Cardlytics ($CDLX): Updates on Investment Prospects, Liquidity, and Bridg Earnouts

Why CDLX continues to be one of the most attractive investments, and the current misconceptions related to liquidity / dilution / Bridg earnouts.

For those interested, this post is also available on YouTube, Apple Podcasts, and Spotify

Market Cap as of 12.22.2022: ~$4.74 Share x 33.2M Shares ~ $157M Market Cap.

Subscribe to not miss upcoming posts, or upgrade to access Research Notes:

Introduction

CDLX continues to be one of the most attractive investments I can find as I continue to research new investment ideas (including other public companies, private companies, and commercial real estate).

Given the current stock price + new information from the 3Q22 earnings and the December 7th conference + current misconceptions, I felt this was an appropriate time to provide an update on the current situation and investment prospects.

The Upside and Current Fears

The Upside: The opportunities on the upside remains the same (multiples of today market cap from average revenue per user increasing), with the probability of achieving the full potential / best scenario for CDLX being much higher with the September 2022 change in CEO + the recent updates provided at 3Q22 earnings and the Dec 7 conference.

CDLX does not need to achieve 100% of what is possible with average revenue per user (“ARPU”) for this to be a worthwhile investment. In fact, CDLX needs to do very little compared to today with respect to increasing ARPU, given the current stock price and given the significant scale of the platform with large operating leverage, and where CDLX is expected to be EBITDA positive in 2Q23 and FCF positive in 3Q23.

If the goal with investing is to find a great business (benefits all constituents + great end-state economics + low future capital requirements + high operating leverage + long runway + growing competitive advantages to achieve large market share and sustain over time), with great management, at a great price, this is it.

The reason we are able to buy at a great price is from others not yet realizing it is a great business (since the first 14 years years were spent building bank relationships and not yet fully monetizing / growing ARPU), not yet realizing it has great management with higher odds of increasing ARPU (given there was a very recent CEO change, combined with additional new executives with more tech backgrounds), and not thinking it is trading at a good price (either from thinking linearly in terms of future ARPU and/or don’t know why it will scale faster, or they don’t think CDLX will make it there given the current fears).

Investors’ Current Fear (Others Worry it Could Prevent the Upside): Today, many are worried about the Bridg earnouts and their impact on liquidity, in combination with the macro headwind. I believe there are misconceptions related to CDLX’s liquidity position (even under a worse-than-expected macro environment) + the Bridg earnouts (some incorrect assumptions by others) + what the dispute related to the Bridg earnout could entail (many do not try to estimate this). CDLX has plenty of liquidity to handle the macro headwinds and Bridg earnouts, with the risk related to the Bridg earnouts being much lower than most realize, and lower than I even originally realized, given I had incomplete information until now, which I’ll discuss.

I feel CDLX’s story as it relates to its stock price has been one of compounded and over-weighted fears: first the fear of BofA not renewing after BofA tested Figg (BofA then renewed), then the fear of Chase leaving after Chase acquired Figg (Chase is most likely the bank that just moved to the new ad server), and now the fear of the Bridg earnouts / macro / liquidity. In each case, it was understandable being concerned upon first hearing about each of the situations, but upon digging a little deeper, you could see the probability and magnitudes of a bad outcome were very small in relation to first drawn conclusions.

This post will go into detail on both the upside and this new fear.

Low Stock Price

What I find amazing is the number of individuals who will look at a company with a very large stock price decline, and not be interested to investigate to see if it is trading significantly below its intrinsic value or medium-term potential cash flow, or to see whether there is accuracy to other investors’ concerns.

I think many who aren’t familiar with CDLX and the previous misconceptions have looked at the stock price and simply assumed there must be a reason it’s fallen so much, so they don’t look further.

For those who are aware of CDLX, I believe some see the continually declining stock price as confirmation for any previous skepticism or concerns they held.

Given the many previous incorrect predictions by others (such as related to BofA and Chase) and current misconceptions (such as related to liquidity and the Bridg earnouts), I think the stock price has declined for many of the wrong reasons, making CDLX even more attractive (given we can see / read the concerns of others, know then that those concerns are largely to explain for the declining and low stock price, and then verify if those concerns are accurate, which many are not).

Focusing on the Business

I also believe some think too differently compared to if this was a private business, where daily stock quotes wouldn’t be how you assessed how the business is doing / its current position / future potential.

Some may jump to, “but the stock price impacts the second Bridg earnout!”, but they don’t realize CDLX has enough liquidity to pay that 100% in cash and avoid using any stock and any dilution. Again, I believe some of that misunderstanding may come from focusing too much on the stock price, or using the stock price as confirmation to their thoughts, and not focusing enough on the actual business and surrounding information.

Why Now

If you were ever interested in CDLX previously, now is the time to look a little closer.

This is due to the all-time-low stock price, where the market cap is extremely small in relation to not only what is possible for cash flow but likely to occur in the not-too-distant future, combined with the many recent changes and upcoming improvements in the business that increase the odds of that future cash flow potential.

I have added significant notes to my CDLX Research Notes the last few months. If you’re interested in CDLX and want significantly more detail, including information not in any public post, or if you want this type of information much sooner than posted, upgrade to access the CDLX notes and more.

The Opportunity and Investment Prospects

In this section I will go over:

The upside (different valuation scenarios)

Why this is possible and likely (competitive advantages vs other digital advertisers)

How CDLX gets there / why now / what is different today (the most significant recent change, ways revenue will increase)

The longer runway (further planned growth opportunities, and the advantages vs competition that increase the odds of staying in business)

Valuation Scenarios

Definitions: MAUs = Monthly Active Users. ARPU = Average Revenue Per User. FI rev share = Financial Institution revenue share. OpEx = Operating Expenses. Also note, minimal cap ex in this business.

To understand why CDLX is attractive, the following are some valuation scenarios. I wanted to add a couple new ones that I haven’t shared before, such as in relation to other digital advertising platforms in the US. Remember, today’s market cap = $157M.

I felt it is important to start with this, since it is no fun to get to the end of an analysis to find the upside is only 15% or something small. There needs to be enough upside to make it worthwhile, and I think CDLX has that.

Notes on the above scenarios and assumptions used and why are in the footnotes1

What I really like about this investment as of today, is the stock is so low given the fear related to the Bridg earnout (due to some misconceptions) that you are not paying for nearly any long-term growth. You don’t need to have Snap or Meta type ARPU to be a worthwhile investment (however those are nice asymmetric outcomes with higher probabilities than most would assume, as I will discuss).

Just ask yourself, would you redeem a free $5 offer to buy more of what you are buying or something very similar? This on average equates to the $10 ARPU scenario above. I explain below what will soon change that will lead to more users doing this in the near-term. (To better understand how redeeming offers translates into ARPU, and why you also need an equal amount of ad budgets, see this footnote2)

CDLX Competitive Advantages Over Other Advertising Platforms

To some, these upper scenarios may seem ridiculous, given it is hard to rationalize such a large non-linear increase from today’s trailing 12 months ARPU of $1.59, as well as due to some currently held beliefs regarding the differences between the digital advertising channels.

I have continued believe CDLX has advantages than other advertising channels, and therefore more ad budget could shift to CDLX, and CDLX reaching ARPU similar to above seems both reasonable and likely.

These advantages over other advertisers include:

Best Data for Targeting:

Purchase data is one of the best underlying data for advertisers. This is one of the reasons all the largest advertisers want it. Actual transactional data leads to better targeting. What better way to determine what a person will buy than what they have bought and are currently buying? I believe this is much richer data than what users are reading, watching, liking, following, etc. that advertisers get on other platforms.

Important to note, using CDLX data to see where customers are spending more elsewhere is not just about switching a customer from one store to another, but to get existing customers to spend more with you than they currently are (these customers are cheaper to shift spend and on average spend more) (more detail in footnotes3)

Also, this is data not even loyalty systems have, given CDLX can see transactions outside of individual store. Bridg helps clients get visibility and the ability to engage and target those not in their loyalty system, and then CDLX improves upon the data for those in the loyalty system since CDLX can see where those customers are even more loyal elsewhere.

Certainty in Measurement (Knowing if They Would Have Purchased Anyway):

Purchase data leads to much better measurement, given it is based on actual transactional data (both online and in stores). CDLX can provide the true incrementality of spending due to the ads from randomized controlled trials based on actual purchases, giving advertisers certainty in the results. This is unlike other advertising platforms, where you can only estimate the attribution, which is not certain. This is one of CDLX’s greatest advantages.

“But how do I know they wouldn’t have made the purchase anyway?” Incrementality! CDLX is the one of the few platforms that can do randomized controlled trials. The incrementality from randomized controlled trials accounts for buyers who would have bought anyway. With a sufficiently large and randomized sample, the test and controls groups would be essentially identical (and CDLX does back tests to ensure similar historical buying levels between the two groups prior to the campaigns), exposed to all the same type of different advertisements, with the only difference between the test and control group is users in the test group are presented a CDLX offer. The control group then shows the level of buying / revenue associated those who would have made a purchase anyway. Therefore, if CDLX offers did not work, the buying levels in the test group would match that of the control group who bought anyway, with no incremental lift in the test group from the CDLX offers. Where if there is incremental lift over the control group, it is the additional spending 100% attributable to the CDLX offer. This is why CDLX’s incremental ROAS (iROAS) numbers are so impressive. This differs from the less accurate and less certain measurements of trying to determine attribution from using attribution models like multi-touch attribution (MTA). CDLX can instead know with certainty how much is 100% attributable to CDLX, from being able perform this testing due to having the total purchase data. These incremental results are even verified by Nielsen.

