figg’s tech stack was “minimal” according to someone close to Figg / Empyr. I didn’t think much about it until separately hearing from someone else from a different source that Figg had a “poor tech stack” that had “tech issues” when working with BofA which led to taking a long time to get Figg content in the channel (which ultimately I believe were the “location-specific” offers originating from Rewards Network).

While hearing from two sources strengthened this information and commentary on the state of Figg’s tech related to card-linked offers, it was until this week did I get significantly more confidence in the accuracy of this information given a third source.

This week I found a post by a current Figg Senior Software Engineer on April 18, 2022, who said “Software platforms are dated and the technology is not useful to newer / younger generation developers.”

This last source is important since:

They were a current employee at the time of the post, which shows they did not get fired or quit from lack of understanding or underperformance, giving more accuracy to the statement.

They not only worked at Figg, but they were a senior software engineer. Therefore they would know firsthand the quality of the tech, and know what they are talking about.

The comment was April 18, 2022, which is very recent, and likely indicates no change in tech prior to the Chase acquisition.

Given I have now heard comments regarding the quality of Figg’s tech from three separate individuals from three separate sources, including from an actual Figg employee in April 2022, it gives me confidence in the accuracy of the information. All three have said the same thing (no disconfirming pieces of information). You can even layer on what we know from watching BofA and the end result (BofA renewing with CDLX).

Why is this important?

Assuming Chase doesn’t know the quality and state of Figg tech and its compatibility and capability within Chase:

It lowers the probability that Chase successfully builds out an in-house offer system using Figg tech that is superior to CDLX to drop CDLX (assuming that is even Chase’s intentions, which does not seem to be the case, given the clues detailed above).

Assuming Chase knows the quality and state of Figg tech and its compatibility and capability within Chase (which seems more likely, given others know, employees know, seen with BofA, etc.):

It lowers the probability that Chase acquired Figg to use their tech to build an in-house offer system to drop CDLX

Therefore Chase likely acquired Figg for a different purpose, such as those detailed above regarding the other Figg capabilities, leveraging Figg’s employees who have highly relevant experience and knowledge dealing with advertising with local / SMB and related reporting and insights capabilities, while at the same time removing the possibility of bank competitors using Figg (possibly widening the differentiation with local offers between Chase and other banks).

My Chase Portal

This is a weaker point, but I actually have a Chase Business bank account, which allows me to track this. As of right now, the “customer insights dashboard” is not currently working, despite launching in June. It has been this way since I discovered this platform with Chase. Could be just an issue with my account, with it possibly working for others. I believe I should only get access if I use Chase’s Payment Solutions, which I am not, so maybe that is the reason for the error. But why not say that in the screen below to up-sell / convince me to switch?

Assuming CDLX doesn’t earn revenue or gross profit from these SMB offers, doesn’t this take away from CDLX’s addressable market, where these SMBs could have advertised through CDLX?

First, remember a part of the new self-service for banks, “Engage”, is to allow banks to do more on their own, including placing offers, with CDLX even mentioning in the context of local.

There is still a chance CDLX will get some cut with offers placed through CDLX, but through a reduced portion or rather with Chase with a higher rev share, given Chase secured these SMBs.

On top of that, these are all advertisers CDLX would likely never have obtained. These are smaller SMBs who likely do not care or have the time to worry about card-linked offers in the banking channel. If they spend time on marketing, it is likely with those they are more aware and familiar with, like Facebook or Google. Therefore, if Chase is even helping these merchants to place offers on their behalf (which could be the rational for acquiring Figg), then this will add to the CDLX channel.

Even if CDLX does not get a cut of this ad spend, it would be a net positive to the channel, adding more offers to increase engagement (such as more visits to the offer section) leading to higher redemption of CDLX-sourced offers.

Additionally, you could think that if Chase is successful in their endeavors with these reports / insights for SMBs, that the other banks won’t have a Figg to acquire, so they could ask CDLX to help build it out within the self-service for banks, leveraging CDLX’s existing capabilities for insights, like those shared in the tweet below:

Conclusion

As a summary, we have:

Chase’s stated intentions with Figg shared to CDLX (then shared to us)

New Chase platform that matches every stated intention (for SMBs, uses first party data not shared to CDLX, and using it to improve targeting for advertising)

Matching Figg expertise with purchase data / advertising / SMBs and insights / reporting / measurement capabilities

Matching Figg job (mentioning specific aspects that line up to the new platform, including insights and recommendations that don’t relate to advertising)

Matching timelines (launched June 2022, then acquired Figg July 2022)

Figg self-service tools for local that could utilized

Chase’s focus with this platform is on SMBs to increase the number using their Chase Payment Solutions, given the increase in threats (such as Stripe or Square), and not focused on the advertising side, let alone for large / national brands.

This seems to fit more than the current speculation based on no supportable evidence and which doesn’t make much rational sense that Chase is replacing CDLX with Figg.