Note, CDLX doesn’t just offer 5 to 1 ROAS….but 5 to 1 incremental ROAS (iROAS), where the revenue is incremental to the sales that would have occurred regardless of the advertisement / CDLX offer. This differs from the traditional ROAS used by other advertising companies, that can include the revenue and sales that would have occurred anyway, given they are not only including the revenue that is incremental or attributable to their ad spend (e.g., say I’m going to buy a new pair of Allbirds with my $50 CDLX Chase offer, and see an ad on FB before my purchase. This FB ad in my path to purchase. I click it and complete the purchase there. Therefore FB is not 100% attributable to that sale, and I would have made that purchase anyway. Unlike CDLX, FB doesn’t have the purchase data to compare the spending to those not shown their ad). And again, it is not an estimated incremental ROAS from MTA, it is true and known incremental ROAS. This is a big difference. This is why you would expect more advertisers maxing this out as long as incremental revenue * internal margin > ad spend (so if 5 iROAS, if incremental margin > 20%, you get “free money” for every dollar you put in, known with certainty, which is why others have referred to this as a “broken slot machine”, compared to other advertising channels where the measurement / attribution is not certain and only can be estimated). If this understanding increases, you would expect advertisers to max out their spending here first, until they no longer achieve incremental profit over their ad spend. You can also think about this from the perspective of advertisers should spend first where the returns / results are more certain (and widening due to issues with cookies and IDFA), and additionally spend more (similar to be willing to pay more / accept a lower return if risk free, like in investing).

Solicited Ads:

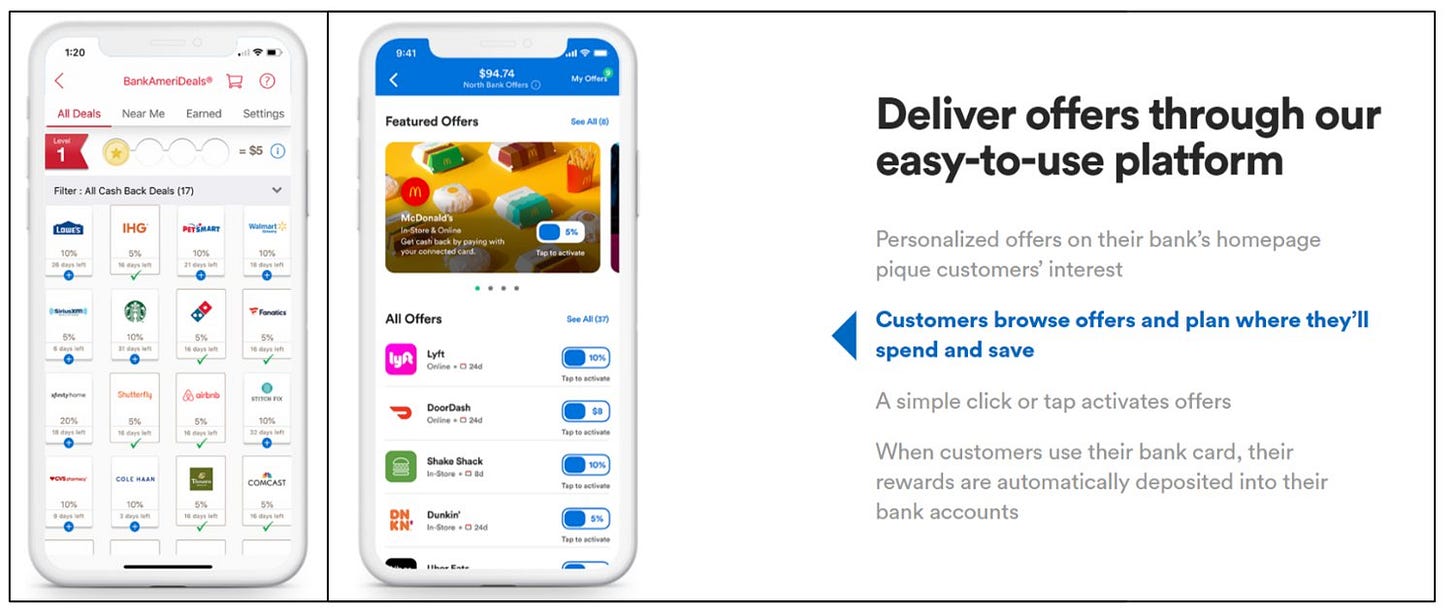

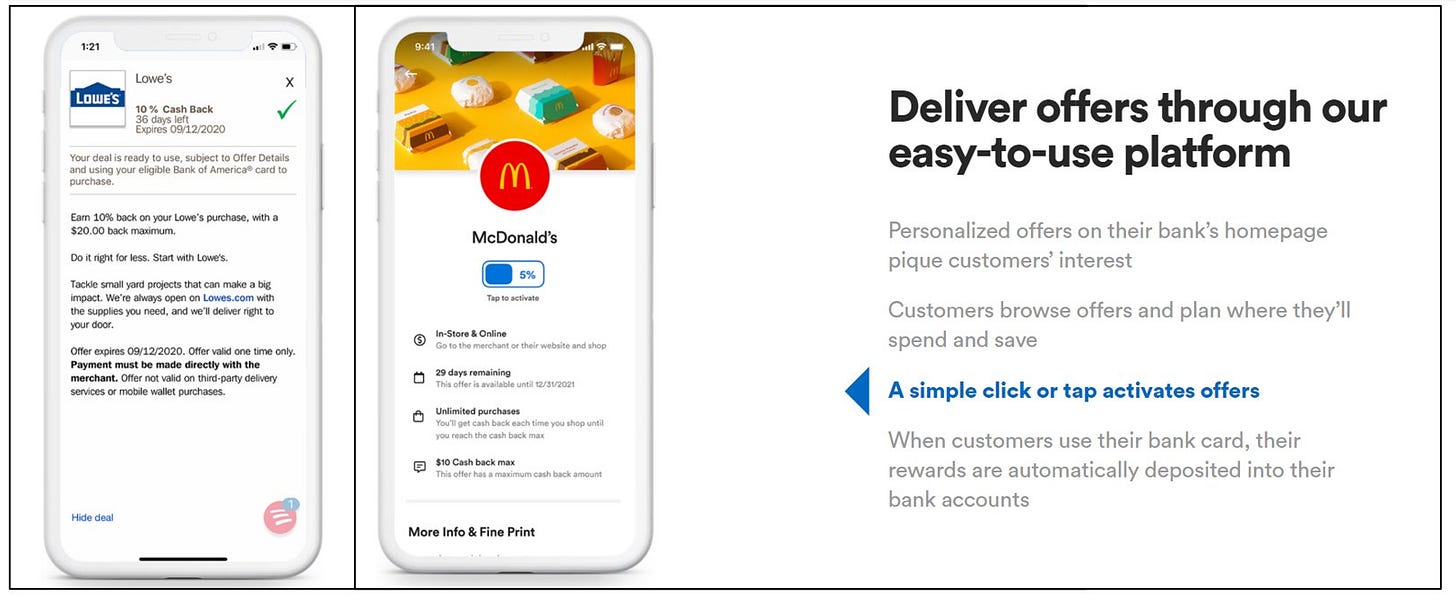

“But how long do users spend in their bank app anyway?” Many are quick to jump to lower engagement or time spent on CDLX compared to say FB / Instagram. Imagine all FB advertisements where condensed onto one page. How long would it take you to look through those ads? In other channels, the advertisements are not why people are there. That is why you need higher engagement and long times in the app, in hopes you can slide unsolicited offers to the user. Or even force them to view your ad (such as via un-skippable ads).

Instead, users choose to view CDLX ads, leading to much more valuable advertising. They are solicited. How long does it take to check 100 offers in a bank app? 5 seconds? You don’t need much time.

How Does CDLX Get There? Why Now? What is Different Today?

New CEO: Karim Temsamani

The big answer for how CDLX will get there, and why now, and why today is different is simply Karim.

Karim Temsamani was just hired as the new CEO of CDLX in September 2022. Karim is likely the most important change and should not be underweighted in terms of importance.

Not only does he have the right background from both at Google and Stripe, but also seems to understand what is currently wrong at CDLX and knows how to fix it. I very much appreciated his transparency and honesty with not trying to hide where there are issues, such as regarding the lack of any previous automation in the business.

In terms of experience and his ability to execute, one example is when he was in charge of Global Mobile at Google, Karim took that non-existent business to $10B in 2.5 years.

“I made the wise decision in 2007 to join Google, where I spent 12 years, initially running the Australian office, then starting the mobile business for Google, which was essentially a non-existent business in the early days of mobile to within two and a half years a $10 billion business. So we saw a incredible scale and obviously that business continued to grow afterwards.” - Interview on 7/23/2020

For context, the $10 and $33.41 ARPU valuations scenarios above with 184M MAUs are $1.8B and $6.1B in revenue respectively…so much smaller than the $10B he achieved at Google in a couple years.

While he was able to leverage Google for this mobile division to help with this growth, Karim can also leverage CDLX and its existing infrastructure, data, tech, employees, partnerships, and acquisitions. This even matched one of the first statements by Karim regarding CDLX, saying, “There is so much potential for further growth following the company’s recent acquisitions and solid progression against its strategic initiatives, and I look forward to leveraging the strong foundation that has been developed.”

Therefore, while different situations, there is at least some possibility he can replicate a fraction of that success here at CDLX, given some similar setups, and similar industries. Karim also has 10 more years of experience since his Global Mobile success at Google, so maybe that possibility is even a little higher.

The Foundation to Leverage

Today CDLX is sitting on an incredibly larger distribution network of bank users, approaching 200M monthly active users (“MAUs”) and growing. This large existing distribution network should enable faster-than-normal growth from here (but has taken since 2008 to get here!). The most obvious way to monetize is to increase the average revenue per user, or “ARPU”.

The first part of the company’s history was creating these relationships, trust, and partnerships with the banks to establish this large MAU base. This was made possible given the backgrounds and knowledge of the co-founders, who previously worked in high positions at Capital One. The business and its potential would never be possible without what they accomplished.

The next part of the business is where we are today, which is monetizing this asset, or leveraging the large distribution of 184M monthly active users (MAUs) and driving higher average revenue per user (ARPU). This requires new background, related to technology and advertising, and is why there was a recent shift to a new CEO, CPO, CTO, with this background.

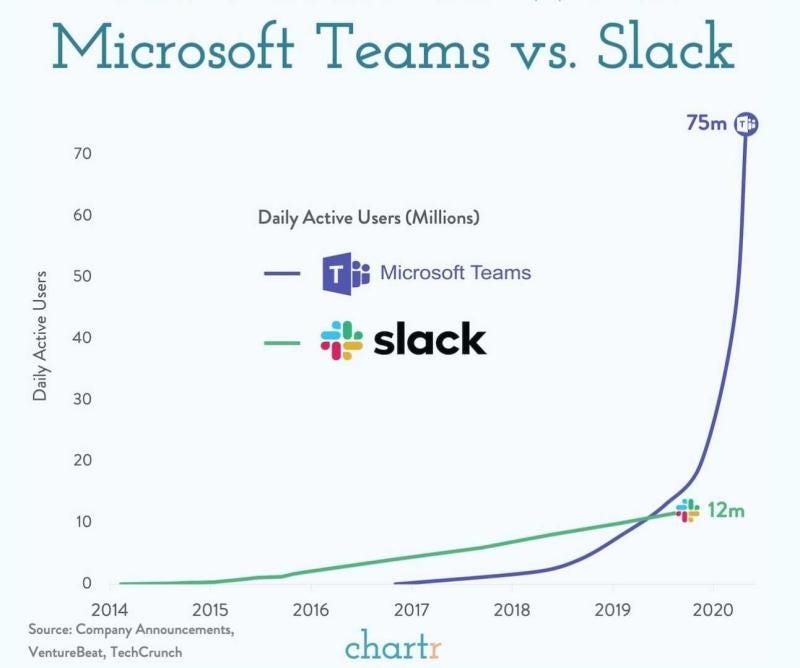

The power and speed of growth from having an in-place distribution system can be seen with the comparison of Slack vs Teams (yes, there are other reasons for the quicker growth, but an in-place distribution network is one reason).

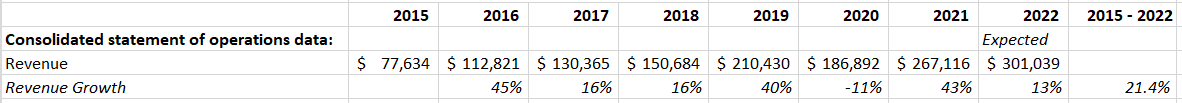

It is important to note, CDLX has grown revenue 21% per year from 2015 to 2022 without even having the necessary management for the monetization aspects. This speaks to the abilities of the platform and the desirability to target and measure based on purchase data with a very large advertising reach.

Additionally, from the Q3 call, CDLX mentioned that, “And excluding the large client mentioned over the past 2 quarters, our core Cardlytics revenue growth was 30% year-over-year.” If you instead assume 30% for 2022 instead of 13% (where 13% comes from assuming the midpoint of the Q4 guidance for $85M), you get 23.9% compounded growth. Again, this is without fully being monetized (no automation, hard to buy from CDLX, no product-level offers, monetization not optimized, etc.). This is why it is very important to have these new hires, including Karim, to improve the odds of increasing ARPU.

Increasing ARPU

There are several areas that will lead to higher ARPU for CDLX.

Some initiatives were started by CDLX’s previous management, but have yet to have an impact on financials. For example, the new ad server and product-level offers have been in the works for a while, but will only now start having positive financial impact for CDLX now that 50% of MAUs are on the new ad server as of 3Q22.

New Ad Server:

New UI: Richer imagery on the outside of offers (such as Featured Offers) should increase the understanding of offers, leading to higher engagement and redemptions. Similarly, it could slightly change how advertisers view the channel, since it goes from a simple logo to now being able to use images. Then you layer on an easier way to find relevant offers with the new UI’s categorization, engagement and redemptions should increase further.

Images within Offers: We heard that US Bank on the new ad server with just adding images within the offers increased click-out rates to external websites dramatically, such as up to 5x (likely from a picture being worth 1000 words…and given most won’t read what the company sells, but will know in 1 second from an image).

Notifications and Time-of-Day Offers: If CDLX can increase and add new push notifications, such as adding real-time notifications, combined with time-of-day offers that advertisers like McDonalds have explicitly expressed interest in (a feature of the new ad server), you could see additional spend and redemptions.

New Offer Constructs: New and improved offers constructs can be much more relevant and much more interesting for consumers, which drives engagement for the banks, but also better returns for advertisers. Karim used the United Airlines example where you earn 5% when you spend $50 or more, but earn 10% when you purchase an Economy Plus ticket. Karim mentioned that this is better for consumer since more cash back, drives higher engagement so the banks are happy, and advertisers get a better ROI since have a better margin on the premium tickets. Panera also just did a similar type of offer on Dosh, where the more you spend, the higher the cash-back percentage.

New Ads Marketplace: The new ad server also opens up the new ads marketplace, that should allow for real-time adjustments based on inventory and allow for auction-based or dynamic pricing. Despite the layoffs, CDLX is still hiring for the ads marketplace, showing its importance and likelihood of occurring in 2023.

Machine Learning and Improved Targeting: Additionally, CDLX said they need cloud to unlock machine learning, such as for targeting. Given this cloud migration is occurring, we could see further benefit from this in 2023. This is also likely, given it is another role CDLX is still hiring for.

Engagement Metrics: I liked that Karim said they are working on new engagement metrics to provide to investors so they can see how engagement is going at early states of the new ad server (allow us to extrapolate that out). We have already seen some early signs of success with US Bank who is on the new ad server, but will be interesting to see impact of the new UI and product-level offers, especially now with 50% of MAUs on the the new ad server.

Unlocks Product-Level Offers: CDLX got one of their largest banks (presumably Chase) on the new ad server, and soon the new UI, which will unlock product-level offers at a large scale (CDLX needed more MAUs to make it worth it and attractive for placing product-level offers). Further benefit will come from the rest of the major banks moving to the new ad server and new UI, which are all ahead of schedule according to 3Q22 comments, and therefore could have a positive impact in 2023 from larger reach for advertisers for product-level offers.

Bridg / Product-Level Offers:

Unlock New Budgets: Previously, CDLX only had access to purchase date at the store-level, but now with Bridg they can see what items were purchased in the store. This unlocks significant ad budgets that are only at the category-level and product-level.

Existing Bridg Clients: In my Research Notes I have listed many existing Bridg clients that I suspect (like Dollar General, Regal Theaters, Taco Bell) that could start spending in CDLX more quickly, with some who likely have very large budgets, like the new home improvement store that was recently signed (which I am guessing is Lowe’s).

Existing CDLX Customers: There are many existing CDLX customers who are now able to place product-level offers. In addition, there are many existing agencies using CDLX (Horizon Media, VaynerMedia), how have clients such as CPGs / brands who previously could not use CDLX, so adding them to place offers should be easy.

Higher Cash Back for Users: This is due to different margin profiles. Should lead to more attractive offers for users since higher cash back, which should lead to higher engagement and redemptions. While not likely from Bridg (despite them being a Bridg client), instead of just a 10% Panera offer, Panera had a 50% off their coffee subscription. They wouldn’t place 50% off the restaurant level, but they can on a specific product with higher margins. This leads to higher visual percentage + more cash back which leads to more usage and redemptions.