While it seems likely that what is discussed in this post are at least one aspect of Chase’s intentions with Figg, it is still possible I am misinterpreting information, or do not have all the information (given Chase’s statements were recommunicated by CDLX, so something could be lost in between), or Chase plans to do more than one thing with Figg such that I am right here but something else occurs too, or something changes.

However, rather than speculate (which seems to be common at this time, given the fear of uncertainty combined with a low stock price), I instead based my analysis on the information I have at this time.

With Chase scheduled to the launch the new ad server in Q4 2022 + possibly already in migration, the odds of Chase continuing to use CDLX seems high.

When we combine that with Chase looking to be focused on something much bigger than simply card-linked offers, using Figg for those efforts, and where it makes the most sense to leverage CDLX and the new self-service platform on the new ad server for that one small aspect related to advertising in Chase Offers, it further increases the odds of Chase planning to use CDLX.

If the fear is still the uncertainty on whether Chase will switch focus or is currently building a replacement to CDLX without any evidence of being the case, then this is once again the importance of getting Chase on the new ad server. It will be up to current CDLX management to onboard and rollout all the key functionality in the quickest period of time (new UI, product-level offers, new local offers, etc.), leading to the highest level of engagement and other desired metrics by the banks. This increases the value proposition offered by CDLX to Chase, increasing their opportunity cost and switching costs, and increasing the odds Chase stays with CDLX even more.

This compares to a stock price that assumes Chase is already gone, when the reality could be that Chase stays, and we see near-term benefits (higher engagement and ARPU) from Chase being on the new ad server, and similar longer-term benefits from more SMB offers with better targeting within Chase Offers.

The wide difference between what is assumed by most and reflected in the stock price, versus what is most likely to occur, is why this is an even more attractive investment today (and why I continue to follow the business and invest more).

Gain Access to Research Notes

For access to these updates, as well all my notes and thoughts on CDLX (which I continually update and are over 700 pages in my Qualitative and Quantitative Research Notes), upgrade to paid today:

(Given the quantity of new notes, leading to hitting Substack limits, I had to split the notes once again, with essentially a part #1 and #2 for both qualitative and quantitative notes)

Qualitative:

Cardlytics $CDLX: Qualitative Research Notes #1 (273 Pages, 99,429 words)

Cardlytics $CDLX: Qualitative Research Notes #2 (65 Pages, 20,166 words)

Quantitative:

Cardlytics $CDLX: Quantitative Research Notes #1 (239 Pages, 84,147 words)

Cardlytics $CDLX: Quantitative Research Notes #2 (143 Pages, 45,375 words)

These notes contain information I have not shared anywhere else. For more general information on Research Notes, see here.

I have been adding a significant quantity of new notes lately, given the many changes around the company. I expect this to continue. Once things settle down, I will shift my focus to releasing my Carvana notes, which for the large number of you who are already paid subscribers (and the substantial number of new paid subscribers this quarter), you will have access to with your current paid subscription at no additional cost, as well all current and future notes. I have greatly appreciated your positive feedback lately, and I look forward to continuing adding to these notes, with intentions of expanding them to more companies over the years.

Follow-Up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more.

-Austin Swanson (Swany407)

Twitter: @Swany407

Website: Swany407.com

More Information on Cardlytics

Research Notes

Free Posts

Chase Updates (Related to Chase Acquiring Figg, and Chase Migrating to the New Ad Server): Write-up and video

CDLX 2.0 (Chase Acquiring Figg, New CEO, New Banks, BofA Renewal, 22Q2 Earnings, and more): Write-up and video

Current Price Decline, Short Thesis, and Q1 2022 Earnings: Write-up and video

Open Banking (The Free Option on the Hidden Potential Cash Cow): Write-up and video

The Power of Bridg (and Why CDLX is Undervalued): Write-up and video

BofA Renewal & Testing Competitors (Update): Write-up and video

New Observations, Upcoming Earnings Calls, and Updated Allocations (10.21.2021): Write-Up and video

Thoughts Following Q2 2021 Earnings and Price Decline: Write-up and video

Thoughts After Price Decline (5.17.2021): Write-up and video

Disclaimer: This content is not investment advice, and is intended for educational and informational purposes only. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.

Articles / Sources

Links to the articles are below, but given the paywall, I have added detail on these posts within my Research Notes at the end of the section (requires scrolling slightly down to the notes titled “9.23.2022 - Clues of Chase’s Intentions with Figg”, below the 9.26.2022 note, given the most recent notes are added to the top in a given section)

"ML-driven Chase platform distills data for business insights: More than 70% of SMBs want customer insights from their bank"

By Whitney McDonald, September 8, 2022

“How JPMorgan Chase is using payments data to woo merchants from fintechs”

By Kate Fitzgerald, June 09, 2022