More Relevant for Users: More specific offers (specific relevant items in the store / restaurant rather than a store level offer), which makes them so more relevant, which should lead to higher engagement and redemptions (Ex: coffee offer at Panera above vs just a general 10% off Panera offer may lead to more usage, given I may not even know Panera did coffee, and CDLX can see I spend a large share of my wallet at other coffee stores so they know it will be relevant)

Attribution: Bridg increases the visibility into a client’s data compared to bank data (which is only available at a more aggregated level). This should increase believability of results leading to increases in ad spend. CDLX has mentioned this should solve attribution issues. Separately, if you see a spike in sales for a very specific product, combined with even certain locations, and the Bridg / CDLX offer is the only one during that time, it is hard to argue CDLX is not working.

New Advertisers:

Largest Pipeline: We heard on the call CDLX has a “strong pipeline” of new advertisers for 2023, where after the call CDLX said it is the largest pipeline as a business from an annual perspective. While existing CDLX advertisers could pull back their ad spend in 2023, if CDLX adds new advertisers even at reduced ad spending levels, it will still have a positive impact, and help offset decreases with existing advertisers.

Increase Understanding of Incrementality:

CDLX has been doing webinars on incrementality recently, but CDLX still needs to do more here to increase the understanding and how CDLX is viewed regarding its measurement quality vs other digital advertising platforms. I believe this could have the biggest impact.

The list below are new mentions from Karim, stated in the 3Q22 call and December 7th conference:

Optimizing Monetization:

On the Q3 call, Karim mentioned, “I believe Cardlytics can better optimize the monetization of its assets to support long-term profitable growth across the business. We are already thinking about various revenue models that better leverage our capabilities, analytics, and the idiosyncrasies of the verticals we serve.”

This could be where CDLX sees a large positive impact in the near to medium term.

I can only speculate on what CDLX could do and its impact.

Charge for Engagement: Example would be charging cost per click for clicking out on the links to external websites from within the offers (more detail in Research Notes in the notes and thoughts after the Q3 call)

Increase Pricing: Karim mentioned offering different pricing. For one, given the certainty in results of CDLX from the incrementality from control vs test groups, you could increase pricing, where either you get less incremental revenue from the same ad spend level, or where you need to spend more to keep that same incremental revenue obtained (more detail and quantification in Research Notes in the notes and thoughts after the Q3 call). I think having auction-based pricing will help with this, where advertisers accept lower returns by bidding higher under auction-based pricing.

Data Analytics: Analytics cannot be sold since they are the banks’ data, so CDLX uses a tier model, where if you spend over a certain amount, you unlock these analytics. Maybe there is a better way to do this that Karim sees. Maybe CDLX can do more with the analytics than we think, even though it is the banks’ data, such as selling higher-level analysis of the data to non-CDLX customers, and not selling the actual underlying data (similar to the reports CDLX puts out that others quote). The banks may be okay with this if it used as a form of advertising to increase the number of advertisers in the channel, or if there is a rev share on this revenue stream.

Charge for LTV / CAC: Given CDLX mentioned “idiosyncrasies of the verticals”, maybe CDLX charges on an LTV / CAC basis for subscription, given CDLX can even see the continuing payments. This differs from today where it is more a function of ROAS and the return on the next purchase or in the 45-day campaign window. Maybe the easier option would be to expand the window for which incrementality and returns are calculated (so not really on an lifetime basis).

Making it Easier for Advertisers to Buy from CDLX:

Automation to Bring Weeks Down to Minutes: Related to quicker aspects in the business, Karim mentioned it currently takes several days to estimate the number of users CDLX can reach for a campaign, and then several more days to book those campaigns into the systems. Mentioned it should take minutes rather than weeks to build and book the campaigns. He said by having more automation in examples like this frees up those resources to hire more machine learning engineers and data scientists.

Self-Service for SMB: Continues to be put on hold. I do like how Karim actually gave reasons, and stated they were his reasons (he seems like someone who takes accountability), related to some risks (such as an SMB placing an offer and then going out of business) and that there are larger opportunities elsewhere to spend time and energy (for instance, with larger advertisers, and making it easier for them to buy from CDLX).

Multiple Models and Pricing: Karim said CDLX currently only has one model, and one pricing, but Karim wants to expand this to multiple models and pricing. While CDLX has Cost per Served Sale and Cost per Redemption, those are both related to a purchase being made, and not say related to engagement like clicking on offers. Maybe opening up different models and pricing will increase the number of advertisers using the platform, such as related to making it more similar to other advertising channels that advertisers are more familiar with.

Faster Testing / Optimizing Campaigns:

Shortening Campaigns: In the Dec 7 conference, CDLX mentioned they are working on creating shorter campaigns, and we should see this in 2023. Currently CDLX’s incrementality model really only allows 45-day campaigns, but they are looking to shorten to even daily campaigns (mentioned banks have expressed interest in this feature, for say Cyber Monday, or Mother’s Day). This should be available on the new ad server, and we have already seen this on Dosh.

I believe this would have the additional benefit of getting faster results, to be able to change and optimize campaigns, leading to more quickly increasing ad budgets due to this faster feedback loop (where Karim mentioned separately CDLX needs to add the ability to optimize campaigns).

Building Better Bank Relationships:

Obsessing Over Banks: “I'm going to drive several areas that we must improve to successfully execute on this next phase of the business. First, we are good partners to banks, but we must obsess over achieving their goals and providing value to their customers. Banks are the most important assets of our business. The only way to create strong outcomes for Cardlytics is to create stronger outcomes for our partners.” - Karim 3Q22

This in turn could lead to obtaining better locations and visibilities in mobile apps, where, “One of our large banks have seen twice as many mobile activations since they improved the program visibility in late February.” - 1Q22

Could also lead to more boosting of offers, where the banks use a portion of their revenue share to increase the cash back to the user. I believe this is what Chase has been doing with their exclusive offers that have offered significantly higher cash back.

This would also lead to faster rollouts of new features or the new UI.

Working with Retail Media Networks with Bridg

Karim mentioned Bridg working more with Retail Media Networks (RMN) as a longer-term opportunity. Bridg has been doing webinars and blogs regarding RMN, and I wouldn’t be surprised if this is where they are getting some new partnerships. For instance, I’ve seen some Bridg employees liking Walmart Connect posts on LinkedIn recently, and Karim used Walmart as an example with product-level offers…

Increasing CDLX’s Brand

Karim mentioned needing to increase CDLX’s place in advertisers’ minds, and be better known in the market. This would lead to higher ad spend and more advertisers using CDLX.

Progression to Higher ARPU

With the existing initiatives finally coming into play in 2023 (such as the new ad server with product-level offers) combined with the new plans by a new CEO who has a proven track record, I believe it increases the odds of increasing ARPU levels.

We already know $2.30 of ARPU is possible with the existing tech and resources, since it was done in 2018 with just BofA as the only major bank, at just 65M MAUs. Now with larger scale from additional banks (Chase and Wells) at 184M MAUs, this additional scale should get CDLX to at least to the $3 ARPU level.

If CDLX could just increase the understanding of CDLX’s quality of measurement and incrementality, I think CDLX could get to significantly more ARPU in the long term with the current number of users and even old tech. If Karim can find a way to effectively do this, we could see meaningful increases in ARPU. A better sales team, improved data analytics and reporting, better communication, improved marketing material, shorter campaigns, product-level offers, Bridg data, all should help with this. Given I have not heard this as a priority yet, I am leaving this impact out of the calculations, but it may naturally occur given many of the items listed are in progress.

I then believe moving to the new ad server and rolling out the new UI should lead to higher engagement and redemptions, which will increase ARPU. Then rolling out product-level offers should have a meaningful impact. I would think together this would lead to at least $5 if not high-single-digit ARPU in the near term (post 100% of MAUs on new ad server + new UI). It is important to note this is not the full potential benefit with product-level offers. This is just a guess with some very large Bridg clients, including some known existing ones, and one potential one. It is not just their direct impact, but also their indirect impact to the channel, where those more relevant and attractive offers leads to seeing other offers and more word-of-mouth advertising.

I would think CDLX could get to $10+ ARPU implementing the new items Karim mentioned. Optimizing pricing would seem obtainable both in the near-term and with existing resources and talent. Charging for engagement or increasing pricing could have significant and quick impact. I’m less sure on the timeline and CDLX’s current ability to execute on the other improvements.

As a reasonability check, $10 of ARPU in the near term would be $1.84B in revenue, which again, compares to $10B in roughly 2.5 years Karim accomplished at Google 10 years ago. This gives me some comfort in my belief that $10 of ARPU is not only reasonable but likely conservative. I think most discount this possibility since it is hard to think in non-linear terms. Most want to just use a specific double-digit growth rate and plug it into their model.

Equity Raise

The next level of ARPU, getting closer to the Snapchat and Meta ARPU scenarios, will likely require additional talent. This would not just be for the currently known improvements, but also improving machine learning targeting + data analytics + new and larger salesforce, etc.

As a rough estimate, if you assumed it would take 100 new such employees with some new senior level staff, maybe that is on average $500K all in with salaries and benefits (assuming a higher end + some senior level + hired in CA), or $50M / year needed.

If Karim wanted a two-year runway, that is $100M needed. My hope is that if an equity raise was done, it would be after first doing what is possible with the current resources to get to $5+ ARPU. This would be close to $200M in cash flow on 184M MAUs, which should be close to a $4B valuation, or over $100 per share after Bridg expected dilution (lots of rounding here). $100M raised at $100 / share is only 1M new shares. Could even raise $500M at that time, to then pay off the 2025 convertible notes and have more cushion.

But obviously, if you are getting close to $200M in cash flow, you are much less in need of new equity or debt, and could self-finance. However, I have a feeling Karim may not want to wait that long, so instead I would hope would be there is no raise until >$15 a share (>=$3 of ARPU), since at $100M raise it would only be <~7M new shares, compared to at today’s price leading to 20M. Then raise again or refi the converts at a later time, or use the higher cash flow from increasing ARPU that was made possible by that first equity raise.

Long Runway of Further Growth Beyond ARPU Growth

To top it off, the valuation scenarios provided above are ignoring:

More MAUs from Adding More U.S. Banks:

Multiple Top 20 U.S. Banks: Adding more banks seems to be a near to medium-term focus for Karim, who said CDLX needs to expand their network for both “reach and frequency”, with CDLX even already in talks with multiple top 20 U.S. banks (possible larger banks include AmEx, Discover, Capital One, Citi, Ally, USAA, etc.).

Banks Doing This In-House: We already know banks can do offers in-house (AmEx has been for years). But in the long run, if CDLX can provide significantly higher engagement + higher card spend + less attrition from offering significantly better offers than what is possible in-house, and providing this with a revenue share (so not even no cost, but a cost benefit), I don’t see why more banks won’t shift to using CDLX.

More MAUs from International Expansion

Karim’s Background: We are not accounting for international growth, where there are clear plans and stated intentions. Karim also has the background for this. One role he held as Stripe was the Head of Global Partnerships. Before Stripe, Karim spent 12 years at Google overseeing all of Google’s sales and operations across the Asia Pacific region. Karim started his career in the media and publishing industries and graduated in International Affairs at the European Business School Paris. With a family background from Morocco, he was born and raised in France. Therefore, beyond the explicitly mentioning international bank partnerships, I believe it makes a great deal of sense of why will see this. Therefore, limiting valuation to just the U.S. is likely too conservative. Could see additional benefits from Open Banking, where rev share is 0%, and where CDLX has already started.

Automation for New International Banks: Karim mentioned how it currently can take 6-9 months to onboard a new bank, but he is looking to bring that down to a week or two, as well as with less help given not on premise anymore and instead on the cloud. This increase in automations (where he said before there was essentially none) will allow for easier and faster growth with adding new banks, especially internationally. This should also come with higher CF from more operating leverage (add a large new bank with little incremental costs compared to before using the new ad server, given do not need to replicate everything on premise, and now only need “a couple of people servicing the bank at the publisher level, and then hire a smaller sales teams that can sell content, and be profitable straight away internationally, rather than having a very heavy cost structure” - Dec 7th).

Decreasing Revenue Share & Higher Gross Profit Margins

CDLX should also benefit from an increasing gross profit percentage as they use Bridg. This is not just due to Brig revenue having higher gross profit margins, but due to Bridg data not being the banks’ data, and therefore should lower the revenue share to the banks given revenue share is based on the banks’ relative contribution of data. Therefore this would increase gross profit (more detail in the footnotes4).

Monetizing Existing Neobanks Partnerships

CDLX has partnerships with many neobanks, including the likes of Credit Karma (120M+ U.S. users as of Dec 20, 2022) and Venmo (80M+ users). Ad agencies have spoken about how they liked using Figg for advertising on neobanks like Acorns to target different types of users, and where there is more flexibility out of the banks for using say push notifications. CDLX could more easily add the neobanks as an additional channel to place ads.

Therefore, the potential / runway of the business is extremely large in relation to today, where CDLX has many competitive advantages over current potential competition that should lead to a higher probability of still being around long enough to achieve that larger market share:

High Barriers to Entry from Trust / Social Proof

Scale Advantages from Large Advertising Reach

High Switching Costs

Growing Customer Value Proposition

Given I have spoken about each one of these in the past, for much more detail on this list and each item, see the footnotes.5

Then Why This Large Stock Price Decline?

This all sounds great, but then why is has the stock decreased so much? From a peak of around $160, down to the $3.50 (-98%)?

I believe a large contributing factor to the current market price and its decline over the last 2 years has first been from two large misconceptions / incorrect fears.

The fear of BofA not renewing due to Figg and renewal delay: There were fears starting mid 2021 that BofA would not renew with CDLX given BofA was testing Figg with local offers. Then the fears grew when it was mentioned in 3Q21 that the renewal may be delayed. Those fears continued until the renewal occurred in July 2022. There was no stock price recovery from this news, given the next new fear occurred just a week or so earlier, related to Chase and Figg.

The fear of Chase dropping CDLX after acquiring Figg: Many worried Chase would drop CDLX after Chase acquired Figg, another card-linked offers provider. However, much of that fear has went away given all current information points to Chase just recently moving to the new CDLX AWS ad server, given they were scheduled to launch in 4Q22 and CDLX hit the 50% MAU goal in 3Q22 where Chase wasn’t the easiest path to hitting the goal. Moving to the new ad server indicates their intention of staying, upon already stating nothing changed with the CDLX relationship given they acquired Figg for SMBs, and given CDLX still powers Chase offers today.

Well with those fears now in the past, then why has the stock continued to decline? I believe it is in part due to the next new fear: the Bridg earnouts. (This is why I believe CDLX has been a story of compounded and over-weighted fears, which is a blessing in the short-term for being able to buy shares at lower prices)

Bridg Earnout Expected Payments

The Bridg earnout payments are the two additional anniversary payments from acquiring Bridg that are a function of Bridg’s Annual Recurring Revenue (ARR).

According to CDLX, the expected Bridg earnouts as of today are:

First Expected Earnout: $126.4M total ($43.5M cash)

Second Expected Earnout: $69.5M total ($24.9M cash)

Bridg Earnout Misconceptions

I believe a portion of the continued depressed stock price is from there still being many misconceptions related to these Bridg earnout payments.

Based on my conversations, management comments to investors, and my own interpretations of reading the merger agreement:

First earnout’s dilution is not based on today’s stock price.

The stock priced used for the first earnout is already locked in at a volume-weighted average price (VWAP) of $40.15 based on April 2022. Therefore, with the remaining payment of $82.9M ($126.4M total - $43.5M cash) that is approx. 2.06M additional shares (which is about the exact same number of CDLX expects, as mentioned in the 3Q22 10-Q).

Additionally, the dispute is on the first payment, and therefore would benefit from the higher locked-in stock price for share issuance (more on the dispute soon below)

Total dilution for both earnouts is capped at 19.9% (not 19.9% each, and not unlimited dilution)

Received confirmation of this after the call.

Therefore, there cannot be unlimited dilution, and so there is no possibility of a death spiral.

Yes, 19.9% is still a lot, but the upside potential of this business would offset most of this dilution, combined with future free cash flow to buy back shares. But dilution may not even hit this, as I’ll explain next.

If the cap was reached, the rest would be paid in cash. But as I’ll discuss and show below, CDLX has enough liquidity to CHOOSE (not forced) to pay 100% cash for the second earnout, leading to no additional dilution following the first earnout. Given Karim will upon vesting have over 1.3M shares, I think he is at least conscious of dilution and aligned with shareholders.

Second earnout is the incremental revenue from existing 1st anniversary customers only (not new customers)

This is why CDLX was able to provide a total expected payment of $69.5M for the second earnout ($24.9M cash), given it is more a function of renewal rates on existing customers. Therefore no risk related to previous growth continuing, or a very large partner being signed.

Liquidity Misconceptions

Beyond the misconceptions related to the Bridg earnouts, there have been many misconceptions related to the CDLX’s current liquidity position.

Line of Credit: CDLX has an unused line of credit. On the 3Q22 call, CFO Andy Christiansen said it was $50M, which it was until April 2022 when it was increased to $60M with the option to increase it to $75M (so there is even more liquidity than those who only listened to the call). Some don’t know this LOC exists, since CDLX has not been using it and doesn’t show up as cash on the balance sheet. Others have feared CDLX will lose this LOC from not meeting growth covenants from a bad macro environment. This is why it was important to hear from CDLX after the call that they was actively in discussions with this bank partner to amend the existing LOC to be a function of EBITDA instead, making it so that it will be available under a bad condition.

Accounts Receivable: CDLX also has additional liquidity from their $97M of accounts receivable that could be securitized / factored to receive a high portion of this in cash today. Some have ignored this, which is fine, given as I will show, CDLX doesn’t need this to make it through the Bridg earnouts.

Liquidity Calculations

3.2.2023 Important Note: CDLX did not separate their Accounts Receivable from their LOC which is used as the collateral for the LOC. I thought CDLX may have attempted to do so with their negotiations and amendments of the LOC to get additional liquidity, but this did not occur. Therefore, the more accurate scenarios are those ignoring the Accounts Receivable, such as in the footnotes. However, in the first example below, the Accounts Receivable is not even needed. But even more accurate are the updated liquidity analysis, such as those included at the end of this post, which also includes a video.

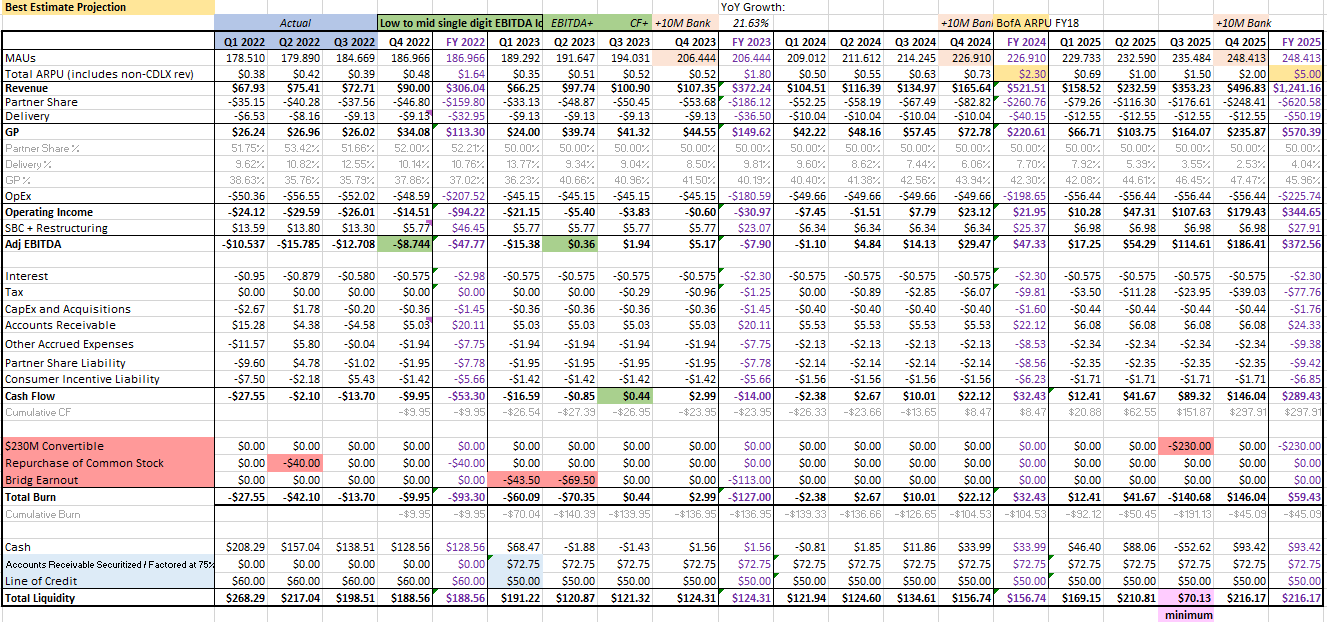

The following liquidity calculations have adjustments for conservatism in many areas, including worse-than-expected macro. Note, I do multiple other projections and give more detail on the assumptions in the last footnote of this post.

In terms of a high level summary of this one conservative scenario:

This shows CDLX has enough liquidity to handle the cash flow burn under a worsening macro environment (and only assuming one growth offset, which I think is too conservative to assume), both Bridg earnouts (including 100% cash for the second earnout), and even the extra cash for the Bridg dispute that is conservatively estimated (assuming Bridg would win). CDLX wouldn’t even need the accounts receivable under this conservative scenario.

Then why do so many worry? Beyond the misconceptions I explained previously above, the next biggest reason is most don’t spend the time to actually project this out or estimate the dispute and just assume the worst case is bankruptcy.

Below I go into a little more detail on how I arrived at each item, and will go into even more detail regarding the Bridg dispute estimate.

In terms of the liquidity as of today:

$138.51M Cash: As of 3Q22

+ $50M LOC: Assumed the $60M available (with option to increase to $75M) decreases to $50M with the new terms of removing the growth component and being based on EBITDA instead. Given CDLX has already supposedly been in talks with this bank partner to amend the existing LOC with the new terms to ensure it is available if needed, I assume this has a high probability of being available.

+ $72.75M Accounts Receivable: Assumed the $97M as of 3Q22 is securitized / factored at 75% to get that in cash. I’ve seen different percentage ranges others will buy receivables / advance at, such as 50-90%, 70-85%, 80-95% and then fees on top. I assume CDLX would try to get near the max they could if they went down this path, so I assumed 75% to be towards the high end and to account for fees. But I don’t think this is as important, since as showed above, CDLX doesn’t need this to make it through the Bridg earnouts. Also, could likely pretty easily collect from the top 5 marketers that make up 13% of these accounts receivable.

= $261.26M of total potential liquidity before free cash flow burn

- $14.75M FCF for 4Q22: Assumed $80M revenue, which was the low end of the guidance provided at 3Q22 (more details below in the screenshot + last footnote if you are curious how I get to FCF)

- $36.48M FCF for 1H23: This is under more conservative assumptions to account for a worse macro environment leading to pull back by existing CDLX advertisers. With no offsets, I assumed CDLX would have -27% YoY revenue (which would be lower than even Covid at -11%). However, I assume under this scenario CDLX will be able to do just ONE action (in reality, I assume they can do many more than just one) to offset some of the macro, which still leads to no growth in 2023 revenue YoY, where even CDLX has stated publicly they could see growth in 2023 (citing the large new advertiser pipeline, new ad server and new offer constructs, etc.). This also means CDLX misses their targets of low to mid-single adjusted EBITDA loss in 4Q22, adjusted EBITDA+ in 2Q23, and FCF+ in 3Q23.

This compares to my Best Estimate scenario assumptions of closer to $17M of burn for 1H23, where the assumptions are based on keeping on track to hit EBITDA positive in 2Q23 and FCF positive in 3Q23 and growth in total 2023 revenue (results for this scenario are in the last footnote).

Possible offsets include: new ad spend advertisers from their large pipeline or optimization of monetization or some benefit from the new ad server / new UI / product-level offers and budgets/ new offer constructs or improving bank relations or improving automation or making it easier to buy from CDLX, etc.

= $210.03M of total potential liquidity for the Bridg earnouts

- $43.5M Cash for First Bridg Earnout: As expected by CDLX, with the excess cash for the dispute handled below.

- $69.5M Cash for Second Bridg Earnout: Assuming 100% paid in cash so no dilution, when only 30% is required for cash. I have been consistently using this assumption since so many investors get caught up in the dilution or hitting the dilution cap and forcing more cash to be used. Therefore, I assume 100% cash to show CDLX can handle this and even avoid all dilution if they desire.

= $97.03M of liquidity left for the extra cash if Bridg won their dispute

Again, this is assuming a worse macro environment + second earnout to be 100% in cash, when I think CDLX has enough growth opportunities to offset even more of any potential decreases in ad spend, leading to instead YoY growth in revenue (see the Best Estimate scenario in the last footnote).

Bridg Earnout Dispute

We learned at 3Q22 earnings that the first Bridg earnout was being disputed.

Regarding the Bridg earnout, the amount for 2022 is being disputed. It is currently in the resolution process outlined in the merger agreement, and it will remain unpaid until it's resolved. While the dispute is unfortunate, we are confident in our position, and we'll vigorously defend it. - 3Q22

The reason this wasn’t announced until 3Q22 earnings was because there was back and forth on the payment in Q2 and the earnout did not formally enter dispute until Q3. According the 3Q22 10-Q, “During the third quarter, we received a Earnout Objection Notice from the Stockholder Representative”.

Given CDLX has enough liquidity for the Bridg earnouts, then the outstanding question and concern is the Bridg dispute. If you believe the $97M of liquidity left for the dispute I projected and shared above, the risk would be if the dispute led to a payment greater than that.

Given no clarity / information has been provided to investors regarding the dispute, I think most jump to absolutely the worst scenarios possible.

I think most see this current situation, and even if there is say a 95% probability of CDLX making it through this (winning the dispute or paying a small/manageable additional amount), investors look at that 5% and treat it as 100% and say the CDLX is un-investable, possibly given how recent it is + having an unknown magnitude. However, I believe that is what most don’t do…they don’t try to estimate the potential magnitude.

So let’s start with a very conservative scenario by assuming an extremely higher-than-expected first Bridg payment.

The first benefit (and one sometimes not understood or overlooked, or again, not even attempted to be estimated) is the dispute is on the first earnout which will be using the $40.15 VWAP of April 2022, which leads to being able to potentially use stock for 70% of the payment with relatively small dilution.

Multiple people have brought up the concern that Bridg may dispute the $40.15 now, given how much lower the stock price is today. I don’t see how Bridg could win such a dispute, given it is not CDLX’s fault that Bridg disputed the first payment and didn’t receive the shares at the time they were suppose to around the $40 price in the market. Otherwise if that was acceptable, CDLX should just keep being in dispute until the stock is significantly higher, but I don’t see how that would be allowed either. The merger agreement is very clear regarding how the stock price to be used is determined, so I don’t see this being an issue.

To determine how much stock could be used, the merger agreement states, “Parent shall in no event issue any Parent Common Stock to the Company Sellers in connection with the transactions described herein to the extent that such issuance (i) in the aggregate constitutes, or is convertible into, Parent Common Stock that constitutes greater than 19.9% of the common stock or voting power of Parent outstanding as of the Agreement Date”, where “April 12, 2021 (the “Agreement Date”)”. As of March 31, 2021 there were 31.770M shares outstanding, and from the 1Q21 10-Q, “As of April 30, 2021, there were 32,876,077 shares outstanding”, which leads to a midpoint of about 32.3M shares to estimate shares as of the Agreement Date (I would interpolate, but this is already an approximation given I don’t know exact timing of exercising options, issuance of restricted stocks, etc.).

I do not know for sure if the 19.9% is of the 32.3M shares, or if the 19.9% is after issuance:

If 19.9% Before Dilution: 32.3M * 19.9% = 6.4M shares * $40.15 VWAP = $258.1 M can be used in stock, so can afford a total payment of $258.1M / 70% = $368.7M

Before Dilution = 6.4277M / 32.3M = 19.9%, but After Dilution = 6.4277 / (32.3M + 6.4277M) = 16.6%

If 19.9% After Dilution: 32.3M / (1 - 19.9%) - 32.3M = 8.0M shares * $40.15 VWAP = $322.2M can be used in stock, so can afford a total payment of $322.2M / 70% = $460.3M

Before Dilution = 8.0246M / 32.3M = 24.8%, but After Dilution = 8.0246M / (32.3M + 8.0246M) = 19.9%

Having the dilution be a function of after issuance makes more sense, so that Bridg doesn’t own more than 19.9% post dilution, but the merger agreement makes it sound like it is 19.9% of the shares outstanding on the agreement date.

Let’s assume the total first payment + dispute does exceed that cap. Let’s say it’s $500M, leaving $177.8M to $241.9M in cash to be paid (depending on if dilution is before or after). This exceeds the $97M I outlined above, requiring an additional $80.8M to $144.9M to be paid. What would CDLX do?

I see multiple solutions if the Bridg dispute leads to an extremely large payment:

Pay Bridg the excess cash component over time with interest (i.e., Bridg carries the loan)

Get a loan from one or more of the CDLX banks

Get 1 year of revenue share deferral with the banks (The banks could say no way, but if CDLX went under, they lose that rev share and all other growing benefits forever. CDLX paid the banks over $140M and likely over $150M the last two years, and will continue to grow. I would say it would be a good investment to pay CDLX / defer rev share for even one year, and get that same amount back every single year and growing + other benefits like less attrition + higher spending, etc. You could even make it such that rev share is lower in 2023, but higher for some amount of years until the banks are made whole with interest).

Equity raise (While the Bridg earnout dilution is capped, a new equity raise is not. While it would be extremely dilutive, it would prevent failure. This to me should be the last resort, and shouldn’t be needed, and is likely difficult in this current environment, unless offered to existing shareholders as a way to prevent them from losing their percentage ownership of the business)

The first bullet above is one I keep coming back to when I start thinking about the worst case. I don’t feel it is as simple as: too high of earnout payment = bankruptcy. Given CDLX is nearing EBITDA and FCF positive, they would have the ability to pay back debt. Therefore, I feel the most logical solution would be to make the Bridg payment over time with interest. Both parties win. Obviously bankruptcy risk increases now with additional debt, but it doesn’t put CDLX shareholders at immediate risk today like many think, and CDLX is likely to be able to service the debt given near EBITDA and FCF positive.

However, I think we can narrow the potential dispute items and corresponding potential payments down to the following, given it sounds like the dispute is related to the ARR and possibly in relation to GAAP revenue and when revenue is recognized: (important note: the first Bridg earnout is based on the April 2022 ARR)

$800K: Bridg revenue is 2Q22 was much higher QoQ, partially due to an extra $800K in revenue recognized, where in 1Q22 CDLX said, “We recognized $800,000 of revenue in Q2 from contracts with effective dates in Q1.” This additional $800K does not look to be in the April ARR, which the first earnout payment is based on. Therefore, Bridg could want a portion of the $800K in the April calculation. However, that seems very unlike to occur because I do not think this is recurring revenue. Therefore, while it is still possible this is an item being disputed, I see it as less likely to be won and paid upon. My best guess is this relates to the renewals that I discuss next, including both paying back for the temporary decrease in revenue from both the large contracts expiring + possible back pay for the higher renewal amounts. Therefore I could see it more likely to argue that the earnout should include the associated recurring revenue.

Renewals: In 1Q22, CDLX said, “Despite this impressive growth in revenue, ARR, which is calculated as annualized revenue from the last month of the quarter, declined quarter-over-quarter from $15.3 million in Q4 to $14 million in Q1. This temporary decline was primarily due to expiration of 2 large contracts in Q1 that we are close to extending at even higher ARR renewals.” From my estimates, it looks like these higher renewal prices are not reflected in financials until after April, but where the original revenue from these contracts did come back in April. Therefore, I can see where Bridg would dispute this if the higher renewal revenue is not in the April ARR calculation for the earnout, despite the contracts expiring in Q1. Now, I can also understand if the renewal was not finalized until after April, which could make sense why it shouldn’t be included (and why there was that $800K revenue later recognized as back pay). I will be using the higher renewal amounts in my calculations for a best estimate of the Bridg dispute below.

$25M Contract: What I’ve felt is most likely the case is related to the large $25M Bridg / CDLX client signed. It takes 5-6 months to sign a Bridg client, so I could see where if Bridg started discussions in say January, and they think they should get credit for them, only for the revenue to not be recognized until after April and therefore not in the April ARR calculation. Now, I do assume this new client is already reflected in Bridg financials today (after April, and seen through 3Q22), but it looks to be at a much lower level compared to $25M / 24 months. The lower amount is likely from this being a joint CDLX / Bridg deal, where a portion of revenue is likely allocated to CDLX instead. Bridg’s allocated revenue from this contract doesn’t come through until after April, which could be why Bridg is disputing, which is why I include it in my estimates as well.

It is important to know that if this client was included in the first earnout, they would also be a second anniversary customer for the second earnout. However, the contract is a 2-year contract, and the second earnout is the increase in revenue from those existing customers, so there shouldn’t be any increases. One could argue there would higher revenue in the second year if they did not recognize the revenue at a constant rate. But Bridg revenue looks to be recognized at a constant rate, since monthly revenue has been consistently around $1.8M the last few months, so I don’t expect this to increase YoY from this contract, and therefore there would be no significant impact to the second earnout if this was changed for the first earnout.

In order to gauge the extreme, I think it makes the most sense to look at 3Q22 ARR, given this likely reflects both the higher revenue from the renewals of the 2 contracts + Bridg’s portion of the $25M contract. I ignore the $800K, since it is likely not recurring revenue, and actually may even be back pay for the renewal contracts.

Therefore, my best estimate of the potential impact of the Bridg dispute is:

Renewals + $25M Contract:

“First Anniversary Payment equal to 20 times the annualized recurring revenue, ("ARR"), based on the month preceding the anniversary, less $12.5 million”

Using ($22.115M Sep ‘22 ARR - $12.5M) * 20 = $192.3M

Then we must subtract the brokerage fees and other bonuses before calculating the 30% / 70% split. Where $6.9M is the brokerage fees, and I believe there is an approx. $1.1M in referral fees and transaction bonuses (more details and my reasoning regarding the fee amounts + when to deduct are in the footnote6).

$192.3M Earnout - $8.006M fees = $184.29M where 70%, or $129.006M is in stock at $40.15 (this is only 3.21M shares, so doesn’t hit the dilution cap), leaving $55.29M in cash for the 30% component + $8.006M in fees = $63.29M.

This means the extra cash needed for the dispute would be $19.79M ($63.29M - $43.5M expected), which is much below the $97M available.

Summary of Liquidity Position After Bridg Earnouts + Dispute + Macro

Accounting for this additional payment if Bridg won the dispute, we are left with $77.23M of liquidity after paying for both Bridg earnouts payments (2Q23), and positive liquidity throughout the projection period:

This shows CDLX can afford both Bridg earnouts + the dispute + the convertible senior notes maturing in late 2025, even under this more conservative scenario factoring in the macro headwinds while only benefiting from just one growth offset, and all with CDLX’s current liquidity resources.

Some may look at this and say, “a minimum of liquidity of $8M is cutting it way too close!” Well that is assuming CDLX pays 100% for the maturing convertible notes. And while CDLX could handle paying 100% cash and not raise equity or refi instead, that seems way too unlikely and too conservative, but it shows CDLX is well capitalized. Given CDLX would likely be EBITDA and FCF for multiple quarters before that maturity, I expect them to raise equity or refi instead, if conversion does not occur.

Others may challenge the ease of getting 75% of the accounts receivable. Well, as seen above, CDLX doesn’t need the accounts receivable to make it through the Bridg earnouts. Therefore the most important component at this time is the LOC. With just this additional liquidity source with CDLX’s cash, CDLX can handle a worse macro + miss EBITDA and FCF targets + lose the Bridg dispute and pay much more cash + pay 100% for the second earnout. This is why it was so good to hear CDLX is working with their bank partner to ensure the LOC will be available under even a bad macro environment, given there is now a very high probability this will be available to draw upon if needed or desired (such as to avoid dilution and pay 100% of the second Bridg earnout).

I go over this specific scenario in detail, even sharing different levels of the accounts receivable, and detail out all the supporting assumptions, in the footnotes. In addition, I do two more projections to test CDLX’s liquidity position: one that is more a “Best Estimate”, and the other that is the “Most Conservative” of the three scenarios. To view this additional detailed information, see the corresponding footnote.7

Waiting for Risk / Reward to Improve

One thought from an investment perspective would be to wait to invest or invest more until there is clarity on the outcome, such as related if management / Karim executes positivity on the following (given each one of these reduces the risk of running into liquidity issues):

Finishes amending existing LOC to ensure able to be used if needed

Resolves the Bridg dispute (if too much cash is needed, finds a rational solution like paying Bridg pay over time with interest)

Completes second Bridg payment, possibly with 100% cash to avoid dilution

The advantage is it would reduce the risk of investing in something that has the chance of declining more.

It is very possible other investors who sold CDLX don’t return, or other investors have other fears, such that a favorable announcement on the items above lead to no change in the stock price. If that occurs, it would be a valuable entry point from the perspective of risk vs reward.

I personally have not elected to do this method, and instead invested more around these levels, because I feel CDLX has a very high probability of executing on the above items, which means the risk/reward possibly decreases upon the news (from the risk staying the same, but the reward decreasing from stock price increasing).

Even more simply, given I think CDLX gets through this, I love being able to acquire so many more shares at these prices than I could even at slightly higher stock prices. I have been aggressively acquiring as many shares as possible. I never thought I would be able to own this many shares. Maybe they won’t be worth anything in the future, but I feel the odds are more in favor of them being worth something, if not many multiples of today.

Closing

I continue to believe the probability of achieving the long-term potential of the business continues to increase. It is simply is a function of getting to the long-term, which means getting through these two Bridg earnouts. Given CDLX has plenty of liquidity, I think it is more likely than not that CDLX makes it through this, and achieves a higher portion of what is possible in the long run given now under Karim.

And even if I am completely off in my assumptions / interpretations related to the Bridg earnouts and the dispute, I gain comfort in knowing how many other very possible solutions there are to handle the Bridg earnout payments for CDLX to come out fine. Others want 100% certainty, but that comes at the cost of considerably higher prices and lower returns (which funny enough, is what I believe will occur with CDLX ad pricing due to the certainty in measurement).

As stated in the beginning, it’s not every day you find a great business, with great management, at a great price. That is typically only possible when others do not believe one or any combination of those to be true. With CDLX, I believe some do not think any are true despite what I shared in the post, which contributes to making CDLX an attractive investment.

Cadence of Public Posts, and Other Activities

I have not done a full post in a while, given:

I’ve been spending more time thinking through the situations of my current holdings (I have been adding many of these thoughts to my Research Notes, such as on CDLX)

+ trying to take advantage of the situations (in the future, I may share all the very creative financing strategies I have done to be able to acquire a significant number of new shares…my last one took a lot of work and negotiations, and I am quite proud of it)

+ spending my time continuing to research previous businesses (recorded in my General Research Notes)

+ researching many new prospective investments (started compiling notes on many of these business, and may release them in the future with the other Research Notes)

I feel the current cadence of full posts has been working quite well, with less frequent full write-ups / videos, but consistently adding to my Research Notes. This provides me with the most time to do the above items (which I believe will lead to the largest long term benefits), while still providing information to those most interested via my Research Notes.

Gain Access to Research Notes

I have added significant notes to my CDLX Research Notes the last few months. If you’re interested in CDLX and want significantly more detail, including information not in any public post, upgrade to access the CDLX notes and more.

(Given the quantity of new notes, leading to hitting Substack limits, I had to split the notes once again, with essentially a part #1 and #2 for both qualitative and quantitative notes)

Qualitative:

Quantitative:

These notes contain information I have not shared anywhere else. For more general information on Research Notes, see here.

I have been adding a significant quantity of new notes lately, given the many changes around the company. I have also released Carvana Research Notes, and General Research Notes. For the large number of you who are already paid subscribers, you have access to with your current paid subscription at no additional cost, as well all current and future notes. I have greatly appreciated your positive feedback lately, and I look forward to continuing adding to these notes, with intentions of expanding them to more companies over the years.

Follow-Up

If you have any questions or push back on any of the above, please contact me. I would enjoy discussing more.

-Austin Swanson (Swany407)

Twitter: @Swany407

Website: Swany407.com

More Information on Cardlytics

Research Notes

Free Posts

Chase Updates (Related to Chase Acquiring Figg, and Chase Migrating to the New Ad Server): Write-up and video

CDLX 2.0 (Chase Acquiring Figg, New CEO, New Banks, BofA Renewal, 22Q2 Earnings, and more): Write-up and video

Current Price Decline, Short Thesis, and Q1 2022 Earnings: Write-up and video

Open Banking (The Free Option on the Hidden Potential Cash Cow): Write-up and video

The Power of Bridg (and Why CDLX is Undervalued): Write-up and video

BofA Renewal & Testing Competitors (Update): Write-up and video

New Observations, Upcoming Earnings Calls, and Updated Allocations (10.21.2021): Write-Up and video

Thoughts Following Q2 2021 Earnings and Price Decline: Write-up and video

Thoughts After Price Decline (5.17.2021): Write-up and video

Disclaimer: This content is not investment advice, and is intended for educational and informational purposes only. Before making any investment, you should do your own analysis. Please see the Disclaimer page for more details.

Notes on the Valuation Scenarios

OpEx + Delivery Costs: Current OpEx + Delivery Costs following the restructuring (-$15M and then another -$20M) is likely even less than $200M. This $200M of OpEx + Delivery Costs likely can handle significantly higher revenue levels without any increase in OpEx expenses, but I assume we will see for each step up in ARPU scenarios an increase OpEx + Delivery Costs. I do this since I assume Karim will continue growing to improve the channel for future growth.

CapEx and Multiple: Very minimal capital expenditures, and little capital needed for future growth + still able to consistently grow in any of the scenarios (given the additional runway beyond these scenarios, as discussed in the main post), so a high portion of cash flow can be distributed to shareholders while continuing to grow, and therefore a higher multiple is reasonable.

Share Count: We do need to account for additional dilution for the upcoming Bridg earnouts + RSUs. However, if these upper valuation scenarios occur, CDLX would be producing CF to be able to buy back stock. And given less dilution in the first earnout, and possibly no dilution in the second earnout, total dilution may not be too significant (especially in relation to the levels some assume). I discuss this more in the Bridg earnout section in the main body of the past.

Different Formula: I am using a slightly different formula than normal to better reflect the operating leverage in the business. Typically we see gross profit as (1- rev share - delivery costs), but given delivery costs should be more fixed and decrease as a percentage of increasing revenue (as stated in the 10-K), compared to rev share that will stay as a cost at percentage of revenue, I wanted to place delivery costs next to OpEx.

Tax: 20% (Google and Meta had lower effective tax rates)

Redeeming Offers Translating into ARPU

The question I continually ask, and it may be the incorrect one, but is it reasonable to assume CDLX could get everyone to redeem a $5 offer, or just 50% of users to redeem one offer to save $10? This would be about $5 redemptions * $2 revenue / redemption = $10 ARPU, or $10 redemptions * $2 revenue / redemption * 50% = $10 ARPU. And shown in the valuation scenarios, that would lead to above a $10B valuation vs $157M today, or 64x.

The following shows the relationship of consumer incentives and revenue:

I wouldn’t be surprised if this relationship increased, with higher pricing or charging for engagement.

So is $5 or $10 of redemptions reasonable? I believe so. $5 or $10 could be as little as one offer! I don’t see how with more advertisers in the fullness of time, especially at the product-level, you cannot offer something highly relevant (since based on purchase data) + attractive (high cash back, that is free money) that someone will not want to take advantage of.

For context, below are my redemptions in the last 90 days (so only 25% of the year), totaling $50.22, or nearly $100 ARPU. Assuming constant redemptions through the next 75% of the year, this would be more ARPU than the FB above, without the new UI, without product-level offers, without many notifications, without additional advertisers, etc.

So if the number of advertisers increases such as from opening up production-level offers + a new UI with enhanced imagery to increase understanding of the offers + new UI with categorization to more easily find relevant offers + notifications to increase awareness, I see users redeeming more.

If you are presented with a free $5 or $10 offer to somewhere or on product that is the same or similar to what you were going to buy, and you were aware of it, would you not use it? Better yet, if you had an offer for a free meal or free item, would you not take it?

Important to note that ad budgets have to grow in sync. If all of a sudden every single user wanted to redeem $100, that is $18.4B in consumer incentives, or over $50B in ad spend, and therefore you would need a similar level of ad budget from advertisers to pay for that. So if the demand is there, the focus has to be on the supply side and getting existing advertisers to increase their ad spend and get new advertisers to start spending.

CDLX is Not Only About Switching Customers

It is also important to remember, CDLX is not just about presenting offers to switch where users spend. Advertisers can target existing customers to get them to spend more. These customers are cheaper to shift spend and on average spend more.

The following from CDLX illustrates this:

Decreasing Revenue Share

It has been stated by CDLX that given the Bridg data does not come from the bank, there could likely be less revenue share. Therefore, this revenue may have higher gross profit margins.

This matches the FI Share description in Cardlytics’ 10-K, where it states: